Professional Documents

Culture Documents

Tecnimont S.P.A. India Project Office

Tecnimont S.P.A. India Project Office

Uploaded by

S F InfrastructureCopyright:

Available Formats

You might also like

- En 1501-1-2021Document78 pagesEn 1501-1-2021Geoff Edwards100% (4)

- NumericalReasoningTest1 SolutionsDocument0 pagesNumericalReasoningTest1 Solutionsinfo_media1No ratings yet

- Toyo Engineering India Private LimitedDocument4 pagesToyo Engineering India Private LimitedWaseem AnsariNo ratings yet

- Thyssenkrupp Industries PDFDocument7 pagesThyssenkrupp Industries PDFBinoy MtNo ratings yet

- EPC Industry in IndiaDocument54 pagesEPC Industry in IndiaHarsh Kedia100% (1)

- Company Profile and Departmental Study at HitachiDocument46 pagesCompany Profile and Departmental Study at Hitachigshetty08_966675801No ratings yet

- United Drilling Tools LTD Visit NoteDocument12 pagesUnited Drilling Tools LTD Visit Noteharsh agarwalNo ratings yet

- PTC India Financial Services: IPO Fact SheetDocument4 pagesPTC India Financial Services: IPO Fact SheetVicky ShahNo ratings yet

- Top 30 Infrastructure Companies - ConstructionWeekIndiaConstructionWeekIndia PDFDocument9 pagesTop 30 Infrastructure Companies - ConstructionWeekIndiaConstructionWeekIndia PDFMelwin PaulNo ratings yet

- Press Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1hussainNo ratings yet

- Dixon Technologies (India) LimitedDocument6 pagesDixon Technologies (India) Limitedsattyak.sharma.2022No ratings yet

- Deepak Phenolics Limited: Summary of Rated InstrumentsDocument7 pagesDeepak Phenolics Limited: Summary of Rated Instrumentsvarun GarjeNo ratings yet

- Dixon Technologies (India) Limited: Financial HighlightsDocument5 pagesDixon Technologies (India) Limited: Financial HighlightsdarshanmaldeNo ratings yet

- Portfolio Management ReportDocument7 pagesPortfolio Management ReportAniruddh Singh ThakurNo ratings yet

- Top Ten Infrasturucture CompanyDocument12 pagesTop Ten Infrasturucture CompanyDwarkesh PanchalNo ratings yet

- Atmnibhar PPT Pune Final 1Document42 pagesAtmnibhar PPT Pune Final 1Sandipan ThombareNo ratings yet

- FY2024AnnualRepLnT IAR24Document668 pagesFY2024AnnualRepLnT IAR24mallikarjun.mba23No ratings yet

- SWOT AnalysisDocument3 pagesSWOT Analysissidlbsim100% (1)

- Press Release: Refer Annexure For DetailsDocument5 pagesPress Release: Refer Annexure For Detailslalit rawatNo ratings yet

- Tatva Chintan IC A Breath of Fresh AirDocument29 pagesTatva Chintan IC A Breath of Fresh AirSandeep WandreNo ratings yet

- Aviation - BOI Roadshow - Full Version - 5ab4f81a06c70Document32 pagesAviation - BOI Roadshow - Full Version - 5ab4f81a06c70kasidis.saNo ratings yet

- R R 339,792 ($ 66.8) R C N P 19,724 ($ 3.9) H e e 208,042 ($ 40.9), 14% I ' eDocument27 pagesR R 339,792 ($ 66.8) R C N P 19,724 ($ 3.9) H e e 208,042 ($ 40.9), 14% I ' eDipen TusharNo ratings yet

- IBP1 - Group 1 - Assignment 1 - Project Proposal OutlineDocument33 pagesIBP1 - Group 1 - Assignment 1 - Project Proposal OutlinephanmaithuyvyNo ratings yet

- Ultratech Cement LimitedDocument7 pagesUltratech Cement LimitedChandan ChanduNo ratings yet

- Annual Budget 2012Document14 pagesAnnual Budget 2012luv9211No ratings yet

- Syngene 3Document44 pagesSyngene 3Puneet KapoorNo ratings yet

- Ian Renewable Energy Development Agency Limited - IPO NoteDocument11 pagesIan Renewable Energy Development Agency Limited - IPO NotedeepaksinghbishtNo ratings yet

- Sunfuel Technologies LLP-01-15-2019Document4 pagesSunfuel Technologies LLP-01-15-2019mansinagpal245286No ratings yet

- To, Listing/Complianpce Department Phiroze Jeejeebhoy Towers, Dalal Street, Mumbai - 400 001. Listing/Compliance DepartmentDocument24 pagesTo, Listing/Complianpce Department Phiroze Jeejeebhoy Towers, Dalal Street, Mumbai - 400 001. Listing/Compliance DepartmentrohitnagrajNo ratings yet

- Sriram - Inv - Pres - Jan10 - f865d6Document27 pagesSriram - Inv - Pres - Jan10 - f865d6anup4frndsNo ratings yet

- Va Tech Ipo NoteDocument7 pagesVa Tech Ipo NoteBharathiraja NarendranNo ratings yet

