Professional Documents

Culture Documents

TTS - DCF Primer

TTS - DCF Primer

Uploaded by

KrystleCopyright:

Available Formats

You might also like

- Task 1 AnswerDocument9 pagesTask 1 AnswerSiddhant Aggarwal20% (5)

- TRX Development - Brochure PDFDocument12 pagesTRX Development - Brochure PDFCheng FrankNo ratings yet

- Mildred Driver The Owner of A Nine Hole Golf Course OnDocument1 pageMildred Driver The Owner of A Nine Hole Golf Course OnAmit PandeyNo ratings yet

- Case 26 An Introduction To Debt Policy ADocument5 pagesCase 26 An Introduction To Debt Policy Amy VinayNo ratings yet

- Michael Porter's Generic StrategiesDocument9 pagesMichael Porter's Generic StrategiesMehak BhargavaNo ratings yet

- Cost of Capital1Document33 pagesCost of Capital1Mark Levi CorpuzNo ratings yet

- Brochure Paulownia InvestDocument8 pagesBrochure Paulownia InvestCorneliu StanciuNo ratings yet

- Training The Street DCFDocument2 pagesTraining The Street DCFantoine.deloisonNo ratings yet

- DCF Presentation Ahemdabad 20 01 2018Document33 pagesDCF Presentation Ahemdabad 20 01 2018pre.meh21No ratings yet

- Business Valuation ModelDocument14 pagesBusiness Valuation Modeldagagovind7No ratings yet

- Bus 5111 Financial Management Written Assignment Unit 7Document5 pagesBus 5111 Financial Management Written Assignment Unit 7Andika GintingNo ratings yet

- Cost of CapitalDocument12 pagesCost of Capitalp9bd49mfc8No ratings yet

- Iefinmt Reviewer For Quiz (#1) : I. Definition of TermsDocument11 pagesIefinmt Reviewer For Quiz (#1) : I. Definition of TermspppppNo ratings yet

- Corporate Financing Decision (FIN 502) MBA Kathmandu University School of ManagementDocument20 pagesCorporate Financing Decision (FIN 502) MBA Kathmandu University School of ManagementShreeya SigdelNo ratings yet

- DCF Analysis JBDocument10 pagesDCF Analysis JBNoah100% (3)

- Financial Analysis Using Financial Performance Metrics-Fitri-IsmiyantiDocument26 pagesFinancial Analysis Using Financial Performance Metrics-Fitri-Ismiyantiputri shanahNo ratings yet

- Cash Flow Valuation Techniques: Adapted From Harvard Business School Note #9-295-155Document2 pagesCash Flow Valuation Techniques: Adapted From Harvard Business School Note #9-295-155...ADITYA… JAINNo ratings yet

- Capital Structure ManagementDocument12 pagesCapital Structure ManagementRentsenjugder NaranchuluunNo ratings yet

- Ch22 Mini CaseDocument9 pagesCh22 Mini CaseindahNo ratings yet

- Cash Flow Valuation MethodsDocument5 pagesCash Flow Valuation MethodsShubakar ReddyNo ratings yet

- Enph EstimacionDocument38 pagesEnph EstimacionPablo Alejandro JaldinNo ratings yet

- Damodaran - Discounted Cash Flow ValuationDocument198 pagesDamodaran - Discounted Cash Flow ValuationYến NhiNo ratings yet

- Capital Budgeting Under UncertaintyDocument30 pagesCapital Budgeting Under UncertaintyJyoti YadavNo ratings yet

- Cash Flow Valuation MethodsDocument5 pagesCash Flow Valuation Methodssan_lookNo ratings yet

- CHAPTER II - Financial Analysis and PlanningDocument84 pagesCHAPTER II - Financial Analysis and PlanningTamiratNo ratings yet

- 4) Vid 005-dcf - Discounted-Cash-Flow-Model PDFDocument3 pages4) Vid 005-dcf - Discounted-Cash-Flow-Model PDFAkshit SoniNo ratings yet

