Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

6 viewsFria Notes

Fria Notes

Uploaded by

Andrea Marie P. GarinThis document provides an overview of key concepts in the Financial Rehabilitation and Insolvency Act of 2010 in the Philippines, including definitions of insolvency, suspension of payments, and rehabilitation. It describes the different types of rehabilitation proceedings (court-supervised voluntary/involuntary, pre-negotiated, out-of-court) and outlines the eligibility requirements, petition process, and basic elements of suspension of payments and rehabilitation orders. The document also defines the scope of debtors and creditors covered by the Act and exemptions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- ACC501-Short Notes Lec 23-45Document39 pagesACC501-Short Notes Lec 23-45dani73% (11)

- Iso 17021Document121 pagesIso 17021IngDanielMartinez100% (1)

- MAPS Coaching - Business Plan For AgentsDocument12 pagesMAPS Coaching - Business Plan For AgentsJohn McMillanNo ratings yet

- RFBT - Special Laws - ReviewerDocument21 pagesRFBT - Special Laws - ReviewerStella LipataNo ratings yet

- WEDP - Loan Policy & Procedures Manual - FinalDocument73 pagesWEDP - Loan Policy & Procedures Manual - Finalendale50% (2)

- SCWM T-CodesDocument29 pagesSCWM T-CodessimplycoolNo ratings yet

- FRIA EditedDocument10 pagesFRIA EditedPatricia ReyesNo ratings yet

- Non-Bank Gfis: GoccsDocument35 pagesNon-Bank Gfis: GoccsAnalyn Grace BasayNo ratings yet

- Insolvency LawDocument3 pagesInsolvency Lawric bolNo ratings yet

- BANKRUPTCY AND LIQUIDATION Class NotesDocument25 pagesBANKRUPTCY AND LIQUIDATION Class NotesitulejamesNo ratings yet

- Fria SummaryDocument6 pagesFria SummaryKris MercadoNo ratings yet

- KTRL Comm ReviewerDocument19 pagesKTRL Comm ReviewerKevin G. PerezNo ratings yet

- BANKRUPTCYDocument8 pagesBANKRUPTCYadesanmiob04ieNo ratings yet

- Financial Rehabilitation and Insolvency ActDocument15 pagesFinancial Rehabilitation and Insolvency ActcarabaldovinoNo ratings yet

- 9412 Special Laws MCQsDocument32 pages9412 Special Laws MCQsheeeyjanengNo ratings yet

- FRIADocument3 pagesFRIAgrapicartist phNo ratings yet

- 2019 Divina FRIA 070919 MJRSIDocument15 pages2019 Divina FRIA 070919 MJRSIMuhammadIbnSulu100% (3)

- Financial Rehabilitation and Insolvency Act: Review Notes (Following 2020 Bar Syllabus)Document13 pagesFinancial Rehabilitation and Insolvency Act: Review Notes (Following 2020 Bar Syllabus)Vanessa VelascoNo ratings yet

- Insolvency Law (Act 1956, As Amended)Document10 pagesInsolvency Law (Act 1956, As Amended)Akosijopay Lomala Amerol RomurosNo ratings yet

- Business Law Mod 2 4Document13 pagesBusiness Law Mod 2 4Atiene VillanuevaNo ratings yet

- Financial Rehabilitation and Insolvency ActDocument7 pagesFinancial Rehabilitation and Insolvency ActChristine BagindaNo ratings yet

- I. Court-Supervised Rehabilitation A. Voluntary RehabilitationDocument10 pagesI. Court-Supervised Rehabilitation A. Voluntary RehabilitationpsilvaNo ratings yet

- Insolvency Law and Corporate RehabilitationDocument33 pagesInsolvency Law and Corporate RehabilitationElizar JoseNo ratings yet

- FriaDocument51 pagesFriapauline.quilalaNo ratings yet

- R.A No. 10142 (Financial Rehabilitation and Insolvency Act or FRIA of 2010) NatureDocument57 pagesR.A No. 10142 (Financial Rehabilitation and Insolvency Act or FRIA of 2010) NatureJee JeeNo ratings yet

- Rehab & AntichresisDocument13 pagesRehab & Antichresismaria luzNo ratings yet

- Financial Rehabilitation and Insolvency Act of 2010 (Fria) (GROUP 6)Document37 pagesFinancial Rehabilitation and Insolvency Act of 2010 (Fria) (GROUP 6)Gdfry RvrntNo ratings yet

- Or Debtor's Business Operations Prior ToDocument8 pagesOr Debtor's Business Operations Prior ToZeah Viendell CruzatNo ratings yet

- Week - 1 FRIA EditedDocument106 pagesWeek - 1 FRIA EditedjemalynjoshlynNo ratings yet

- Financial Rehabilitation and Insolvency Act of 2010: (R.A. No.10142)Document11 pagesFinancial Rehabilitation and Insolvency Act of 2010: (R.A. No.10142)gilbert213No ratings yet

- RFBT.3409 Fria Tila PDFDocument12 pagesRFBT.3409 Fria Tila PDFMonica GarciaNo ratings yet

- Insolvency Law: Requisites OF Petition FOR Suspension of PaymentsDocument20 pagesInsolvency Law: Requisites OF Petition FOR Suspension of PaymentsKatharsisNo ratings yet

- Financial Rehabilitation and Insolvency Act (FRIA) of 2010" 1. Liquidation of Insolvent Juridical DebtorsDocument9 pagesFinancial Rehabilitation and Insolvency Act (FRIA) of 2010" 1. Liquidation of Insolvent Juridical DebtorsKNo ratings yet

- Pre-Week 2017 - FriaDocument6 pagesPre-Week 2017 - FriaSarah TaliNo ratings yet

- Financial Rehabilitation and Insolvency ActDocument7 pagesFinancial Rehabilitation and Insolvency ActAggi Rayne Sali BucoyNo ratings yet

- Summary OF FRIADocument5 pagesSummary OF FRIAMegan AglauaNo ratings yet

- FRIA Lecture NotesDocument12 pagesFRIA Lecture NotesBEHAIFAH BOTONES100% (1)

- Ra 10142 Fria of 2010 ReportDocument70 pagesRa 10142 Fria of 2010 ReportIzo JamerNo ratings yet

- Fria NotesDocument6 pagesFria NotesRad IsnaniNo ratings yet

- Solvency Law FCADocument76 pagesSolvency Law FCAMarc Benedict TalamayanNo ratings yet

- Financial Rehabilitation and Insolvency Act RA No. 10142Document7 pagesFinancial Rehabilitation and Insolvency Act RA No. 10142MarkNo ratings yet

- m2 - Fria Law Ra 10142 - Bsa31Document85 pagesm2 - Fria Law Ra 10142 - Bsa31Erica RamirezNo ratings yet

- Financial Rehabilitation and Insolvency ActDocument4 pagesFinancial Rehabilitation and Insolvency ActBhenz Bryle TomilapNo ratings yet

- Banruptcy Notes IntroductionDocument3 pagesBanruptcy Notes IntroductionkennedyNo ratings yet

- Fria Handout PDFDocument13 pagesFria Handout PDFReve Joy Eco IsagaNo ratings yet

- Banking Laws Chapters 19 21Document40 pagesBanking Laws Chapters 19 21john uyNo ratings yet

- Commercial Law Review Justice DimaampaoDocument19 pagesCommercial Law Review Justice DimaampaoMegan MateoNo ratings yet

- Financial Rehabilitation and Insolvency Act (FRIA) of 2010: Signed On July 18, 2010Document15 pagesFinancial Rehabilitation and Insolvency Act (FRIA) of 2010: Signed On July 18, 2010Maika NarcisoNo ratings yet

- Creditors' Rights and Bankruptcy: W C I ADocument21 pagesCreditors' Rights and Bankruptcy: W C I AHolli Boyd-White100% (1)

- Insolvency Proceedings Under FRIADocument13 pagesInsolvency Proceedings Under FRIAAnonymous XvwKtnSrMR100% (1)

- Financial Rehabilitation and Insolvency Act (Fria) : Atty. Ivan Yannick S. Bagayao Cpa, MbaDocument40 pagesFinancial Rehabilitation and Insolvency Act (Fria) : Atty. Ivan Yannick S. Bagayao Cpa, MbaChristoper BalangueNo ratings yet

- Bar Exam QuestionsDocument5 pagesBar Exam QuestionsColeen BiocalesNo ratings yet

- Fria ReviewerDocument19 pagesFria ReviewerViner VillariñaNo ratings yet

- Insolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (FRIA) of 2010Document22 pagesInsolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (FRIA) of 2010Kobe BullmastiffNo ratings yet

