Professional Documents

Culture Documents

International Business The New Realities 4th Edition Cavusgil Solutions Manual Download

International Business The New Realities 4th Edition Cavusgil Solutions Manual Download

Uploaded by

Walter WadeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International Business The New Realities 4th Edition Cavusgil Solutions Manual Download

International Business The New Realities 4th Edition Cavusgil Solutions Manual Download

Uploaded by

Walter WadeCopyright:

Available Formats

International Business The New

Realities 4th Edition Cavusgil

Solutions Manual

Full download at link:

Solution Manual: https://testbankpack.com/p/solution-manual-for-

international-business-the-new-realities-4th-edition-cavusgil-knight-

riesenberger-0134324838-9780134324838/

Test Bank: https://testbankpack.com/p/test-bank-for-international-

business-the-new-realities-4th-edition-cavusgil-knight-riesenberger-

0134324838-9780134324838/

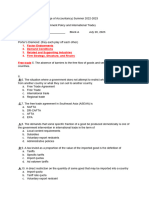

PART 2

THE ENVIRONMENT OF INTERNATIONAL BUSINESS

CHAPTER 7

GOVERNMENT INTERVENTION AND REGIONAL ECONOMIC INTEGRATION

Instructor’s Manual by Marta Szabo White, Ph.D.

I. LECTURE STARTER/LAUNCHER

■ Governments have long intervened in international business, hindering the free flow of

trade and investment.

■ Intervention can take many forms- tariffs and quotas, restrictions on international

investment, bureaucratic procedures and red tape, regulations that restrict value-chain

activities. Governments can also provide subsidies and financial incentives intended to

sustain or develop domestic firms and industries.

■ Although studies have found a strong association between market openness

(unimpeded free trade) and economic growth, as well as the fact that market liberalization

and free trade are robust contexts for fostering economic growth and national living

standards, in reality:

There is no such thing as unimpeded free trade.

■ Ask your students to think about government intervention- what are the pros and cons?

Make two lists, pros on one side and cons on the other. Why is there no such thing as

unimpeded free trade? That is, what is the justification for government intervention? By

Copyright © 2017 Pearson Education, Inc. 1 | Page

contrast, why is free trade good? (The answer can be found in Chapter 5: Theories of

International Trade and Investment.)

■ To better understand regional integration, think of international business as existing

along a continuum where, at one extreme, the world operates as one large free-trade

area in which there are no tariffs or quotas, all countries use the same currency, and

products, services, capital, and workers can move freely among nations without

restriction.

■ At the other extreme of this continuum is a world of prohibitive barriers to trade and

investment where countries have separate currencies and have very little commercial

interaction with each other.

■ It is useful to draw this continuum on the board or screen, featuring the two extremes.

Then ask the students where their country falls on this continuum and why. Then ask the

students for examples of countries or regions that might fall at the opposite extremes of

this continuum. Ask them to justify their answers.

■ Ask your students if they know one of the major motives in creating the European

Community (the precursor to the EU).

● Members sought to strengthen their mutual defense against the expanding

influence of the former Soviet Union.

■ The European Union is the most advanced economic bloc. Describe the characteristics

of the EU.

■ The CIA World Factbook provides additional details of the EU:

https://www.cia.gov/library/publications/the-world-factbook/geos/ee.html

■ Ask students whether their favorite country is a member of an economic bloc- which

one. Ask them what advantages/disadvantages being in this bloc brings to their country.

[1] YOUTUBE

William Spaniel

International Relations 101 (#9): Tariffs and the Barriers to Free Trade

Published on Jul 11, 2012

Modeling free trade as a prisoner's dilemma provides an explanation. Although

everyone is collectively better off with free trade, individual incentives tell states to place

tariffs on imported goods. Thus, although the result is collectively crazy, it is individually

rational.

https://www.youtube.com/watch?v=Kc-bgKyPDz4

8.33 Minutes

[2] TED TALK

George Papandreou: Imagine a European democracy without borders

Published on Jun 12, 2013

Greece has been the poster child for European economic crisis, but former Prime Minister

George Papandreou wonders if it's just a preview of what's to come. "Our democracies,"

he says, "are trapped by systems that are too big to fail, or more accurately, too big to

Copyright © 2017 Pearson Education, Inc. 2 | Page

control" -- while "politicians like me have lost the trust of their peoples." How to solve it?

Have citizens re-engage more directly in a new democratic bargain.

https://www.youtube.com/watch?v=y9ALB39wRKo

20.06 Minutes

[3] PBS NewsHour

Is NAFTA a success story or damaging policy?

Published on Feb 20, 2014

A one-day summit in Mexico between President Obama and his North American

counterparts marked the 20th anniversary of NAFTA, a trade agreement designed to

eliminate cross-border duties and other barriers. What's the legacy, effect and the future

of NAFTA? Jeffrey Brown gets debate from former U.S. Trade Representative Carla Hills

and Lori Wallach of the Public Citizen's Global Trade Watch.

https://www.youtube.com/watch?v=DGeTZ4u2jbg

11.55 Minutes

[4] YOUTUBE

The Big Picture with Thom Hartmann

Why TPP Will Be A Disaster for Americans

Published on Mar 13, 2015

Neil Sroka, Democracy for America joins Thom Hartmann. Just like every other so-called

free trade deal - the Trans Pacific Partnership is a raw deal for the American people. So

why is Congress doing everything in its power to make this bad deal a reality as soon as

possible?

https://www.youtube.com/watch?v=bTrPsFTGmYI

11.46 Minutes

II. LEARNING OBJECTIVES AND THE OPENING VIGNETTE

LEARNING OBJECTIVES

After studying this chapter, students should be able to:

7.1 Understand the nature of government intervention

7.2 Know the instruments of government intervention

7.3 Explain the evolution and consequences of government trade intervention

7.4 Describe how firms can respond to government trade intervention

7.5 Understand regional integration and economic blocs

7.6 Identify the leading economic blocs

7.7 Understand the advantages and implications of regional integration

Key Themes

Copyright © 2017 Pearson Education, Inc. 3 | Page

■ In this chapter, there are eight themes:

[1] The nature of government intervention

[2] Instruments of government intervention

[3] Evolution and consequences of government intervention

[4] How firms can respond to government intervention

[5] Regional integration and economic blocs

[6] The leading economic blocs

[7] Advantages and implications of regional integration

■ The focus of this chapter is government intervention and regional economic integration

in international business.

■ Despite the value of free trade, governments often intervene in international business.

■ Key concepts to familiarize yourself with:

◘ Protectionism refers to national economic policies designed to restrict free trade

and protect domestic industries from foreign competition.

◘ Government intervention arises typically in the form of tariffs (e.g. duty),

nontariff trade barriers (e.g. quota), and investment barriers (target FDI).

■ Rationale for government intervention

■ Governments impose trade and investment barriers to achieve political, social, or

economic objectives. Such barriers are either defensive or offensive:

◘ Defensive barriers safeguard industries, workers, special interest groups,

protect infant industries and to promote national security (export controls).

◘ Offensive barriers pursue a strategic or public policy objective, such as

increasing employment or generating taxes.

■ Instruments of government intervention

■ Governments also impose regulations and technical standards, as well as

administrative and bureaucratic procedures.

■ Countries may also impose currency controls to minimize international withdrawal of

national currency.

■ FDI and ownership restrictions ensure that the nation maintains partial or full ownership

of firms within its national borders.

■ Governments also provide subsidies, a form of payment or other material support.

■ Foreign governments may offset foreign subsidies by imposing countervailing duties.

■ With dumping, a firm charges abnormally low prices abroad.

■ A government may respond to dumping by imposing an antidumping duty.

■ Governments support domestic firms by providing investment incentives and biased

government procurement policies.

■ Consequences of government intervention:

◘ Economic freedom - the extent of government intervention in the national

economy, assessed using the Heritage Foundation’s Index of Economic Freedom.

