Professional Documents

Culture Documents

Amendment For Auditing and Assurance

Amendment For Auditing and Assurance

Uploaded by

10SHARMA SUMIT RAMADHINOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amendment For Auditing and Assurance

Amendment For Auditing and Assurance

Uploaded by

10SHARMA SUMIT RAMADHINCopyright:

Available Formats

ACADEMIC UPDATE

FOR STUDENTS APPEARING IN NOVEMBER, 2023 INTERMEDIATE

PAPER-6: AUDITING AND ASSURANCE

Chapter 9 (Printed Copy)

At Page 10- Topic “Shares issued at a discount” is revised and being given

hereunder. Students are advised to study this topic from here and not from printed

copy of the study material.

Shares issued at a discount

According to Section 53 of the Companies Act, 2013,

(1) a company shall not issue shares at a discount, except in the case of an issue of sweat

equity shares given under Section 54 of the Companies Act, 2013.

(2) any share issued by a company at a discounted price shall be void.

(2A) Notwithstanding anything contained in sub-sections (1) and (2), a company may issue

shares at a discount to its creditors when its debt is converted into shares in pursuance

of any statutory resolution plan or debt restructuring scheme in accordance with any

guidelines or directions or regulations specified by the Reserve Bank of India under the

Reserve Bank of India Act, 1934 or the Banking (Regulation) Act, 1949.

(3) Where any company fails to comply with the provisions of this section, such company

and every officer who is in default shall be liable to a penalty which may extend to an

amount equal to the amount raised through the issue of shares at a discount or five

lakh rupees, whichever is less, and the company shall also be liable to refund all monies

received with interest at the rate of twelve per cent. per annum from the date of issue

of such shares to the persons to whom such shares have been issued.

The auditor needs to check

(i) the movement in share capital during the year and wherever there is any issue,

(ii) he should verify that the Company has not issued any of its shares at a discount by

reading the minutes of meeting of its directors and shareholders authorizing issue of

share capital and the issue price.

(iii) Further, auditor should also verify that whether the company has issued shares at a

discount to its creditors when its debt is converted into shares in pursuance of any statutory

resolution plan or debt restructuring scheme in accordance with any guidelines or directions

or regulations specified by the Reserve Bank of India under the Reserve Bank of India Act,

1934 or the Banking (Regulation) Act, 1949.

This topic has also been revised at page no. 10 of chapter 9 and students can refer

at the link given below

https://resource.cdn.icai.org/66605bos53774-cp9.pdf

© The Institute of Chartered Accountants of India

CHAPTER 10 – COMPANY AUDIT

On Page number 10.36, point (j) to be read as under:

(j) such other matters as may be prescribed. Rule 11 of the Companies (Audit

and Auditors) Rules, 2014 prescribes the other matters to be included in auditor’s

report. The auditor’s report shall also include their views and comments on the

following matters, namely:-

(i) whether the company has disclosed the impact, if any, of pending litigations on its

financial position in its financial statement;

(ii) whether the company has made provision, as required under any law or accounting

standards, for material foreseeable losses, if any, on long term contracts including

derivative contracts;

(iii) whether there has been any delay in transferring amounts, required to be transferred,

to the Investor Education and Protection Fund by the company.

[(iv) (1) Whether the management has represented that, to the best of it’s knowledge

and belief, other than as disclosed in the notes to the accounts, no funds have

been advanced or loaned or invested (either from borrowed funds or share

premium or any other sources or kind of funds) by the company to or in any

other person(s) or entity(ies), including foreign entities (“Intermediaries”), with

the understanding, whether recorded in writing or otherwise, that the

Intermediary shall, whether, directly or indirectly lend or invest in other persons

or entities identified in any manner whatsoever by or on behalf of the company

(“Ultimate Beneficiaries”) or provide any guarantee, security or the like on

behalf of the Ultimate Beneficiaries;

