Professional Documents

Culture Documents

HDFC FD

HDFC FD

Uploaded by

Bhupender SinghCopyright:

Available Formats

You might also like

- ICT Trading StrategyDocument21 pagesICT Trading Strategytestxn1aNo ratings yet

- CSG Systems International (India) Private LimitedDocument3 pagesCSG Systems International (India) Private LimitedPrabhuTeja CSGINo ratings yet

- G. L. Bajaj Institute of Technology & Management: Fee ReceiptDocument1 pageG. L. Bajaj Institute of Technology & Management: Fee ReceiptmaniastuntNo ratings yet

- Frank Spence ValuationDocument2 pagesFrank Spence ValuationShivam AryaNo ratings yet

- Make The TransferDocument2 pagesMake The TransferBog ChNo ratings yet

- E FDRDocument1 pageE FDRktsingh2024No ratings yet

- Revised Offer Letter - ResolveTechDocument2 pagesRevised Offer Letter - ResolveTechsayali kadNo ratings yet

- Aeries Technology Group Private Limited: Full and Final Settlement - December 2018Document3 pagesAeries Technology Group Private Limited: Full and Final Settlement - December 2018तेजस्विनी रंजनNo ratings yet

- BSC 3rd SemesterDocument3 pagesBSC 3rd Semestervikashyadav51209No ratings yet

- Unit Holder Previleges: Account Statement 3012950203 Folio NumberDocument2 pagesUnit Holder Previleges: Account Statement 3012950203 Folio Numberanand mishraNo ratings yet

- Account Statement (From 01-JAN-1990 To 22-JAN-2024) : Folio No.: 12644481 / 56Document6 pagesAccount Statement (From 01-JAN-1990 To 22-JAN-2024) : Folio No.: 12644481 / 56Avtar SinghNo ratings yet

- Payslip 4 2021Document1 pagePayslip 4 2021Mehraj PashaNo ratings yet

- Virchow Petrochemical Private Limited: (C.Subbareddy) General ManagerDocument5 pagesVirchow Petrochemical Private Limited: (C.Subbareddy) General ManagerraajiNo ratings yet

- Ack 367661020050723Document1 pageAck 367661020050723Sivaram PopuriNo ratings yet

- Offer Letter SampleDocument2 pagesOffer Letter Sampleyevadimata vinakuNo ratings yet

- Rahul Gangarekar - Offer LetterDocument2 pagesRahul Gangarekar - Offer Letterrahul gangarekarNo ratings yet

- CertificateDocument1 pageCertificateAjay Dada GaykarNo ratings yet

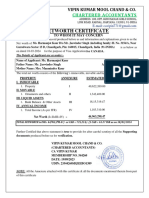

- CA Report Harmanjot KaurDocument5 pagesCA Report Harmanjot Kaurnishanegi9375No ratings yet

- PDF 816776770290723Document1 pagePDF 816776770290723Sunita SinghNo ratings yet

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Document2 pagesHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971sumit keshriNo ratings yet

- G. L. Bajaj Institute of Technology & Management: Fee ReceiptDocument2 pagesG. L. Bajaj Institute of Technology & Management: Fee Receiptamirqureshi6281No ratings yet

- Pay Slip Feb 2024Document1 pagePay Slip Feb 2024hariprasathnishik5293No ratings yet

- Siddharth KumarDocument1 pageSiddharth KumarSiddharthNo ratings yet

- S Feb 2017 PDFDocument1 pageS Feb 2017 PDFHanumanthNo ratings yet

- AugustDocument1 pageAugustNikhil DubeyNo ratings yet

- Account / Folio No: 421157028325 CAN: 20062QZ01E: Summary of InvestmentsDocument4 pagesAccount / Folio No: 421157028325 CAN: 20062QZ01E: Summary of InvestmentsRanjan SharmaNo ratings yet

- Salary Slip S5Document1 pageSalary Slip S5M.B TrickNo ratings yet

- Origin To Future Consultancy Services. (P) .LTD.: Payslip For The Month of October 2013Document1 pageOrigin To Future Consultancy Services. (P) .LTD.: Payslip For The Month of October 2013Logeshwaran ArunNo ratings yet

