Professional Documents

Culture Documents

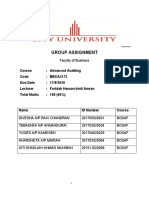

Audit Final Project

Audit Final Project

Uploaded by

JOHN DAVID WONG MADRONACopyright:

Available Formats

You might also like

- Case 1.1 Enron CorporationDocument6 pagesCase 1.1 Enron CorporationZizhang Huang88% (8)

- Services Marketing 7th Edition Zeithaml Test BankDocument25 pagesServices Marketing 7th Edition Zeithaml Test BankRobertCookdktg100% (38)

- Recommendations Made To Strengthen The Independent Audit Function Following The Enron Scandal.Document3 pagesRecommendations Made To Strengthen The Independent Audit Function Following The Enron Scandal.tyro91No ratings yet

- Nike Case Study-ResponseDocument8 pagesNike Case Study-ResponseAnurag Sukhija100% (5)

- Case 1Document22 pagesCase 1Let it be100% (1)

- ACCA AAA Ethical Threats and Safeguards by Alan Biju Palak PDFDocument8 pagesACCA AAA Ethical Threats and Safeguards by Alan Biju Palak PDFBlade StormNo ratings yet

- Week 1Document39 pagesWeek 1random17341No ratings yet

- Case 1 1 Enron CorporationDocument6 pagesCase 1 1 Enron CorporationMichael Gorby WijayaNo ratings yet

- Marry An Accountant: Submitted ToDocument12 pagesMarry An Accountant: Submitted Toanshita9shrivastavaNo ratings yet

- Enron Case StudyDocument3 pagesEnron Case StudyDavid Wijaya100% (1)

- Aaa 5Document3 pagesAaa 5Hamza ZahidNo ratings yet

- Theories For AuditingDocument3 pagesTheories For Auditingfiq100% (1)

- Test 1 7ddDocument94 pagesTest 1 7ddMbadilishaji DuniaNo ratings yet

- AccountingDocument4 pagesAccountingErma AlferezNo ratings yet

- Types of Independence: Auditor Independence Refers To TheDocument10 pagesTypes of Independence: Auditor Independence Refers To TheAngelo FrancisNo ratings yet

- Homework - Attestation ServicesDocument2 pagesHomework - Attestation ServicesMycah AliahNo ratings yet

- ACCG315Document4 pagesACCG315Joannah Blue0% (1)

- Auditor's IndependenceDocument4 pagesAuditor's IndependenceSamya DasNo ratings yet

- What Are Assurance Services?Document4 pagesWhat Are Assurance Services?Sheila Mae AramanNo ratings yet

- Chapter 1 AuditDocument13 pagesChapter 1 AuditMisshtaC100% (1)

- Are The Audit Profession's Conflicts IrreconcilableDocument15 pagesAre The Audit Profession's Conflicts IrreconcilableChetan ChouguleNo ratings yet

- AAS CH1 2 1 - MergedDocument19 pagesAAS CH1 2 1 - MergedRoel PaisteNo ratings yet

- KPMG AnalysisDocument2 pagesKPMG AnalysisElaine YapNo ratings yet

- Pest AnalysisDocument4 pagesPest AnalysisRizalyn Huraño MalalisNo ratings yet

- Pre 1 and 2Document3 pagesPre 1 and 2HD MINo ratings yet

- Corporate GovernanceDocument10 pagesCorporate GovernanceBhuwan GulatiNo ratings yet

- Akka HyuiDocument15 pagesAkka HyuiAkkamaNo ratings yet

- Advantages of AuditingDocument3 pagesAdvantages of AuditingNikita ChavanNo ratings yet

- Financial Advice For People Who Aren't Rich - The New York TimesDocument5 pagesFinancial Advice For People Who Aren't Rich - The New York TimesRaceMoChridheNo ratings yet

- Pribanic WhitepaperDocument9 pagesPribanic WhitepaperCaleb PribanicNo ratings yet

- Diagnostic Test - Audit TheoryDocument13 pagesDiagnostic Test - Audit TheoryYenelyn Apistar CambarijanNo ratings yet

- Assignment June 15Document3 pagesAssignment June 15BlackChemistry GuipetacioNo ratings yet

