Professional Documents

Culture Documents

Tesco Scandal

Tesco Scandal

Uploaded by

Design RauzCopyright:

Available Formats

You might also like

- Accounting Scandal in The UKDocument12 pagesAccounting Scandal in The UKBeibarysNo ratings yet

- Unit 7 Business StrategyDocument12 pagesUnit 7 Business StrategyRameza RahmanNo ratings yet

- Lloyds Banking Group PLCDocument20 pagesLloyds Banking Group PLCImran HussainNo ratings yet

- Article - Innovative Financial Products Tax AspectsDocument44 pagesArticle - Innovative Financial Products Tax AspectsSuneel UdpaNo ratings yet

- Yasmine-Khalaf - AF4S31 Strategic Financial Management - Assignemnt 1Document24 pagesYasmine-Khalaf - AF4S31 Strategic Financial Management - Assignemnt 1Yasmine A. Khalaf100% (3)

- Tesco Accounting Misstatements Myopic Ideologies ODocument11 pagesTesco Accounting Misstatements Myopic Ideologies OAbbas JafriNo ratings yet

- Strategic Analysis - Tesco PLC - February PDFDocument23 pagesStrategic Analysis - Tesco PLC - February PDFlokeshNo ratings yet

- Tesco Strategic MarketingDocument20 pagesTesco Strategic MarketingMIHAELACARMEN OLTIANU100% (1)

- TESCODocument19 pagesTESCOEmmanuel OkemeNo ratings yet

- 001 Article A001 enDocument46 pages001 Article A001 enatarashiiii6No ratings yet

- TescoDocument16 pagesTescoMIHAELACARMEN OLTIANUNo ratings yet

- Chapter 1: The Business Environment and Business EconomicsDocument7 pagesChapter 1: The Business Environment and Business EconomicsHuzaimaNo ratings yet

- Business StrategyDocument18 pagesBusiness StrategySam Sah100% (1)

- Theamag: The Best of (Both) Worlds..Document6 pagesTheamag: The Best of (Both) Worlds..freemind3682No ratings yet

- Singapore Management University: Tax Treaty Policy of Developing Countries post-BEPSDocument37 pagesSingapore Management University: Tax Treaty Policy of Developing Countries post-BEPSTường Vi ĐặngNo ratings yet

- Cartilla - S3Document14 pagesCartilla - S3Anneli MNo ratings yet

- Rev 41 Pastor EspanaDocument18 pagesRev 41 Pastor EspanaDiego P00No ratings yet

- The Real Cost of Our Shoes REPORT ENG - AT - 04-2017Document64 pagesThe Real Cost of Our Shoes REPORT ENG - AT - 04-2017Osho AryanNo ratings yet

- FN 307 FinalDocument8 pagesFN 307 FinalJasco JohnNo ratings yet

- IB9BT0 1667073 Essay v02Document28 pagesIB9BT0 1667073 Essay v02Sergio SantosNo ratings yet

- Ua Business StrategyDocument23 pagesUa Business Strategyrakshika somrajanNo ratings yet

- TAKIMAKI - Internationalisation StrategyDocument13 pagesTAKIMAKI - Internationalisation StrategyZegeye DamtewNo ratings yet

- Strategic Management - Phase 1 - Ricardo Rolon - 9Document8 pagesStrategic Management - Phase 1 - Ricardo Rolon - 9carinaNo ratings yet

- Analyzing Tyco: Aggressive or Out of Line?: Rahmat Faizal & Sensony DPDocument10 pagesAnalyzing Tyco: Aggressive or Out of Line?: Rahmat Faizal & Sensony DPLheegar TanNo ratings yet

- Financial Analysis of Latex of ColombiaDocument7 pagesFinancial Analysis of Latex of Colombiaagiraldo_14No ratings yet

- AS Dita - IfRS As A Guide To Overcome Challenges in International AccountingDocument9 pagesAS Dita - IfRS As A Guide To Overcome Challenges in International AccountingYor AdeNo ratings yet

- Af4S31 - Assessment 1 (Av2) Af4S31 - Strategic Financial ManagementDocument13 pagesAf4S31 - Assessment 1 (Av2) Af4S31 - Strategic Financial ManagementugochiNo ratings yet

- 1800 Toshiba Fraud Case Study 1Document8 pages1800 Toshiba Fraud Case Study 1wenlei liuNo ratings yet

- 2020-Donald E. Kieso - Intermediate Accounting IFRS 4e-53-120Document68 pages2020-Donald E. Kieso - Intermediate Accounting IFRS 4e-53-120moonstar93837No ratings yet

- SA2210123 R3195 Ionut Bucks GIDDocument7 pagesSA2210123 R3195 Ionut Bucks GIDZarin TashnimNo ratings yet

- Artikel 1A - Ghio Verona (2018) Accounting Practitioners AttitudesDocument21 pagesArtikel 1A - Ghio Verona (2018) Accounting Practitioners AttitudesmeisyafitriNo ratings yet

- Woking CapitalDocument91 pagesWoking CapitalSanthosh SomaNo ratings yet

- Project Management - Tesco PLC's OperationDocument30 pagesProject Management - Tesco PLC's OperationZamzam AbdelazimNo ratings yet

- COMPARISON OF IFRS AND GAAP REPORTONG STANDARDS Case Study On Abay BankDocument29 pagesCOMPARISON OF IFRS AND GAAP REPORTONG STANDARDS Case Study On Abay BanknigusNo ratings yet

