Professional Documents

Culture Documents

BAM 127 Day 14 - TG

BAM 127 Day 14 - TG

Uploaded by

Paulo BelenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BAM 127 Day 14 - TG

BAM 127 Day 14 - TG

Uploaded by

Paulo BelenCopyright:

Available Formats

BAM 127: Income Taxation for BA

Teachers’ Guide Module #14

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

Quiz No. 2 Materials:

Coverage: FLM Activity Sheets

1. Gain on Sale, Exchange and Other Disposition of Real

Property

2. Scope of Regular Income Tax and classifications of

Gross Income.

3. Inclusions in Gross Income

Hi! I hope you’re having an amazing day! Today, we will be having an assessment of your learning

on the previous lessons. I hope that you have studied very well.

This is a 6 paged test and is composed of 3 sections and have a total score of fifty six (56) points.

You have forty (45) Minutes to finish this assessment. Carefully read the instructions before answering.

Strictly No Erasures – any forms of erasure will invalidate your answers.

Now, let’s start!

I – MCQ – Write the letter of your answer before each number. (1 pt. each)

1. A taxpayer purchased a building to be used as a future plant site. The building remained

unused for 3 years due to significant decline in customer’s demand in product of the taxpayer. The

taxpayer eventually disposed the property. What is the classification of the property?

a. Ordinary asset c. Either A or B at the discretion of BIR

b. Capital Asset d. Either A or B depending on the intent of the buyer

2. Assuming the sane data in the preceding number except that the property was not disposed of

but the same was used as a sales outlet after which it became vacant for more than 2 years. What is

the classification of the property?

a. Ordinary asset, regardless of the taxpayer

b. Capital asset, regardless of the taxpayer

c. Ordinary asset, if the taxpayer is not engage in real estate business

d. Capital asset, if the taxpayer is not engaged in real estate business

This document is the property of PHINMA EDUCATION

BAM 127: Income Taxation for BA

Teachers’ Guide Module #14

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

3. Anderson disposes a vancant lot for P 3,000,000. The lot has an Assessor’s fair value of

P2,800,000, a zonal value of P 3,200,00, and an appraisal value of P3,500,00. What is capital gains tax?

a. P 0 c. P 192,000

b. P 180,000 d. P 210,000

4. Puerto Princessa Company sold its parking lot for P2,000,000. The lot has a zonal value of

P2,500,000 and appraisal value of P1,800,000. The capital gains tax on the sale of the lot is

a. P 0 c. P 192,000

b. P 180,000 d. P 210,000

5. Mr. Antonio disposed his principal residence for P 2,000,000 and imeediately acquired a new

one for P1,800,000. The old residence cost Mr. Antonio P 1,000,000 and had a fair market value of P

2,500,000 on the date of sale.

Compute the capital gains tax to be deposited in escrow.

a. P 0 c. P 120,000

b. P 60,000 d. P 150,000

6. On August 15, 2020, Ms. Mones sold a 500-square meter residential house and lot for

P3,000,000. The house was acquired in 2005 at P2,000,000. The assessor’s fair market values of the

house and lot, respectively were P1,500,000 and P1,000,000. The zonal value of the lot was P5,000

per square meter.

How much is the capital gains tax?

a. P 180,000 c. P 150,000

b. P 120,000 d. P 240,000

7. Manny, a resident Filipino citizen, sold his principal residence (house and lot) at its original

purchase price of P 11,000,000. The property had a P13,000,000 fair market value at that time.

If the proceeds of the sale were not invested in the new principal residence but, instead, new

funds of P15,000,000 were used to construct it, the capital gains tax is

a. P 0 c. P 750,000

b. P 660,000 d. P 780,000

This document is the property of PHINMA EDUCATION

BAM 127: Income Taxation for BA

Teachers’ Guide Module #14

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

Numbers through 8 to 9 are based on the following information:

Mr. Pepito sold his residential land in Manila with fair market value of P 12,000,000 for P

10,000,000.

