Professional Documents

Culture Documents

Tax Rebate 80ccf Ifci Long Term Infra Bond

Tax Rebate 80ccf Ifci Long Term Infra Bond

Uploaded by

Investmentstartegy TipsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Rebate 80ccf Ifci Long Term Infra Bond

Tax Rebate 80ccf Ifci Long Term Infra Bond

Uploaded by

Investmentstartegy TipsCopyright:

Available Formats

Private & Confidential ot for Circulation

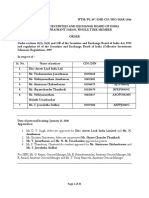

[This is a Disclosure Document prepared in conformity with Securities and Exchange Board of India (Issue and Listing of Debt Securities), Guidelines, 2008] PRIVATE PLACEME T OF 80CCF TAX SAVI G IFCI LO G TERM I FRASTRUCTURE BO DS - SERIES-III I FORMATIO MEMORA DUM IFCI LIMITED Registered & Corporate Office: IFCI Tower, 61, Nehru Place, New Delhi - 110019 Tel No.: (011) 41792800, 41732000 Fax No. 91-11- 26230029, 26230466 E-mail: infrabonds@ifciltd.com, Website: www.ifciltd.com

PRIVATE PLACEME T OF IFCI LO G TERM I FRASTRUCTURE BO DS- SERIES III OF RS.5,000/- EACH FOR CASH AT PAR WITH BE EFITS U DER SECTIO 80CCF OF THE I COME TAX ACT, 1961 REGISTRAR TO THE ISSUE TRUSTEE FOR THE BO DHOLDERS

Karvy Computershare Private Limited

Plot nos.17-24, Vittal Rao Nagar Madhapur, Hyderabad 500 081 Toll Free No.1-800-3454001 Tel : +91 40 4465 5000 Fax: +91 40 2343 1551

IDBI Trusteeship Services Limited Asian Building, Gr. Floor, 17, R. Kamani Marg, Ballard Estate, Mumbai - 400 001 Tel: (022) 4080 7000 Fax: (022) 6631 1776

ISSUE OPE S O ISSUE CLOSES O DEEMED DATE OF ALLOTME T

September 21, 2011 ovember 14, 2011 December 12, 2011

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

ARRA GERS TO THE ISSUE (In alphabetical order)

Almondz Global Securities Limited 2nd Floor, 3 Scindia House Janpath, New Delhi - 110 001

Bajaj Capital Limited th Bajaj House, 5 Floor 97, Nehru Place, New Delhi-110 019

ICICI Securities Ltd. Shree Sawan Knowledge Park, Plot NO. D-507, T.T .C. Industrial Area, M.I.D.C., strial Turbhe, Navi Mumbai- 400 706

IFCI Financial Services Ltd. 2B (1), Ground Floor, Film Centre 68, Tardeo Road, Mumbai 400 034

Karvy Investor Services Limited 2nd Floor, Regent Chambers, Nariman Point,Mumbai - 400 021 Tel: D +91 22-22895190/5174 Fax : +91 22-30204040

RR Investors Capital Services Pvt Ltd 47, M M Road, Rani Jhansi Marg, Jhandewalan, New Delhi 110 055 Tel: 011-23636362/63, 9312940483 23636362/63, Fax: 011-23636666

Stock Holding Corporation of India Ltd. SHCIL HOUSE , Plot No. P - 51 , T.T.C. Industrial Area, MIDC , Mahape , Navi Mumbai - 400710 Tel:(022) 61778500 Fax No. : (022) 61779049

SBICAP Securities Limited

Mafatlal Chambers, C wing, 2nd Floor, N M Joshi Marg, Lower Parel, Mumbai - 13 Tel : 022-4227 3446 Fax no: 022-4227 3390

TRUST I VESTME T ADVISORS PVT. LTD.

109/110, Balrama, 1st Bandra Kurla Complex, Bandra (East), Mumbai 400051. TelNo. 022-408450002

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

TABLE OF CO TE TS I II III IV DEFI ITIO S/ABBREVIATIO S......4 DISCLAIMER STATEME T.......................................................................................................6 RISK FACTORS..............................................................................................................................7 GE ERAL I FORMATIO ........................................................................................................12 i. ii. iii. iv. v. vi. vii. viii. ix. V Registration Arrangers Registrar Trustees Bankers Credit Rating Listing Future Resource raising Permission/consent from prior creditors

THE ISSUE A. ISSUE STRUCTURE (SUMMARY)................................................................................16 B. TERMS OF THE ISSUE....................................................................................................17 i. Issue ii. Subscription related payments iii. Title iv. Nomination v. Transfer vi. Interest vii. Tenor & Redemption viii. Modes of payment ix. Debentures Trustee x. Rights of bondholders

VI VII

STATEME T OF TAX BE EFITS..........................................................................................31 PROCEDURE OF APPLICATIO ...........................................................................................33 i. ii. iii. iv. v. Who can apply How to apply Payment Instructions Rejection of Applications Letters of allotment/refund order

VIII

ABOUT IFCI LTD.......................................................................................................................39 i. ii. iii. iv. Background and Main Objects Board of Directors Operational performance Details of other borrowings

IX

APPE DICES i. Notification for issuance of Infrastructure Bonds........................................................51 ii. Rating assignment letters........................................................................................53-58 iii. Consent letter of Debenture Trustee............................................................................59 iv. List of Collecting Branches.........................................................................................60

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

DEFI ITIO S/ ABBREVIATIO S Arrangers Almondz Global Securities Ltd., Bajaj Capital Ltd., ICICI Securities Ltd., IFCI Financial Services Ltd., Karvy Investor Services Ltd., RR Investors Capital Services Ltd., SBICAP Securities Ltd., Stock Holding Corporation of India Ltd. and Trust Investment Advisors Pvt. Ltd. Articles of Association of IFCI Ltd. The Board of Directors of IFCI Ltd. or Committee thereof Unsecured, Redeemable, Non-Convertible Bonds Series-III having benefits under section 80 CCF of the Income Tax, 1961 for Long Term Infrastructure Bonds The date of closure of register of Bonds for payment of interest and repayment of principal The amount specified as the buyback amount for the various options of bonds The date on which the buyback of the Bonds shall be effected by the Company The period during which the request of investor for buyback should be received by the Issuer Capital Adequacy Ratio Central Depository Services (India) Ltd. IFCI Limited Non-Convertible debt securities which create or acknowledge indebtedness and include debenture, bonds and such other securities of the Issuer, whether constituting a charge on the assets of the Issuer or not, but excludes security receipts and securitized debt instruments A Depository registered with SEBI under the SEBI (Depositories and Participant) Regulations, 1996, as amended from time to time The Depositories Act, 1996, as amended from time to time. A Depository participant as defined under Depositories Act Bombay Stock Exchange Ltd. Debt Equity Ratio Director(s) of IFCI Ltd. unless otherwise mentioned Disclosure Document dated September 20, 2011 for Private Placement of Unsecured, Redeemable, Non-Convertible Bonds Series III having benefits under section 80 CCF of the Income Tax, 1961 for Long Term Infrastructure Bonds Depository Participant Earning Per Share Financial Institutions Foreign Institutional Investors Period of twelve months period ending March 31, of that particular year Government of India/ Central Government Hindu Undivided Family 4

Articles Board/ Board of Directors Bonds

Book Closure/ Record Date Buyback Amount Buyback Date Buyback Intimation Period CAR CDSL Company Debt Securities

Depository Depositories Act Depository Participant Designated Stock Exchange DER Director(s) Disclosure Document

DP EPS FIs FIIs Financial Year/ FY GoI HUF

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

Issuer/ IFCI/ Company IFCI Ltd. I.T. Act The Income Tax Act, 1961, as amended from time to time Listing Agreement Listing Agreement for Debt Securities issued by Securities and Exchange Board of India vide circular no. SEBI/IMD/BOND/1/2009/11/05 dated May 11, 2009 and Amendments to Simplified Debt Listing Agreement for Debt Securities issued by Securities and Exchange Board of India vide circular no.SEBI/IMD/DOF-1/BOND/Cir-5/2009 dated November 26, 2009 and Amendments to Simplified Debt Listing Agreement for Debt Securities issued by Securities and Exchange Board of India vide Circular No. SEBI/IMD/DOF-1/BOND/Cir-1/2010 dated January 07, 2010 MoF Ministry of Finance Notification Notification SO.2060(E) No.50/2011/F.No.178/43/2011-SO(ITA.1)

dated September 9, 2011, issued by CBDT, Deptt. of Revenue, Ministry of Finance, Government of India

