Professional Documents

Culture Documents

Cong Ty TNHH Thuong Mai Thien Long Pib 20230721151234

Cong Ty TNHH Thuong Mai Thien Long Pib 20230721151234

Uploaded by

Ftu NGUYỄN THỊ NGỌC MINHOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cong Ty TNHH Thuong Mai Thien Long Pib 20230721151234

Cong Ty TNHH Thuong Mai Thien Long Pib 20230721151234

Uploaded by

Ftu NGUYỄN THỊ NGỌC MINHCopyright:

Available Formats

CONG TY TNHH THUONG MAI THIEN LONG: Company Profile

Company Info Financial Summary

Company FY2016/12 FY2017/12 FY2018/12 FY2019/12 FY2020/12 FY2021/12

CONG TY TNHH THUONG MAI THIEN LONG (Unit: SGD Million) - - - - - Non-con

Actual Actual Actual Actual Actual Actual

Ticker - I/S Total Revenue 2 2 2 3 4 4

Description Net Profit 0 0 0 0 0 0

Bán buôn nông, lâm sn nguyên liu (tr g, tre, na) và đng vt sng Data source: Net Margin 0.2% 0.2% 0.3% 0.3% 0.3% 0.1%

https://dichvuthongtin.dkkd.gov.vn/inf/default.aspx BS Total Assets 0 0 1 1 1 1

Shldr' Eq. 0 0 0 0 1 1

Industry Shldr' Eq. Ratio 55.00% 26.51% 20.51% 72.87% 82.20% 85.10%

-

Debt(IBD) 0 0 0 - - -

Representative D/E Ratio 0.68x 2.01x 2.46x - - -

-

Address

ROE 2.84% 3.50% 6.40% 3.65% 2.31% -

140 - Tran Hung Dao, Phuong Chanh Lo, Thanh pho Quang Ngai, Quang Ngai, Vietnam

ROA 1.40% 1.25% 1.48% 1.68% 1.81% -

Phone +842553828484

Website -

Founded 12/05/2004

IPO Date -

Main Stock Exchange

Private

Capital Stock -(-)

Headcount 7 ( 2020/05 )

Shareholders Segment Info

No Data No Data

No Data No Data

Composed by SPEEDA 1/14

CONG TY TNHH THUONG MAI THIEN LONG: KPI Charts

Trends of Sales and Margin Cost-related Ratios

No Data

Composed by SPEEDA 2/14

CONG TY TNHH THUONG MAI THIEN LONG: KPI Charts

Historical ROE/ROA Historical Turnover Period

Composed by SPEEDA 3/14

CONG TY TNHH THUONG MAI THIEN LONG: KPI Charts

Trends of Leverage Trend of Shareholders Equity to Asset Ratio

Composed by SPEEDA 4/14

CONG TY TNHH THUONG MAI THIEN LONG: KPI Charts

Cash Flows Dividend Payout Ratio

No Data No Data

Composed by SPEEDA 5/14

Competitor Analysis : Basic Information

Earnings Result Valuation

Ticker Total Revenue Net Profit Enterprise P/E P/BV

Description Market Cap

Company Name Latest FY Attribute to Last closing price Value(EV) LTM LTM

SGD Million parent SGD Million LTM x x

Bán buôn nông, lâm sn nguyên liu (tr g, tre, na) và đng vt sng Data

*CONG TY TNHH THUONG MAI source: https://dichvuthongtin.dkkd.gov.vn/inf/default.aspx 4 0 N/A N/A N/A N/A

THIEN LONG (Private)

VC2 Olam Group Ltd sources, processes, packages, and sells agricultural

Olam Group Ltd 54,901 588 5,296 17,058 9.0 0.69

commodities.