- Company Management. The Management Team Needs To Understand TheDocument3 pagesCompany Management. The Management Team Needs To Understand TheGopali AoshieaneNo ratings yet

- Purpose of Financial ReportingDocument3 pagesPurpose of Financial Reportingbmgarg1989No ratings yet

- Speech by Ferguson, B., Head of Department, Strategy & Competition DivisionDocument5 pagesSpeech by Ferguson, B., Head of Department, Strategy & Competition DivisionRentonNo ratings yet

- Research Paper On Auditor IndependenceDocument9 pagesResearch Paper On Auditor Independenceorlfgcvkg100% (1)

- Chapter 3Document6 pagesChapter 3Clarisse AnnNo ratings yet

- As Sing MentDocument6 pagesAs Sing MentErnest NyangiNo ratings yet

- (Download PDF) Auditing and Assurance Services An Asia Edition 1st Edition Rittenberg Solutions Manual Full ChapterDocument55 pages(Download PDF) Auditing and Assurance Services An Asia Edition 1st Edition Rittenberg Solutions Manual Full Chapterwanyuecykler35100% (6)

- Fdnacct C31a - Reflection Paper - Helaina SalesDocument4 pagesFdnacct C31a - Reflection Paper - Helaina SalesyannaNo ratings yet

- Assignment 2 AglagadanDocument3 pagesAssignment 2 Aglagadangian kaye aglagadanNo ratings yet

- Complete Ethics and Professional Issues (Along Professional Marks)Document6 pagesComplete Ethics and Professional Issues (Along Professional Marks)moizzaiqbalNo ratings yet

- Ijefm 20200802 12Document9 pagesIjefm 20200802 12imamsatriaNo ratings yet

- Avantax White Paper Referrals Final 3.18.22Document4 pagesAvantax White Paper Referrals Final 3.18.22mondlyNo ratings yet

- T3 - Ethics - Seminar - Q - AnswerDocument4 pagesT3 - Ethics - Seminar - Q - AnswerPham TungNo ratings yet

- Advanced Auditing Group Assignment Final 2Document38 pagesAdvanced Auditing Group Assignment Final 2TebashiniNo ratings yet

- Intuit-Corp Banking2020 FINALDocument14 pagesIntuit-Corp Banking2020 FINALSRGVPNo ratings yet

- Cases Mancon 10-12Document2 pagesCases Mancon 10-12Teresa RevilalaNo ratings yet

- Code of Ethics Reviewer - CompressDocument44 pagesCode of Ethics Reviewer - CompressGlance Piscasio CruzNo ratings yet

- Advance Audit and Assurance 3Document13 pagesAdvance Audit and Assurance 3Muhammad SiddiqNo ratings yet

- Chapter 1 - AACA P1Document7 pagesChapter 1 - AACA P1Toni Rose Hernandez LualhatiNo ratings yet

- There Are Three Main Ways in Which The AuditorDocument5 pagesThere Are Three Main Ways in Which The AuditornathagilangNo ratings yet

- Current Issues in Auditing: The Implications of Low Perceived Value of The Audit Function On Audit.Document15 pagesCurrent Issues in Auditing: The Implications of Low Perceived Value of The Audit Function On Audit.YISHAL THILLINADAN -No ratings yet

- Regarding Their Audit WorkDocument8 pagesRegarding Their Audit Workyahye ahmedNo ratings yet

- Auditor Independence, Audit Fees Low-Balling, and Non-Audit Services: Evidence From FijiDocument18 pagesAuditor Independence, Audit Fees Low-Balling, and Non-Audit Services: Evidence From FijijavisNo ratings yet

- Financial Statement Fraud Risk Mechanisms and Strategies: The Case Studies of Malaysian Commercial CompaniesDocument8 pagesFinancial Statement Fraud Risk Mechanisms and Strategies: The Case Studies of Malaysian Commercial CompaniesfitriNo ratings yet

- Chapter 3 USERS OF ACCOUNTING INFORMATIONDocument27 pagesChapter 3 USERS OF ACCOUNTING INFORMATIONmarkalvinlagunero1991No ratings yet

- Section 320 MIADocument9 pagesSection 320 MIANaem EmahNo ratings yet

- 3799 LN VOTC OnlineDocument15 pages3799 LN VOTC OnlineCaroline PimentelNo ratings yet