◘ Government intervention and trade barriers may disproportionately impact

developing economies and low-income consumers because countries in for example

Africa, Bangladesh, Pakistan, and India are taxed at relatively unjustly higher levels.

Copyright © 2017 Pearson Education, Inc. 4 | Page

◘ Government intervention can also offset such harmful effects (e.g. subsidies).

■ Evolution of government intervention: Intervention has a long history.

◘ 1800s- (late) many countries imposed substantial protectionism.

◘ 1930s- countries reduced trade barriers worldwide.

◘ Import substitution -Latin America- delayed countries’ eventual transition to

free trade.

◘ Industrialization- Following World War II, Japan embarked on export-led

development.

◘ Protectionist policies- India

◘ 1980s - China had limited foreign involvement until then.

◘ General Agreement on Tariffs and Trade (GATT) - the most important

development for reducing trade barriers of the last several decades

◘ 1995- replaced by the World Trade Organization (WTO)

◘ The 150 members of the WTO account for nearly all world trade.

■ Intervention and the global financial crisis

◘ Crisis impetus- inadequate regulation in the banking/ finance sectors

◘ Response- new government regulations and increasing protectionism to

safeguard jobs, wages, and protect domestic industries via subsidies

◘ Ripple Effect- Government reforms transcend beyond the banking and financial

areas.

■ How should firms respond to government intervention?

◘ Firms should first undertake research to understand the extent and nature of

trade and investment barriers abroad.

◘ When trade barriers are substantial, FDI or joint ventures to produce products in

target countries are often the most appropriate entry strategies.

◘ Where importing is essential, the firm can take advantage of foreign trade zones,

areas where imports receive preferential tariff treatment.

◘ Management should try to obtain a favorable export classification for the firm’s

exported products- being familiar with the harmonized code schedules, which provide

a standardized directory for applicable tariffs.

◘ Government assistance in the form of subsidies and incentives helps reduce the

impact of protectionism.

◘ Firms sometimes lobby the home and foreign governments for freer trade and

investment.

■ Regional integration involves groups of countries forming alliances to promote free

trade, cross-national investment, and other mutual goals.

■ This integration results from economic blocs, in which member countries agree to

eliminate tariffs and other restrictions on the cross-national flow of products, services,

capital, and, in more advanced stages, labor, within the bloc.

■ Stages of regional integration:

◘ Free trade area, in which tariffs and other trade barriers are eliminated

Copyright © 2017 Pearson Education, Inc. 5 | Page

◘ Customs union, a free trade area in which common trade barriers are imposed

on nonmember countries

◘ Common market, a customs union in which factors of production move freely

among the members

◘ Economic union, a common market in which some economic policies are

harmonized among the member states

◘ Political union does not yet exist

■ There are roughly 200 economic integration agreements in the world.

■ The European Union (EU) is the most advanced of these, comprising 28 countries in

Europe.

■ The most notable bloc (free-trade-area) in the Americas is the North American Free

Trade Agreement (NAFTA) - consisting of Canada, Mexico, and the U.S.

■ Countries pursue regional integration because:

◘ It contributes to corporate and industrial growth, economic growth, better living

standards, and higher tax revenues for the member countries.

◘ It increases market size by integrating the economies within a region.

◘ It increases economies of scale and factor productivity among firms in the

member countries and attracts foreign investors to the bloc.

◘ It also increases competition and economic dynamism within the bloc, and

increases the bloc’s political power.

■ Success factors for regional integration:

◘ Countries that are relatively similar in terms of culture, language, and economic

and political structures.

◘ Countries that are geographically close to each other.

■ Ethical dilemmas of regional integration:

◘ Regional integration simultaneously leads to trade creation, whereby new trade

is generated among the countries inside the bloc, and trade diversion, in which member

countries discontinue some trade with countries outside the bloc.

◘ It can reduce global free trade, particularly when member countries form a

customs union that results in substantial trade barriers to countries outside the bloc.

◘ When economic blocs involve many countries of various sizes, regional

integration can concentrate power into large firms and large nations inside the bloc.

◘ Regional integration results in economic restructuring, which may harm particular

industries and firms.

◘ When a country joins an economic bloc, it must relinquish some of its autonomy

and national power to the bloc’s central authority. Individual countries risk losing some of

their national identity

■ Consequences of regional integration:

●Regional integration can concentrate power into large firms and large nations inside

the bloc.

●Regional integration results in economic restructuring, which may harm particular

industries and firms.

Copyright © 2017 Pearson Education, Inc. 6 | Page

●When a country joins an economic bloc, it must relinquish some of its autonomy to

the bloc’s central authority.

●Regional integration leads to increased internationalization by firms inside their

economic bloc.

●Firms reconfigure value-chain activities and rationalize their operations.

●The formation of economic blocs also leads to mergers and acquisitions.

●Managers revise marketing strategies by standardizing products and developing

regional brands.

●Regional integration also leads firms from outside the bloc to invest into the bloc.

Teaching Tips

■ The challenge for this chapter is how to get students excited about something that is a

macro-environmental force, over which businesses have little or no control. Corporate-

level strategic decisions that firms can control concern whether to compete or not to

compete in a particular business/market. Before such a decision can be crafted,

management should conduct a country-specific analysis of barriers to entry in the form of

intervention, regulations, and restrictions, vs. market openness and degree of economic

freedom. This would be part of Due Diligence.

■ One strategy to induce interest in this chapter and the topic of government intervention

might be to assign students to analyze the Index of Economic Freedom, published by the

Heritage Foundation (www.heritage.org) that measures economic freedom in 186

countries. Hong Kong, Singapore and New Zealand are the top three countries in terms

of Economic Freedom as measured by the ten freedoms comprising this index.

■ Note: Economic freedom flourishes when government supports those institutions that

foster freedom and provide an appropriate level of intervention and regulation. In 2010

for the first time, the U.S. slipped into the second highest category, due to increased U.S.

federal government intervention following the global financial crisis.

■ An assignment (for credit) might be to select two countries at opposite ends of the

spectrum and create an argument why entry into country A makes more sense than

country B- then reverse the case by now arguing the opposite. Entry modes (which one

is optimal and why) should be included as required components for both sides of the

argument. The entire class may be involved if students present their positions to the rest

of the class, and reactions from other students are encouraged with participation points.

■ Regional integration is an attempt to achieve freer economic relations.

■ Two of the most well-known examples of this trend are the European Union (EU) and

the North American Free Trade Agreement area (NAFTA). The EU is composed of 28

member countries in Europe. NAFTA is composed of Canada, Mexico, and the United

States.

■ Free trade agreement (less advanced economic blocs- NAFTA) - formal arrangement

between two or more countries to reduce or eliminate tariffs, quotas, and other barriers

to trade in products and services

■ More advanced economic blocs (EU) permit the free flow of capital, labor, technology

and the harmonization of monetary and fiscal policies.

Copyright © 2017 Pearson Education, Inc. 7 | Page

Commentary on the Opening Vignette:

INDIA’S EVOLUTION TO A LIBERAL ECONOMY

• Key message

■ India is a paradox- it is the world’s leading emerging economy in information technology

and e-business, and simultaneously, a bureaucratic nightmare- trade barriers, business

regulations, import taxes, and controls on foreign investment are substantial- with tariffs

averaging over 15% on many products, compared to less than 4% in Europe, Japan, and

the United States.

■ Hundreds of commodities, from cement to household appliances, can be imported only

after receiving government approval. Licensing fees, testing procedures, and other

hurdles can be very costly to importers.

■ India is plagued with poor infrastructure- inadequate roads, bridges, airports, &

telecommunications

■1980s (early) – India has been liberalizing regulations:

◘ Abolished/minimized import licenses

◘ Reduced tariffs substantially

◘ Privatization incentives- numerous state enterprises have been “privatized” –

sold to the private sector and to foreign investors.

