Professional Documents

Culture Documents

Updated Guidance Regarding Valuation Assessment of Solar Electric Generation Systems 750801

Updated Guidance Regarding Valuation Assessment of Solar Electric Generation Systems 750801

Uploaded by

Dennis JudsonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Updated Guidance Regarding Valuation Assessment of Solar Electric Generation Systems 750801

Updated Guidance Regarding Valuation Assessment of Solar Electric Generation Systems 750801

Uploaded by

Dennis JudsonCopyright:

Available Formats

5102 (Rev.

01-19)

STATE OF MICHIGAN

GRETCHEN WHITMER DEPARTMENT OF TREASURY RACHAEL EUBANKS

GOVERNOR LANSING STATE TREASURER

DATE: April 5, 2022

TO: Assessors and Equalization Directors

FROM: Members of the State Tax Commission

SUBJECT: Updated Guidance Regarding Valuation and Assessment of Photovoltaic

(Solar) Electric Generation Systems

Following the Solar Ad Hoc Committee’s Final Report, the State Tax Commission has

evaluated its recommended procedures for valuing utility-scale photovoltaic (solar) electric

generation systems where the electricity is produced for sale, or which operates as a

commercial activity. The information in this memorandum clarifies the guidance previously

adopted by the Commission regarding the treatment and valuation of real and personal

property associated with utility-scale photovoltaic (solar) electric generation systems which

produce electricity with a 2-megawatt name plate capacity or greater (hereinafter “Solar

Energy System”).

Starting with the 2022 tax year, utility-scale photovoltaic systems (2-megawatt nameplate

capacity or larger) are to be reported, classified, and assessed as industrial personal

property. Form 5762, Solar Energy System Report should be completed and attached to

the Form 632 (L-4175), Personal Property Statement, and filed with the Assessor of each

local assessing jurisdiction where the Solar Energy System(s) greater than 2-megawatt

nameplate capacity are located. The photovoltaic panels, supporting structure for the

panels, wiring, service and access drives, security fencing, communication equipment,

surveillance, lighting, fencing, interconnection infrastructure which is an integral part of the

array, and the transducers, which convert the direct current produced by the system to

alternating current suitable for transmission off-site, and underlying foundations of all

aforementioned items, are treated as part of the Solar Energy System. Any and all

structures that do not support the operation, service, or security of the Solar Energy

System are to be valued as part of the real property, using the appropriate sections of the

Assessor’s Manual or other authorized valuation manual or procedure.

The State Tax Commission has not changed its guidance regarding the classification of

photovoltaic electric energy systems with less than 2-megawatt name place capacity.

Photovoltaic electric energy systems with less than 2-megawatt name plate capacity are to

be considered industrial personal property and are to be reported on Section B of the

Personal Property Statement, Form 632 (L-4175) rather than Form 5762 Solar Energy

System Report. For more information regarding commercial and industrial personal

property considered alternative energy personal property under Public Act 118 of 2019,

please review State Tax Commission Bulletin 7 of 2020.

P.O. BOX 30471 • LANSING, MICHIGAN 48909

www.michigan.gov/statetaxcommission • 517-335-3429

Page 2

Any facilities located on the site which are used to transmit electricity after it has been

converted to alternating current should be valued using the electric transmission valuation

multipliers contained in Table I of Form 3589. Miscellaneous personal property of the

operator which is located on the site but is not an integral part of the Solar Energy System

itself should be reported and valued using the appropriate section of Treasury Form 632

(L-4175).

For equalization purposes, the classification of real property used in association with the

Solar Energy System will be determined in accordance with the provisions of MCL

211.34c. The presence of a Solar Energy System alone with no other competing uses

would indicate an industrial real property classification. Assessors are reminded that MCL

211.34c(5) provides that if the usage of a parcel includes more than one classification, the

assessor shall determine the classification that most significantly influences the total

valuation of the parcel for equalization purposes. If only a portion of a larger parcel is

devoted to use as a freestanding, Solar Energy System site, an assessor is authorized to

establish a separate tax parcel for the real property so used, if deemed appropriate. In the

case of Solar Energy Systems mounted on structures, the assessor must carefully analyze

the uses of the property to determine the correct classification. For those solar electric

generation facility less than 2-megawatt of name place capacity, the classification of the

underlying real property for equalization purposes will be based on the use or uses of the

real property, as provided in MCL 211.34c, without treating of the photovoltaic system as a

separate use.

If the solar energy system is located on exempt real property, the assessor must often

consider establishing an assessment pursuant to Act 189 of 1953 (MCL 211.181, et seq).

With certain exceptions, this act provides that if real property exempt for any reason from

ad valorem property taxation is leased, loaned, or otherwise made available to and used

by a private individual, association, or corporation in connection with a business conducted

for profit, the lessee or user of the real property is subject to taxation in the same amount

and to the same extent as though the lessee or user owned the real property.

If the owner of the structure(s) or improvements is different than the owner of the real

property on which the system is located, the structure(s) or improvements are assessed as

structures or improvements on leased land, pursuant to MCL 211.2(c), using the

procedures contained in State Tax Commission Bulletin 8 of 2002.

Assessors and Equalization Directors are reminded that the limitation on the increase in

taxable value under MCL 211.27a(b)(4) applies to personal property. For more information

regarding personal property value limitations, see State Tax Commission memorandum

dated December 16, 2015.

Finally, residential solar electric generation systems may benefit from the Mathieu Gast Act

provision relating to non-consideration of alternative energy systems until the property is

sold. Please refer to State Tax Commission Bulletin 6 of 2020 for additional information

regarding alternative energy systems located on residential property.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Fals TCBDocument58 pagesFals TCBDennis JudsonNo ratings yet

- Will Your Taxes Go Up If You Install Solar Panels - in Ann Arbor, Yes. - MLiveDocument11 pagesWill Your Taxes Go Up If You Install Solar Panels - in Ann Arbor, Yes. - MLiveDennis JudsonNo ratings yet

- Assessing The Taxability of Solar Energy Systems in Michigan - Tax Law - Varnum LLPDocument2 pagesAssessing The Taxability of Solar Energy Systems in Michigan - Tax Law - Varnum LLPDennis JudsonNo ratings yet

- MCL Act 93 of 1981Document4 pagesMCL Act 93 of 1981Dennis JudsonNo ratings yet

- Right To Farm Act BasicsDocument3 pagesRight To Farm Act BasicsDennis JudsonNo ratings yet

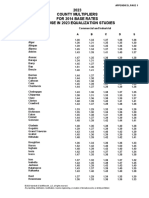

- 2023 County Multipliers Residential FarmDocument1 page2023 County Multipliers Residential FarmDennis JudsonNo ratings yet

- Amar 2.0Document46 pagesAmar 2.0Dennis JudsonNo ratings yet

- 2023 County Multipliers Commercial and IndustrialDocument2 pages2023 County Multipliers Commercial and IndustrialDennis JudsonNo ratings yet

- AMAR Power Point Presentation 602601 7Document22 pagesAMAR Power Point Presentation 602601 7Dennis JudsonNo ratings yet