NPAs NRIs NSDL OCBs PAN PLR Rs. RBI RTGS Registrar SEBI SEBI Act SEBI Regulations Non Performing Assets Non Resident Indians National Securities Depository Ltd. Overseas Corporate Bodies Permanent Account Number Prime Lending Rate Indian National Rupee Reserve Bank of India Real Time Gross Settlement Registrar to the Issue, in this case being Karvy Computershare Pvt. Ltd. The Securities and Exchange Board of India, constituted under the SEBI Act, 1992 Securities and Exchange Board of India Act, 1992, as amended from time to time Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations, 2008 issued vide Circular No. LADNRO/GN/2008/13/127878 dated June 06, 2008 Tax Deducted at Source The Companies Act, 1956 as amended from time to time Issue through Private Placement of 2,00,000 Unsecured, Redeemable, NonConvertible Long Term Infrastructure Bonds Series-III having benefits under section 80 CCF of the Income Tax Act, 1961, for Long Term Infrastructure Bonds (in the nature of promissory notes of Rs.5000/- each) with unspecified green shoe option, to retain over-subscription for issuance of additional Infrastructure Bonds.

TDS The Companies Act/ The Act The Issue/ The Offer/ Private Placement

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

DISCLAIMER STATEMENT This Information Memorandum is neither a Prospectus nor a statement in lieu of Prospectus. It does not constitute an offer or an invitation to the Public to subscribe to the IFCI Long Term Infrastructure Bonds issued by IFCI Limited. This Information Memorandum is not intended for distribution and is for the consideration of the person to whom it is addressed and should not be reproduced/redistributed by the recipient. It cannot be acted upon by any person other than to whom it has been specifically addressed. Multiple copies hereof given to the same entity shall be deemed to be offered to the same person. The securities mentioned herein are being issued strictly on a private placement basis and this offer does not constitute a public offer/invitation. This Information Memorandum is not intended to form the basis of evaluation for the potential investors to whom it is addressed and who are willing and eligible to subscribe to these IFCI Long Term Infrastructure Bonds issued by IFCI. This Information Memorandum has been prepared to give general information regarding IFCI to parties proposing to invest in this issue of IFCI Long Term Infrastructure Bonds and it does not purport to contain all the information that any such party may require. IFCI and the Arrangers do not undertake to update this Information Memorandum to reflect subsequent events and thus it should not be relied upon without first confirming its accuracy with IFCI. Potential investors are required to make their own independent valuation and judgment before making the investment and are believed to be experienced in investing in debt markets and are able to bear the economic risk of investing in the Bonds. It is the responsibility of potential investors to have obtained all consents, approvals or authorisation required by them to make an offer to subscribe for, and purchase the Bonds. Potential investors should not rely solely on information in the Information Memorandum or by the Arrangers nor would providing of such information by the Arrangers be construed as advice or recommendation by the Issuer or by the Arrangers to subscribe to and purchase the Bonds. Potential investors also acknowledge that the Arrangers do not owe them any duty of care in respect of their offer to subscribe for and purchase of the Bonds. It is the responsibility of potential investors to also ensure that they will sell these Bonds in strict accordance with this Information Memorandum and other applicable laws, and that the sale does not constitute an offer to the public within the meaning of the Companies Act, 1956. Potential investors should also consult their own tax advisors on the tax implications of the acquisitions, ownership, sale and redemption of Bonds and income arising thereon. The Company may have included statements in this Information Memorandum, which contain words or phrases such as will, would, aim, aimed, will likely result, is likely, are likely, believe, expect, expected to, will continue, will achieve, anticipate, estimate, estimating, intend, plan, contemplate, seek to, seeking to, trying to, target, propose to, future, objective, goal, project, should, can, could, may, will pursue, our judgment and similar expressions or variations of such expressions, that are forward-looking statements. Actual results may differ materially from those suggested by the forward-looking statements due to certain risks or uncertainties associated with the Companys expectations. By their nature, certain market risk disclosures are only estimates and could be materially different from what actually occurs in the future. As a result, actual future gains, losses or impact on net interest income and net income could materially differ from those that have been estimated.

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

RISK FACTORS Prospective investors should carefully consider the risks and uncertainties described below, in addition to the other information contained in this Information Memorandum before making any investment decision relating to the Issue. Investors must rely on their own examination of the Company and this Issue, including the risks and uncertainties involved. I TER AL RISK FACTORS 1) CREDIT RISK As a financial institution, the risk of default and non-payment by borrowers and other counterparties is one of the most significant risks which may affect our profitability and asset quality. Our loan portfolio consists of loans provided to large corporates, and medium scale enterprises, with the earlier segment constituting a significant portion of our portfolio. While large corporate customers are generally stable in their risk profile, the relatively large sized single ticket exposures to the same can impact profitability and result in NPAs on even a small number of defaults. The borrowers and/or guarantors and/or third parties may default in their repayment obligations due to various reasons including insolvency, lack of liquidity, and operational failure. Besides macroeconomic conditions, we face risks specific to each line of our business. Though the Companys total provisioning against the NPAs, with 94% provision coverage, may be considered at present adequate to cover all the identified losses in the loan portfolio, there may not be any assurance that in the future, provisioning levels, though compliant with regulatory requirements, will be sufficient to cover all anticipated losses. This is because the Company may not be able to meet our recovery targets for NPAs set for the particular fiscal year due to the general economic slowdown at both global and domestic levels and other factors mentioned above. 2) HIGHER COST OF BORROWI GS We may not be able to access funds at competitive rates and such higher cost of borrowings could have a significant impact on the scale of our operations and on our profit margins. Our growing business needs would require us to raise funds through commercial borrowings. Our ability to raise funds at competitive rates would depend on our credit rating, regulatory, economic and financial markets environment in the country and on the price and availability of liquidity in the financial markets. Besides any domestic developments, changes in the international markets also affect the Indian interest rate environment, and may relatively impact our borrowing costs. A substantial position of our borrowing is on floating interest rate basis, which has been rising due to policy rate hikes by RBI. Further increase in interest rates would affect the NIM and profitability of the company adversely. We may also face certain restrictions in raising lower cost sources of funds from international markets, which could affect our ability to carry out business operations and expansion plans. 3) DELAY I E FORCI G COLLATERAL The Company may experience delays in enforcing its collateral when borrowers default on their obligations to the Company, which may result in failure to recover the expected value of collateral security, exposing it to a potential loss. A substantial portion of the Companys loans to corporate customers are secured by real assets, including property, plant and equipment. In some cases, the Company may have taken further security 7