- Mentors Associates Pvt. LTD.: Plot No. #1061P, First Floor SECTOR - 40, Gurgaon - 122002, HaryanaDocument1 pageMentors Associates Pvt. LTD.: Plot No. #1061P, First Floor SECTOR - 40, Gurgaon - 122002, HaryanaGirish SharmaNo ratings yet

- SarjaPayslip Jun22Document1 pageSarjaPayslip Jun22Anand TNo ratings yet

- ZHR RVPN 111500Document69 pagesZHR RVPN 111500vinodk33506No ratings yet

- Teamlease Services LimitedDocument1 pageTeamlease Services LimitedMimin khsNo ratings yet

- Offer Letter - Noor Basha.sDocument7 pagesOffer Letter - Noor Basha.sVenkatesh RoyalNo ratings yet

- SalarySlip Prasar-6Document1 pageSalarySlip Prasar-6mishramanu1990No ratings yet

- G CR RK Gia 1 X 57 AV0 T64 P DF6 Xrog DAEWFFDocument2 pagesG CR RK Gia 1 X 57 AV0 T64 P DF6 Xrog DAEWFFjay krishnaNo ratings yet

- Worldwide SolutionsDocument1 pageWorldwide SolutionsKamlesh NandanwarNo ratings yet

- Accenture PaySlip PDFDocument1 pageAccenture PaySlip PDFSumit ChakrabortyNo ratings yet

- Salary Slip March 2024Document1 pageSalary Slip March 2024mandeepsingh157157157No ratings yet

- A Unit of Haryana Power Generation Corporation LTD.: Panipat Thermal Power Station Urja Bhawan, C-7, Sector - 6 PanchkulaDocument2 pagesA Unit of Haryana Power Generation Corporation LTD.: Panipat Thermal Power Station Urja Bhawan, C-7, Sector - 6 PanchkulaRamchanderNo ratings yet

- Dharmbir Computation 23-24 (1) - 1Document2 pagesDharmbir Computation 23-24 (1) - 1Ashish SehrawatNo ratings yet

- OctDocument1 pageOctRamPrasadNo ratings yet

- Gross Earning Gross DeductionDocument2 pagesGross Earning Gross Deductionavisinghoo7No ratings yet

- Payslip - 2019 09 20Document1 pagePayslip - 2019 09 20Nut T. PaulNo ratings yet

- Pay SlipDocument1 pagePay SlipKumar AshuNo ratings yet

- Raghavendra Nayak S Signed OfferLetterDocument6 pagesRaghavendra Nayak S Signed OfferLetterVikram DNo ratings yet

- Payslip - 2023 06 28Document1 pagePayslip - 2023 06 28ttamilpNo ratings yet

- Vijay Patil - MFDocument1 pageVijay Patil - MFVijay S PatilNo ratings yet

- Salary Slip in Excel FormatDocument2 pagesSalary Slip in Excel FormatSandepally ShivajiNo ratings yet

- Appraisal LetterDocument1 pageAppraisal LetterManeesh GuptaNo ratings yet

- Rapid Methodical Testing Private Limited: Payslip For The Month of July-2017Document6 pagesRapid Methodical Testing Private Limited: Payslip For The Month of July-2017goblinsNo ratings yet

- 1529302103778Document6 pages1529302103778Bibhuranjan MohantaNo ratings yet

- Sandy Jan PayslipDocument1 pageSandy Jan PayslipJoginderNo ratings yet

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- Manish Kumar - Appointment LetterDocument4 pagesManish Kumar - Appointment Letterak4784449No ratings yet

- Lotus Manpower Consultants Services Pvt. LTD.: Payslip For The Month of April 2019Document1 pageLotus Manpower Consultants Services Pvt. LTD.: Payslip For The Month of April 2019Jayanta Kumar SwainNo ratings yet

- E20934 Payslip Aug2022Document1 pageE20934 Payslip Aug2022vikramNo ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part AMithlesh SharmaNo ratings yet

- Statement of Account: State Bank of IndiaDocument10 pagesStatement of Account: State Bank of IndiaacscomcparandaNo ratings yet

- Ack 638167400230723Document1 pageAck 638167400230723gamers SatisfactionNo ratings yet

