Professional Documents

Culture Documents

Economics Tutorial-Sheet-2

Economics Tutorial-Sheet-2

Uploaded by

Saburo SahibOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Economics Tutorial-Sheet-2

Economics Tutorial-Sheet-2

Uploaded by

Saburo SahibCopyright:

Available Formats

3

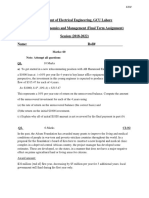

Engineering Economics

Tutorial Sheet 2

1 Payback Period

1.1 Consider the given cash flows:

a. Calculate the payback period for each project.

b. Determine whether it is meaningful to calculate a payback

period for project D.

c. Assuming that calculate the discounted payback period for each

project.

2 NPW Criterion

2.1 Consider the given sets of investment projects, all of which

have a three-year investment life:

a. Compute the net present worth of each project ati= 10%.

b. Plot the present worth as a function of the interest rate

(from 0% to 30%) for project B.

2.2 Your firm is considering purchasing an old office building with an estimated remaining service life of

25 years. Recently, the tenants signed long

long-term

term leases, which leads you to believe that the current

rental income of $150,000 per year will remain constant for the first 5 years. Then the rental income

will increase by 10% for every 5-year

year interval over the remaining life of the asset. For example, the

annual rental income would be $165,000 for years 6 through 10, $181,500 for years 11 through 15,

$199,650 for years 16 through 20, and $219,615 for years 21 through 25. You estimate that operating

expenses, including income taxes, will be $45,000 for the first year and that they will increase by

$3,000 each year thereafter. You also estimate that razing the building and selling the lot on which it

stands will realize a net amount of $50,000 at the end of the 25

25-year

year period. If you had the opportunity

to invest your money elsewhere and thereby earn interest at the rate of 12% per annum, what would be

the maximum amount you would be willing to pay for the building and lot at the present time?

2.3 A large food-processing

processing corporation is considering using laser technology to speed up and eliminate

waste in the potato-peelingg process. To implement the system, the company anticipates needing $3.5

million to purchase the industrial strength lasers. The system will save $1,550,000 per year in labor

and materials. However, it will require an additional operating and maintenance costcost of $350,000.

Annual income taxes will also increase by $150,000. The system is expected to have a 10-year

10 service

life and will have a salvage value of about $200,000. If the company’s MARR is 18%, use the NPW

method to justify the economics of the pro

project.

3 Future Worth and Project Balance

3.1 Consider the following sets of investment projects, all of

which have a three-year

year investment life:

a. Compute the net present worth of each project at i=15%

b. Compute the net future worth of each project at i=15%

c. Which project

roject or projects are acceptable?

3.2 Your R&D group has developed and tested a computer software package that assists engineers to

control the proper chemical mix for the various process manufacturing industries. If you decide to

market the software, your first-year operating net cash flow is estimated to be $1,000,000. Because of

market competition, product life will be about 4 years, and the product’s market share will decrease by

25% each year over the previous year’s share. You are approached by a big software house which

wants to purchase the right to manufacture and distribute the product. Assuming that your interest rate

is 15%, for what minimum price would you be willing to sell the software?

4 Capitalized Equivalent Worth

4.1 Maintenance money for a new building has been sought. Mr. Kendall would like to make a donation to

cover all future expected maintenance costs for the building. These maintenance costs are expected to

be $50,000 each year for the first 5 years, $70,000 each year for years 6 through 10, and $90,000 each

year after that. (The building has an indefinite service life.)

a. If the money is placed in an account that will pay 13% interest compounded annually, how large

should the gift be?

b. What is the equivalent annual maintenance cost over the infinite service life of the building?

4.2 To decrease the costs of operating a lock in a large river, a new system of operation is proposed. The

system will cost $650,000 to design and build. It is estimated that it will have to be reworked every 10

years at a cost of $100,000. In addition, an expenditure of $50,000 will have to be made at the end of

the fifth year for a new type of gear that will not be available until then. Annual operating costs are

expected to be $30,000 for the first 15 years and $35,000 a year thereafter. Compute the capitalized

cost of perpetual service at i= 8%.

5 Mutually Exclusive Alternative

5.1 Two methods of carrying away surface runoff water from a new subdivision are being evaluated:

Method A. Dig a ditch. The first cost would be $60,000, and $25,000 of redigging and shaping would

be required at five-year intervals forever.