- 4 The Firm's Capital Structure and Degree of LeverageDocument9 pages4 The Firm's Capital Structure and Degree of LeverageMariel GarraNo ratings yet

- S6 Cost of Capital Online VersionDocument28 pagesS6 Cost of Capital Online Versionconstruction omanNo ratings yet

- Public Debt: Sir WaheedliaqatDocument7 pagesPublic Debt: Sir WaheedliaqatusamaNo ratings yet

- Financial StatementsDocument17 pagesFinancial StatementsFuzuliNo ratings yet

- Ch03 ShowDocument54 pagesCh03 ShowMahmoud AbdullahNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Ratio AnalysisDocument66 pagesRatio AnalysisRenny WidyastutiNo ratings yet

- CHAPTER II - Financial Analysis and PlanningDocument84 pagesCHAPTER II - Financial Analysis and PlanningMan TKNo ratings yet

- LeverageDocument8 pagesLeverageTHE SHAYARI HOUSENo ratings yet

- 6U CedarDocument28 pages6U CedarGagan SawhneyNo ratings yet

- Risk, Return and Capital Budgeting: For 9.220, Term 1, 2002/03 02 - Lecture15.ppt Student VersionDocument27 pagesRisk, Return and Capital Budgeting: For 9.220, Term 1, 2002/03 02 - Lecture15.ppt Student VersionZee ZioaNo ratings yet

- Liv PDFDocument24 pagesLiv PDFravi sharmaNo ratings yet

- Ratio AnalysisDocument29 pagesRatio AnalysisatharNo ratings yet

- Cost of CapitalDocument24 pagesCost of CapitalVincitta MuthappanNo ratings yet

- ECN 3422 - Lecture 9 - 2021.10.26Document32 pagesECN 3422 - Lecture 9 - 2021.10.26Cornelius MasikiniNo ratings yet

- Fm-May-June 2015Document18 pagesFm-May-June 2015banglauserNo ratings yet

- Financial Statement Ratio Analysis: Your Company, IncDocument4 pagesFinancial Statement Ratio Analysis: Your Company, IncPeninahNo ratings yet

- Assessment-3b-2 (1) (AutoRecovered)Document6 pagesAssessment-3b-2 (1) (AutoRecovered)Trúc NguyễnNo ratings yet

- LectureDocument29 pagesLectureatharNo ratings yet

- Distress PDFDocument65 pagesDistress PDFKhushal UpraityNo ratings yet

- Topic 8Document7 pagesTopic 8黄芷琦No ratings yet

- Week 3 Asset Based Valuation Part 2 MG3Document26 pagesWeek 3 Asset Based Valuation Part 2 MG3VENICE MARIE ARROYONo ratings yet

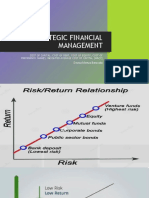

- Strategic Financial ManagementDocument28 pagesStrategic Financial ManagementDayana MasturaNo ratings yet

- TROW Q1 2022 Earnings ReleaseDocument15 pagesTROW Q1 2022 Earnings ReleaseKevin ParkerNo ratings yet

- Draft 4Document19 pagesDraft 4Zarif TajwarNo ratings yet

- 2019-09-21T174353.577Document4 pages2019-09-21T174353.577Mikey MadRat100% (1)

- Cost of Capital: Risk & ReturnDocument27 pagesCost of Capital: Risk & ReturnKrisi ManNo ratings yet

- CorpFin 2021 Fall 2 Risk Lecture 11Document27 pagesCorpFin 2021 Fall 2 Risk Lecture 11Krisi ManNo ratings yet

- 3rd Presentation 2020Document51 pages3rd Presentation 2020Camila Arango PérezNo ratings yet

- InsuranceDocument15 pagesInsurancekananguptaNo ratings yet

- Weighted Average Cost of Capital (WACC)Document1 pageWeighted Average Cost of Capital (WACC)hukaNo ratings yet

- Cours 2 Essec 2018 Lbo PDFDocument81 pagesCours 2 Essec 2018 Lbo PDFmerag76668No ratings yet