- India Ratings and Research - Most Respected Credit Rating and Research Agency IndiaDocument6 pagesIndia Ratings and Research - Most Respected Credit Rating and Research Agency IndiainfotodollyraniNo ratings yet

- Company Name: Shivalik Bimetal Controls LTDDocument4 pagesCompany Name: Shivalik Bimetal Controls LTDSandyNo ratings yet

- Press Release Saksoft Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Saksoft Limited: Details of Instruments/facilities in Annexure-1Sandy SanNo ratings yet

- Anupam Rasayan India Limited IPO Note-202103102014074255053Document12 pagesAnupam Rasayan India Limited IPO Note-202103102014074255053sureshvadNo ratings yet

- Production Linked Incentive (PLI) SchemeDocument4 pagesProduction Linked Incentive (PLI) Schemeanil peralaNo ratings yet

- Indian Infrastructure Industry - The Road Ahead: IntroductionDocument7 pagesIndian Infrastructure Industry - The Road Ahead: IntroductionAkhil KapoorNo ratings yet

- Swot of LTDocument9 pagesSwot of LTJames TuckerNo ratings yet

- Research Report On Bharti Infratel LTD: Table of ContentDocument11 pagesResearch Report On Bharti Infratel LTD: Table of ContentSrinivas NandikantiNo ratings yet

- Research Report On Bharti Infratel LTD: Table of ContentDocument11 pagesResearch Report On Bharti Infratel LTD: Table of ContentSrinivas NandikantiNo ratings yet

- Research Report On Bharti Infratel LTD: Table of ContentDocument11 pagesResearch Report On Bharti Infratel LTD: Table of ContentSrinivas NandikantiNo ratings yet

- FR CceDocument11 pagesFR CceSamrat SinghNo ratings yet

- Prime Urban ICRA April 17Document7 pagesPrime Urban ICRA April 17BALMERNo ratings yet

- Endurance Technologies LTDDocument15 pagesEndurance Technologies LTDUNKNOWN PersonNo ratings yet

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- PR R Krishnamurthy June10 20214Document7 pagesPR R Krishnamurthy June10 20214Karthikeyan RK SwamyNo ratings yet

- Biz PlanDocument4 pagesBiz Planapi-3700769No ratings yet

- Jtekt IndiaDocument2 pagesJtekt IndiaHrishikesh R BhatNo ratings yet

- Stocks For Investment-1Document8 pagesStocks For Investment-1Balkrishna PatelNo ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- A Presentation ON Company Analysis OF L&T: BY:-Konark GuptaDocument20 pagesA Presentation ON Company Analysis OF L&T: BY:-Konark GuptaKonark GuptaNo ratings yet

- 3i Infotech LimitedDocument5 pages3i Infotech LimitedPratik SuranaNo ratings yet

- PMEGP Revised Schemes For 5 Years From 2012-22 To 2025-26Document43 pagesPMEGP Revised Schemes For 5 Years From 2012-22 To 2025-26Naresh KadyanNo ratings yet

- Tata Technologies Limited IPO Note-202311220905289760400Document15 pagesTata Technologies Limited IPO Note-202311220905289760400williamsmith199110No ratings yet

- April 2022Document43 pagesApril 2022Indraneel MahantiNo ratings yet

- Kumar Arch Tech - R-06082020Document7 pagesKumar Arch Tech - R-06082020Denish GalaNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- Dynamatic Technologies - IsEC - 31 Mar 2024Document63 pagesDynamatic Technologies - IsEC - 31 Mar 2024rawatalokNo ratings yet

- KPIT Technologies - Initiating Coverage - Centrum 26022020Document32 pagesKPIT Technologies - Initiating Coverage - Centrum 26022020Adarsh ReddyNo ratings yet

- Stockifi - Engineers India - DetailedNote - WWW - Stockifi.inDocument13 pagesStockifi - Engineers India - DetailedNote - WWW - Stockifi.inAditi WareNo ratings yet

- Emkay DixonTech 27july 2022Document16 pagesEmkay DixonTech 27july 2022Puneet kumarNo ratings yet

- Airbnb, Inc.: Category Creator and Leader, Driving Substitution Effect in Lodging AbnbDocument46 pagesAirbnb, Inc.: Category Creator and Leader, Driving Substitution Effect in Lodging AbnbsospeterNo ratings yet

- Ezekiel Complete Thesis PDFDocument69 pagesEzekiel Complete Thesis PDFCletus OgeibiriNo ratings yet

- Annual Equivalence Analysis: Annual Equivalent Criterion Applying Annual Worth Analysis Mutually Exclusive ProjectsDocument43 pagesAnnual Equivalence Analysis: Annual Equivalent Criterion Applying Annual Worth Analysis Mutually Exclusive ProjectsGayuh WNo ratings yet

- Project Management Notes (UNIT - 3)Document29 pagesProject Management Notes (UNIT - 3)DEV BHADANANo ratings yet

- Bidding For Hertz: Leveraged Buyout Question 1: How Does The Dual-Track Process Used by Ford To Initiate "Consideration ofDocument6 pagesBidding For Hertz: Leveraged Buyout Question 1: How Does The Dual-Track Process Used by Ford To Initiate "Consideration ofBryard Conhuay InfantesNo ratings yet