中国供集有限公司(称“中国供集”)是国院批准成立的我国大型涉流通集,是

China Co-op Group Co., Ltd. 45,228 -178 N/A N/A N/A N/A

中全国供合作社(称“供合作社”)全企。

(Private)

WHOLESALE TRADE OF A VARIETY OF GOODS WITHOUT A

CONCORDIA AGRITRADING 29,138 82 N/A N/A N/A N/A

DOMINANT PRODUCT,MANUFACTURE OF EDIBLE VEGETABLE

PTE LTD (Private) AND ANIMAL OILS AND FATS

WHOLESALE OF AGRICULTURAL RAW MATERIALS AND LIVE

BUNGE ASIA PTE. LTD. 23,695 117 N/A N/A N/A N/A

ANIMALS N.E.C. (EXCLUDING TROPICAL PRODUCE),OTHER

HOLDING COMPANIES

WHOLESALE TRADE OF A VARIETY OF GOODS WITHOUT A

WILMAR TRADING PTE LTD 21,451 -7 N/A N/A N/A N/A

DOMINANT PRODUCT,WHOLESALE ON A FEE OR CONTRACT

(Private) BASIS (EG COMMISSION AGENTS)

WHOLESALE TRADE OF A VARIETY OF GOODS WITHOUT A

CARGILL INTERNATIONAL 16,513 364 N/A N/A N/A N/A

DOMINANT PRODUCT

TRADING PTE LTD (Private)

600096 Yunnan Yuntianhua Co Ltd is engaged in manufacturing of phosphate

Yunnan Yuntianhua Co Ltd 15,442 1,235 6,707 10,378 5.8 1.93

fertilizer, nitrogen fertilizer, and copolymerized formaldehyde.

WHOLESALE OF AGRICULTURAL RAW MATERIALS AND LIVE

COFCO INTERNATIONAL 12,161 215 N/A N/A N/A N/A

ANIMALS N.E.C. (EXCLUDING TROPICAL PRODUCE),WHOLESALE

SINGAPORE PTE. LTD. (Private) TRADE OF A VARIETY OF GOODS WITHOUT A DOMINANT

PRODUCT

一般目:易;物出口;出口代理;国内易代理;技出口;食品售(售包装食品);谷物售

Xiamen Xiangyu Logistics Group ;豆及薯售;料原料售;畜牧料售;副品售;棉、麻售;棉花收;品及原料售;鞋帽批;建 12,089 381 N/A N/A N/A N/A

Corporation (Private) 筑材料售;化肥售;林品售;五金品批;煤炭及制品售;石油制品售(不含危化学品

);非金属及制品售;金属石售;金属材料售;高品特种材料售;高性能有色金属及

合金材料售;金制品售;珠宝首零售;化工品售(不含可化工品);塑料制品售;工程

塑料及合成脂售;橡制品售;高品合成橡售;用制成品售;国物代理;国内物代理

;普通物服(不含危化学品等需可批的目);幼儿配方乳粉及其他幼儿配方食品

售。(除依法批准的目外,凭照依法自主开展活)可目:食品售;粮食收;黄金及其

制品出口;批;危化学品;原油批。(依法批准的目,相关部批准后方可开展活,具体

目以相关部批准文件或可件准)

OTHER HOLDING COMPANIES,ACTIVITIES OF HEAD AND

FKS FOOD AND AGRI PTE. LTD. REGIONAL HEAD OFFICES; CENTRALISED ADMINISTRATIVE 9,881 71 N/A N/A N/A N/A

(Private) OFFICES AND SUBSIDIARY MANAGEMENT OFFICES

中粮易有限公司是中粮、中谷、粮“三粮合一”的大型粮食内、外、物流企。

COFCO Trading Ltd. (Private) 9,357 140 N/A N/A N/A N/A

Composed by SPEEDA 6/14

Note: Sales = Net Sale which is calculated as Gross Sales - Sales Allowance Return. Depending on industry, sales is defined as Operating Income, Ordinary Income.

Note: Enterprise Value = Market Cap+(Interest-bearing debt- Cash Equivalents and Short Term Investments)+Minority Interests. The negative Enterprise Value is displayed as N/A.