- Fria Reviewer Lecture Notes 1 - CompressDocument31 pagesFria Reviewer Lecture Notes 1 - CompressReyna Pearl VillamorNo ratings yet

- Credit Notes On LiquidationDocument7 pagesCredit Notes On Liquidationpaulaplaza_7No ratings yet

- Financial Rehabilitation and Insolvency Act - ReportDocument35 pagesFinancial Rehabilitation and Insolvency Act - ReportAilyn AñanoNo ratings yet

- Fria SummaryDocument5 pagesFria SummaryBelteshazzarL.CabacangNo ratings yet

- Special Banking Law12Document4 pagesSpecial Banking Law12xinfamousxNo ratings yet

- Revocation of Discharge: 2M Module27 BankruptcyDocument2 pagesRevocation of Discharge: 2M Module27 BankruptcyZeyad El-sayedNo ratings yet

- Scan 0002Document2 pagesScan 0002El Sayed AbdelgawwadNo ratings yet

- Questions and Answers On FriaDocument18 pagesQuestions and Answers On FriaJoseph John Santos Ronquillo100% (2)

- Small BankruptciesDocument3 pagesSmall BankruptciesitulejamesNo ratings yet

- ACC 112 Code of Corporate GovernanceDocument1 pageACC 112 Code of Corporate GovernanceAndrea Marie P. GarinNo ratings yet

- Acc 110 Practice SetDocument42 pagesAcc 110 Practice SetAndrea Marie P. GarinNo ratings yet

- CASE LIST FOR RECITATION - JulyDocument2 pagesCASE LIST FOR RECITATION - JulyAndrea Marie P. GarinNo ratings yet

- BusinessDocument1 pageBusinessAndrea Marie P. GarinNo ratings yet

- Mengerial Economics PDFDocument41 pagesMengerial Economics PDFmohanraokp2279No ratings yet

- EBRD Serbia Roads Final Phase 1 ReportDocument327 pagesEBRD Serbia Roads Final Phase 1 ReportradovicnNo ratings yet

- Responsibility Accounting and Transfer PricingDocument68 pagesResponsibility Accounting and Transfer PricingMari Louis Noriell MejiaNo ratings yet

- MS 27Document8 pagesMS 27Rajni KumariNo ratings yet

- Elder Care BenefitsDocument27 pagesElder Care Benefitssidrah_farooq2878No ratings yet

- Strategic Competence ManagementDocument25 pagesStrategic Competence ManagementHaslam UdaraniNo ratings yet

- Rodney Frank Lynch Great Advice About Lead Generation That Anyone Can Easily FollowDocument4 pagesRodney Frank Lynch Great Advice About Lead Generation That Anyone Can Easily FollowRodney Frank LynchNo ratings yet

- JD - Centre of ExcellenceDocument4 pagesJD - Centre of ExcellenceAlka AggarwalNo ratings yet

- Idea Generation and Business DevelopmentDocument13 pagesIdea Generation and Business DevelopmentbitetNo ratings yet

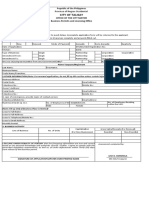

- City of Talisay: Requirements: 1. Brgy. Clearance 2. Dti/Sec/Cda 3. Sanitary Permit 4. OthersDocument1 pageCity of Talisay: Requirements: 1. Brgy. Clearance 2. Dti/Sec/Cda 3. Sanitary Permit 4. OthersDexter Q. JaducanaNo ratings yet

- Lecture 2 Values, Mission, Vision and ObjectivesDocument61 pagesLecture 2 Values, Mission, Vision and ObjectivesDavid Abbam AdjeiNo ratings yet

- Pad101.3 PlanningDocument54 pagesPad101.3 Planningnadine emilyNo ratings yet

- Iso 17026 Tangible Product Scheme Type 5Document37 pagesIso 17026 Tangible Product Scheme Type 5Elsayed Bedir100% (1)

- HubSpot SummaryDocument13 pagesHubSpot SummaryRifqi Al-GhifariNo ratings yet

- Sensitivity Analysis: Sales Price Reduces by 5% and No Change in Raw Material CostDocument4 pagesSensitivity Analysis: Sales Price Reduces by 5% and No Change in Raw Material CostRajat NaiduNo ratings yet

- How Would You Justify The Use of A Matrix Design Since It Potentially Violates The Principle of Unity of CommandDocument2 pagesHow Would You Justify The Use of A Matrix Design Since It Potentially Violates The Principle of Unity of CommandAnastasiia BaiukNo ratings yet

- The Factors Affecting Construction Performance in Ghana: The Perspective of Small-Scale Building ContractorsDocument8 pagesThe Factors Affecting Construction Performance in Ghana: The Perspective of Small-Scale Building ContractorsCitizen Kwadwo AnsongNo ratings yet

- Quiz 2Document7 pagesQuiz 2Fiona MiralpesNo ratings yet

- IPCA+ Master Quest FullScope Airbus CONVERT v1.1Document34 pagesIPCA+ Master Quest FullScope Airbus CONVERT v1.1MagninNo ratings yet

- Service: According To ActivitiesDocument9 pagesService: According To ActivitiesMarichelle Brisueño100% (1)

- Ali HusseinDocument64 pagesAli Husseinbalu100% (1)

- Service Marketing Study NotesDocument26 pagesService Marketing Study NotesSam BenNo ratings yet

- Air Waybill: Shenzhen Anda Shun International Logistics Co.,Ltd. Ningbo BranchDocument2 pagesAir Waybill: Shenzhen Anda Shun International Logistics Co.,Ltd. Ningbo BranchRicardo Castillo IbericoNo ratings yet

- Pag Ibig Foreclosed Properties For Public Bidding Legazpi Naga 082416 No DiscountDocument3 pagesPag Ibig Foreclosed Properties For Public Bidding Legazpi Naga 082416 No DiscountJay CastilloNo ratings yet

- Goods Receipt in Sap The Process ManualDocument31 pagesGoods Receipt in Sap The Process ManualsupriyoNo ratings yet

Fria Notes

Fria Notes

Uploaded by

Andrea Marie P. Garin0 ratings0% found this document useful (0 votes)

6 views11 pagesThis document provides an overview of key concepts in the Financial Rehabilitation and Insolvency Act of 2010 in the Philippines, including definitions of insolvency, suspension of payments, and rehabilitation. It describes the different types of rehabilitation proceedings (court-supervised voluntary/involuntary, pre-negotiated, out-of-court) and outlines the eligibility requirements, petition process, and basic elements of suspension of payments and rehabilitation orders. The document also defines the scope of debtors and creditors covered by the Act and exemptions.

Original Description:

Original Title

FRIA NOTES

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an overview of key concepts in the Financial Rehabilitation and Insolvency Act of 2010 in the Philippines, including definitions of insolvency, suspension of payments, and rehabilitation. It describes the different types of rehabilitation proceedings (court-supervised voluntary/involuntary, pre-negotiated, out-of-court) and outlines the eligibility requirements, petition process, and basic elements of suspension of payments and rehabilitation orders. The document also defines the scope of debtors and creditors covered by the Act and exemptions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6 views11 pagesFria Notes

Fria Notes

Uploaded by

Andrea Marie P. GarinThis document provides an overview of key concepts in the Financial Rehabilitation and Insolvency Act of 2010 in the Philippines, including definitions of insolvency, suspension of payments, and rehabilitation. It describes the different types of rehabilitation proceedings (court-supervised voluntary/involuntary, pre-negotiated, out-of-court) and outlines the eligibility requirements, petition process, and basic elements of suspension of payments and rehabilitation orders. The document also defines the scope of debtors and creditors covered by the Act and exemptions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 11

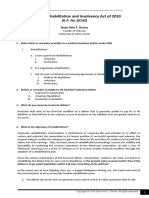

Financial Rehabilitation and inventory of assess; and (c) a proposed

Insolvency Act of 2010 agreement with his creditors. [Sec. 94]

The section numbers hereinafter generally Definition

pertain to RA 10142 or the Financial Suspension of payments is a judicial

Rehabilitation and Insolvency Act (FRIA), insolvency proceeding by which an individual

unless otherwise indicated. debtor submits, for approval by his debtors, a

Definition of Insolvency proposed agreement, containing

Insolvency refers to the financial condition of propositions delaying or extending the time

a debtor that is: of payment of his debts.

a. Generally unable to pay liabilities as they Who Can Avail – An illiquid debtor

fall due on the ordinary course of business An individual debtor (natural person) who, possesses

(hence illiquid); or sufficient property to cover all his debts but foresees

b. Has liabilities that are greater than its or his the impossibility of meeting them when they

assets (balance sheet insolvent). [Sec. respectively fall due.

