Professional Documents

Culture Documents

Dipesh Jain - CFC Assignment 1

Dipesh Jain - CFC Assignment 1

Uploaded by

Dipesh JainOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dipesh Jain - CFC Assignment 1

Dipesh Jain - CFC Assignment 1

Uploaded by

Dipesh JainCopyright:

Available Formats

Dipesh Jain Title Page

Key Financial Indicators Benchmarking

Case & Homework Assignment

Master of Business Administration & Engineering

Dipesh Jain

-

Matriculation number: s0581383

Date:

Berlin, 29.10.2021

Guided By:

Prof. Dr. Thomas Rachfall

Quality in applied research Ⅰ

Dipesh Jain Abstract

ABSTRACT

Key Financial indicators (KPIs) are the base on which organizations are evaluated for their

profitability and success rate. Not all KPIs are the same. Importance of certain KPIs depends

upon the company and its field of market. Selecting the appropriate indicators to evaluate

different companies from different fields is of great significance. Comparing different

companies using these indicators, as a method to find sector of improvement is called

benchmarking. This assignment evaluates various KPIs of 6 top companies in global market

along with carrying out their financial rating and benchmarking them to identify the best-in-

class company.

Keywords: Key financial indicators, benchmarking, finance rating, scoring model, quartiles.

Quality in applied research IⅠ

Dipesh Jain List of Abbreviations

LIST OF ABBREVIATIONS

KPIs: Key Performance Indicators

ROI: Return on Investments

EBIT: Earnings before Interest and Tax

EBITDA: Earnings before Interest, Tax, Depreciation and Amortization

Quality in applied research IIⅠ

Dipesh Jain Index of Formulas

INDEX OF FORMULAS

𝑇𝑜𝑡𝑎𝑙 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

1. 𝐷𝑒𝑏𝑡 𝐸𝑞𝑢𝑖𝑡𝑦 𝑅𝑎𝑡𝑖𝑜 = 𝑇𝑜𝑡𝑎𝑙 𝑆ℎ𝑎𝑟𝑒ℎ𝑜𝑙𝑑𝑒𝑟 𝐸𝑞𝑢𝑖𝑡𝑦

𝐸𝐵𝐼𝑇

2. 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝐶𝑜𝑣𝑒𝑟𝑎𝑔𝑒 𝑅𝑎𝑡𝑖𝑜 = 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝐸𝑥𝑝𝑒𝑛𝑠𝑒

𝐸𝐵𝐼𝑇

3. 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑀𝑎𝑟𝑔𝑖𝑛% = ∗ 100

𝑆𝑎𝑙𝑒𝑠

𝐸𝐵𝐼𝑇

4. 𝑅𝑂𝐼% = ∗ 100

𝑇𝑜𝑡𝑎𝑙 𝐵𝑜𝑜𝑘 𝐶𝑎𝑝𝑖𝑡𝑎𝑙

𝑇𝑜𝑡𝑎𝑙 𝐴𝑐𝑐𝑜𝑢𝑛𝑡 𝑅𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒

5. 𝐷𝑎𝑦𝑠 𝐴𝑐𝑐𝑜𝑢𝑛𝑡 𝑅𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒 = ∗ 360

𝑆𝑎𝑙𝑒𝑠

Quality in applied research IV

Dipesh Jain Table of Contents

TABLE OF CONTENTS

ABSTRACT………………………………………………………………………………….. Ⅱ

LIST OF ABBREVIATIONS.……………………………………………………………….. ⅡI

INDEX OF FORMULAS……………………………………………………………………..IV

TABLE OF CONTENTS…………………………………………………………………….. V

1. KPIs…………….………………………………………………………………….….…. 01

2. FINANCE RATING………………………………………………………………….......01

3. BENCHMARKING & SCORING….…………………………………………………... 02

4. COMPARABILITY & INSIGHTS……………………………………………………... 03

5. CONCLUSION…………………………………………………………………………. 03

REFERENCES……………………………………………………………………………… VI

Quality in applied research V

Dipesh Jain Homework

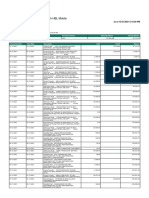

1. KPIs

The following 5 KPIs have been calculated as per the given formulas in the class.

