Professional Documents

Culture Documents

IDirect TataChemical Q1FY23

IDirect TataChemical Q1FY23

Uploaded by

Ayush GoelCopyright:

Available Formats

You might also like

- Bilans Stanja - BALANCE SHEETDocument2 pagesBilans Stanja - BALANCE SHEETLorimer01080% (10)

- CCM Corporate Overview - v2Document37 pagesCCM Corporate Overview - v2Mohammed Hammoudeh100% (2)

- Control Obj For Non-Current AssetsDocument6 pagesControl Obj For Non-Current AssetsTrần TùngNo ratings yet

- Sudarshan Chemical: Upcoming Capex Offers Strong Visibility AheadDocument7 pagesSudarshan Chemical: Upcoming Capex Offers Strong Visibility AheadEquityLabs IndiaNo ratings yet

- Vinati Organics: Newer Businesses To Drive Growth AheadDocument6 pagesVinati Organics: Newer Businesses To Drive Growth AheadtamilNo ratings yet

- IDirect Pidilite Q1FY22Document8 pagesIDirect Pidilite Q1FY22Ranjith ChackoNo ratings yet

- Equity Research Report On Pidilite LTDDocument9 pagesEquity Research Report On Pidilite LTDDurgesh ShuklaNo ratings yet

- Icici Direct ResearchDocument9 pagesIcici Direct Researchfinanceharsh6No ratings yet

- IDirect CenturyPly Q3FY22Document9 pagesIDirect CenturyPly Q3FY22Tai TranNo ratings yet

- Sumitomo Chemicals: CRAMS Offers Strong Visibility AheadDocument7 pagesSumitomo Chemicals: CRAMS Offers Strong Visibility AheadhamsNo ratings yet

- Mahindra & Mahindra: (Mahmah)Document10 pagesMahindra & Mahindra: (Mahmah)Ashwet JadhavNo ratings yet

- Divi's Laboratories: Strong Growth Outlook Backed by ExecutionDocument9 pagesDivi's Laboratories: Strong Growth Outlook Backed by ExecutionRahul AggarwalNo ratings yet

- RIL 3Q FY20 Analyst Presentation 17jan20Document94 pagesRIL 3Q FY20 Analyst Presentation 17jan20prince9sanjuNo ratings yet

- Valiant Organics LTD.: Eureka in The LabDocument11 pagesValiant Organics LTD.: Eureka in The LabAJNo ratings yet

- TATACOMM ICICIDirect 06082021Document8 pagesTATACOMM ICICIDirect 06082021gbNo ratings yet

- Deepak Nitrite - FinalDocument24 pagesDeepak Nitrite - Finalvajiravel407No ratings yet

- HOLD Relaxo Footwears IDirect 16.5.2022Document9 pagesHOLD Relaxo Footwears IDirect 16.5.2022Vaishali AgrawalNo ratings yet

- IDirect ABFRL Q3FY22Document7 pagesIDirect ABFRL Q3FY22Parag SaxenaNo ratings yet

- IDirect Voltas Q1FY23Document11 pagesIDirect Voltas Q1FY23Rehan SkNo ratings yet

- IDirect Biocon Q3FY17Document16 pagesIDirect Biocon Q3FY17Jagadish TangiralaNo ratings yet

- Reliance Press Release-JuneDocument9 pagesReliance Press Release-Junenakarani39No ratings yet

- IDirect SunTV Q2FY22Document7 pagesIDirect SunTV Q2FY22Sarah AliceNo ratings yet

- Dixon Technologies - Q4FY22 Result Update - 31052022 - 31-05-2022 - 14Document8 pagesDixon Technologies - Q4FY22 Result Update - 31052022 - 31-05-2022 - 14Sachin DhimanNo ratings yet

- ICICI Direct - Astec Lifesciences - Q3FY22Document7 pagesICICI Direct - Astec Lifesciences - Q3FY22Puneet367No ratings yet

- qt9gz4f4gj NosplashDocument195 pagesqt9gz4f4gj NosplashNhu QuynhNo ratings yet

- Ad AnalysisDocument6 pagesAd Analysisnani reddyNo ratings yet

- Aarti Industries - 3QFY20 Result - RsecDocument7 pagesAarti Industries - 3QFY20 Result - RsecdarshanmaldeNo ratings yet

- Deepak Fertilizers & Petrochemicals Corporation: Result As Per Expectation, Project On TimeDocument4 pagesDeepak Fertilizers & Petrochemicals Corporation: Result As Per Expectation, Project On TimeNandan AcharyaNo ratings yet

- IDirect RelianceInd CoUpdate Dec22Document6 pagesIDirect RelianceInd CoUpdate Dec22adityazade03No ratings yet

- Bharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Document9 pagesBharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Sanjeedeep Mishra , 315No ratings yet

- Steel Authority of India 250522 IciciDocument8 pagesSteel Authority of India 250522 IcicidurjoythermaxNo ratings yet

- IDirect IEX Q4FY21Document5 pagesIDirect IEX Q4FY21SushilNo ratings yet

- SODA 2020 Q1 IR PresentationDocument42 pagesSODA 2020 Q1 IR PresentationprasenjitNo ratings yet

- IDirect Larsen CompanyUpdateDocument6 pagesIDirect Larsen CompanyUpdateD TNo ratings yet

- ITC LTD - Axis Annual Analysis 2023 - 20-07-2023 - 15Document27 pagesITC LTD - Axis Annual Analysis 2023 - 20-07-2023 - 15Sanjeedeep Mishra , 315No ratings yet

- 26july2023 India Daily 230726 084131Document105 pages26july2023 India Daily 230726 084131Mahaveer BadalNo ratings yet

- Titan Company (TITIND) : Multiple Levers in Place To Drive Sales GrowthDocument5 pagesTitan Company (TITIND) : Multiple Levers in Place To Drive Sales Growthaachen_24No ratings yet

- Bodal Chemicals (BODCHE) : Expansion in Place, Volume Led Growth Ahead!Document9 pagesBodal Chemicals (BODCHE) : Expansion in Place, Volume Led Growth Ahead!P.B VeeraraghavuluNo ratings yet

- Centrica Ar2020Document228 pagesCentrica Ar2020Mustafa BaigNo ratings yet

- Princpip 11 8 23 PLDocument6 pagesPrincpip 11 8 23 PLAnubhi Garg374No ratings yet

- RIL 2Q FY19 Analyst Presentation 17oct18Document75 pagesRIL 2Q FY19 Analyst Presentation 17oct18Raghunath GuruvayurappanNo ratings yet

- Shivalik Bimetals - Q3FY24 - Dalal&BroachaDocument9 pagesShivalik Bimetals - Q3FY24 - Dalal&BroachaKirtan Ramesh JethvaNo ratings yet

- (Kotak) Reliance Industries, October 29, 2023Document36 pages(Kotak) Reliance Industries, October 29, 2023Naushil ShahNo ratings yet

- ESTER INDUSTRIES LTD Research ReportDocument7 pagesESTER INDUSTRIES LTD Research ReportKOUSHIKNo ratings yet