- Itr-V FKTPM7864L 2023-24 756976760270723Document1 pageItr-V FKTPM7864L 2023-24 756976760270723Samrat AseshNo ratings yet

- A S Soft Technologies Private Limited: Pay Slip For The Month of August 2018Document1 pageA S Soft Technologies Private Limited: Pay Slip For The Month of August 2018csreddyatsapbiNo ratings yet

- Kirubai Udyam Registration CertificateDocument1 pageKirubai Udyam Registration CertificatePradeep SalaNo ratings yet

- 5030XXXXDocument1 page5030XXXXgaurav sharmaNo ratings yet

- Word Problems On Commission, Discount, InterestDocument1 pageWord Problems On Commission, Discount, InterestMarivic Echaveria Depala100% (1)

- Stanbicpricingguide2022 2023Document1 pageStanbicpricingguide2022 2023Yaseen QariNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument4 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceMANISH VYASNo ratings yet

- Marketing Bank StrategiesDocument7 pagesMarketing Bank StrategieskaanthikeerthiNo ratings yet

- #13 Convertible NotesDocument1 page#13 Convertible NotesSeth RogersNo ratings yet

- Resume Albert H Manwaring VDocument1 pageResume Albert H Manwaring VKaarthik MandhulaNo ratings yet

- Local Media4930298822971004354Document17 pagesLocal Media4930298822971004354Haks MashtiNo ratings yet

- RSPDocument24 pagesRSPMassrNo ratings yet

- Batul Zaheer PatelDocument44 pagesBatul Zaheer PatelbatulNo ratings yet

- ACCOB1 Quiz 1 RequirementDocument33 pagesACCOB1 Quiz 1 RequirementjanericachuaNo ratings yet

- Chapter2 - Audit in ReceivablesDocument35 pagesChapter2 - Audit in ReceivablesVidia Ayu Kusuma100% (1)

- Reviewer Quiz 1 and 2Document7 pagesReviewer Quiz 1 and 2Devil AkiNo ratings yet

- Financial ManagementDocument24 pagesFinancial ManagementJulius Earl MarquezNo ratings yet

- Understanding Financial Statements 11th Edition Fraser Test BankDocument12 pagesUnderstanding Financial Statements 11th Edition Fraser Test BankKaylaCruzjcoma100% (13)

- Project Report: A Comparative Study On Consumer Preferences Towards Cryptocurrency and Stock Market'Document81 pagesProject Report: A Comparative Study On Consumer Preferences Towards Cryptocurrency and Stock Market'Vivek BansalNo ratings yet

- Exercise 2 Development Economics Prof. Iwan Jaya Azis Fall 2022Document2 pagesExercise 2 Development Economics Prof. Iwan Jaya Azis Fall 2022Gede Tristan Desirata RamaNo ratings yet

- Trent - Q4FY22 Result - DAMDocument6 pagesTrent - Q4FY22 Result - DAMRajiv BharatiNo ratings yet

- CUB - Account DetailsDocument1 pageCUB - Account DetailsAsim DasNo ratings yet

- Payment Methods in Mergers and Acquisitions: A Theoretical FrameworkDocument18 pagesPayment Methods in Mergers and Acquisitions: A Theoretical FrameworkBijay SankarNo ratings yet

- Risks Associated With Investing in Bonds - Class ExamplesDocument10 pagesRisks Associated With Investing in Bonds - Class ExamplesmohammedNo ratings yet

- International Capital MovementDocument14 pagesInternational Capital MovementRohan NairNo ratings yet

- Domondon Acctg 3 Prelim ExamDocument3 pagesDomondon Acctg 3 Prelim ExamPrince Anton DomondonNo ratings yet

- Full TaxDocument220 pagesFull TaxRahulNo ratings yet

- DividendsDocument17 pagesDividendsZafrul ZafNo ratings yet

- Nicholes PLCDocument6 pagesNicholes PLCjoshua.o.adenijiNo ratings yet

- Ias 7 Cash FlowDocument15 pagesIas 7 Cash FlowManda simzNo ratings yet

- Chapter 3 - Activity/Assignment: 1. Who Are The Users of Accounting Information?Document2 pagesChapter 3 - Activity/Assignment: 1. Who Are The Users of Accounting Information?Jhey NolealNo ratings yet