- Damodaran - Value CreationDocument27 pagesDamodaran - Value Creationishuch24No ratings yet

- Gross Profit - Margin RatioDocument16 pagesGross Profit - Margin RatioaaronNo ratings yet

- Cost of CapitalDocument16 pagesCost of CapitalParth BindalNo ratings yet

- Sfas 109-EeDocument132 pagesSfas 109-EekyougiNo ratings yet

- Sbi-Nifty Index Fund September-2022Document1 pageSbi-Nifty Index Fund September-2022kumarNo ratings yet

- CREDO PresentationDocument23 pagesCREDO PresentationPampalini01No ratings yet

- Rajat Agarwal ResumeDocument2 pagesRajat Agarwal ResumeAditya PrakashNo ratings yet

- UIN Information System ("UIS") : Frequently Asked Questions (FAQ's)Document7 pagesUIN Information System ("UIS") : Frequently Asked Questions (FAQ's)Syed Hareem Ul HasanNo ratings yet

- Acknowledgement: These Slides Have Been Adapted FromDocument56 pagesAcknowledgement: These Slides Have Been Adapted FromagnesNo ratings yet

- ABRAHAM ADESANYA POLYTECHNI2 Mr. OlabamijiDocument12 pagesABRAHAM ADESANYA POLYTECHNI2 Mr. OlabamijiRasheed Onabanjo DamilolaNo ratings yet

- Chapter-I: Sjcet Mba Dept 1Document78 pagesChapter-I: Sjcet Mba Dept 1thouseef06No ratings yet

- Prudential Bank Vs CADocument2 pagesPrudential Bank Vs CAKent UgaldeNo ratings yet

- Solutions For End-of-Chapter Questions and Problems: Chapter OneDocument14 pagesSolutions For End-of-Chapter Questions and Problems: Chapter Onejl123123No ratings yet

- Discussion 4 FinanceDocument5 pagesDiscussion 4 Financepeter njovuNo ratings yet

- Grant and Funding From MyCreative Ventures CorporateDocument27 pagesGrant and Funding From MyCreative Ventures CorporateMegat Zainurul Anuar bin Megat JohariNo ratings yet

- Derivatives - 8 - Binomial Option Pricing ModelDocument73 pagesDerivatives - 8 - Binomial Option Pricing ModelHins LeeNo ratings yet

- Your Club: TreasurerDocument32 pagesYour Club: TreasurerPreetham RajalabandiNo ratings yet

- Firstcry Startup by PrasanthDocument9 pagesFirstcry Startup by PrasanthSrilaya GudlaNo ratings yet

- MSE604 Ch. 8 - Price Changes & Exchange RatesDocument18 pagesMSE604 Ch. 8 - Price Changes & Exchange RatesFerrolinoLouieNo ratings yet

- Public Investment Fund - Saudi ArabiaDocument92 pagesPublic Investment Fund - Saudi Arabiaace187100% (2)

- Microsoft Dynamics AX Cube and KPI Refer PDFDocument138 pagesMicrosoft Dynamics AX Cube and KPI Refer PDFVictor FadeevNo ratings yet

- Introduction To Risk ManagementDocument16 pagesIntroduction To Risk ManagementJenniferNo ratings yet

- Officer Scale English Part - pdf-55 PDFDocument9 pagesOfficer Scale English Part - pdf-55 PDFGaurav TajaneNo ratings yet

- Practice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Document3 pagesPractice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Sumit Kumar SahooNo ratings yet

- Impact of Dividend Policy On Firm Performance: An Empirical Evidence From Pakistan Stock ExchangeDocument7 pagesImpact of Dividend Policy On Firm Performance: An Empirical Evidence From Pakistan Stock ExchangeZeeni KhanNo ratings yet

- 5.2 Converting Between Fractions Decimals and PercentsDocument10 pages5.2 Converting Between Fractions Decimals and PercentsKent WhiteNo ratings yet