- Axis Securities Sees 12% UPSIDE in Dalmia Bharat Limited in LineDocument9 pagesAxis Securities Sees 12% UPSIDE in Dalmia Bharat Limited in LinemisfitmedicoNo ratings yet

- IDirect TCS Q1FY23Document11 pagesIDirect TCS Q1FY23uefqyaufdQNo ratings yet

- Dixon Technologies Q1FY22 Result UpdateDocument8 pagesDixon Technologies Q1FY22 Result UpdateAmos RiveraNo ratings yet

- Sterlite Technologies: Ambitious Target To Double Revenues in Three Years!Document8 pagesSterlite Technologies: Ambitious Target To Double Revenues in Three Years!Guarachandar ChandNo ratings yet

- Glenmark Pharmaceuticals: Stable Numbers Margin Expansion To The ForeDocument11 pagesGlenmark Pharmaceuticals: Stable Numbers Margin Expansion To The ForeChirag NakumNo ratings yet

- Investor Presentation - Q4 FY22Document80 pagesInvestor Presentation - Q4 FY22Khushal ShahNo ratings yet

- IDirect Titan Q1FY23Document10 pagesIDirect Titan Q1FY23AKHILESH HEBBARNo ratings yet

- Pricol - CU-IDirect-Mar 3, 2022Document6 pagesPricol - CU-IDirect-Mar 3, 2022rajesh katareNo ratings yet

- In Line Performance... : (Natmin) HoldDocument10 pagesIn Line Performance... : (Natmin) HoldMani SeshadrinathanNo ratings yet

- Fy20 Agm PresentationDocument21 pagesFy20 Agm PresentationVinay BNo ratings yet

- Reliance Industries (RIL IN) : Q1FY21 Result UpdateDocument7 pagesReliance Industries (RIL IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- Hindalco Industries LTD - Q3FY24 Result Update - 14022024 - 14-02-2024 - 14Document9 pagesHindalco Industries LTD - Q3FY24 Result Update - 14022024 - 14-02-2024 - 14Nikhil GadeNo ratings yet

- Pidilite Industries (PIDIND) : High Raw Material Prices Hit MarginDocument10 pagesPidilite Industries (PIDIND) : High Raw Material Prices Hit MarginSiddhant SinghNo ratings yet

- Dalal Broacha ReportDocument12 pagesDalal Broacha Reportvedantpatnaik.privNo ratings yet

- Mrs. Bectors Food Specialities 04062024 AcDocument6 pagesMrs. Bectors Food Specialities 04062024 AcgreyistariNo ratings yet

- Fineotex Chemicals 21022024 KRDocument6 pagesFineotex Chemicals 21022024 KRProton CongoNo ratings yet

- RIL 4Q FY18 Analyst Presentation 27apr18 PDFDocument110 pagesRIL 4Q FY18 Analyst Presentation 27apr18 PDFneethuNo ratings yet

- A New Dawn for Global Value Chain Participation in the PhilippinesFrom EverandA New Dawn for Global Value Chain Participation in the PhilippinesNo ratings yet

- HSIE Results Daily - 13 Aug 22-202208130806034185877Document10 pagesHSIE Results Daily - 13 Aug 22-202208130806034185877Ayush GoelNo ratings yet

- IDirect BharatForge Q1FY23Document9 pagesIDirect BharatForge Q1FY23Ayush GoelNo ratings yet

- HSIE Results Daily - 12 Aug 22-202208120715438230865Document15 pagesHSIE Results Daily - 12 Aug 22-202208120715438230865Ayush GoelNo ratings yet

- TCP Research Report 1Document9 pagesTCP Research Report 1Ayush GoelNo ratings yet

- TCP Research Report OldDocument5 pagesTCP Research Report OldAyush GoelNo ratings yet

- Motilal Tata ConsumersDocument16 pagesMotilal Tata ConsumersAyush GoelNo ratings yet

- TCP Research ReportDocument6 pagesTCP Research ReportAyush GoelNo ratings yet

- Goldiam Annual Report 19-20Document161 pagesGoldiam Annual Report 19-20Ayush GoelNo ratings yet

- Chap 3-5Document5 pagesChap 3-5jessa mae zerdaNo ratings yet

- Fin ZC415 Ec-3r First Sem 2019-2020Document5 pagesFin ZC415 Ec-3r First Sem 2019-2020srideviNo ratings yet

- EVA ProblemDocument1 pageEVA ProblemAshutosh BiswalNo ratings yet

- Lecture: Statement of Cash Flow Ii Lecture ADocument27 pagesLecture: Statement of Cash Flow Ii Lecture ATinashe ChikwenhereNo ratings yet

- Questions and Answers For Essay QuestionsDocument12 pagesQuestions and Answers For Essay QuestionsPushpendra Singh ShekhawatNo ratings yet

- Chapter 1 - Logistics and Supply Chain Part 1Document41 pagesChapter 1 - Logistics and Supply Chain Part 1Nichole Patricia PedriñaNo ratings yet

- Setting Up The Financial Statement ModelDocument45 pagesSetting Up The Financial Statement ModelSyed Ameer Ali ShahNo ratings yet

- FABM2 - Q1 - Module 4 - Statement of Cash FlowsDocument22 pagesFABM2 - Q1 - Module 4 - Statement of Cash FlowsHanzel NietesNo ratings yet

- 12 Accounts Imp ch10 PDFDocument14 pages12 Accounts Imp ch10 PDFmukesh kumarNo ratings yet

- Bab 9 AkmDocument44 pagesBab 9 Akmcaesara geniza ghildaNo ratings yet

- Business Combinations : Ifrs 3Document45 pagesBusiness Combinations : Ifrs 3alemayehu100% (1)

- Kode Unit Kompetensi Judul Kompetensi Kode Soal: Instruksi KerjaDocument34 pagesKode Unit Kompetensi Judul Kompetensi Kode Soal: Instruksi Kerjanabilah syNo ratings yet

- Asse T Management: How To Develop An PlanDocument2 pagesAsse T Management: How To Develop An Planvisoni.marseuNo ratings yet

- English Active PasiveDocument15 pagesEnglish Active PasiveAna DanaNo ratings yet

- Fundamentals of Accountancy, Business, and Management 2 Activity 2Document1 pageFundamentals of Accountancy, Business, and Management 2 Activity 2Joseph CincoNo ratings yet

- The Role of Financial Management: Instructor: Ajab Khan BurkiDocument20 pagesThe Role of Financial Management: Instructor: Ajab Khan BurkiGaurav KarkiNo ratings yet

- Emaar Consolidated EAS Dec 20 English FSsDocument38 pagesEmaar Consolidated EAS Dec 20 English FSsAly A. SamyNo ratings yet

- ACC Chapter 8 QuestionsDocument12 pagesACC Chapter 8 Questionsmasud.mily06No ratings yet

- United Food Pakistan Balance Sheet For The Year 2011 To 2020Document34 pagesUnited Food Pakistan Balance Sheet For The Year 2011 To 2020tech& GamingNo ratings yet

- Production Process of Bags PDFDocument22 pagesProduction Process of Bags PDFSk Mosaib AhamedNo ratings yet