(2) Whether the management has represented, that, to the best of it’s knowledge

and belief, other than as disclosed in the notes to the accounts, no funds have

been received by the company from any person(s) or entity(ies), including

foreign entities (“Funding Parties”), with the understanding, whether recorded

in writing or otherwise, that the company shall, whether, directly or indirectly,

lend or invest in other persons or entities identified in any manner whatsoever

by or on behalf of the Funding Party (“Ultimate Beneficiaries”) or provide any

guarantee, security or the like on behalf of the Ultimate Beneficiaries; and

(3) Based on such audit procedures that the auditor has considered reasonable

and appropriate in the circumstances, nothing has come to their notice that has

caused them to believe that the representations under sub-clause (1) and (2)

contain any material misstatement.

© The Institute of Chartered Accountants of India

(v) Whether the dividend declared or paid during the year by the company is in

compliance with section 123 of the Companies Act, 2013.

(vi) Whether the company has used such accounting software for maintaining its books

of account which has a feature of recording audit trail (edit log) facility and the

same has been operated throughout the year for all transactions recorded in the

software and the audit trail feature has not been tampered with and the audit trail

has been preserved by the company as per the statutory requirements for record

retention.

© The Institute of Chartered Accountants of India

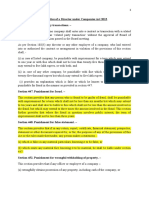

Chapter 10 (Printed Copy) At Page 10.61- Topic “Punishment for non-compliance” is

revised and being given hereunder. Students are advised to study this topic from

here and not from printed copy of the study material.

PUNISHMENT FOR NON-COMPLIANCE

Section 147 of the Companies Act, 2013 prescribes following punishments for contravention:

(1) If any of the provisions of sections 139 to 146 (both inclusive) is contravened, the

company shall be punishable with fine which shall not be less than twenty-five thousand

rupees, but which may extend to five lakh rupees and every officer of the company who

is in default shall be punishable with fine which shall not be less than ten thousand

rupees, but which may extend to one lakh rupees.

(2) If an auditor of a company contravenes any of the provisions of section 139, section

144 or section 145, the auditor shall be punishable with fine which shall not be less than

twenty-five thousand rupees, but which may extend to five lakh rupees or four times

the remuneration of the auditor, whichever is less.

It may be noted that if an auditor has contravened such provisions knowingly or willfully

with the intention to deceive the company or its shareholders or creditors or tax

authorities, he shall be punishable with imprisonment for a term which may extend to

one year and with fine which shall not be less than fifty thousand rupees but which may

extend to twenty-five lakh rupees or eight times the remuneration of the auditor,

whichever is less.

(3) Where an auditor has been convicted under sub-section (2), he shall be liable to: -

(i) refund the remuneration received by him to the company.

(ii) and pay for damages to the company statutory bodies or authorities or to

members or the creditors of the Company for loss arising out of incorrect or

misleading statements of particulars made in his audit report.

(4) The Central Government shall, by notification, specify any statutory body or authority

of an officer for ensuring prompt payment of damages to the company or the persons

under clause (ii) of sub-section (3) and such body, authority or officer shall after

payment of damages such company or persons file a report with the Central Government

© The Institute of Chartered Accountants of India

in respect of making such damages in such manner as may be specified in the said

notification.

(5) Where, in case of audit of a company being conducted by an audit firm, it is proved that

the partner or partners of the audit firm has or have acted in a fraudulent manner or

abetted or colluded in an fraud by, or in relation to or by, the company or its directors

or officers, the liability, whether civil criminal as provided in this Act or in any other law

for the time being in force, for such act shall be the partner or partners concerned of

the audit firm and of the firm jointly and severally. However, in case of criminal liability

of an audit firm, in respect of liability other than fine, the concerned partner or partners,

who acted in a fraudulent manner or abetted or, as the case may be, colluded in any

fraud shall only be liable.