- BOC Aviation Investor Presentation - FINALDocument27 pagesBOC Aviation Investor Presentation - FINALFIIM12No ratings yet

- NDFC 16Document3 pagesNDFC 16Rafi AzamNo ratings yet

- Certificate of Approval: Presented byDocument7 pagesCertificate of Approval: Presented bySudipta HalderNo ratings yet

- How To Reduce, Reuse and Recycle - Instruction EssayDocument2 pagesHow To Reduce, Reuse and Recycle - Instruction EssayApril Gonzales100% (1)

- Business Plan BasicsDocument5 pagesBusiness Plan BasicsMETANOIANo ratings yet

- Development of Multinozzle Pesticides Sprayer Pump: Sandeep H. Poratkar, Dhanraj R. RautDocument5 pagesDevelopment of Multinozzle Pesticides Sprayer Pump: Sandeep H. Poratkar, Dhanraj R. Rautkamal kamalnath.bNo ratings yet

- School of Business and Management Financial Management (FM) - Module - 3 Dividend DecisionDocument26 pagesSchool of Business and Management Financial Management (FM) - Module - 3 Dividend DecisionAyesha RachhNo ratings yet

- Unit II National Income AccountingDocument61 pagesUnit II National Income Accountinggeeta neupaneNo ratings yet

- Eco Friendly Housing Policy For Signature of DTCPDocument3 pagesEco Friendly Housing Policy For Signature of DTCPNeelofar AhsanNo ratings yet

- Genicon A Surgical Strike Into Emerging MarketsDocument12 pagesGenicon A Surgical Strike Into Emerging MarketsSwati SharmaNo ratings yet

- PESTLE Analysis of SingaporeDocument3 pagesPESTLE Analysis of Singaporejason LuvNo ratings yet

- Market Overview AGMDocument17 pagesMarket Overview AGMbrunobueno.lmNo ratings yet

- ACRA - Ordinary Members ListDocument2 pagesACRA - Ordinary Members ListVery LiciousNo ratings yet

- Karvy Company ProfileDocument17 pagesKarvy Company ProfileSubhadeep Basu64% (14)

- IGCSE Economics Self Assessment Exam Style Question's Answers - Section 2Document9 pagesIGCSE Economics Self Assessment Exam Style Question's Answers - Section 2DesreNo ratings yet

- Laarhoven R 1994 Part1Document100 pagesLaarhoven R 1994 Part1indrani royNo ratings yet

- Inv 20-21 127878Document1 pageInv 20-21 127878ayyappadasNo ratings yet

- ECON 3410 - Money and Payment SystemDocument39 pagesECON 3410 - Money and Payment SystemAysha KamalNo ratings yet

- Welding ElectroidDocument28 pagesWelding Electroidbirukbrook2No ratings yet

- Salted EggDocument3 pagesSalted EggArmi BautistaNo ratings yet

- Reflection On The Wedding DanceDocument48 pagesReflection On The Wedding DanceAnnamarie Cagadas DaapongNo ratings yet

- Nism Ii B - Registrar - Practice Test 4Document19 pagesNism Ii B - Registrar - Practice Test 4HEMANSH vNo ratings yet

- India Import Refrigerator Feb 19Document161 pagesIndia Import Refrigerator Feb 19ajayNo ratings yet

Tecnimont S.P.A. India Project Office

Tecnimont S.P.A. India Project Office

Uploaded by

S F InfrastructureOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tecnimont S.P.A. India Project Office

Tecnimont S.P.A. India Project Office

Uploaded by

S F InfrastructureCopyright:

Available Formats

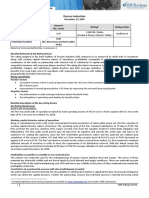

Press Release

Tecnimont S.p.A. India Project Office

January 27, 2023

Facilities Amount (₹ crore) Rating1 Rating Action

Long-term bank facilities 15.00 CARE AA-; Stable Assigned

Short-term bank facilities 280.00 CARE A1+ Assigned

Details of facilities in Annexure-1.

Rationale and key rating drivers

The ratings assigned to the bank facilities of Tecnimont S.p.A. India Project Office (TIPO) takes into account established

presence of the Maire Tecnimont group in India through Tecnimont Private Limited (TPL) and other project offices, strong

operational and financial linkages with its parent, Maire Tecnimont S.p.A., and the groups’ vast scale of operations spread

across the globe with established position in engineering, procurement and construction (EPC) of polymerbased plants and

fertilizer segment. The rating also derives strength from track record of TIPO in Indian petrochemical industry, satisfactory

execution of two projects from Indian Oil Corporation Limited (IOCL), nil debt in the books of TIPO with strong liquidity position

and stable industry outlook.

The rating strengths are partially offset by modest size and scale of operation limited to two projects and execution risk

associated with the projects.

Rating sensitivities: Factors likely to lead to rating actions

Positive factors

• Scaling-up of business operation through additional projects with satisfactory profit margins

Negative factors

• Raising of term debt for project under execution impacting the liquidity profile

• Non-adherence to sanction terms regarding repatriation of funds from Tecnimont S.p.A. India Project Office (TIPO) to

Tecnimont SpA

Analytical approach: Standalone financials of Tecnimont S.p.A. India Project Office (TIPO) has been considered along with

group linkages with Tecnimont Private Limited (TPL) as there exist group linkages with the entities belonging to the Maire

Tecnimont group which has presence in India through TPL and other project offices.