Note: P/E = Market Cap / Net Profit.

Note: P/BV = Market Cap / Total Shareholders Equity.

Note: * in company name indicates automatic industry classifications by algorithm.

Composed by SPEEDA 7/14

Competitor Analysis : Valuation

Market Cap EV P/E P/BV EV/Sales EV/EBITDA EV/Operating Income

Ticker Company Name Last closing

LTM Latest FY LTM LTM Latest FY LTM Latest FY LTM Latest FY LTM

price

SGD Million SGD Million x x x x x x x x x

*CONG TY TNHH N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

VC2 Olam Group Ltd 5,296 17,058 9.0 9.0 0.69 0.31 0.31 7.8 7.8 4.6 4.6

600096 Yunnan Yuntianhua Co 6,707 10,378 5.8 5.8 1.93 0.70 0.71 4.6 4.8 5.6 5.9

Mean 6,001 13,718 7.4 7.4 1.31 0.50 0.51 6.2 6.3 5.1 5.2

Median 6,001 13,718 7.4 7.4 1.31 0.50 0.51 6.2 6.3 5.1 5.2

Minimum 5,296 10,378 5.8 5.8 0.69 0.31 0.31 4.6 4.8 4.6 4.6

Maximum 6,707 17,058 9.0 9.0 1.93 0.70 0.71 7.8 7.8 5.6 5.9

Note: Enterprise Value = Market Cap+(Interest-bearing debt- Cash Equivalents and Short Term Investments)+Minority Interests.

Note: P/E = Market Cap / Net Profit.

Note: P/BV = Market Cap / Total Shareholders Equity.

Note: N/A stands for EV/Sales, EV/EBITDA, and EV/Operating Profit are negative or unreleased.

Note: * in company name indicates automatic industry classifications by algorithm.

Composed by SPEEDA 8/14

Competitor Analysis : Profitability

EBITDA Margin Operating Profit Margin Net Profit Margin (Attribute to parent

Ticker Company Name FY2021 FY2022 LTM FY2021 FY2022 LTM FY2021 FY2022 LTM

% % % % % % % % %

*CONG TY TNHH N/A N/A N/A N/A N/A N/A 0.1 N/A 0.1

VC2 Olam Group Ltd 3.8 4.0 4.0 7.1 6.8 6.8 1.3 1.1 1.1

China Co-op Group Co., N/A N/A N/A N/A N/A N/A -1.1 -0.4 -0.4

CONCORDIA 0.3 N/A N/A N/A N/A N/A 0.3 N/A -2.3

BUNGE ASIA PTE. LTD. 0.6 N/A N/A N/A N/A N/A 0.5 N/A 0.8

WILMAR TRADING PTE 0.1 N/A N/A N/A N/A N/A -0.0 N/A N/A

CARGILL 2.3 N/A N/A N/A N/A N/A 2.2 N/A N/A

600096Yunnan Yuntianhua Co 12.8 15.4 14.8 9.4 12.4 12.0 5.8 8.0 7.8

COFCO INTERNATIONAL 1.9 N/A N/A N/A N/A N/A 1.8 N/A N/A

Xiamen Xiangyu Logistics N/A N/A N/A N/A N/A N/A N/A N/A 1.6

FKS FOOD AND AGRI 2.6 N/A N/A N/A N/A N/A 0.7 N/A N/A

COFCO Trading Ltd. N/A N/A N/A N/A N/A N/A N/A N/A N/A

Mean 3.1 9.7 9.4 8.3 9.6 9.4 1.2 2.9 1.2

Median 2.1 9.7 9.4 8.3 9.6 9.4 0.6 1.1 0.8

Minimum 0.1 4.0 4.0 7.1 6.8 6.8 -1.1 -0.4 -2.3

Maximum 12.8 15.4 14.8 9.4 12.4 12.0 5.8 8.0 7.8

Note: Profitability items are calculated as each profit items/Sales×100. Sales = Net Sale which is calculated as Gross Sales - Sales Allowance Return. Depending on industry, sales is defined as Operating

Income, Ordinary Income.