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

of a first or second charge on fixed assets, a pledge of financial assets like marketable securities, corporate guarantees and personal guarantees. Although in general the Companys loans are overcollateralized, an economic downturn could result in a fall in relevant collateral values for the Company. In India, foreclosure on immovable property generally requires a written petition to an Indian court or tribunal. An application, when made, may be subject to delays and administrative requirements that may result, or be accompanied by, a decrease in the value of the immovable property. Security created on shares of a borrower can be enforced without court proceedings. However, there can be delays in realization in the event that the borrower challenges the enforcement in an Indian court. In the event a corporate borrower makes a reference to a specialized quasi-judicial authority called the Board for Industrial and Financial Reconstruction (BIFR), foreclosure and enforceability of collateral is stayed. The Company may not be able to realize the full value on its collateral as a result of, among other factors, delays in bankruptcy and foreclosure proceedings, defects in the registration of collateral and fraudulent transfers by borrowers. A failure to recover the expected value of collateral security could expose the Company to a potential loss. Any unexpected loss could adversely affect the Companys business, its future financial performance and the trading price of the Bonds. 4) RISK OF MO EY LAU DERI G ACTIVITIES The Company may not be able to detect money-laundering and other illegal or improper activities fully or on a timely basis, which could expose it to additional liability and harm its business or reputation The Company is required to comply with applicable anti-money-laundering and anti-terrorism laws and other regulations in India. These laws and regulations require the Company, among other things, to adopt and enforce know-your-customer policies and procedures and to report suspicious and large transactions to the applicable regulatory authorities in different jurisdictions. While the Company has adopted policies and procedures aimed at detecting and preventing the use of its network for moneylaundering activities and by terrorists and terrorist-related organizations and individuals generally, such policies and procedures may not completely eliminate instances where the Company may be used by other parties to engage in money-laundering and the relevant government agencies to whom the Company reports have the power and authority to impose fines and other penalties. In addition, the Companys business and reputation could suffer. 5) CO TI GE T LIABILITIES Devolvement of Contingent Liabilities could adversely impact the Companys profitability. As on March 31, 2011, the company had contingent liabilities of about Rs.165 crore in respect of guarantees issued, bank/performance guarantees, claims not acknowledged as debts and disputed tax liabilities etc. as against contingent liabilities of about Rs. 430 crore as on March 31, 2010. These liabilities, if devolved on the Company, may adversely affect the financial performance of the Company and the trading price of the Bonds. 6) DEBE TURE REDEMPTIO RESERVE o Debenture Redemption Reserve (DRR) for Bonds The Department of Company Affairs General Circular No.9/2002 on 6/3/2001-CL.V dated April 18, 2002 specifies that no DRR is required to be maintained by NBFCs for privately placed debentures. Therefore IFCI, an NBFC, shall not bemaintaining any DRR in respect of the Bonds issued and theBondholders may find it difficult to enforce their interests in the event of or to the extent of default. 8

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

7) SYSTEMS A D TECH OLOGY System failures and infrastructure bottlenecks in computer systems may adversely affect our business Our business is highly dependent on our ability to process, on a daily basis, a large number of transactions. Our financial, accounting or other data processing systems may fail to operate adequately or may become disabled as a result of events that are wholly or partially beyond our control, including a disruption of electrical or communications services. These circumstances could affect our operations and/or result in financial loss, disruption of our businesses and/or damage to our reputation. In addition, our ability to conduct business may be adversely impacted by a disruption in the infrastructure that supports our businesses and the localities in which we are located. Significant security breaches could adversely impact the Companys business The Company seeks to protect its computer systems and network infrastructure from physical breakins as well as security breaches and other disruptions caused by increased use of technology including the internet. Computer break-ins and power disruptions could affect the security of information stored in and transmitted through these computer systems and network infrastructure. Although the Company intends to continue to implement security technology and establish operational procedures to prevent break-ins, failed security measures could have a material adverse effect on the Companys business, its future financial performance and the trading price of the Bonds. 8) LIQUIDITY CO CER S We may face asset-liability mismatches, which could affect our liquidity position The difference between the value of assets and liabilities maturing, in any time period category provides the measure to which we are exposed to the liquidity risk. However, a large portion of our liabilities have medium to long-term maturities and asset-liability cumulative gap is positive. Still, on account of unforeseen factors, the funding mismatches could happen, which could have an adverse effect on our business and future financial performance. 9) LIQUIDITY OF BO DS The current trading of our existing listed privately placed unsecured non-convertible bonds may not reflect the liquidity of the Bonds We have offered other unsecured non-convertible bonds from time to time, on private placement basis, which have been listed on BSE. There can be no assurance that an active public market for the Bonds will develop, and if such a market were to develop, there is no obligation on us to maintain such a market. 10) CHA GES I SYSTEMIC I TEREST RATES Changes in interest rates may affect the price of the Bonds All securities where a fixed rate of interest is offered, such as the Bonds, are subject to price risk. The price of such securities will vary inversely with changes in prevailing interest rates, i.e. when interest rates rise, prices of fixed income securities fall and when interest rates drop, the prices increase. The extent to which prices increase or decrease is a function of the existing coupon, days to maturity and the extent to which prevailing interest rates increase or decrease.

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

11) CHA GES I RATI G Any downgrade in the credit ratings of our Bonds may affect the value of the Bonds and thus our ability to refinance our debt. Brickwork Ratings, ICRA and CARE Ratings have assigned the rating of BWR AA-, LA and CARE A respectively, for issue of these Bonds for long term borrowings of the Company. The Issuer cannot guarantee that these ratings will not be downgraded. The Rating Agencies have the right to revise/suspend/withdraw the ratings in future on the basis of any information etc. Any downgrades in rating may affect our ability to refinance our debt and lower the price of the Bond. 12) LEGAL PROCEEDI GS The Company is involved in legal proceedings arising from its operations from time to time The Company is involved in various litigations which have mostly arisen out of its operations, when the Company seeks to recover its dues from the borrowers. The Company is also involved in various legal cases by its customers, employees, seeking claims/compensation. The Company does not make provisions or disclosure in its financial investments where in its assessment, the risk is insignificant. Adverse decisions against the Company in major cases may affect its financial performance adversely.

A. EXTER AL RISK FACTORS 1) I TEREST RATE RISK A large part of the Companys loans are disbursed at fixed rates for specific tenures which may differ from its funding sources and therefore interest rate fluctuations could impact the Companys margins as well as profitability. Our Companys business is largely dependent on interest income from our operations. We are exposed to interest rate risk principally as a result of lending to customers at interest rates and in amounts and for periods, which may differ from the funding sources (institutional/bank borrowings and debt offerings). We endeavour to match our interest rate positions to minimize our interest rate risk. Despite these efforts, there can be no assurance that significant interest rate movements will not have an effect on the results of our operations. Any adverse/unexpected movements in interest rates may affect our profitability. 2) MATERIAL CHA GES I LEGISLATIO / EW LEGISLATIO Regulatory changes in India could adversely affect our business. Changes in laws and regulations or to the regulatory or enforcement environment in India may have an adverse effect on the products or services we offer, on the value of our assets or on the collateral available for our loans or on our business in general. 3) SLOWDOW I ECO OMIC GROWTH A slowdown in economic growth could cause the Companys business to suffer. The Companys performance and the quality and growth of its assets are necessarily dependent on the health of the Indian economy as well as on global economic conditions. An economic slowdown could adversely affect our business, including our ability to grow our asset portfolio, to maintain the

10

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

quality of our assets and to implement our strategy. The domestic economy could be adversely affected by a variety of domestic as well as global factors. 4) FORCE MAJEURE Our business may be adversely impacted by natural calamities or unfavourable climatic changes. India has experienced natural calamities such as earthquakes, floods, droughts and a tsunami in recent years. India has also experienced pandemics, including the outbreak of avian flu and swine flu. The extent and severity of these natural disasters and pandemics determine their impact on the economy and in turn their effect on the financial services sector of which our Company is a part. Prolonged spells of abnormal rainfall and other natural calamities could have an adverse impact on the economy which in turn could adversely affect our results of operations. 5) COMPETITIO The Company faces increasing competition from other established banks and other The success of our business depends on our ability to face the competition.

BFCs.

The Companys main competitors are established commercial banks and other NBFCs. Over the past few years, the infrastructure financing area has seen the entry of banks, both public and private sectors as well as foreign. Banks have access to low cost funds which could enable them to offer finance to our customers at lower rates, thereby reducing our Companys margins as well as attracting quality customers.