The group provides operational, financial and management support to the entity. The financial support is demonstrated by way

of co-borrowing of partial facilities by TPL for the project-specific debt availed by TIPO. As per the co-borrowing agreement,

both the entities are jointly and severally liable for the partial debt availed by TIPO.

The debt raised by TIPO satisfies the conditions stipulated by Reserve Bank of India for project office set up in India by foreign

entities-

1. Assets being financed are located in India

2. Debt is secured in nature

3. Income from the project office is ring fenced (i.e. the revenue generated from the project is escrowed to the account

maintained with the lender and no repatriation of funds is permitted without prior permission of the lender)

Key strengths

Part of the larger Maire Tecnimont group having operations spread across the globe: TIPO is a project office set-up

in India by Tecnimont SpA for execution of contracts on EPC basis in oil & gas sector. Tecnimont SpA is a wholly owned

subsidiary of Maire Technimont SpA, an Italian listed company (Milan Stock Exchange) with market cap of around Euro 1.03

billion (₹9,044 crore as on December 23, 2022). The Maire Tecnimont group operates in around 45 countries through its

Complete definitions of the ratings assigned are available at www.careedge.in and in other CARE Ratings Ltd.’s publications.

1

1 CARE Ratings Ltd.

Press Release

various group companies spread across the four continents. The group had an order book of 8 billion Euro as on September 30,

2022, out of which orders worth 6.85 billion Euro pertain to hydrocarbon business and the balance is from green energy

segment.

The Maire group is present in petrochemical segment since 1970 and has around five decades of existence. The group has

completed construction of more than 200 polyethylene and polypropylene plants, 172 ammonia and urea plants and more than

250 hydrogen and sulphur recovery unit projects. The group has more than 1,850 patents registered on its name.

The Maire Tecnimont group is a global market leader for installed capacity with 30% market share in polyolefin plants and 50%

market share in low-density polyethylene (LDPE) plants. In the fertilizer segment, the group has 52% market share in licensing

urea plants technology (first worldwide) and 34% market share in licensing urea granulation technology (second worldwide).

Strong business linkages with the group: The Maire Tecnimont group operates in around 45 countries through its various

group companies spread across the four continents. In India, the group has presence through Tecnimont Private Limited,

Tecnimont SpA and KT Kinetics Technology SpA. The group extends support to its Indian counterpart in the execution of

projects by providing access to its technologies and know-how as well as deployment of skilled personnel wherever necessary.

The strong credentials of the Maire Tecnimont group have enabled TPL & Tecnimont SpA to bid for the IOCL projects.

Furthermore, the group also enables TPL to bid for large and complex projects. TPL & Tecnimont SpA in turn support the

international operations of the group by providing engineering consultation and execution services (both onshore and offshore)

such as engineering and detailed engineering services, field engineering services, project management services, procurement

services, etc.

TPL has a master agreement with Tecnimont SpA (parent entity of TPL) for supply of 2.2 million man-hours annually which

provides stable source of revenue to TPL (almost 50% of the revenue). This apart, TIPO receives management support from

the group with common management personnel for the group operations. Furthermore, financing support is demonstrated by

virtue of co-borrowing of partial facilities by TPL for the project-specific limits availed by TIPO.

Proven track record of TIPO in petrochemical industry: TIPO has a track record of successfully executing four projects

since FY12. TIPO in association with TPL has executed large and complex projects which includes EPC of polyethylene (PE) and

polypropylene (PP) plants for well-known clients such as ONGC Petro Additions Limited (OPAL) and HPCL-Mittal Energy Limited

(HMEL).

TIPO has outstanding order book of ₹1,469 crore as on July 31, 2022. The entire work order is from IOCL for Paradip and

Barauni projects. The IOCL Paradip and IOCL Barauni Project are 41.30% and 33.45% completed as on September 30, 2022

and are scheduled to be completed by June 30, 2024 and March 31, 2024 respectively.

No term debt availed for execution of projects: TIPO has not availed any term debt for execution of IOCL projects and

the same is being funded through fund received from Tecnimont SpA and project cashflows. There was no outstanding debt in

books of TIPO as on March 31, 2022.

However, TIPO has availed overdraft limit (for exigencies) and non-fund-based limits (Letter of Credit) for purchase/import of

raw materials.

Liquidity: Strong

The liquidity position of TIPO is strong as it does not have any term debt and has majorly availed project specific non-fund-

based limits for project execution. TIPO also has sanctioned working capital limits of ₹15 crore which remains unutilized as on

December 31, 2022. Furthermore, out of the total sanctioned non-fund-based limits to TIPO; partial sanctioned limits are

supported by Tecnimont Private Limited as co-borrower. TIPO had cash and cash equivalents of ₹59.51 crore as November 30,

2022 (₹70.87 crore as on March 31, 2022).