■ 10 million ‘mom-and-pop’ shops scattered across 500,000 cities/villages.

■ 2012- Indian government yielded to political pressure and denied Walmart, Carrefour,

and other foreign retailers the opportunity to participate in India’s huge retailing sector. In

a joint venture with the Indian firm Bharti Enterprises, Walmart had planned to open

numerous stores nationwide.

■ India’s entrepreneurial potential is significant

■ Special Economic Zones (SEZs) introduced- territories that offer foreign firms the

benefits of India's low-cost, high-skilled labor, are exempt from trade barriers, sales and

income taxes, licensing requirements, FDI restrictions, and customs clearance

procedures.

■ Example-

◘ The Mahindra City SEZ, an 840-acre development, is focusing on a $277 million

software development complex constructed by Infosys Technologies, India’s leading IT

firm.

◘ However, Europe and North America aim to minimize outsourcing of jobs to

India; therefore demand protectionism—trade barriers and defensive measures

intended to minimize the export of jobs abroad.

• Uniqueness of the situation described

■ India is a study in contrasts.

■ The world’s leading emerging economy in IT and e-business vs. its saturation in trade

barriers and business regulations- at the federal and 28 state levels.

Copyright © 2017 Pearson Education, Inc. 8 | Page

■ Trade barriers and government bureaucracy in India vs. protectionism demands in

Europe and the U.S. exemplify the complex world of government intervention.

• Classroom discussion

■ Define outsourcing and offshoring

Outsourcing is the purchase of a value-creating activity from an external supplier.

Offshoring is the relocation of manufacturing and other value-chain activities to cost-

effective destinations abroad.

■ Should firms balance competitive advantages of value chain global sourcing

(offshoring) with the impact of domestic job displacement? Do firms have a greater

obligation to their stakeholders or shareholders?

QUESTIONS

7-1. Describe the nature of government intervention in India? What is the likely

effect on business activities?

(LO 7.1; LO 7.3; AACSB: Application of knowledge)

■ Government intervention creates a bureaucratic nightmare for businesses- trade

barriers, business regulations, import taxes, and controls on foreign investment are

substantial- with tariffs averaging over 15% on many products, compared to less than 4%

in Europe, Japan, and the United States.

■ Hundreds of commodities, from cement to household appliances, can be imported only

after receiving government approval. Licensing fees, testing procedures, and other

hurdles can be very costly to importers.

■ India is plagued with poor infrastructure- inadequate roads, bridges, airports, &

telecommunications

■ This can only have a negative impact on business.

7-2. Why has the Indian government hindered the entry of Walmart, Carrefour, and

other large retailers into the country?

(LO 7.2; AACSB: Application of knowledge)

■ There are 10 million ‘mom-and-pop’ shops scattered across 500,000 cities/villages.

■ In order to protect these ‘mom-and-pop’ shops, the Indian government yielded to

political pressure and denied Walmart, Carrefour, and other foreign retailers the

opportunity to participate in India’s huge retailing sector.

7-3. Describe how India’s government is attempting to liberalize the nation’s

regulatory environment.

(LO 7.2; AACSB: Application of knowledge)

■ Only recently, has the Indian government employed pro-business incentives such as:

Copyright © 2017 Pearson Education, Inc. 9 | Page

◘ Abolished/minimized import licenses

◘ Reduced tariffs substantially

◘ Privatization incentives- numerous state enterprises have been “privatized” –

sold to the private sector and to foreign investors.

■ To enhance India’s significant entrepreneurial potential:

■ Special Economic Zones (SEZs) were introduced- territories that offer foreign firms the

benefits of India's low-cost, high-skilled labor, are exempt from trade barriers, sales and

income taxes, licensing requirements, FDI restrictions, and customs clearance

procedures.

■ Example-

◘ The Mahindra City SEZ, an 840-acre development, is focusing on a $277 million

software development complex constructed by Infosys Technologies, India’s leading IT

firm.

III. DETAILED CHAPTER OUTLINE

GOVERNMENT INTERVENTION IN INTERNATIONAL BUSINESS

■ Governments intervene in trade and investment to achieve political, social, or economic

objectives.

■ Barriers benefit specific interest groups, such as domestic firms, industries, and labor

unions.

■ Government Intervention Rationale: Job creation by protecting industries from

foreign competition; support homegrown industries/firms.

GOVERNMENT FREE

INTERVENTION TRADE

■ Government intervention is at odds with free trade, the unrestricted flow of products,

services, and capital across national borders.

■ Market liberalization and free trade foster economic growth and improved living

standards.

■ Economists have long argued that free trade is good for the world: resources are

efficiently employed; living standards increased and value chain activities exploited.

■ Research suggests a strong positive relationship between market openness

(unimpeded free trade) and economic growth.

Study of more than 100 countries 1945-1995

Copyright © 2017 Pearson Education, Inc. 10 | Page

Open Economies Less-free trade Economies

( Market liberalization & free trade) (Restrict trade & investment)

Per-capita GDP growth greater than 4% Per-capita GDP growth close to 0.

■ Example- Poland- Role Model: Free trade provides enormous benefits for economic

growth and individual welfare.

◘ Comparative advantage- With time, Poland lowered trade barriers and

participated more freely in international trade, leveraging their comparative advantage.

◘ Poland focused on producing and exporting goods it was best suited to produce,

and importing those goods that other nations produce more efficiently.

◘ Poland began to use its resources more efficiently, generating more overall

profits for firms and workers, and, acquiring more resources with which to import the

goods that Polish consumers demanded.

◘ Poland’s average annual income rose:

1990 2015

$1,625 $14,000

■ Unintended consequences:

◘ Employment shift- unemployment increased in certain industries as jobs

producing those goods shifted to other, more efficient countries.

■ Positive effects of free trade substantially outweighed the negative ones

■ Unimpeded free trade is a myth.

■ Government intervention obstructs the free flow of trade and investment.

■ Intervention alters the competitive position of companies and industries and takes the

form of: tariffs, quotas, subsidies, FDI restrictions, bureaucratic procedures, regulations

that restrict business types/value-chain activities, and financial incentives to sustain

domestic firms.

■ Exhibit 7.1- underscores that government intervention is an important dimension

of COUNTRY RISK.

THE NATURE OF GOVERNMENT INTERVENTION

■ Motivation Government Intervention: Protectionism

■ Protectionism – (hinders imports) national economic policies designed to restrict free

trade and protect domestic industries from foreign competition, and is manifested through:

◘ Tariff (duty) - tax imposed by a government on imported products, thus

increasing the acquisition cost for the customer.

Example-

● Customs- ports of entry checkpoints in each country where government

officials inspect imported products and levy tariffs.

◘ Nontariff trade barrier- government policy, regulation, or procedure that

impedes trade through means other than explicit tariffs

Example-

Copyright © 2017 Pearson Education, Inc. 11 | Page

● Quota - a quantitative restriction placed on imports of a specific product

over a specified period of time.

◘ Investment barriers target FDI thus restricting foreign firm operations.

■Government intervention alters the competitive landscape- by hindering or helping the

ability of its indigenous firms to compete internationally

■ Firms, labor unions, and other special interest groups convince governments to adopt

policies that benefit them-

■ Examples of Protectionism Hindering Competitiveness-

◘ U.S. tariffs on imported steel:

● 2000s- The Bush administration imposed tariffs on the import of foreign

steel into the U.S. because tough competition from foreign steel manufacturers

had bankrupted several U.S. steel firms, and this measure was to allow the U.S.

steel industry time to restructure and revive itself.

● U.S. jobs were saved at the expense of higher material costs, making

these firms less competitive domestically and globally, and increasing the

production costs for downstream firms that use steel, such as Ford, Whirlpool, and

General Electric.

● The steel tariffs were removed within two years, but only after causing

significant harm.