- Assessment 1 - Aguilera Sanchez Mavy LenaDocument21 pagesAssessment 1 - Aguilera Sanchez Mavy LenaMavy Aguilera SánchezNo ratings yet

- Why Trade InternationallyDocument13 pagesWhy Trade Internationallyoskar zNo ratings yet

- Definitions of Selected Financial Terms, Ratios, and Adjustments For MicrofinanceDocument28 pagesDefinitions of Selected Financial Terms, Ratios, and Adjustments For Microfinancebineet1311No ratings yet

- Strategic Financial Management Assessment Point 1Document15 pagesStrategic Financial Management Assessment Point 1gulfaaa btleNo ratings yet

- TESCODocument21 pagesTESCOderrickvamos91No ratings yet

- KPMG Comments On OECD Consultation Document FINAL 20190306Document26 pagesKPMG Comments On OECD Consultation Document FINAL 20190306HarryNo ratings yet

- Accounting Fraud and Accounting Standards: The Case of Toshiba'S Fraudulent AccountingDocument11 pagesAccounting Fraud and Accounting Standards: The Case of Toshiba'S Fraudulent AccountingxyzNo ratings yet

- Business Combinations in Cooperatives A Critical View of AccountingDocument18 pagesBusiness Combinations in Cooperatives A Critical View of Accountingatinafu assefaNo ratings yet

- Bingo EditedDocument8 pagesBingo EditedRaghav Rawat 2027407No ratings yet

- Acconting StudyDocument10 pagesAcconting Studymohamedfrag133No ratings yet

- Managing A Sucessfull Business ProjectDocument30 pagesManaging A Sucessfull Business ProjectHamza MaqboolNo ratings yet

- Demat AccountDocument72 pagesDemat AccountAnkit MehraNo ratings yet

- CR November 2016 Mark Plan-1Document26 pagesCR November 2016 Mark Plan-1Isavic AlsinaNo ratings yet

- DM MBLM 2021Document64 pagesDM MBLM 2021Shahzeb HayatNo ratings yet

- Vann Paper TAXDocument50 pagesVann Paper TAXMitiku ShewaNo ratings yet

- Tax Composition and Growth: A Broad Cross-Country PerspectiveDocument36 pagesTax Composition and Growth: A Broad Cross-Country Perspectivehector martinezNo ratings yet

- FinTech RegTech and SupTech - What They Mean For Financial Supervision FINALDocument19 pagesFinTech RegTech and SupTech - What They Mean For Financial Supervision FINALirvandi syahputraNo ratings yet

- Privatisation in The 21 Century: Recent Experiences of OECD CountriesDocument75 pagesPrivatisation in The 21 Century: Recent Experiences of OECD CountriesLeiway Thar BlogspotNo ratings yet

- Business Strategy Tesco Feedback - EditedDocument25 pagesBusiness Strategy Tesco Feedback - EditedvikasNo ratings yet

- International Business Review 29 (2020) 101692Document20 pagesInternational Business Review 29 (2020) 101692Dragnea GeorgianaNo ratings yet

- ADBI Working Paper Series: Asian Development Bank InstituteDocument25 pagesADBI Working Paper Series: Asian Development Bank InstituteOre.ANo ratings yet

- 2010-2014 Outline The Main Business Strategy Over This Period. StrategyDocument9 pages2010-2014 Outline The Main Business Strategy Over This Period. Strategyfammakhan1No ratings yet

- Revisiting Perpetual SecuritiesDocument9 pagesRevisiting Perpetual Securitiesjune hoNo ratings yet

- GROUP DISCUSSION 1 FinalDocument11 pagesGROUP DISCUSSION 1 FinalMuhammad FaisalNo ratings yet

- Guide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017From EverandGuide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017No ratings yet

- Kassahun Merawi PDFDocument58 pagesKassahun Merawi PDFDawit WorkyeNo ratings yet

- (Chapter 4) Advance (Chapter 5) Working Capital Chapter 1: Introduction To Financial ManagementDocument92 pages(Chapter 4) Advance (Chapter 5) Working Capital Chapter 1: Introduction To Financial ManagementYukiNo ratings yet

- Balance Sheet - LifeDocument77 pagesBalance Sheet - LifeYisehak NibereNo ratings yet

- Pfizer Exam Solution ManualDocument25 pagesPfizer Exam Solution ManualDiego AguirreNo ratings yet

- FIN202 - Individual AssignmentDocument25 pagesFIN202 - Individual Assignmentquangnmhs186217No ratings yet

- B.A.Corporate EcoDocument33 pagesB.A.Corporate EcoSam PeterNo ratings yet

- Q3 4 Personal Finance EditedDocument11 pagesQ3 4 Personal Finance Editedbeavivo1No ratings yet

- 2001 Financial Statements enDocument63 pages2001 Financial Statements enEarn8348No ratings yet

- Week 5 - ch17Document61 pagesWeek 5 - ch17bafsvideo4No ratings yet

- Solution Chapter 8Document20 pagesSolution Chapter 8Clarize R. Mabiog100% (1)

- Poverty Estimation and MeasurementDocument6 pagesPoverty Estimation and MeasurementYaronBabaNo ratings yet

- DCF ModelingDocument12 pagesDCF ModelingTabish JamalNo ratings yet

- CFAS Testbank Answer KeyDocument15 pagesCFAS Testbank Answer KeyPrince Jeffrey FernandoNo ratings yet

