Professional Documents

Culture Documents

Prak Shal

Prak Shal

Uploaded by

Sumit SrivastavaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prak Shal

Prak Shal

Uploaded by

Sumit SrivastavaCopyright:

Available Formats

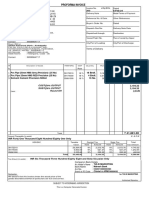

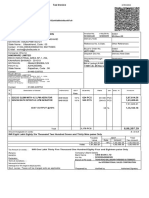

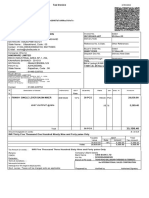

TAX-INVOICE GSTIN: 29CYTPP4973Q1ZV

PAN: CYTPP4973Q

PRAKSHAL DIGITAL ZONE STATE: KARNATAKA

STATE CODE: 29

No. 151. 1st E -Main, Jakkasandra,Bangalore,

Email:prakshaldigitalzone@gmail.com

Karnataka, 560034

Invoice No: PDZ/2223/332 P.O Date: Contact Person:

Invoice Date: 13-06-2022 P.O No : Mr. Sumit

M/S: Ship To:

The ICFAI Foundation For Higher Education Trust NA

#361, Sterling Arcade, 3rd Floor,

1st Main, 7th Block,Koramangala

Bangalore 560095

GSTIN 36AABTT3573G1ZC

Sl D.C Description HSN QTY Rate Amount CGST SGST IGST

No No. CODE % % %

1 DB Visiting card F/B 9989 800 2.60 2,080.00 9.00 9.00

GST% Taxable CGST SGST IGST

GST 0% Total: 2,080.00

GST 5% Discount:

GST 12%

CGST: 187.20

GST 18% 2080.00. 187.20 . 187.20 SGST: 187.20

GST 28% IGST:

187.20 187.20 0.40

Round Off :

Amount charged in words:

TWO THOUSAND FOUR HUNDRED AND FIFTY FOUR ONLY Net Amount: 2,454.00

Note :

IF THE DELIVERY CHALLAN IS SIGNED BY ANY ONE OF THE COMPANY OFFICIAL THEN THE

For PRAKSHAL DIGITAL ZONE

COMPANY IS LIABLE TO MAKE THE PAYMENT.

NO COMPLAINTS WILL BE ENTERTAINED IF THE ERROR IS NOT NOTIFIED WITHIN 24 HOURS OF THE

RECEIPT OF THE BILL

Terms : 1. INTEREST AT 18% WILL BE CHARGED IF BILL IS NOT PAID, WITHIN THE DUE DATE

2. ALL PAYMENTS ARE TO BE MADE BY PAYEES ACCOUNT CHEQUE ONLY

3. GOODS ONCE SOLD CANNOT BE RETURNED OR EXCHANGED.

4. IF ANY CORRECTION IS THERE IN INVOICES KINDLY SHARE THE DETAIL WITHIN 4

WORKING DAYS, AFTERWARDS WE ARE NOT RESPONSIBLE FOR ANY REJECTION.

5. SUBJECT TO BANGALORE JURISDICTION ONLY.

Authorised Signatory

You might also like

- GR03755 PrakashDocument2 pagesGR03755 Prakashsaniyasteel786No ratings yet

- Samsung Refrigerator Tax InvoiceDocument1 pageSamsung Refrigerator Tax InvoiceJyoti Sarkar0% (1)

- Glassbox Phil Company ProfileDocument148 pagesGlassbox Phil Company Profileflip06No ratings yet

- Tax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJDocument1 pageTax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJMrugesh Joshi50% (2)

- Siya Trading Company: Tax InvoiceDocument4 pagesSiya Trading Company: Tax InvoiceGURDIAL SINGH DHIMANNo ratings yet

- Ue 195Document1 pageUe 195Tejas ShawNo ratings yet

- F22nb01a00044 Nb01a F2410989Document1 pageF22nb01a00044 Nb01a F2410989HEMANTHNo ratings yet