◘ Japanese voluntary export restraints:

● 1980s- The number of Japanese vehicle imports were voluntarily

controlled by Japan to help insulate the U.S. auto industry.

● In this protected environment, Detroit automakers had less of an incentive

to improve quality, design, and overall product appeal.

● Thus, government intervention motivated by protectionism weakened

Detroit’s ability to compete in the global auto industry.

■ Protectionist policies may also lead to price inflation- when supply is restricted, domestic

prices increase.

■ By restricting variety, tariffs may also reduce the choices available to buyers.

■ In a complex world, there are adverse unintended consequences- thus due diligence-

careful planning and implementation- is paramount when considering government

intervention.

RATIONALE FOR GOVERNMENT INTERVENTION: FOUR REASONS

■ There are four main motives for government intervention:

(1) Generate revenue

■ Example- the “Hamilton Tariff,” enacted July 4, 1789, was the second statute passed

by the newly founded United States, providing revenue for the federal government.

■ Today, Ghana and Sierra Leone generate more than 25% of their total government

revenue from tariffs.

Copyright © 2017 Pearson Education, Inc. 12 | Page

(2) Ensure citizen safety, security, and welfare

■ Example- governments pass laws to prevent importation of harmful products such

as contaminated food.

(3) Pursue economic, political, or social objectives

■ In most cases, tariffs and similar forms of intervention are intended to promote job

growth and economic development.

(4) Serve company and industrial interests

■ Governments may devise regulations to stimulate development of home-grown

industries.

■ Special interest groups often serve as strong advocates for trade and investment

barriers that protect their interests.

■ Example- U.S. vs. Mexico

◘ Trade dispute - the U.S. government imposed a $50 per ton duty on the import

of Mexican cement after U.S. cement makers lobbied the U.S. Congress.

◘ Mexican imports can comprise 10% of U.S. domestic cement consumption.

◘ Mexico proposed substituting import quotas instead of the tariffs.

◘ The two governments have negotiated for years to resolve this dispute.

■ Rationale for trade and investment barriers fall into two major categories: defensive and

offensive.

■ Defensive barriers are imposed to safeguard industries, workers, special interest

groups, and to promote national security.

■ Offensive barriers are imposed to pursue a strategic or public policy objectives, such

as increasing employment or generating tax revenues.

DEFENSIVE RATIONALE

■ Four major defensive motives:

[1] PROTECTION OF THE NATIONAL ECONOMY

Proponents Argue:

●Firms in advanced economies cannot compete with those in developing

countries that employ low-cost labor, thus governments should impose trade barriers to

block low-priced imports.

● Fear is that advanced-economy manufacturers will be undersold, wages

will fall, and home country jobs will be lost.

Critics Argue:

●Protectionism is at odds with the theory of comparative advantage, which

argues for more international trade, not less- b/c trade barriers interfere with country-

specific specialization of labor, thus blocking the opportunity for superior living standards.

● Blocking imports reduces the availability and increases the cost of

products sold in the home market.

Copyright © 2017 Pearson Education, Inc. 13 | Page

● Protectionism may trigger retaliation, where foreign governments impose

their own trade barriers, reducing sales prospects for exporters

[2] PROTECTION OF AN INFANT INDUSTRY

● Emerging industry firms may lack experience, technological expertise and

economies of scale.

● Therefore, an infant industry may need protection from foreign

competitors, e.g. temporary trade barriers on foreign competitors

● Infant industry protection has allowed some countries to develop modern

industrial sectors

Examples-

● Japan became extremely competitive in global automobiles

● South Korea achieved great success in consumer electronics.

● U.S. government imposed tariffs on the import of inexpensive Chinese-

made solar cells to protect the emerging U.S. solar power industry.

Challenges-

■ Difficult to remove- industry owners and workers tend to lobby to preserve government

incentives indefinitely.

■ Infant industries (especially in Latin America, South Asia, and Eastern Europe) have

remained dependent on government protection for prolonged periods.

■ Industry inefficiencies result in higher taxes and higher prices for the products produced

by the protected industry.

[3] NATIONAL SECURITY

■ Countries impose trade restrictions on products viewed as critical to national defense

and security, such as military technology and computers.

■ Trade barriers can help retain domestic production in security-related products-

computers, weaponry, and certain transportation equipment.

Example-

◘ Russia blocked a bid by Siemens (German engineering giant) to purchase the

Russian turbine manufacturer OAO Power Machines, due to national security.

■ Export controls- governments manage/prevent the export of certain products or trade

with specific countries.

Examples-

◘ Many countries do not allow the export of plutonium to North Korea because it

can be used to make nuclear weapons.

◘ The U.S. generally blocks exports of nuclear and military technology to countries

it deems state sponsors of terrorism, such as Iran, and Syria.

[4] NATIONAL CULTURE AND IDENTITY

■ Governments seek to protect certain occupations, industries, and public assets that are

considered central to national culture and identity- restrict/prohibit certain imports-

Examples-

Copyright © 2017 Pearson Education, Inc. 14 | Page

◘ U.S. opposed Japanese investors’ purchase of the Seattle Mariners baseball

team, Pebble Beach golf course in California, and New York’s Rockefeller Center-

because these are viewed as part of the national heritage.

◘ France does not allow significant foreign ownership of its TV stations because

of concerns about foreign influences on French culture.

◘ Switzerland imposed trade barriers to preserve its long-established tradition in

watch making.

◘ Japanese restrict the import of rice because this product is central to the nation’s

diet and food culture.

OFFENSIVE RATIONALE

■ Two offensive categories:

[1] NATIONAL STRATEGIC PRIORITIES

■ Intervention encourages the development of industries that bolster the nation’s

economy.

■ This is a proactive variation of the infant industry rationale, related to national industrial

policy.

■ Countries with many high-tech or high-value-adding industries—such as information

technology, pharmaceuticals, car manufacturing, or financial services—create better jobs

and higher tax revenues than economies based on low-value-adding industries—such as

agriculture, textile manufacturing, or discount retailing.

■ Examples- Germany, South Korea, Japan, Norway—devise policies that promote the

development of more desirable industries.

■ Implementation:

◘ Financing for investment in high-tech or high-value-adding industries

◘ Encourage citizens to save money to ensure a steady supply of loanable funds

for industrial investment

◘ Fund public education to provide citizens the skills and flexibility needed to

perform in key industries

■ Deciding which industries to support is challenging because it is difficult to predict which

industries will produce comparative advantages. Poor choices may result in continuous

subsidization of underperforming industries.

[2] INCREASING EMPLOYMENT

■ Import barriers may be imposed to protect employment in designated industries.

■ By insulating domestic firms from foreign competition, national output is stimulated,

leading to more jobs in the protected industries.

■ Most effective- import-intensive industries that employ much labor to produce normally

imported products. Example- A joint venture between Shanghai Automotive Industry

Corporation (SAIC) and Volkswagen created jobs in China.

Copyright © 2017 Pearson Education, Inc. 15 | Page

INSTRUMENTS OF GOVERNMENT INTERVENTION

■ Exhibit 7.2 highlights most common forms of government intervention and their effects.

(Great table)

■ Traditional forms of protectionism are tariffs and nontariff trade barriers.

■ Barriers can be imposed by individual countries or groups of countries, such as the

European Union (http://europa.eu)

■ United Nations estimates that trade barriers alone cost developing countries over $500

billion in lost trading opportunities with developed countries every year.

Tariffs

■ Export tariffs- taxes on products exported by domestic firms

Example- Russia charges a duty on oil exports, intended to generate government

revenue and maintain higher oil stocks within Russia.

■ Import tariff (most common) - tax levied on imported products.

■ Ad valorem tariffs are assessed as a percentage of the value of the imported product.

■ Specific tariff—a flat fee or fixed amount per unit of the imported product—based on

weight, volume, or surface area (such as barrels of oil or square meters of fabric).