- LKAS 19 2021 UploadDocument31 pagesLKAS 19 2021 Uploadpriyantha dasanayake100% (2)

- Metlife Report 1Document77 pagesMetlife Report 1JaiHanumankiNo ratings yet

- Consol Pack Mar22 ANTDocument149 pagesConsol Pack Mar22 ANTAries BautistaNo ratings yet

- The Putnam Company Sales Budget For The Year Ended December 31, 20X2Document13 pagesThe Putnam Company Sales Budget For The Year Ended December 31, 20X2susi aNo ratings yet

- Financial Report H1 2009 enDocument27 pagesFinancial Report H1 2009 eniramkkNo ratings yet

- Private Placement Memorandum Template 04Document105 pagesPrivate Placement Memorandum Template 04charliep8No ratings yet

- MODULE 10 Non-Current Assets Held For SaleDocument7 pagesMODULE 10 Non-Current Assets Held For SaleKim JisooNo ratings yet

- Avidesa Mac Pollo S A (Colombia)Document18 pagesAvidesa Mac Pollo S A (Colombia)Batfori clucksNo ratings yet

IDirect TataChemical Q1FY23

IDirect TataChemical Q1FY23

Uploaded by

Ayush GoelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IDirect TataChemical Q1FY23

IDirect TataChemical Q1FY23

Uploaded by

Ayush GoelCopyright:

Available Formats

Tata Chemicals (TATCHE)

CMP: | 1155 Target: | 1370 (19%) Target Period: 12 months BUY

August 12, 2022

Soda ash propels growth; outlook strong…

About the stock: Commencing operations in 1944, Tata Chemicals has come a long

way to become one of the top five players in the global soda ash market.

Result Update

Under basic chemical, TCL offers soda ash, sodium bicarbonate, cement,

Particulars

salt, marine chemicals and crushed refined soda. Speciality chemical

Particular Amount

consists of solution towards agro chemical through Rallis and other

Market cap (| Crore) 29,432

specialty solutions such as nutritional products and HDS

FY22 Total Debt (| Crore) 7,025

Basic chemical forms 75% of overall revenue while the rest comes from FY22 Cash & Inv (| Crore) 2,791

EV (| Crore) 33,666

speciality products

52 Week H/L 1158/671

Equity Capital (| Crore) 254.8

Q1FY23 Results: Reported strong numbers across the board largely led by robust Face Value (|) 10

realisation growth across all geographies in basic chemical segment Shareholding pattern

Reported revenue growth of 34.2% YoY to | 3995 crore, led by good growth in % Sept-21 Dec-21 Mar-22 Jun-22

Promoter 38.0 38.0 38.0 38.0

in the basic chemical segment (+41%YoY) and in speciality products

DII 20.0 18.3 19.9 19.1

(+17% YoY) FII 14.5 14.0 13.6 15.0

Gross margins improved 190 bps YoY to ~80.1% while EBITDA margin Others 27.6 29.7 28.5 27.9

expanded 520 bps YoY to 25.4%, highest till date Price Chart

80,000 1200

EBITDA was up 69% YoY to | 1015 crore 60,000

1000

800

ICICI Securities – Retail Equity Research

40,000 600

Adjusted PAT was at | 544.7 crore vs. | 288 crore in Q1FY22 400

20,000

200

What should investors do? The stock appreciated at 55% CAGR in last three years. 0 0

Aug-19

Aug-20

Aug-21

Aug-22

Feb-20

Feb-21

Feb-22

We revise our rating from HOLD to BUY on the stock due to better soda ash

pricing environment Sensex Tata Chemicals

Target Price and Valuation: We value Tata Chemicals at SOTP valuation to arrive

at a revised target price of | 1370/share (earlier | 1155/share). Recent event & key risks

Outlined a phase 2 capex of

| 2000 crore post FY24

Key triggers for future price performance:

Key Risk: (i) Fall in soda ash

Improvement in the soda ash pricing environment bodes well for future

prices and rise in crude to impact

growth outlook EBITDA/tonne (ii) Revival in

demand and thereby prices

Revival in export demand for North America unit to sustain group

performance .Research Analyst

Higher share of speciality business to command better valuations for the Siddhant Khandekar

overall group siddhant.khandekar@icicisecurities.com

Dhavan Shah

Alternate Stock Idea: Apart from Tata Chemicals, in our chemical coverage we also dhavan.shah@icicisecurities.com

like Neogen Chemical.

Trigger for Neogen Chemical’s future revenue growth would be increasing

CRAMS opportunity

BUY with a target price of | 1645

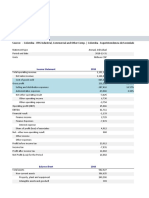

Key Financial Summary

5 year CAGR 2 year CAGR

(| Crore) FY19 FY20 FY21 FY22 FY23E FY24E

(FY17-22) (FY22-24E)

Net Revenue 10,336.7 10,356.8 10,199.8 12,622.1 4.1% 13,984.7 15,240.7 9.9%

EBITDA 1,780.5 1,949.2 1,500.6 2,304.6 1.9% 2,776.0 3,089.9 15.8%

EBITDA Margins (%) 17.2% 18.8% 14.7% 18.3% 19.9% 20.3%

Adj.PAT 875.0 806.6 256.4 1,211.5 6.6% 1,535.2 1,774.5 21.0%

Adj. EPS (|) 34.3 31.7 10.1 47.5 60.2 69.6

EV/EBITDA 14.0x 13.2x 18.6x 12.3x 9.4x 7.0x

P/E 27.4x 29.7x 93.4x 19.8x 15.6x 13.5x

ROE (%) 7.1 6.3 1.8 6.6 7.9 8.4

ROCE (%) 7.1 7.7 4.1 6.6 8.0 8.7

Source: Company, ICICI Direct Research

Result Update | Tata Chemicals ICICI Direct Research

Key takeaways of recent quarter & conference call highlight

Q1FY23 Results: Higher soda ash realisations aid better performance

Basic chemical topline performance: Revenues were up 37% YoY to

| 2901.8 crore. The India business reported growth of 31.8% YoY to | 1062.8

crore while the same from North America, UK and Magadi was up 35.3%

YoY, 50.4% YoY & 48.7% YoY to | 1092 crore, | 576 crore & | 171 crore,

respectively. The growth across geographies was largely driven by higher

realisation owing to revival in the demand of end user industry

Basic chemical operational performance: EBITDA for the segment increased

137% YoY to | 661.5 crore, largely on the back of better margins from North

America and Magadi businesses. EBITDA/tonne for North America and

Magadi remained at | 4472 (+302% YoY) & | 8000 (+172% YoY)

respectively

Q1FY23 Earnings Conference Call highlights

India:

Mithapur unit operating at full capacity

Higher soda ash and bi carb realisations on the back of strong market

demand, market tightness

EBITDA improvement due to improved realisations, which offset significant

increase in raw material and energy costs

North America:

Overall US volumes remain strong with growth in domestic and export

market; overall market remains tight.