- Scenario: Intended Audience: Professional Accountants in Public PracticeDocument4 pagesScenario: Intended Audience: Professional Accountants in Public PracticeCharles PalacioNo ratings yet

- What Type of Auditor You Want To Be .??: The Primary Goals of This Chapter Are As FollowsDocument7 pagesWhat Type of Auditor You Want To Be .??: The Primary Goals of This Chapter Are As FollowsJhonrey BragaisNo ratings yet

- The Tech Entrepreneur’s Financial Playbook: Winning Plays for Forming, Financing & Operating Tech CompaniesFrom EverandThe Tech Entrepreneur’s Financial Playbook: Winning Plays for Forming, Financing & Operating Tech CompaniesNo ratings yet

- AEC 21 LOST-UNITSinPROCESS-COST-SYSTEMDocument2 pagesAEC 21 LOST-UNITSinPROCESS-COST-SYSTEMJOHN DAVID WONG MADRONANo ratings yet

- Cooperative Code of The Philippines - Madrona, John David W. - ACADocument30 pagesCooperative Code of The Philippines - Madrona, John David W. - ACAJOHN DAVID WONG MADRONANo ratings yet

- AEC 21 SUPERIOR - (LOSTunitsFIFO)Document2 pagesAEC 21 SUPERIOR - (LOSTunitsFIFO)JOHN DAVID WONG MADRONANo ratings yet

- FAR Comprehensive Notes Prof KCDocument22 pagesFAR Comprehensive Notes Prof KCJOHN DAVID WONG MADRONANo ratings yet

- Namaste Final PaperDocument73 pagesNamaste Final Paperapi-451202161No ratings yet

- A Study On Parameters of Online Reviews Content TH PDFDocument14 pagesA Study On Parameters of Online Reviews Content TH PDFpramodNo ratings yet

- Cost Accounting (1) First Grade: Inventories For A Manufacturing BusinessDocument3 pagesCost Accounting (1) First Grade: Inventories For A Manufacturing BusinessAmer Wagdy GergesNo ratings yet

- I. Instances When The Price Is CertainDocument13 pagesI. Instances When The Price Is CertainasdasdaNo ratings yet

- Process of Advertising Process of AdvertisingDocument8 pagesProcess of Advertising Process of AdvertisingYuvnesh KumarNo ratings yet

- Role of Merchant BsnkingDocument7 pagesRole of Merchant BsnkingKishor BiswasNo ratings yet

- Chapter 8 - The Marketing PlanDocument41 pagesChapter 8 - The Marketing PlanMelissa Linda BandiezNo ratings yet

- Individual Assignment 3: Chapter 7: Process StrategyDocument2 pagesIndividual Assignment 3: Chapter 7: Process StrategyVũ Hoàng DiệuNo ratings yet

- IFA Chapter 1Document12 pagesIFA Chapter 1Suleyman TesfayeNo ratings yet

- Ficha 3Document3 pagesFicha 3Elsa MachadoNo ratings yet

- Econ 1001 Lecture Notes - Week 2Document6 pagesEcon 1001 Lecture Notes - Week 2shotboi69No ratings yet

- CFA RC Team-Eternals UFE Mongolia-1Document21 pagesCFA RC Team-Eternals UFE Mongolia-1oyunnominNo ratings yet

- Sony Corporation Mission StatementDocument3 pagesSony Corporation Mission StatementvampireweekendNo ratings yet

- Role of Digital MarketingDocument2 pagesRole of Digital MarketingZarish IlyasNo ratings yet

- Accounting Financial Reporting 2022Document45 pagesAccounting Financial Reporting 2022Mobeen AhmadNo ratings yet

- Tc8-Overview SRMDocument30 pagesTc8-Overview SRMsmurphy225No ratings yet

- Guide To The Secondary Market, 2015Document92 pagesGuide To The Secondary Market, 2015ed_nycNo ratings yet

- Case Study #11: Frieslandcampina Global RolloutDocument4 pagesCase Study #11: Frieslandcampina Global RolloutmohamedelwarithNo ratings yet

- Chapter 6 Solution Cost AccountingDocument4 pagesChapter 6 Solution Cost Accountingmarcole19840% (2)

- Chapter 17 Questions V1Document4 pagesChapter 17 Questions V1lyellNo ratings yet