2. FINANCE RATING

Days Account Receivables represents the average no of days its takes for the company to

convert credit sales in cash. A lower Days account receivable ratio shows that company gets

cash in hand faster and can utilize it for further operational expenses. Hence, I have come up

with the following rating solution:

Quality in applied research 1

Dipesh Jain Homework

3. BENCHMARKING & SCORING

Debt Equity Ratio Interest Coverage Ratio Operating Margin

ROI % Days Acc Receivables

Weighted Scoring Results

Quality in applied research 2

Dipesh Jain Homework

4. COMPARABILITY & INSIGHTS

The best way to compare two companies is by comparing their Net profit margin or the financial

ratios. Comparison becomes easier when you compare companies of similar field. For example,

John Deere and Caterpillar are both companies that sell Agricultural and heavy machinery. Both

companies have almost similar Sales per year, and similar EBIT data. However, Caterpillar

faces hard time converting credit to cash and hence lacks behind John Deere. Dow falls under

similar category as it sells industrial equipment’s and materials, but a direct comparison cannot

be made.

Similarly, Walmart and Metro are grocery sellers. However, Walmart works on a really large

scale as compared to Metro which can be seen by the difference in their Total Book Capital.

The Home Depot has the highest ROI% among all the companies. Its shows that it sells its

products with a high profit margin as compared to its peers.

The success of a company depends on a lot of factors. By just looking at the financial figures

we can derive that a company’s success over its peers can be based on the trust of the

shareholders on the company’s finances, its market recognition, the capital invested in advances

for the future, Dividends to the shareholders, etc.

5. CONCLUSION

The calculated KPIs, Financial Rating and the scoring model identified the best-in-class

company among the 6 companies given. However, the scoring model is subjective and may

vary according to the company’s industry type. Overall, a company can be judged and evaluated

with the help of some powerful financial indicators. The discussed financial criteria are not

exhaustive and form a small portion of the vast number of financial criteria which can be used

to choose the right company.

Quality in applied research 3

Dipesh Jain References

REFERENCES

https://www.wsj.com/market-data/quotes/WMT/financials/annual/balance-sheet

https://www.wsj.com/market-data/quotes/DOW/financials/annual/balance-sheet

https://www.wsj.com/market-data/quotes/CAT/financials/annual/balance-sheet

https://www.wsj.com/market-data/quotes/DE/financials/annual/balance-sheet

https://www.wsj.com/market-data/quotes/XE/XETR/B4B/financials/annual/balance-sheet

https://www.wsj.com/market-data/quotes/HD/financials/annual/balance-sheet

https://www.macrotrends.net/

Quality in applied research VI

You might also like

- FS - Final Restobar Feasibility StudyDocument66 pagesFS - Final Restobar Feasibility StudyJedric Smpyn100% (4)

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementFrom EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementNo ratings yet

- Quiz 1 - Matematika Bisnis (2021)Document18 pagesQuiz 1 - Matematika Bisnis (2021)Andreas ChandraNo ratings yet

- Managerial Accounting Course OutlineDocument4 pagesManagerial Accounting Course OutlineASMARA HABIB100% (1)

- Khushpreet MbaDocument55 pagesKhushpreet MbaKaran SandhuNo ratings yet

- 1.2.1 Financial Performance RatiosDocument135 pages1.2.1 Financial Performance RatiosGary ANo ratings yet

- Index: Linktech Engineering Pvt. LTDDocument52 pagesIndex: Linktech Engineering Pvt. LTDmathanabalajiNo ratings yet