8. If Mr. Pepito utilized all of the P10,000,000 in buying a house and lot to be used as his new

principal residence, the final tax due from him is

a. P 720,000 c. P 120,000

b. P 600,000 d. P 0

9. If Mr. Pepito utilized only P 7,000,000 from the proceeds of the sale in acquiring a new

residence, the final tax due from him is

a. P 720,000 c. P 180,000

b. P 216,000 d. P 0

10. The general rule in income taxation is

a. Final income tax c. Regular income tax

b. Capital Gains tax d. Fringe benefit tax

11. Active income is subject to

a. Regular tax c. Final tax

b. Capital gains tax d. Any of these

Question 12 & 13 are based on the following

A. Regular Tax B. Final Tax C. Capital Gains Tax

12. Which of the foregoing are passive incomes are subject to?

a. A only c. Both A and B

b. B only d. Either A or B

13. Which of the foregoing are capital gains subject to?

This document is the property of PHINMA EDUCATION

BAM 127: Income Taxation for BA

Teachers’ Guide Module #14

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

a. A only c. Both A and B

b. B only d. Either A or B

14. The net amount of regular income subject to regular tax is called

a. Taxable income c. Net Income

b. Compensation income d. Gross Income

15. Which is not generally subject to regular income tax?

a. Compensation income c. Professional income

b. Business income d. Passive income

16. Which is not true with the creditable withholding tax?

a. Advances to the annual tax due c. Need to file annual income tax return

b. No need to pay further taxes d. Applicable to items of regular income

17. Progressive income tax is applicable to

a. Corporate taxpayers c. Compensation earners only

b. Individual taxpayers d. Individuals in business only

18. Proportional regular income tax is applicable to

a. Corporations only c. Individuals engaged in business

b. Compensation earners only d. Both individuals and corporations

19. Which of the following individual taxpayers is not subject to tax on taxable income?

a. Non-resident citizen c. NRA-NETB

b. Resident Alien d. Non-resident alien engaged in business

20. Which of the following corporate taxpayers is not subject to tax on taxable income?

a. Domestic corporation c. Non-resident foreign corporation

b. Business Partnership d. Resident Foreign Corporation

This document is the property of PHINMA EDUCATION

BAM 127: Income Taxation for BA

Teachers’ Guide Module #14

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

II – True or False – Write “True” if the statement is correct otherwise write “False”

_____________1. Items of gross income subject to regular income tax and capital gains tax are

reportable to the government.

_____________2. Rent is a passive income, but not subject to final tax.

_____________3. The interest income from bonds issued by banks is subject to final tax

_____________4. Gains from dealings in capital assets are generally subject to the regular income.

_____________5. The gross income from operations enjoying a tax holiday are included in gross

income subject to regular tax, but are presented as deductions in the income tax return.

_____________6. The share in a business partnership is subject to final tax, but the share in a general

professional partnership is subject to regular income tax.

_____________7. Gains from dealings in ordinary assets are subject to regular income tax.

_____________8. Items of passive royalty income are subject to final income tax while items of active

royalty income are subject to regular income tax.

_____________9. Compensation income is an inclusion in gross income subject to regular tax except

compensation income of special aliens.

_____________10. The reportable gross income from business or the exercise of a profession is net

of the cost of goods sold or cost of services.

_____________11. Items of income which are included in gross income subject to final tax are

excluded in gross income subject to regular income tax.

_____________12. Imputed interest income is an item of gross income subject to regular income tax.

_____________13. Advanced rentals are income in the year received.

_____________14. Real property tax and insurance on the property if assumed by the lessee

constitute income to the lessor.

_____________15. Corporate winnings are exclusions in gross income; hence, they are exempt from

income tax.

_____________16. Stock dividends are never subject to income tax.

_____________17. Pensions or retirement benefits are inclusions in gross income subject to regular

income tax if the employee is terminated due to any cause within his control.

_____________18. Prizes in athletic competitions sanctioned by the Philippine government are

This document is the property of PHINMA EDUCATION

BAM 127: Income Taxation for BA

Teachers’ Guide Module #14

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

exclusions in gross income subject to final tax, but are inclusions in gross income subject to regular

income tax.