Note: If company’s account standard is US GAAP(SEC), Ordinary Income is defined as Profit Before Income Taxes.

Note: * in company name indicates automatic industry classifications by algorithm.

Composed by SPEEDA 9/14

Competitor Analysis : Growth

Sales Growth Operating Profit Growth Net Profit Growth EPS Growth

Ticker Company Name FY2021 FY2022 LTM FY2021 FY2022 LTM FY2021 FY2022 LTM FY2021 FY2022 LTM

% % % % % % % % % % % %

*CONG TY TNHH N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

VC2 Olam Group Ltd 31.2 16.8 16.8 32.1 11.4 11.4 232.3 -6.5 -6.5 214.8 -14.8 -14.8

China Co-op Group Co., 31.7 9.9 9.9 N/A N/A N/A -406.8 N/A N/A N/A N/A N/A

CONCORDIA 7.7 N/A -96.4 N/A N/A N/A N/A N/A N/A N/A N/A N/A

BUNGE ASIA PTE. LTD. 49.8 N/A -33.9 N/A N/A N/A N/A N/A N/A N/A N/A N/A

WILMAR TRADING PTE 56.0 N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

CARGILL 12.4 N/A N/A N/A N/A N/A 10.2 N/A N/A N/A N/A N/A

600096Yunnan Yuntianhua Co 21.4 19.1 17.3 201.0 57.0 25.1 1,238.8 65.3 26.2 942.0 65.5 N/A

COFCO INTERNATIONAL 185.7 N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

Xiamen Xiangyu Logistics N/A N/A -0.7 N/A N/A N/A N/A N/A 24.8 N/A N/A N/A

FKS FOOD AND AGRI 45.1 N/A N/A N/A N/A N/A 86.1 N/A N/A N/A N/A N/A

COFCO Trading Ltd. N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

Mean 49.0 15.2 -14.5 116.6 34.2 18.3 232.1 29.4 14.9 578.4 25.4 -14.8

Median 31.7 16.8 4.6 116.6 34.2 18.3 86.1 29.4 24.8 578.4 25.4 -14.8

Minimum 7.7 9.9 -96.4 32.1 11.4 11.4 -406.8 -6.5 -6.5 214.8 -14.8 -14.8

Maximum 185.7 19.1 17.3 201.0 57.0 25.1 1,238.8 65.3 26.2 942.0 65.5 -14.8

Note: Note: Growth rates are calculated using the formula (Current FY Figure/Previous FY Figure - 1)×100. Rates are listed as “N/A” in cases where figures have not yet been released, there has been

a change in FY closing date, the period of comparison contains consolidated and non-consolidated statements, there have been changes in accounting standards or currency, or a previous FY figure is

negative.

Note: * in company name indicates automatic industry classifications by algorithm.

Composed by SPEEDA 10/14

Competitor Analysis : Efficiency

ROE ROA Total Assets Turnover Ratio ROIC(Invested Capital)

Ticker Company Name FY2021 FY2022 LTM FY2021 FY2022 LTM FY2021 FY2022 LTM FY2021 FY2022 LTM

% % % % % % % % %

*CONG TY TNHH N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

VC2 Olam Group Ltd 9.88 8.15 8.15 2.14 1.84 1.84 1.6 1.72 1.72 4.77 5.44 5.44

China Co-op Group Co., -7.67 -2.53 -2.53 -1.45 -0.49 -0.49 1.29 1.24 1.24 N/A N/A N/A

CONCORDIA 74.69 N/A -5.72 0.63 N/A -0.12 2.22 N/A 0.05 N/A N/A N/A

BUNGE ASIA PTE. LTD. 1.20 N/A 3.40 1.04 N/A 2.71 2.11 N/A 3.57 N/A N/A N/A

WILMAR TRADING PTE -3.95 N/A N/A -0.20 N/A N/A 6 N/A N/A N/A N/A N/A

CARGILL 32.04 N/A N/A 10.67 N/A N/A 4.85 N/A N/A N/A N/A N/A

600096Yunnan Yuntianhua Co 43.77 45.31 39.78 6.86 11.32 10.00 1.19 1.42 1.28 12.97 19.27 17.67

