Professional Documents

Culture Documents

Reporte de Tendencias PP

Reporte de Tendencias PP

Uploaded by

Erick CamachoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reporte de Tendencias PP

Reporte de Tendencias PP

Uploaded by

Erick CamachoCopyright:

Available Formats

FOCUS ON CATALYSTS

from an estimated $3.57 bn in 2017, at a resolved during 2Q 2017, prices fell through mid- plastics, with the remaining processed mainly into

CAGR of 19.9%. 2017. The hurricane on 3Q 2017 pushed prices fibres. About half of the compounded PA6 and

upward until late-Sep 2017 due to affected PA66 are consumed by the automobile industry,

MarketsandMarkets, 2017. Found on PR ethylene productions. With the delay of many followed by the electrical and electronics segment

Newswire, 6 Dec 2017, (Website: http://www. crackers into early-2018, ethylene supply is (around 33%). Approximately 31% of PA6 and

prnewswire.com). projected to be tight in early-2018. Three project PA66 compounds demand in 2016 came from

start-ups were rescheduled. These include the China, followed by Europe (around 30%) and

1.5 M tonnes/y cracker of Chevron Phillips NAFTA and South America (21%). The remaining

US set to become PE powerhouse Chemical at Cedar Bayou, TX; the 1.5 M tonnes/y Asian countries have an 18% share. The biggest

cracker of ExxonMobil at Baytown, TX; and the PA6 compounds producers include BASF, DSM

Polyethylene (PE) capacity in the US is poised to 370,000 tonnes/y unit of Indorama at Lake Charles, and Lanxess, while top PA66 compounds

soar by 50% or 6.5 M tonnes/y through 2019, with LA. All three projects, supposedly to be launched in companies are Solvay, DuPont and Asahi Kasei.

most of the capacity now under construction. end-2017, are now expected to come online on China has emerged as the leading PA6 and

Including the planned capacity through early early 2018. Dow recently launched its cracker at PA66 compound market in recent years. The

2020s, the addition stands at 12.1 M tonnes/y or Freeport, TX in Sep 2017. Upon the launch of the country’s dependence on caprolactam supplies

74%. The growth is attributed to shale gas and its delayed projects, ethylene stocks are anticipated to from Europe and North America have also

competitive advantage through low-cost natural increase by over 5 M tonnes/y by mid-2018 and steadily declined as domestic raw material

gas liquids (NGLs) of butane, propane and 3 M tonnes/y by end-2018. Other projects to be production facilities were built. In 2015, Invista

ethane. The shale gas revolution in the US began launched in 2018 include the 500,000 tonnes/y and BASF launched their respective facilities in

to materialize around 2013, resulting in the cracker of Shintech at Plaquemine, LA, in early Shanghai with capacities of 150,000 tonnes/y and

establishment of eight new ethane crackers, 2018, the 1.2 M tonnes/y cracker of Formosa 100,000 tonnes/y, respectively. Outside of Asia,

seven of which are world-scale (at least 1 M Plastics at Point Comfort, TX, in 2Q 2018 and the capacities are also being expanded. Ube intends

tonnes/y) and many have downstream PE lines. 1.5 M tonnes/y cracker of Sasol at Lake Charles, to expand its PA6 production in Castellon, Spain

Much of the fresh PE capacity is aimed for LA, in 2H 2018. A table shows the US ethylene by 40,000 tonnes/y to 70,000 tonnes/y in 2018.

export, primarily to Africa, Europe, Latin America producers with their plant locations and capacities. Meanwhile, PA6 prices have drastically increased

and Asia. Foreign companies are also investing in ExxonMobil has a 2,200,000 tonnes/y cracker in in the first few months of 2017 due mainly to the

the US including Borealis, Total, Shell Chemicals, Baytown, TX. DowDuPont has a 1,507,000 tonnes/ extreme hikes in caprolactam raw material

SABIC, Mexichem, Braskem, PTT Global y cracker in Plaquemine, LA. Shell has an 835,000 benzene. As of end-of 2017, benzene prices are

Chemical and Formosa Plastics. The industry has tonnes/y cracker in Deer Park, TX. A line graph declining but they remain higher than those

witnessed the launching of new crackers through shows the US ethylene prices (cents/lb) in pipeline recorded in end-2016.