11

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

GE ERAL I FORMATIO Registration IFCI Ltd. was established in 1948 by an Act of Parliament and subsequently corporatised in 1993.Our Company holds a certificate of registration dated August 18, 2009 bearing registration no.B-14.00009 issued by the RBI to carry on the activities of a NBFC under section 45 IA of the RBI Act, 1934. Corporate Identification Number is: L74899DL1993PLC053677 issued by the Registrar of Companies,

Registered Office IFCI Tower, 61 Nehru Place, New Delhi 110 019

Board of Directors of IFCI as on September 1, 2011: ame Shri P. G. Muralidharan Shri Atul Kumar Rai Shri Umesh Kumar Shri Sanjeev Kumar Jindal Shri Shilabhadra Banerjee Shri Prakash P Mallya Shri Rakesh Bharti Mittal Smt. Usha Sangwan Prof. Shobhit Mahajan Shri Omprakash Mishra Shri K. Raghuraman Shri S. Shabbeer Pasha Shri Sujit K. Mandal Designation Non-Executive Chairman of the Board Chief Executive Officer and Managing Director Govt. Nominee Govt. Nominee Independent Director Independent Director Independent Director Independent Director Independent Director Independent Director Independent Director Independent Director Whole Time Director

For further details on the IFCIs Management, please refer Chapter VIII of this Information Memorandum. Compliance Officer Ms.Rupa Deb, Company Secretary Tel.: 91 11 41732104 Fax: 91 11 26230206 Email: complianceofficer@ifciltd.com Contact Person Ms Barkha Chhabra, Sr. Associate Vice President Tel.: 011-26488473 Fax: 011-26230029 Email: barkha.chhabra@ifciltd.com

12

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

ARRA 1. 2. 3. 4. 5. 6. 7. 8. 9.

GERS TO THE ISSUE Almondz Global Securities Ltd. Bajaj Capital Ltd. ICICI Securities Ltd. IFCI Financial Services Ltd. Karvy Investor Services Ltd. RR Investors Capital Services Pvt. Ltd. SBICAP Securities Ltd. Stock Holding Corporation of India Ltd. Trust Investment Advisors Ltd.

REGISTRAR TO THE ISSUE Karvy Computershare Private Limited has been appointed as Registrar to the Issue. The Registrar will monitor the applications while the private placement is open and will coordinate the post private placement activities of allotment, dispatch of interest warrants etc. Investors can contact the Registrar in case of any post-issue problems such as non receipt of letters of allotment, demat credit, physical bond certificate, refund orders, interest on application money. TRUSTEE IDBI Trusteeship Services Limited has given its consent to act as the Trustee to the proposed Issue and for its name to be included in this Information Memorandum. All remedies of the Bond holder(s) for the amount due on the Bonds will be vested with the Trustees on behalf of the Bond holders. The holders of the Bonds shall without any further act or deed be deemed to have irrevocably given their consent to and authorised the trustees to do inter-alia, all acts, deeds, and things necessary for servicing the Bonds being offered.

BA KER TO THE ISSUE HDFC Bank, HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai- 400 013

CREDIT RATI G Brickwork Ratings India (P) Ltd. (BRICKWORK) has vide its letter No. BWR/BLR/RA/2011-12/0061 dated May 24, 2011 assigned credit rating of "BWR AA- (pronounced as BWR Double A Minus) with positive outlook for long term bonds. Instruments with this rating are considered to offer High Credit Quality in terms of timely servicing of debt obligations. Credit Analysis and Research Ltd. (CARE Ratings) has vide its letter dated May 30, 2011 assigned credit rating of "CARE A+ to the Bonds. Instruments with this rating are considered to offer Adequate Safety for timely servicing of debt obligations. ICRA has vide its letter dated May 18, 2011 assigned credit rating of "LA with stable outlook for long term bonds of IFCI. Instruments with this rating have adequate credit quality and carries average credit risk.

13

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

Copies of rating letters received from BRICKWORK, CARE Ratings & ICRA are enclosed as appendix to this Information Memorandum. The above rating is not a recommendation to buy, sell or hold securities and investors should take their own decision. The Rating Agencies have the right to revise/suspend/withdraw the rating at any time on the basis of new information etc. LISTI G The Bonds are proposed to be listed on the Bombay Stock Exchange (BSE). IFCI has applied for inprinciple approval from the BSE for listing of IFCI Long Term Infrastucture Bonds Series-III. After closure of the issue, IFCI shall make an application to the BSE to list the Bonds to be issued and allotted under this Information Memorandum and complete all the formalities relating to listing of the Bonds within reasonable time. In connection with listing of Bonds with BSE, IFCI hereby undertakes that: It shall comply with conditions of listing of Bonds as may be specified in the Listing Agreement with BSE. Rating obtained by IFCI shall be periodically reviewed by the credit rating agency and any revision in the rating shall be promptly disclosed by IFCI to BSE. Any change in rating shall be promptly disseminated to the holder(s) of the Bonds in such manner as BSE may determine from time to time. The Company, the Trustees and BSE shall disseminate all information and reports on Bonds including compliance reports filed by the Company and the Trustees regarding the Bonds to the holder(s) of Bonds and the general public by placing them on their websites.

ISSUE PROGRAMME The Issue shall remain open for subscription during banking hours for the period indicated below: ISSUE OPE S O ISSUE CLOSES O September 21, 2011 November 14, 2011

The issuer would have the right to pre-close the issue or extend the closing date by giving 1 day notice to the Arrangers. AUTHORITY FOR THE ISSUE This issue is being made pursuant to the Resolution of the Board of Directors of the Company, passed at its Meeting held on April 18, 2011 and the delegation provided there under. The current issue of bonds is within the overall borrowings limits set out in the resolution passed under section 293(1)(d) of the Companies Act, 1956. The Company can issue the bonds proposed by it in view of the present approvals and no further approvals in general from any Government Authority is required by it to undertake the proposed activity. OBJECTS OF THE ISSUE The objective of the issue is to raise funds for utilisation towards infrastructure lending.

14

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

The main objects clause of the Memorandum of Association of the Company permits the Company to undertake its existing activities as well as the activities for which the funds are being raised through this issue. UTILISATIO OF THE ISSUE PROCEEDS

The proceeds of the issue shall be utilized towards Infrastructure lending as defined by the RBI in the Guidelines issued by it from time to time, after meeting the expenditures of, & related to the issue. The Company is managed by professionals under the supervision of its Board of Directors. Further, the Company is subject to a number of regulatory checks and balances as stipulated in its regulatory environment. Therefore, the management shall ensure that the funds raised via this private placement shall be utilized only towards satisfactory fulfillment of the Objects of the Issue. Further, in accordance with the SEBI Debt Regulations, the Company will not utilize the proceeds of the issue for providing loans to or acquisition of shares of any person who is a part of the same group as the Company or who is under the same management as the Company or any subsidiary of the Company. The issue proceeds shall not be utilized towards full or part consideration for the purchase or any other acquisition, inter alia by way of a lease, of any property. FUTURE RESOURCE RAISI G IFCI will be entitled to borrow/raise loans or avail financial assistance both from domestic and international market as also issue Bonds/Equity Shares/Preference Shares/other securities in any manner ranking paripassu or otherwise and on terms and conditions as IFCI may think fit without the consent of or intimation to Bondholders or Trustees in this connection. PERMISSIO / CO SE T FROM PRIOR CREDITORS The Company hereby confirms that it is entitled to raise money through current issue of Long Term Infrastructure Bonds without the consent/permission/approval from the Bondholders/Trustees /Lenders/ other creditors of IFCI. Further the Bonds proposed to be issued under the terms of this Information Memorandum being unsecured there is no requirement for obtaining permission/consent from the prior creditors.

