Professional Documents

Culture Documents

Bank Reconciliation Question

Bank Reconciliation Question

Uploaded by

FinnCopyright:

Available Formats

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Additional Practical Problems-13-1Document5 pagesAdditional Practical Problems-13-1sharmaarmaan103No ratings yet

- Adobe Scan Apr 10, 2023Document12 pagesAdobe Scan Apr 10, 2023ineshbanerjee80No ratings yet

- WS - Xi BRS - 2Document5 pagesWS - Xi BRS - 2richshivamshahNo ratings yet

- BRS PPT StudentDocument26 pagesBRS PPT StudentgganyanNo ratings yet

- 06 BRS - Practice QuestionsDocument1 page06 BRS - Practice QuestionsNeelanjana RayNo ratings yet

- Dkgoel BRS 11Document15 pagesDkgoel BRS 11DhruvNo ratings yet

- Exercises of Bank Reconciliation Statement: Exercise No. IDocument9 pagesExercises of Bank Reconciliation Statement: Exercise No. ITayyab AliNo ratings yet

- Practice With MT - BRSDocument6 pagesPractice With MT - BRSsrushtibhawsar07No ratings yet

- CHP 2 - BRSDocument5 pagesCHP 2 - BRSPayal Mehta DeshpandeNo ratings yet

- Worksheet BRSDocument2 pagesWorksheet BRSCA Chhavi Gupta100% (1)

- Accountancy XI: Pankaj Rajan 9810194206Document4 pagesAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhNo ratings yet

- 6 BRS 08-2023 RegularDocument7 pages6 BRS 08-2023 RegularjahnaviNo ratings yet

- BRS Class 11Document1 pageBRS Class 11tarun aroraNo ratings yet

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- BRS Ca FoundationDocument9 pagesBRS Ca FoundationJunaid Iqbal MastoiNo ratings yet

- Bank Reconciliation StatementDocument22 pagesBank Reconciliation StatementasimaNo ratings yet

- Igcse - Extented Tutoring - 2023 - 2024 - Cash Book and BrsDocument6 pagesIgcse - Extented Tutoring - 2023 - 2024 - Cash Book and BrsMUSTHARI KHANNo ratings yet

- Brs Practise SheetDocument1 pageBrs Practise Sheetapi-252642432No ratings yet

- 0c26dbank Reconciliation Statement Practice QuestionsDocument2 pages0c26dbank Reconciliation Statement Practice QuestionsRahul AgarwalNo ratings yet

- Accounting For Manager: - CA Ankita JainDocument13 pagesAccounting For Manager: - CA Ankita JainrahulthexNo ratings yet

- Bank Reconciliation Statement Practice ProblemsDocument2 pagesBank Reconciliation Statement Practice ProblemsHaya DanishNo ratings yet

- MGT 101Document4 pagesMGT 101Taiba ShehzadiNo ratings yet

- CA F BRS WithDocument10 pagesCA F BRS WithG. DhanyaNo ratings yet

- 06 SLLC - 2021 - Acc - Review Question - Set 03Document7 pages06 SLLC - 2021 - Acc - Review Question - Set 03Chamela MahiepalaNo ratings yet

- BRS & Rectification of Errors SumsDocument7 pagesBRS & Rectification of Errors SumsGautam MehraNo ratings yet

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationDocument2 pagesWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulNo ratings yet

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationDocument2 pagesWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulNo ratings yet

- Bank Reconcilement Statement (BRS) AccountsDocument5 pagesBank Reconcilement Statement (BRS) AccountsVedanth RamNo ratings yet

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashant100% (1)

- 16772BRSDocument47 pages16772BRSSketch KathayatNo ratings yet

- B.R.S. Test 3Document5 pagesB.R.S. Test 3Sudhir SinhaNo ratings yet

- Bank Reconciliaton Statement Practice Questions: ST ST STDocument2 pagesBank Reconciliaton Statement Practice Questions: ST ST STHuma SamuelNo ratings yet