4(p)] Purpose

Liabilities refer to money claims against the Debt moratorium: To delay or extend the time of

debtor. [Sec. 4(s)] payment of one’s debts.

Debtors Under The FRIA Allows distressed debtor to defer payment of his

Includes: debts by presenting a plan.

a. Sole proprietorship registered with DTI; a. Must relate to a schedule of payments

b. Partnership registered with SEC; b. No haircut (reduction of debts), only a

c. Corporation duly registered and existing grace period to pay the debts

under Philippine laws; or How Initiated

d. Individual debtor, who is a natural person Illiquid debtor files a duly verified petition that he be

that is a resident citizen, that has become declared in the state of suspension of payments by the

insolvent. [Sec. 4(k)] court of the province/city in which he has resided for 6

Note: Under the FRIA, the rules on debtors also months prior to the filing of the petition

include and apply to groups of debtors: Minimum Requirements for Petition

a. Corporations financially related to one (1) Schedule of debts and liabilities

another as parent corporations, (2) Inventory of assets

subsidiaries or affiliates; (3) Proposed agreement with his creditors

b. Partnerships owned more than 50% by the

same person; and Suspension of Payments Order

c. Single proprietorships owned by the same When Issued

person. Within 5 working days if the court finds the petition

Excludes: sufficient in form and substance

a. Banks Remains effective from the time of the filing of the

b. Insurance companies petition until the termination of the proceedings

c. Pre-need companies Most Important Elements

d. National and local government agencies or units Automatic Stay: No creditor except those exempt

[Sec. 5] shall institute proceedings to collect its claim from the

Suspension of Payments time of filing until the termination of the proceedings

Suspension of Payments – A remedy where an o Exempt from stay order:

individual debtor who, possessing sufficient property (1) Claims for personal labor,

to cover all his debts but foreseeing the impossibility (2) Expense of last illness and funeral,

of meeting them when they respectively fall due, may (3) Secured creditors

file a verified petition that he be declared in the state Injunction against debtor: The individual

of suspension of payments by the court of the province debtor is subjected to an injunction against:

or city in which he has resided for six (6) months prior (1) Disposing of his property except those

to the filing of his petition. He shall attach to his used in the ordinary operations of

petition, as a minimum: commerce or industry in which he is

(a) a schedule of debts and liabilities; (b) an engaged

(2) Making any payment outside of the

FINANCIAL REHABILITATION AND INSOLVENCY ACT NOTES by CMPoserio-Pascual Page 1 of 11

necessary or legitimate expenses of authorized by the stockholders

his business representing 2/3 of the outstanding capital

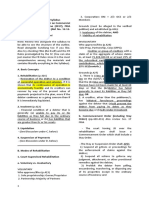

Approval of Proposed Agreement stock in a meeting called for the purpose;

Once a majority vote is reached in the creditors 4. Non-Stock Corporation: When approved

meeting, the court shall issue an by 2/3 of the members in a meeting called

Order that the agreement be carried out and all parties for the purpose.

bound thereby with its terms A group of debtors may file a petition for

Order shall be binding upon all creditors. rehabilitation when:

whose claims are included in the 1. One of more of its members foresee the

schedule of debts and liabilities submitted impossibility of meeting debts when they

by the individual debtor, and who were respectively fall due; and

properly summoned. 2. The financial distress would likely

Rehabilitation adversely affect the financial condition

Rehabilitation refers to the restoration of the debtor and/or operations of the other members of

to a condition of successful operation and solvency, if the group, and/or the participation of the

it is shown that: other members of the group is essential Rehabilitation

a. Its continuance of operation is Plan.

economically feasible; and The debtor must file a verified petition for

b. Its creditors can recover more, by way of rehabilitation with the court, to establish:

the present value of payments projected in (a) The insolvency of the debtor; and

the plan, if the debtor continues as a going (b) The viability of the rehabilitation.

concern than if it is immediately liquidated. ii.Involuntary [Secs. 13 and 14]

[Sec. 4(gg)] Involuntary — Refers to proceedings initiated

Rehabilitation proceedings are by the creditor(s).

In Rem: Jurisdiction over all persons Value Requirement for Creditors

affected is considered as acquired upon The claim(s), or aggregate thereof, must

publication of the notice of proceedings. amount to at least Php 1 million or at least 25%

Summary and Non-Adversarial [Sec. 3] of the subscribed capital stock or partners’

Types contributions, whichever is higher.

Types of Rehabilitation Proceedings Circumstances for Involuntary

a. Court-Supervised: A judicial proceeding; Rehabilitation

may be voluntary or involuntary. There is no genuine issue of fact or law on the

b. Pre-Negotiated: An insolvency proceeding claims of the creditors; and –

involving negotiation of terms between the a. That the due and demandable payments

debtor and the creditor(s). It commences have not been made for at least 60 days;

as an extrajudicial proceeding but or

terminates as a judicial proceeding. b. The debtor has failed generally to meet its

c. Out-of-Court: An insolvency proceeding liabilities as they fall due (illiquidity); or

involving a consensual contract between c. At least one creditor, other than the

the debtor and the creditor(s). Unlike prenegotiation petitoner(s), has initiated foreclosure

rehabilitation, no petitions are proceedings against the debtor that will

filed with the court. [Somera] prevent the debtor from paying its debts as

(a) Court–Supervised they become due or will render it insolvent.

i.Voluntary [Sec. 12] (b) Pre–Negotiated

Refer to proceedings initiated by the debtor, Pre-Negotiated Rehabilitation – An

which may be: insolvency proceeding involving a prenegotiated

1. Sole Proprietorship: When approved by Rehabilitation Plan between the

the owner; debtor and the creditor(s). It commences as an

2. Partnership: When approved by a majority extrajudicial proceeding but terminates as a

of the partners; judicial proceeding. [Somera]

3. Stock Corporation: When approved by a Requirements for Petition

majority vote of the BOD or trustees, and An insolvent debtor, either by itself or jointly

FINANCIAL REHABILITATION AND INSOLVENCY ACT NOTES by CMPoserio-Pascual Page 2 of 11

with any of its creditors, may file a verified petitions are filed with the court, though the

petition for approval of the Pre-Negotiated debtor and/or the creditor may seek court

Rehabilitation Plan that complies with the assistance in implementation.

following: Pending negotiation and finalization of the

Approval of creditors holding at least OCRA, there may be a standstill period that

2/3 of the total liabilities of the debtor, allows the debtor not to pay liabilities as they

including – fall due and prevents creditors from enforcing

Secured creditors holding more than their claims. [Somera]

50% of the total secured claims; and Requirements for OCRA

Unsecured creditors holding more than i. The debtor must agree to the out-of-court

50% of the total unsecured claims. or informal restructuring/workout

[Sec. 76] agreement or Rehabilitation Plan;

Within five working days, and after ii. It must be approved by creditors

determination that the petition is sufficient in representing at least 67% of the secured

form and substance, the court shall issue an obligations;

Order. [Sec. 77] iii. It must be approved by creditors

Objections to the Petition or Rehabilitation representing at least 75% of the unsecured

Plan obligations;

Any creditor or other interested party may iv. It must be approved by creditors holding at

submit a verified objection to the petition or the least 85% of the total liabilities, secured or

Rehabilitation Plan. The objections shall be unsecured, of the debtor. [Sec. 84]

limited to the following: Standstill Period/Agreement

a. The allegations in the petition or the Rehabilitation This refers to the period agreed upon by the

Plan, or the attachments debtor and its creditors to enable them to

thereto, are materially false or misleading; negotiate and enter into an out-of-court or

b. The majority of any class of creditors do not in fact informal restructuring/workout agreement or

support the Rehabilitation Plan; rehabilitation plan. It may include provisions

c. The Rehabilitation Plan fails to accurately account for identical with or similar to the legal effects of a

a claim against the debtor and the claim is not commencement order. [Financial

categorically declared as a contested claim; or Rehabilitation Rules, Rule 1, Sec. 5(q)]

d. The support of the creditors, or any of them, was The standstill period/agreement is effective

induced by fraud. [Sec. 79] and enforceable not only against contracting

Approval of the Plan parties but also against other creditors,

Within 10 days from the date of the second publication provided that:

of the Order, the court shall approve the Rehabilitation (a) Such agreement is approved by creditors

Plan unless an objection is submitted. representing more than 50% of the total liabilities of the

The court has a maximum period of 120 days from the debtor;

date of the filing of the petition to approve the (b) Notice of the standstill agreement is published in a