Oct 2017. According to an economist from spot DEL and contract DEL transactions from Dec

Chemical Marketing & Economics Group (CME), 2016 to Nov 2017. Kunststoffe International, Oct 2017, 2017 (10),

the US output of synthetic materials and basic 20-24 (Website: http://www.

chemicals is forecast to rise by approximately ICIS Chemical Business, 8-14 Dec 2017, 292 kunststoffe-international.com) ã Carl Hanser

6.25% in 2018, 7.75% in 2019 and 7.25% in (21), 34 (Website: http://www.icis.com) Verlag 2017.

2020. As per the American Chemistry Council ã Reed Business Information Limited 2017.

(ACC), planned spending in the US chemical

industry attributed to shale gas has reached

about $185 bn, with just around $35 bn Trend report: polyurethanes

completed. By 2020, capital investment in the US Trend report: polypropylene (PP)

chemical industry is forecast to soar to $240-250 Global polyurethane (PU) consumption

bn, with more than $20 bn stemming from new Polyolefins, mainly polypropylene (PP) and continues to grow constantly across all

ethylene projects. A table shows a number of PE polyethylene (PE), are versatile polymers that application sectors. PU consumption worldwide

projects in North America including Dow consistently exhibit high growth rate. PP in 2016 increased by nearly 1 M tonnes year-on-

Chemical’s 400,000 tonnes/y LDPE plant in particularly exhibits consistently higher growth year to more than 18.5 M tonnes and is

Plaquemine, LA, US (start-up: 4Q 2017); and rate in Europe relative to other polymers, expected to increase by around 4%/y in the

Chevron Phillips Chemical’s 1 M tonnes/y especially PE. PP increases at 4%/y globally. PP medium term. This will be driven by China’s

mLLDPE (500) and Bimodal HDPE (500) facility has a wider range of applications than PE and economic performance as it is by far PU’s

in Old Ocean, TX, that will start up in 3Q 2017. PP products continue to evolve due to product largest single market representing around 40%

Also included is LyondellBasell’s 500,000 tonnes/ and application development initiatives. Although of global PU sales. This is followed by Europe,

y HDPE plant in La Porte, TX, scheduled to open biopolymer growth rates are high at as much as Middle East and African region (almost 33%)

in mid-2019. 30%/y, the absolute market for these sustainable and NAFTA and Latin America (almost 20%). In

polymers remains significantly low at under 1%. terms of processing industries, the furniture and

ICIS Chemical Business, 1-7 Dec 2017, 292 The continuous improvements in PP products and timber industry remains the market leader in

(20 (ICIS Special Supplement)), 2-3 (Website: applications cannot be associated with catalysts 2016 with 30% share, followed by the

alone, but also with the understanding and new

http://www.icis.com) ã Reed Business construction sector (25%), automotive/transport

knowledge of structure/property relationships. The sector (15%), electrical and electronics (9%)

Information Limited 2017. reinforcement provided by glass or thermoplastic and shoe sector (6%). Flexible foams led all

fibres gradually approaches physical restrictions application segments with around 36% of

making carbon fibre a centre of focus. Borealis market share in 2016, followed by rigid foams

US chemical profile: ethylene and Magna Industries, for instance, have (30%), coatings, adhesives and sealants (13%)

combined the benefits of PP-carbon fibre and and elastomers (9%). China’s PU consumption

Ethylene supply in the US is anticipated to class A surface using Fibremod L102SY. The

shorten in late-2017 due to new downstream continues to increase that keep investments

material reduced weight by 20%. Recycling coming. Wanhua is currently building a 300,000

polymerization capacity, which has started-up in efforts are also becoming more rampant as the

advance of projected new ethane cracking tonnes/y toluene diisocyanate (TDI) facility in the

European Commission aims to have 55% of country. Along with industry partners, Huntsman is

capacity. In late-2017, one idled cracker along reusable and recyclable plastic packaging waste

with three new crackers had been scheduled to also expanding its existing methylene diphenyl

by 2025. A pie chart shows the proportion of diisocyanate (MDI) plant in Caojing by 240,000

come online. One cracker already started different polymer types out of the overall

operations in Sep 2017, with others projected to tonnes/y. New PU capacities are also being