- Daily Commodities Coverage: Commodity ResearchDocument6 pagesDaily Commodities Coverage: Commodity ResearchThe red RoseNo ratings yet

- FMI Long Questions EditedDocument7 pagesFMI Long Questions EditedChanna KeshavaNo ratings yet

TTS - DCF Primer

TTS - DCF Primer

Uploaded by

KrystleOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TTS - DCF Primer

TTS - DCF Primer

Uploaded by

KrystleCopyright:

Available Formats

A Primer on Discounted Cash Flow Analysis

Discounted Cash Flow (DCF) Analysis yields the theoretical valuation of a firm. The concept behind a DCF

analysis is that the value of a company is based on the present value of the cash flows that it can generate in

the future. The technical term commonly used is “Intrinsic Value”.

A DCF valuation has three major components:

1) A discount rate, called the weighted average cost of capital (WACC), which we will use to discount the

future cash flows and the terminal value back to their present value;

2) Forecasting cash flows or, more precisely, unlevered free cash flows;

3) A terminal value of the company.

Let’s take each of these in turn:

1) Weighted average cost of capital

In a DCF analysis, a company’s value is determined by estimating its future free cash flows over several

years (i.e. 5 – 10 years), then discounting those cash flows back to the present, using a risk factor called

the weighted average cost of capital (WACC). WACC captures the risk of those future cash flows and

reflects the cost of the company’s equity capital (cost of equity) and of its debt capital (cost of debt). You

can also think of WACC as the blended rate of return that the company’s equity and debt investors require

to compensate them for the risk of investing in the company. The formula for weighted average cost of

capital (WACC) is illustrated below:

Cost of

Debt

Where:

After tax

X

cost of debt • The tax rate is the marginal rate

1 – Tax rate X

Weighted cost • The risk-free rate is typically the yield

of debt

Percentage

on the 10-year U.S. Government Bond

of debt

Weighted Average

• Beta measures the volatility of a

Risk free

rate + Cost of Capital company’s stock price compared to the

(WACC) overall market

Percentage

+ of equity • Market risk premium is the rate of

Weighted cost

Beta X

of equity

return in the market minus the risk-free

Cost of rate. For example, the historical U.S.

X

equity market risk premium is often in the

Market risk

premium

range of 5.0% to 7.0%

2) Unlevered free cash flow

Unlevered free cash flow is cash available to capital holders before debt holders are paid. “Free” implies

that it is the cash flow in excess of what is needed to fund the company’s operations. Loosely translated, it

is the cash flow after taxes are paid, capital expenditure requirements are met, and working capital needs

are satisfied.

Historical Projected

FYE-2 FYE-1 FYE FYE+1 FYE+2 FYE+3 FYE+4 FYE+5

Sales $7,385.0 $7,998.0 $7,586.0 $7,705.5 $7,826.8 $7,950.0 $8,075.2 $8,202.4

Cost of goods sold 4,121.0 4,549.0 4,272.0 4,339.3 4,407.6 4,477.0 4,547.5 4,619.1

Gross Profit 3,264.0 3,449.0 3,314.0 3,366.2 3,419.2 3,473.0 3,527.7 3,583.3

Selling, General and Administrative 1,808.0 1,885.0 1,782.0 1,810.1 1,838.6 1,867.5 1,896.9 1,926.8

EBITDA 1,456.0 1,564.0 1,532.0 1,556.1 1,580.6 1,605.5 1,630.8 1,656.5

Less: Depreciation (263.0) (271.0) (264.0) (297.9) (315.0) (332.6) (350.7) (369.3)

Less: Amortization 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

EBIT 1,193.0 1,293.0 1,268.0 1,258.3 1,265.6 1,272.9 1,280.1 1,287.2

Less: Taxes @ 36.7% (437.9) (474.6) (465.4) (461.9) (464.6) (467.2) (469.9) (472.5)

Tax-effected EBIT 755.1 818.4 802.6 796.4 801.1 805.7 810.2 814.7

Plus: Depreciation and amortization 271.0 264.0 297.9 315.0 332.6 350.7 369.3

Less: Capital expenditures (298.0) (345.0) (350.4) (356.0) (361.6) (367.2) (373.0)