- Inventories ActivityDocument3 pagesInventories ActivityGigi LuceroNo ratings yet

- Topic 8 - Accounting For Income TaxesDocument65 pagesTopic 8 - Accounting For Income TaxesLê Thiên Giang 2KT-19No ratings yet

- EDreams ODIGEO FY 2017 Annual ReportDocument232 pagesEDreams ODIGEO FY 2017 Annual ReportmailimailiNo ratings yet

- Completing AuditDocument20 pagesCompleting AuditmeseleNo ratings yet

- FS WorkDocument122 pagesFS WorkRodolfo SantosNo ratings yet

- Chapter 1Document6 pagesChapter 1placalus nimbusNo ratings yet

- Microeconomics 4Th Edition Krugman Test Bank Full Chapter PDFDocument67 pagesMicroeconomics 4Th Edition Krugman Test Bank Full Chapter PDFletitiajasminednyaa100% (12)

- CUP VI - Financial Accounting and ReportingDocument17 pagesCUP VI - Financial Accounting and ReportingRonieOlarte0% (1)

Audit Final Project

Audit Final Project

Uploaded by

JOHN DAVID WONG MADRONAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Final Project

Audit Final Project

Uploaded by

JOHN DAVID WONG MADRONACopyright:

Available Formats

The big 4 audit firms are gradually pushing the small and medium sized auditing firms out

ut from

the market because of their business strategy of adding consulting services aside from auditing

big corporations.

Based on data (provided by the video source), two-thirds of their revenues come not from their

auditing services but on their consultancy services offered to corporate clients.

Because of this business strategy, these large auditing firms build strong relationships with their

clients, which, I believe eventually then becomes the major factor for the client to avail their

audit services.

This client-firm relationship is suspected to be the root cause as to why large companies commit

fraud while not being detected through audit.

An expert said that companies do not invest to strengthening their internal control in a way that

they are not the ones recording complex transactions but instead hire third-party which are

mostly from auditing firms. When this happens, if auditors be the ones to prepare and present

their financial statements, then who will audit auditors?

Auditing firms building a relationship with large companies who their offer their consultancy

services creates an entrance to the idea of ‘conflict of interest’. This is because their clients will

eventually hire them to audit their financial statements but because of their relationship

established, the principle of independence is impaired.

Users of the giant corporations’ financial statements need to be assured that the information

they read are reasonably assured to be free from material misstatements. According to an

expert, determining whether fraud or error caused a misstatement or omission is irrelevant.

However, what could be the reactions of the users of the financial statements who demand for a

fairly prepared and presented information, if they will know that the company and the auditing

firm have a continuing relationship?

Although this may create suspicion in the minds of the users, however, no one can deny the

importance of consultancy services being provided by the auditing firm. In most cases, these

auditing firms are the ones suggesting their clients how to get away from high taxes while not

directly or explicitly creating an unlawful action. This helps these companies to earn high net

profit.

Aside from the large corporations becoming the clients of the auditing firms’ consultancy

services, because of complexity in tax laws, even the government requests their aid. This makes

the big 4 accounting firms to create an enormous influence even to the political sector.

However, the focus here is that creating a client-firm relationship because of the consultancy

services provided by the auditing firm, influences the same firm as they provide audit services to

the same client. In this case, it is already clear that the principle of independence is already

impaired and if we try to connect this to the fraud scandal committed by ABC corporation (firm

sa video), one can say these auditing firms can be the ones helping these corporations to

conceal misstatements in their financial statements.

That is why many experts strongly suggest that a regulation be imposed wherein auditing firms

will be disallowed in offering consultancy services.

You might also like

- Case 1.1 Enron CorporationDocument6 pagesCase 1.1 Enron CorporationZizhang Huang88% (8)

- Services Marketing 7th Edition Zeithaml Test BankDocument25 pagesServices Marketing 7th Edition Zeithaml Test BankRobertCookdktg100% (38)

- Recommendations Made To Strengthen The Independent Audit Function Following The Enron Scandal.Document3 pagesRecommendations Made To Strengthen The Independent Audit Function Following The Enron Scandal.tyro91No ratings yet

- Nike Case Study-ResponseDocument8 pagesNike Case Study-ResponseAnurag Sukhija100% (5)

- Case 1Document22 pagesCase 1Let it be100% (1)