Rehabilitation Plan. If the court fails to act within the newspaper of general circulation in the Philippines

same period, the Plan once a week for two consecutive weeks;

shall be deemed approved. (c) The standstill period does not exceed 120 days from

Effect of Approval the date of effectivity. The notice must invite creditors

Approval of a Plan has the same legal effect as to participate in the negotiation for the OCRA and

confirmation of a Plan in Court- Supervised inform them that the agreement would bind all

Rehabilitation. It also results in a cram down, as it binds creditors if the minimum vote requirements were met.

not only the debtor but also all persons affected by it. [Sec. 85]

Out–of–Court Effects of the OCRA

Out-of-Court Rehabilitation – An extrajudicial a. Results in a cram down, binding not only

insolvency proceeding of an Out-of-Court or the debtor but also all persons affected;

Informal Restructuring Agreement (OCRA), or b. Any proceedings arising or relating to the

a restructuring of the claims negotiated OCRA shall not stay its implementation,

between the debtor and the creditor(s). No unless the relevant party secures a TRO or

FINANCIAL REHABILITATION AND INSOLVENCY ACT NOTES by CMPoserio-Pascual Page 3 of 11

injunctive relief from the Court of Appeals. 15. States that any creditor or debtor, not the

Annulment of the OCRA/Standstill petitioner, may submit the name or nominate any

Agreement other qualified person to the position of rehabilitation

The debtor or creditor may file a petition to annul receiver;

based only on the following grounds: 16. Includes a Stay or Suspension Order. [Sec. 16]

a. Non-compliance with the requirements for a Effects of the Commencement Order

standstill agreement or an OCRA under the FRIA or the In addition to the effects of a Stay or

implementing rules; or Suspension Order:

b. Vitiation of consent due to fraud, intimidation or 1. Vests the rehabilitation receiver with all the powers

violence if committed against such number of creditors and functions provided for this Act, subject to the

required approval by the court of the performance bond filed by

to approve the OCRA or the standstill agreement. [FR the rehabilitation receiver;

Rules, Rule 4, Sec. 11] 2. Prohibits or otherwise serves as the legal basis

Commencement order rendering null and void the results of any attempt to

If the petition for rehabilitation is deficient in form and collect or enforce a claim against the debtor after the

substance, the court may give a reasonable period to commencement date, unless otherwise allowed under

amend or supplement the petition. If such deficiency is the FRIA;

not complied with, the court may dismiss the petition. 3. Serves as the legal basis for rendering null and void

If the petition for rehabilitation is sufficient in form and any setoff after the commencement date of any debt

substance, it shall issue a Commencement Order within owed to the debtor by any of the debtor's creditors;

five (5) working days from the filing of the petition. 4. Serves as the legal basis for rendering null and void

The rehabilitation proceedings shall commence upon the perfection of any lien against the debtor's

the issuance of the Commencement Order. property, after the commencement date; and

Contents of the Commencement Order 5. Consolidates the resolution of all legal proceedings

1. Identifies the debtor, its principal business and by and against the debtor to the court; however, the

principal place of business; court may allow the continuation of cases on other

2. Summarize the grounds for initiating proceedings; courts where the debtor had initiated the suit. [Sec. 17]

3. States the legal effects of the Order; Effectivity and Duration of the

4. Declares the debtor is under rehabilitation; Commencement Order

5. Directs the publication of the Commencement Unless lifted by the court, the Commencement Order

Order; shall be effective for the duration of the rehabilitation

6. Directs service by personal delivery of a copy of the proceedings for as long as there

petition to the creditor or to the debtor (not the is a substantial likelihood that the debtor will be

petitioner); successfully rehabilitated. [Sec. 21]

7. Appoints a rehabilitation receiver; Minimum Requirements for Substantial

8. Summarizes the requirements and deadlines for Likelihood

creditors to establish their claims against the debtor; a. The proposed Rehabilitation Plan complies

9. Directs the BIR to file and serve its comment or with the minimum contents prescribed by

opposition; the FRIA;

10. Prohibits the debtor’s suppliers from withholding b. There is sufficient monitoring by the rehabilitation

the supply of goods and services in the ordinary course receiver of the debtor's business for the protection of

of business for as long as the debtor makes payments creditors;

for services/goods supplied after issuance of the Order; c. The debtor has met with its creditors to the extent

11. Authorizes the payment of administrative reasonably possible in attempts to reach consensus on

expenses; the proposed

12. Sets the case for initial hearing; Rehabilitation Plan;

13. Makes available copies of the petition and d. The rehabilitation receiver submits a report, based

Rehabilitation Plan for examination and copying by any on preliminary evaluation, stating that the underlying

interested party; assumptions and the goals stated in the petitioner's

14. Indicates the location(s) at which documents may Rehabilitation Plan are realistic, feasible and

be reviewed and copied; reasonable or if not, there is, in any case, a substantial

FINANCIAL REHABILITATION AND INSOLVENCY ACT NOTES by CMPoserio-Pascual Page 4 of 11

likelihood for the debtor to be successfully appeal shall be referred to the court for

rehabilitated because, among others: appropriate action;

(1) There are sufficient assets with/which to b. Subject to the discretion of the court, cases

rehabilitate the debtor; pending or filed at a specialized court or

(2) There is sufficient cash flow to maintain the quasi-judicial agency which, upon

operations of the debtor; determination by the court is capable of

(3) The debtor's, partners, stockholders, directors and resolving the claim more quickly, fairly and

officers have been acting in good faith and which due efficiently than the court: Provided, That

diligence; any final and executory judgment of such

(4) The petition is not a sham filing intended only to court or agency shall be referred to the

delay the enforcement of the rights of the creditor’s or court and shall be treated as a nondisputed

of any group of creditors; and claim;

(5) The debtor would likely be able to pursue a viable c. Enforcement of claims against sureties and

Rehabilitation Plan; other persons solidarily liable with the

e. The petition, the Rehabilitation Plan and the debtor, and third party or accommodation

attachments thereto do not contain any materially mortgagors as well as issuers of letters of

false or misleading statement; credit, unless the property subject of the

f. If the petitioner is the debtor, that the debtor has third party or accommodation mortgage is

met with its creditor/s representing at least three- necessary for the rehabilitation of the

fourths (3/4) of its total obligations to the extent debtor as determined by the court upon

reasonably possible and made a good faith effort to recommendation by the rehabilitation

reach a consensus on the proposed Rehabilitation receiver;

Plan; or if the petitioner/s is/are a creditor or group of d. Any form of action of customers or clients

creditors, that/ the petitioner/s has/have met with the of a securities market participant to recover

debtor and made a good faith effort to reach a or otherwise claim moneys and securities

consensus on the proposed Rehabilitation Plan; and entrusted to the latter in the ordinary

g. The debtor has not committed acts of course of the latter's business as well as

misrepresentation or in fraud of its any action of such securities market

creditor/s or a group of creditors. participant or the appropriate regulatory

Stay or suspension order agency or self-regulatory organization to

Stay And Suspension Order – An order pay or settle such claims or liabilities;

included in the Commencement Order that has e. Actions of a licensed broker or dealer to sell pledged

the following effects: securities of a debtor pursuant to

1. Suspending all actions or proceedings, in a securities pledge or margin agreement

court or otherwise, for the enforcement of for the settlement of securities transactions

claims against the debtor; in accordance with the provisions of the

2. Suspending all actions to enforce any Securities Regulation Code and its

judgment, attachment or provisional implementing rules and regulations;

remedies against the debtor; f. Clearing and settlement of financial

3. Prohibiting the debtor from selling, transactions through the facilities of a

encumbering, transferring or disposing in clearing agency or similar entities duly

any manner any of its properties except in authorized, registered and/or recognized

the ordinary course of business; and by the appropriate regulatory agency like the BSP and

4. Prohibiting the debtor from making any the SEC as well as any form

payment of its liabilities outstanding as of of actions of such agencies or entities to

the commencement date except as may be reimburse themselves for any transactions

provided herein [Sec. 16] settled for the debtor; and

Exceptions to the Stay or Suspension Order g. Criminal action against individual debtor or

a. Cases already pending appeal in the owner, partner, director or officer of a

Supreme Court as of commencement debtor. [Sec. 18]

date Provided, That any final and Rehabilitation receiver

executory judgment arising from such REHABILATION RECEIVER – Any qualified

FINANCIAL REHABILITATION AND INSOLVENCY ACT NOTES by CMPoserio-Pascual Page 5 of 11

person, natural or juridical, may serve as a Determining the viability of the

receiver. [Sec. 28] rehabilitation of the debtor;

If the receiver is a juridical entity, he must Preparing and recommending a

designate a natural person as a representative. Rehabilitation Plan; and

Such representative must possess all the Implementing the approved Rehabilitation

qualifications and none of the disqualifications. Plan [Sec. 31]