■ Revenue tariff - intended to raise revenue for the government, e.g. taxing cigarette

imports.

■ Protective tariff - protects domestic industries from foreign competition.

■ Prohibitive tariff - is so high that no one can import any of the items.

■ Harmonized code (harmonized tariff) – tariffs determined according to this

synchronized worldwide system that classifies products according to 8,000 unique codes

and assigns standardized tariffs accordingly

■ Developing economies- tariffs are common.

■ Advanced economies- tariffs still provide a significant source of revenue.

Shoes and Tariffs

■ Interestingly, The U.S. collects high tariffs (often 48%) on imports of low-end shoes,

and low tariffs (just 9%) on luxury shoes. Low-income shoe buyers end up paying the

highest tariffs.

■ Ask your students why this is the case… why would the U.S. discourage low-end

shoes? Sweatshop; child labor issues?

■ The European Union applies tariffs of up to 191% on meat, 118% on cereals, and 106%

on sugar and confectionary products.

■ Exhibit 7.3 provides a sample of import tariffs in selected countries.

■ Under the North American Free Trade Agreement (NAFTA), Canada, Mexico, and

the U.S. have eliminated nearly all tariffs on product imports from each other. However,

Copyright © 2017 Pearson Education, Inc. 16 | Page

Mexico maintains significant tariffs with the rest of the world—19.7% for agricultural

products and 5.9% for nonagricultural goods.

■ India’s tariff system lacks transparency. Tariffs are high, especially in agriculture-

33.5%.

■ China- reduced tariffs significantly since joining the WTO in 2001, (World Trade

Organization, www.wto.org) but trade barriers remain high in some areas.

■ Africa- over half of all workers are employed in agriculture. Significant tariffs and other

trade barriers in the advanced economies hinder imports of agricultural goods from Africa,

which worsens already severe poverty in African countries.

■ Governments realize that high tariffs inhibit free trade and economic growth, thus have

tended to reduce tariffs over time- in fact this was the primary goal of the General

Agreement on Tariffs and Trade (GATT; now the WTO).

■ Countries as diverse as Chile, Hungary, Turkey, and South Korea have liberalized their

previously protected markets, lowering trade barriers and subjecting themselves to

greater competition from abroad.

■ Exhibit 7.4 illustrates trends in average world tariff rates over time. Notice that

developing economies have been lowering their tariff rates since the 1980s.

Major driver of market globalization- continued tariff reductions.

Nontariff Trade Barriers

■ Government policies that restrict trade without imposing a direct tax or duty - quotas,

import licenses, local content requirements, government regulations, and administrative

or bureaucratic procedures

■ The use of nontariff barriers has grown substantially in recent decades- they are easier

to conceal from the WTO and other monitoring organizations.

■ Quotas restrict the physical volume or value of products that firms can import into a

country.

■ The upside is that domestic producers are protected from cheaper imports, giving them

a competitive edge over foreign producers.

■ The downside is that domestic consumers and producers of certain types of products

pay more for the product.

■ It also means that firms that manufacture products containing the higher-priced product

can save money by moving production to countries that do not impose quotas or tariffs

on this product.

■ Voluntary export/import restraints (VERs/VIRs) are voluntary quotas imposed by

governments whereby firms agree to limit exports/imports of certain products.

■ Example- EU impounded the Chinese-made clothing when China exceeded the

voluntary import quotas it had negotiated with the EU; millions of Chinese-made garments

piled up at European ports/borders; European retailers were challenged having ordered

their clothing inventory several months in advance.

Copyright © 2017 Pearson Education, Inc. 17 | Page

■ Import license - government permission to import, which restricts imports similarly to

quotas- a costly, complicated, bureaucratic process in some countries

■ Note: Different from licensing a strategy for entering foreign markets in which one firm

allows another the right to use its intellectual property in return for a fee.

■ Governments sell import licenses to firms on a competitive basis or on a first-come,

first-served basis - a process that discriminates against smaller firms, which typically lack

the resources to purchase the licenses.

■ Examples-

◘ Russia- a complex web of licensing requirements limits imports of alcoholic

beverages.

◘ India- until the 1990s, the government imposed the “license raj,” an especially

elaborate system of licenses that regulated establishing/running businesses in the

country.

■ Local content requirements stipulate that production must include a certain

percentage of local value added production, i.e. locally produced.

■ These are usually imposed in economic bloc countries, such as the European Union

and NAFTA. The so called “rules of origin requirement” specifies that a certain

proportion of products and supplies, or of intermediate goods used in local manufacturing,

must be produced within the bloc.

◘ Example- about 60% of the value of a car manufactured within NAFTA must

originate within the NAFTA member countries, if not, then the product becomes subject

to the tariffs charged to non-NAFTA countries.

■ Government regulations and technical standards include safety regulations for

motor vehicles and electrical equipment, health regulations for hygienic food preparation,

labeling requirements that indicate a product’s country of origin, technical standards for

computers, and bureaucratic procedures for customs clearance.

■ Examples of protecting domestic firms by imposing red tape for foreign firms:

◘ European Union strictly regulates genetically modified (GM); a policy that blocks

some food imports into Europe from the U.S. b/c GM food regulations are relatively lax in

the U.S.

◘ China requires foreign firms to obtain special permits to import GM foods.

◘ Chinese government clashed with Google when it refused to censor its Web

search and news services in mainland China. The government has historically censored

material it considers subversive, which has hindered Google’s attempts to enter China’s

huge Internet market.

ADDITIONAL EXAMPLES:

◘ China, Japan, and Taiwan require that imported agricultural products undergo

strict testing, a process that may require considerable time and expense

◘ Japan prohibited the import of snow skis on the unlikely grounds that Japanese

snow is different from snow in other countries.

◘ Canada is officially bilingual (English and French), the provincial government of

Quebec requires that all product labeling be in French.

Copyright © 2017 Pearson Education, Inc. 18 | Page

◘ A requirement that products indicate their country of origin may constitute a

barrier because people may prefer to buy domestic products.

■ Administrative or bureaucratic procedures that hinder the activities of importers or

foreign firms

■ Examples-

◘ India- business sector is burdened by countless regulations, standards, and

administrative hurdles at the state and federal levels.

◘ Mexico- government imposed bureaucratic procedures led United Parcel

Service to temporarily suspend its ground delivery service across the U.S.- Mexican

border.

◘ U.S. barred Mexican trucks from entering the U.S. on the grounds that they were

unsafe.

◘ Saudi Arabia- every foreign business traveler to the Arab kingdom must hold an

entry visa that can be obtained only by securing the support of a Saudi sponsor - a citizen

who vouches for the visitor’s actions- very difficult to get.

ADDITIONAL EXAMPLES:

◘ France- government restricted the import of Japanese video recording

equipment by requiring that it be cleared through a single customs office in Poitiers, a

town in the middle of France.

◘ Africa/Latin America - commercial activities and business start-ups hindered

by countless bureaucratic procedures

■ By Contrast:

◘ Australia, Canada, Ireland, New Zealand, Singapore, and the United Kingdom

impose relatively few such procedures.

■ The revenue generated by tariffs depends on how customs authorities classify imported

products - thousands of categories exist for customs classification, a product can be

easily misclassified, either by accident or intent.

■ Example- a sport utility vehicle could be classified as a truck, a car, or a van. Each of

these categories can entail a different tariff.

Investment Barriers

■ In order to bypass tariffs, firms may enter countries via FDI, yet be subject to ownership

restrictions.

■ Globally, FDI and ownership restrictions are common in industries such as

broadcasting, utilities, air transportation, military technology, and financial services, as

well as industries that involve major government holdings, such as oil and key minerals.

■ Examples-

◘ Mexico- government restricts FDI by foreign investors to protect its oil industry,

which is deemed critical to the nation’s security.