This topic has also been revised at page no. 10.61 of chapter 10 and students can

refer at the link given below

https://resource.cdn.icai.org/66606bos53774-cp10.pdf

© The Institute of Chartered Accountants of India

You might also like

- Strategic Management 2nd Edition Rothaermel Test Bank 1Document128 pagesStrategic Management 2nd Edition Rothaermel Test Bank 1dorothyNo ratings yet

- Mutual Fund SEBI RegulationDocument17 pagesMutual Fund SEBI RegulationSarvesh ShuklaNo ratings yet

- Bos 60186Document5 pagesBos 60186ROCKSPYNo ratings yet

- Ammendment AuditDocument5 pagesAmmendment Auditaadikun89No ratings yet

- CA Inter RTP Complied Nov23-May 20Document475 pagesCA Inter RTP Complied Nov23-May 20ronex45326No ratings yet

- 75571bos61147 p6Document33 pages75571bos61147 p6Rajesh SharmaNo ratings yet

- CA Inter Auditing RTP Nov22Document30 pagesCA Inter Auditing RTP Nov22tholkappiyanjk14No ratings yet

- P6 AMENDMENTS - May 2022Document2 pagesP6 AMENDMENTS - May 2022pangsdsaNo ratings yet

- Iii. Insurance Business A. Insurance Corporations, Secs 190, 254Document11 pagesIii. Insurance Business A. Insurance Corporations, Secs 190, 254NHYNo ratings yet

- Revision Test Paper... RTP - Nov14 - Ipcc-6Document34 pagesRevision Test Paper... RTP - Nov14 - Ipcc-6Sai ArjunNo ratings yet

- Audit 1Document8 pagesAudit 1ashishNo ratings yet

- Subsidiary: Explanation: For The Purposes of Clause (B) ofDocument11 pagesSubsidiary: Explanation: For The Purposes of Clause (B) ofSuyash TiwariNo ratings yet

- Criminal Liability of Directors Under Company Law in IndiaDocument11 pagesCriminal Liability of Directors Under Company Law in IndiaRajeNo ratings yet

- Insurance Amendment Act 2015Document9 pagesInsurance Amendment Act 2015Anonymous yoWp5Yi5No ratings yet

- Cgble Long TheoryDocument17 pagesCgble Long Theoryuroojfatima21299No ratings yet

- The Companies Act, 2013 - Sections 185 & 186Document4 pagesThe Companies Act, 2013 - Sections 185 & 186Jhon PriceNo ratings yet

- Regulation of The AuditorDocument20 pagesRegulation of The AuditorPhebieon MukwenhaNo ratings yet

- Collective Investment SchemeDocument3 pagesCollective Investment SchemeParas MittalNo ratings yet

- Symbiosis Law School, Pune: Subject: Company Law I (SEM V) Batch 2017-22 B.A.LL.B (Hons)Document8 pagesSymbiosis Law School, Pune: Subject: Company Law I (SEM V) Batch 2017-22 B.A.LL.B (Hons)vipin gautamNo ratings yet

- Raising of Funds Through Compulsorily Convertible Debentures - Taxguru - inDocument4 pagesRaising of Funds Through Compulsorily Convertible Debentures - Taxguru - inCloxan India Pvt LtdNo ratings yet

- Salient Features o The Insurance ActDocument15 pagesSalient Features o The Insurance Actchandni babunuNo ratings yet

- The Insurance ActDocument10 pagesThe Insurance ActAnsary LabibNo ratings yet

- Corporate Law Assignment1234Document4 pagesCorporate Law Assignment1234Areej AJNo ratings yet

- CARODocument10 pagesCARODhiraj JaiswalNo ratings yet

- Incorporation of NBFCDocument11 pagesIncorporation of NBFCanabellasweleNo ratings yet

- University of Jahangir Nagar Institute of Business AdministrationDocument12 pagesUniversity of Jahangir Nagar Institute of Business Administrationtabassum tasnim SinthyNo ratings yet

- CARO Notes by CA Ankit OberoiDocument8 pagesCARO Notes by CA Ankit OberoiKumkum AggarwalNo ratings yet