Qualifications Management

a. Citizen or resident for at least six (6) Unless otherwise provided, the management of

months immediately prior to nomination; the debtor remains with the existing

b. Of good moral character and with management, subject to laws and agreements,

acknowledged integrity, impartiality and if any, on election or appointment of directors,

independence; managers, or managing partner. [Sec. 47]

c. Has the requisite knowledge of insolvency The debtor retains control of its business and

and other relevant commercial laws, rules properties, subject only to monitoring by the

and procedures, as well as the relevant receiver. This is referred to as the principle of

training and/or experience that may be debtor–in–possession or debtor–in–place.

necessary to enable him to properly [Umale v ASB Realty, G.R. No. 181126 (2011)]

discharge the duties and obligations of a Exception: The following are subject to the

receiver; and approval of the receiver or the court:

d. Has no conflict of interest. [Sec. 29] 1. Disbursements affecting title or interest in

Conflicts of Interest the property;

Test: An individual is deemed to have a conflict 2. Payments affecting title or interest in

of interest if he is so situated as to be materially property;

influenced in the exercise of his judgment for or 3. Sale, disposal, assignment, transfer or

against any party to the proceedings. [Sec. 40] encumbrance of property; or

An individual may have a conflict of interest if: 4. Any other act affecting title or interest in

a. He is a creditor, owner, partner or property. [Sec. 47]

stockholder of the debtor;

b. He is engaged in a line of business which Report of the Receiver

competes with that of the debtor; Within 40 days from the initial hearing, the

c. He is, or was, within five (5) years from the receiver shall submit a report to the court on

filing of the petition, a director, officer, whether:

owner, partner or employee of the debtor 1. The debtor is insolvent, and if so, the

or any of the creditors, or the auditor or causes thereof; and

accountant of the debtor; 2. There is any unlawful or irregular act(s)

d. He is, or was, within two (2) years from the committed by the management of the

filing of the petition, an underwriter of the debtor in contemplation of the insolvency

outstanding securities of the debtor; or which may have contributed to the

e. He is related by consanguinity or affinity insolvency;

within the fourth civil degree to any 3. The assumptions, goals and procedures of

individual creditor, owners of a sale the Rehabilitation Plan are realistic,

proprietorship-debtor, partners of a feasible and reasonable;

partnership- debtor or to any stockholder, 4. There is a substantial likelihood of

director, officer, employee or underwriter of successful rehabilitation;

a corporation-debtor; or 5. The petition should be dismissed; and

f. He has any other direct or indirect material 6. The debtor should be dissolved and/or

interest in the debtor or any of the creditors. liquidated.

[Sec. 40] Removal

Principal Duties The receiver may be removed at any time by

Preserving and maximizing the value of the the court, either by (1) motu propio or (2)

assets of the debtor during the motion by any creditor(s) holding more than

rehabilitation proceedings; 50% of the total obligations of the creditor, on

the following grounds:

FINANCIAL REHABILITATION AND INSOLVENCY ACT NOTES by CMPoserio-Pascual Page 6 of 11

1. Incompetence, gross negligence, failure to appoint the member(s) concerned. In case the

perform or failure to exercise the proper decision to appoint a management committee

degree of care in the performance of his is due to the third ground (mismanagement,

duties and powers; etc.), the court shall appoint the first member.

2. Lack of particular or specialized

competency required by the specific case; Rehabilitation plan

3. Illegal acts or conduct in the performance Rehabilitation Plan

of his duties and powers; Refers to a plan by which the financial wellbeing

4. Lack or qualification or presence of any and viability of an insolvent debtor can

disqualification; restored using various means including, but not

5. Conflict of interest that arises after his limited to:

appointment; and 1. Debt Forgiveness: Condoning and/or

6. Manifest lack of independence that is waiving the claims;

detrimental to the general body of the 2. Debt Rescheduling: Extending the time to

stakeholders. [Sec. 32] pay the claim;

The Implementing Rules add the following 3. Reorganization or Quasi-

grounds for removal: Reorganization: Changing the equity,

1. Failure, without just cause, to perform any corporate or operating structure of the

of the powers and functions under the debtor;

Rules; or 4. Dacion en Pago: Assigning property and

2. Any of the grounds for removing a trustee assets as payment for certain claims;

under the general principles for trusts [FR 5. Debt to Equity Conversion: The issuance

Rules, Rule 2, Sec. 27] of equity and/or ownership interests as

Management committee payment for certain claims;

Management Commiittee – Upon motion of 6. Sale of the Business (or parts of it) as a

any interested party, the court may appoint going concern;

either (1) the rehabilitation receiver or (2) a 7. Setting up of new business entities; or

management committee to assume the 8. Other similar arrangements as may be

management of the debtor. [Sec. 36] approved by the court or the creditors.

Grounds [Sec. 4(ii); Somera]

1. There must be clear and convincing Important Requirements of A Rehabilitation

evidence of any of the following Plan

circumstances: (a) Concept of Feasibility

2. Actual or imminent danger of dissipation, Rehabilitation, otherwise referred to as the

loss, waste or destruction of the debtor’s restoration of the debtor to a condition of

assets or other properties; successful operation and solvency, is resorted

3. Paralyzation of the business operations of to when it is shown that the continuance of its

the debtor; or operation is economically feasible and its

4. Gross mismanagement of the debtor, or creditors can recover by way of the present

fraud or other wrongful conduct, or gross or value of payments projected in the plan, more

willful violation of the FRIA. [Sec. 36] if the debtor continues as a going concern than

Composition of the Committee if it is immediately liquidated. [Sec. 4(gg)]

Three qualified members appointed as follows: Hence, the Rehabilitation Plan must contain

1. The first member shall be appointed by the such relevant information to enable a

debtor; reasonable investor to make an informed

2. The second member shall be appointed by decision on the feasibility of the Plan. [FR

the creditor(s) holding more than 50% of Rules, Rule 2, Sec. 61(BB)]

the total obligations of the debtor; and Note: Findings as to whether the assumptions,

3. The third member shall be appointed by the goals and procedures of the Rehabilitation

first and second members within 10 from Plan are realistic, feasible and reasonable are

the appointment. also part of the Report of the Rehabilitation

In case of failure to nominate, the court shall Receiver. [Sec. 24]

(b) It must comply with the required

FINANCIAL REHABILITATION AND INSOLVENCY ACT NOTES by CMPoserio-Pascual Page 7 of 11

contents under FRIA and FR include a liquidation analysis, renders the

Rules. Aside from the above, this CA's considerations for approving the

includes, among others: same as actually unsubstantiated, and

i. Material Financial Commitments hence, insufficient to decree the feasibility

The Rehabilitation Plan, shall “include of respondents' rehabilitation. It is well to

material financial undertakings or emphasize that the remedy of rehabilitation

commitments to support [it].” [FR Rules, should be denied to corporations that do

Rule 2, Sec.61 (Y)] not qualify under the Rules. Neither should

A material financial commitment becomes it be allowed to corporations whose sole

significant in gauging the resolve, purpose is to delay the enforcement of any

determination, earnestness and good faith of the rights of the creditors. [Ibid]

of the distressed corporation in financing Approval of the Rehabilitation Plan

the proposed rehabilitation plan. The receiver shall notify the stakeholders that

This commitment may include the the Plan is ready for examination. Within 20

voluntary undertakings of the days from notification, the receiver shall

stockholders or the would-be investors of convene the creditors to vote on the Plan.

the debtor-corporation indicating their The Plan must be approved by all classes of

readiness, willingness and ability to creditors whose rights are adversely modified

contribute funds or property to guarantee or affected. Otherwise, it is deemed rejected.

the continued successful operation of The Plan is approved by a class of creditors if

the debtor corporation during the members of the said class holding more than

period of rehabilitation. [Philippine Bank 50% of the total claims of the class vote in favor

of Communications v. Basic Polyprinters of the Plan. [Sec. 64]

and Packaging Corporation, G.R. No. If the Plan is approved, the receiver shall

187581 (2014 submit the same to the court for confirmation.