- Sip ReportDocument57 pagesSip Reportvijay soniNo ratings yet

- A Functional Project Done In: Analysis On Performance of Wipro and Infosys"Document29 pagesA Functional Project Done In: Analysis On Performance of Wipro and Infosys"anand guptaNo ratings yet

- Top 10 KPIs - 2023-1Document17 pagesTop 10 KPIs - 2023-1Khaled IbrahimNo ratings yet

- Dipesh Jain - CFC Assignment 5Document14 pagesDipesh Jain - CFC Assignment 5Dipesh JainNo ratings yet

- Revision Book CAFMDocument104 pagesRevision Book CAFMDeep Patel100% (1)

- Black BookDocument49 pagesBlack BookKiran PatilNo ratings yet

- A Study On Banking Services of HDFC BankDocument9 pagesA Study On Banking Services of HDFC BankNageshwar SinghNo ratings yet

- Document 1Document60 pagesDocument 1Bhavana HoneyNo ratings yet

- Finance ProjectDocument80 pagesFinance ProjectDinoop Devaraj0% (1)

- CA FINAL COSTINGSCMPE REVISION CLASS NOTES 5 Part 1Document58 pagesCA FINAL COSTINGSCMPE REVISION CLASS NOTES 5 Part 1justinmajok8No ratings yet

- Ratio AnalysisDocument53 pagesRatio Analysisravi kangneNo ratings yet

- Financial Statement Analysis of Nestle IndiaDocument43 pagesFinancial Statement Analysis of Nestle IndiaAmanNo ratings yet

- Submitted By: Project Submitted in Partial Fulfillment For The Award of Degree ofDocument21 pagesSubmitted By: Project Submitted in Partial Fulfillment For The Award of Degree ofMOHAMMED KHAYYUMNo ratings yet

- Cost IM - CH 14Document23 pagesCost IM - CH 14Mr. FoxNo ratings yet

- Research Papers On Financial Performance Analysis PDFDocument5 pagesResearch Papers On Financial Performance Analysis PDFsuz1sezibys2No ratings yet

- A Project Study Report On Training Undertaken At: Submitted in Partial Fulfillment For The Award of Degree ofDocument15 pagesA Project Study Report On Training Undertaken At: Submitted in Partial Fulfillment For The Award of Degree ofdivyaNo ratings yet

- Venture Capital: Noel J. Maquiling, Mba Car, Micb, CFMP, MosDocument18 pagesVenture Capital: Noel J. Maquiling, Mba Car, Micb, CFMP, MosKrisha Pioco0% (1)

- Profitability Analysis: CHADARGHAT Hyderabad TelanganaDocument10 pagesProfitability Analysis: CHADARGHAT Hyderabad TelanganakhayyumNo ratings yet

- Effective Financial ManagementDocument19 pagesEffective Financial Managementhafmar firiNo ratings yet

- Introduction To Business Valuation: January 2020Document24 pagesIntroduction To Business Valuation: January 2020Avinash SharmaNo ratings yet

- Tata Analysis ProjectDocument60 pagesTata Analysis ProjectSeema YadavNo ratings yet

- NCERT Class 12 Accountancy Accounting RatiosDocument47 pagesNCERT Class 12 Accountancy Accounting RatiosKrish Pagani100% (1)

- Financial Statement Analysis of ICICI Bank': A Study OnDocument79 pagesFinancial Statement Analysis of ICICI Bank': A Study OnAjay SanthNo ratings yet

- Chapter 4Document32 pagesChapter 4ragi malikNo ratings yet

- Chapter 6Document25 pagesChapter 6HM.No ratings yet

- Finance Project 147Document68 pagesFinance Project 147Himanshu ParakhNo ratings yet

- Anjali Summer Training Report 1Document43 pagesAnjali Summer Training Report 1Prashant SinghNo ratings yet

- 1.3 None Financial PerformanceDocument80 pages1.3 None Financial PerformanceGary ANo ratings yet