- Auditing ChapterDocument9 pagesAuditing ChapterWania HaqNo ratings yet

- Applicability of Companies (Auditor'S Report) Order, 2020Document7 pagesApplicability of Companies (Auditor'S Report) Order, 2020GopiNo ratings yet

- 76322bos61648 cp5Document70 pages76322bos61648 cp5pikachupiki181No ratings yet

- Duties of An AuditorDocument4 pagesDuties of An AuditorAtul GuptaNo ratings yet

- Liabilities and Duties of A Director Under Companies Act 2013Document2 pagesLiabilities and Duties of A Director Under Companies Act 2013anvit seemanshNo ratings yet

- Chapter 22 Professional Ethics PMDocument51 pagesChapter 22 Professional Ethics PMDevi PrasadNo ratings yet

- 4.CARO 2020 by Ankit OberioDocument8 pages4.CARO 2020 by Ankit OberioMishan PrasaiNo ratings yet

- Inter Corporate LoansDocument9 pagesInter Corporate LoansYashJainNo ratings yet

- DividendDocument9 pagesDividendr.k.sir7856No ratings yet

- Auditing of The CompanyDocument10 pagesAuditing of The CompanyRASMITA BHANDARINo ratings yet

- Acceptance of Deposits by CompaniesDocument51 pagesAcceptance of Deposits by Companiesjhanani karthikaNo ratings yet

- Brief Note On Schedule III AmendmentsDocument4 pagesBrief Note On Schedule III Amendmentsbiged53723No ratings yet

- Notes On Consolidation of Financial StatementsDocument2 pagesNotes On Consolidation of Financial Statementsrgusain75No ratings yet

- CA Final Audit AmendmentDocument8 pagesCA Final Audit AmendmentSandesh LaddhaNo ratings yet

- Investment in Associated CompaniesDocument10 pagesInvestment in Associated CompaniesMuhammad IbrahimNo ratings yet

- Investor Rights Agreement Series A Template 1Document17 pagesInvestor Rights Agreement Series A Template 1David Jay MorNo ratings yet

- Unit 2 - Part 3Document6 pagesUnit 2 - Part 3Ridhima AggarwalNo ratings yet

- General Information: Ifci Tax Exemption Long Term Infrastructre Bond SERIES II - Information MemorandumDocument8 pagesGeneral Information: Ifci Tax Exemption Long Term Infrastructre Bond SERIES II - Information Memorandumsiriasvs_bNo ratings yet

- Legal Obligation of Auditors A. To CADocument5 pagesLegal Obligation of Auditors A. To CAShahidul Hoque FaisalNo ratings yet

- Dividend & Accounts of ComplanyDocument38 pagesDividend & Accounts of ComplanySrikant0% (1)

- Benefits Available To Non ResidentsDocument16 pagesBenefits Available To Non ResidentsArchita TiwariNo ratings yet

- Auditors and ReportingDocument6 pagesAuditors and ReportingAnonymous br29lnPbNo ratings yet

- Caro 2016Document10 pagesCaro 2016mrpstaff00007No ratings yet

- Auditors and Their RoleDocument10 pagesAuditors and Their RoleKeshav DograNo ratings yet

- Caro 2003Document10 pagesCaro 2003Aftab KhanNo ratings yet

- Shareholding Agreement PFLDocument3 pagesShareholding Agreement PFLHitesh SainiNo ratings yet

- SECTION 185 of Companies ActDocument5 pagesSECTION 185 of Companies Actimmaestro.9999No ratings yet

- 64 Amendmntnotes 10 18 PDFDocument9 pages64 Amendmntnotes 10 18 PDFkhusbu jainNo ratings yet

- Law2 PDFDocument9 pagesLaw2 PDFPushkar PriyamNo ratings yet

- Set OffDocument9 pagesSet OffAditya MehtaniNo ratings yet

- Stock PlanDocument20 pagesStock PlanrodrigomorenofdzNo ratings yet

- Audit Report Caro in ExcelDocument14 pagesAudit Report Caro in ExcelNikhil KasatNo ratings yet