Export prices remain strong and above pre-Covid levels

Maintenance shutdown in one dryer leading to 10K MT production loss

Gas prices remain at elevated levels

Part pre-payment of $30 million debt during the quarter

Europe:

EBITDA improvement on account of improved realisations, which offset

significant increase in raw material and energy costs

Marginally lower volumes in Q1FY23

Kenya:

Kenya operation maintained its steady performance with higher sales

volume and higher export realisations

Margins improved compared to past year on account of higher realisations

and robust market demand

Unit continues its focus to optimisation cost and improve efficiencies

Rallis:

Higher revenues driven by robust growth in crop care

Margins impacted due to cost inflation and competitive pricing

External factors affecting costs, margins and operations are being

addressed

Crop care margins improved while seeds margin was impacted and

continues to be under pressure

ICICI Securities | Retail Research 2

Result Update | Tata Chemicals ICICI Direct Research

Soda Ash:

Soda ash prices are expected to remain firm in the next 18-24 months

Demand for soda ash is strong in spite of high prices. Demand is robust

from detergent and glass industry

If energy prices remain at current levels, soda ash prices will have high

realisations in future

Other updates:

Revenue in the current quarter was driven by core business of soda ash and

bi-carbonate

Capex plan is progressing well. The company expects it to get

commissioned in FY24

There is a shift in contract pattern for exports. The company has started to

enter contracts on a quarterly basis

Bi-carb business is doing well. New business has seen revenue growth

Volumes growth can be expected from China and the US. Capacity has been

announced and is likely to come on stream in FY25-16

Better growth from solar panel to aid demand for glass industry and thereby

soda ash

Russia-Ukraine crisis can have limited impact on the UK business given that

it sources gas from other Middle East countries

Silica business continues to gain traction for its rubber and food grade silica

products with new customers added

Net debt for the quarter was at | 4233 crore vs. | 4120 crore as on December

2021

ICICI Securities | Retail Research 3

Result Update | Tata Chemicals ICICI Direct Research

Financial story in charts

Exhibit 1: Basic chemical revenues – Geographical bifurcation (| crore)

Basic chem Revenue Q1FY21 Q2FY21 Q3FY21 Q4FY21 Q1FY22 Q2FY22 Q3FY22 Q4FY22 Q1FY23

India 637 700 764 806 795 812 874 1,063 1,164

TCA - North America 619 711 742 807 837 867 891 1,092 1,119

TCE - Europe 316 337 374 383 407 416 551 576 531

TCM - Magadi 100 91 107 115 134 140 132 171 246

Source: ICICI Direct Research

Exhibit 2: Basic chemical volumes – Geographical break-up (‘000 MT)

Basic chem sales volume ( '0 0 0 MT) Q1 FY 2 1 Q2 FY 2 1 Q3 FY 2 1 Q4 FY 2 1 Q1 FY 2 2 Q2 FY 2 2 Q3 FY 2 2 Q4 FY 2 2 Q1 FY 2 3

TC L I nd ia 139 176 204 213 195 208 189 205 199

Soda Ash 118 151 178 184 167 178 156 176 169

Sodium Bicarbonate 21 25 26 29 28 30 33 29 30

TC A - Nor t h Amer ica 387 475 474 566 578 613 586 615 568

Soda Ash 387 475 474 566 578 613 586 615 568

TC E - Eur op e 92 94 98 96 95 93 99 100 93

Soda Ash 62 67 70 67 68 68 71 70 65

Sodium Bicarbonate 30 27 28 29 27 25 28 30 28

TC M - Mag ad i 57 51 56 68 83 86 73 75 83

Soda Ash 57 51 56 68 83 86 73 75 83

Source: ICICI Direct Research

Exhibit 3: Basic chemical realisation/tonne– Geographical break-up

Basic chem r ealisat ion/t onne Q1FY21 Q2FY21 Q3FY21 Q4FY21 Q1FY22 Q2FY22 Q3FY22 Q4FY22 Q1FY23

India 45,850 39,755 37,431 37,856 40,758 39,033 46,233 51,842 58,463

TCA - North America 15,995 14,968 15,654 14,258 14,491 14,144 15,205 17,756 19,704

TCE - Europe 34,348 35,851 38,163 39,896 42,842 44,731 55,657 57,600 57,282

TCM - Magadi 17,544 17,843 19,107 16,912 16,145 16,279 18,082 22,800 29,532

Source: ICICI Direct Research

Exhibit 4: Basic chemical EBITDA/tonne– Geographical break-up

Basic chem EBI TDA/t onne Q1FY21 Q2FY21 Q3FY21 Q4FY21 Q1FY22 Q2FY22 Q3FY22 Q4FY22 Q1FY23

India 12,710 7,454 9,214 8,342 13,487 10,705 13,231 13,925 21,265

TCA - North America 904 2,021 3,333 1,113 2,995 3,197 2,440 4,472 4,860

TCE - Europe 3,043 4,894 4,592 1,979 3,053 -1,935 6,667 4,100 10,572

TCM - Magadi 1,754 1,176 4,643 2,941 3,012 2,674 3,425 8,000 14,286

Source: ICICI Direct Research

Exhibit 5: Basic chemical OPM %– Geographical break-up

Basic chem OPM ( %) Q1FY21 Q2FY21 Q3FY21 Q4FY21 Q1FY22 Q2FY22 Q3FY22 Q4FY22 Q1FY23

India 27.7% 18.8% 24.6% 22.0% 33.1% 27.4% 28.6% 26.9% 36.4%

TCA - North America 5.7% 13.5% 21.3% 7.8% 20.7% 22.6% 16.0% 25.2% 24.7%

TCE - Europe 8.9% 13.6% 12.0% 5.0% 7.1% -4.3% 12.0% 7.1% 18.5%

TCM - Magadi 10.0% 6.6% 24.3% 17.4% 18.7% 16.4% 18.9% 35.1% 48.4%

Source: ICICI Direct Research

Exhibit 6: SOTP valuation

Revenue EBITDA EV/EBITDA EV

In | Crore unless other mentioned

FY23E FY24E FY23E FY24E FY24E FY24E

Basic Chemical

India 4,282 4,766 1,134 1,262 9.0x 11,359

ROW 7,401 7,748 1,437 1,512 8.0x 12,094

Speciality Products

Rallis (50.09% stake and 20% holding company discount) 3,020 3,426 293 400 11.5x 1,836

Other Speciality 339 452 38 51 10.0x 513

Consolidated EV 25,802

Less: Net debt 448

Residual business MCAP 25,354

Add: NC investment portfolio excl Tata sons inv @ 70% disc 1,600

Add: Fair value of Tata sons inv @ 70% disc 8,000

Target MCAP 34,954

No.of shares 25.5

Target price/share 1,370

CMP 1,155

Upside/downside 19%

Source: ICICI Direct Research

ICICI Securities | Retail Research 4

Result Update | Tata Chemicals ICICI Direct Research

Exhibit 7: Revenue trend (| crore)