- Ch.3, Understanding Financial Statements and Cash FlowsDocument13 pagesCh.3, Understanding Financial Statements and Cash Flowsمحمد اسامہ فیاضNo ratings yet

- Albanese Company Worksheet (Partial) For The Month Ended April 30,2014Document2 pagesAlbanese Company Worksheet (Partial) For The Month Ended April 30,2014Daffa100% (1)

- I Semester Financial Accounting - Bpz1A: Theory 15 Problems 60Document28 pagesI Semester Financial Accounting - Bpz1A: Theory 15 Problems 60Blaze MysticNo ratings yet

- ACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsDocument1 pageACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsNikko Bowie PascualNo ratings yet

- Noncurrent Assets Held For SaleDocument5 pagesNoncurrent Assets Held For Salesoonie leeNo ratings yet

- FundamentalsOfFinancialManagement Chapter8Document17 pagesFundamentalsOfFinancialManagement Chapter8Adoree RamosNo ratings yet

- BPH5CDocument6 pagesBPH5CHarriniNo ratings yet

- Chapter 1 Accounting For Joint ArrangementsDocument3 pagesChapter 1 Accounting For Joint ArrangementsPrince100% (2)

- Inequality For AllDocument2 pagesInequality For AllAnjelica Marie MavintaNo ratings yet

- P9-1 Polly and Subsidiaries: Sea's BooksDocument9 pagesP9-1 Polly and Subsidiaries: Sea's BooksFarrell DmNo ratings yet

- Concepts in Federal Taxation 2014 21st Edition Murphy Test BankDocument35 pagesConcepts in Federal Taxation 2014 21st Edition Murphy Test Bankdouglasjohnsonrjysbnwzdf100% (26)

- Javier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesDocument7 pagesJavier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesRean Raphaelle GonzalesNo ratings yet

- Tugas Studi Kasus AKM1 Kelompok 4Document4 pagesTugas Studi Kasus AKM1 Kelompok 4Marchelino GirothNo ratings yet

- Tle 6 - Home Economics Quarter 3 - Week 1: Family ResourcesDocument7 pagesTle 6 - Home Economics Quarter 3 - Week 1: Family ResourcesEllenTiapsonAgenciaNo ratings yet

- Preparing Financial StatementsDocument80 pagesPreparing Financial StatementsnaveenkandarpaNo ratings yet

- Priya Sagar Jena Hod Assignment-1 222122233Document12 pagesPriya Sagar Jena Hod Assignment-1 222122233Priya Sagar JenaNo ratings yet

- Taxes: Viko Óvida Burbiene Faculty of Economics, 2004Document9 pagesTaxes: Viko Óvida Burbiene Faculty of Economics, 2004Daiva ValienėNo ratings yet

Tesco Scandal

Tesco Scandal

Uploaded by

Design RauzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tesco Scandal

Tesco Scandal

Uploaded by

Design RauzCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/319979994

Tesco scandal - Financial Reporting

Article · January 2017

CITATION READS

1 33,349

1 author:

Gianmarco Persiani

Università degli Studi di Milano-Bicocca

9 PUBLICATIONS 1 CITATION

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

S&P GOI's linear regression View project

La Polonia dovrebbe adottare l'Euro? View project

All content following this page was uploaded by Gianmarco Persiani on 22 September 2017.

The user has requested enhancement of the downloaded file.

1

TESCO SCANDAL

GROUP PROJECT:

CRESPI C LAUDIO 3001

GIANMARCO P ERSIANI 3033

SIMONE R IGATTI 3058

Course: 2238-Financial Reporting-1617_T2

Professor: Xhanti Gkougkousi

Grader: Rafael Sequeira

TESCO SCANDAL 11/11/2016

2

Table of content

1. Brief description of company and its operation

2. Accounting method analysis

3. How the scandal was uncovered

4. Impact of the accounting scandal on the company's financial statements

5. Impact of the accounting scandal on the company's various stakeholders

6. Appendix

7. References

TESCO SCANDAL 11/11/2016

3

1) Brief description of the company and its operations

Tesco is one of the leading multinational grocery and general merchandising retailer in the world which was

founded in 1919 by Jack Cohen in the East End of London. The company employed almost 476,00 people

and it operates in 11 countries. Tesco’s main activities are concentrated in three areas: distribution in United

Kingdom, international distribution and financial services. In order to provide a better experience for its

customers, Tesco diversified its business portfolio. Today, it operates also as telephonic operator and it

provides fuel selling service. In fact, the company opened its first petrol stations at major sites across the UK

in 1973 and, 20 years later, Tesco started fuel selling in service station with Tesco brand.

Since 2008 Tesco Bank, founded in 1997, has been wholly owned Tesco PLC. The financial institution

offers a range of simple personal banking product like mortgages, credit cards, personal loans and savings.

Tesco is listed on the London Stock Exchange and is a component of the FTSE 100 Index. On the 09th of

December 2016, it had a market capitalization of £17.69 billion.

Since 1996, Tesco has adopted an international expansion strategy: enlarging its business in Europe, in Asia

and in USA.