HDFC FD

HDFC FD

Uploaded by

Bhupender SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HDFC FD

HDFC FD

Uploaded by

Bhupender SinghCopyright:

Available Formats

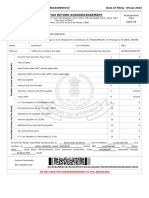

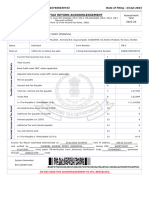

DEPOSIT CONFIRMATION/ RENEWAL ADVICE

We understand your world

MS RAJWINDER KAUR Deposit Account 50300277148239

A22/65, DLF PHASE 1 Cust ID of 1st Applicant 582732379

SECTOR 26, GURGAON Deposit Branch Name Vatika Atrium

GURGAON 122002

Deposit Type RESIDENT

HARYANA

New Deposit

Joint 1 :

INITIAL DEPOSIT

Joint 2 :

PAN IQPPK3490D

Deposit Deposit Period Rate of Maturity Maturity +

Amount Start Date of Deposit Interest (%p.a) Date Amount (in Rs.)

450,000.00 01 Sep 2022 12 Month(s)2 Day(s) 5.3500 03 Sep 2023 474,701.00

Deposit Amount (in words) FOUR LAKH FIFTY THOUSAND ONLY

Thank you for banking with us

Mode of operations EITHER OR SURVIVOR

This is a system generated Advice,and

hence does not require any Signature

Nominee Registered

Interest Payment Frequency ON MATURITY

Maturity Instruction RENEW PRINCIPAL AND INTEREST

IMPORTAN T:- "As per section 206AA introduced by finance (No.2) Act, 2009 w ef 01.4.2010 , every person who receives income on which TDS

is deductible shall furnish his PAN, failing which TDS shall be deducted at the rate of 20%(as against 10% which is existing TDS rate)in

case of domestic deposits and 31.20% in case of NRO deposits". Please further note that in the absence of PAN as per CBDT circular no:

03/11,TDS certificate will not be issued. Form 15G/H and other exemption certificates will be invalid even if submitted and Penal TDS will

be applicable.

Terms & Conditions

Bank Computes interest based on the actual number of days in a year. In case, the deposit is spread over a leap or a non-leap year, the

interest is calculated based on the number of days

i.e. 366 days in a leap year 365 days in a non leap year

Tax Deduction at Source (TDS)

As per section 206AA introduced by finance (No.2) Act, 2009 wef 01.4.2010, every person who receives income on which TDS is

deductible shall furnish his PAN, failing which TDS shall be deducted at the rate of 20% as against 10% which is existing TDS rate. In

case of domestic deposits and 30% plus applicable surcharge and health and Education Cess in case of NRO deposits". Please further

note that in the absence of PAN as per CBDT circular no: 03/11. TDS certificate will not be issued. In absence of PAN, Form 15G/H and

other exemption certificates will be invalid even if submitted and TDS at higher rate will be applicable.

Every person who has been allotted a Permanent Account Number (PAN) and is eligible to obtain Aadhaar number, must update their

Aadhaar number to the Income tax department (PAN -Aadhaar Linkage) as per Section 139 AA of the Income Tax Act 1961 by 30th

September 2021. Further non linking of PAN with Aadhaar shall make PAN "inoperative" and may attract higher TDS rate.

TDS rates is applicable from time to time as per the IT Act, 1961 and IT rules. The current rates applicable for TDS would be displayed

on the Bank’s website. Today, TDS is recovered when interest payable or reinvested on FD or RD per customer, across all Branch,

exceeds Rs. 40,000/- (Rs. 50,000/- for senior citizen) in a Financial Year. Further, TDS is recovered at the end of the financial year on

Interest accruals if applicable .

If interest amount is insufficient to recover the TDS, the same may get recovered from the principal amount of Fixed Deposit.If customer

wishes to have TDS recovered from CASA, same can be availed by filling separate declaration at branch.