- Warshi Bill No-3297Document1 pageWarshi Bill No-3297Aafak KhanNo ratings yet

- Tax Invoice: Kedia PolymerDocument1 pageTax Invoice: Kedia Polymerchotonpl95No ratings yet

- Final 2nd Revised Adityapur P & SecondaryDocument1 pageFinal 2nd Revised Adityapur P & Secondarylab.skfNo ratings yet

- BLR 23-24 00920Document5 pagesBLR 23-24 00920printsNo ratings yet

- ACFrOgChjadm4o-MrTVxex4SuIEqzn4MKCNtBUMTpM0M5NHgn22PC5tErm9A6 4nISBnhwHt5Msm oyjbQfoQgjtu0Cs2p99 - 7q5nvLkM6yq2ZGZptrcHT6tnhn1sE - SignedDocument6 pagesACFrOgChjadm4o-MrTVxex4SuIEqzn4MKCNtBUMTpM0M5NHgn22PC5tErm9A6 4nISBnhwHt5Msm oyjbQfoQgjtu0Cs2p99 - 7q5nvLkM6yq2ZGZptrcHT6tnhn1sE - SignedKolkata PIUNo ratings yet

- Aslum Ele-1Document1 pageAslum Ele-1muqtar4uNo ratings yet

- Accounting VoucherDocument2 pagesAccounting VoucherAvijitSinharoyNo ratings yet

- TK Elevator India Private Limited: Tax InvoiceDocument3 pagesTK Elevator India Private Limited: Tax InvoiceNarayan Kumar GoaNo ratings yet

- Accounting Voucher-1Document1 pageAccounting Voucher-1kishorNo ratings yet

- Pendrive BillDocument1 pagePendrive BillNITIN VERMANo ratings yet

- HMB Ispat Pi 81022Document1 pageHMB Ispat Pi 81022Suman PramanikNo ratings yet

- SV Roofing 2067Document1 pageSV Roofing 2067bikkumalla shivaprasadNo ratings yet

- Tax Invoice Piyush Arora: Billing Period Invoice Date Amount Payable Due Date Amount After Due DateDocument2 pagesTax Invoice Piyush Arora: Billing Period Invoice Date Amount Payable Due Date Amount After Due DatePiyush AroraNo ratings yet

- Tax Invoice: Gurudev Plastic 369 369 20-Jul-23Document1 pageTax Invoice: Gurudev Plastic 369 369 20-Jul-23satishshetty15No ratings yet

- SG112Document1 pageSG112rohanNo ratings yet

- Screenshot 2020-03-18 at 11.13.01 AM PDFDocument2 pagesScreenshot 2020-03-18 at 11.13.01 AM PDFKartik MathukiyaNo ratings yet

- 1504 SVCDocument3 pages1504 SVCAmitabh PatraNo ratings yet

- 3D Enterprises - SJ221Document1 page3D Enterprises - SJ221sjenterprises.jsNo ratings yet

- Tax Invoice: 11-Nov-23 Status Tie-Up Private LimitedDocument1 pageTax Invoice: 11-Nov-23 Status Tie-Up Private Limiteddibyendug1983No ratings yet

- Samsung Invoice 11368149082-7136589175-29S1I0155587Document1 pageSamsung Invoice 11368149082-7136589175-29S1I0155587bobbilipooliNo ratings yet

- Sudheer - Haldia Direct Invoice Dtd. 14.02.2022Document1 pageSudheer - Haldia Direct Invoice Dtd. 14.02.2022Amdiyala EnterprisesNo ratings yet

- Shree Guru Nanak BillDocument1 pageShree Guru Nanak BillPrahlad JhaNo ratings yet

- SP Steel - InvoiceDocument2 pagesSP Steel - Invoiceaniketshaw228No ratings yet

- Sales GST 283Document1 pageSales GST 283ashish.asati1No ratings yet

- MP 104 24 25Document1 pageMP 104 24 25minarplastic200No ratings yet

- Barak CommDocument1 pageBarak CommTula rashi videosNo ratings yet

- MP 1451 23 24Document1 pageMP 1451 23 24minarplastic200No ratings yet

- Wa0014.Document2 pagesWa0014.communication pointNo ratings yet

- Tax Invoice: No.358, Mettupalayam Road Coimbatore - 641043 Gstin/Uin 33Aabfp6358D1ZgDocument1 pageTax Invoice: No.358, Mettupalayam Road Coimbatore - 641043 Gstin/Uin 33Aabfp6358D1ZgGokul BNo ratings yet