16,361

15,105

12,622

10,270 10,337 10,357 10,200

FY18 FY19 FY20 FY21 FY22 FY23E FY24E

Source: Company, ICICI Direct Research

Exhibit 8: EBITDA (| crore) and OPM (%) trend

3,500 25.0%

21.3%

19.1% 19.6%

3,000 18.8% 18.3% 20.0%

17.2%

2,500

14.7%

2,000 15.0%

1,500 10.0%

1,000

5.0%

500

2,191 1,780 1,949 1,501 2,305 2,889 3,203

0 0.0%

FY18 FY19 FY20 FY21 FY22 FY23E FY24E

EBITDA OPM%

Source: Company, ICICI Direct Research

Exhibit 9: Adjusted PAT growth trend (| crore)

2,000 14.0%

12.0%

1,800 11.4%

10.7% 12.0%

1,600 9.6%

1,400 8.5% 10.0%

7.8%

1,200 8.0%

1,000

800 6.0%

600 2.5% 4.0%

400

2.0%

200 1,229 875 807 256 1,212 1,621 1,860

0 0.0%

FY18 FY19 FY20 FY21 FY22 FY23E FY24E

Adjusted PAT ANPM%

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 5

Result Update | Tata Chemicals ICICI Direct Research

Financial summary

Exhibit 10: Profit and loss statement | crore Exhibit 11: Cash flow statement | crore

Year end March FY21 FY22 FY23E FY24E Year end March FY21 FY22 FY23E FY24E

Total Operating Income 10,199.8 12,622.1 15,104.8 16,361.0 PBT & Extraordinary 634.0 1,684.9 2,226.7 2,583.4

Growth (%) -1.5 23.7 19.7 8.3 Depreciation 759.3 806.1 917.3 964.8

Raw Material Expenses 2,396.9 2,637.3 3,021.0 3,272.2

After other adjustments

Gross Profit 7,802.9 9,984.8 12,083.8 13,088.8

(Inc) / Dec in Working Capital 323.3 -648.8 964.9 -63.6

Employee Cost 1,399.7 1,540.0 1,767.3 1,865.2

Other Operating Expenses 4,902.5 6,140.2 7,427.4 8,020.6 Taxes -96.3 -263.4 -445.3 -516.7

EBITDA 1,500.6 2,304.6 2,889.1 3,203.0 Others 417.0 65.5 245.2 166.5

Growth (%) -23.0 53.6 25.4 10.9 CF from operating activities 2,037.3 1,644.3 3,908.7 3,134.4

Other Income 234.4 256.0 260.1 271.6 Purchase of Fixed Assets -1,241.9 -1,276.8 -1,065.0 -1,065.0

EBITDA, including OI 1,735.1 2,560.6 3,149.2 3,474.6 Others 111.6 440.7 625.1 -500.0

Depreciation 759.3 806.1 917.3 964.8 CF from investing activities -1,130.3 -836.1 -439.9 -1,565.0

Net Interest Exp. 367.4 302.8 245.2 166.5 Proceeds from issue of shares 0.0 0.0 0.0 0.0

Other exceptional items 0.0 -11.0 0.0 0.0

Borrowings (Net) -634.1 -40.5 -2,750.0 -877.6

PBT 608.4 1,440.6 1,986.7 2,343.4

Others -821.5 -714.8 -525.5 -446.8

Total Tax 197.8 266.5 445.3 516.7

Tax Rate 32.5% 18.5% 22.4% 22.0% CF from financing activities -1,455.6 -755.2 -3,275.5 -1,324.4

PAT 410.6 1,174.1 1,541.4 1,826.7 Net cash flow -548.6 53.0 193.3 245.0

Adj.PAT after Minority interest 256.4 1,211.5 1,621.1 1,860.0 Effects of foreign currency translation 0.0 0.0 0.0 0.0

Adj. EPS (|) 10.1 47.5 63.6 73.0 Opening Cash 2,079.5 1,411.0 1,310.4 1,503.7

Shares Outstanding 25.5 25.5 25.5 25.5 Closing Cash 1,411.0 1,310.4 1,503.7 1,748.7

Source: Company, ICICI Direct Research Source: Company, ICICI Direct Research

Exhibit 12: Balance sheet | crore Exhibit 13: Key ratios

Year end March FY21 FY22 FY23E FY24E Year end March FY21 FY22 FY23E FY24E

Liabilities Per share data (|)

Share Capital 254.8 254.8 254.8 254.8 Adj. EPS 10.1 47.5 63.6 73.0

Reserves 14,035.2 17,998.1 19,338.8 20,918.5 Adj. Cash EPS 39.9 79.2 99.6 110.9

Total Shareholders Funds 14,290.0 18,252.9 19,593.6 21,173.4 BV 560.8 716.3 768.9 830.9

Minority Interest 852.6 904.5 1,064.8 1,271.5 DPS 10.0 12.5 11.0 11.0

Long Term Borrowings 5,388.1 3,860.5 1,210.5 410.5 Operating Ratios (%)

Net Deferred Tax liability 1,572.1 2,036.5 2,036.5 2,036.5

Gross Margin (%) 76.5 79.1 80.0 80.0

Other long term liabilities 173.0 413.6 133.9 145.0

EBITDA Margin (%) 14.7 18.3 19.1 19.6

Long term provisions 1,598.1 1,279.3 2,601.7 2,818.1

PAT Margin (%) 2.5 9.6 10.7 11.4

Current Liabilities and Provisions

Debtor Days 50 56 57 57

Short term borrowings 1,544.5 3,164.1 3,064.1 2,986.5

Trade Payables 1,682.9 2,444.7 2,896.8 3,137.7

Inventory Days 60 66 67 67

Other Current Liabilities 870.9 1,116.1 1,335.6 1,446.7 Creditor Days 60 71 70 70

Short Term Provisions 365.1 371.2 444.2 481.1 Cash Conversion Cycle 50 52 54 54

Total Current Liabilities 4,463.4 7,096.0 7,740.7 8,052.0 Return Ratios (%)

Total Liabilities 28,337.2 33,843.3 34,381.7 35,906.9 Return on Assets (%) 0.9 3.6 4.7 5.2

Assets RoCE (%) 4.1 6.6 8.4 9.0

Net Block 12,971.3 13,758.9 15,331.2 15,431.3 Core RoIC (%) 4.1 6.6 9.1 10.4

Capital Work in Progress 1,034.7 1,589.6 165.0 165.0 RoE (%) 1.8 6.6 8.3 8.8

Intangible assets under devl. 58.8 77.8 77.8 77.8 Solvency Ratios

Goodwill on Consolidation 1,963.3 2,016.4 2,016.4 2,016.4 Total Debt / Equity 0.5 0.4 0.2 0.2

Non-current investments 4,252.3 6,357.5 6,357.5 6,357.5 Interest Coverage 2.7 5.8 9.1 15.1

Deferred tax assets 0.0 0.1 0.1 0.1 Current Ratio 1.5 1.2 1.2 1.3

Long term loans and advances 10.7 0.0 11.7 12.7 Quick Ratio 1.1 0.9 0.9 1.0

Other Non Current Assets 1,400.4 1,298.1 1,017.6 1,097.8 Valuation Ratios (x)