For renewed deposits, the new deposit amount consists of the original deposit amount plus Interest Less TDS,if any, less compounding

effect on TDS. For reinvestment deposit, the interest reinvested is post TDS recovery and "hence the maturity amount for reinvestment

deposits would vary to the extent of tax and Compounding effect on tax for the period subsequent of deduction till maturity.

You might also like

- ICT Trading StrategyDocument21 pagesICT Trading Strategytestxn1aNo ratings yet

- CSG Systems International (India) Private LimitedDocument3 pagesCSG Systems International (India) Private LimitedPrabhuTeja CSGINo ratings yet

- G. L. Bajaj Institute of Technology & Management: Fee ReceiptDocument1 pageG. L. Bajaj Institute of Technology & Management: Fee ReceiptmaniastuntNo ratings yet

- Frank Spence ValuationDocument2 pagesFrank Spence ValuationShivam AryaNo ratings yet

- Make The TransferDocument2 pagesMake The TransferBog ChNo ratings yet

- E FDRDocument1 pageE FDRktsingh2024No ratings yet

- Revised Offer Letter - ResolveTechDocument2 pagesRevised Offer Letter - ResolveTechsayali kadNo ratings yet

- Aeries Technology Group Private Limited: Full and Final Settlement - December 2018Document3 pagesAeries Technology Group Private Limited: Full and Final Settlement - December 2018तेजस्विनी रंजनNo ratings yet

- BSC 3rd SemesterDocument3 pagesBSC 3rd Semestervikashyadav51209No ratings yet

- Unit Holder Previleges: Account Statement 3012950203 Folio NumberDocument2 pagesUnit Holder Previleges: Account Statement 3012950203 Folio Numberanand mishraNo ratings yet

- Account Statement (From 01-JAN-1990 To 22-JAN-2024) : Folio No.: 12644481 / 56Document6 pagesAccount Statement (From 01-JAN-1990 To 22-JAN-2024) : Folio No.: 12644481 / 56Avtar SinghNo ratings yet

- Payslip 4 2021Document1 pagePayslip 4 2021Mehraj PashaNo ratings yet

- Virchow Petrochemical Private Limited: (C.Subbareddy) General ManagerDocument5 pagesVirchow Petrochemical Private Limited: (C.Subbareddy) General ManagerraajiNo ratings yet

- Ack 367661020050723Document1 pageAck 367661020050723Sivaram PopuriNo ratings yet

- Offer Letter SampleDocument2 pagesOffer Letter Sampleyevadimata vinakuNo ratings yet

- Rahul Gangarekar - Offer LetterDocument2 pagesRahul Gangarekar - Offer Letterrahul gangarekarNo ratings yet

- CertificateDocument1 pageCertificateAjay Dada GaykarNo ratings yet

- CA Report Harmanjot KaurDocument5 pagesCA Report Harmanjot Kaurnishanegi9375No ratings yet

- PDF 816776770290723Document1 pagePDF 816776770290723Sunita SinghNo ratings yet

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Document2 pagesHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971sumit keshriNo ratings yet

- G. L. Bajaj Institute of Technology & Management: Fee ReceiptDocument2 pagesG. L. Bajaj Institute of Technology & Management: Fee Receiptamirqureshi6281No ratings yet

- Pay Slip Feb 2024Document1 pagePay Slip Feb 2024hariprasathnishik5293No ratings yet

- Siddharth KumarDocument1 pageSiddharth KumarSiddharthNo ratings yet

- S Feb 2017 PDFDocument1 pageS Feb 2017 PDFHanumanthNo ratings yet

- AugustDocument1 pageAugustNikhil DubeyNo ratings yet

- Account / Folio No: 421157028325 CAN: 20062QZ01E: Summary of InvestmentsDocument4 pagesAccount / Folio No: 421157028325 CAN: 20062QZ01E: Summary of InvestmentsRanjan SharmaNo ratings yet

- Salary Slip S5Document1 pageSalary Slip S5M.B TrickNo ratings yet

- Origin To Future Consultancy Services. (P) .LTD.: Payslip For The Month of October 2013Document1 pageOrigin To Future Consultancy Services. (P) .LTD.: Payslip For The Month of October 2013Logeshwaran ArunNo ratings yet