Less: Additions to intangibles 0.0 0.0 0.0 0.0 0.0 0.0 0.0

(Increase)/decrease in w orking capital (119.0) (59.0) (3.9) (4.0) (4.1) (4.1) (4.2)

Unlevered Free Cash Flow $672.4 $662.6 $739.9 $756.1 $772.7 $789.6 $806.8

In practice, finance professionals typically select a forecast period of 5 to 10 years. The length of the

projection period depends on the characteristics of the company and its industry. The main consideration

for determining the length of this period is when the company will reach a “steady state.” One steady-state

indicator is when a company is sustaining its capital investment – that is, all the company’s new spending

goes simply to replacing the fixed assets that they are losing each year from depreciation. This implies that

© 1999-2019 Training The Street, Inc. Page 1 of 2

All rights reserved.

the business is only replacing existing fixed assets in order to sustain its current levels of production, rather

than investing in new or additional property, plants or equipment. Another sign of steady-state operations

is when the company’s working capital or short-term operating cash flows have stabilized.

3) Terminal value of the company

The terminal value of a company represents the present value of the sum of the additional cash flows

beyond the forecasted period. Two methods are widely used to project the terminal value:

a) The Terminal Multiple Method: This assumes that at the end of the forecast period, the company is

worth a lump sum that is calculated as a multiple of an operating metric, e.g., a multiple of EBITDA:

Terminal Value = multiple x EBITDAn

Where

• n equals the final year of the forecast period

There are many important factors to consider when determining the terminal multiple. Most practitioners

begin with the current trading multiple, then examine whether that multiple is sustainable and reasonable. If

it is not, they adjust reflect the estimated multiple in a mature-state and in a normal economic environment.

b) The Perpetuity Growth Rate Method: This assumes that the company’s free cash flows will grow at a

moderate, constant rate indefinitely:

Where

FCFn x (1 + g) • FCF is the normalized free cash flow in period n

Terminal Value =

(r - g) • g is the nominal perpetual growth rate, and

• r is the discount rate or WACC

The nominal perpetual growth rate (g) is the company’s sustainable long-run growth rate. This rate can be

higher than inflation but should not exceed the growth rate of the overall economy. Rates vary by situation

and company, but the typical range is 2% to 5%.

Getting to a per share value:

PV of PV of The present value of unlevered free cash flows

Free Cash Flows Terminal Value plus the present value of the terminal value

gives you the enterprise value of a firm. To

derive equity value from enterprise value,

Enterprise subtract net debt.* For a public company, most

Value professionals will calculate down to equity

value per share, so that they can compare the

Net Debt* calculated intrinsic value to the current share

price.

Diluted Shares

Equity Equity Value

To calculate equity value per share, take the

Value Diluted Shares total equity value calculated above and divide it

by the number of diluted shares outstanding.

Conclusion

There is no single right answer when doing a DCF analysis, but there are simple steps one can take to improve

the quality of the analysis. First, use reasonable and defensible assumptions for your forecasted period. The

starting point for assumptions is usually management, consensus estimates, historical analysis or based on

performance of peers. Second, consider materiality when you are trying to develop your assumptions; what is

the impact on the final output? Third, there is no perfect WACC or terminal multiple to use, but observe

industry averages as a sanity check which can be sourced from equity research reports. Fourth, compare your

final equity value per share to the current stock price and calculate the implied CY+1 P/E multiple and compare

against the peer group to build confidence around your assumptions. If your assumptions reflect general

market consensus, then your implied share price should be within a reasonable range of the current share

price. Finally, because a DCF analysis has so many variables, your final equity value per share should be

shown as a range rather than as one single number in order to account for some variability in those

assumptions.

* In this example, net debt refers to all interest-bearing liabilities, plus the value of preferred stock, plus the value on any non-controlling interest

(often called minority interest), less all cash and cash equivalents.