2 CARE Ratings Ltd.

Press Release

Key weaknesses

Size and scale of operation limited to two projects: Project office restricts the size and scale of operation with TIPO

having only two projects in hand from IOCL. During FY22, TIPO has booked revenue of ₹209.99 crore (against ₹120.42 crore in

FY21) which was majorly contributed by revenue from HMEL project.

There is risk associated with non-performance of the project and levy of any penalty for the same. As on November 30, 2022,

TIPO has receivable of about ₹111 crore which majorly pertains to IOCL Paradip project. Strong credit profile of the

counterparty minimizes the receivable risk. Any cashflow support is expected to be met from existing liquid funds and/or

sponsor support.

Applicable criteria

Rating Outlook and Credit Watch

Policy on default recognition

Policy on Withdrawal of Ratings

Construction

Infrastructure Sector Ratings

Factoring Linkages Parent Sub JV Group

Short Term Instruments

Financial Ratios – Non financial Sector

Liquidity Analysis of Non-financial sector entities

About the company

Tecnimont S.p.A. India Project Office (TIPO):

TIPO is a project office set-up in India by Tecnimont SpA for execution of contracts on EPC basis in oil & gas sector. In FY22,

TIPO received two projects from IOCL at Paradip, Odisha & Barauni, Bihar which are currently being executed by TIPO in

association with TPL. The share of TIPO in IOCL Paradip and IOCL Barauni Project is ₹1,297 crore and ₹372 crore respectively.

The projects are expected to be completed in FY24-25.

Brief Financials- TIPO (₹ crore) 31-03-2021 (A) 31-03-2022 (A) 9MFY23 (Prov.)

Total operating income 120.42 209.99

PBILDT 10.10 0.56

PAT 6.62 4.46 Not Available

Overall gearing (times) NA NA

Interest coverage (times) - -

A: Audited, Prov.: Provisional, NA: Not Applicable as project office

Tecnimont SpA:

Tecnimont SpA is an international process engineering contractor with high expertise in hydrocarbon processing industry.

Tecnimont SpA is a wholly owned subsidiary of Maire Tecnimont SpA, Italy (Maire Tecnimont group) which operates as a

provider of proprietary technologies and as an EPC contractor in the chemical and Oil and Gas complexes.

Tecnimont SpA, Italy has in terms of a general permission granted by Reserve Bank of India (RBI) to open project offices to

execute engineering EPC contracts awarded by Indian Oil Corporation Limited (IOCL). Tecnimont SpA is registered with

registrar of companies as foreign company for establishment of place of business in India and has accordingly set-up project

office named as Tecnimont S.p.A. India Project Office (TIPO).

Brief Financials (Mn Euro) 31-12-2020 (A) 31-12-2021 (A) 31-12-2022 (A)

Total operating income 836.08 1262.23

PBILDT (3.58) 48.54

PAT (2.82) 44.99 Not Available

Overall gearing (times) 1.11 0.88

Interest coverage (times) NM 1.88

A: Audited, NM: Not meaningful

Status of non-cooperation with previous CRA: Not Applicable

3 CARE Ratings Ltd.

Press Release

Any other information: Not Applicable

Rating history for last three years: Please refer Annexure-2

Covenants of rated instrument/facilities: Detailed explanation of covenants of the rated instruments/facilities is given in

Annexure-3

Complexity level of various instruments rated: Annexure-4

Lender details: Annexure-5

Annexure-1: Details of instruments/facilities

Coupon Size of the

Name of the Date of Maturity Rating Assigned along

ISIN Rate Issue

Instrument Issuance Date with Rating Outlook

(%) (₹ crore)

Fund-based - LT-Bank

- - - - 15.00 CARE AA-; Stable

Overdraft

Non-fund-based - ST-

- - - - 280.00 CARE A1+

Letter of credit

Annexure-2: Rating history for the last three years

Current Ratings Rating History

Date(s)

Date(s) Date(s) Date(s)

Name of the and

Sr. Amount and and and

Instrument/Bank Rating(s)

No. Type Outstanding Rating Rating(s) Rating(s) Rating(s)

Facilities assigned

(₹ crore) assigned in assigned in assigned in

in 2019-

2022-2023 2021-2022 2020-2021

2020

Non-fund-based - ST- CARE

1 ST 280.00 - - - -

Letter of credit A1+

CARE

Fund-based - LT-

2 LT 15.00 AA-; - - - -

Bank Overdraft

Stable

Annexure-3: Detailed explanation of the covenants of the rated instruments/facilities: Not Applicable

Annexure-4: Complexity level of the various instruments rated

Sr. No. Name of the Instrument Complexity Level

1 Fund-based - LT-Bank Overdraft Simple

2 Non-fund-based - ST-Letter of credit Simple

Annexure-5: Lender details

To view the lender wise details of bank facilities please click here

Note on the complexity levels of the rated instruments: CARE Ratings has classified instruments rated by it on the basis

of complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for any

clarifications.