◘ Canada- government restricts foreign ownership of local movie studios and TV

networks to protect its indigenous film and TV industries from excessive foreign influence.

Copyright © 2017 Pearson Education, Inc. 19 | Page

◘Services sector - FDI and ownership restrictions are particularly burdensome

because services usually cannot be exported and providers must establish a physical

presence in target markets.

■ Smuggling may be an unintended consequence.

Currency controls

■ Restrictions on the outflow of hard currency (such as the U.S. dollar, the euro, and the

yen), or the inflow of foreign currencies

■ These controls are used to conserve valuable hard currency, reduce the risk of capital

flight, and are particularly common in developing countries.

■ Dual official exchange rates- Some countries employ a system of offering exporters

a relatively favorable rate to encourage exports, while importers receive a relatively

unfavorable rate to discourage imports.

■ Help and Hinder- Currency controls favor companies when they export their products

from the host country but harm those that rely heavily on imported parts and components.

■ Repatriation of profits– restrictions on revenue transfer from profitable operations back

to the home country.

■ Example-

◘ Venezuela- currency controls have led to a shortage of dollars and other hard

currencies. Multinational firms avoid doing business in Venezuela because strict currency

rules limit the amount of profits they can take out of the country or limit their ability to

receive payment for imports at reasonable prices. Venezuela imposed the controls to

keep imports inexpensive and retain a base of hard currencies in the country.

ADDITIONAL EXAMPLE:

◘ Colombia- international investors who wish to buy stocks and bonds must make

a refundable deposit of 40% of their total investment with the Banco de la Republica

(www.banrep.gov.co), the central bank of Colombia, for a minimum of six months, which

allows monetary authorities monitor the inflow and outflow of foreign investments and

helps ensure foreign funds will not be used for speculative activities.

Subsidies and Other Government Support Programs

■ Subsidies - Monetary or other resources that a government grants to a firm or group

of firms, intended to encourage exports or to facilitate the production and marketing of

products at reduced prices, to ensure the involved firms prosper.

■ Examples-

Cash disbursements, material inputs, services, tax breaks, infrastructure construction,

and inflated government contracts.

■ Examples-

◘ France- government provided large subsidies to Air France, the national airline.

◘European government support of Airbus, the leading European manufacturer of

commercial aircraft

Copyright © 2017 Pearson Education, Inc. 20 | Page

◘ China- Several leading corporations, such as China Minmetals ($39 billion

annual sales) and Shanghai Automotive ($34 billion annual sales), are state enterprises

wholly or partly owned by the Chinese government, which provides these firms with huge

financial resources.

■ Critics – unfair advantages- subsidies artificially reduce the cost of business for the

recipient. The WTO prohibits subsidies when it can be proven that they hinder free trade.

■ Example-

◘ India- government provides massive subsidies to state-owned oil companies,

which allows them to offer gasoline at very low prices. Foreign MNEs such as Royal Dutch

Shell cannot operate profitably at such prices and consequently avoid doing business in

that market.

■ Subsidies encourage overproduction, which lower domestic food prices, making

agricultural imports from developing countries less competitive.

■ Difficult to Define- when a government provides land, infrastructure,

telecommunications systems, or utilities to corporate park firms, this is technically a

subsidy- yet many would argue that this is just an appropriate public function

■ European and U.S. governments provide agricultural subsidies to supplement the

income of farmers and help manage the supply of agricultural commodities.

●The U.S. government grants subsidies for over two dozen commodities,

including corn, soybeans, wheat, cotton, and rice.

●In Europe, the Common Agricultural Policy (CAP) is a system of subsidies

that represents about 40% of the EU's budget, amounting to tens of billions of

euros annually.

■ Countervailing duties - government retaliation against foreign subsidies by imposing

a duty on imported products to offset subsidies in the exporting country.

◘ The duty cancels out the effect of the subsidy.

■ Dumping - subsidies may allow a manufacturer to engage in dumping, which is

charging an unusually low price for exported products, typically lower than that for

domestic or third-country customers, or even lower than manufacturing cost.

■ Example - The EU subsidy to sugar producers allows EU farmers to dump massive

amounts of sugar at artificially low prices onto world markets, making them the largest

exporters of sugar- without the subsidies Europe would be one of the world’s biggest

sugar importers.

■ Dumping is against WTO rules because it amounts to unfair competition, but it is hard

to prove.

■ A large MNE that charges very low prices could conceivably drive competitors out of a

foreign market, thereby achieving a monopoly, and later raise its prices.

■ Antidumping duty - a tax imposed on products deemed to be dumped and causing

injury to producers of competing products in the importing country.

■ The WTO allows this practice.

Copyright © 2017 Pearson Education, Inc. 21 | Page

■ Examples of indirect government subsidies- support home country businesses by

funding R&D initiatives, granting tax exemptions, and offering business development

services, such as market information, trade missions, and privileged access to key foreign

contacts.

■ Agency Examples-

◘ Canada- the Department of Foreign Affairs and International Trade (www.dfait-

maeci.gc.ca)

◘ United Kingdom- U.K. Trade & Investment (www.uktradeinvest.gov.uk)

◘ U.S. - the International Trade Administration of the U.S. Department of

Commerce (www.doc.gov)

■ Investment incentives- related to subsidies- transfer payments or tax concessions

made directly to individual foreign firms to entice them to invest in the country.

■ Examples-

◘ Hong Kong government put up most of the cash to build the Hong Kong Disney

Park (park.hongkongdisneyland.com). While the theme park and facilities cost about

$1.81 billion, the government provided an investment of $1.74 billion to Walt Disney to

develop the site.

◘ Austin, Texas and Albany, New York competed to have the Korean manufacturer

Samsung Electronics (www.samsung.com) build a semiconductor plant in their regions.

Austin offered $225 million worth of tax relief and other concessions in its successful bid

to attract Samsung's $300 million plant, estimated to create nearly 1,000 new jobs locally.

◘ Macedonia entices MNEs with incentives such as low corporate taxes,

immediate access to utilities and transportation, and financial support for training workers

(www.investinmacedonia.com).

◘ 1990s- Germany encouraged foreign firms to invest in the economically

disadvantaged East German states by providing tax and investment incentives.

◘ 1990s- Ireland achieved an economic renaissance through proactive promotion

of Ireland as a place to do business. Targeting foreign firms in the high-tech sector—

including medical instruments, pharmaceuticals, and computer software- foreign firms

were offered preferential corporate tax rates of 12%.

■ Government procurement policies support domestic industries and constitute an

indirect form of nontariff trade barrier.

■ Government procurement policies restrict government-funded purchases to home-

country suppliers.

■Example- Several governments require that air travel purchased with government funds

be with home-country carriers.

■ Government procurement policies are common in countries with large public sectors,

such as China, Russia, and various Middle Eastern countries.

■ U.S. - government agencies favor domestic suppliers unless their prices are higher than

foreign suppliers.

Copyright © 2017 Pearson Education, Inc. 22 | Page

■ Japan- government agencies often do not even consider foreign bids, regardless of

pricing.

EVOLUTION AND CONSEQUENCES OF GOVERNMENT INTERVENTION

■ Trade barriers, two World Wars and the Great Depression shaped the trading

environment of the twentieth century.

■ 1930 - Smoot-Hawley Tariff Act - raised U.S. tariffs to more than 50% (compared to

only about 4% today).

■ 1940s - Prudent international trade policies reduced worldwide tariffs

Protectionist Policies

■ Import substitution - substituting local production for imports - Government-supported

local enterprises producing previously imported products

◘ Example- 1950s- Latin America adopted protectionist policies aimed at

industrialization and economic development. With protected industries requiring ongoing

subsidies, most countries experimenting with import substitution eventually rejected it.

■ Protectionist Policies- did not succeed. Domestic firms that enjoyed government

subsidies and the protection of high tariffs never became competitive in world

markets. Living standards remained relatively low.