Method B. Lay concrete pipe. The first cost would be $150,000, and a replacement would be required

at 50-year intervals at a net cost of $180,000 forever.

At i=12% which method is the better one?

5.2 A local car dealer is advertising a standard 24-month lease of $1,150 per month for its new XT 3000

series sports car. The standard lease requires a down payment of $4,500, plus a $1,000 refundable

initial deposit now. The first lease payment is due at the end of month 1. In addition, the company

offers a 24-month lease plan that has a single up-front payment of $30,500, plus a refundable initial

deposit of $1,000. Under both options, the initial deposit will be refunded at the end of month 24.

Assume an interest rate of 6% compounded monthly. With the present worth criterion, which option is

preferred?

5.3 Two machines are being considered for a manufacturing process. Machine A has a first cost of

$75,200, and its salvage value at the end of six years of estimated service life is $21,000. The

operating costs of this machine are estimated to be $6,800 per year. Extra income taxes are estimated

at $2,400 per year. Machine B has a first cost of $44,000, and its salvage value at the end of six

years’service is estimated to be negligible. The annual operating costs will be $11,500. Compare these

two mutually exclusive alternatives by the present-worth method at i= 13%.

5.4 An electric motor is rated at 10 horsepower (HP) and costs $800. Its full load efficiency is specified to

be 85%. A newly designed high-efficiency motor of the same size has an efficiency of 90%, but costs

$1,200. It is estimated that the motors will operate at a rated 10 HP output for 1,500 hours a year, and

the cost of energy will be $0.07 per kilowatt-hour. Each motor is expected to have a 15-year life. At

the end of 15 years, the first motor will have a salvage value of $50 and the second motor will have a

salvage value of $100. Consider the MARR to be 8%.

a. Use the NPW criterion to determine which motor should be installed.

b. In (a), what if the motors operated 2,500 hours a year instead of 1,500 hours ayear? Would the motor

you chose in (a) still be the choice?

5.5 A largerefinery–petrochemical complex is to manufacture caustic soda, which will use feed water of

10,000 gallons per day. Two types of feed water storage installation are being considered over the 40

years of their useful life.

Option 1. Build a 20,000-gallon tank on a tower. The cost of installing the tank and tower is estimated

to be $164,000. The salvage value is estimated to be negligible.

Option 2. Place a tank of 20,000-gallon capacity on a hill, which is 150 yards away from the refinery.

The cost of installing the tank on the hill, including the extra length of service lines, is estimated to be

$120,000, with negligible salvage value. Because of the tank’s location on the hill, an additional

investment of $12,000 in pumping equipment is required. The pumping equipment is expected to have

a service life of 20 years, with a salvage value of $1,000 at the end of that time. The annual operating

and maintenance cost (including any income tax effects) for the pumping operation is estimated at

$1,000. If the firm’s MARR is known to be 12%, which option is better, on the basis of the present-

worth criterion?

5.6 A mall with two levels is under construction. The plan is to install only 9 escalators at the start,

although the ultimate design calls for 16. The question arises as to whether to provide necessary

facilities (stair supports, wiring conduits, motor foundations, etc.) that would permit the installation of

the additional escalators at the mere cost of their purchase and installation or to defer investment in

these facilities until the escalators need to be installed.

• Option 1. Provide these facilities now for all 7 future escalators at $200,000.

• Option 2. Defer the investment in the facility as needed. Install 2 more escalators in two years, 3

more in five years, and the last 2 in eight years.

The installation of these facilities at the time they are required is estimated to cost $100,000 in year 2,

$160,000 in year 5, and $140,000 in year 8. Additional annual expenses are estimated at $3,000 for

each escalator facility installed. At an interest rate of 12%, compare the net present worth of each

option over eight years.

5.7 An electrical utility is experiencing a sharp power demand that continues to grow at a high rate in a

certain local area. Two alternatives are under consideration. Each is designed to provide enough

capacity during the next 25 years, and both will consume the same amount of fuel, so fuel cost is not

considered in the analysis.

Alternative A. Increase the generating capacity now so that the ultimate demand can be met with

additional expenditures later. An initial investment of $30 million would be required, and it is

estimated that this plant facility would be in service for 25 years and have a salvage value of $0.85

million. The annual operating and maintenance costs (including income taxes) would be $0.4 million.