© 1999-2019 Training The Street, Inc. Page 2 of 2

All rights reserved.

You might also like

- Task 1 AnswerDocument9 pagesTask 1 AnswerSiddhant Aggarwal20% (5)

- TRX Development - Brochure PDFDocument12 pagesTRX Development - Brochure PDFCheng FrankNo ratings yet

- Mildred Driver The Owner of A Nine Hole Golf Course OnDocument1 pageMildred Driver The Owner of A Nine Hole Golf Course OnAmit PandeyNo ratings yet

- Case 26 An Introduction To Debt Policy ADocument5 pagesCase 26 An Introduction To Debt Policy Amy VinayNo ratings yet

- Michael Porter's Generic StrategiesDocument9 pagesMichael Porter's Generic StrategiesMehak BhargavaNo ratings yet

- Cost of Capital1Document33 pagesCost of Capital1Mark Levi CorpuzNo ratings yet

- Brochure Paulownia InvestDocument8 pagesBrochure Paulownia InvestCorneliu StanciuNo ratings yet

- Training The Street DCFDocument2 pagesTraining The Street DCFantoine.deloisonNo ratings yet

- DCF Presentation Ahemdabad 20 01 2018Document33 pagesDCF Presentation Ahemdabad 20 01 2018pre.meh21No ratings yet

- Business Valuation ModelDocument14 pagesBusiness Valuation Modeldagagovind7No ratings yet

- Bus 5111 Financial Management Written Assignment Unit 7Document5 pagesBus 5111 Financial Management Written Assignment Unit 7Andika GintingNo ratings yet

- Cost of CapitalDocument12 pagesCost of Capitalp9bd49mfc8No ratings yet

- Iefinmt Reviewer For Quiz (#1) : I. Definition of TermsDocument11 pagesIefinmt Reviewer For Quiz (#1) : I. Definition of TermspppppNo ratings yet

- Corporate Financing Decision (FIN 502) MBA Kathmandu University School of ManagementDocument20 pagesCorporate Financing Decision (FIN 502) MBA Kathmandu University School of ManagementShreeya SigdelNo ratings yet

- DCF Analysis JBDocument10 pagesDCF Analysis JBNoah100% (3)

- Financial Analysis Using Financial Performance Metrics-Fitri-IsmiyantiDocument26 pagesFinancial Analysis Using Financial Performance Metrics-Fitri-Ismiyantiputri shanahNo ratings yet

- Cash Flow Valuation Techniques: Adapted From Harvard Business School Note #9-295-155Document2 pagesCash Flow Valuation Techniques: Adapted From Harvard Business School Note #9-295-155...ADITYA… JAINNo ratings yet

- Capital Structure ManagementDocument12 pagesCapital Structure ManagementRentsenjugder NaranchuluunNo ratings yet

- Ch22 Mini CaseDocument9 pagesCh22 Mini CaseindahNo ratings yet

- Cash Flow Valuation MethodsDocument5 pagesCash Flow Valuation MethodsShubakar ReddyNo ratings yet

- Enph EstimacionDocument38 pagesEnph EstimacionPablo Alejandro JaldinNo ratings yet

- Damodaran - Discounted Cash Flow ValuationDocument198 pagesDamodaran - Discounted Cash Flow ValuationYến NhiNo ratings yet

- Capital Budgeting Under UncertaintyDocument30 pagesCapital Budgeting Under UncertaintyJyoti YadavNo ratings yet

- Cash Flow Valuation MethodsDocument5 pagesCash Flow Valuation Methodssan_lookNo ratings yet

- CHAPTER II - Financial Analysis and PlanningDocument84 pagesCHAPTER II - Financial Analysis and PlanningTamiratNo ratings yet

- 4) Vid 005-dcf - Discounted-Cash-Flow-Model PDFDocument3 pages4) Vid 005-dcf - Discounted-Cash-Flow-Model PDFAkshit SoniNo ratings yet

- 4 The Firm's Capital Structure and Degree of LeverageDocument9 pages4 The Firm's Capital Structure and Degree of LeverageMariel GarraNo ratings yet