- ACCA AAA Ethical Threats and Safeguards by Alan Biju Palak PDFDocument8 pagesACCA AAA Ethical Threats and Safeguards by Alan Biju Palak PDFBlade StormNo ratings yet

- Week 1Document39 pagesWeek 1random17341No ratings yet

- Case 1 1 Enron CorporationDocument6 pagesCase 1 1 Enron CorporationMichael Gorby WijayaNo ratings yet

- Marry An Accountant: Submitted ToDocument12 pagesMarry An Accountant: Submitted Toanshita9shrivastavaNo ratings yet

- Enron Case StudyDocument3 pagesEnron Case StudyDavid Wijaya100% (1)

- Aaa 5Document3 pagesAaa 5Hamza ZahidNo ratings yet

- Theories For AuditingDocument3 pagesTheories For Auditingfiq100% (1)

- Test 1 7ddDocument94 pagesTest 1 7ddMbadilishaji DuniaNo ratings yet

- AccountingDocument4 pagesAccountingErma AlferezNo ratings yet

- Types of Independence: Auditor Independence Refers To TheDocument10 pagesTypes of Independence: Auditor Independence Refers To TheAngelo FrancisNo ratings yet

- Homework - Attestation ServicesDocument2 pagesHomework - Attestation ServicesMycah AliahNo ratings yet

- ACCG315Document4 pagesACCG315Joannah Blue0% (1)

- Auditor's IndependenceDocument4 pagesAuditor's IndependenceSamya DasNo ratings yet

- What Are Assurance Services?Document4 pagesWhat Are Assurance Services?Sheila Mae AramanNo ratings yet

- Chapter 1 AuditDocument13 pagesChapter 1 AuditMisshtaC100% (1)

- Are The Audit Profession's Conflicts IrreconcilableDocument15 pagesAre The Audit Profession's Conflicts IrreconcilableChetan ChouguleNo ratings yet

- AAS CH1 2 1 - MergedDocument19 pagesAAS CH1 2 1 - MergedRoel PaisteNo ratings yet

- KPMG AnalysisDocument2 pagesKPMG AnalysisElaine YapNo ratings yet

- Pest AnalysisDocument4 pagesPest AnalysisRizalyn Huraño MalalisNo ratings yet

- Pre 1 and 2Document3 pagesPre 1 and 2HD MINo ratings yet

- Corporate GovernanceDocument10 pagesCorporate GovernanceBhuwan GulatiNo ratings yet

- Akka HyuiDocument15 pagesAkka HyuiAkkamaNo ratings yet

- Advantages of AuditingDocument3 pagesAdvantages of AuditingNikita ChavanNo ratings yet

- Financial Advice For People Who Aren't Rich - The New York TimesDocument5 pagesFinancial Advice For People Who Aren't Rich - The New York TimesRaceMoChridheNo ratings yet

- Pribanic WhitepaperDocument9 pagesPribanic WhitepaperCaleb PribanicNo ratings yet

- Diagnostic Test - Audit TheoryDocument13 pagesDiagnostic Test - Audit TheoryYenelyn Apistar CambarijanNo ratings yet

- Assignment June 15Document3 pagesAssignment June 15BlackChemistry GuipetacioNo ratings yet

- Company Management. The Management Team Needs To Understand TheDocument3 pagesCompany Management. The Management Team Needs To Understand TheGopali AoshieaneNo ratings yet

- Purpose of Financial ReportingDocument3 pagesPurpose of Financial Reportingbmgarg1989No ratings yet

- Speech by Ferguson, B., Head of Department, Strategy & Competition DivisionDocument5 pagesSpeech by Ferguson, B., Head of Department, Strategy & Competition DivisionRentonNo ratings yet

- Research Paper On Auditor IndependenceDocument9 pagesResearch Paper On Auditor Independenceorlfgcvkg100% (1)

- Chapter 3Document6 pagesChapter 3Clarisse AnnNo ratings yet

- As Sing MentDocument6 pagesAs Sing MentErnest NyangiNo ratings yet

- (Download PDF) Auditing and Assurance Services An Asia Edition 1st Edition Rittenberg Solutions Manual Full ChapterDocument55 pages(Download PDF) Auditing and Assurance Services An Asia Edition 1st Edition Rittenberg Solutions Manual Full Chapterwanyuecykler35100% (6)