15

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

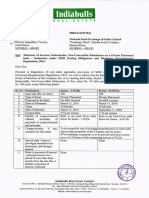

SUMMARY OF THE ISSUE PRIVATE PLACEME T IFCI LO G TERM I FRASTRUCTURE BO DS SERIES III The following is a summary of the IFCI Long Term Infrastructure Bonds- Series III Issue. The summary should be read in conjunction with, and is qualified in its entirety by, more detailed information in the section Terms of the Series III Issue. Common Terms

Issuer Offering IFCI Limited (the Issuer) 2,00,000 Nos. Unsecured, Redeemable, Non-Convertible Bonds SeriesIII (Rs.5,000/each aggregating to Rs.100 crore with a green-shoe option to retain over-subscription) Private Placement basis Unsecured, Redeemable, Non-Convertible Long Term Infrastructure Bonds - Series III having benefits under section 80CCF of the Income Tax, 1961 for long term Infrastructure Bonds Resident Indian Individuals (Major) and HUF through Karta of the HUF BWR AA by Brickwork Ratings India Pvt. Limited CAREA+ by CARE Ratings (Credit Analysis & Research Ltd.) LA by ICRA Limited Rs. 5000/- per bond Rs. 5,000/- (i.e. 1 bond) Rs. 5,000/- (i.e. 1 Bond) December 12, 2011 Unsecured The Bonds are Unsecured, Redeemable, Non-Convertible Bonds in the nature of Promissory Notes, having benefits under section 80 CCF of the Income Tax Act, 1961. IDBI Trusteeship Services Limited Proposed to be listed on Bombay Stock Exchange (BSE) National Securities Depository Ltd. and Central Depository Services (India) Ltd. Karvy Computershare Pvt. Ltd. Bonds shall be issued both in dematerialised form and physical form. However, trading allowed only in dematerialised mode after the expiry of Lock-in Period of 5 years ECS/At Par Cheques/Demand Drafts Issue Open Date : September 21, 2011 Issue Close Date : November 14, 2011 The issuer would have the right to pre-close the issue or extend the closing date by giving 1 day notice to the Arrangers

Type Instrument

Eligible Investors Rating

Face Value Minimum Application Application in multiples of Deemed Date of Allotment Security ature of indebtedness and ranking Trustee Listing Depositories Registrars Issuance & Trading

Mode of Interest Payment / Redemption Issue Schedule

16

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

The specific terms of available Options under this Infrastructure Bond Series III Issue are set out below: Options Frequency of Interest Payment Tenor Face Value (Rs./Bond) Issue Price (Rs./Bond) Terms of Payment I Cumulative 10 (Ten) years Rs. 5000/At par Full amount with application 8.50 % p.a. (Annual compounding) At the time of redemption II Annual 10 (Ten) years Rs. 5000/At par Full amount with application III Cumulative 15 (Fifteen) years Rs. 5000/At par Full amount with application 8.75 % p.a. (Annual compounding) At the time of redemption IV Annual 15 (Fifteen ) years Rs. 5000/At par Full amount with application

Coupon (% p.a.)

8.50% p.a. December 12 each year

8.75% p.a. December 12 each year

Coupon Payment Date Redemption/ Maturity Maturity Date Buyback Option Buyback Dates

At the end of 10 years from the deemed date of allotment December 12, December 12, 2021 2021 Yes Yes December 12 of the calendar years 2016 and 2018 August 12 to September 11 of the calendar years 2016 and 2018

At the end of 15 years from the deemed date of allotment December 12, December 12, 2026 2026 Yes Yes December 12 of the calendar years 2018, 2021 and 2023 August 12 to September 11 of the calendar years 2018, 2021 and 2023 5,000/N.A. 5,000 5,000 5,000

Buyback Intimation period

Redemption amount 11,305/5,000/17,596/(Rs. per bond) Redemption amount in case buy back option is exercised : (in Rs.) At the end of Year 5 7,519 5,000 N.A. Year 7 8,851 5,000 8,995 Year 10 N.A. N.A. 11,569 Year 12 N.A. N.A. 13,682 5 years from the deemed date of Allotment Lock-in period

Interest on Application Money shall be paid at the respective coupon from the date of realisation of subscription amount to the date immediately preceding the deemed date of allotment.

17

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

Terms of IFCI Long Term Infrastructure Bonds Series- III Issue The following are the terms and conditions of Bonds being offered under this Information Memorandum for an amount of Rs.100 crore with a green-shoe option to retain over-subscription.

1.

Issue

IFCI Limited (IFCI or Issuer or Company) is offering for subscription unsecured, redeemable, non-convertible bonds in the nature of promissory notes of Rs.5,000/- each for cash at par with benefits under section 80 CCF of the Income Tax Act, 1961 termed as Long Term Infrastructure Bonds (Infrastructure Bonds) by way of private placement ('the Issue).

2.

Status of Bonds

The Bonds are classified as long term infrastructure bonds and are being issued in terms of Section 80 CCF of the Income Tax Act and the Notification SO.2060(E) No.50/2011/F.No.178/43/2011-SO(ITA.1) issued by Central Board of Direct Taxes, Department of Revenue, Ministry of Finance, Government of India, A copy of the Notification is annexed to this Memorandum. The Infrastructure Bonds shall be redeemable, non-convertible and unsecured. In accordance with Section 80CCF of the Income Tax Act, the amount not exceeding Rs.20,000 per annum, paid or deposited as subscription to long term infrastructure bonds during the previous year i.e FY 2011-12 relevant to the assessment year beginning April 01, 2012 shall be deducted in computing the taxable income of a resident individual or HUF. Eligible investors can apply for up to any amount of the Bonds across any of the Options or a combination thereof. The investors will be allotted the total number of Bonds applied for in accordance with the Basis of Allotment.

3.

Face Value & Issue Price

The face value of each Bond is Rs.5000/- and is issued at par.

4.

Application size

Eligible investors can apply upto any amount of the Bonds across any of the Option(s) or a combination thereof. In case of multiple applications, which is two or more application forms submitted by a single applicant, the applications shall be aggregated bases on the PAN of the applicant.

5.

Subscription and Related Payments (a) Subscription

This Issue will open for subscription at the commencement of banking hours and close at the close of banking hours on the dates indicated: Issue Opens on : September 21, 2011 Issue Closes on : November 14, 2011 The issuer would have the right to pre-close the issue or extend the closing date by giving 1 day notice to the Arrangers. 18

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

(b)

Application amount

Application amount will be required to be made in full with the application. Any payment made in excess of application amount mentioned in the Application will be refunded to the applicant. No additional Bonds shall be issued for this excess of Application Amount, and the same shall be refunded along with issuance of other Refund Orders without any interest. Further, in case of allotment of lesser number of Bonds than the number applied for, the excess amount paid on Application shall be refunded to the applicant, without any interest in such refund amount. (c) Interest on Application Money

Interest on Application money will be paid at the respective coupon applicable for the particular option chosen. The interest shall be payable from the date of realisation of cheque/DD until one day prior to the Deemed Date of Allotment. No interest shall be payable in case of rejection of application on any count. (d) Tax Deduction at Source

Interest on Application money shall be paid with respect to the value of Bonds Allotted, subject to deduction of income tax at source under the Income Tax Act, as applicable. The interest on application money shall be paid on the deemed date of allotment.

6.

Deemed Date of Allotment

Deemed date of allotment shall be December 12, 2011. All benefits relating to the Bonds, to the extent permitted by law, will be available to the investors from the Deemed Date of Allotment. The actual allotment may occur on a date other than the Deemed Date of Allotment.

7.

Withdrawal by investors

Investors are allowed to withdraw their Application any time prior to closure of the Issue.

8.

Over-subscription amount

The issue size is Rs.100 crore with unspecified green shoe option. At its sole discretion, IFCI (the Issuer) will decide the amount of over-subscription to be retained over and above the basic Issue book size of Rs.100 crore, within the limit specified in the Notification.

9.

Basis of Allotment

In case the aggregate of subscription of bonds under this issue exceeds the limit, if any, upto which such bonds can be issued, as would be decided by IFCI, the Allotment of bonds shall be made in the following order of priority in consultation with the Registrar and the Registrar shall be responsible for ensuring that the Basis of Allotment is finalized in a fair and proper manner. (a) Full Allotment of Bonds to the Applicants on a first come first basis upto the date falling one day prior to the Oversubscription Date. 19

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

(b)For Applications received on the Oversubscription Date, the Bonds shall be allotted in the following order of priority: (i) Allotment to the Applicants for Option - I Bonds (ii) Allotment to the Applicants for Option - II Bonds (iii) Allotment to the Applicants for Option - III Bonds (iv) Allotment to the Applicants for Option - IV Bonds Provided, however, that in the event of oversubscription in any Option of Bonds mentioned in (i), (ii), (iii) and (iv) above, the Bonds shall be allotted proportionately in that respective Option, subject to the overall limit,and the Applications for the Bonds in subsequent Options shall be rejected. (c) All Applications received after the Oversubscription Date shall be rejected.

10.