COFCO INTERNATIONAL N/A N/A N/A 11.79 N/A N/A 6.66 N/A N/A N/A N/A N/A

Xiamen Xiangyu Logistics N/A N/A 7.87 N/A N/A 3.05 N/A N/A 1.93 N/A N/A N/A

FKS FOOD AND AGRI 8.71 N/A N/A 2.57 N/A N/A 3.56 N/A N/A N/A N/A N/A

COFCO Trading Ltd. N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

Mean 19.83 16.98 8.49 3.78 4.22 2.83 3.28 1.46 1.63 8.87 12.36 11.55

Median 9.29 8.15 5.63 2.14 1.84 2.27 2.22 1.42 1.5 8.87 12.36 11.55

Minimum -7.67 -2.53 -5.72 -1.45 -0.49 -0.49 1.19 1.24 0.05 4.77 5.44 5.44

Maximum 74.69 45.31 39.78 11.79 11.32 10.00 6.66 1.72 3.57 12.97 19.27 17.67

Note: ROE = Net Profit/Average Total Shareholders Equity at beginning and end of the period×100.

Note: ROA = Net Profit/Average Total Assets at beginning and end of the period×100.

Note: ROIC = NOPAT/Invested Capital×100. NOPAT is defined as EBIT(Net Profit Before Income Taxes+Interest Expenses)-Income Taxes. NOPAT of Japanese Company is defined as Total Operating

Profit-Income Taxes. Invested Capital = Interest-bearing debt + Total Stockholders Equity

Note: Ordinary Income/Total Assets = Ordinary Income/Average Total Assets at beginning and end of the period×100. If company’s account standard is US GAAP(SEC), Ordinary Income is defined as

Profit Before Income Taxes.

Note: Total Assets Turnover Ratio = Sales/Average Total Assets at beginning and end of the period

Note: * in company name indicates automatic industry classifications by algorithm.

Composed by SPEEDA 11/14

Competitor Analysis : Leverage

D/E Ratio Net D/E Ratio Total Interest Bearing Debt/EBITDA Net Total Interest Bearing Debt/EBITDA Shareholders' Equity Ratio

Ticker Company Name FY2021 FY2022 LTM FY2021 FY2022 LTM FY2021 FY2022 LTM FY2021 FY2022 LTM FY2021 FY2022 LTM

x x x x x x x x x x x x % % %

*CONG TY TNHH N/A N/A N/A -0.01 N/A -0.01 N/A N/A N/A N/A N/A N/A 85.10 N/A 85.10

VC2 Olam Group Ltd 2.47 2.11 2.11 1.98 1.54 1.54 9.27 7.40 7.40 7.45 5.41 5.41 21.12 23.97 23.97

China Co-op Group Co., N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A 18.18 20.16 20.16

CONCORDIA N/A N/A N/A -0.07 N/A -0.01 N/A N/A N/A N/A N/A N/A 0.52 N/A 2.08

BUNGE ASIA PTE. LTD. N/A N/A N/A -0.00 N/A -0.00 N/A N/A N/A N/A N/A N/A 88.08 N/A 82.73

WILMAR TRADING PTE N/A N/A N/A -0.37 N/A N/A N/A N/A N/A N/A N/A N/A 5.22 N/A N/A

CARGILL N/A N/A N/A -0.00 N/A N/A N/A N/A N/A N/A N/A N/A 45.39 N/A N/A

600096Yunnan Yuntianhua Co 2.93 1.36 1.28 N/A N/A N/A 3.70 1.93 2.04 N/A N/A N/A 19.22 30.75 30.08