- Fdnacct C31a - Reflection Paper - Helaina SalesDocument4 pagesFdnacct C31a - Reflection Paper - Helaina SalesyannaNo ratings yet

- Assignment 2 AglagadanDocument3 pagesAssignment 2 Aglagadangian kaye aglagadanNo ratings yet

- Complete Ethics and Professional Issues (Along Professional Marks)Document6 pagesComplete Ethics and Professional Issues (Along Professional Marks)moizzaiqbalNo ratings yet

- Ijefm 20200802 12Document9 pagesIjefm 20200802 12imamsatriaNo ratings yet

- Avantax White Paper Referrals Final 3.18.22Document4 pagesAvantax White Paper Referrals Final 3.18.22mondlyNo ratings yet

- T3 - Ethics - Seminar - Q - AnswerDocument4 pagesT3 - Ethics - Seminar - Q - AnswerPham TungNo ratings yet

- Advanced Auditing Group Assignment Final 2Document38 pagesAdvanced Auditing Group Assignment Final 2TebashiniNo ratings yet

- Intuit-Corp Banking2020 FINALDocument14 pagesIntuit-Corp Banking2020 FINALSRGVPNo ratings yet

- Cases Mancon 10-12Document2 pagesCases Mancon 10-12Teresa RevilalaNo ratings yet

- Code of Ethics Reviewer - CompressDocument44 pagesCode of Ethics Reviewer - CompressGlance Piscasio CruzNo ratings yet

- Advance Audit and Assurance 3Document13 pagesAdvance Audit and Assurance 3Muhammad SiddiqNo ratings yet

- Chapter 1 - AACA P1Document7 pagesChapter 1 - AACA P1Toni Rose Hernandez LualhatiNo ratings yet

- There Are Three Main Ways in Which The AuditorDocument5 pagesThere Are Three Main Ways in Which The AuditornathagilangNo ratings yet

- Current Issues in Auditing: The Implications of Low Perceived Value of The Audit Function On Audit.Document15 pagesCurrent Issues in Auditing: The Implications of Low Perceived Value of The Audit Function On Audit.YISHAL THILLINADAN -No ratings yet

- Regarding Their Audit WorkDocument8 pagesRegarding Their Audit Workyahye ahmedNo ratings yet

- Auditor Independence, Audit Fees Low-Balling, and Non-Audit Services: Evidence From FijiDocument18 pagesAuditor Independence, Audit Fees Low-Balling, and Non-Audit Services: Evidence From FijijavisNo ratings yet

- Financial Statement Fraud Risk Mechanisms and Strategies: The Case Studies of Malaysian Commercial CompaniesDocument8 pagesFinancial Statement Fraud Risk Mechanisms and Strategies: The Case Studies of Malaysian Commercial CompaniesfitriNo ratings yet

- Chapter 3 USERS OF ACCOUNTING INFORMATIONDocument27 pagesChapter 3 USERS OF ACCOUNTING INFORMATIONmarkalvinlagunero1991No ratings yet

- Section 320 MIADocument9 pagesSection 320 MIANaem EmahNo ratings yet

- 3799 LN VOTC OnlineDocument15 pages3799 LN VOTC OnlineCaroline PimentelNo ratings yet

- Scenario: Intended Audience: Professional Accountants in Public PracticeDocument4 pagesScenario: Intended Audience: Professional Accountants in Public PracticeCharles PalacioNo ratings yet

- What Type of Auditor You Want To Be .??: The Primary Goals of This Chapter Are As FollowsDocument7 pagesWhat Type of Auditor You Want To Be .??: The Primary Goals of This Chapter Are As FollowsJhonrey BragaisNo ratings yet

- The Tech Entrepreneur’s Financial Playbook: Winning Plays for Forming, Financing & Operating Tech CompaniesFrom EverandThe Tech Entrepreneur’s Financial Playbook: Winning Plays for Forming, Financing & Operating Tech CompaniesNo ratings yet

- AEC 21 LOST-UNITSinPROCESS-COST-SYSTEMDocument2 pagesAEC 21 LOST-UNITSinPROCESS-COST-SYSTEMJOHN DAVID WONG MADRONANo ratings yet