4 CARE Ratings Ltd.

Press Release

Contact us

Media Contact

Name: Mradul Mishra

Phone: +91-22-6754 3596

E-mail: mradul.mishra@careedge.in

Analyst Contact

Name: Puja Jalan

Phone: +91- 91600 01511

E-mail: puja.jalan@careedge.in

Relationship Contact

Name: Saikat Roy

Phone: +91-22-6754 3404

E-mail: saikat.roy@careedge.in

About us:

Established in 1993, CARE Ratings is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India, it has been acknowledged as an External Credit Assessment Institution by the RBI. With an equitable

position in the Indian capital market, CARE Ratings provides a wide array of credit rating services that help corporates raise

capital and enable investors to make informed decisions. With an established track record of rating companies over almost

three decades, CARE Ratings follows a robust and transparent rating process that leverages its domain and analytical expertise,

backed by the methodologies congruent with the international best practices. CARE Ratings has played a pivotal role in

developing bank debt and capital market instruments, including commercial papers, corporate bonds and debentures, and

structured credit.

Disclaimer:

The ratings issued by CARE Ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not recommendations to

sanction, renew, disburse, or recall the concerned bank facilities or to buy, sell, or hold any security. These ratings do not convey suitability or price for the investor.

The agency does not constitute an audit on the rated entity. CARE Ratings has based its ratings/outlook based on information obtained from reliable and credible

sources. CARE Ratings does not, however, guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions

and the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated by CARE Ratings have paid a credit rating fee,

based on the amount and type of bank facilities/instruments. CARE Ratings or its subsidiaries/associates may also be involved with other commercial transactions

with the entity. In case of partnership/proprietary concerns, the rating/outlook assigned by CARE Ratings is, inter-alia, based on the capital deployed by the

partners/proprietors and the current financial strength of the firm. The ratings/outlook may change in case of withdrawal of capital, or the unsecured loans brought

in by the partners/proprietors in addition to the financial performance and other relevant factors. CARE Ratings is not responsible for any errors and states that it

has no financial liability whatsoever to the users of the ratings of CARE Ratings. The ratings of CARE Ratings do not factor in any rating-related trigger clauses as

per the terms of the facilities/instruments, which may involve acceleration of payments in case of rating downgrades. However, if any such clauses are introduced

and triggered, the ratings may see volatility and sharp downgrades.

For the detailed Rationale Report and subscription information,

please visit www.careedge.in

5 CARE Ratings Ltd.

You might also like

- En 1501-1-2021Document78 pagesEn 1501-1-2021Geoff Edwards100% (4)

- NumericalReasoningTest1 SolutionsDocument0 pagesNumericalReasoningTest1 Solutionsinfo_media1No ratings yet

- Toyo Engineering India Private LimitedDocument4 pagesToyo Engineering India Private LimitedWaseem AnsariNo ratings yet

- Thyssenkrupp Industries PDFDocument7 pagesThyssenkrupp Industries PDFBinoy MtNo ratings yet

- EPC Industry in IndiaDocument54 pagesEPC Industry in IndiaHarsh Kedia100% (1)

- Company Profile and Departmental Study at HitachiDocument46 pagesCompany Profile and Departmental Study at Hitachigshetty08_966675801No ratings yet

- United Drilling Tools LTD Visit NoteDocument12 pagesUnited Drilling Tools LTD Visit Noteharsh agarwalNo ratings yet

- PTC India Financial Services: IPO Fact SheetDocument4 pagesPTC India Financial Services: IPO Fact SheetVicky ShahNo ratings yet

- Top 30 Infrastructure Companies - ConstructionWeekIndiaConstructionWeekIndia PDFDocument9 pagesTop 30 Infrastructure Companies - ConstructionWeekIndiaConstructionWeekIndia PDFMelwin PaulNo ratings yet

- Press Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1hussainNo ratings yet

- Dixon Technologies (India) LimitedDocument6 pagesDixon Technologies (India) Limitedsattyak.sharma.2022No ratings yet

- Deepak Phenolics Limited: Summary of Rated InstrumentsDocument7 pagesDeepak Phenolics Limited: Summary of Rated Instrumentsvarun GarjeNo ratings yet

- Dixon Technologies (India) Limited: Financial HighlightsDocument5 pagesDixon Technologies (India) Limited: Financial HighlightsdarshanmaldeNo ratings yet

- Portfolio Management ReportDocument7 pagesPortfolio Management ReportAniruddh Singh ThakurNo ratings yet

- Top Ten Infrasturucture CompanyDocument12 pagesTop Ten Infrasturucture CompanyDwarkesh PanchalNo ratings yet

- Atmnibhar PPT Pune Final 1Document42 pagesAtmnibhar PPT Pune Final 1Sandipan ThombareNo ratings yet

- FY2024AnnualRepLnT IAR24Document668 pagesFY2024AnnualRepLnT IAR24mallikarjun.mba23No ratings yet

- SWOT AnalysisDocument3 pagesSWOT Analysissidlbsim100% (1)

- Press Release: Refer Annexure For DetailsDocument5 pagesPress Release: Refer Annexure For Detailslalit rawatNo ratings yet

- Tatva Chintan IC A Breath of Fresh AirDocument29 pagesTatva Chintan IC A Breath of Fresh AirSandeep WandreNo ratings yet

- Aviation - BOI Roadshow - Full Version - 5ab4f81a06c70Document32 pagesAviation - BOI Roadshow - Full Version - 5ab4f81a06c70kasidis.saNo ratings yet