European consumption. constructed in other regions worldwide. By late-

be operational in early 2018. The hurricane that

struck Texas in Aug 2017 caused ethylene 2018, Covestro will double its MDI capacity in

Kunststoffe International, Oct 2017, 2017 (10), Brunsbuttel, Germany to 400,000 tonnes/y. BASF

outages from Texas to Louisiana. Other units

were back online, while others were still closed

14-19 (Website: http://www.kunststoffe- also plans to operate at 100% capacity its new

until 4Q 2017. The hurricane also affected international.com) ã Carl Hanser Verlag 2017. 300,000 tonnes/y TDI unit in Ludwigshafen,

downstream industries, which reduced pressure Germany, which began operations in 2015. Sadara

to ethylene supply in 3Q 2017. Ethylene stocks also announced the recent launch of its new MDI

and TDI production plants in Al-Jubail, Saudi Arabia

rose at end-3Q 2017, according to the American Trend report: polyamide 6 and 66 with 400,000 tonnes/y and 200,000 tonnes/y

Fuel & Petrochemical Manufacturers (AFPM).

During early-2017, outages and strong demand capacities, respectively. Meanwhile, biomass-based

Polyamide 6 (PA6) and polyamide 66 (PA66)

caused ethylene supplies to be tightened. It was aniline is now being developed as a raw material

sales are being driven by major trends in front

replenished in mid-2017 as outages were for MDI. Global aniline production is currently at

running application sectors. PA6 and PA66

resolved and demand was reduced. Prices of about 5 M tonnes.

production worldwide exceeded 7.5 M tonnes in

ethylene peaked during 1Q 2017 due to limited 2016 compared with 7.3 M tonnes in 2015, with

supplies caused by turnarounds and strong

Kunststoffe International, Oct 2017, 2017 (10),

PA6 constituting over 70%. Compounds

demand. In Feb 2017, spot and contract represented about 25% of the world’s PA6

46-51 (Website: http://www.

prices were assessed at 36-38 cents/lb and polymer consumption in 2016. About 50% of kunststoffe-international.com) ã Carl Hanser

35.75 cents/lb, respectively. As outages were PA66 base resins are converted into engineering Verlag 2017.

2 February 2018

You might also like

- Araldite CY 225 Hardener HY 925 Filler Silica Flour: Araldite Casting Resin SystemDocument8 pagesAraldite CY 225 Hardener HY 925 Filler Silica Flour: Araldite Casting Resin SystemZackNo ratings yet

- List of PEZA-registered Warehousing and Logistics CompaniesDocument219 pagesList of PEZA-registered Warehousing and Logistics CompaniesJeremy YapNo ratings yet

- LEEA Academy P1E Revision Test 1 - July 2015 ANSWERSDocument17 pagesLEEA Academy P1E Revision Test 1 - July 2015 ANSWERSMohmed Allam100% (1)

- MARKET OUTLOOK - Europe and Asia Polymer OutlookDocument6 pagesMARKET OUTLOOK - Europe and Asia Polymer OutlookRead ArticlesNo ratings yet

- Company News: Focus ON CatalystsDocument1 pageCompany News: Focus ON CatalystsDavid LevisteNo ratings yet

- HTTP WWW PlastemartDocument7 pagesHTTP WWW PlastemartrishikeshmandawadNo ratings yet

- Packaging-Ajemra Industry Note - 2017Document4 pagesPackaging-Ajemra Industry Note - 2017rchawdhry123No ratings yet

- Plastic IndustryDocument9 pagesPlastic IndustryYepuru ChaithanyaNo ratings yet

- Recovery For The Paraxylene Industry or Temporary Reprieve?: Chemicals Research & AnalysisDocument9 pagesRecovery For The Paraxylene Industry or Temporary Reprieve?: Chemicals Research & AnalysisJuan Jose SossaNo ratings yet

- Supreme Petrochem LTD.: I) Overview of Global PlasticsDocument13 pagesSupreme Petrochem LTD.: I) Overview of Global PlasticsRevathi MNo ratings yet

- Report Bioplastics Market Data 2019Document4 pagesReport Bioplastics Market Data 2019Donato GalloNo ratings yet

- New Microsoft Office Word DocumentDocument8 pagesNew Microsoft Office Word DocumentShyam KrishnanNo ratings yet

- Pigments: Focus OnDocument3 pagesPigments: Focus OnRoshni PattanayakNo ratings yet