Form

The Bonds being issued hereunder can be applied for in the dematerialised or physical form through a valid Application Form filled in by the applicant along with attachments, as applicable. The Bondholders holding the Bonds in dematerialised form shall deal with them in accordance with the provisions of the Depositories Act and/or rules as notified by the Depositories from time to time. The Bonds will be issued in Indian Rupees only. Subsequent to the issuance of the Bonds, a Bondholder holding bonds in dematerialised form may request the Depository to convert the demat bonds into physical form and provide a physical Bond certificate. In case of any Bonds rematerialised by a Bondholder in physical form, a single certificate will be issued to the Bondholder for the aggregate amount (Consolidated Bond Certificate) for each option of Bonds allotted to him under this Issue. In respect of Consolidated Bond Certificates, upon receipt of a request from the Bondholder, the company will split such Consolidated Bond Certificates into smaller denominations subject to the minimum of the Market Lot. No fees would be charged for splitting of Bond Certificates into Market Lots, but stamp duty payable, if any, would be borne by the Bondholder. The request for splitting is required to be accompanied by the original Bond Certificate(s) which would then be treated as cancelled by us.

11.

Market Lot and Trading Lot of the Bonds

The market lot will be One Bond (Market Lot). Trading of the Bonds shall be compulsorily in dematerialised form in Market Lot after expiry of lock-in period of 5 years. Investors may note that the Bonds in dematerialised form can be traded only on the Stock Exchange having electronic connectivity with NSDL or CDSL.

12.

Listing

The Bonds are proposed to be listed on Bombay Stock Exchange (BSE).

20

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

13.

Record date

The record date for payment of interest and redemption of principal amount shall be 15 (fifteen) days prior to the Interest payment date or redemption date respectively or any other date on which interest and/or principal is due and payable.

14.

Title

(i) In case of Bonds held in the dematerialized form, the person for the time being appearing in the register of beneficial owners maintained by the Depository; and (ii) In case of Bonds held in physical form, the name of the person for the time being appearing in the Register of bondholders, as Bondholder, shall be treated for all purposes by the Company, the Debenture Trustee, the Depositories and all other persons dealing with such person as the holder thereof and its absolute owner for all purposes whether or not it is overdue and regardless of any notice of ownership, trust or any interest in it or any writing on, theft or loss of the Consolidated Bond Certificate issued in respect of the Bonds and no person will be liable for so treating the Bondholder. No transfer of title of a Bond will be valid unless and until entered on the Register of Bondholders or the register of beneficial owners maintained by the Depository prior to the Record Date. In the absence of transfer being registered, interest and/or Maturity Amount, as the case may be, will be paid to the person, whose name appears first in the Register of Bondholders maintained by the Depositories and/or the Company and/or the Registrar, as the case may be. In such cases, claims, if any, by the purchasers of the Bonds will need to be settled with the seller of the Bonds and not with the Company or the Registrar. The provisions relating to transfer and transmission and other related matters in respect of the Company's shares contained in the Articles of Association of the Company and the Companies Act shall apply, mutatis mutandis (to the extent applicable) to the Bond(s) as well.

15.

omination

The Companies Act, 1956, vide Section 109A gives the bondholder an option to nominate a person to whom his/her bond(s) shall rest in the event of his/her death. In respect of allotment of the Bonds in dematerialised mode, there is no need to make a separate nomination with the Company. Nominations registered with the respective Depository Participant of the applicant would prevail. If the Bondholders require changing their nomination, they are requested to inform their respective Depository Participant. Nominee shall become entitled to the bond(s) in the event of death of the bond holder on production of death certificate or such other evidence as may be required by IFCI. Investors applying for bonds in physical form are required to fill in the nomination details in the form. The sole Bondholder or first Bondholder, along with other joint Bondholders (being individual(s)) may nominate any one person (being individual) who, in the event of death of the sole holder or all the jointholders, as the case may be, shall become entitled to the Bond. A person, being a nominee, becoming entitled to the Bond by reason of the death of the Bondholder(s), shall be entitled to the same rights to which he would be entitled if he were the registered holder of the Bond. Where the nominee is a minor,

21

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

the Bondholder(s) may make a nomination to appoint, in the prescribed manner, any person to become entitled to the Bond(s), in the event of his death, during the minority. A nomination shall stand rescinded upon sale of a Bond by the person nominating. A buyer will be entitled to make a fresh nomination in the manner prescribed. When the Bond is held by two or more persons, the nominee shall become entitled to receive the amount only on the demise of all the holders. Fresh nominations can be made only in the prescribed form available on request at our Registered/Corporate Office/Registrar or such other person at such addresses as may be notified by us.

16.

Transfer of Bonds

There are no restrictions on transfers and except as per Applicable Laws. Register of Bondholders: The Company shall maintain at its registered office or such other place as permitted by law a register of Bondholders (the "Register of Bondholders") containing such particulars as required by Section 152 of the Companies Act. In terms of Section 152A of the Companies Act, the Register of Bondholders maintained by a Depository for any Bond in dematerialized form under Section 11 of the Depositories Act shall be deemed to be a Register of Bondholders for this purpose. The Bonds shall be transferred/transmitted in accordance with applicable laws. A suitable instrument as may be prescribed by us may be used to effect this. Lock in period: In accordance with the Notification, the bondholders shall not sell or transfer the Bonds in any manner for a period of 5 years from the Deemed Date of Allotment (the lock in period). The Bondholders may sell or transfer the bonds after the expiry of the Lock in period on the stock exchange where the bonds are listed. These bonds can also be pledged, hypothecated or given on lien for obtaining loans from Scheduled Commercial Banks after the lock-in period of five years. Transmission of Bonds: However, transmission of the Bonds to the legal heirs in case of death of the Bondholder/Beneficiary to the Bonds is allowed. Bondholder(s) are advised to provide the specimen signature of the nominee to the Company/Registrar to expedite the transmission of the Bond(s) to the nominee in the event of demise of the Bondholder(s). The signature can be provided at the time of making fresh nominations. This facility of providing the specimen signature of the nominee is purely optional. Transfer of Bonds held in dematerialized form: In respect of Bonds held in the dematerialized form, transfers of the Bonds may be effected only through the Depository(ies) where such Bonds are held, in accordance with the provisions of the Depositories Act, 1996 and/or rules as notified by the Depositories from time to time. The Bondholder shall give delivery instructions containing details of the prospective purchaser's Depository Participant's account to his Depository Participant. If a prospective purchaser does not have a Depository Participant account, the Bondholder may rematerialize his or her Bonds and transfer them in a manner as specified below. The transferee(s) should ensure that the transfer formalities are completed prior to the Record Date, otherwise the Maturity Amount for the Bonds shall be paid to the person whose name appears as a Bondholder in the Register of Bondholders. In such cases, any claims shall be settled inter se between the parties and no claim or action shall be brought against the Company/Registrar. 22

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

Transfer of Bonds held in physical form The Bonds are negotiable instruments and Bonds held in physical form may be transferred by endorsement and delivery by the Bondholder(s). All endorsements must be clear and vernacular endorsements must be translated into English immediately below the endorsement. However, buyers of the Bonds are advised to send the Bond Certificate(s) to us or to such persons as may be notified by us from time to time, along with a duly executed transfer deed or other suitable instrument of transfer as may be prescribed by us for registration of transfer of the Bond(s). No transfer will be valid unless and until entered on the IFCI Register. Provision of bank account details As a matter of precaution against possible fraudulent encashment of Bond Certificates due to loss or misplacement, the particulars of the Applicants bank account are mandatorily required to be provided at the time of rematerialisation of the Bonds or transfer of Bond Certificate. Applications without these details are liable to be rejected. The Bondholders are advised to submit their bank account details with the Registrar before the Record Date failing which the amounts will be dispatched to the postal address of the Bondholders as held in the records of the IFCI. However, in relation to Applications for dematerialised Bonds, these particulars will be taken directly from the Depositories.

17.