- S6 Cost of Capital Online VersionDocument28 pagesS6 Cost of Capital Online Versionconstruction omanNo ratings yet

- Public Debt: Sir WaheedliaqatDocument7 pagesPublic Debt: Sir WaheedliaqatusamaNo ratings yet

- Financial StatementsDocument17 pagesFinancial StatementsFuzuliNo ratings yet

- Ch03 ShowDocument54 pagesCh03 ShowMahmoud AbdullahNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Ratio AnalysisDocument66 pagesRatio AnalysisRenny WidyastutiNo ratings yet

- CHAPTER II - Financial Analysis and PlanningDocument84 pagesCHAPTER II - Financial Analysis and PlanningMan TKNo ratings yet

- LeverageDocument8 pagesLeverageTHE SHAYARI HOUSENo ratings yet

- 6U CedarDocument28 pages6U CedarGagan SawhneyNo ratings yet

- Risk, Return and Capital Budgeting: For 9.220, Term 1, 2002/03 02 - Lecture15.ppt Student VersionDocument27 pagesRisk, Return and Capital Budgeting: For 9.220, Term 1, 2002/03 02 - Lecture15.ppt Student VersionZee ZioaNo ratings yet

- Liv PDFDocument24 pagesLiv PDFravi sharmaNo ratings yet

- Ratio AnalysisDocument29 pagesRatio AnalysisatharNo ratings yet

- Cost of CapitalDocument24 pagesCost of CapitalVincitta MuthappanNo ratings yet

- ECN 3422 - Lecture 9 - 2021.10.26Document32 pagesECN 3422 - Lecture 9 - 2021.10.26Cornelius MasikiniNo ratings yet

- Fm-May-June 2015Document18 pagesFm-May-June 2015banglauserNo ratings yet

- Financial Statement Ratio Analysis: Your Company, IncDocument4 pagesFinancial Statement Ratio Analysis: Your Company, IncPeninahNo ratings yet

- Assessment-3b-2 (1) (AutoRecovered)Document6 pagesAssessment-3b-2 (1) (AutoRecovered)Trúc NguyễnNo ratings yet

- LectureDocument29 pagesLectureatharNo ratings yet

- Distress PDFDocument65 pagesDistress PDFKhushal UpraityNo ratings yet

- Topic 8Document7 pagesTopic 8黄芷琦No ratings yet

- Week 3 Asset Based Valuation Part 2 MG3Document26 pagesWeek 3 Asset Based Valuation Part 2 MG3VENICE MARIE ARROYONo ratings yet

- Strategic Financial ManagementDocument28 pagesStrategic Financial ManagementDayana MasturaNo ratings yet

- TROW Q1 2022 Earnings ReleaseDocument15 pagesTROW Q1 2022 Earnings ReleaseKevin ParkerNo ratings yet

- Draft 4Document19 pagesDraft 4Zarif TajwarNo ratings yet

- 2019-09-21T174353.577Document4 pages2019-09-21T174353.577Mikey MadRat100% (1)

- Cost of Capital: Risk & ReturnDocument27 pagesCost of Capital: Risk & ReturnKrisi ManNo ratings yet

- CorpFin 2021 Fall 2 Risk Lecture 11Document27 pagesCorpFin 2021 Fall 2 Risk Lecture 11Krisi ManNo ratings yet

- 3rd Presentation 2020Document51 pages3rd Presentation 2020Camila Arango PérezNo ratings yet

- InsuranceDocument15 pagesInsurancekananguptaNo ratings yet

- Weighted Average Cost of Capital (WACC)Document1 pageWeighted Average Cost of Capital (WACC)hukaNo ratings yet

- Cours 2 Essec 2018 Lbo PDFDocument81 pagesCours 2 Essec 2018 Lbo PDFmerag76668No ratings yet

- Damodaran - Value CreationDocument27 pagesDamodaran - Value Creationishuch24No ratings yet

- Gross Profit - Margin RatioDocument16 pagesGross Profit - Margin RatioaaronNo ratings yet