- Recent Amendments in Companies ActDocument1 pageRecent Amendments in Companies ActCA VK AsawaNo ratings yet

- Report On Pulse Power CapacitorsDocument15 pagesReport On Pulse Power Capacitors10SHARMA SUMIT RAMADHINNo ratings yet

- Ped Report 2 PCDocument8 pagesPed Report 2 PC10SHARMA SUMIT RAMADHINNo ratings yet

- DocScanner Aug 5, 2023 9-05 AMDocument33 pagesDocScanner Aug 5, 2023 9-05 AM10SHARMA SUMIT RAMADHINNo ratings yet

- SHARMA SUMIT RAMAHDIN - Lokmanya Tilak College of Engineering - 16-11-2021Document2 pagesSHARMA SUMIT RAMAHDIN - Lokmanya Tilak College of Engineering - 16-11-202110SHARMA SUMIT RAMADHINNo ratings yet

- Vikas YoDocument3 pagesVikas Yo10SHARMA SUMIT RAMADHINNo ratings yet

- VIKASYDocument9 pagesVIKASY10SHARMA SUMIT RAMADHINNo ratings yet

- Amendment For Corporate LawDocument10 pagesAmendment For Corporate Law10SHARMA SUMIT RAMADHINNo ratings yet

- PolarizationsDocument2 pagesPolarizations10SHARMA SUMIT RAMADHINNo ratings yet

- Faraday Integral FormDocument2 pagesFaraday Integral Form10SHARMA SUMIT RAMADHINNo ratings yet

- Faraday Point FormDocument3 pagesFaraday Point Form10SHARMA SUMIT RAMADHINNo ratings yet

- DocScanner 15 Nov 2022 12 36 PMDocument1 pageDocScanner 15 Nov 2022 12 36 PM10SHARMA SUMIT RAMADHINNo ratings yet

- DocScanner 15-Nov-2022 12-39 PMDocument2 pagesDocScanner 15-Nov-2022 12-39 PM10SHARMA SUMIT RAMADHINNo ratings yet

- DE Sem4 QBDocument54 pagesDE Sem4 QB10SHARMA SUMIT RAMADHINNo ratings yet

- Mini Project 2a - Microcontroller Based TachometerDocument17 pagesMini Project 2a - Microcontroller Based Tachometer10SHARMA SUMIT RAMADHINNo ratings yet

- Physics Project (F e Sem 1)Document10 pagesPhysics Project (F e Sem 1)10SHARMA SUMIT RAMADHINNo ratings yet

- Vikas CR Has Done The AssignmentDocument29 pagesVikas CR Has Done The Assignment10SHARMA SUMIT RAMADHINNo ratings yet

- Physics Project (F e Sem 1)Document10 pagesPhysics Project (F e Sem 1)10SHARMA SUMIT RAMADHINNo ratings yet

- Mini Project 2a - Microcontroller Based TachometerDocument12 pagesMini Project 2a - Microcontroller Based Tachometer10SHARMA SUMIT RAMADHINNo ratings yet

- Mini Project ReportDocument15 pagesMini Project Report10SHARMA SUMIT RAMADHINNo ratings yet

- Mini Project 2a - Microcontroller Based TachometerDocument12 pagesMini Project 2a - Microcontroller Based Tachometer10SHARMA SUMIT RAMADHINNo ratings yet

- Farm Bills 2020 PCE Final ReportDocument36 pagesFarm Bills 2020 PCE Final Report10SHARMA SUMIT RAMADHINNo ratings yet

- Grade 10 Provincial Case Study MG 2023Document3 pagesGrade 10 Provincial Case Study MG 2023kwazy dlaminiNo ratings yet

- Mobile Car Wash & Detailing Project Part 2Document4 pagesMobile Car Wash & Detailing Project Part 2rama sportsNo ratings yet