In Europe, the company got market shares through some operations of acquisition as the purchase of the five

Kipa stores in Turkey, in 2003, and the retailer LeaderPrice in Poland, in 2006. It adopted the same strategy

in Hungary and in Czech Republic. In Asia, given the local customer’s expectations, Tesco had to enter into

joint ventures with local partner to start its business. In South Korea and Thailand, it founded Samsung-

Tesco Home plus and Tesco Lotus respectively with Samsung and Charoen Pokphand. Then, Tesco opened

some stores in China and Japan. As regarding the United States of America’s market, Tesco implemented a

different strategy to extend its business there. It started its activities under the name Fresh & Easy, opening

stores in California, Arizona and Nevada. The company owned more than 200 stores and employed over

5000 people until the selling of Fresh & Easy to YFE Holdings Inc in 2013.

The good reputation and the success of Tesco were shamed by an accounting scandal in 2014. Tesco has

revealed an overstatement of £250 million of its expected profit for the half year, principally due to the

accelerated recognition of commercial income and delayed accrual of costs. To interpret the reasons of

Tesco’s fraud is essential to know the competitive environment who were exposed the company.

In recent years, Tesco was suffering a fierce competition in its core market, UK. The German hard-

discounters Aldi and Lidl practised a low pricing policy that has caused difficulties to the Britain company. It

lost a large part of its market shares in favour of the German retailer. Until then, Tesco has been considered

the cheapest retailer, thus it had to retool its business plan. The Britain company has announced drastic

reorganisation of the supermarket’s management, price reductions on hundreds of items, the closed-down of

43 unprofitable stores and the selling of its non-core businesses, as BlinkBox an online entertainment system.

Subsequently, Tesco started aggressive tactics with its suppliers to create income. From there on, Tesco

scandal begins.

TESCO SCANDAL 11/11/2016

4

2) The accounting methods used and how should have been used

This part talk about the accounting methods that was used, and the accounting methods that should have

been used by Tesco and it’s structured by reporting specific fragments of the International accounting

policies violated during the analyzed period. In this way we give a description of the correct methodology of

accounting and ( read in the opposite sense ) of the behaviour adopted by Tesco. In the fiscal year

(“2011/12”), Tesco began to misrepresent profits and losses during the Class Period, and operated in

violation of International Financial Accounting Standards (“IFRS”) reporting requirements: a) recognizing

premature and fictitious commercial income; b) delaying accrual of costs; c) overstating inventory; d)

misrepresenting “trading profit” and “underlying profit.”

Specifically, Tesco violated IFRS the reporting requirements:

-IAS 18 - Revenue: “When the outcome of a transaction involving the rendering of services can be estimated

reliably, revenue associated with the transaction shall be recognised by reference to the stage of completion

of the transaction at the end of the reporting period. The outcome of a transaction can be estimated reliably

when all the following conditions are satisfied: (a) the amount of revenue can be measured reliably; (b) it is

probable that the economic benefits associated with the transaction will flow to the entity; (c) the stage of

completion of the transaction at the end of the reporting period can be measured reliably; (d) the costs

incurred for the transaction and the costs to complete the transaction can be measured reliably.”

Tesco violated each one of this four point, by tens or hundreds of millions (combined with commercial

income cost reductions, at least £326 million), both with respect to recording prematurely the commercial

income as revenues (meaning Tesco could not justify recording such revenue in the period it did so), and

with respect to fictitious commercial income revenue (meaning that Tesco could never justify recording such

revenue). This happened because of the great element of subjectivities used on the estimation of rebates: the

manager was asked to estimate the provisional value for the rebates by an individual judgment based on the

expected future transactions. It’s clear that in absence of a transparent methodology for the estimation there

could be the temptation to be overly optimistic.

IAS 2 – Inventories:

“rebates and purchase discounts are not recorded as revenue, but as a reduction to the cost of

inventory, or, if the inventory has already been sold, as a reduction to the cost of sales”.

Tesco instead a) recorded tens or hundreds of millions of dollars (combined with commercial income

revenue, at least £326 million) in reductions to cost of sales before the products were actually sold.

b) recorded rebates and discounts to that it was not contractually entitled to, or to which the seller had not

agreed, or was not willing to provide a discount for other reasons.

Inventories shall be measured at the lower of cost and net realizable value.”…“Trade discounts, rebates

and other similar items are deducted in determining the costs of purchase”

Tesco failed to respect this principle and based his accounting method on the only purpose to inflate the

gross margin percentage by fictitious and/or premature commercial income and/or by overstating inventory.

TESCO SCANDAL 11/11/2016

5

Tesco also had been capitalizing store activities as inventory rather than expensing the activities.

IAS 37, a contingent asset is “a possible asset that arises from past events and whose existence will be

confirmed only by the occurrence or non occurrence of one or more uncertain events not wholly within

control of the entity(…) An entity shall not recognize a contingent asset(…).”When the realisation of income

is virtually certain, then the related asset is not a contingent asset and its recognition is appropriate”.

Tesco violated the “bright line” rule that contingent gains may never be recorded.

IAS 34, Interim Financial Reporting, required Tesco to provide “an explanation of events and transactions

that are significant to an understanding of the changes in financial position and performance of the entity

since the end of the last annual reporting period.” Tesco failed to disclose its increased commercial income

balances, both on its balance sheets and its income statements.

IAS 8, Accounting Policies, Changes in Accounting Estimates and Errors, “comparative information for

prior periods is presented as if (…) prior period errors had never occurred.”. Tesco violated IAS 8 because

in both its interim and year-end financial statements for 2014/15, it failed to correct 2013/14 for the

commercial income errors. About comparative information IAS also say that “revenues and related expenses

must be matched and recorded in the same reporting period. If the amount is either unknown or not fixed the

registration must be deferred”. Tesco recorded revenues but deferred the associated costs and also operated

by reducing cost in the right period but improperly defer the associated reduction of revenue. So saying that

Tesco “delayed accrual of costs” means that failed to record expenses.

