Professional Documents

Culture Documents

Sweeping Tax Cuts in 2019

Sweeping Tax Cuts in 2019

Uploaded by

SIDDHANT PARKHEOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sweeping Tax Cuts in 2019

Sweeping Tax Cuts in 2019

Uploaded by

SIDDHANT PARKHECopyright:

Available Formats

Here are some of the taxation policies that led to Sri Lanka's economic downfall:

Sweeping tax cuts in 2019:

In November 2019, the Sri Lankan government implemented a number of sweeping tax cuts, including a reduction in the

value-added tax (VAT) from 15% to 8% and the abolition of several other taxes. These tax cuts were implemented in

order to stimulate economic growth, but they had the opposite effect. By reducing government revenue, the tax cuts

made it more difficult for the government to finance its spending, which led to a budget deficit.

Lack of transparency and accountability in the tax system:

The Sri Lankan tax system is known for its lack of transparency and accountability. This makes it difficult for the

government to track tax revenue and ensure that it is being collected fairly. As a result, there is a significant amount of

tax evasion in Sri Lanka, which further reduces government revenue.

Weak tax enforcement:

The Sri Lankan government has a weak track record of enforcing tax laws. This makes it easy for businesses and

individuals to avoid paying their taxes, which further reduces government revenue.

Inefficient tax administration:

The Sri Lankan tax administration is inefficient and bureaucratic. This makes it difficult and time-consuming for

businesses and individuals to comply with tax laws, which discourages them from paying their taxes.

These are just some of the taxation policies that led to Sri Lanka's economic downfall. It is important to note that these

policies were not the only factor that contributed to the crisis. Other factors, such as the COVID-19 pandemic and the

war in Ukraine, also played a role. However, the taxation policies were a major contributing factor, and they will need to

be addressed if Sri Lanka is to recover from its economic crisis.

In addition to the above, here are some other factors that contributed to Sri Lanka's economic downfall:

High levels of government debt:

Sri Lanka's government debt has been rising steadily in recent years. In 2022, it stood at around 110% of GDP. This high

level of debt makes it difficult for the government to borrow more money to finance its spending, which has further

exacerbated the economic crisis.

A weak currency:

The Sri Lankan rupee has been depreciating rapidly in recent months. In 2022, it lost around 80% of its value against the

US dollar. This has made it more expensive for Sri Lanka to import goods and services, which has further increased

inflation and put pressure on the economy.

A lack of foreign investment:

Sri Lanka has been unable to attract significant foreign investment in recent years. This is due to a number of factors,

including the country's economic instability, its political uncertainty, and its poor business environment. The lack of

foreign investment has made it difficult for Sri Lanka to finance its development and grow its economy.

The economic crisis in Sri Lanka is a complex issue with no easy solutions. However, it is clear that the country's

economic policies need to be overhauled in order to recover. The government needs to reduce its debt burden, improve

its tax collection, and create a more business-friendly environment. Only then will Sri Lanka be able to attract foreign

investment and grow its economy.

You might also like

- Case Questions - Grocery GatewayDocument4 pagesCase Questions - Grocery GatewayPankaj SharmaNo ratings yet

- Challanges Faced by MNCs in SrilankaDocument10 pagesChallanges Faced by MNCs in SrilankaM Hassan100% (3)

- Fiscal Policy of PakistanDocument26 pagesFiscal Policy of PakistanMuhammad Muavia Siddiqy60% (5)

- Role of Income Tax in Economic Development of BangladeshDocument3 pagesRole of Income Tax in Economic Development of BangladeshBijoy Salahuddin71% (21)

- H.E. Heacock Co. v. Macondray - Company, IncDocument3 pagesH.E. Heacock Co. v. Macondray - Company, IncJanlo FevidalNo ratings yet

- Macroeconomic Factors Behind SriLankaDocument2 pagesMacroeconomic Factors Behind SriLankaTanmai MoundekarNo ratings yet

- Sri Lanka State of The Economy 2015: Economic PerformanceDocument3 pagesSri Lanka State of The Economy 2015: Economic PerformanceIPS Sri LankaNo ratings yet

- TCS+Sri+Lanka+Economic+Crisis+V1 2+30august2022Document42 pagesTCS+Sri+Lanka+Economic+Crisis+V1 2+30august2022Aksh SainiNo ratings yet

- Minor ProjectDocument21 pagesMinor ProjectAksh SainiNo ratings yet

- Economic Crisis in Sri LankaDocument12 pagesEconomic Crisis in Sri LankaFBG ARMYNo ratings yet

- An Investigation On Sri Lanka Inflation EasesDocument4 pagesAn Investigation On Sri Lanka Inflation EasesRezaulkarim RifatNo ratings yet

- Class 12 Project EcoDocument18 pagesClass 12 Project EcoKunal GuptaNo ratings yet

- TAX EVASION and AVOIDANCE - A REAL PROBDocument14 pagesTAX EVASION and AVOIDANCE - A REAL PROBAsaduzzaman ShuvoNo ratings yet