- Acoount ProjectDocument54 pagesAcoount Projectvikassharma7068No ratings yet

- The Balanced Scorecard (BSC) Method: From Theory To PracticeDocument12 pagesThe Balanced Scorecard (BSC) Method: From Theory To Practicecpriya tarsshiniNo ratings yet

- Group 2Document97 pagesGroup 2SXCEcon PostGrad 2021-23100% (1)

- Sample Thesis Financial Performance AnalysisDocument4 pagesSample Thesis Financial Performance Analysissandraahnwashington100% (2)

- 1247am - 25.EPRA JOURNALS 8073 PDFDocument3 pages1247am - 25.EPRA JOURNALS 8073 PDFRasi framesNo ratings yet

- Research Paper On Ratio Analysis in IndiaDocument6 pagesResearch Paper On Ratio Analysis in Indiafzqs7g1d100% (1)

- Chapter 1 - Class MaterialDocument5 pagesChapter 1 - Class Materialkushigowda.2000hpNo ratings yet

- Racio Analiza HBDocument14 pagesRacio Analiza HBHivzo BektovicNo ratings yet

- Ratio Analysis - NATRAJ OILDocument8 pagesRatio Analysis - NATRAJ OILRaja MadhanNo ratings yet

- Balanced Score Card PDFDocument14 pagesBalanced Score Card PDFtyoafsNo ratings yet

- Basecamp Whitepaper Profitability AnalysisDocument21 pagesBasecamp Whitepaper Profitability AnalysisYano FélixNo ratings yet

- 10 Chapter 10Document21 pages10 Chapter 10Ruben SucionoNo ratings yet

- Analysis of Financial Leverage On Profitability and RiskDocument90 pagesAnalysis of Financial Leverage On Profitability and RiskRajesh BathulaNo ratings yet

- Whitepaper-How To Measure ROIDocument10 pagesWhitepaper-How To Measure ROIandini eldanantyNo ratings yet

- Write Up m201802 SinghalDocument14 pagesWrite Up m201802 Singhalshalini singhalNo ratings yet

- Establishing and Improving Manufacturing Performance MeasuresDocument6 pagesEstablishing and Improving Manufacturing Performance MeasuresIslamSharafNo ratings yet

- CH - 5 Accounting RatiosDocument47 pagesCH - 5 Accounting RatiosAaditi V100% (1)

- Final Ratio AnalysisDocument40 pagesFinal Ratio AnalysisShruti PatilNo ratings yet

- Nitin517 Final Project (NBFC)Document78 pagesNitin517 Final Project (NBFC)Abhishek RanaNo ratings yet

- (Scan QR Code To Answer Pre-Assessment) : 1 of 22 (For Dfcamclp Used Only)Document22 pages(Scan QR Code To Answer Pre-Assessment) : 1 of 22 (For Dfcamclp Used Only)maelyn calindong100% (1)

- Summer Internship Presentation 1-1Document12 pagesSummer Internship Presentation 1-1Hardik KothiyalNo ratings yet

- Cost Analysis and Control Hero 2017Document81 pagesCost Analysis and Control Hero 2017aurorashiva1No ratings yet

- BSBI422 Final Special Project V4Document10 pagesBSBI422 Final Special Project V4hamzaNo ratings yet

- Balanced Scorecard for Performance MeasurementFrom EverandBalanced Scorecard for Performance MeasurementRating: 3 out of 5 stars3/5 (2)

- Mastering Operational Performance : The Ultimate KPI HandbookFrom EverandMastering Operational Performance : The Ultimate KPI HandbookNo ratings yet

- Planning Cycles and Types of PlanDocument34 pagesPlanning Cycles and Types of Planmaricel catorceNo ratings yet

- Investor Doc 1649199Document382 pagesInvestor Doc 1649199Jijo VargheseNo ratings yet

- D - Data Processing Agreement For SAP ServicesDocument10 pagesD - Data Processing Agreement For SAP ServicesUlysse TpnNo ratings yet