- R R 339,792 ($ 66.8) R C N P 19,724 ($ 3.9) H e e 208,042 ($ 40.9), 14% I ' eDocument27 pagesR R 339,792 ($ 66.8) R C N P 19,724 ($ 3.9) H e e 208,042 ($ 40.9), 14% I ' eDipen TusharNo ratings yet

- IBP1 - Group 1 - Assignment 1 - Project Proposal OutlineDocument33 pagesIBP1 - Group 1 - Assignment 1 - Project Proposal OutlinephanmaithuyvyNo ratings yet

- Ultratech Cement LimitedDocument7 pagesUltratech Cement LimitedChandan ChanduNo ratings yet

- Annual Budget 2012Document14 pagesAnnual Budget 2012luv9211No ratings yet

- Syngene 3Document44 pagesSyngene 3Puneet KapoorNo ratings yet

- Ian Renewable Energy Development Agency Limited - IPO NoteDocument11 pagesIan Renewable Energy Development Agency Limited - IPO NotedeepaksinghbishtNo ratings yet

- Sunfuel Technologies LLP-01-15-2019Document4 pagesSunfuel Technologies LLP-01-15-2019mansinagpal245286No ratings yet

- To, Listing/Complianpce Department Phiroze Jeejeebhoy Towers, Dalal Street, Mumbai - 400 001. Listing/Compliance DepartmentDocument24 pagesTo, Listing/Complianpce Department Phiroze Jeejeebhoy Towers, Dalal Street, Mumbai - 400 001. Listing/Compliance DepartmentrohitnagrajNo ratings yet

- Sriram - Inv - Pres - Jan10 - f865d6Document27 pagesSriram - Inv - Pres - Jan10 - f865d6anup4frndsNo ratings yet

- Va Tech Ipo NoteDocument7 pagesVa Tech Ipo NoteBharathiraja NarendranNo ratings yet

- India Ratings and Research - Most Respected Credit Rating and Research Agency IndiaDocument6 pagesIndia Ratings and Research - Most Respected Credit Rating and Research Agency IndiainfotodollyraniNo ratings yet

- Company Name: Shivalik Bimetal Controls LTDDocument4 pagesCompany Name: Shivalik Bimetal Controls LTDSandyNo ratings yet

- Press Release Saksoft Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Saksoft Limited: Details of Instruments/facilities in Annexure-1Sandy SanNo ratings yet

- Anupam Rasayan India Limited IPO Note-202103102014074255053Document12 pagesAnupam Rasayan India Limited IPO Note-202103102014074255053sureshvadNo ratings yet

- Production Linked Incentive (PLI) SchemeDocument4 pagesProduction Linked Incentive (PLI) Schemeanil peralaNo ratings yet

- Indian Infrastructure Industry - The Road Ahead: IntroductionDocument7 pagesIndian Infrastructure Industry - The Road Ahead: IntroductionAkhil KapoorNo ratings yet

- Swot of LTDocument9 pagesSwot of LTJames TuckerNo ratings yet

- Research Report On Bharti Infratel LTD: Table of ContentDocument11 pagesResearch Report On Bharti Infratel LTD: Table of ContentSrinivas NandikantiNo ratings yet

- Research Report On Bharti Infratel LTD: Table of ContentDocument11 pagesResearch Report On Bharti Infratel LTD: Table of ContentSrinivas NandikantiNo ratings yet

- Research Report On Bharti Infratel LTD: Table of ContentDocument11 pagesResearch Report On Bharti Infratel LTD: Table of ContentSrinivas NandikantiNo ratings yet

- FR CceDocument11 pagesFR CceSamrat SinghNo ratings yet

- Prime Urban ICRA April 17Document7 pagesPrime Urban ICRA April 17BALMERNo ratings yet

- Endurance Technologies LTDDocument15 pagesEndurance Technologies LTDUNKNOWN PersonNo ratings yet

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- PR R Krishnamurthy June10 20214Document7 pagesPR R Krishnamurthy June10 20214Karthikeyan RK SwamyNo ratings yet

- Biz PlanDocument4 pagesBiz Planapi-3700769No ratings yet

- Jtekt IndiaDocument2 pagesJtekt IndiaHrishikesh R BhatNo ratings yet

- Stocks For Investment-1Document8 pagesStocks For Investment-1Balkrishna PatelNo ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- A Presentation ON Company Analysis OF L&T: BY:-Konark GuptaDocument20 pagesA Presentation ON Company Analysis OF L&T: BY:-Konark GuptaKonark GuptaNo ratings yet

- 3i Infotech LimitedDocument5 pages3i Infotech LimitedPratik SuranaNo ratings yet

- PMEGP Revised Schemes For 5 Years From 2012-22 To 2025-26Document43 pagesPMEGP Revised Schemes For 5 Years From 2012-22 To 2025-26Naresh KadyanNo ratings yet

- Tata Technologies Limited IPO Note-202311220905289760400Document15 pagesTata Technologies Limited IPO Note-202311220905289760400williamsmith199110No ratings yet