- Cost of CapitalDocument16 pagesCost of CapitalParth BindalNo ratings yet

- Sfas 109-EeDocument132 pagesSfas 109-EekyougiNo ratings yet

- Sbi-Nifty Index Fund September-2022Document1 pageSbi-Nifty Index Fund September-2022kumarNo ratings yet

- CREDO PresentationDocument23 pagesCREDO PresentationPampalini01No ratings yet

- Rajat Agarwal ResumeDocument2 pagesRajat Agarwal ResumeAditya PrakashNo ratings yet

- UIN Information System ("UIS") : Frequently Asked Questions (FAQ's)Document7 pagesUIN Information System ("UIS") : Frequently Asked Questions (FAQ's)Syed Hareem Ul HasanNo ratings yet

- Acknowledgement: These Slides Have Been Adapted FromDocument56 pagesAcknowledgement: These Slides Have Been Adapted FromagnesNo ratings yet

- ABRAHAM ADESANYA POLYTECHNI2 Mr. OlabamijiDocument12 pagesABRAHAM ADESANYA POLYTECHNI2 Mr. OlabamijiRasheed Onabanjo DamilolaNo ratings yet

- Chapter-I: Sjcet Mba Dept 1Document78 pagesChapter-I: Sjcet Mba Dept 1thouseef06No ratings yet

- Prudential Bank Vs CADocument2 pagesPrudential Bank Vs CAKent UgaldeNo ratings yet

- Solutions For End-of-Chapter Questions and Problems: Chapter OneDocument14 pagesSolutions For End-of-Chapter Questions and Problems: Chapter Onejl123123No ratings yet

- Discussion 4 FinanceDocument5 pagesDiscussion 4 Financepeter njovuNo ratings yet

- Grant and Funding From MyCreative Ventures CorporateDocument27 pagesGrant and Funding From MyCreative Ventures CorporateMegat Zainurul Anuar bin Megat JohariNo ratings yet

- Derivatives - 8 - Binomial Option Pricing ModelDocument73 pagesDerivatives - 8 - Binomial Option Pricing ModelHins LeeNo ratings yet

- Your Club: TreasurerDocument32 pagesYour Club: TreasurerPreetham RajalabandiNo ratings yet

- Firstcry Startup by PrasanthDocument9 pagesFirstcry Startup by PrasanthSrilaya GudlaNo ratings yet

- MSE604 Ch. 8 - Price Changes & Exchange RatesDocument18 pagesMSE604 Ch. 8 - Price Changes & Exchange RatesFerrolinoLouieNo ratings yet

- Public Investment Fund - Saudi ArabiaDocument92 pagesPublic Investment Fund - Saudi Arabiaace187100% (2)

- Microsoft Dynamics AX Cube and KPI Refer PDFDocument138 pagesMicrosoft Dynamics AX Cube and KPI Refer PDFVictor FadeevNo ratings yet

- Introduction To Risk ManagementDocument16 pagesIntroduction To Risk ManagementJenniferNo ratings yet

- Officer Scale English Part - pdf-55 PDFDocument9 pagesOfficer Scale English Part - pdf-55 PDFGaurav TajaneNo ratings yet

- Practice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Document3 pagesPractice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Sumit Kumar SahooNo ratings yet

- Impact of Dividend Policy On Firm Performance: An Empirical Evidence From Pakistan Stock ExchangeDocument7 pagesImpact of Dividend Policy On Firm Performance: An Empirical Evidence From Pakistan Stock ExchangeZeeni KhanNo ratings yet

- 5.2 Converting Between Fractions Decimals and PercentsDocument10 pages5.2 Converting Between Fractions Decimals and PercentsKent WhiteNo ratings yet

- Daily Commodities Coverage: Commodity ResearchDocument6 pagesDaily Commodities Coverage: Commodity ResearchThe red RoseNo ratings yet

- FMI Long Questions EditedDocument7 pagesFMI Long Questions EditedChanna KeshavaNo ratings yet