Succession:

Where a nomination has not been made or the nominee predeceases the Bondholder(s) the provisions of the following paragraphs will apply: In the event of demise of the holder(s) of the Bonds, IFCI will recognise the executor or administrator of deceased bondholder, being an individual / HUF, or the holder of the succession certificate or other legal representative, being an individual / HUF as having title to the Bonds. IFCI shall not be bound to recognise such executor, administrator, or holder of succession certificate, unless such executor or administrators obtains probate or letter of administration or such holder is the holder of succession certificate or other legal representation, as the case may be, from a Court of India having jurisdiction over the matter. IFCI may at its absolute discretion, where it thinks fit, dispense with production of probate or letter of administration or succession certificate or other legal representation, in order to recognise such holder, being an individual / HUF as being entitled to the Bonds standing in the name of the deceased bond holder(s) on production of documentary proof or indemnity. All requests for registration of transmission along with requisite documents should be sent to the Registrars.

18.

Dematerialisation and Rematerialisation of Bonds

Dematerialisation of bonds viz. conversion of bonds from physical mode to electronic form and rematerialisation of bonds viz. conversion of bonds from electronic to physical form have to be carried out by giving necessary instructions through the Depository Participant where the demat account is maintained by the bondholder.

23

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

19.

Interest

a. Rate of Interest: Option I & II Bonds bear interest at a fixed rate of 8.50% per annum while Option III & IV bonds bear interest at a fixed rate of 8.75 % per annum. Frequency of Payment of Interest: For Option II and Option IV, interest will be paid annually b. commencing from the Deemed Date of Allotment and on the equivalent date falling every year thereafter till redemption or buyback as the case may be. For Option I and Option III, cumulative Interest will be paid at the time of redemption upon maturity or upon exercise of buyback option, as applicable. c. Day Count Convention: Actual/Actual basis. This means, interest shall be computed on a 365 days-a-year basis on the principal outstanding on the Bonds. However, where the interest period (start date to end date) includes February 29, interest shall be computed on 366 days-a-year basis, on the principal outstanding on the Bonds. d. Interest on Application and Refund Money: The Company shall not pay any interest on refund of Application Amount, in whole or part. However, interest on Application Money, to the extent of allotment of bonds, shall be paid from the date of credit of this money to IFCI account of IFCI to the date immediately preceding the deemed date of allotment at the respective coupon rates. e. Tax Deduction at Source: Payment of interest will be subject to deduction of tax as per the Income Tax Act, or any statutory modification or re-enactment thereof, for the time being in force. As per the current tax laws, no income tax is deductible at source for payment of interest on bonds, if such bonds are listed and in demat form. If the bonds are held in physical form, tax would be deducted at source from interest on bonds, if such interest exceeds Rs.2,500/- during a year unless the bondholder has submitted, at least 30 days before the interest payment due date, Form 15H (for senior citizens), Form 15G (for others) or a certificate from the Assessing Officer u/s 197 of the Income Tax Act, 1961, as applicable. It may be noted that as per extant laws, TDS shall be deductible for interest on application money if the amount of interest payable is more than Rs.5,000/- irrespective of whether the application has been made for bonds in demat or physical form.

20.

Interest Payments

Payment of interest on the Bonds will be made to those holders of the Bonds, whose name appears first in the Register of Bondholders maintained by the Depositories and/or the Company and/or the Registrar, as the case may be, as on the Record Date. In Option-II & IV interest amounts due will be payable on December 12 of every year starting from the year 2012. The last interest payment will be made along with repayment of the principal amount. In Options-I & III interest payment will be made along with repayment of the principal amount. In case of transfer of Bond Certificates held in physical form, Bondholders are advised to send the Bond Certificate(s) and the duly completed transfer deeds or other suitable instrument of transfer as may be prescribed by us for registration of transfer of Bond(s) to us or such other persons as may be notified by us from time to time, well before the Record Date. In the event the transfer formalities are not completed before the Record date, the interest will be paid to the seller and not to the buyer. In such cases, claims in respect of interest, if any, shall be settled inter se amongst the parties and no claim or action shall lie against the Company, or the Registrar to the Issue. 24

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

(a) Record Date: The record date for the payment of interest or the Maturity Amount shall be 15 days prior to the date on which such amount is due and payable ("Record date"). (b) Effect of holidays on payment: If the date of payment of interest or principal or any date specified does not fall on a Working Day, then the succeeding Working Day will be considered as the effective date. Interest and principal or other amounts, if any, will be paid on the succeeding Working Day. In case the Maturity Date falls on a holiday, the payment will be made on the next Working Day, without any interest for the period overdue. (c) Modes of Payment Please see Para 21 below.

21.

Tenor & Redemption Buyback of Bonds

(a)

In respect of Option-I & II, buyback option shall be available at the end of 5th & 7th year i.e. calendar years 2016 and 2018, while for Option-III & IV, buyback option shall be available at the end of 7th, 10th & 12th year i.e. calendar years 2018, 2021 and 2023. The investors, who wish to exit through this facility shall have to apply for buyback by writing to the company of his/her intention to redeem all the Bonds held by him/her under the buyback option. Such early Redemption Notice from the Bondholder should reach the Registrar or the Company between August 12 to September 11 of the calendar years 2016 or 2018 for Option-I & II , and in the calendar years 2018, 2021 or for Option-III & IV for redeeming the bonds in that particular financial year. The bonds will be redeemed on December 12 of the same financial year. Partial buyback of the bonds held under the buyback option shall not be permissible. In case the bonds are transferred after exercising the buyback option, the buyback option shall not be considered valid. (b) The buyback/maturity amounts at the applicable dates are given below: Redemption amount in case of buyback option/maturity, as applicable Option I 7,519 8,851 11,305 N.A N.A Option II 5,000 5,000 5,000 N.A N.A Option III N.A 8,995 11,569 13,682 17,596 Option IV N.A 5,000 5,000 5,000 5,000

At the end of 5th year At the end of 7th year At the end of 10th year At the end of 12th year At the end of 15th year

(c)

Procedure of redemption

Bonds held in electronic form: No action is required on the part of Bondholders at the time of maturity of the Bonds. On the Maturity Date, the Maturity Amount will be paid as per the Depositories' records on the Record Date fixed for this purpose. The bank details will be obtained from the Depositories for payments. Investors who have applied or who are holding the Bond in electronic form, are advised to 25

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

immediately update their bank account details as appearing on the records of Depository Participant as and when changed. Failure to do so could result in delays in credit of the payments to investors at their sole risk and neither the Company nor the Registrar shall have any responsibility and undertake any liability for such delays on part of the investors. Bonds held in physical form: No action will ordinarily be required on the part of the Bondholder at the time of redemption and the maturity amount will be paid to those Bondholders whose names appear in the Register of Bondholders maintained by the Company on the Record Date fixed for the purpose of redemption. The bank details will be obtained from the Registrar for effecting payments. However, the Company may require that the Consolidated Bond Certificate(s), duly discharged by the sole holder or all the joint-holders (signed on the reverse of the Consolidated Bond Certificate(s)) to be surrendered for redemption on Maturity Date and sent by registered post with acknowledgment due or by hand delivery to the Registrar or Company or to such persons at such addresses as may be notified by the Company from time to time. Bondholders shall have to surrender the Consolidated Bond Certificate(s) in the manner as stated above, not more than three months and not less than one month prior to the Maturity Date so as to facilitate timely payment. Payments of redemption amount will be made on the Maturity Date or Buyback Date, as applicable, or within a period of 30 days from the date of receipt of the duly discharged certificate, whichever is later. The Company's liability to the Bondholders including for payment or otherwise shall stand extinguished from the Maturity Date or the Buyback Date, applicable, or upon despatch of the Redemption Amounts to the Bondholders. Further, the Company will not be liable to pay any interest, income or compensation of any kind from the Maturity Date or the Buyback Date, as applicable. If the Redemption date falls on a Saturday, Sunday or a public holiday, redemption proceeds would be paid on the next working day.

22.