- Name: Efshal Ateeq Roll No: B-23232 Project: Ict Submitted To: Sir Rahat BukhariDocument5 pagesName: Efshal Ateeq Roll No: B-23232 Project: Ict Submitted To: Sir Rahat BukhariEfshal AtiqueNo ratings yet

- 2 Non-Tax Sources of RevenueDocument15 pages2 Non-Tax Sources of RevenueTushar PatilNo ratings yet

- Eco ProjectDocument16 pagesEco ProjectBedBrokenNo ratings yet

- Fiscal Crisis in IndiaDocument8 pagesFiscal Crisis in IndiaKapil YadavNo ratings yet

- Problem of Tax Collection in IndiaDocument4 pagesProblem of Tax Collection in IndiaGarvit DevediNo ratings yet

- Debt Situation of PakistanDocument4 pagesDebt Situation of PakistanAli AhmerNo ratings yet

- High Fiscal DeficitDocument14 pagesHigh Fiscal Deficituroosa vayaniNo ratings yet

- Need For Tax Reforms Government Should Not Lose It This Time But Go For Them EarlyDocument11 pagesNeed For Tax Reforms Government Should Not Lose It This Time But Go For Them EarlyThavamNo ratings yet

- Aditya Somya Business Research ArticleDocument16 pagesAditya Somya Business Research ArticleAditya SomyaNo ratings yet

- Srilanka UpdatedDocument6 pagesSrilanka UpdatedBaba HeadquaterNo ratings yet

- Pakistan Taxation SystemDocument4 pagesPakistan Taxation SystemAdil BalochNo ratings yet

- Why People in Pakistan Are Reluctant To Pay Taxes?: Course Laws of TaxationsDocument5 pagesWhy People in Pakistan Are Reluctant To Pay Taxes?: Course Laws of TaxationsDavid CarlNo ratings yet

- Sri Lanka Economic Crises-2Document6 pagesSri Lanka Economic Crises-2Baba HeadquaterNo ratings yet

- Tax EvasionDocument5 pagesTax Evasiongfreak0100% (1)

- Reducing The Tax Burden - Mahinda RajapaksaDocument3 pagesReducing The Tax Burden - Mahinda RajapaksaAdaderana OnlineNo ratings yet

- MacroDocument11 pagesMacroAditya RajNo ratings yet

- State FinancesDocument13 pagesState FinancesSatpal KhoondNo ratings yet

- Macroeconomic Issues of PakistanDocument3 pagesMacroeconomic Issues of PakistanaaqibmamshaNo ratings yet

- Fiscal PolicyDocument3 pagesFiscal PolicyHarshit mittalNo ratings yet

- Public Sector Budgeting Short Essay QuestionDocument7 pagesPublic Sector Budgeting Short Essay QuestionBrilliant MycriNo ratings yet

- Budget Analysis 2011-12 (RR)Document10 pagesBudget Analysis 2011-12 (RR)Gandharav BajajNo ratings yet

- Sri Lanka Beyond 2011Document26 pagesSri Lanka Beyond 2011SaranganNo ratings yet

- Introduction 307Document14 pagesIntroduction 307sakibecon47No ratings yet

- Srilankan Economic CrisisDocument7 pagesSrilankan Economic CrisisDebojyoti Roy100% (1)

- Presentation On Fiscal Policy of India: Submitted To:-Mrs. Anuradha MittalDocument19 pagesPresentation On Fiscal Policy of India: Submitted To:-Mrs. Anuradha MittalpreetsinghjjjNo ratings yet

- Fiscal Policy in PakistanDocument37 pagesFiscal Policy in Pakistankanwal_bawa75% (4)

- Tax Reforms in IndiaDocument9 pagesTax Reforms in IndiaNabeel ZahiriNo ratings yet

- Group 4Document10 pagesGroup 4SOHAM DIXITNo ratings yet

- Untitled DocumentDocument14 pagesUntitled DocumentShivani BalaniNo ratings yet

- Tax Evasion Ijariie9684Document4 pagesTax Evasion Ijariie9684Vikas AnandNo ratings yet

- Thesis Full Page - FinalDocument125 pagesThesis Full Page - FinalMADHU KHANALNo ratings yet

- C 1Document16 pagesC 1Abidah BajwaNo ratings yet

- Methods of Enhancing Tax Revenue.: Subitted By-Saima SultanDocument14 pagesMethods of Enhancing Tax Revenue.: Subitted By-Saima Sultansaima sultanNo ratings yet

- Tax Watch June 2016Document4 pagesTax Watch June 2016usherthNo ratings yet

- Fiscal ManagementDocument2 pagesFiscal ManagementLei JardinNo ratings yet

- Direct Tax Vs Indirect Tax in BangladeshDocument5 pagesDirect Tax Vs Indirect Tax in Bangladeshmaz_bdNo ratings yet

- Key Macro-Economic Challenges For India, at Present, Include: InflationDocument5 pagesKey Macro-Economic Challenges For India, at Present, Include: InflationAmita SinwarNo ratings yet

- Issues in Taxation (PresentationDocument3 pagesIssues in Taxation (PresentationAreeba YousufNo ratings yet

