Professional Documents

Culture Documents

PDF 367608010310521

PDF 367608010310521

Uploaded by

Kishan UnadkatOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PDF 367608010310521

PDF 367608010310521

Uploaded by

Kishan UnadkatCopyright:

Available Formats

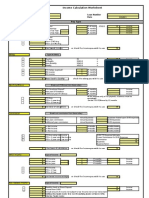

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessment Year

[Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4(SUGAM), ITR-5, ITR-6, ITR-7 filed and verified]

2020-21

(Please see Rule 12 of the Income-tax Rules, 1962)

PAN AMBPV1446J

Name VIMAL NATHALAL VAYA

VIMAL NATHALAL VAYADERAFALI, , , JAM KHAMBHALIA, JAMNAGAR, Gujarat, 361305

Address

Status Individual Form Number ITR-4

Filed u/s 139(5)-Revised e-Filing Acknowledgement Number 367608010310521

Current Year business loss, if any 1 0

Taxable Income and Tax details

Total Income 476430

Book Profit under MAT, where applicable 2 0

Adjusted Total Income under AMT, where applicable 3 0

Net tax payable 4 0

Interest and Fee Payable 5 0

Total tax, interest and Fee payable 6 0

Taxes Paid 7 0

(+)Tax Payable /(-)Refundable (6-7) 8 0

Dividend Tax Payable 9 0

Distribution Tax

Interest Payable 10 0

Dividend

details

Total Dividend tax and interest payable 11 0

Taxes Paid 12 0

(+)Tax Payable /(-)Refundable (11-12) 13 0

Accreted Income & Tax

Accreted Income as per section 115TD 14 0

Additional Tax payable u/s 115TD 15 0

16 0

Detail

Interest payable u/s 115TE

Additional Tax and interest payable 17 0

Tax and interest paid 18 0

(+)Tax Payable /(-)Refundable (17-18) 19 0

Income Tax Return submitted electronically on 31-05-2021 23:59:52 from IP address 106.213.251.83 and verified by

VIMAL NATHALAL VAYA

having PAN AMBPV1446J using duly signed ITR-V form received at “Centralized Processing Centre, Income Tax Department,

Bengaluru - 560500” on 29-09-2021

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

You might also like

- Income Calculation WorksheetDocument1 pageIncome Calculation Worksheetrush2serveNo ratings yet

- BIR Ruling (DA - (IL-045) 516-08)Document7 pagesBIR Ruling (DA - (IL-045) 516-08)Jerwin DaveNo ratings yet

- Bitumen Price List Wef 01-09-2015Document1 pageBitumen Price List Wef 01-09-2015P. Balaji Chakravarthy100% (2)

- Assignment Print View Lesson 6 PDFDocument8 pagesAssignment Print View Lesson 6 PDFnewonemadeNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRohit kandpalNo ratings yet

- Itr 20-21Document1 pageItr 20-21Rohit kandpalNo ratings yet

- Itr-V Atbpa1322p 2020-21 890365290251220Document1 pageItr-V Atbpa1322p 2020-21 890365290251220Niraj JaiswalNo ratings yet

- Itr 20-21Document1 pageItr 20-21Ruloans VaishaliNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurusafiNo ratings yet

- LJ FinancialDocument21 pagesLJ Financialsunil jadhavNo ratings yet

- NJ 20-21Document1 pageNJ 20-21sunil jadhavNo ratings yet

- PDF 575804930230920Document1 pagePDF 575804930230920Arpit meenaNo ratings yet

- Itr2020 21Document1 pageItr2020 21Debabrata pahariNo ratings yet

- PDF 185896120100121Document1 pagePDF 185896120100121Karan Dev SinghNo ratings yet

- ITR-2020-21.pdf (MIRZA)Document1 pageITR-2020-21.pdf (MIRZA)yogiprathmeshNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRas AgroNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruJhalak ThapaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKaka JENo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKaka JENo ratings yet

- Return 2021Document1 pageReturn 2021rgd8b7kzr6No ratings yet

- Itr-V Derpk2934d 2020-21 642243430121020Document1 pageItr-V Derpk2934d 2020-21 642243430121020Ambati Madhava ReddyNo ratings yet

- Bharath Itr 3 YearsDocument3 pagesBharath Itr 3 Yearssyedibrahim.aliasad786No ratings yet

- 2020 10 17 15 39 31 472 - 1602929371472 - XXXPP3112X - Acknowledgement PDFDocument1 page2020 10 17 15 39 31 472 - 1602929371472 - XXXPP3112X - Acknowledgement PDFParmeshwar PrasadNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurumahesh bhorNo ratings yet