- Mentors Associates Pvt. LTD.: Plot No. #1061P, First Floor SECTOR - 40, Gurgaon - 122002, HaryanaDocument1 pageMentors Associates Pvt. LTD.: Plot No. #1061P, First Floor SECTOR - 40, Gurgaon - 122002, HaryanaGirish SharmaNo ratings yet

- SarjaPayslip Jun22Document1 pageSarjaPayslip Jun22Anand TNo ratings yet

- ZHR RVPN 111500Document69 pagesZHR RVPN 111500vinodk33506No ratings yet

- Teamlease Services LimitedDocument1 pageTeamlease Services LimitedMimin khsNo ratings yet

- Offer Letter - Noor Basha.sDocument7 pagesOffer Letter - Noor Basha.sVenkatesh RoyalNo ratings yet

- SalarySlip Prasar-6Document1 pageSalarySlip Prasar-6mishramanu1990No ratings yet

- G CR RK Gia 1 X 57 AV0 T64 P DF6 Xrog DAEWFFDocument2 pagesG CR RK Gia 1 X 57 AV0 T64 P DF6 Xrog DAEWFFjay krishnaNo ratings yet

- Worldwide SolutionsDocument1 pageWorldwide SolutionsKamlesh NandanwarNo ratings yet

- Accenture PaySlip PDFDocument1 pageAccenture PaySlip PDFSumit ChakrabortyNo ratings yet

- Salary Slip March 2024Document1 pageSalary Slip March 2024mandeepsingh157157157No ratings yet

- A Unit of Haryana Power Generation Corporation LTD.: Panipat Thermal Power Station Urja Bhawan, C-7, Sector - 6 PanchkulaDocument2 pagesA Unit of Haryana Power Generation Corporation LTD.: Panipat Thermal Power Station Urja Bhawan, C-7, Sector - 6 PanchkulaRamchanderNo ratings yet

- Dharmbir Computation 23-24 (1) - 1Document2 pagesDharmbir Computation 23-24 (1) - 1Ashish SehrawatNo ratings yet

- OctDocument1 pageOctRamPrasadNo ratings yet

- Gross Earning Gross DeductionDocument2 pagesGross Earning Gross Deductionavisinghoo7No ratings yet

- Payslip - 2019 09 20Document1 pagePayslip - 2019 09 20Nut T. PaulNo ratings yet

- Pay SlipDocument1 pagePay SlipKumar AshuNo ratings yet

- Raghavendra Nayak S Signed OfferLetterDocument6 pagesRaghavendra Nayak S Signed OfferLetterVikram DNo ratings yet

- Payslip - 2023 06 28Document1 pagePayslip - 2023 06 28ttamilpNo ratings yet

- Vijay Patil - MFDocument1 pageVijay Patil - MFVijay S PatilNo ratings yet

- Salary Slip in Excel FormatDocument2 pagesSalary Slip in Excel FormatSandepally ShivajiNo ratings yet

- Appraisal LetterDocument1 pageAppraisal LetterManeesh GuptaNo ratings yet

- Rapid Methodical Testing Private Limited: Payslip For The Month of July-2017Document6 pagesRapid Methodical Testing Private Limited: Payslip For The Month of July-2017goblinsNo ratings yet

- 1529302103778Document6 pages1529302103778Bibhuranjan MohantaNo ratings yet

- Sandy Jan PayslipDocument1 pageSandy Jan PayslipJoginderNo ratings yet

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- Manish Kumar - Appointment LetterDocument4 pagesManish Kumar - Appointment Letterak4784449No ratings yet

- Lotus Manpower Consultants Services Pvt. LTD.: Payslip For The Month of April 2019Document1 pageLotus Manpower Consultants Services Pvt. LTD.: Payslip For The Month of April 2019Jayanta Kumar SwainNo ratings yet

- E20934 Payslip Aug2022Document1 pageE20934 Payslip Aug2022vikramNo ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part AMithlesh SharmaNo ratings yet

- Statement of Account: State Bank of IndiaDocument10 pagesStatement of Account: State Bank of IndiaacscomcparandaNo ratings yet

- Ack 638167400230723Document1 pageAck 638167400230723gamers SatisfactionNo ratings yet

- Itr-V FKTPM7864L 2023-24 756976760270723Document1 pageItr-V FKTPM7864L 2023-24 756976760270723Samrat AseshNo ratings yet