COFCO INTERNATIONAL N/A N/A N/A -0.00 N/A N/A N/A N/A N/A N/A N/A N/A 3.65 N/A N/A

Xiamen Xiangyu Logistics N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A 36.99

FKS FOOD AND AGRI N/A N/A N/A -0.53 N/A N/A N/A N/A N/A N/A N/A N/A 25.66 N/A N/A

COFCO Trading Ltd. N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

Mean 2.70 1.73 1.70 0.12 1.54 0.38 6.48 4.66 4.72 7.45 5.41 5.41 31.21 24.96 40.16

Median 2.70 1.73 1.70 -0.01 1.54 -0.00 6.48 4.66 4.72 7.45 5.41 5.41 20.17 23.97 30.08

Minimum 2.47 1.36 1.28 -0.53 1.54 -0.01 3.70 1.93 2.04 7.45 5.41 5.41 0.52 20.16 2.08

Maximum 2.93 2.11 2.11 1.98 1.54 1.54 9.27 7.40 7.40 7.45 5.41 5.41 88.08 30.75 85.10

Note: Capital Adequacy Ratio = Total Shareholders Equity/Total Asset at the end of the period×100.

Note: D/E Ratio = Interest-bearing debt/Total Shareholders Equity. Net D/E Ratio = Interest-bearing debt - Cash and Cash Equivalents/Total Shareholders Equity.

Note: If Interest-bearing debt is zero or each items are negative, D/E Ratio, Net D/E Ratio, Interest-bearing debt/EBITDA, Net Interest-bearing debt/EBITDA are displayed as N/A.

Note: * in company name indicates automatic industry classifications by algorithm.

Composed by SPEEDA 12/14

Competitor Analysis : Productivity

Total Operating Net

Ticker Company Name FY2021 FY2021 FY2021

SGD SGD SGD

*CONG TY TNHH N/A N/A N/A

VC2 Olam Group Ltd 571,105 40,691 7,641

China Co-op Group Co., N/A N/A N/A

CONCORDIA N/A N/A N/A

BUNGE ASIA PTE. LTD. N/A N/A N/A

WILMAR TRADING PTE N/A N/A N/A

CARGILL N/A N/A N/A

600096Yunnan Yuntianhua Co N/A N/A N/A

COFCO INTERNATIONAL N/A N/A N/A

Xiamen Xiangyu Logistics N/A N/A N/A

FKS FOOD AND AGRI N/A N/A N/A

COFCO Trading Ltd. N/A N/A N/A

Mean 571,105 40,691 7,641

Median 571,105 40,691 7,641

Minimum 571,105 40,691 7,641

Maximum 571,105 40,691 7,641

Note: Sales = Net Sale which is calculated as Gross Sales - Sales Allowance Return. Depending on industry, sales is defined as Operating Income, Ordinary Income.

Note: : If company’s account standard is US GAAP(SEC), Ordinary Income is defined as Profit Before Income Taxes.

Note: * in company name indicates automatic industry classifications by algorithm.