- Bora Omary Ndanyungu TyrDocument101 pagesBora Omary Ndanyungu TyrMohamed AlmesryNo ratings yet

- Foundations of Multinational Financial Management 6th Edition Shapiro Solutions ManualDocument11 pagesFoundations of Multinational Financial Management 6th Edition Shapiro Solutions Manualdextrermachete4amgqgNo ratings yet

- International MarketingDocument14 pagesInternational Marketingshahid ahmedNo ratings yet

- Capital Structure of Commercial BankDocument8 pagesCapital Structure of Commercial Bankyashaswisharma68No ratings yet

- Economic Research - IndiaCPIIIP June - Centrum 12072023Document5 pagesEconomic Research - IndiaCPIIIP June - Centrum 12072023OIC TestNo ratings yet

- Saunders 8e PPT Chapter05Document33 pagesSaunders 8e PPT Chapter05sdgdfs sdfsfNo ratings yet

- 2020-02-ACCA112-OPTION CONTRACT-ILLUS 1 and 2Document7 pages2020-02-ACCA112-OPTION CONTRACT-ILLUS 1 and 2Nicole Anne Santiago SibuloNo ratings yet

- Nestle Equity Research ReportDocument7 pagesNestle Equity Research Reportyadhu krishnaNo ratings yet

- Luxury Hotel Business Plan ExampleDocument77 pagesLuxury Hotel Business Plan Examplebenn mansourNo ratings yet

- IM FinalDocument18 pagesIM Finalgayatri nairNo ratings yet

- 3 Foreign Exchange Markets - IIDocument5 pages3 Foreign Exchange Markets - IINaomi LyngdohNo ratings yet

- 168 - SPM Assignment 19 Dec 2022Document5 pages168 - SPM Assignment 19 Dec 2022PUBG NoobNo ratings yet

- Unit 6 - DiversificationDocument31 pagesUnit 6 - DiversificationSasha MacNo ratings yet

- Business Studies Grade 12 JUne 2021 QP and Memo 1Document29 pagesBusiness Studies Grade 12 JUne 2021 QP and Memo 1Akshitha RameshvijayalakshmiNo ratings yet

- MorningStar PEP648014202Document4 pagesMorningStar PEP648014202JERONo ratings yet

- Class - Xi - Business Studies - Question Bank - Series - Chapter 1 - Nature - and - Purpose - of - Business - 2018-19Document5 pagesClass - Xi - Business Studies - Question Bank - Series - Chapter 1 - Nature - and - Purpose - of - Business - 2018-19sainimanish170gmailcNo ratings yet

- In Person Week 9 10 Entrep Day 1 2Document14 pagesIn Person Week 9 10 Entrep Day 1 2arrowtachieNo ratings yet

- MKT# 12 Product & Brand StrategyDocument38 pagesMKT# 12 Product & Brand StrategyLabibur Rahman LabibNo ratings yet

- Bank CodeDocument11 pagesBank CodeOkpara Emmanuel EbukaNo ratings yet

- Resume CVDocument5 pagesResume CVNicky NgNo ratings yet

- NOC FormatDocument1 pageNOC Formatkconsultancy00No ratings yet

- M2SR2 BDocument8 pagesM2SR2 BMarvin CincoNo ratings yet

- Ratio AnalysisDocument4 pagesRatio AnalysisJohn MuemaNo ratings yet

- Marketing Theory PDFDocument16 pagesMarketing Theory PDFthanaphone KittiyavongNo ratings yet

- Trần Thị Thu Nguyệt-Pa3-Hwchapter17Document2 pagesTrần Thị Thu Nguyệt-Pa3-Hwchapter17Nguyet Tran Thi ThuNo ratings yet

- Knowledge-Based Systems TSF TradingDocument10 pagesKnowledge-Based Systems TSF Tradingbayraktar.freelanceNo ratings yet

- Delvi IJEETDocument4 pagesDelvi IJEETihda0farhatun0nisakNo ratings yet