- Cooperative Code of The Philippines - Madrona, John David W. - ACADocument30 pagesCooperative Code of The Philippines - Madrona, John David W. - ACAJOHN DAVID WONG MADRONANo ratings yet

- AEC 21 SUPERIOR - (LOSTunitsFIFO)Document2 pagesAEC 21 SUPERIOR - (LOSTunitsFIFO)JOHN DAVID WONG MADRONANo ratings yet

- FAR Comprehensive Notes Prof KCDocument22 pagesFAR Comprehensive Notes Prof KCJOHN DAVID WONG MADRONANo ratings yet

- Namaste Final PaperDocument73 pagesNamaste Final Paperapi-451202161No ratings yet

- A Study On Parameters of Online Reviews Content TH PDFDocument14 pagesA Study On Parameters of Online Reviews Content TH PDFpramodNo ratings yet

- Cost Accounting (1) First Grade: Inventories For A Manufacturing BusinessDocument3 pagesCost Accounting (1) First Grade: Inventories For A Manufacturing BusinessAmer Wagdy GergesNo ratings yet

- I. Instances When The Price Is CertainDocument13 pagesI. Instances When The Price Is CertainasdasdaNo ratings yet

- Process of Advertising Process of AdvertisingDocument8 pagesProcess of Advertising Process of AdvertisingYuvnesh KumarNo ratings yet

- Role of Merchant BsnkingDocument7 pagesRole of Merchant BsnkingKishor BiswasNo ratings yet

- Chapter 8 - The Marketing PlanDocument41 pagesChapter 8 - The Marketing PlanMelissa Linda BandiezNo ratings yet

- Individual Assignment 3: Chapter 7: Process StrategyDocument2 pagesIndividual Assignment 3: Chapter 7: Process StrategyVũ Hoàng DiệuNo ratings yet

- IFA Chapter 1Document12 pagesIFA Chapter 1Suleyman TesfayeNo ratings yet

- Ficha 3Document3 pagesFicha 3Elsa MachadoNo ratings yet

- Econ 1001 Lecture Notes - Week 2Document6 pagesEcon 1001 Lecture Notes - Week 2shotboi69No ratings yet

- CFA RC Team-Eternals UFE Mongolia-1Document21 pagesCFA RC Team-Eternals UFE Mongolia-1oyunnominNo ratings yet

- Sony Corporation Mission StatementDocument3 pagesSony Corporation Mission StatementvampireweekendNo ratings yet

- Role of Digital MarketingDocument2 pagesRole of Digital MarketingZarish IlyasNo ratings yet

- Accounting Financial Reporting 2022Document45 pagesAccounting Financial Reporting 2022Mobeen AhmadNo ratings yet

- Tc8-Overview SRMDocument30 pagesTc8-Overview SRMsmurphy225No ratings yet

- Guide To The Secondary Market, 2015Document92 pagesGuide To The Secondary Market, 2015ed_nycNo ratings yet

- Case Study #11: Frieslandcampina Global RolloutDocument4 pagesCase Study #11: Frieslandcampina Global RolloutmohamedelwarithNo ratings yet

- Chapter 6 Solution Cost AccountingDocument4 pagesChapter 6 Solution Cost Accountingmarcole19840% (2)

- Chapter 17 Questions V1Document4 pagesChapter 17 Questions V1lyellNo ratings yet

- Inventories ActivityDocument3 pagesInventories ActivityGigi LuceroNo ratings yet

- Topic 8 - Accounting For Income TaxesDocument65 pagesTopic 8 - Accounting For Income TaxesLê Thiên Giang 2KT-19No ratings yet

- EDreams ODIGEO FY 2017 Annual ReportDocument232 pagesEDreams ODIGEO FY 2017 Annual ReportmailimailiNo ratings yet

- Completing AuditDocument20 pagesCompleting AuditmeseleNo ratings yet

- FS WorkDocument122 pagesFS WorkRodolfo SantosNo ratings yet

- Chapter 1Document6 pagesChapter 1placalus nimbusNo ratings yet

- Microeconomics 4Th Edition Krugman Test Bank Full Chapter PDFDocument67 pagesMicroeconomics 4Th Edition Krugman Test Bank Full Chapter PDFletitiajasminednyaa100% (12)

- CUP VI - Financial Accounting and ReportingDocument17 pagesCUP VI - Financial Accounting and ReportingRonieOlarte0% (1)