Objections to Rehabilitation Plan

Liquidation Analysis The creditor may file an objection to the Plan

As one of the required contents of a with 20 days from receipt of notice that it has

Rehabilitation Plan, a liquidation analysis been submitted for confirmation.

sets out for each creditor or each class of Objections are limited to the following:

creditor, as applicable, the amounts they 1. The creditors’ support was induced by

expect to receive under the Rehabilitation fraud;

Plan and those that they will receive if 2. The documents or data relied upon in the

liquidation ensues within one hundred Plan are materially false or misleading;

twenty (120) days after the filing of the 3. The Plan is in fact not supported by the

petition. [FR Rules, Rule 2, Sec. 61 (B)] voting creditors. [Sec. 66]

The total liquidation assets and the If upon hearing, the court finds merit in the

estimated liquidation return to the creditors, objections, it should order the curing of the

as well as the fair market value vis-a-vis the defect.

forced liquidation value of the fixed assets If the court determines the debtor acted in bad

were not shown. As such, the Court could faith, or that it is not possible to cure the defect,

not ascertain if the petitioning debtor's the court shall convert the proceedings into one

creditors can recover by way of the present for liquidation.

value of payments projected in the plan, Confirmation of the Rehabilitation Plan

more if the debtor continues as a going The court has a maximum period of one year

concern than if it is immediately liquidated. from the date of filing to confirm a

[Philippine Asset Growth Two, Inc. v. Rehabilitation Plan.

Fastech Synergy Phils. Inc., G.R. 206528 If no Rehabilitation Plan is confirmed, the

(2016)] proceedings may be converted into one for

Note: liquidation. [Sec. 72]

Effect: The failure of the Rehabilitation Plan Confirmation has the following effects:

to state any material financial commitment 1. The Plan and its provisions shall be binding

to support rehabilitation, as well as to

FINANCIAL REHABILITATION AND INSOLVENCY ACT NOTES by CMPoserio-Pascual Page 8 of 11

upon the debtor and all persons who may group of creditors; or

be affected by it; 3. Conversion: When the court-supervised

or pre-negotiated rehabilitation proceeding

2. The debtor shall comply with the provisions is converted by the court into liquidation

of the Plan and shall take all actions proceedings

necessary to carry out the Plan;

3. Payments shall be made to the creditors in Conversion of

accordance with the provisions of the Plan; rehabilitation to

4. Contracts and other arrangements The Liquidation Order shall:

between the debtor and its creditors shall 1. Declare the debtor insolvent;

be interpreted as continuing to apply to the 2. Order the liquidation of the debtor and, in

extent that they do not conflict with the the case of a juridical debtor, declare it as

provisions of the Rehabilitation Plan; dissolved;

5. Any compromises on amounts or rescheduling of 3. Order the sheriff to take possession and

timing of payments by the debtor shall be binding on control of all the property of the debtor,

creditors regardless of whether the Plan is except those that may be exempt from

successfully implemented; and execution;

6. Claims arising after approval of the Plan that are 4. Order the publication of the petition or

otherwise not treated by the Plan are not subject to motion in a newspaper of general

any Suspension Order. circulation once a week for two (2)

[Sec. 69] consecutive weeks;

Cram down effect 5. Direct payments of any claims and

Cram Down Effect – Notwithstanding the rejection of conveyance of any property due the debtor

the creditors of the Rehabilitation Plan, the court may to the liquidator;

nonetheless confirm the Rehabilitation Plan in what is 6. Prohibit payments by the debtor and the

known as a cram down. transfer of any property by the debtor;

The effect of the cram down is to bind the debtor and 7. Direct all creditors to file their claims with

all persons who may be affected, whether or not they the liquidator within the period set by the

participated in the proceedings or opposed the plan. rules of procedure;

A cram down is permitted only if all of the following 8. Authorize the payment of administrative

circumstances are present: liquidation proceedings

1. The Rehabilitation Plan complies with the Under the FRIA, court-supervised or prenegotiated

requirements specified in the FRIA; rehabilitation proceedings may be

2. The receiver recommends confirmation of converted in the following instances:

the Rehabilitation Plan; 1. Within 10 days from receipt of the

3. The shareholders, owners or partners of the debtor receiver’s report, a court finding that the

lost at least their controlling interest as a result of the debtor is insolvent and there is no

Rehabilitation Plan; and substantial likelihood of substantial

4. The Rehabilitation Plan would likely provide the rehabilitation; [Sec. 25(c)]

objecting class or creditors with compensation which 2. If no Rehabilitation Plan is confirmed within

has a net present value greater than that which they 1 year from filing the petition to confirm the

would have received if the debtor were under Plan; [Sec. 72]

liquidation. [Sec. 64] 3. If termination is due to failure or

Liquidation rehabilitation or dismissal of the petition for

Liquidation is a judicial insolvency proceeding by reasons other than technical grounds [Sec.

which the debtor’s assets are reduced and converted 75]; or

to cash in order to discharge the claims against the 4. Motion filed by the insolvent debtor for

debtor. [Somera] conversion into liquidation proceedings.

Types [Sec. 90]

Types of Liquidation Liquidation order

Liquidation may be: Liquidation Order – Such order results in the

1. Voluntary: Instituted by the debtor; or dissolution of a juridical debtor, however, the

2. Involuntary: Instituted by a creditor or a expenses as they become due;

FINANCIAL REHABILITATION AND INSOLVENCY ACT NOTES by CMPoserio-Pascual Page 9 of 11

9. State that the debtor and creditors who are secured.

not petitioner/s may submit the names of General Rule: Upon issuance of the

other nominees to the position of liquidator; Liquidation Order, no foreclosure proceeding

and shall be allowed for 180 days. [Sec. 113]

10. Set the case for hearing for the election and Exception: However, the Liquidation Order

appointment of the liquidator, which date shall not affect the right of a secured

shall not be less than thirty (30) days nor creditor to enforce his lien.

more than forty-five (45) days from the date During the proceedings, a secured creditor

of the last publication. [Sec. 112] may:

Effects of the Liquidation Order: a. Waive his right under the security or lien,

1. The juridical debtor shall be deemed prove his claim in the liquidation

dissolved and its corporate or juridical proceedings and share in the distribution of

existence terminated; the assets of the debtor; or

2. Legal title to and control of all the assets of b. Maintain his rights under the security or

the debtor, except those that may be lien.

exempt from execution, shall be deemed If the secured creditor maintains his rights

vested in the liquidator or, pending his under the security or lien:

election or appointment, with the court; a. The value of the property may be fixed in a

3. All contracts of the debtor shall be deemed manner agreed upon by the creditor and the

terminated and/or breached, unless the liquidator.

liquidator, within ninety (90) days from the If the value of the property is less than the claim, the

date of his assumption of office, declares liquidator may convey the property to the secured

otherwise and the contracting party agrees creditor and the latter will be admitted in the

liquidation proceedings as a creditor for the balance.

4. No separate action for the collection of an If its value exceeds the claim secured, the liquidator

unsecured claim shall be allowed. Such may convey the property to the creditor and waive

actions already pending will be transferred the debtor's right of redemption upon receiving the

to the Liquidator for him to accept and excess from the creditor.

settle or contest. If the liquidator contests b. The liquidator may sell the property and satisfy the

or disputes the claim, the court shall allow, secured creditor's entire claim from the proceeds of

hear and resolve such contest except when the sale; or

the case is already on appeal. In such a c. The secure creditor may enforce the lien or

case, the suit may proceed to judgment, foreclose on the property pursuant to applicable laws.

and any final and executor judgment [Sec. 114]

therein for a claim against the debtor shall Cf. Rights of Unsecured Creditors

be filed and allowed in court; and General Rule: No separate action for the collection of

5. No foreclosure proceeding shall be allowed an unsecured claim shall be allowed. Actions already

for a period of one hundred eighty (180) pending will be transferred to the liquidator.

days. Exception: When the action is already on appeal, the

Rights of secured creditors suit may proceed to judgment, and any final and

Creditor refers to natural or juridical persons executory judgment shall be filed and allowed. [Sec.

which have claims against the debtor that 113]

arose on or before the commencement date. Liquidator

[Sec. 4] Liquidator – Any qualified person, natural or juridical,

General Unsecured Creditor refers to a may serve as a receiver. If the receiver is a juridical

creditor whose claim or a portion thereof is entity, he must designate a natural person as a

neither secured, preferred nor subordinated representative. Such representative must possess all

under the FRIA. the qualifications and none of the disqualifications.

Secured Creditor refers to a claim secured by Qualifications

a lien, which is a statutory or contractual claim The liquidator shall have the same qualifications as

or juridical charge on real or personal property that of rehabilitator, thus:

that legally entitles a creditor to resort to said 1. Citizen or resident for at least six (6)

property for payment of the debt or claim

FINANCIAL REHABILITATION AND INSOLVENCY ACT NOTES by CMPoserio-Pascual Page 10 of 11

months immediately prior to nomination; 3. The registry shall be available for public

inspection and publication notice shall be

2. Of good moral character and with acknowledged provided to stakeholders. [Sec. 123]

integrity, impartiality and independence; 4. The debtor and the creditor have the right

to set off their debts against each other;

3. Has the requisite knowledge of insolvency and

only the balance, if any, shall be allowed in

other relevant commercial laws, rules and procedures,

the proceedings. [Sec. 124]

as well as the relevant training and/or experience that

5. Within 30 days from expiration of the period for

may be necessary to enable him to properly discharge

filing of applications for recognition of claims,

the duties and obligations of a receiver; and

interested parties may challenge claims to the court.