- Vietnam Plastic Industry Report (EN) - VCBS - 2016 PDFDocument21 pagesVietnam Plastic Industry Report (EN) - VCBS - 2016 PDFKhoi NguyenNo ratings yet

- Petrochemicals - A SWOT AnalysisDocument2 pagesPetrochemicals - A SWOT AnalysisShwet KamalNo ratings yet

- Wood-Plastic Composite GrowthDocument2 pagesWood-Plastic Composite GrowthMehra PourbeheshtianNo ratings yet

- Pla PDFDocument11 pagesPla PDFbhavesh moorjaniNo ratings yet

- GliolDocument1 pageGliolCaballeroGiovanniNo ratings yet

- Flexible Plastics - A Global Market Watch, 2011 - 2016 - BroucherDocument4 pagesFlexible Plastics - A Global Market Watch, 2011 - 2016 - BroucherAxis ResearchMindNo ratings yet

- DN 053246Document12 pagesDN 053246Kalpesh IndiannNo ratings yet

- BOPPDocument21 pagesBOPPN khade100% (1)

- Global Polymer TrendsDocument4 pagesGlobal Polymer TrendsTrevor J. HutleyNo ratings yet

- MathsDocument11 pagesMathsAAYUSHI VERMA 7ANo ratings yet

- Demanda CaprolactamDocument2 pagesDemanda CaprolactamSoraya100% (1)

- J Focat 2019 09 010Document1 pageJ Focat 2019 09 010Toni TanNo ratings yet

- World Plastics Market Outlook 2015 2030Document3 pagesWorld Plastics Market Outlook 2015 2030akashdalwadi100% (1)

- Petrochemical Supply ChainDocument50 pagesPetrochemical Supply ChainrubenpeNo ratings yet

- PDocument15 pagesPBerry101No ratings yet

- TheBronxHighSchoolOfScience GaSm Pro Harvard National Speech and Debate Tournament Round 2Document8 pagesTheBronxHighSchoolOfScience GaSm Pro Harvard National Speech and Debate Tournament Round 2Aarav AgarwalNo ratings yet

- The Incorporation of Plastics in Asphalt A ReviewDocument7 pagesThe Incorporation of Plastics in Asphalt A ReviewKrizzia FloresNo ratings yet

- Executive SummaryDocument1 pageExecutive SummaryRamyaa LakshmiNo ratings yet

- Global Refractories - Facing The Next Production Revolution PDFDocument11 pagesGlobal Refractories - Facing The Next Production Revolution PDFmohit narayanNo ratings yet

- StyreneDocument3 pagesStyreneelainejournalistNo ratings yet

- Sustainable Chemistry and Pharmacy: Katrin J Ogi, Rajeev BhatDocument10 pagesSustainable Chemistry and Pharmacy: Katrin J Ogi, Rajeev BhatKate DauNo ratings yet

- الطريق نحو صفر كربون في البتروكيماوياتDocument28 pagesالطريق نحو صفر كربون في البتروكيماوياتRania YaseenNo ratings yet

- Case Summaries - For Strategic Management Class: Current (2400) +800 3200Document4 pagesCase Summaries - For Strategic Management Class: Current (2400) +800 3200Abi Serrano TaguiamNo ratings yet

- Indian Polymer Industry OutlookDocument9 pagesIndian Polymer Industry OutlookHappy RoxNo ratings yet

- Paint and Coatings Industry OverviewDocument3 pagesPaint and Coatings Industry OverviewYash VasantaNo ratings yet

- Sour Times: Outlook - 6 Mar 2020Document19 pagesSour Times: Outlook - 6 Mar 2020Franco Camacho CanchariNo ratings yet

- Khushboo Plastics Project 2Document42 pagesKhushboo Plastics Project 2vishalNo ratings yet

- Focus On Surfactants ArticleDocument8 pagesFocus On Surfactants ArticleAngieNo ratings yet

- Case Summaries CSDocument13 pagesCase Summaries CSJayaSiva KatneniNo ratings yet

- Us China Trade WarDocument7 pagesUs China Trade WarTushar MidgeNo ratings yet

- Industry Profile OF High Density Polyethylene (HDPE) ProductsDocument4 pagesIndustry Profile OF High Density Polyethylene (HDPE) ProductsManohar Waghela100% (1)