_____________19. Corporate prizes are exclusions in gross income subject to final tax but are

inclusions in gross income subject to regular income tax.

_____________20. Stock splits are never subject to income tax.

III – Problem Solving – Compute what is being asked. Provide your solutions. (2 pts. Each)

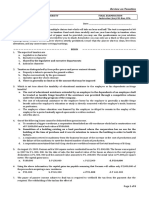

Problem 1 - Lesde, Inc. had the following income in 2020:

1. Compute the taxable income if Lesde Inc. was a domestic corporation.

2. Compute the income tax due in the immediately preceding problem.

3. Compute taxable income assuming Lesde Corporation was a resident foreign corporation.

4. Compute the income tax due in the immediate preceding number.

5. Compute the tax due if Lesde, Inc. was a non-resident foreign corporation. Assume that tax

sparring is not applicable.

This document is the property of PHINMA EDUCATION

BAM 127: Income Taxation for BA

Teachers’ Guide Module #14

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

Problem 2 – Mr. Allan derived the following income in 2019:

6. Compute the total passive income subject to final tax

7. Compute the total passive income subject to regular tax

8. Compute the capital gain subject to capital gains tax.

This document is the property of PHINMA EDUCATION

BAM 127: Income Taxation for BA

Teachers’ Guide Module #14

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

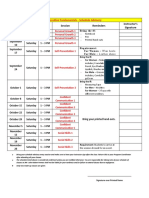

Key Answers

I - MCQ - Answers

1. A 11. A

2. D 12. D

3. C 13. D

4. A 14. A

5. D 15. D

6. D 16. B

7. D 17. B

8. A 18. A

9. A 19. C

10. C 20. D

II – True or False

1. True 11. True

2. True 12. False

3. False 13. True

4. True 14. True

5. False 15. False

6. True 16. False

7. True 17. True

8. True 18. False

9. True 19. True

10. True 20. True

III – Problem Solving

1. P 3,700,000 5. P 3,039,000

2. P 1,110,000 6. P 170,000

3. P 1,300,000 7. P 630,000

This document is the property of PHINMA EDUCATION

BAM 127: Income Taxation for BA

Teachers’ Guide Module #14

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

4. P 390,000 8. P 40,000

This document is the property of PHINMA EDUCATION

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Travel and Tourism Coursebook AnswersDocument8 pagesTravel and Tourism Coursebook AnswersHuy LeNo ratings yet

- TAX First Preboard 2021Document10 pagesTAX First Preboard 2021Ser Crz JyNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Taxation First Preboard 93 - QuestionnaireDocument16 pagesTaxation First Preboard 93 - QuestionnaireAmeroden AbdullahNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Semi Final Exam For Tax 1Document6 pagesSemi Final Exam For Tax 1Gregorio ReyNo ratings yet

- Question - Chapter 2Document17 pagesQuestion - Chapter 2Mạnh Đỗ ĐứcNo ratings yet

- TAX1101 - Summative Assesment # 1 WITH ANS KEYDocument11 pagesTAX1101 - Summative Assesment # 1 WITH ANS KEYElisabeth HenangerNo ratings yet

- Taxation - Quiz No. 3Document8 pagesTaxation - Quiz No. 3Heidee ManliclicNo ratings yet

- Quiz 5Document7 pagesQuiz 5Jud Rossette Arcebes100% (1)

- Real Estate Taxation - 12.11.15 (Answers)Document7 pagesReal Estate Taxation - 12.11.15 (Answers)Juan Frivaldo33% (3)

- Taxation With AnswersDocument8 pagesTaxation With AnswersMarion Tamani Jr.50% (2)

- Exam For Business TaxDocument3 pagesExam For Business TaxJenyll MabborangNo ratings yet

- C B A A: Department of AccountancyDocument11 pagesC B A A: Department of AccountancyROMAR A. PIGANo ratings yet

- Intro To Income TaxDocument4 pagesIntro To Income TaxJennifer Arcadio100% (1)

- First City Providential College: Brgy. Narra, Francisco Homes, City of San Jose Del Monte, BulacanDocument4 pagesFirst City Providential College: Brgy. Narra, Francisco Homes, City of San Jose Del Monte, BulacanArjhay CruzNo ratings yet