4. Has no conflict of interest, which may be waived by

6. Upon the expiration of the 30-day period, the

a party who may be prejudiced. [Sec. 29]

liquidator shall submit the registry of claims

Powers, Duties and Responsibilities

containing the claims not subject to challenge. Such

The principal duty of the liquidator is to

claims shall become final upon filing of the register.

preserve and maximize the value and recover

7. Claims that have become final may be set aside only

the assets of the debtor, with the end of

on grounds of fraud, accident, mistake or inexcusable

liquidating them and discharging all the claims

neglect. [Sec. 125]

against the debtor.

8. The liquidator shall submit disputed claims to court

The powers, duties and responsibilities

for final approval. [Sec. 126]

include:

Treatment of Contracts

1. To sue and recover all the assets, debts and claims,

General Rule: All contracts are deemed terminated

belonging or due to the debtor;

and/or breached.

2. To take possession of all the property of the debtor

Exception: When the liquidator, within 90 days from

except property exempt by law from execution;

assumption of office, declares otherwise and the

3. To sell, with the approval of the court, any property

contracting party agrees. [Sec. 113]

of the debtor which has come into his possession or

Liquidation Plan

control;

Liquidation Plan – Within three months from

4. To redeem all mortgages and pledges, and so

assuming office, the liquidator shall submit a

satisfy any judgement which may be an encumbrance

Liquidation Plan enumerating the assets,

on any property sold by him;

claims and a schedule of liquidation and

5. To settle all accounts between the debtor and his

payment. [Sec. 129]

creditors, subject to the approval of the court;

6. To recover any property or its value, fraudulently Properties exempted by law shall be set apart

conveyed by the debtor; from liquidation for the use and benefit of the

7. To recommend to the court the creation of a insolvent. [Sec. 130]

creditors' committee which will assist him in the The Plan and its implementation shall observe

discharge of the functions and which shall have the concurrence and preference of credits

powers as the court deems just, reasonable and under the Civil Code. [Sec. 133]

necessary; and Sale of Assets in Liquidation

8. Upon approval of the court, to engage such The liquidator may sell the unencumbered assets of

professional as may be necessary and reasonable to the debtor and convert the same into money.

assist him in the discharge of his duties. General Rule: The sale shall be made at public auction.

Determination of claims Exception: A private sale may be allowed with

Determination of Claims the approval of the court if:

The rules on the determination of claims are as 1. The goods are of perishable nature;

follows: 2. The goods are likely to quickly deteriorate in value;

1. Within 20 days from assuming office, the 3. The goods are disproportionately expensive to keep

liquidator shall prepare a preliminary or maintain; or

registry of claims. 4. The private sale is for the best interest of

2. Secured creditors who have waived their the debtor and creditors

security or have fixed the value of the

property subject of the security shall be

considered unsecured.

FINANCIAL REHABILITATION AND INSOLVENCY ACT NOTES by CMPoserio-Pascual Page 11 of 11

You might also like

- ACC501-Short Notes Lec 23-45Document39 pagesACC501-Short Notes Lec 23-45dani73% (11)

- Iso 17021Document121 pagesIso 17021IngDanielMartinez100% (1)

- MAPS Coaching - Business Plan For AgentsDocument12 pagesMAPS Coaching - Business Plan For AgentsJohn McMillanNo ratings yet

- RFBT - Special Laws - ReviewerDocument21 pagesRFBT - Special Laws - ReviewerStella LipataNo ratings yet

- WEDP - Loan Policy & Procedures Manual - FinalDocument73 pagesWEDP - Loan Policy & Procedures Manual - Finalendale50% (2)

- SCWM T-CodesDocument29 pagesSCWM T-CodessimplycoolNo ratings yet

- FRIA EditedDocument10 pagesFRIA EditedPatricia ReyesNo ratings yet

- Non-Bank Gfis: GoccsDocument35 pagesNon-Bank Gfis: GoccsAnalyn Grace BasayNo ratings yet

- Insolvency LawDocument3 pagesInsolvency Lawric bolNo ratings yet

- BANKRUPTCY AND LIQUIDATION Class NotesDocument25 pagesBANKRUPTCY AND LIQUIDATION Class NotesitulejamesNo ratings yet

- Fria SummaryDocument6 pagesFria SummaryKris MercadoNo ratings yet

- KTRL Comm ReviewerDocument19 pagesKTRL Comm ReviewerKevin G. PerezNo ratings yet

- BANKRUPTCYDocument8 pagesBANKRUPTCYadesanmiob04ieNo ratings yet

- Financial Rehabilitation and Insolvency ActDocument15 pagesFinancial Rehabilitation and Insolvency ActcarabaldovinoNo ratings yet

- 9412 Special Laws MCQsDocument32 pages9412 Special Laws MCQsheeeyjanengNo ratings yet

- FRIADocument3 pagesFRIAgrapicartist phNo ratings yet

- 2019 Divina FRIA 070919 MJRSIDocument15 pages2019 Divina FRIA 070919 MJRSIMuhammadIbnSulu100% (3)

- Financial Rehabilitation and Insolvency Act: Review Notes (Following 2020 Bar Syllabus)Document13 pagesFinancial Rehabilitation and Insolvency Act: Review Notes (Following 2020 Bar Syllabus)Vanessa VelascoNo ratings yet

- Insolvency Law (Act 1956, As Amended)Document10 pagesInsolvency Law (Act 1956, As Amended)Akosijopay Lomala Amerol RomurosNo ratings yet

- Business Law Mod 2 4Document13 pagesBusiness Law Mod 2 4Atiene VillanuevaNo ratings yet

- Financial Rehabilitation and Insolvency ActDocument7 pagesFinancial Rehabilitation and Insolvency ActChristine BagindaNo ratings yet

- I. Court-Supervised Rehabilitation A. Voluntary RehabilitationDocument10 pagesI. Court-Supervised Rehabilitation A. Voluntary RehabilitationpsilvaNo ratings yet

- Insolvency Law and Corporate RehabilitationDocument33 pagesInsolvency Law and Corporate RehabilitationElizar JoseNo ratings yet

- FriaDocument51 pagesFriapauline.quilalaNo ratings yet

- R.A No. 10142 (Financial Rehabilitation and Insolvency Act or FRIA of 2010) NatureDocument57 pagesR.A No. 10142 (Financial Rehabilitation and Insolvency Act or FRIA of 2010) NatureJee JeeNo ratings yet

- Rehab & AntichresisDocument13 pagesRehab & Antichresismaria luzNo ratings yet

- Financial Rehabilitation and Insolvency Act of 2010 (Fria) (GROUP 6)Document37 pagesFinancial Rehabilitation and Insolvency Act of 2010 (Fria) (GROUP 6)Gdfry RvrntNo ratings yet

- Or Debtor's Business Operations Prior ToDocument8 pagesOr Debtor's Business Operations Prior ToZeah Viendell CruzatNo ratings yet

- Week - 1 FRIA EditedDocument106 pagesWeek - 1 FRIA EditedjemalynjoshlynNo ratings yet

- Financial Rehabilitation and Insolvency Act of 2010: (R.A. No.10142)Document11 pagesFinancial Rehabilitation and Insolvency Act of 2010: (R.A. No.10142)gilbert213No ratings yet

- RFBT.3409 Fria Tila PDFDocument12 pagesRFBT.3409 Fria Tila PDFMonica GarciaNo ratings yet

- Insolvency Law: Requisites OF Petition FOR Suspension of PaymentsDocument20 pagesInsolvency Law: Requisites OF Petition FOR Suspension of PaymentsKatharsisNo ratings yet

- Financial Rehabilitation and Insolvency Act (FRIA) of 2010" 1. Liquidation of Insolvent Juridical DebtorsDocument9 pagesFinancial Rehabilitation and Insolvency Act (FRIA) of 2010" 1. Liquidation of Insolvent Juridical DebtorsKNo ratings yet

- Pre-Week 2017 - FriaDocument6 pagesPre-Week 2017 - FriaSarah TaliNo ratings yet

- Financial Rehabilitation and Insolvency ActDocument7 pagesFinancial Rehabilitation and Insolvency ActAggi Rayne Sali BucoyNo ratings yet