3) How the accounting scandal was uncovered

The year 2014 represented a financial disaster for Tesco PLC. A series of signal was anticipating the

accounting scandal. For instance, the company issued fifth profits warning in only 12 months, it reported a

decline of 3,7% in like-for-like sales in Q1 on 4 th June and it slashed its dividend on 29 th August. This was

clearly a delicate situation until an internal employer triggered an investigation on Tesco’s accounting issues,

bringing these practices to the attention of management.

On 22nd September, the company shocked the market with an admission that it has overstated its half-year

profit forecast by £250m. It issued a press release where they said that the overstating was “principally due

to the accelerated recognition of commercial income and delayed accrual of costs” and “[o]n the basis of

preliminary investigations in to the UK food business, the Board believes that the guidance issued on 29

August 2014 for the Group profits for the six months to 23 August 2014 was overstated by an estimated

£250m. Some of this impact includes in-year timing differences.”. Furthermore, during the same period the

analysts were criticizing “the misstatement related to Tesco’s financial arrangements with suppliers, which

typically provide generous credit terms to big grocers in order to win contracts”.

Therefore, the CEO Dave Lewis asked Deloitte to undertake a comprehensive independent investigation

about these accounting issues, working closely with Freshfields, the Group's external legal advisers.

TESCO SCANDAL 11/11/2016

6

4) Impact of the accounting scandal on the company's financial statements

The magnitude of the scandal denotes especially in light of the corporate balance sheet and subsequent

analysis of key ratios, although Tesco has insisted that the impact was "material" and will not mean the

results have to be restated.

The company has shown a weaker performance of production efficiency proving it hadn't the ability to

generate earnings compare to its expenses. Low profitability is a result of excessive operating costs and

inadequate revenue due to the quick recognition of commercial income and deferred accrual of costs, which

had an impact on financial statement of 2015. ROE went from 6,21 % in 2014 to -52,7% ( Table 4) in 2015

in one year, destroying value for shareholders. Indeed, also ROA and ROIC are negative in 2015.

On liquidity side it doesn't look a huge change, but the current ratio is decreased more than the quick ratio

since this one is similar to the current ratio but it takes into account the liquid assets and not the current

assets, in which inventories are excluded from the liquid assets.

Taking a look to the income statement's items(Table 1), it is possible to notice that the biggest loss came

from the cost of sales. In fact, it went from 59,5 billion in 2014 to 64,3 billion in 2015, growing

approximately of 8%. This is due to the bad recognition of supplier discount occurred in the end of 2014 and

it is observable in 2015's annual report. Instead, considering the Financial Statement, it can observed a big

decrease of Inventories of around 17 % (from £ 3576m in 2014 to £ 2957m in 2015).

These factors also impacted on efficiency ratio decreasing control over their inventory levels and on

payments to suppliers for goods sold.

5) Impact of the accounting scandal on the company's various stakeholders

A. BOARD OF DIRECTORS

Since the scandal nine senior managers were put on leave at the time and seven of those have since been

dismissed or left.

The SFO launched a criminal investigation into accounting practices at Tesco in October 2014 after the

company admitted it had overstated profits by £263m because it had incorrectly booked payments from

suppliers, relating to issues such as marketing costs or reaching sales targets. Three former Tesco executives

have been charged with fraud by abuse of position and with false accounting by the Serious Fraud Office

(SFO):Carl Rogberg, the former finance director of Tesco UK, Christopher Bush, the former managing

director of Tesco UK, and John Scouler, the former commercial director for food. Even former executives,

including ex-CEO Philip Clarke, have been called in for interviews by the SFO.

TESCO SCANDAL 11/11/2016

7

B. SHAREHOLDERS

One of the biggest problems caused by Tesco’s mistakes was the great loss in shareholders’ equity.

Considering the trend of Tesco’s stock price ( Table 5) it is possible to catch the moment of the “scandal”.

In fact, there is a big fall down from August 2014 (before that Tesco declares the error) to October 2014

(after the declaration of the error by Tesco). Over this period the stock price fell from £ 228.41 to £ 171.

With this blow, shareholders were subjected to a potential capital loss of around 25%, which it forced them

to take legal action against the company. Taking into account the market capitalization of Tesco, during the

same period were burned more than £ 463 million.

After scandal the company was worth less than half what it was in 2013 and furthermore Moody’s has cut

Tesco's credit rating to Baa3. Tesco also had a growing pension deficit, which rose to 3.4 billion pounds

from 2.6 billion pounds in just six months during 2014. Dave Lewis didn't worked on a rights offering to

boost the company's equity base but he moved fast to raise capital .Tesco Plc Chief Executive Officer set out

his plan for reviving the U.K. grocer, a process that involved dozens of store closures and asset sales that

was worth billions of pounds.

C. INDIPENDENT AUDITORS

Another relevant factor that characterized Tesco’s stakeholders is the change of independent auditors. PwC

warned in 2014’s annual report that the company’s commercial revenues was at “risk of manipulation”,

which effectively flagged up that this could be a problem for Tesco. Since Tesco’s accelerated recognition of

commercial income and delayed accrual of costs was an isolated incident, it's not been problematic for PwC.