■ Export- led development -1970s - Singapore, Hong Kong, Taiwan, and South Korea,

Malaysia, Thailand, and Indonesia achieved rapid economic growth by encouraging the

development of export-intensive industries. Their model proved much more successful

than import substitution. Living standards improved and a rising middle class helped

transform these countries into competitive economies.

■ Japanese miracle - Following World War II, Japan launched an ambitious program of

export-led development and national strategic policies- tariffs that protected Japan’s

infant industries- automobiles, shipbuilding, and consumer electronics, resulting in

Japan’s rise from poverty in the 1940s to become one of the world’s wealthiest countries

by the 1980s.

■ Both China and India have long sheltered themselves through protectionism and

government intervention, relying on centralized economic planning, in which

agriculture and manufacturing were controlled by state-run industries.

■ China –

◘ 1949- Mao Tse Tung established a communist regime.

◘ China - centralized economic planning- agriculture and manufacturing were

controlled by inefficient state-run industries- focus on national self-sufficiency- China

closed to international trade.

Copyright © 2017 Pearson Education, Inc. 23 | Page

◘ 1990s- China began to liberalize its economy.

◘ 1992 - China joined the Asia-Pacific Economic Cooperation (APEC) group, a

free-trade organization.

◘ 2001 -China joined the WTO and committed to reducing trade barriers and

increasing intellectual property protections.

◘ 2008- China’s GDP was more than ten times the 1978 level, and the value of

exports had reached $1.5 trillion.

◘ 2012- GDP was more than ten times the 1995 level, and the value of exports

had reached nearly $1.9 trillion.

◘ 2015- GDP was more than ten times the 1998 level, and the value of exports

had reached $2.2 trillion.

◘ China has become a leading exporter of manufactured products and home to

large MNEs that compete with western firms.

■ India -

◘ Independence from Britain in 1947

◘ Adopted a quasi-socialist model of isolationism and strict government control.

◘ Poor economic performance due to high trade and investment barriers, state

intervention in labor and financial markets, a large public sector, heavy regulation of

business, and central planning.

◘ Early 1990s - markets opened to foreign trade and investment, free-trade

reforms, privatization of state enterprises.

◘ Trade liberalization and privatization of state enterprises fueled economic

progress.

◘ Between 2000 and 2015, India’s average annual income rose from about $470

in real terms to more than $1,800 in 2015, an impressive achievement.

General Agreement on Tariffs and Trade (GATT)

■ 1947- 23 nations signed the General Agreements on Tariffs and Trade (GATT), the first

major effort to systematically reduce trade barriers worldwide.

■ GATT created:

(1) A process to reduce tariffs among member nations- through continuous

negotiations;

(2) An agency to serve as a watchdog over world trade; and

(3) A forum for resolving trade disputes.

■ GATT introduced the concept of most favored nation (renamed normal trade

relations in 1998), according to which each signatory nation agreed to extend the tariff

reductions covered in a trade agreement with a trading partner to all other countries- A

concession to one country became a concession to all.

■ 1995, the GATT was superseded by the WTO, and grew to include 150 member

nations- historically- resulted in the greatest global decline in trade barriers.

Copyright © 2017 Pearson Education, Inc. 24 | Page

■ 2008- The global financial crisis arose largely from inadequate regulation and

enforcement of current regulations in the banking and finance sectors- and raised new

questions about government’s role in business and the world economy

■ Governments around the world are increasing regulation and examining ways to

improve enforcement.

■ Increasing Protectionism to safeguard jobs and wages

■ Examples-

◘ Argentina and Brazil increased import tariffs on numerous products.

◘ Russia raised tariffs on dozens of goods, including cars and combine harvesters.

◘ United Kingdom- Government provided substantial subsidies to U.K. banks and

financial institutions.

◘ China pumped hundreds of billions of dollars into its own economy

◘ U.S. government has increased the power of its Treasury Department, Federal

Reserve System, and Federal Deposit Insurance Corporation (FDIC).

◘ The European Central Bank is creating a new agency that aims to take

aggressive action in needed areas.

◘ The European Union is increasing oversight of multinational banks and

supervision of financial institutions.

◘ The United Nations has called for greater transparency in financial activities

and closure of loopholes that allow excessive speculation in global finance.

◘ The EU granted over $50 billion in aid to Daimler (Germany), Skoda (Czech

Republic), and other struggling carmakers in Europe.

◘ U.S. government provided billions to banks and carmakers in the U.S.

■ Rising protectionism has impacted international commerce

■ Ripple effects of government reforms extend well beyond the banking and financial

areas.

■ Exhibit 7.5 illustrates the relationship among Tariffs, World GDP, and the Volume of

World Trade, demonstrating that while average tariffs have declined (Exhibit 7.4), world

trade and GDP have flourished.

■ Growth of Global Commerce/International Trade:

◘ Driver- Decreasing Trade Barriers

◘ Consequence- Rising Global Incomes/Poverty Reduction

◘ Consequence- Improved Firm Performance

■ Effects- Government Intervention may be measured by a nation’s Ease of Doing

Business, an index developed by the World Bank that ranks 189 countries.

■ A high ease of doing business ranking means the country’s regulatory environment is

business-friendly; very conducive to starting and operating a company there.

Copyright © 2017 Pearson Education, Inc. 25 | Page

■ Ease of Doing Business Index

10 variables are rated per country for a total ranking index:

●Starting a business

●Dealing with construction permits

●Getting electricity

●Registering property

●Getting credit

●Protecting minority investors

●Paying taxes

●Trading across borders

●Enforcing contracts

●Resolving insolvency

■ Exhibit 7.6 illustrates the ease of doing business for each country.

■ Business-Friendly Countries

●The “easiest” countries are advanced economies that enjoy high living standards.

●The “easiest” group also includes emerging markets that have simplified their

regulatory environment in an effort to encourage entrepreneurship and investment.

■ Business- Less-Friendly Countries

●The “moderately hard” and “hardest” countries are relatively difficult places to do

business, and characterized by severe poverty and other hardships.

Ethical Concerns

■ Government intervention and trade barriers disproportionately impact developing

economies and low-income consumers because countries such as Bangladesh,

Pakistan, India, Cambodia and Africa- where clothing and shoe exporters are

concentrated- are taxed at relatively higher levels than UK imports- U.S. import tariffs on

clothing and shoes exceed 20%.

■The tariffs that confront less-developed economies are often several times those faced

by the richest countries.

■ Government intervention can also offset harmful effects- create or protect jobs:

◘ Example- Globalization has affected thousands of European workers whose

jobs have been shifted to other countries with lower labor costs. The European

governments have provided subsidies for the unemployed, aimed at retraining workers to

upgrade their job skills or find work in other fields.

HOW FIRMS CAN RESPOND TO GOVERNMENT INTERVENTION

■ Firms must cope with protectionism and other forms of intervention- impractical to avoid

markets with high trade and investment barriers or excessive government intervention.

■ Industries particularly susceptible to government intervention:

●Aluminum

●Petroleum

●Food-processing

Copyright © 2017 Pearson Education, Inc. 26 | Page

●Biotechnology

●Pharmaceutical

Strategies for Managers

■ Emerging markets, e.g. China, India, and countries in Africa, Asia, Latin America, are

characterized by extensive trade barriers and never-ending government intervention.

■ Despite the challenges, firms target emerging markets and developing economies

because they promise significant long-term potential.

(1) RESEARCH TO GATHER KNOWLEDGE AND INTELLIGENCE

■ Firms should first undertake research to understand the extent and nature of trade and

investment barriers abroad.

■ Scan the business environment to identify the nature of government intervention, plan

market-entry strategies and host-country operations, and capitalize upon government

support opportunities.