- Focus ON Catalysts: Markets and BusinessDocument1 pageFocus ON Catalysts: Markets and BusinessMohammed HeshamNo ratings yet

- Future Scenarios of Global Plastic Waste GeneratioDocument12 pagesFuture Scenarios of Global Plastic Waste Generatioresha dwipayanaNo ratings yet

- 2018 JC2 H2 Economics SA2 Temasek Junior CollegeDocument71 pages2018 JC2 H2 Economics SA2 Temasek Junior CollegeReuben Gopalan Raman (Millenniainst)No ratings yet

- Linear Alkylbenzene in Asia 2017Document1 pageLinear Alkylbenzene in Asia 2017محمد عليNo ratings yet

- Markets: Global Demand For PVC To Rise by About 3.2%/year To 2021Document2 pagesMarkets: Global Demand For PVC To Rise by About 3.2%/year To 2021Ian FarhatNo ratings yet

- Global Trends For Polypropylene: Basell Polyolefins USA, Inc., Lansing, Michigan, U.S.ADocument9 pagesGlobal Trends For Polypropylene: Basell Polyolefins USA, Inc., Lansing, Michigan, U.S.AAvinash Upmanyu BhardwajNo ratings yet

- Polylactic Acid (PLA) - A Global Market Watch, 2011 - 2016 - BroucherDocument4 pagesPolylactic Acid (PLA) - A Global Market Watch, 2011 - 2016 - BroucherAxis ResearchMindNo ratings yet

- Sintex Industries Companyanalysis92384293424Document16 pagesSintex Industries Companyanalysis92384293424Vijay Gohil100% (1)

- C1951 GLDocument30 pagesC1951 GLArnu Felix CamposNo ratings yet

- Report Bioplastics - Market-Data - 2018Document4 pagesReport Bioplastics - Market-Data - 2018Jorge Alberto Cuellar BolivarNo ratings yet

- Kowledge Paper PlasticDocument185 pagesKowledge Paper PlasticNishant MishraNo ratings yet

- WWF Plastics Consumption Report FinalDocument15 pagesWWF Plastics Consumption Report FinalPooja ShettyNo ratings yet

- New Polyurethane Capacity Closes in On Tight MarketDocument5 pagesNew Polyurethane Capacity Closes in On Tight Marketkatie farrellNo ratings yet

- Https WWW IhsDocument5 pagesHttps WWW IhsrishikeshmandawadNo ratings yet

- Market SurveyDocument4 pagesMarket SurveyGenesis LowNo ratings yet

- Ranem Ahmed SabryDocument3 pagesRanem Ahmed SabryHamzah A. LaftaNo ratings yet

- 32521CA Plastic & Resin Manufacturing in Canada Industry ReportDocument35 pages32521CA Plastic & Resin Manufacturing in Canada Industry ReportArnu Felix CamposNo ratings yet

- Biodegradable Plastics in China 2017Document5 pagesBiodegradable Plastics in China 2017mouda8148No ratings yet

- Cutting plastics pollution: Financial measures for a more circular value chainFrom EverandCutting plastics pollution: Financial measures for a more circular value chainNo ratings yet

- Rheological Behavior of Talc and Calcium Carbonate Filled Polypropylene Hybrid CompositesDocument41 pagesRheological Behavior of Talc and Calcium Carbonate Filled Polypropylene Hybrid CompositesErick Camacho100% (1)

- CREEPPAPERDocument8 pagesCREEPPAPERErick CamachoNo ratings yet

- Jcs 05 00302Document16 pagesJcs 05 00302Erick CamachoNo ratings yet

- Polymerblend ChapterDocument38 pagesPolymerblend ChapterErick CamachoNo ratings yet

- 10 5923 J Ajps 20160601 01Document12 pages10 5923 J Ajps 20160601 01Erick CamachoNo ratings yet

- Dealy Plazek Time Temp Super 2009Document9 pagesDealy Plazek Time Temp Super 2009Erick CamachoNo ratings yet

- Review Module 44 - RC ONE-WAY SLAB (USD)Document2 pagesReview Module 44 - RC ONE-WAY SLAB (USD)Hannah BelleNo ratings yet