- Summary OF FRIADocument5 pagesSummary OF FRIAMegan AglauaNo ratings yet

- FRIA Lecture NotesDocument12 pagesFRIA Lecture NotesBEHAIFAH BOTONES100% (1)

- Ra 10142 Fria of 2010 ReportDocument70 pagesRa 10142 Fria of 2010 ReportIzo JamerNo ratings yet

- Fria NotesDocument6 pagesFria NotesRad IsnaniNo ratings yet

- Solvency Law FCADocument76 pagesSolvency Law FCAMarc Benedict TalamayanNo ratings yet

- Financial Rehabilitation and Insolvency Act RA No. 10142Document7 pagesFinancial Rehabilitation and Insolvency Act RA No. 10142MarkNo ratings yet

- m2 - Fria Law Ra 10142 - Bsa31Document85 pagesm2 - Fria Law Ra 10142 - Bsa31Erica RamirezNo ratings yet

- Financial Rehabilitation and Insolvency ActDocument4 pagesFinancial Rehabilitation and Insolvency ActBhenz Bryle TomilapNo ratings yet

- Banruptcy Notes IntroductionDocument3 pagesBanruptcy Notes IntroductionkennedyNo ratings yet

- Fria Handout PDFDocument13 pagesFria Handout PDFReve Joy Eco IsagaNo ratings yet

- Banking Laws Chapters 19 21Document40 pagesBanking Laws Chapters 19 21john uyNo ratings yet

- Commercial Law Review Justice DimaampaoDocument19 pagesCommercial Law Review Justice DimaampaoMegan MateoNo ratings yet

- Financial Rehabilitation and Insolvency Act (FRIA) of 2010: Signed On July 18, 2010Document15 pagesFinancial Rehabilitation and Insolvency Act (FRIA) of 2010: Signed On July 18, 2010Maika NarcisoNo ratings yet

- Creditors' Rights and Bankruptcy: W C I ADocument21 pagesCreditors' Rights and Bankruptcy: W C I AHolli Boyd-White100% (1)

- Insolvency Proceedings Under FRIADocument13 pagesInsolvency Proceedings Under FRIAAnonymous XvwKtnSrMR100% (1)

- Financial Rehabilitation and Insolvency Act (Fria) : Atty. Ivan Yannick S. Bagayao Cpa, MbaDocument40 pagesFinancial Rehabilitation and Insolvency Act (Fria) : Atty. Ivan Yannick S. Bagayao Cpa, MbaChristoper BalangueNo ratings yet

- Bar Exam QuestionsDocument5 pagesBar Exam QuestionsColeen BiocalesNo ratings yet

- Fria ReviewerDocument19 pagesFria ReviewerViner VillariñaNo ratings yet

- Insolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (FRIA) of 2010Document22 pagesInsolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (FRIA) of 2010Kobe BullmastiffNo ratings yet

- Fria Reviewer Lecture Notes 1 - CompressDocument31 pagesFria Reviewer Lecture Notes 1 - CompressReyna Pearl VillamorNo ratings yet

- Credit Notes On LiquidationDocument7 pagesCredit Notes On Liquidationpaulaplaza_7No ratings yet

- Financial Rehabilitation and Insolvency Act - ReportDocument35 pagesFinancial Rehabilitation and Insolvency Act - ReportAilyn AñanoNo ratings yet

- Fria SummaryDocument5 pagesFria SummaryBelteshazzarL.CabacangNo ratings yet

- Special Banking Law12Document4 pagesSpecial Banking Law12xinfamousxNo ratings yet

- Revocation of Discharge: 2M Module27 BankruptcyDocument2 pagesRevocation of Discharge: 2M Module27 BankruptcyZeyad El-sayedNo ratings yet

- Scan 0002Document2 pagesScan 0002El Sayed AbdelgawwadNo ratings yet

- Questions and Answers On FriaDocument18 pagesQuestions and Answers On FriaJoseph John Santos Ronquillo100% (2)

- Small BankruptciesDocument3 pagesSmall BankruptciesitulejamesNo ratings yet

- ACC 112 Code of Corporate GovernanceDocument1 pageACC 112 Code of Corporate GovernanceAndrea Marie P. GarinNo ratings yet

- Acc 110 Practice SetDocument42 pagesAcc 110 Practice SetAndrea Marie P. GarinNo ratings yet

- CASE LIST FOR RECITATION - JulyDocument2 pagesCASE LIST FOR RECITATION - JulyAndrea Marie P. GarinNo ratings yet

- BusinessDocument1 pageBusinessAndrea Marie P. GarinNo ratings yet

- Mengerial Economics PDFDocument41 pagesMengerial Economics PDFmohanraokp2279No ratings yet

- EBRD Serbia Roads Final Phase 1 ReportDocument327 pagesEBRD Serbia Roads Final Phase 1 ReportradovicnNo ratings yet

- Responsibility Accounting and Transfer PricingDocument68 pagesResponsibility Accounting and Transfer PricingMari Louis Noriell MejiaNo ratings yet

- MS 27Document8 pagesMS 27Rajni KumariNo ratings yet

- Elder Care BenefitsDocument27 pagesElder Care Benefitssidrah_farooq2878No ratings yet

- Strategic Competence ManagementDocument25 pagesStrategic Competence ManagementHaslam UdaraniNo ratings yet

- Rodney Frank Lynch Great Advice About Lead Generation That Anyone Can Easily FollowDocument4 pagesRodney Frank Lynch Great Advice About Lead Generation That Anyone Can Easily FollowRodney Frank LynchNo ratings yet

- JD - Centre of ExcellenceDocument4 pagesJD - Centre of ExcellenceAlka AggarwalNo ratings yet

- Idea Generation and Business DevelopmentDocument13 pagesIdea Generation and Business DevelopmentbitetNo ratings yet

- City of Talisay: Requirements: 1. Brgy. Clearance 2. Dti/Sec/Cda 3. Sanitary Permit 4. OthersDocument1 pageCity of Talisay: Requirements: 1. Brgy. Clearance 2. Dti/Sec/Cda 3. Sanitary Permit 4. OthersDexter Q. JaducanaNo ratings yet

- Lecture 2 Values, Mission, Vision and ObjectivesDocument61 pagesLecture 2 Values, Mission, Vision and ObjectivesDavid Abbam AdjeiNo ratings yet

- Pad101.3 PlanningDocument54 pagesPad101.3 Planningnadine emilyNo ratings yet

- Iso 17026 Tangible Product Scheme Type 5Document37 pagesIso 17026 Tangible Product Scheme Type 5Elsayed Bedir100% (1)

- HubSpot SummaryDocument13 pagesHubSpot SummaryRifqi Al-GhifariNo ratings yet

- Sensitivity Analysis: Sales Price Reduces by 5% and No Change in Raw Material CostDocument4 pagesSensitivity Analysis: Sales Price Reduces by 5% and No Change in Raw Material CostRajat NaiduNo ratings yet

- How Would You Justify The Use of A Matrix Design Since It Potentially Violates The Principle of Unity of CommandDocument2 pagesHow Would You Justify The Use of A Matrix Design Since It Potentially Violates The Principle of Unity of CommandAnastasiia BaiukNo ratings yet

- The Factors Affecting Construction Performance in Ghana: The Perspective of Small-Scale Building ContractorsDocument8 pagesThe Factors Affecting Construction Performance in Ghana: The Perspective of Small-Scale Building ContractorsCitizen Kwadwo AnsongNo ratings yet

- Quiz 2Document7 pagesQuiz 2Fiona MiralpesNo ratings yet

- IPCA+ Master Quest FullScope Airbus CONVERT v1.1Document34 pagesIPCA+ Master Quest FullScope Airbus CONVERT v1.1MagninNo ratings yet

- Service: According To ActivitiesDocument9 pagesService: According To ActivitiesMarichelle Brisueño100% (1)

- Ali HusseinDocument64 pagesAli Husseinbalu100% (1)

- Service Marketing Study NotesDocument26 pagesService Marketing Study NotesSam BenNo ratings yet

- Air Waybill: Shenzhen Anda Shun International Logistics Co.,Ltd. Ningbo BranchDocument2 pagesAir Waybill: Shenzhen Anda Shun International Logistics Co.,Ltd. Ningbo BranchRicardo Castillo IbericoNo ratings yet

- Pag Ibig Foreclosed Properties For Public Bidding Legazpi Naga 082416 No DiscountDocument3 pagesPag Ibig Foreclosed Properties For Public Bidding Legazpi Naga 082416 No DiscountJay CastilloNo ratings yet

- Goods Receipt in Sap The Process ManualDocument31 pagesGoods Receipt in Sap The Process ManualsupriyoNo ratings yet