■ Review return-on-investment criteria to account for the increased risk/cost of trade and

investment barriers

■ Example- EU is devising new guidelines that affect firms in areas ranging from product

liability laws to standards for investment in European industries.

(2) CHOOSE THE MOST APPROPRIATE ENTRY STRATEGIES

■ Exporting- Tariffs and most nontariff trade barriers

■ FDI - Investment barriers

■ Most firms choose exporting as their initial entry strategy. However, if high tariffs are

present, managers should consider other strategies, such as FDI, licensing, and joint

ventures that allow the firm to operate directly in the target market, avoiding import

barriers.

◘ Example-Taiwan’s Foxconn, a contract manufacturer for Apple and other

electronics firms, built a factory in Brazil to avoid the high import tariffs.

■ Even FDI can be impacted by tariffs- if it requires importing raw materials and parts to

manufacture finished products in the host country.

■ Tariffs often vary with the form of an imported product.

◘ Companies often ship manufactured products “knocked-down” and assemble

them in the target market.

◘ In countries with relatively high tariffs on imported personal computers, importers

often bring in the parts and assemble the computers locally.

◘ Example- Eastman Kodak (www.kodak.com) imports parts into the U.S. to

manufacture photographic equipment, thereby avoiding higher import tariffs applicable

to finished goods.

(3) TAKE ADVANTAGE OF FOREIGN TRADE ZONES

■ Governments establish foreign trade zones (FTZs; free trade zones or free ports) in an

effort to create jobs and stimulate local economic development.

Copyright © 2017 Pearson Education, Inc. 27 | Page

■ Products brought into an FTZ are not subject to duties, taxes, or quotas until they, or

the products made from them, enter into the non-FTZ commercial territory of the country

where the FTZ is located.

■ Firms use FTZs to assemble foreign dutiable materials and components into finished

products, which are then re-exported.

■ Firms may use FTZs to manage inventory of parts, components, or finished products

that the firm will eventually need at some other location.

■ Example- Japanese carmakers store vehicles at the port of Jacksonville, Florida,

without having to pay duties until the cars are shipped to U.S. dealerships.

■ FTZs exist in more than 75 countries, usually near seaports or airports.

■ The U.S. is home to several hundred FTZs used by thousands of firms.

■ Located on the Atlantic side of the Panama Canal, the Colon Free Zone

(www.colonfreezone.com) is an enormous FTZ where products are imported, stored,

modified, repacked, and re-exported without being subject to tariffs or customs

regulations.

■ Example- A successful experiment with FTZs has been the maquiladoras—export-

assembly plants in northern Mexico along the U.S. border that produce components and

finished products destined for the U.S. - e.g. clothing, furniture, car parts, electronics, etc.

■ Now under NAFTA (North American Free Trade Agreement), the collaboration enables

firms from the U.S., Asia, and Europe to tap low-cost labor, favorable duties, and

government incentives, while serving the U.S. market.

■ Maquilas account for about half of Mexico’s exports

(4) SEEK FAVORABLE CUSTOMS CLASSIFICATIONS FOR EXPORTED PRODUCTS

■ Reduce exposure to trade barriers by classifying products according to the appropriate

harmonized product code.

■ Since many products can be classified in several categories, ensure that the exported

products are classified under the lowest tariff code.

■ Example- Some telecommunications equipment can be classified as electric

machinery, electronics, or measuring devices.

■ Manufacturers may also modify the exported product in a way that classifies it according

to the lowest tariff code, thereby minimizing trade barriers.

■ Example- South Korea faced a quota on the export of non-rubber footwear to the U.S.

- by shifting manufacturing to rubber-soled shoes, Korean firms greatly increased their

footwear exports

(5) TAKE ADVANTAGE OF INVESTMENT INCENTIVES AND OTHER GOVERNMENT

SUPPORT PROGRAMS

■ Government assistance in the form of subsidies and incentives is another strategy for

reducing the cost of trade and investment barriers.

■ Examples-

◘ Mercedes- built a factory in Alabama, it benefitted from reduced taxes and direct

subsidies provided by the Alabama state government.

Copyright © 2017 Pearson Education, Inc. 28 | Page

◘ Siemens- built a semiconductor plant in Portugal; it received subsidies from the

Portuguese government and the EU. These incentives covered nearly 40% of Siemen’s

investment and training costs.

◘ Governments in Europe, Japan, and the U.S. increasingly provide incentives to

companies that set up shop within their borders

■ Incentives also include reduced utility rates, employee training programs, tax holidays,

and construction of new roads and communications infrastructure.

(6) LOBBY FOR FREER TRADE AND INVESTMENT

Increasingly, nations are liberalizing markets in order to create jobs and increase tax

revenues.

■ Firms can lobby foreign governments to lower trade and investment barriers.

■ Foreign firms often hire former government officials to help lobby their former colleagues

■ Examples-

●Japanese- have achieved much success in reducing trade barriers by lobbying

U.S. and European governments.

●China- domestic and foreign firms lobby the government to relax protectionist

policies and regulations that make China a difficult place to do business. Foreign firms

often hire former Chinese government officials to help lobby their former colleagues.

■ The private sector lobbies federal authorities to undertake government-to-government

trade negotiations, aimed at lowering barriers.

■ Private firms bring complaints to world bodies, e.g. the WTO, to address unfair trading

practices of key international markets.

MyManagementLab: Watch It!

Government Intervention: Spotlight on China and Germany

Apply what you have learned in this chapter by watching a video on government

intervention in two nations with distinctive political and legal systems.

Go to MyManagementLab; click on your course; click on Multimedia Library

REGIONAL INTEGRATION AND ECONOMIC BLOCS

■ Governments play an important role in facilitating:

■ Regional economic integration (regional integration), refers to the growing economic

interdependence that results when two or more countries within a geographic region form

an alliance aimed at reducing barriers to trade and investment.

■ Example- European Union (EU) formation- regional integration increases economic

activity and makes doing business easier among nations within the alliance.

■ Economic bloc members are at a minimum parties to free trade agreement.

■ Free trade agreement- formal arrangement between two or more countries to reduce

or eliminate tariffs, quotas, and barriers to trade in products and services

Copyright © 2017 Pearson Education, Inc. 29 | Page

■ 50% (more than) of world trade today is under some form of (bloc) preferential trade

agreement.

■ Premise- mutual advantages for cooperating nations within a common geography,

history, culture, language, economics, and/or politics

■The free trade that results from economic integration helps nations attain higher living

standards by encouraging specialization, lower prices, greater choices, increased

productivity, and more efficient use of resources.

■ Regional Economic Integration Bloc or Economic Bloc- a geographic area that

consists of two or more countries that agree to pursue economic integration by reducing

tariffs and other restrictions to cross-border flow of products, services, capital, and, in

more advanced stages, labor.

■ Examples of Regional Integration-

●European Union (EU)

●North American Free Trade Agreement (NAFTA)- Canada, Mexico, and the U.S.

■ Example- EU

◘ More advanced economic bloc

◘ Permits the free flow of capital, labor, and technology among their member

countries

◘ Harmonizing monetary policy (to manage the money supply and currency

values) and fiscal policy (to manage government finances, especially tax revenues)

■ Still, recent crises in Greece, Italy, Spain, and Portugal, and general discord among

EU members, are challenging the progress of regional integration in Europe.

INTERNATIONAL BUSINESS CONTINUUM- TWO EXTREMES:

WORLD-WIDE FREE TRADE

World operates as one large free-

trade area in which there are no

tariffs or quotas, all countries use

the same currency, and products,

services, capital, and workers

can move freely among nations

without restriction.

WORLD-WIDE RESTRICTED

TRADE

World of prohibitive barriers to

trade and investment where

countries have separate

currencies and very little

commercial interaction with

each other.

Copyright © 2017 Pearson Education, Inc. 30 | Page

Regional integration is a compromise, a middle-ground along this continuum.

Levels of Regional Integration