- Bank Reconciliation Statement - DPP 05 (Accounting)Document4 pagesBank Reconciliation Statement - DPP 05 (Accounting)ashoknandi156No ratings yet

- Bank ReconciliationDocument7 pagesBank ReconciliationMohammad Faizan Farooq Qadri AttariNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- BRS Practice QuestionsDocument2 pagesBRS Practice Questionssyed ali raza kazmiNo ratings yet

- Quiz 1 - Audit of CashDocument4 pagesQuiz 1 - Audit of CashmillescaasiNo ratings yet

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashantNo ratings yet

- BRS WSDocument2 pagesBRS WSShrajith A NatarajanNo ratings yet

- Bank Reconciliation StatementDocument4 pagesBank Reconciliation StatementRadhakrishna MishraNo ratings yet

- Cashbook and Brs ProblemsDocument3 pagesCashbook and Brs Problemsmaheshbendigeri5945No ratings yet

- Amazing RaceDocument6 pagesAmazing RaceHanns Lexter PadillaNo ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- Bank Reconciliation Statement 70Document6 pagesBank Reconciliation Statement 70xyzNo ratings yet

- Bank Reconciliation StatementDocument44 pagesBank Reconciliation StatementDubai SheikhNo ratings yet

- Contact: 9033311500, 8866611600: Best of LuckDocument1 pageContact: 9033311500, 8866611600: Best of LuckRavi UdeshiNo ratings yet

- Time:-01:00Hr. F.M.:-25Document2 pagesTime:-01:00Hr. F.M.:-25mishralakshay629No ratings yet

- Work Book Unit 12 Bank Reconcilaition Statement (Solved)Document9 pagesWork Book Unit 12 Bank Reconcilaition Statement (Solved)Zaheer SwatiNo ratings yet

- BRS Statement IllustrationsDocument3 pagesBRS Statement Illustrationssurekha khandebharadNo ratings yet

- BRS ProblemsDocument28 pagesBRS ProblemsKutbuddin JawadwalaNo ratings yet

- Activity in Bank Reconciliation Part 2Document1 pageActivity in Bank Reconciliation Part 2CHERIE MAY ANGEL QUITORIANONo ratings yet

- Brs Practical QuestionsDocument5 pagesBrs Practical QuestionsSwarupa VNo ratings yet

- Practical - Bank Reconciliation StatementDocument5 pagesPractical - Bank Reconciliation StatementUniversal SoldierNo ratings yet

- Bank Reconciliation StatementDocument12 pagesBank Reconciliation StatementBhuvan PrajapatiNo ratings yet

- AttachmentDocument3 pagesAttachmentnugusuNo ratings yet

- AC101 Quiz 2Document2 pagesAC101 Quiz 2irene TogaraNo ratings yet

- Ca Foundation Accounts Test Paper: Maximum Marks: 40 Time Allowed: 1hr. Allowed: 1hr. 15 MinutesDocument3 pagesCa Foundation Accounts Test Paper: Maximum Marks: 40 Time Allowed: 1hr. Allowed: 1hr. 15 Minutesvanshikha.agarwal345No ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 9 BankDocument34 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 9 Bankmyankjindal9No ratings yet

- Navyug Commerce Institute Lakhanpur Kanpur Topic-B.R.SDocument2 pagesNavyug Commerce Institute Lakhanpur Kanpur Topic-B.R.SparthNo ratings yet

Bank Reconciliation Question

Bank Reconciliation Question

Uploaded by

FinnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Reconciliation Question

Bank Reconciliation Question

Uploaded by

FinnCopyright:

Available Formats

BANK RECONCILIATION QUESTION

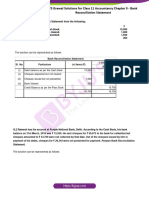

Spencer and sons limited has a difference in its balance as per cash book and bank statement as

on 31st March 2023.

The following is noted:

1. Balance as per bank statement as on 31st March 2023 is Kshs. 50,000. The balance as per

the cash book is Kshs. 16,500.