Current Assets, Loans & Advances EV/EBITDA 22.3 14.7 10.9 8.5

Current Investments 1,563.5 1,325.1 700.0 1,200.0 P/E 114.8 24.3 18.2 15.8

Inventories 1,686.6 2,293.5 2,772.7 3,003.3 P/B 2.1 1.6 1.5 1.4

Sundry Debtors 1,397.0 1,933.4 2,358.8 2,555.0

EV/Sales 3.3 2.7 2.1 1.7

Cash and Bank 1,411.0 1,310.4 1,503.7 1,748.7 Source: Company, ICICI Direct Research

Loans and Advances 0.2 0.2 0.2 0.2

Other Current assets 587.5 1,882.5 2,069.1 2,241.2

Current Assets 6,645.7 8,745.0 9,404.5 10,748.4

Total Assets 28,337.2 33,843.3 34,381.7 35,906.9

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 6

Result Update | Tata Chemicals ICICI Direct Research

Exhibit 14: ICICI Direct coverage universe (Chemicals)

CMP M Cap EPS (|) P/E (x) EV/EBITDA (x) RoCE (%) RoE (%)

Company

(|) TP(|) Rating (| Cr) FY22 FY23E FY24E FY22 FY23E FY24E FY22 FY23E FY24E FY22 FY23E FY24E FY22 FY23E FY24E

SRF 2340 2,735 Buy 69,466 63.5 68.9 82.7 36.1 33.2 27.7 22.4 20.6 17.0 23.8 21.6 22.5 22.1 20.3 20.4

PI Industries 3200 3,710 Buy 48,550 55.5 67.2 82.4 57.6 47.6 38.8 40.8 34.2 27.8 16.3 17.1 18.2 13.8 14.5 15.2

Aarti Industries 712 860 Hold 25,812 21.7 24.4 30.7 32.8 29.2 23.2 22.6 18.9 15.4 12.0 12.6 13.6 13.3 13.2 14.4

Tata Chemical 1155 1,370 Buy 29,432 47.5 63.6 73.0 24.3 18.2 15.8 14.7 10.9 8.5 6.6 8.4 9.0 6.6 8.3 8.8

Vinati Organics 2238 2,320 Hold 23,000 33.7 40.1 51.5 56.0 47.1 36.7 44.7 37.0 28.3 24.3 23.2 23.9 19.0 19.1 20.5

Sumitomo Chemical 476 565 Buy 23,809 8.5 10.9 12.5 56.1 43.5 38.0 38.9 30.4 26.1 30.2 30.4 28.2 22.0 22.6 21.0

Navin Fluorine 4200 4,450 Hold 20,812 52.3 67.4 89.0 80.3 62.3 47.2 58.4 41.8 30.6 17.8 18.7 19.6 14.0 15.8 17.9

Rallis India 208 200 Hold 3,987 8.4 8.9 12.4 24.3 23.1 16.6 13.9 14.1 10.1 12.7 11.6 15.3 9.7 9.5 12.1

Sudarshan chemical 455 515 Hold 3,153 18.8 19.3 28.5 24.0 23.3 15.8 14.2 12.8 9.6 10.9 11.3 15.4 15.6 14.3 18.3

Neogen Chemicals 1422 1,645 Buy 3,545 17.9 27.2 32.9 79.5 52.2 43.2 41.8 30.2 25.0 12.0 15.0 16.2 10.2 13.6 14.3

Astec Lifesciences 1791 2,215 Buy 3,509 45.1 54.8 69.3 39.7 32.7 25.9 24.6 20.7 16.5 19.3 17.7 19.4 22.3 21.3 21.2

Source: Bloomberg, ICICI Direct Research

ICICI Securities | Retail Research 7

Result Update | Tata Chemicals ICICI Direct Research

RATING RATIONALE

ICICI Direct endeavours to provide objective opinions and recommendations. ICICI Direct assigns ratings to its

stocks according to their notional target price vs. current market price and then categorizes them as Buy, Hold,

Reduce and Sell. The performance horizon is two years unless specified and the notional target price is defined

as the analysts' valuation for a stock

Buy: >15%

Hold: -5% to 15%;

Reduce: -15% to -5%;

Sell: <-15%

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICI Direct Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities | Retail Research 8

Result Update | Tata Chemicals ICICI Direct Research

ANALYST CERTIFICATION

I/We, Siddhant Khandekar, Inter CA, Dhavan Shah, MS (Finance) Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views

about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. It is also confirmed that above

mentioned Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months and do not serve as an officer, director or employee of the companies mentioned in

the report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products.

ICICI Securities is Sebi registered stock broker, merchant banker, investment adviser, portfolio manager and Research Analyst. ICICI Securities is registered with Insurance Regulatory Development Authority of India Limited (IRDAI)

as a composite corporate agent and with PFRDA as a Point of Presence. ICICI Securities Limited Research Analyst SEBI Registration Number – INH000000990. ICICI Securities Limited SEBI Registration is INZ000183631 for stock

broker. ICICI Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture

capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com.

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking and other business relationship

with a significant percentage of companies covered by our Investment Research Department. ICICI Securities and its analysts, persons reporting to analysts and their relatives are generally prohibited from maintaining a financial

interest in the securities or derivatives of any companies that the analysts cover.

Recommendation in reports based on technical and derivative analysis centre on studying charts of a stock's price movement, outstanding positions, trading volume etc as opposed to focusing on a company's fundamentals and, as

such, may not match with the recommendation in fundamental reports. Investors may visit icicidirect.com to view the Fundamental and Technical Research Reports.

Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

ICICI Securities Limited has two independent equity research groups: Institutional Research and Retail Research. This report has been prepared by the Retail Research. The views and opinions expressed in this document may or may

not match or may be contrary with the views, estimates, rating, and target price of the Institutional Research.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected

recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would

endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI

Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in

circumstances where ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein

is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers

simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting

and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who

must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient.

The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities

whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks

associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-

managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned in the report in the past

twelve months.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not receive any compensation or other

benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts and their relatives have any material conflict of

interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of

the research report.

Since associates of ICICI Securities and ICICI Securities as a entity are engaged in various financial service businesses, they might have financial interests or actual/beneficial ownership of one percent or more or other material conflict

of interest various companies including the subject company/companies mentioned in this report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or

use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in

all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

ICICI Securities | Retail Research 9

You might also like

- Bilans Stanja - BALANCE SHEETDocument2 pagesBilans Stanja - BALANCE SHEETLorimer01080% (10)

- CCM Corporate Overview - v2Document37 pagesCCM Corporate Overview - v2Mohammed Hammoudeh100% (2)

- Control Obj For Non-Current AssetsDocument6 pagesControl Obj For Non-Current AssetsTrần TùngNo ratings yet

- Sudarshan Chemical: Upcoming Capex Offers Strong Visibility AheadDocument7 pagesSudarshan Chemical: Upcoming Capex Offers Strong Visibility AheadEquityLabs IndiaNo ratings yet

- Vinati Organics: Newer Businesses To Drive Growth AheadDocument6 pagesVinati Organics: Newer Businesses To Drive Growth AheadtamilNo ratings yet

- IDirect Pidilite Q1FY22Document8 pagesIDirect Pidilite Q1FY22Ranjith ChackoNo ratings yet