Modes of Payment:

All payments to be made by the Company to the Bondholders shall be by cheques or demand drafts or through ational Electronic Clearing System (" ECS"). Despatch of cheques or pay orders in respect of payments with respect to redemptions will be made on the Maturity Date or the Buyback Option Date, as applicable, or within a period of 30 days from the date of receipt of the duly discharged Consolidated Bond Certificate, if required by the Company, whichever is later. The mode of payments of refunds, interest or principal shall be undertaken in any of the following ways: 1. ECS: Payment of refunds, interest or principal redemption to Applicants having an account at the centres permitted by RBI and SEBI, shall be undertaken through NECS. This mode of payment would be subject to availability of complete bank account details including the MICR code as appearing on a cheque leaf, from the Depositories. 2. EFT: Payment of refunds, interest or principal redemption shall be undertaken through NEFT wherever the Applicants bank has been assigned the IFSC which can be linked to MICR, if any, available to that particular bank branch, and where the Applicants have registered their nine-digit MICR number and their bank account number while opening and operating the dematerialised account. The 26

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

IFSC of that bank branch will be obtained from the RBIs website as on a date immediately prior to the date of payment of refund, and will be duly mapped with the MICR numbers. 3. For all other Applicants, including those who have not updated their bank particulars with the MICR code the interest payment/refund/redemption orders shall be dispatched by ordinary post/Speed Post/courier for value up to Rs.1,500 and through speed/registered post/courier for refund orders of above Rs.1,500. Such refunds will be made by cheques, pay orders or demand drafts drawn on the collecting bank and payable at par at places where Applications are received. Bank charges, if any, for cashing such cheques, pay orders or demand drafts at other centres will be payable by the Applicant. We will not be responsible for any delay in payment of refunds, interest or principal redemption, provided that the process of such request has been initiated within reasonable time, as per the process detailed above.

23.

Taxation

The interest on Bonds will be subject to deduction of tax at source at the rates prevailing from time to time under the provisions of the Income Tax Act or any statutory modification or re-enactment thereof.

As per the current provisions of the Income Tax Act, on payment to all categories of resident Bondholders, tax will not be deducted at source from interest on Bonds, if such interest does not exceed Rs.2,500/- in a financial year.

As per clause (ix) of Section 193 of the Income Tax Act, no income tax is required to be withheld on any interest payable on any security issued by a company, where such security is in dematerialized form and is listed on a recognized stock exchange in India in accordance with the Securities Contracts Regulation Act, 1956, as amended, and the rules notified thereunder. Accordingly, no income tax will be deducted at source from the interest on Bonds held in dematerialized form. In case of Bonds held in a physical form, tax may be withheld, as applicable. Further, such interest is taxable income in the hands of resident Bondholders. If interest on Bonds exceeds the prescribed limit, which is currently Rs.2,500/-, in case of resident individual Bondholders, to ensure non-deduction or lower deduction of tax at source, as the case may be, the Bondholders are required to furnish either: (a) a declaration (in duplicate) in the prescribed form i.e. Form 15G, subject to provisions of section 197A of the Income Tax Act; or (b) a certificate, from the assessing officer of the Bondholder, in the prescribed form under section 197 of the Income Tax Act which may be obtained by the Bondholders. (c) Senior citizens, who are 60 or more years of age at any time during the financial year, can submit a self-declaration in the prescribed Form 15H for non-deduction of tax at source in accordance with the provisions of section 197A even if the aggregate income credited or paid or likely to be credited or paid exceeds the maximum limit for the financial year. These certificates may be submitted to the Registrar/Company or to such person at such address as may be notified by us from time to time, quoting the name of the sole or first Bondholder, Bondholder number and the distinctive number(s) of the Bond(s) held, at the time of submitting application and at any point of time as required by the Issuer from time to time.

27

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

Tax exemption certificate or document, if any, must be lodged at the office of the Registrar prior to the Record Date or as specifically required. Tax applicable on coupon will be deducted at source on accrual thereof in the Company's books and / or on payment thereof, in accordance with the provisions of the Income Tax Act and / or any other statutory modification, re-enactment or notification as the case may be. A tax deduction certificate will be issued for the amount of tax so deducted on annual basis.

24.

Trustee

IFCI has appointed a Trustee for the Bondholders. IFCI and the Trustee will enter into a Debenture Trust Deed specifying, inter alia, the powers, authorities and obligations of the Debenture Trustee and the Company. All Bondholders shall, without further act or deed, be deemed to have irrevocably given their consent to the Debenture Trustee or any of their agents or authorized officials to do all such acts, deeds, matters and things in respect of or relating to the Bonds as the Debenture Trustee may in their absolute discretion deem necessary or require to be done in the interest of the Bondholders. Any payment made by us to the Debenture Trustee on behalf of the Bondholders shall discharge us pro tantoto the Bondholders. The Debenture Trustee will protect the interest of the Bondholders in the event of default by us in regard to timely payment of interest and repayment of principal and they will take necessary action at the Companys cost.

25.

Security

The Bonds are unsecured, which means that the Bonds are not secured against any of the assets of the company.

26.

Bondholder not a shareholder

The Bondholders will not be entitled to any of the rights and privileges available to the equity and preference shareholders of the Company.

27.

Rights of Bondholders:

The Bonds shall not confer upon the holders thereof any rights or privileges including the right to receive notices or annual reports of, or to attend and/or vote, at a General Meeting of IFCI. The Bonds comprising the present Private Placement shall rank paripassu inter se without any preference to or priority of one over the other or others over them and shall also be subject to the other terms and conditions to be incorporated in the Agreement / Trust Deed(s) to be entered into by IFCI with the Trustees and the Letters of Allotment/Bond Certificates that will be issued. A register of Bondholders will be maintained and sums becoming due and payable in respect of the Bonds will be paid to the Registered Holder thereof. The Bonds are subject to the provisions of the Act and the terms of this Information Memorandum. Over and above such terms and conditions, the Bonds shall also be subject to other terms and conditions as may be incorporated in the Agreement/Bond Trust Deed/Letters of Allotments/Bond Certificates, guidelines, notifications and regulations relating to the issue of capital and listing of securities issued from time to time by the Government of India and/or other authorities and other documents that may be executed in respect of the Bonds.

28

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

28.

Modification of rights:

The rights, privileges and conditions attached to the Bonds may be varied, modified and/or abrogated with the consent in writing of the holders of at least three-fourths of the outstanding amount of the Bonds or with the sanction of special resolution passed at a meeting of the concerned Bondholders, provided that nothing in such consent or sanction shall be operative against IFCI, where such consent or sanction modifies or varies the terms and conditions governing the Bonds, if the same are not acceptable to IFCI.

29.

otices

The communications to the bondholder(s) required to be sent by IFCI or the Trustees shall be deemed to have been given if sent by an ordinary post/ courier to the registered holder of the Bonds. All communications to be given by the bondholder(s) shall be sent by registered post to the Registrar and Transfer Agents or to IFCI or to such person, at such addresses as may be notified by IFCI from time to time. All notices to the Bondholders required to be given by IFCI or the Debenture Trustee shall be published in one English language newspaper having wide circulation and one regional language daily newspaper each in Mumbai, Chennai, Delhi, Kolkata and Ahmedabad or will be sent by post/courier to the registered Bondholders from time to time.

30.

Loan against Bonds

The Bonds can be pledged or hypothecated for obtaining loans from scheduled commercial banks only after the Lockin period of 5 years. In accordance with the RBI guidelines applicable to the Company, it shall not grant loans against the security of the Bonds. Right to Re-issue Bond(s)

31.

Subject to the provisions of the Act, where the Company has redeemed or repurchased any Bond(s), the Company shall have and shall be deemed always to have had the right to keep such Bonds alive without extinguishment for the purpose of resale or reissue and in exercising such right, the Company shall have and be deemed always to have had the power to resell or reissue such Bonds either by reselling or reissuing the same Bonds or by issuing other Bonds in their place. This includes the right to reissue original Bonds.

32.

Future borrowings

IFCI shall be entitled to make further issue of secured or unsecured debentures and/or raise term loans or raise further funds from time to time from any persons, banks, financial institutions or bodies corporate or any other agency without the consent of, or notification to or consultation with the Bondholders or the Debenture Trustee.

33.

Joint-holders

Where two or more persons are holders of any Bond (s), they shall be deemed to hold the same as joint holders with benefits of survivorship subject to Articles and applicable law.

29

IFCI Long Term Infrastructure Bonds Series III 2011-12 Information Memorandum

34.

Sharing of Information