Composed by SPEEDA 13/14

Competitor Analysis : Shareholder Return

Dividends per Share Dividend Yield

Ticker Company Name FY2021 FY2022 LTM FY2021 FY2022 LTM

SGD SGD SGD % % %

*CONG TY TNHH N/A N/A N/A N/A N/A N/A

VC2 Olam Group Ltd 0.08 0.09 0.09 4.5 5.8 6.2

China Co-op Group Co., N/A N/A N/A N/A N/A N/A

CONCORDIA N/A N/A N/A N/A N/A N/A

BUNGE ASIA PTE. LTD. N/A N/A N/A N/A N/A N/A

WILMAR TRADING PTE N/A N/A N/A N/A N/A N/A

CARGILL N/A N/A N/A N/A N/A N/A

600096Yunnan Yuntianhua Co N/A N/A N/A N/A N/A N/A

COFCO INTERNATIONAL N/A N/A N/A N/A N/A N/A

Xiamen Xiangyu Logistics N/A N/A N/A N/A N/A N/A

FKS FOOD AND AGRI N/A N/A N/A N/A N/A N/A

COFCO Trading Ltd. N/A N/A N/A N/A N/A N/A

Mean 0.08 0.09 0.09 4.5 5.8 6.2

Median 0.08 0.09 0.09 4.5 5.8 6.2

Minimum 0.08 0.09 0.09 4.5 5.8 6.2

Maximum 0.08 0.09 0.09 4.5 5.8 6.2

Note: Dividend Payout Ratio = Annual Total of Dividends/Net Profit×100. Annual Total of Dividends is defined as Nonconsolidated value, and Net Profit is defined as Consolidated value prior to

Nonconsolidated.

Note: Dividend Yield = (Dividends per Share / Stock Price) × 100. Dividends per Share refers to data disclosed by the company. The dividend yield at the end of previous fiscal years refers to the

closing stock price at fiscal year end of each company. For latest fiscal year and LTM, the last closing price is used.

Note: * in company name indicates automatic industry classifications by algorithm.

Composed by SPEEDA 14/14

You might also like

- Fact201003 FDDocument23 pagesFact201003 FDLeinadNo ratings yet

- DSRP Dangote Sugar Refinery PLC PIB 20230727174619Document13 pagesDSRP Dangote Sugar Refinery PLC PIB 20230727174619Ftu NGUYỄN THỊ NGỌC MINHNo ratings yet

- Ey Japan Jbs India Flashnews c8 May 2020Document11 pagesEy Japan Jbs India Flashnews c8 May 2020Himanshu KashyapNo ratings yet

- (9434) ソフトバンクの株価・業績・競合 - 会社四季報オンラインDocument3 pages(9434) ソフトバンクの株価・業績・競合 - 会社四季報オンラインya aNo ratings yet

- 2014経産省-もの作り白書 概要Document41 pages2014経産省-もの作り白書 概要MICK MINAMINo ratings yet

- Ku 1100 20121205 01Document16 pagesKu 1100 20121205 01BファリサNo ratings yet

- Economic Report 202306Document16 pagesEconomic Report 202306himiyaNo ratings yet

- (BarCap) 202312D DraftDocument1 page(BarCap) 202312D DraftlouisNo ratings yet

- 双葉電子工業 買収に向けてDocument41 pages双葉電子工業 買収に向けて俣野莉歩No ratings yet

- 個股報告 力成 (6239)Document6 pages個股報告 力成 (6239)皓名No ratings yet

- R031223mitoshi GaiyoDocument1 pageR031223mitoshi GaiyoLendy Irawan 剣道イラワンNo ratings yet

- 23Q3PPT JDocument78 pages23Q3PPT Jtakahiro.kurodaNo ratings yet

- A World of Possibilities: Winners ReportDocument24 pagesA World of Possibilities: Winners Reportfumihiro yonekuraNo ratings yet

- 2021 PWC 内外一体の経済成長戦略構築にかかる国際経済調査事業 イスラエルと我が国及び主要第三国との経済関係に関する現状調査Document103 pages2021 PWC 内外一体の経済成長戦略構築にかかる国際経済調査事業 イスラエルと我が国及び主要第三国との経済関係に関する現状調査Feng LinNo ratings yet

- 4231 Tigers Polymer Corporation Company Finance PLDocument6 pages4231 Tigers Polymer Corporation Company Finance PLRikuriNo ratings yet

- BEA ABC YTD Performance Apr 2021Document5 pagesBEA ABC YTD Performance Apr 2021tytaityNo ratings yet

- 128731Document163 pages128731pill pillarNo ratings yet

- EirDocument143 pagesEirAtsushi YoshidaNo ratings yet

- 番號Document1 page番號道格拉斯No ratings yet

- FujikawaDocument49 pagesFujikawaAan Laskar Umat IslamNo ratings yet

- TD3 - SolutionDocument7 pagesTD3 - Solutionnoufel farhiNo ratings yet

- SBKK Financial Report 20220511Document45 pagesSBKK Financial Report 20220511qicaiNo ratings yet