- Equity Research Report On Pidilite LTDDocument9 pagesEquity Research Report On Pidilite LTDDurgesh ShuklaNo ratings yet

- Icici Direct ResearchDocument9 pagesIcici Direct Researchfinanceharsh6No ratings yet

- IDirect CenturyPly Q3FY22Document9 pagesIDirect CenturyPly Q3FY22Tai TranNo ratings yet

- Sumitomo Chemicals: CRAMS Offers Strong Visibility AheadDocument7 pagesSumitomo Chemicals: CRAMS Offers Strong Visibility AheadhamsNo ratings yet

- Mahindra & Mahindra: (Mahmah)Document10 pagesMahindra & Mahindra: (Mahmah)Ashwet JadhavNo ratings yet

- Divi's Laboratories: Strong Growth Outlook Backed by ExecutionDocument9 pagesDivi's Laboratories: Strong Growth Outlook Backed by ExecutionRahul AggarwalNo ratings yet

- RIL 3Q FY20 Analyst Presentation 17jan20Document94 pagesRIL 3Q FY20 Analyst Presentation 17jan20prince9sanjuNo ratings yet

- Valiant Organics LTD.: Eureka in The LabDocument11 pagesValiant Organics LTD.: Eureka in The LabAJNo ratings yet

- TATACOMM ICICIDirect 06082021Document8 pagesTATACOMM ICICIDirect 06082021gbNo ratings yet

- Deepak Nitrite - FinalDocument24 pagesDeepak Nitrite - Finalvajiravel407No ratings yet

- HOLD Relaxo Footwears IDirect 16.5.2022Document9 pagesHOLD Relaxo Footwears IDirect 16.5.2022Vaishali AgrawalNo ratings yet

- IDirect ABFRL Q3FY22Document7 pagesIDirect ABFRL Q3FY22Parag SaxenaNo ratings yet

- IDirect Voltas Q1FY23Document11 pagesIDirect Voltas Q1FY23Rehan SkNo ratings yet

- IDirect Biocon Q3FY17Document16 pagesIDirect Biocon Q3FY17Jagadish TangiralaNo ratings yet

- Reliance Press Release-JuneDocument9 pagesReliance Press Release-Junenakarani39No ratings yet

- IDirect SunTV Q2FY22Document7 pagesIDirect SunTV Q2FY22Sarah AliceNo ratings yet

- Dixon Technologies - Q4FY22 Result Update - 31052022 - 31-05-2022 - 14Document8 pagesDixon Technologies - Q4FY22 Result Update - 31052022 - 31-05-2022 - 14Sachin DhimanNo ratings yet

- ICICI Direct - Astec Lifesciences - Q3FY22Document7 pagesICICI Direct - Astec Lifesciences - Q3FY22Puneet367No ratings yet

- qt9gz4f4gj NosplashDocument195 pagesqt9gz4f4gj NosplashNhu QuynhNo ratings yet

- Ad AnalysisDocument6 pagesAd Analysisnani reddyNo ratings yet

- Aarti Industries - 3QFY20 Result - RsecDocument7 pagesAarti Industries - 3QFY20 Result - RsecdarshanmaldeNo ratings yet

- Deepak Fertilizers & Petrochemicals Corporation: Result As Per Expectation, Project On TimeDocument4 pagesDeepak Fertilizers & Petrochemicals Corporation: Result As Per Expectation, Project On TimeNandan AcharyaNo ratings yet

- IDirect RelianceInd CoUpdate Dec22Document6 pagesIDirect RelianceInd CoUpdate Dec22adityazade03No ratings yet

- Bharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Document9 pagesBharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Sanjeedeep Mishra , 315No ratings yet

- Steel Authority of India 250522 IciciDocument8 pagesSteel Authority of India 250522 IcicidurjoythermaxNo ratings yet

- IDirect IEX Q4FY21Document5 pagesIDirect IEX Q4FY21SushilNo ratings yet

- SODA 2020 Q1 IR PresentationDocument42 pagesSODA 2020 Q1 IR PresentationprasenjitNo ratings yet

- IDirect Larsen CompanyUpdateDocument6 pagesIDirect Larsen CompanyUpdateD TNo ratings yet

- ITC LTD - Axis Annual Analysis 2023 - 20-07-2023 - 15Document27 pagesITC LTD - Axis Annual Analysis 2023 - 20-07-2023 - 15Sanjeedeep Mishra , 315No ratings yet

- 26july2023 India Daily 230726 084131Document105 pages26july2023 India Daily 230726 084131Mahaveer BadalNo ratings yet

- Titan Company (TITIND) : Multiple Levers in Place To Drive Sales GrowthDocument5 pagesTitan Company (TITIND) : Multiple Levers in Place To Drive Sales Growthaachen_24No ratings yet

- Bodal Chemicals (BODCHE) : Expansion in Place, Volume Led Growth Ahead!Document9 pagesBodal Chemicals (BODCHE) : Expansion in Place, Volume Led Growth Ahead!P.B VeeraraghavuluNo ratings yet

- Centrica Ar2020Document228 pagesCentrica Ar2020Mustafa BaigNo ratings yet

- Princpip 11 8 23 PLDocument6 pagesPrincpip 11 8 23 PLAnubhi Garg374No ratings yet

- RIL 2Q FY19 Analyst Presentation 17oct18Document75 pagesRIL 2Q FY19 Analyst Presentation 17oct18Raghunath GuruvayurappanNo ratings yet

- Shivalik Bimetals - Q3FY24 - Dalal&BroachaDocument9 pagesShivalik Bimetals - Q3FY24 - Dalal&BroachaKirtan Ramesh JethvaNo ratings yet

- (Kotak) Reliance Industries, October 29, 2023Document36 pages(Kotak) Reliance Industries, October 29, 2023Naushil ShahNo ratings yet

- ESTER INDUSTRIES LTD Research ReportDocument7 pagesESTER INDUSTRIES LTD Research ReportKOUSHIKNo ratings yet

- Axis Securities Sees 12% UPSIDE in Dalmia Bharat Limited in LineDocument9 pagesAxis Securities Sees 12% UPSIDE in Dalmia Bharat Limited in LinemisfitmedicoNo ratings yet

- IDirect TCS Q1FY23Document11 pagesIDirect TCS Q1FY23uefqyaufdQNo ratings yet

- Dixon Technologies Q1FY22 Result UpdateDocument8 pagesDixon Technologies Q1FY22 Result UpdateAmos RiveraNo ratings yet

- Sterlite Technologies: Ambitious Target To Double Revenues in Three Years!Document8 pagesSterlite Technologies: Ambitious Target To Double Revenues in Three Years!Guarachandar ChandNo ratings yet

- Glenmark Pharmaceuticals: Stable Numbers Margin Expansion To The ForeDocument11 pagesGlenmark Pharmaceuticals: Stable Numbers Margin Expansion To The ForeChirag NakumNo ratings yet

- Investor Presentation - Q4 FY22Document80 pagesInvestor Presentation - Q4 FY22Khushal ShahNo ratings yet