• Alternative B.Spend $10 million now and follow this expenditure with future additions during the

10th year and the 15th year. These additions would cost $18 million and $12 million, respectively. The

facility would be sold 25 years from now, with a salvage value of $1.5 million. The annual operating

and maintenance costs (including income taxes) initially will be $250,000 and will increase to $0.35

million after the second addition (from the 11th year to the 15th year)and to $0.45 million during the

final 10 years. (Assume that these costs begin 1 year subsequent to the actual addition.)

On the basis of the present-worth criterion, if the firm uses 15% as a MARR, which alternative should

be undertaken?

You might also like

- Bài Tập Buổi 4 (Updated)Document4 pagesBài Tập Buổi 4 (Updated)Minh NguyenNo ratings yet

- CFD ExercisesDocument6 pagesCFD ExercisesJohn Paul CristobalNo ratings yet

- NPV & Capital Budgeting QuestionsDocument8 pagesNPV & Capital Budgeting QuestionsAnastasiaNo ratings yet

- 05 Exercises On Capital BudgetingDocument4 pages05 Exercises On Capital BudgetingAnshuman AggarwalNo ratings yet

- BT Lựa Chọn Dự Án EDocument2 pagesBT Lựa Chọn Dự Án EstormspiritlcNo ratings yet

- Engineering Economics and Finacial Management (HUM 3051)Document5 pagesEngineering Economics and Finacial Management (HUM 3051)uday KiranNo ratings yet

- Tutorial Problems - Capital BudgetingDocument6 pagesTutorial Problems - Capital BudgetingMarcoBonaparte0% (1)

- EE Assignment 1-5 PDFDocument6 pagesEE Assignment 1-5 PDFShubhekshaJalanNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)Document8 pagesNanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)asdsadsaNo ratings yet

- Eceecon Problem Set 2Document8 pagesEceecon Problem Set 2Jervin JamillaNo ratings yet

- Exercise 1 - TVM & Equivalence 2.0Document5 pagesExercise 1 - TVM & Equivalence 2.0Bayu PurnamaNo ratings yet

- Ie342 SS4Document8 pagesIe342 SS4slnyzclrNo ratings yet

- SFM Practice QuestionsDocument13 pagesSFM Practice QuestionsAmmar Ahsan0% (1)

- Cap BudgDocument5 pagesCap BudgShahrukhNo ratings yet

- Engineering Economy HW-5 SpringDocument2 pagesEngineering Economy HW-5 SpringPantatNyanehBurikNo ratings yet

- Tutorial Questions (Module 3)Document3 pagesTutorial Questions (Module 3)Ayush RajNo ratings yet

- Homework - Cash Flow PrinciplesDocument2 pagesHomework - Cash Flow PrinciplesCristina Maria ConstantinescuNo ratings yet

- PlantDocument20 pagesPlantfrankizzta0% (3)

- Week 12 HomeworkDocument2 pagesWeek 12 HomeworkMichael Clark0% (1)

- EE Assignments 2016Document8 pagesEE Assignments 2016manojNo ratings yet

- Engg Econ QuestionsDocument7 pagesEngg Econ QuestionsSherwin Dela CruzzNo ratings yet

- 2nd Assignment 2021Document3 pages2nd Assignment 2021No NameNo ratings yet

- Problem 12-1aDocument8 pagesProblem 12-1aJose Ramon AlemanNo ratings yet

- Chapter 10 - Capital Budgeting - ProblemsDocument4 pagesChapter 10 - Capital Budgeting - Problemsbraydenfr05No ratings yet

- AsfasdaDocument2 pagesAsfasdaAli Emre YeğinNo ratings yet

- 1 Sample-AssignmentDocument1 page1 Sample-AssignmentKatherine McLarneyNo ratings yet

- EEM - Assignment 2 During QuaramtineDocument2 pagesEEM - Assignment 2 During Quaramtineshreya mishraNo ratings yet

- Eefm ProblemsDocument4 pagesEefm ProblemsChitrala DhruvNo ratings yet

- Mock - Econ - Exercise 4Document2 pagesMock - Econ - Exercise 4najib casanNo ratings yet