- 連結經營Document1 page連結經營道格拉斯No ratings yet

- ReporteDocument1 pageReportepedromiguelNo ratings yet

- 表取Document1 page表取道格拉斯No ratings yet

- NIO - NIO IncDocument10 pagesNIO - NIO IncPrimož KozlevčarNo ratings yet

- DownloadDocument24 pagesDownloadNikhil MalankarNo ratings yet

- RPK0401-001 20220105094718143Document1 pageRPK0401-001 20220105094718143Yuan ShiNo ratings yet

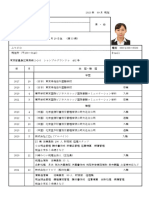

- 崔秀美 履歴書2023Document2 pages崔秀美 履歴書2023Xiumei CuiNo ratings yet

- 4.indonesian Investment 2020:21 - JPNDocument118 pages4.indonesian Investment 2020:21 - JPNfaizaldalimiNo ratings yet

- ConsumerServices InvestmentStrategy 200715Document33 pagesConsumerServices InvestmentStrategy 200715skNo ratings yet

- 009 02 00Document62 pages009 02 00ratosaNo ratings yet

- 配當Document1 page配當道格拉斯No ratings yet

- 5025 20220301 応用地質Document12 pages5025 20220301 応用地質RikuriNo ratings yet

- PCA アナリストレポートDocument40 pagesPCA アナリストレポートDNo ratings yet

- RPK0401-001 20230407042557180Document1 pageRPK0401-001 20230407042557180Gupril AdinebabaNo ratings yet

- Irpdf 001384Document36 pagesIrpdf 001384houhuixin2021No ratings yet

- 2 ADBの官民連携事業への支援プレゼン資料 PDFDocument32 pages2 ADBの官民連携事業への支援プレゼン資料 PDFADBJRONo ratings yet

- 信連Document1 page信連道格拉斯No ratings yet

- 1 00 CRSDOutlookDocument56 pages1 00 CRSDOutlookmikrosanimjajaNo ratings yet

- Business Model and Strategy Presentation JPNDocument45 pagesBusiness Model and Strategy Presentation JPNjoneNo ratings yet

- RPK0401-001_20230615093214200Document1 pageRPK0401-001_20230615093214200tiffanialotxertNo ratings yet

- Yo 00242319Document105 pagesYo 00242319Bibin CherianNo ratings yet

- 00Document131 pages00appleNo ratings yet

- 代表Document1 page代表道格拉斯No ratings yet

- Teisei JDocument2 pagesTeisei Jname158No ratings yet

- 算短Document1 page算短道格拉斯No ratings yet

- 2014総務省-情報通信白書 概要Document48 pages2014総務省-情報通信白書 概要MICK MINAMINo ratings yet

- 3 15三化Document1 page3 15三化道格拉斯No ratings yet

- 間配Document1 page間配道格拉斯No ratings yet

- LS 2022 Reports EnglishDocument86 pagesLS 2022 Reports English方浚諺No ratings yet

- IR Presentation FY18Document32 pagesIR Presentation FY18choiand1No ratings yet

- (SBI) 202402D DraftDocument1 page(SBI) 202402D DraftlouisNo ratings yet

- Keyeast JPDocument4 pagesKeyeast JPhongbo.liNo ratings yet

- 会員企業景気・事業環境認識アンケート結果第三回 20240515Document70 pages会員企業景気・事業環境認識アンケート結果第三回 20240515hny930430No ratings yet

- Parking Solutions Final March 2010 by IBS&RoyDocument22 pagesParking Solutions Final March 2010 by IBS&RoyRoy TriptoNo ratings yet

- Iso 201910Document9 pagesIso 201910MOHAMEDNo ratings yet

- 本比Document1 page本比道格拉斯No ratings yet