- Fee Voucher Fee Voucher Fee Voucher Voucher # 499276 Voucher # 499276 Voucher # 499276Document1 pageFee Voucher Fee Voucher Fee Voucher Voucher # 499276 Voucher # 499276 Voucher # 499276M Irfan IqbalNo ratings yet

- OGL 482 Pro-Seminar II Module 6 Assignment: Career Plan TemplateDocument12 pagesOGL 482 Pro-Seminar II Module 6 Assignment: Career Plan Templateapi-410456179No ratings yet

- Revenue Cycle AuditDocument5 pagesRevenue Cycle Auditandi TenriNo ratings yet

- Quantitative Strategic Planning MatrixDocument13 pagesQuantitative Strategic Planning Matrixkripa dudu50% (2)

- IPHMT309Document13 pagesIPHMT309Munish GargNo ratings yet

- Bachelor of Business Administration (BBA) in Retailing Ist YearDocument6 pagesBachelor of Business Administration (BBA) in Retailing Ist YearNadimNo ratings yet

- EntrepreneurshipDocument20 pagesEntrepreneurshipbbrraaddNo ratings yet

- Corporate Governance Practices-Final ProjectDocument58 pagesCorporate Governance Practices-Final ProjectRaj KumarNo ratings yet

- 8422 Methodology eDocument12 pages8422 Methodology eNguyen Trung KienNo ratings yet

- Bar Q&A PartnershipDocument4 pagesBar Q&A PartnershipFrances Ann Marie GumapacNo ratings yet

- Test Bank For Nursing Research in Canada 3rd Edition Geri Lobiondo WoodDocument10 pagesTest Bank For Nursing Research in Canada 3rd Edition Geri Lobiondo WoodDonaldSmithwrmc100% (44)

- Vijaya Bank Officer Employees (Acceptance of Jobs in Private Sector Concerns After Retirement) Regulations, 2000Document4 pagesVijaya Bank Officer Employees (Acceptance of Jobs in Private Sector Concerns After Retirement) Regulations, 2000Latest Laws TeamNo ratings yet

- Resource Generated CommitteeDocument12 pagesResource Generated Committeerhea marieNo ratings yet

- Effect of Customer Experience in Business and Financial Performance of BanksDocument9 pagesEffect of Customer Experience in Business and Financial Performance of BanksCathaline MeganNo ratings yet

- Chapter 6 - Strategic Human Resource ManagementDocument10 pagesChapter 6 - Strategic Human Resource ManagementJinessa LanceNo ratings yet

- Finance Modeling Handbook (00000002)Document1 pageFinance Modeling Handbook (00000002)baronfgfNo ratings yet

- Commercial ApplicationsDocument5 pagesCommercial ApplicationsFriend Gamer LAKSHYANo ratings yet

- Account Activity Generated Through HBL MobileDocument2 pagesAccount Activity Generated Through HBL Mobileimran LarNo ratings yet

- Segmentation For Marketing Channel Design For Service OutputDocument25 pagesSegmentation For Marketing Channel Design For Service OutputHajiMasthanSabNo ratings yet

- CHP 21 Location DecisionsDocument6 pagesCHP 21 Location DecisionsHiNo ratings yet

- Module 2-Pre1Document17 pagesModule 2-Pre1Jhon Paulo RojoNo ratings yet

- IO Agreement Hamza NajamDocument10 pagesIO Agreement Hamza NajamHamza NajamNo ratings yet

- Kasavan Architects ArchitectureDocument17 pagesKasavan Architects ArchitectureL. A. PatersonNo ratings yet

- Human Resources - Final PaperDocument11 pagesHuman Resources - Final PaperRue NarraNo ratings yet

- ManpowersupplytenderdocF 21042021 9400Document57 pagesManpowersupplytenderdocF 21042021 9400MohammedBujairNo ratings yet