The company of professional services has audited Tesco’s accounts since 1983 even thought EU rules

require companies to retender their audit contract every 10 years. Indeed, after the "accounting scandal”,

Tesco nominated Deloitte as new auditor in order to work with its accountancy department to avoid that

other mistakes of misreporting happening again. It found that profits were overstated by £118m in the first

half of this year, by £70m in the 2013-2014 financial year and by £75m before that. Tesco had been doing

deals with suppliers over promotions, which is commonplace for supermarkets, but it appears Tesco had

been booking returns from those promotions too early, while pushing back the costs according to Deloitte.

D. SUPPLIERS

During 2014 Tesco paid suppliers later and taking monies from them earlier than it should have. Suppliers

have been paid to secure a prime position on Tesco’s shelves, and to fund certain promotional activities. The

problem was related to the extra incentives, called “rebates”, that Tesco received from suppliers for hitting a

certain level of sales, or for support for promotions. Furthermore he has recorded these promotional rebates

based on historical precedent rather than on current volumes. Since Tesco has been suffering meaningful

volume declines for some time then suppliers have shifted support from Tesco to other.

After scandal Dave Lewis sold many of the retailer’s assets and has refocused the brand on being a UK

grocery business rather than a global retail conglomerate companies.

TESCO SCANDAL 11/11/2016

8

6) Appendix

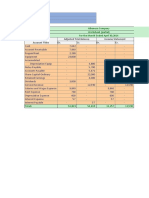

Table 1: Group income statement

Table 2: Group statement of comprehensive income(loss).

TESCO SCANDAL 11/11/2016

9

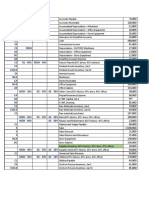

Table 3: Financial statement

Table 4: Profitability ratio, Efficiency Ratio, Liquidity Ratio.

TESCO SCANDAL 11/11/2016

10

Table 5: Tesco’ market capitalization (October 2013- October 2014)

Source: Bloomberg

TESCO SCANDAL 11/11/2016

11

7) REFERENCES

https://www.tescoplc.com/

http://securities.stanford.edu/filings-documents/1052/TP00_01/2015618_r01c_14CV08495.pdf

http://finance.yahoo.com/quote/TSCO.L?p=TSCO.L

“A history of Tesco: The rise of Britain's biggest supermarket”:

http://www.telegraph.co.uk/finance/markets/2788089/A-history-of-Tesco-The-rise-of-Britains-biggest-

supermarket.html

“Tesco fights back”:

http://www.economist.com/news/business-and-finance/21638208-tesco-fights-back

Tesco PLC Annual report and Financial Statement 2015:

https://www.tescoplc.com/

“What went wrong at Tesco?”:

https://www.ft.com/content/5eee792c-423f-11e4-a9f4-00144feabdc0

TESCO SCANDAL 11/11/2016

View publication stats

You might also like

- Accounting Scandal in The UKDocument12 pagesAccounting Scandal in The UKBeibarysNo ratings yet

- Unit 7 Business StrategyDocument12 pagesUnit 7 Business StrategyRameza RahmanNo ratings yet

- Lloyds Banking Group PLCDocument20 pagesLloyds Banking Group PLCImran HussainNo ratings yet

- Article - Innovative Financial Products Tax AspectsDocument44 pagesArticle - Innovative Financial Products Tax AspectsSuneel UdpaNo ratings yet

- Yasmine-Khalaf - AF4S31 Strategic Financial Management - Assignemnt 1Document24 pagesYasmine-Khalaf - AF4S31 Strategic Financial Management - Assignemnt 1Yasmine A. Khalaf100% (3)

- Tesco Accounting Misstatements Myopic Ideologies ODocument11 pagesTesco Accounting Misstatements Myopic Ideologies OAbbas JafriNo ratings yet

- Strategic Analysis - Tesco PLC - February PDFDocument23 pagesStrategic Analysis - Tesco PLC - February PDFlokeshNo ratings yet

- Tesco Strategic MarketingDocument20 pagesTesco Strategic MarketingMIHAELACARMEN OLTIANU100% (1)

- TESCODocument19 pagesTESCOEmmanuel OkemeNo ratings yet

- 001 Article A001 enDocument46 pages001 Article A001 enatarashiiii6No ratings yet

- TescoDocument16 pagesTescoMIHAELACARMEN OLTIANUNo ratings yet

- Chapter 1: The Business Environment and Business EconomicsDocument7 pagesChapter 1: The Business Environment and Business EconomicsHuzaimaNo ratings yet

- Business StrategyDocument18 pagesBusiness StrategySam Sah100% (1)

- Theamag: The Best of (Both) Worlds..Document6 pagesTheamag: The Best of (Both) Worlds..freemind3682No ratings yet

- Singapore Management University: Tax Treaty Policy of Developing Countries post-BEPSDocument37 pagesSingapore Management University: Tax Treaty Policy of Developing Countries post-BEPSTường Vi ĐặngNo ratings yet

- Cartilla - S3Document14 pagesCartilla - S3Anneli MNo ratings yet

- Rev 41 Pastor EspanaDocument18 pagesRev 41 Pastor EspanaDiego P00No ratings yet

- The Real Cost of Our Shoes REPORT ENG - AT - 04-2017Document64 pagesThe Real Cost of Our Shoes REPORT ENG - AT - 04-2017Osho AryanNo ratings yet