- April 2022Document43 pagesApril 2022Indraneel MahantiNo ratings yet

- Kumar Arch Tech - R-06082020Document7 pagesKumar Arch Tech - R-06082020Denish GalaNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- Dynamatic Technologies - IsEC - 31 Mar 2024Document63 pagesDynamatic Technologies - IsEC - 31 Mar 2024rawatalokNo ratings yet

- KPIT Technologies - Initiating Coverage - Centrum 26022020Document32 pagesKPIT Technologies - Initiating Coverage - Centrum 26022020Adarsh ReddyNo ratings yet

- Stockifi - Engineers India - DetailedNote - WWW - Stockifi.inDocument13 pagesStockifi - Engineers India - DetailedNote - WWW - Stockifi.inAditi WareNo ratings yet

- Emkay DixonTech 27july 2022Document16 pagesEmkay DixonTech 27july 2022Puneet kumarNo ratings yet

- Airbnb, Inc.: Category Creator and Leader, Driving Substitution Effect in Lodging AbnbDocument46 pagesAirbnb, Inc.: Category Creator and Leader, Driving Substitution Effect in Lodging AbnbsospeterNo ratings yet

- Ezekiel Complete Thesis PDFDocument69 pagesEzekiel Complete Thesis PDFCletus OgeibiriNo ratings yet

- Annual Equivalence Analysis: Annual Equivalent Criterion Applying Annual Worth Analysis Mutually Exclusive ProjectsDocument43 pagesAnnual Equivalence Analysis: Annual Equivalent Criterion Applying Annual Worth Analysis Mutually Exclusive ProjectsGayuh WNo ratings yet

- Project Management Notes (UNIT - 3)Document29 pagesProject Management Notes (UNIT - 3)DEV BHADANANo ratings yet

- Bidding For Hertz: Leveraged Buyout Question 1: How Does The Dual-Track Process Used by Ford To Initiate "Consideration ofDocument6 pagesBidding For Hertz: Leveraged Buyout Question 1: How Does The Dual-Track Process Used by Ford To Initiate "Consideration ofBryard Conhuay InfantesNo ratings yet

- BOC Aviation Investor Presentation - FINALDocument27 pagesBOC Aviation Investor Presentation - FINALFIIM12No ratings yet

- NDFC 16Document3 pagesNDFC 16Rafi AzamNo ratings yet

- Certificate of Approval: Presented byDocument7 pagesCertificate of Approval: Presented bySudipta HalderNo ratings yet

- How To Reduce, Reuse and Recycle - Instruction EssayDocument2 pagesHow To Reduce, Reuse and Recycle - Instruction EssayApril Gonzales100% (1)

- Business Plan BasicsDocument5 pagesBusiness Plan BasicsMETANOIANo ratings yet

- Development of Multinozzle Pesticides Sprayer Pump: Sandeep H. Poratkar, Dhanraj R. RautDocument5 pagesDevelopment of Multinozzle Pesticides Sprayer Pump: Sandeep H. Poratkar, Dhanraj R. Rautkamal kamalnath.bNo ratings yet

- School of Business and Management Financial Management (FM) - Module - 3 Dividend DecisionDocument26 pagesSchool of Business and Management Financial Management (FM) - Module - 3 Dividend DecisionAyesha RachhNo ratings yet

- Unit II National Income AccountingDocument61 pagesUnit II National Income Accountinggeeta neupaneNo ratings yet

- Eco Friendly Housing Policy For Signature of DTCPDocument3 pagesEco Friendly Housing Policy For Signature of DTCPNeelofar AhsanNo ratings yet

- Genicon A Surgical Strike Into Emerging MarketsDocument12 pagesGenicon A Surgical Strike Into Emerging MarketsSwati SharmaNo ratings yet

- PESTLE Analysis of SingaporeDocument3 pagesPESTLE Analysis of Singaporejason LuvNo ratings yet

- Market Overview AGMDocument17 pagesMarket Overview AGMbrunobueno.lmNo ratings yet

- ACRA - Ordinary Members ListDocument2 pagesACRA - Ordinary Members ListVery LiciousNo ratings yet

- Karvy Company ProfileDocument17 pagesKarvy Company ProfileSubhadeep Basu64% (14)

- IGCSE Economics Self Assessment Exam Style Question's Answers - Section 2Document9 pagesIGCSE Economics Self Assessment Exam Style Question's Answers - Section 2DesreNo ratings yet

- Laarhoven R 1994 Part1Document100 pagesLaarhoven R 1994 Part1indrani royNo ratings yet

- Inv 20-21 127878Document1 pageInv 20-21 127878ayyappadasNo ratings yet

- ECON 3410 - Money and Payment SystemDocument39 pagesECON 3410 - Money and Payment SystemAysha KamalNo ratings yet

- Welding ElectroidDocument28 pagesWelding Electroidbirukbrook2No ratings yet

- Salted EggDocument3 pagesSalted EggArmi BautistaNo ratings yet

- Reflection On The Wedding DanceDocument48 pagesReflection On The Wedding DanceAnnamarie Cagadas DaapongNo ratings yet

- Nism Ii B - Registrar - Practice Test 4Document19 pagesNism Ii B - Registrar - Practice Test 4HEMANSH vNo ratings yet

- India Import Refrigerator Feb 19Document161 pagesIndia Import Refrigerator Feb 19ajayNo ratings yet