2. Cheques of Kshs. 20,000 and Kshs. 10,000 had been issued as on 30th March 2023, but

had not yet cleared.

3. Insurance paid by the bank of Kshs. 2,000 had not yet been recorded in the cash book.

4. An outgoing cheque of Kshs. 10,000 had been recorded twice in the cash book. It is

accurately recorded in the bank statement.

5. A cheque payment of Kshs. 5,000 is recorded twice in the bank statement.

6. Dividends received of Kshs. 6,000 had only been recorded in the bank statement and not

in the cash book.

7. A cheque of Kshs. 5,000 was deposited 29th March 2023 and it does not reflect in the bank

statement.

8. Bank charges of Kshs. 500 were debited and only recorded in the bank statement.

Required:

a) Prepare the updated cash book

b) Prepare a bank reconciliation statement as at 31 March 2023

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Additional Practical Problems-13-1Document5 pagesAdditional Practical Problems-13-1sharmaarmaan103No ratings yet

- Adobe Scan Apr 10, 2023Document12 pagesAdobe Scan Apr 10, 2023ineshbanerjee80No ratings yet

- WS - Xi BRS - 2Document5 pagesWS - Xi BRS - 2richshivamshahNo ratings yet

- BRS PPT StudentDocument26 pagesBRS PPT StudentgganyanNo ratings yet

- 06 BRS - Practice QuestionsDocument1 page06 BRS - Practice QuestionsNeelanjana RayNo ratings yet

- Dkgoel BRS 11Document15 pagesDkgoel BRS 11DhruvNo ratings yet

- Exercises of Bank Reconciliation Statement: Exercise No. IDocument9 pagesExercises of Bank Reconciliation Statement: Exercise No. ITayyab AliNo ratings yet

- Practice With MT - BRSDocument6 pagesPractice With MT - BRSsrushtibhawsar07No ratings yet

- CHP 2 - BRSDocument5 pagesCHP 2 - BRSPayal Mehta DeshpandeNo ratings yet

- Worksheet BRSDocument2 pagesWorksheet BRSCA Chhavi Gupta100% (1)

- Accountancy XI: Pankaj Rajan 9810194206Document4 pagesAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhNo ratings yet

- 6 BRS 08-2023 RegularDocument7 pages6 BRS 08-2023 RegularjahnaviNo ratings yet

- BRS Class 11Document1 pageBRS Class 11tarun aroraNo ratings yet

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- BRS Ca FoundationDocument9 pagesBRS Ca FoundationJunaid Iqbal MastoiNo ratings yet

- Bank Reconciliation StatementDocument22 pagesBank Reconciliation StatementasimaNo ratings yet

- Igcse - Extented Tutoring - 2023 - 2024 - Cash Book and BrsDocument6 pagesIgcse - Extented Tutoring - 2023 - 2024 - Cash Book and BrsMUSTHARI KHANNo ratings yet

- Brs Practise SheetDocument1 pageBrs Practise Sheetapi-252642432No ratings yet

- 0c26dbank Reconciliation Statement Practice QuestionsDocument2 pages0c26dbank Reconciliation Statement Practice QuestionsRahul AgarwalNo ratings yet

- Accounting For Manager: - CA Ankita JainDocument13 pagesAccounting For Manager: - CA Ankita JainrahulthexNo ratings yet

- Bank Reconciliation Statement Practice ProblemsDocument2 pagesBank Reconciliation Statement Practice ProblemsHaya DanishNo ratings yet

- MGT 101Document4 pagesMGT 101Taiba ShehzadiNo ratings yet

- CA F BRS WithDocument10 pagesCA F BRS WithG. DhanyaNo ratings yet

- 06 SLLC - 2021 - Acc - Review Question - Set 03Document7 pages06 SLLC - 2021 - Acc - Review Question - Set 03Chamela MahiepalaNo ratings yet

- BRS & Rectification of Errors SumsDocument7 pagesBRS & Rectification of Errors SumsGautam MehraNo ratings yet

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationDocument2 pagesWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulNo ratings yet