- Construction Project Management AssignmentDocument6 pagesConstruction Project Management AssignmentMilashu0% (1)

- FDHDFGSGJHDFHDSHJDDocument8 pagesFDHDFGSGJHDFHDSHJDbabylovelylovelyNo ratings yet

- Prob SetDocument9 pagesProb SetVynz Higuit100% (1)

- Ps Capital Budgeting PDFDocument7 pagesPs Capital Budgeting PDFcloud9glider2022No ratings yet

- Cash Flows-Capbud PDFDocument2 pagesCash Flows-Capbud PDFErjohn PapaNo ratings yet

- Capital Expenditure DecisionDocument4 pagesCapital Expenditure DecisionSayan MitraNo ratings yet

- ENIN 255 Homework 2Document3 pagesENIN 255 Homework 2Faris alharbiNo ratings yet

- Engineering Economy: Page 1 of 1Document1 pageEngineering Economy: Page 1 of 1Den CelestraNo ratings yet

- Engineering Economics Assignment BETE 54D Present WorthDocument1 pageEngineering Economics Assignment BETE 54D Present WorthAbdullah QureshiNo ratings yet

- Due Oct 9 Assignment 2 GEN 200.doc - Fall 2023Document2 pagesDue Oct 9 Assignment 2 GEN 200.doc - Fall 2023hudaNo ratings yet

- Chapter 3 - Economic Evaluation of AlternativesDocument21 pagesChapter 3 - Economic Evaluation of Alternativessam guptNo ratings yet

- Assignment Cel 779Document8 pagesAssignment Cel 779Arneet Sarna100% (1)

- Soal-Soal Capital Budgeting # 1Document2 pagesSoal-Soal Capital Budgeting # 1Danang0% (2)

- PGPM FM I Glim Assignment 3 2014Document5 pagesPGPM FM I Glim Assignment 3 2014sexy_sam280% (1)

- Homework ExerciseDocument4 pagesHomework Exerciseazhar0% (1)

- Corporate Finance I: Home Assignment 2 Due by January 30Document2 pagesCorporate Finance I: Home Assignment 2 Due by January 30RahulNo ratings yet

- Theoretical and Conceptual Questions: (See Notes or Textbook)Document4 pagesTheoretical and Conceptual Questions: (See Notes or Textbook)raymondNo ratings yet

- Part 2 Long Term Decision 1Document4 pagesPart 2 Long Term Decision 1Aye Mya KhineNo ratings yet

- Tutorial 2 Answers (Module 2)Document7 pagesTutorial 2 Answers (Module 2)Ayush RajNo ratings yet

- Practice Questions From SlidesDocument4 pagesPractice Questions From SlidesSukaina SalmanNo ratings yet

- CF1 Homework 4Document2 pagesCF1 Homework 4Rudine Pak MulNo ratings yet

- WKT MFGDocument4 pagesWKT MFGGODNo ratings yet

- Engineering Economics - Practice ProblemsDocument5 pagesEngineering Economics - Practice ProblemsSai Krish PotlapalliNo ratings yet

- Financial Management AssignmentDocument2 pagesFinancial Management AssignmentyosefNo ratings yet

- Economics For Engineers Model QuestionsDocument16 pagesEconomics For Engineers Model QuestionsNaman KumarNo ratings yet

- Previous Assignment 2Document2 pagesPrevious Assignment 2marryam nawazNo ratings yet

- Assignment For CB TechniquesDocument2 pagesAssignment For CB TechniquesRahul TirmaleNo ratings yet

- 101 Practice Problems-Looksfam For MSTC CE Board Exam Prepared by - CEneerDocument17 pages101 Practice Problems-Looksfam For MSTC CE Board Exam Prepared by - CEneernoriebel Oliva100% (1)

- EM Final Paper Assingment EE GCU S18Document4 pagesEM Final Paper Assingment EE GCU S18KhanNo ratings yet

- Improving Energy Efficiency and Reducing Emissions through Intelligent Railway Station BuildingsFrom EverandImproving Energy Efficiency and Reducing Emissions through Intelligent Railway Station BuildingsNo ratings yet

- Toward a National Eco-compensation Regulation in the People's Republic of ChinaFrom EverandToward a National Eco-compensation Regulation in the People's Republic of ChinaNo ratings yet