- FN 307 FinalDocument8 pagesFN 307 FinalJasco JohnNo ratings yet

- IB9BT0 1667073 Essay v02Document28 pagesIB9BT0 1667073 Essay v02Sergio SantosNo ratings yet

- Ua Business StrategyDocument23 pagesUa Business Strategyrakshika somrajanNo ratings yet

- TAKIMAKI - Internationalisation StrategyDocument13 pagesTAKIMAKI - Internationalisation StrategyZegeye DamtewNo ratings yet

- Strategic Management - Phase 1 - Ricardo Rolon - 9Document8 pagesStrategic Management - Phase 1 - Ricardo Rolon - 9carinaNo ratings yet

- Analyzing Tyco: Aggressive or Out of Line?: Rahmat Faizal & Sensony DPDocument10 pagesAnalyzing Tyco: Aggressive or Out of Line?: Rahmat Faizal & Sensony DPLheegar TanNo ratings yet

- Financial Analysis of Latex of ColombiaDocument7 pagesFinancial Analysis of Latex of Colombiaagiraldo_14No ratings yet

- AS Dita - IfRS As A Guide To Overcome Challenges in International AccountingDocument9 pagesAS Dita - IfRS As A Guide To Overcome Challenges in International AccountingYor AdeNo ratings yet

- Af4S31 - Assessment 1 (Av2) Af4S31 - Strategic Financial ManagementDocument13 pagesAf4S31 - Assessment 1 (Av2) Af4S31 - Strategic Financial ManagementugochiNo ratings yet

- 1800 Toshiba Fraud Case Study 1Document8 pages1800 Toshiba Fraud Case Study 1wenlei liuNo ratings yet

- 2020-Donald E. Kieso - Intermediate Accounting IFRS 4e-53-120Document68 pages2020-Donald E. Kieso - Intermediate Accounting IFRS 4e-53-120moonstar93837No ratings yet

- SA2210123 R3195 Ionut Bucks GIDDocument7 pagesSA2210123 R3195 Ionut Bucks GIDZarin TashnimNo ratings yet

- Artikel 1A - Ghio Verona (2018) Accounting Practitioners AttitudesDocument21 pagesArtikel 1A - Ghio Verona (2018) Accounting Practitioners AttitudesmeisyafitriNo ratings yet

- Woking CapitalDocument91 pagesWoking CapitalSanthosh SomaNo ratings yet

- Project Management - Tesco PLC's OperationDocument30 pagesProject Management - Tesco PLC's OperationZamzam AbdelazimNo ratings yet

- COMPARISON OF IFRS AND GAAP REPORTONG STANDARDS Case Study On Abay BankDocument29 pagesCOMPARISON OF IFRS AND GAAP REPORTONG STANDARDS Case Study On Abay BanknigusNo ratings yet

- Assessment 1 - Aguilera Sanchez Mavy LenaDocument21 pagesAssessment 1 - Aguilera Sanchez Mavy LenaMavy Aguilera SánchezNo ratings yet

- Why Trade InternationallyDocument13 pagesWhy Trade Internationallyoskar zNo ratings yet

- Definitions of Selected Financial Terms, Ratios, and Adjustments For MicrofinanceDocument28 pagesDefinitions of Selected Financial Terms, Ratios, and Adjustments For Microfinancebineet1311No ratings yet

- Strategic Financial Management Assessment Point 1Document15 pagesStrategic Financial Management Assessment Point 1gulfaaa btleNo ratings yet

- TESCODocument21 pagesTESCOderrickvamos91No ratings yet

- KPMG Comments On OECD Consultation Document FINAL 20190306Document26 pagesKPMG Comments On OECD Consultation Document FINAL 20190306HarryNo ratings yet

- Accounting Fraud and Accounting Standards: The Case of Toshiba'S Fraudulent AccountingDocument11 pagesAccounting Fraud and Accounting Standards: The Case of Toshiba'S Fraudulent AccountingxyzNo ratings yet

- Business Combinations in Cooperatives A Critical View of AccountingDocument18 pagesBusiness Combinations in Cooperatives A Critical View of Accountingatinafu assefaNo ratings yet

- Bingo EditedDocument8 pagesBingo EditedRaghav Rawat 2027407No ratings yet

- Acconting StudyDocument10 pagesAcconting Studymohamedfrag133No ratings yet

- Managing A Sucessfull Business ProjectDocument30 pagesManaging A Sucessfull Business ProjectHamza MaqboolNo ratings yet

- Demat AccountDocument72 pagesDemat AccountAnkit MehraNo ratings yet

- CR November 2016 Mark Plan-1Document26 pagesCR November 2016 Mark Plan-1Isavic AlsinaNo ratings yet

- DM MBLM 2021Document64 pagesDM MBLM 2021Shahzeb HayatNo ratings yet

- Vann Paper TAXDocument50 pagesVann Paper TAXMitiku ShewaNo ratings yet

- Tax Composition and Growth: A Broad Cross-Country PerspectiveDocument36 pagesTax Composition and Growth: A Broad Cross-Country Perspectivehector martinezNo ratings yet

- FinTech RegTech and SupTech - What They Mean For Financial Supervision FINALDocument19 pagesFinTech RegTech and SupTech - What They Mean For Financial Supervision FINALirvandi syahputraNo ratings yet

- Privatisation in The 21 Century: Recent Experiences of OECD CountriesDocument75 pagesPrivatisation in The 21 Century: Recent Experiences of OECD CountriesLeiway Thar BlogspotNo ratings yet