- A S Soft Technologies Private Limited: Pay Slip For The Month of August 2018Document1 pageA S Soft Technologies Private Limited: Pay Slip For The Month of August 2018csreddyatsapbiNo ratings yet

- Kirubai Udyam Registration CertificateDocument1 pageKirubai Udyam Registration CertificatePradeep SalaNo ratings yet

- 5030XXXXDocument1 page5030XXXXgaurav sharmaNo ratings yet

- Word Problems On Commission, Discount, InterestDocument1 pageWord Problems On Commission, Discount, InterestMarivic Echaveria Depala100% (1)

- Stanbicpricingguide2022 2023Document1 pageStanbicpricingguide2022 2023Yaseen QariNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument4 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceMANISH VYASNo ratings yet

- Marketing Bank StrategiesDocument7 pagesMarketing Bank StrategieskaanthikeerthiNo ratings yet

- #13 Convertible NotesDocument1 page#13 Convertible NotesSeth RogersNo ratings yet

- Resume Albert H Manwaring VDocument1 pageResume Albert H Manwaring VKaarthik MandhulaNo ratings yet

- Local Media4930298822971004354Document17 pagesLocal Media4930298822971004354Haks MashtiNo ratings yet

- RSPDocument24 pagesRSPMassrNo ratings yet

- Batul Zaheer PatelDocument44 pagesBatul Zaheer PatelbatulNo ratings yet

- ACCOB1 Quiz 1 RequirementDocument33 pagesACCOB1 Quiz 1 RequirementjanericachuaNo ratings yet

- Chapter2 - Audit in ReceivablesDocument35 pagesChapter2 - Audit in ReceivablesVidia Ayu Kusuma100% (1)

- Reviewer Quiz 1 and 2Document7 pagesReviewer Quiz 1 and 2Devil AkiNo ratings yet

- Financial ManagementDocument24 pagesFinancial ManagementJulius Earl MarquezNo ratings yet

- Understanding Financial Statements 11th Edition Fraser Test BankDocument12 pagesUnderstanding Financial Statements 11th Edition Fraser Test BankKaylaCruzjcoma100% (13)

- Project Report: A Comparative Study On Consumer Preferences Towards Cryptocurrency and Stock Market'Document81 pagesProject Report: A Comparative Study On Consumer Preferences Towards Cryptocurrency and Stock Market'Vivek BansalNo ratings yet

- Exercise 2 Development Economics Prof. Iwan Jaya Azis Fall 2022Document2 pagesExercise 2 Development Economics Prof. Iwan Jaya Azis Fall 2022Gede Tristan Desirata RamaNo ratings yet

- Trent - Q4FY22 Result - DAMDocument6 pagesTrent - Q4FY22 Result - DAMRajiv BharatiNo ratings yet

- CUB - Account DetailsDocument1 pageCUB - Account DetailsAsim DasNo ratings yet

- Payment Methods in Mergers and Acquisitions: A Theoretical FrameworkDocument18 pagesPayment Methods in Mergers and Acquisitions: A Theoretical FrameworkBijay SankarNo ratings yet

- Risks Associated With Investing in Bonds - Class ExamplesDocument10 pagesRisks Associated With Investing in Bonds - Class ExamplesmohammedNo ratings yet

- International Capital MovementDocument14 pagesInternational Capital MovementRohan NairNo ratings yet

- Domondon Acctg 3 Prelim ExamDocument3 pagesDomondon Acctg 3 Prelim ExamPrince Anton DomondonNo ratings yet

- Full TaxDocument220 pagesFull TaxRahulNo ratings yet

- DividendsDocument17 pagesDividendsZafrul ZafNo ratings yet

- Nicholes PLCDocument6 pagesNicholes PLCjoshua.o.adenijiNo ratings yet

- Ias 7 Cash FlowDocument15 pagesIas 7 Cash FlowManda simzNo ratings yet

- Chapter 3 - Activity/Assignment: 1. Who Are The Users of Accounting Information?Document2 pagesChapter 3 - Activity/Assignment: 1. Who Are The Users of Accounting Information?Jhey NolealNo ratings yet