- Capital GainsDocument5 pagesCapital GainsJCGonzalesNo ratings yet

- BA 126 Preliminary ExaminationDocument6 pagesBA 126 Preliminary ExaminationKitagawa, Misia Sophia Jan B.No ratings yet

- Finals Tax301Document9 pagesFinals Tax301Pauline De VillaNo ratings yet

- Quiz IndividualDocument4 pagesQuiz IndividualRezhel Vyrneth TurgoNo ratings yet

- Taxation Preweek and Additional MaterialsDocument26 pagesTaxation Preweek and Additional MaterialsMarvin ClementeNo ratings yet

- TAX 1st Monthly-AssessmentDocument5 pagesTAX 1st Monthly-AssessmentEeuhNo ratings yet

- Real Estate Taxation - 12.11.15Document8 pagesReal Estate Taxation - 12.11.15Juan Frivaldo100% (3)

- TAX Assessment October 2020Document8 pagesTAX Assessment October 2020FuturamaramaNo ratings yet

- Session 8 Exercise Drill - AKDocument6 pagesSession 8 Exercise Drill - AKMitzi WamarNo ratings yet

- Dealings in PropertiesDocument12 pagesDealings in PropertiesJane Tuazon50% (2)

- Real Estate Taxation - 12.11.15 (Wo Answers)Document7 pagesReal Estate Taxation - 12.11.15 (Wo Answers)Juan FrivaldoNo ratings yet

- Second PB Acctg 203BDocument12 pagesSecond PB Acctg 203BBella AyabNo ratings yet

- Drill Discssion Inc and ExcDocument32 pagesDrill Discssion Inc and ExcJao FloresNo ratings yet

- Tax Pre TestDocument5 pagesTax Pre TestKryzzel Anne JonNo ratings yet

- Integrated Review Prob 2Document6 pagesIntegrated Review Prob 2Regine ConsueloNo ratings yet

- Accounting Hawk - TAXATIONDocument14 pagesAccounting Hawk - TAXATIONClaire BarbaNo ratings yet

- Taxation GroupDocument19 pagesTaxation GroupJoanne Castillo100% (1)

- Tax Review - FinalsDocument8 pagesTax Review - FinalsRobert Castillo100% (2)

- QUIZ 2 MKM v.23Document3 pagesQUIZ 2 MKM v.23Ronnalene Cerbas Glori0% (1)

- Tax - 2nd Monthly Assessment - QuestionsDocument12 pagesTax - 2nd Monthly Assessment - QuestionsGRACELYN SOJORNo ratings yet

- Tax - Midterm NTC 2017Document12 pagesTax - Midterm NTC 2017Red YuNo ratings yet

- Capital Gains TaxDocument3 pagesCapital Gains TaxMary Christen Canlas0% (1)

- Capital Gains Tax PDFDocument3 pagesCapital Gains Tax PDFJustine Paulo EnerlanNo ratings yet

- Funda of Acctg 2-Semifinal ExamDocument4 pagesFunda of Acctg 2-Semifinal ExamHLeigh Nietes-GabutanNo ratings yet

- Short Quiz 3 Set A With AnswerDocument3 pagesShort Quiz 3 Set A With AnswerJean Pierre Isip100% (1)

- Introduction To Business Taxation: Property of STIDocument3 pagesIntroduction To Business Taxation: Property of STIDong RoselloNo ratings yet

- Instruction: Write The Letter of Your Choice On The Space Provided Before The NumberDocument4 pagesInstruction: Write The Letter of Your Choice On The Space Provided Before The NumberASDDD100% (2)

- BLT 101Document14 pagesBLT 101NIMOTHI LASENo ratings yet

- 1st Pre-Board TaxationDocument11 pages1st Pre-Board Taxationrandyblanza2014No ratings yet

- BTX 113 Final Examination With QuestionsDocument6 pagesBTX 113 Final Examination With Questionsjanus lopezNo ratings yet