- Business Strategy Tesco Feedback - EditedDocument25 pagesBusiness Strategy Tesco Feedback - EditedvikasNo ratings yet

- International Business Review 29 (2020) 101692Document20 pagesInternational Business Review 29 (2020) 101692Dragnea GeorgianaNo ratings yet

- ADBI Working Paper Series: Asian Development Bank InstituteDocument25 pagesADBI Working Paper Series: Asian Development Bank InstituteOre.ANo ratings yet

- 2010-2014 Outline The Main Business Strategy Over This Period. StrategyDocument9 pages2010-2014 Outline The Main Business Strategy Over This Period. Strategyfammakhan1No ratings yet

- Revisiting Perpetual SecuritiesDocument9 pagesRevisiting Perpetual Securitiesjune hoNo ratings yet

- GROUP DISCUSSION 1 FinalDocument11 pagesGROUP DISCUSSION 1 FinalMuhammad FaisalNo ratings yet

- Guide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017From EverandGuide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017No ratings yet

- Kassahun Merawi PDFDocument58 pagesKassahun Merawi PDFDawit WorkyeNo ratings yet

- (Chapter 4) Advance (Chapter 5) Working Capital Chapter 1: Introduction To Financial ManagementDocument92 pages(Chapter 4) Advance (Chapter 5) Working Capital Chapter 1: Introduction To Financial ManagementYukiNo ratings yet

- Balance Sheet - LifeDocument77 pagesBalance Sheet - LifeYisehak NibereNo ratings yet

- Pfizer Exam Solution ManualDocument25 pagesPfizer Exam Solution ManualDiego AguirreNo ratings yet

- FIN202 - Individual AssignmentDocument25 pagesFIN202 - Individual Assignmentquangnmhs186217No ratings yet

- B.A.Corporate EcoDocument33 pagesB.A.Corporate EcoSam PeterNo ratings yet

- Q3 4 Personal Finance EditedDocument11 pagesQ3 4 Personal Finance Editedbeavivo1No ratings yet

- 2001 Financial Statements enDocument63 pages2001 Financial Statements enEarn8348No ratings yet

- Week 5 - ch17Document61 pagesWeek 5 - ch17bafsvideo4No ratings yet

- Solution Chapter 8Document20 pagesSolution Chapter 8Clarize R. Mabiog100% (1)

- Poverty Estimation and MeasurementDocument6 pagesPoverty Estimation and MeasurementYaronBabaNo ratings yet

- DCF ModelingDocument12 pagesDCF ModelingTabish JamalNo ratings yet

- CFAS Testbank Answer KeyDocument15 pagesCFAS Testbank Answer KeyPrince Jeffrey FernandoNo ratings yet

- Ch.3, Understanding Financial Statements and Cash FlowsDocument13 pagesCh.3, Understanding Financial Statements and Cash Flowsمحمد اسامہ فیاضNo ratings yet

- Albanese Company Worksheet (Partial) For The Month Ended April 30,2014Document2 pagesAlbanese Company Worksheet (Partial) For The Month Ended April 30,2014Daffa100% (1)

- I Semester Financial Accounting - Bpz1A: Theory 15 Problems 60Document28 pagesI Semester Financial Accounting - Bpz1A: Theory 15 Problems 60Blaze MysticNo ratings yet

- ACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsDocument1 pageACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsNikko Bowie PascualNo ratings yet

- Noncurrent Assets Held For SaleDocument5 pagesNoncurrent Assets Held For Salesoonie leeNo ratings yet

- FundamentalsOfFinancialManagement Chapter8Document17 pagesFundamentalsOfFinancialManagement Chapter8Adoree RamosNo ratings yet

- BPH5CDocument6 pagesBPH5CHarriniNo ratings yet

- Chapter 1 Accounting For Joint ArrangementsDocument3 pagesChapter 1 Accounting For Joint ArrangementsPrince100% (2)

- Inequality For AllDocument2 pagesInequality For AllAnjelica Marie MavintaNo ratings yet

- P9-1 Polly and Subsidiaries: Sea's BooksDocument9 pagesP9-1 Polly and Subsidiaries: Sea's BooksFarrell DmNo ratings yet

- Concepts in Federal Taxation 2014 21st Edition Murphy Test BankDocument35 pagesConcepts in Federal Taxation 2014 21st Edition Murphy Test Bankdouglasjohnsonrjysbnwzdf100% (26)

- Javier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesDocument7 pagesJavier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesRean Raphaelle GonzalesNo ratings yet

- Tugas Studi Kasus AKM1 Kelompok 4Document4 pagesTugas Studi Kasus AKM1 Kelompok 4Marchelino GirothNo ratings yet

- Tle 6 - Home Economics Quarter 3 - Week 1: Family ResourcesDocument7 pagesTle 6 - Home Economics Quarter 3 - Week 1: Family ResourcesEllenTiapsonAgenciaNo ratings yet

- Preparing Financial StatementsDocument80 pagesPreparing Financial StatementsnaveenkandarpaNo ratings yet

- Priya Sagar Jena Hod Assignment-1 222122233Document12 pagesPriya Sagar Jena Hod Assignment-1 222122233Priya Sagar JenaNo ratings yet

- Taxes: Viko Óvida Burbiene Faculty of Economics, 2004Document9 pagesTaxes: Viko Óvida Burbiene Faculty of Economics, 2004Daiva ValienėNo ratings yet