- Policy 2011Document8 pagesPolicy 2011IPS Sri LankaNo ratings yet

- Economics AssignmentDocument10 pagesEconomics AssignmentshristiNo ratings yet

- Consequences of Tax EvasionDocument3 pagesConsequences of Tax EvasionSankarshan BaddarNo ratings yet

- The Tax Season of 2020 Is Going To Be Different Than What You Know - PostDocument2 pagesThe Tax Season of 2020 Is Going To Be Different Than What You Know - PostShahu PawarNo ratings yet

- Effects of Fiscal Policy On Indian FirmsDocument14 pagesEffects of Fiscal Policy On Indian FirmsTewari UtkarshNo ratings yet

- Public Finance AssignmentDocument6 pagesPublic Finance AssignmentJawad MalikNo ratings yet

- Fiscal Deficit and Its Impact On GDPDocument15 pagesFiscal Deficit and Its Impact On GDPFlorosia StarshineNo ratings yet

- Bangladesh Studies Main BodyDocument20 pagesBangladesh Studies Main BodyNowshad AyubNo ratings yet

- MIPEEEEEEDocument6 pagesMIPEEEEEENida AliNo ratings yet

- Unit 5a - VocabularyDocument1 pageUnit 5a - VocabularyCarlos ManriqueNo ratings yet

- Code of Ethics and Professional ResponsibilityDocument6 pagesCode of Ethics and Professional ResponsibilityEunice Panopio LopezNo ratings yet

- Ethics (Merged)Document54 pagesEthics (Merged)Stanley T. VelascoNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- 2nd Year English (MCO)Document10 pages2nd Year English (MCO)YouNo ratings yet

- Recruitment & Selection PolicyDocument7 pagesRecruitment & Selection PolicyAnonymous CmDManNo ratings yet

- Mrunal Explained: Cheque Truncation System CTS-features, BenefitsDocument3 pagesMrunal Explained: Cheque Truncation System CTS-features, BenefitsPrateek BayalNo ratings yet

- Applications Are Invited in Prescribed Format Available Online On Shivaji University WebsiteDocument3 pagesApplications Are Invited in Prescribed Format Available Online On Shivaji University WebsiteAtul TcsNo ratings yet

- Notes On Cash and Cash EquivalentsDocument5 pagesNotes On Cash and Cash EquivalentsLeonoramarie BernosNo ratings yet

- Assemblage Art Shadow Box Eller's ArtistsDocument1 pageAssemblage Art Shadow Box Eller's ArtistsRadu CiurariuNo ratings yet

- Sintesis de Las Tres Montanas - Es.enDocument12 pagesSintesis de Las Tres Montanas - Es.enMungai123No ratings yet

- BG Construction POW.R1V6Document13 pagesBG Construction POW.R1V6Deepum HalloomanNo ratings yet

- What You See Is Not What You Get: A Man-in-the-Middle Attack Applied To Video ChannelsDocument20 pagesWhat You See Is Not What You Get: A Man-in-the-Middle Attack Applied To Video ChannelsAlessandro VisintinNo ratings yet

- 65 263 1 PBDocument11 pages65 263 1 PBChinedu Martins OranefoNo ratings yet

- ACTAEONDocument1 pageACTAEONLouphChristopherNo ratings yet

- Essays On Contemporary Issues in AfricanDocument19 pagesEssays On Contemporary Issues in AfricanDickson Omukuba JuniorNo ratings yet

- Chapter 6 FeminismDocument20 pagesChapter 6 FeminismatelierimkellerNo ratings yet

- Auditing Theory: Related Psas: Psa 100, 120, 200 and 610Document7 pagesAuditing Theory: Related Psas: Psa 100, 120, 200 and 610cynthia reyesNo ratings yet

- 2-3 Excavation & EmbankmentDocument23 pages2-3 Excavation & Embankmentzrilek1No ratings yet

- Flight TicketDocument3 pagesFlight TicketAkshay KanyanNo ratings yet

- Missionary Sisters of Fatima V AlzonaDocument2 pagesMissionary Sisters of Fatima V AlzonaJean Mary AutoNo ratings yet

- Future Enterprise Billing Report 2021Document35 pagesFuture Enterprise Billing Report 2021zulhelmy zulhelmyNo ratings yet

- AA Soal Bedah SKL 2019 Ke 2Document4 pagesAA Soal Bedah SKL 2019 Ke 2fitrihidayatiNo ratings yet

- Teaching Note Archer Daniels Midland Company: Case OverviewDocument7 pagesTeaching Note Archer Daniels Midland Company: Case OverviewRoyAlexanderWujatsonNo ratings yet

- Lecture 5-6 BudgetingDocument15 pagesLecture 5-6 BudgetingAfzal AhmedNo ratings yet

- G3X GarminDocument450 pagesG3X GarmincrguanapolloNo ratings yet

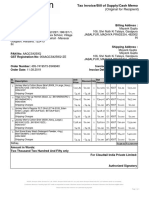

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)MAYANK GUPTANo ratings yet

- Ancestors: Optional Rules For Legend of The 5 Rings Third EditionDocument5 pagesAncestors: Optional Rules For Legend of The 5 Rings Third EditionGerrit DeikeNo ratings yet