- Taxation Compiled Questions With AnswersDocument18 pagesTaxation Compiled Questions With AnswersJeneleen TalledoNo ratings yet

- Bainte1x - Q3Document3 pagesBainte1x - Q3Shaina SantosNo ratings yet

- Introductory ConceptsDocument3 pagesIntroductory ConceptsJosh BustamanteNo ratings yet

- Tax1 Final Exam 2022 ADocument7 pagesTax1 Final Exam 2022 AEjie MarabeNo ratings yet

- Chapter 3,4,5,6 (Income Tax)Document14 pagesChapter 3,4,5,6 (Income Tax)Txos Vaj50% (4)

- 85184767Document9 pages85184767Garp BarrocaNo ratings yet

- True False False True True True False True True True True True True True True True True False False True True True False True TrueDocument5 pagesTrue False False True True True False True True True True True True True True True True False False True True True False True TrueDong RoselloNo ratings yet

- Quiz #2: SEMI-FINAL: Answer KeyDocument3 pagesQuiz #2: SEMI-FINAL: Answer KeyAngel MaghuyopNo ratings yet

- Income Tax Fundamentals 2019 37Th Edition Whittenburg Test Bank Full Chapter PDFDocument36 pagesIncome Tax Fundamentals 2019 37Th Edition Whittenburg Test Bank Full Chapter PDFacrania.dekle.z2kajy100% (12)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument20 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionFebby Grace Villaceran Sabino0% (2)

- 5.2 Answer Key - FWT and CGTDocument6 pages5.2 Answer Key - FWT and CGTRezhel Vyrneth Turgo100% (1)

- Introduction To Income TaxDocument4 pagesIntroduction To Income Taxkimberlyann ongNo ratings yet

- How an Experienced Real Estate Professional Lost a Million Dollars on a Small Apartment ProjectFrom EverandHow an Experienced Real Estate Professional Lost a Million Dollars on a Small Apartment ProjectNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Rethink Property Investing, Fully Updated and Revised Edition: Become Financially Free with Commercial Property InvestingFrom EverandRethink Property Investing, Fully Updated and Revised Edition: Become Financially Free with Commercial Property InvestingNo ratings yet

- Speedtest 1Document1 pageSpeedtest 1Paulo BelenNo ratings yet

- Field House Residential Care LTDDocument13 pagesField House Residential Care LTDPaulo BelenNo ratings yet

- BAM 127 Day 1 - TGDocument7 pagesBAM 127 Day 1 - TGPaulo BelenNo ratings yet

- APPLICATIONDocument2 pagesAPPLICATIONPaulo BelenNo ratings yet

- Listofitems SaucemattersDocument1 pageListofitems SaucemattersPaulo BelenNo ratings yet

- Sworn Declaration of SalesDocument4 pagesSworn Declaration of SalesPaulo BelenNo ratings yet

- Cash Monitoring and Sales MonitoringDocument29 pagesCash Monitoring and Sales MonitoringPaulo BelenNo ratings yet

- Automatic ScoresheetDocument4 pagesAutomatic ScoresheetPaulo BelenNo ratings yet

- MenuDocument7 pagesMenuPaulo BelenNo ratings yet

- 2 ND Finals TOSDocument4 pages2 ND Finals TOSPaulo BelenNo ratings yet

- Executive Fundamentals Schedule AdvisoryDocument1 pageExecutive Fundamentals Schedule AdvisoryPaulo BelenNo ratings yet

- Details SiDocument1 pageDetails SiPaulo BelenNo ratings yet

- Eudaimon DtiDocument1 pageEudaimon DtiPaulo BelenNo ratings yet

- 2020 Sales SLSPDocument2 pages2020 Sales SLSPPaulo BelenNo ratings yet

- Sworn Declaration of SalesDocument1 pageSworn Declaration of SalesPaulo BelenNo ratings yet

- 2019 and 2020 Purchases SLSPDocument6 pages2019 and 2020 Purchases SLSPPaulo BelenNo ratings yet

- 2019 Sales SLSPDocument2 pages2019 Sales SLSPPaulo BelenNo ratings yet

- Ground Handling in AsiaDocument34 pagesGround Handling in AsiaBảo ĐứcNo ratings yet