- IDirect Titan Q1FY23Document10 pagesIDirect Titan Q1FY23AKHILESH HEBBARNo ratings yet

- Pricol - CU-IDirect-Mar 3, 2022Document6 pagesPricol - CU-IDirect-Mar 3, 2022rajesh katareNo ratings yet

- In Line Performance... : (Natmin) HoldDocument10 pagesIn Line Performance... : (Natmin) HoldMani SeshadrinathanNo ratings yet

- Fy20 Agm PresentationDocument21 pagesFy20 Agm PresentationVinay BNo ratings yet

- Reliance Industries (RIL IN) : Q1FY21 Result UpdateDocument7 pagesReliance Industries (RIL IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- Hindalco Industries LTD - Q3FY24 Result Update - 14022024 - 14-02-2024 - 14Document9 pagesHindalco Industries LTD - Q3FY24 Result Update - 14022024 - 14-02-2024 - 14Nikhil GadeNo ratings yet

- Pidilite Industries (PIDIND) : High Raw Material Prices Hit MarginDocument10 pagesPidilite Industries (PIDIND) : High Raw Material Prices Hit MarginSiddhant SinghNo ratings yet

- Dalal Broacha ReportDocument12 pagesDalal Broacha Reportvedantpatnaik.privNo ratings yet

- Mrs. Bectors Food Specialities 04062024 AcDocument6 pagesMrs. Bectors Food Specialities 04062024 AcgreyistariNo ratings yet

- Fineotex Chemicals 21022024 KRDocument6 pagesFineotex Chemicals 21022024 KRProton CongoNo ratings yet

- RIL 4Q FY18 Analyst Presentation 27apr18 PDFDocument110 pagesRIL 4Q FY18 Analyst Presentation 27apr18 PDFneethuNo ratings yet

- A New Dawn for Global Value Chain Participation in the PhilippinesFrom EverandA New Dawn for Global Value Chain Participation in the PhilippinesNo ratings yet

- HSIE Results Daily - 13 Aug 22-202208130806034185877Document10 pagesHSIE Results Daily - 13 Aug 22-202208130806034185877Ayush GoelNo ratings yet

- IDirect BharatForge Q1FY23Document9 pagesIDirect BharatForge Q1FY23Ayush GoelNo ratings yet

- HSIE Results Daily - 12 Aug 22-202208120715438230865Document15 pagesHSIE Results Daily - 12 Aug 22-202208120715438230865Ayush GoelNo ratings yet

- TCP Research Report 1Document9 pagesTCP Research Report 1Ayush GoelNo ratings yet

- TCP Research Report OldDocument5 pagesTCP Research Report OldAyush GoelNo ratings yet

- Motilal Tata ConsumersDocument16 pagesMotilal Tata ConsumersAyush GoelNo ratings yet

- TCP Research ReportDocument6 pagesTCP Research ReportAyush GoelNo ratings yet

- Goldiam Annual Report 19-20Document161 pagesGoldiam Annual Report 19-20Ayush GoelNo ratings yet

- Chap 3-5Document5 pagesChap 3-5jessa mae zerdaNo ratings yet

- Fin ZC415 Ec-3r First Sem 2019-2020Document5 pagesFin ZC415 Ec-3r First Sem 2019-2020srideviNo ratings yet

- EVA ProblemDocument1 pageEVA ProblemAshutosh BiswalNo ratings yet

- Lecture: Statement of Cash Flow Ii Lecture ADocument27 pagesLecture: Statement of Cash Flow Ii Lecture ATinashe ChikwenhereNo ratings yet

- Questions and Answers For Essay QuestionsDocument12 pagesQuestions and Answers For Essay QuestionsPushpendra Singh ShekhawatNo ratings yet

- Chapter 1 - Logistics and Supply Chain Part 1Document41 pagesChapter 1 - Logistics and Supply Chain Part 1Nichole Patricia PedriñaNo ratings yet

- Setting Up The Financial Statement ModelDocument45 pagesSetting Up The Financial Statement ModelSyed Ameer Ali ShahNo ratings yet

- FABM2 - Q1 - Module 4 - Statement of Cash FlowsDocument22 pagesFABM2 - Q1 - Module 4 - Statement of Cash FlowsHanzel NietesNo ratings yet

- 12 Accounts Imp ch10 PDFDocument14 pages12 Accounts Imp ch10 PDFmukesh kumarNo ratings yet

- Bab 9 AkmDocument44 pagesBab 9 Akmcaesara geniza ghildaNo ratings yet

- Business Combinations : Ifrs 3Document45 pagesBusiness Combinations : Ifrs 3alemayehu100% (1)

- Kode Unit Kompetensi Judul Kompetensi Kode Soal: Instruksi KerjaDocument34 pagesKode Unit Kompetensi Judul Kompetensi Kode Soal: Instruksi Kerjanabilah syNo ratings yet

- Asse T Management: How To Develop An PlanDocument2 pagesAsse T Management: How To Develop An Planvisoni.marseuNo ratings yet

- English Active PasiveDocument15 pagesEnglish Active PasiveAna DanaNo ratings yet

- Fundamentals of Accountancy, Business, and Management 2 Activity 2Document1 pageFundamentals of Accountancy, Business, and Management 2 Activity 2Joseph CincoNo ratings yet

- The Role of Financial Management: Instructor: Ajab Khan BurkiDocument20 pagesThe Role of Financial Management: Instructor: Ajab Khan BurkiGaurav KarkiNo ratings yet

- Emaar Consolidated EAS Dec 20 English FSsDocument38 pagesEmaar Consolidated EAS Dec 20 English FSsAly A. SamyNo ratings yet

- ACC Chapter 8 QuestionsDocument12 pagesACC Chapter 8 Questionsmasud.mily06No ratings yet

- United Food Pakistan Balance Sheet For The Year 2011 To 2020Document34 pagesUnited Food Pakistan Balance Sheet For The Year 2011 To 2020tech& GamingNo ratings yet

- Production Process of Bags PDFDocument22 pagesProduction Process of Bags PDFSk Mosaib AhamedNo ratings yet

- LKAS 19 2021 UploadDocument31 pagesLKAS 19 2021 Uploadpriyantha dasanayake100% (2)

- Metlife Report 1Document77 pagesMetlife Report 1JaiHanumankiNo ratings yet

- Consol Pack Mar22 ANTDocument149 pagesConsol Pack Mar22 ANTAries BautistaNo ratings yet

- The Putnam Company Sales Budget For The Year Ended December 31, 20X2Document13 pagesThe Putnam Company Sales Budget For The Year Ended December 31, 20X2susi aNo ratings yet

- Financial Report H1 2009 enDocument27 pagesFinancial Report H1 2009 eniramkkNo ratings yet

- Private Placement Memorandum Template 04Document105 pagesPrivate Placement Memorandum Template 04charliep8No ratings yet

- MODULE 10 Non-Current Assets Held For SaleDocument7 pagesMODULE 10 Non-Current Assets Held For SaleKim JisooNo ratings yet

- Avidesa Mac Pollo S A (Colombia)Document18 pagesAvidesa Mac Pollo S A (Colombia)Batfori clucksNo ratings yet