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailsJS TradersNo ratings yet

- Retail Invoice: Other Details of SupplierDocument1 pageRetail Invoice: Other Details of SupplierPubali Deb BurmanNo ratings yet

- Tax Invoice: Billing Address: Regd. OfficeDocument1 pageTax Invoice: Billing Address: Regd. OfficeHorse RidingNo ratings yet

- 46 Dec 2019 - Ingram Micro India PVT LTDDocument1 page46 Dec 2019 - Ingram Micro India PVT LTDAseem TamboliNo ratings yet

- Pdf&rendition 1 1Document1 pagePdf&rendition 1 1Chennel SwamiNo ratings yet

- Salesreturn Report SAP35965 13052024Document1 pageSalesreturn Report SAP35965 13052024Prabhulal ChoudharyNo ratings yet

- Inv G488Document1 pageInv G488ALOK SINGHNo ratings yet

- Kritika Electrical6846Document1 pageKritika Electrical6846goutammandNo ratings yet

- 1499 SVCDocument3 pages1499 SVCAmitabh PatraNo ratings yet

- MP 1805 23 24Document1 pageMP 1805 23 24minarplastic200No ratings yet

- Tax Invoice: CIN:U72900DL2020PTC361314 GSTIN: 07AAFCE8193A1ZPDocument1 pageTax Invoice: CIN:U72900DL2020PTC361314 GSTIN: 07AAFCE8193A1ZPAbhijit SarkarNo ratings yet

- SV Roofing-13Document1 pageSV Roofing-13bikkumalla shivaprasadNo ratings yet

- Sinvoice 4000025727 9394530Document2 pagesSinvoice 4000025727 9394530ajit23nayakNo ratings yet

- Invoice 961Document1 pageInvoice 961Imran KhanNo ratings yet

- KA2924TS038432 NF1138 31-Dec-2023Document4 pagesKA2924TS038432 NF1138 31-Dec-202318063503196No ratings yet

- Diwali MelaDocument1 pageDiwali MelaGAUTAM SATHWARANo ratings yet

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailsSeeni Sathish KumarNo ratings yet

- bjs16 PDFDocument2 pagesbjs16 PDFMayank UkaniNo ratings yet

- Airtel 974Document1 pageAirtel 974OL RentNo ratings yet

- BillDocument1 pageBillmukeshnathmjNo ratings yet

- Minar Plastic 0104 - 240329 - 151232Document3 pagesMinar Plastic 0104 - 240329 - 151232minarplastic200No ratings yet

- Einvoice of Japla PVC 2nd BillDocument1 pageEinvoice of Japla PVC 2nd BillSAYAN SARKARNo ratings yet

- Invoice: Click Here To Download Seller InvoiceDocument2 pagesInvoice: Click Here To Download Seller InvoicearyandjNo ratings yet

- Inv G487Document1 pageInv G487ALOK SINGHNo ratings yet

- SLV Printer and TaxiDocument3 pagesSLV Printer and TaxiSumit SrivastavaNo ratings yet

- ElectricityDocument1 pageElectricitySumit SrivastavaNo ratings yet

- AcknowledgementDocument1 pageAcknowledgementSumit SrivastavaNo ratings yet

- Samuel MayDocument20 pagesSamuel MaySumit SrivastavaNo ratings yet

- Shri Balaji StoreDocument1 pageShri Balaji StoreSumit SrivastavaNo ratings yet

- Lunch BillDocument2 pagesLunch BillSumit SrivastavaNo ratings yet

- Id Card BillDocument1 pageId Card BillSumit SrivastavaNo ratings yet

- Lecture Note 11 (2014 S)Document42 pagesLecture Note 11 (2014 S)Lily EisenringNo ratings yet