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationDocument2 pagesWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulNo ratings yet

- Bank Reconcilement Statement (BRS) AccountsDocument5 pagesBank Reconcilement Statement (BRS) AccountsVedanth RamNo ratings yet

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashant100% (1)

- 16772BRSDocument47 pages16772BRSSketch KathayatNo ratings yet

- B.R.S. Test 3Document5 pagesB.R.S. Test 3Sudhir SinhaNo ratings yet

- Bank Reconciliaton Statement Practice Questions: ST ST STDocument2 pagesBank Reconciliaton Statement Practice Questions: ST ST STHuma SamuelNo ratings yet

- Bank Reconciliation Statement - DPP 05 (Accounting)Document4 pagesBank Reconciliation Statement - DPP 05 (Accounting)ashoknandi156No ratings yet

- Bank ReconciliationDocument7 pagesBank ReconciliationMohammad Faizan Farooq Qadri AttariNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- BRS Practice QuestionsDocument2 pagesBRS Practice Questionssyed ali raza kazmiNo ratings yet

- Quiz 1 - Audit of CashDocument4 pagesQuiz 1 - Audit of CashmillescaasiNo ratings yet

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashantNo ratings yet

- BRS WSDocument2 pagesBRS WSShrajith A NatarajanNo ratings yet

- Bank Reconciliation StatementDocument4 pagesBank Reconciliation StatementRadhakrishna MishraNo ratings yet

- Cashbook and Brs ProblemsDocument3 pagesCashbook and Brs Problemsmaheshbendigeri5945No ratings yet

- Amazing RaceDocument6 pagesAmazing RaceHanns Lexter PadillaNo ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- Bank Reconciliation Statement 70Document6 pagesBank Reconciliation Statement 70xyzNo ratings yet

- Bank Reconciliation StatementDocument44 pagesBank Reconciliation StatementDubai SheikhNo ratings yet

- Contact: 9033311500, 8866611600: Best of LuckDocument1 pageContact: 9033311500, 8866611600: Best of LuckRavi UdeshiNo ratings yet

- Time:-01:00Hr. F.M.:-25Document2 pagesTime:-01:00Hr. F.M.:-25mishralakshay629No ratings yet

- Work Book Unit 12 Bank Reconcilaition Statement (Solved)Document9 pagesWork Book Unit 12 Bank Reconcilaition Statement (Solved)Zaheer SwatiNo ratings yet

- BRS Statement IllustrationsDocument3 pagesBRS Statement Illustrationssurekha khandebharadNo ratings yet

- BRS ProblemsDocument28 pagesBRS ProblemsKutbuddin JawadwalaNo ratings yet

- Activity in Bank Reconciliation Part 2Document1 pageActivity in Bank Reconciliation Part 2CHERIE MAY ANGEL QUITORIANONo ratings yet

- Brs Practical QuestionsDocument5 pagesBrs Practical QuestionsSwarupa VNo ratings yet

- Practical - Bank Reconciliation StatementDocument5 pagesPractical - Bank Reconciliation StatementUniversal SoldierNo ratings yet

- Bank Reconciliation StatementDocument12 pagesBank Reconciliation StatementBhuvan PrajapatiNo ratings yet

- AttachmentDocument3 pagesAttachmentnugusuNo ratings yet

- AC101 Quiz 2Document2 pagesAC101 Quiz 2irene TogaraNo ratings yet

- Ca Foundation Accounts Test Paper: Maximum Marks: 40 Time Allowed: 1hr. Allowed: 1hr. 15 MinutesDocument3 pagesCa Foundation Accounts Test Paper: Maximum Marks: 40 Time Allowed: 1hr. Allowed: 1hr. 15 Minutesvanshikha.agarwal345No ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 9 BankDocument34 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 9 Bankmyankjindal9No ratings yet

- Navyug Commerce Institute Lakhanpur Kanpur Topic-B.R.SDocument2 pagesNavyug Commerce Institute Lakhanpur Kanpur Topic-B.R.SparthNo ratings yet