- Rsti 5854Document4 pagesRsti 5854ing.dmanriq27No ratings yet

- MM207 Ice-AxeDocument19 pagesMM207 Ice-AxeAnkit RanaNo ratings yet

- Engineering MaterialsDocument32 pagesEngineering MaterialsAdhanom G.No ratings yet

- Effect of Aggregate Gradation Variation On The Marshall Mix Properties of Asphalt ConcreteDocument8 pagesEffect of Aggregate Gradation Variation On The Marshall Mix Properties of Asphalt ConcreteRed RedNo ratings yet

- APVO No. 1 - Changes Design Retaining WallDocument46 pagesAPVO No. 1 - Changes Design Retaining WallHazwan NasirNo ratings yet

- Chapter 5 Lamina Failure TheoriesDocument15 pagesChapter 5 Lamina Failure TheoriesyousefNo ratings yet

- Compendium Vol. 3 - Austenitic and Martensitic SS - BARC Ext ReportDocument83 pagesCompendium Vol. 3 - Austenitic and Martensitic SS - BARC Ext ReportRagvendra BistNo ratings yet

- Post Test 3rd QTRDocument11 pagesPost Test 3rd QTRPamela AltarejosNo ratings yet

- Valpra Wash Basin E-Catalogue 13 Juni 2023Document14 pagesValpra Wash Basin E-Catalogue 13 Juni 2023Aska JanakiNo ratings yet

- Mechanical Properties of Plastic Concrete Containing BentoniteDocument7 pagesMechanical Properties of Plastic Concrete Containing Bentonitejuan munera100% (1)

- Historicalsteels PDFDocument1 pageHistoricalsteels PDFtylerlhsmithNo ratings yet

- 1323class 8 SST Geography Chapter 8Document7 pages1323class 8 SST Geography Chapter 8THE FULL CARTNo ratings yet

- 703 Aggregate PDFDocument5 pages703 Aggregate PDFdrNo ratings yet

- NEW Manual - MSE315 2022-2023Document42 pagesNEW Manual - MSE315 2022-2023yhjklNo ratings yet

- Ceramic Fiber - A3A GROUP (HK) CO. LTD PDFDocument12 pagesCeramic Fiber - A3A GROUP (HK) CO. LTD PDFVictor Hugo Valqui LopezNo ratings yet

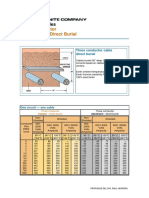

- Three Conductor Underground Direct Burial: Ampacity TablesDocument2 pagesThree Conductor Underground Direct Burial: Ampacity TablesalbertoNo ratings yet

- L28 Viscoelasticity ClassDocument18 pagesL28 Viscoelasticity ClassSuiajNo ratings yet

- Materials Science and Engineering Mime-260 Midterm: Mid Term Test, Feb. 27, 2014 Duration: 2 HrsDocument10 pagesMaterials Science and Engineering Mime-260 Midterm: Mid Term Test, Feb. 27, 2014 Duration: 2 Hrsredviolet7371No ratings yet

- At 800 BulletinDocument2 pagesAt 800 BulletinNaveedharalNo ratings yet

- Native ElementsDocument3 pagesNative ElementsDattaraj JawdekarNo ratings yet

- Construction Africa CLIENT RATEDocument5 pagesConstruction Africa CLIENT RATEDessalegn GaminiNo ratings yet

- Polyolefin Compounds and Materials Fundamentals and Industrial Applications 354p PDFDocument354 pagesPolyolefin Compounds and Materials Fundamentals and Industrial Applications 354p PDFLi HojunNo ratings yet

- VacuumDocument14 pagesVacuumGudeta J AtomsaNo ratings yet

- Creep and Shrinkage Behavior of High-Strength Concrete and Minimum Reinforcement Ratio For Bridge ColumnsDocument17 pagesCreep and Shrinkage Behavior of High-Strength Concrete and Minimum Reinforcement Ratio For Bridge ColumnsDre u7iNo ratings yet

- Aluminum-Magnesium Alloy 535.0 Sand Castings: Chemical Composition & Physical PropertiesDocument1 pageAluminum-Magnesium Alloy 535.0 Sand Castings: Chemical Composition & Physical PropertiesAnonymous P8Bt46mk5INo ratings yet

- ChevronDocument4 pagesChevronanon_464848664No ratings yet