- Faisalabad MembersDocument14 pagesFaisalabad Memberssaifullah.siddiquiNo ratings yet

- SelectionDocument87 pagesSelectionRAVI ANANTHAKRISHNANNo ratings yet

- Maths Formulas: 1. AveragesDocument7 pagesMaths Formulas: 1. AveragesRam PrasadNo ratings yet

- Chapter 10 - Lessee Accounting Chapter 10 - Lessee AccountingDocument53 pagesChapter 10 - Lessee Accounting Chapter 10 - Lessee AccountingApple LucinoNo ratings yet

- Hawassa University College of Business and Economics Department of Accounting and FinanceDocument39 pagesHawassa University College of Business and Economics Department of Accounting and FinanceMarshet yohannes100% (1)

- Teamstar Hauss Catalog 2023 R1Document108 pagesTeamstar Hauss Catalog 2023 R1KamarulZamanNo ratings yet

- Lecture 9 Engg. Economy Comparing AlternativesDocument13 pagesLecture 9 Engg. Economy Comparing AlternativesILEENVIRUSNo ratings yet

- Deed of Ab. SaleDocument2 pagesDeed of Ab. Salereeny_sala3812No ratings yet

- Documents Required For JIT InspectionDocument1 pageDocuments Required For JIT InspectionmrsakyNo ratings yet

- LR Mate100iDocument7 pagesLR Mate100iFrancisco RojasNo ratings yet

- Questionnaire of Accounting Literacy Among Sari-Sari StoreDocument4 pagesQuestionnaire of Accounting Literacy Among Sari-Sari StoreErica lyn VeranioNo ratings yet

- Cambridge IGCSE: Design & Technology 0445/32Document24 pagesCambridge IGCSE: Design & Technology 0445/32muhammad harisNo ratings yet

- Right Hygiene 2022 - Press ReleaseDocument5 pagesRight Hygiene 2022 - Press ReleaseShubhendra MishraNo ratings yet

- Present Simple Vs Present Continous WorksheetDocument3 pagesPresent Simple Vs Present Continous WorksheetCamila BrandNo ratings yet

- 11th Cost and RevenueDocument2 pages11th Cost and Revenueshaurya patelNo ratings yet

- Economic Models of Environment IssuesDocument5 pagesEconomic Models of Environment IssuesKristine Joy MercadoNo ratings yet

- IPCC Chapter Topic Wise Analysis of Past Exam Papers PDFDocument133 pagesIPCC Chapter Topic Wise Analysis of Past Exam Papers PDFKansal Abhishek73% (15)

- Fund Acc - Ringkasan Chapter 1Document3 pagesFund Acc - Ringkasan Chapter 1Andini OleyNo ratings yet

- ReportDocument3 pagesReportDaniel AgyapongNo ratings yet

- Module.1 Session 7, 8, 9 & 10Document109 pagesModule.1 Session 7, 8, 9 & 10Khushal ThakerNo ratings yet

- Worthy: Key: B Lead SheetDocument20 pagesWorthy: Key: B Lead SheetLeonardo MuentesNo ratings yet

- Lucknow Digital Members Directory 29 Nov HKDocument84 pagesLucknow Digital Members Directory 29 Nov HKNeeraj RatheeNo ratings yet

- How To Read Your Account Analysis StatementDocument2 pagesHow To Read Your Account Analysis StatementhanhNo ratings yet

- 9706 Accounting: MARK SCHEME For The May/June 2014 SeriesDocument6 pages9706 Accounting: MARK SCHEME For The May/June 2014 SeriesDanny DrinkwaterNo ratings yet

- KL-ABC CostingDocument6 pagesKL-ABC CostingDebarpan HaldarNo ratings yet

- Furniture AnnexDocument6 pagesFurniture AnnexAlaa HusseinNo ratings yet

- Adler Brochure Layout (Lo Res)Document40 pagesAdler Brochure Layout (Lo Res)Chris DresdenNo ratings yet

- Addtional ExercisesDocument36 pagesAddtional ExercisesGega XachidENo ratings yet