- Chapter 3Document2 pagesChapter 3marisNo ratings yet

- Soal Sap Ac010Document2 pagesSoal Sap Ac010Celine LianataNo ratings yet

- IFRS 18 Presentation and Disclosure in Financial StatementsDocument180 pagesIFRS 18 Presentation and Disclosure in Financial StatementsSophia Alexandra CabuangNo ratings yet

- Submitted To: Anjum Zia Submitted By:: Ambreen Riaz (09) Dania Waheed (29) Advertising BS Mass CommunicationDocument5 pagesSubmitted To: Anjum Zia Submitted By:: Ambreen Riaz (09) Dania Waheed (29) Advertising BS Mass CommunicationAmbreen RiazNo ratings yet

- Test Begins HereDocument6 pagesTest Begins HereRichardDinongPascual100% (1)

- Project Vision DocumentDocument9 pagesProject Vision DocumentSujal JaviaNo ratings yet

- DC CropedDocument63 pagesDC Cropedanishaenterprises1992No ratings yet

- Major Project ReportDocument25 pagesMajor Project Reportstemmed09escapeNo ratings yet

- Dissertation Business PlanDocument5 pagesDissertation Business PlanCheapPaperWritingServiceCanada100% (1)

- HPM 34 346Document24 pagesHPM 34 346Htet Lynn HtunNo ratings yet

- AP-115-Unit-4 RECORDING BUSINESS TRANSACTIONSDocument40 pagesAP-115-Unit-4 RECORDING BUSINESS TRANSACTIONSBebie Joy Urbano100% (1)

- Apparel Production Planning Control AE 405Document56 pagesApparel Production Planning Control AE 405ইসলামিক টিভিNo ratings yet

- Quiz Bowl - Acctg 3Document2 pagesQuiz Bowl - Acctg 3sharen jill montero100% (1)

- Donation Political PartiesDocument4 pagesDonation Political Partiessockalingam.mNo ratings yet

- Lawteacher InsuranceDocument39 pagesLawteacher InsuranceWanangwa ChiumeNo ratings yet

- Marketing Management:: An IntroductionDocument66 pagesMarketing Management:: An IntroductionWilsonNo ratings yet

- Ajol File Journals - 463 - Articles - 151750 - Submission - Proof - 151750 5461 398082 1 10 20170217Document22 pagesAjol File Journals - 463 - Articles - 151750 - Submission - Proof - 151750 5461 398082 1 10 20170217lucìaNo ratings yet

- YMPH PriceList MC Jan'19Document2 pagesYMPH PriceList MC Jan'19Christofer De Los ReyesNo ratings yet

- Dissertation Topics in Marketing CommunicationsDocument8 pagesDissertation Topics in Marketing CommunicationsDoMyPapersLowell100% (1)

- Hazards and Operability (HAZOP) StudyDocument28 pagesHazards and Operability (HAZOP) StudyXiang Jintao100% (1)

- Case Studies of Unit 5 & 6 of BUsiness StudiesDocument19 pagesCase Studies of Unit 5 & 6 of BUsiness StudiesPallavi Gupta bhallaNo ratings yet

- FTM CIF Quotation of 250TPH Mobile Crushing PlantDocument15 pagesFTM CIF Quotation of 250TPH Mobile Crushing PlantPT. SULAWESI BERLIAN JAYANo ratings yet

- Final ExamDocument13 pagesFinal ExamddddddaaaaeeeeNo ratings yet

- West Covina HeightsDocument1 pageWest Covina HeightsBryan Rudolph PascualNo ratings yet

- Marketing Management Cases and Problems: SyllabusDocument8 pagesMarketing Management Cases and Problems: SyllabusKJ VillNo ratings yet

- Click To Edit Master Subtitle Style: - By-Arkaprava GhoshDocument49 pagesClick To Edit Master Subtitle Style: - By-Arkaprava Ghosh1234pinkuNo ratings yet

- MGT603 Short NotesDocument20 pagesMGT603 Short NotesAdnan JavedNo ratings yet