- Neetu Singh - FY 2019 20 - Detailed ITRVDocument1 pageNeetu Singh - FY 2019 20 - Detailed ITRVRakesh PatilNo ratings yet

- Itr A.Y 2020-21Document1 pageItr A.Y 2020-21kishan bhalodiyaNo ratings yet

- 1655200445Document3 pages1655200445avdesh7777No ratings yet

- It 2020-21Document1 pageIt 2020-21BUDDHADEV BISWASNo ratings yet

- 2020 10 27 18 00 07 326 - 1603801807326 - XXXPK6104X - AcknowledgementDocument1 page2020 10 27 18 00 07 326 - 1603801807326 - XXXPK6104X - AcknowledgementRamya SriNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSACHIN MENEZESNo ratings yet

- 20 - 21 Original MailDocument1 page20 - 21 Original Mailmohdmoin0493No ratings yet

- PDF 112866730060121Document1 pagePDF 112866730060121Siddhant SinghNo ratings yet

- 2020 07 01 19 02 26 404 - 1593610346404 - XXXPD2732X - AcknowledgementDocument1 page2020 07 01 19 02 26 404 - 1593610346404 - XXXPD2732X - Acknowledgementraju1965.dNo ratings yet

- 2021 01 10 16 31 40 128 - 1610276500128 - XXXPV5796X - AcknowledgementDocument1 page2021 01 10 16 31 40 128 - 1610276500128 - XXXPV5796X - AcknowledgementSteve BurnsNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPradeep RaoNo ratings yet

- RK 1Document1 pageRK 1Sharada ShankarNo ratings yet

- PDF 298947820220321Document1 pagePDF 298947820220321savitakant13600No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurucpe plNo ratings yet

- PDF 163461030090121Document1 pagePDF 163461030090121jasjeetNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurusam kapoorNo ratings yet

- Pranjal - Itr VDocument1 pagePranjal - Itr VPradnyesh GuramNo ratings yet

- Itr-V DWZPK3321N 2020-21 103179330050121Document1 pageItr-V DWZPK3321N 2020-21 103179330050121aspire misNo ratings yet

- PDF - 173919020100121 Ad 1Document1 pagePDF - 173919020100121 Ad 1Abhishek GUPTANo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruJaydeep WayalNo ratings yet

- RJ 20-21Document1 pageRJ 20-21sunil jadhavNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDebbrat SinghNo ratings yet

- Itr RCPT-19-20Document1 pageItr RCPT-19-20homcoactNo ratings yet

- NJ FinancialDocument9 pagesNJ Financialsunil jadhavNo ratings yet

- Itr V 20 21Document1 pageItr V 20 21SiddharthNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluruyash kavitaNo ratings yet

- ITR Ack. AY 2020-21Document1 pageITR Ack. AY 2020-21Amit ShawNo ratings yet

- Itr-V Amzpy8600m 2020-21 347932700070620Document1 pageItr-V Amzpy8600m 2020-21 347932700070620Piyu VaiNo ratings yet

- Itr-V GMCPS4166R 2020-21 713160470101120Document1 pageItr-V GMCPS4166R 2020-21 713160470101120kumarhealthcare2000No ratings yet

- Atul Rana 20Document1 pageAtul Rana 20Manu ChopraNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruTed Mosby100% (1)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBANDARU SRINUNo ratings yet

- Chandra Kant PDFDocument1 pageChandra Kant PDFSujan SamantaNo ratings yet

- PDF 870515920231220Document1 pagePDF 870515920231220b2bservices007No ratings yet

- PDF 870515920231220Document1 pagePDF 870515920231220b2bservices007No ratings yet

- Itr-V Aagca7888p 2020-21 251075181110221Document1 pageItr-V Aagca7888p 2020-21 251075181110221Balwant SinghNo ratings yet

- Screenshot 2023-10-16 at 11.38.24 AMDocument1 pageScreenshot 2023-10-16 at 11.38.24 AMappurajan51No ratings yet

- Emailing PDF - 133712590080121Document1 pageEmailing PDF - 133712590080121Manisha JangidNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruTransnet Movers LogisticsNo ratings yet

- Eagle LNG Safety Data Sheet USA DEC2015Document19 pagesEagle LNG Safety Data Sheet USA DEC2015Kishan UnadkatNo ratings yet

- SafetywalaDocument9 pagesSafetywalaKishan UnadkatNo ratings yet

- PDF 484667060300322Document1 pagePDF 484667060300322Kishan UnadkatNo ratings yet

- PDF 507970650300322Document1 pagePDF 507970650300322Kishan UnadkatNo ratings yet

- Dark Hour Mock Dril Report - 13.04.2022Document2 pagesDark Hour Mock Dril Report - 13.04.2022Kishan UnadkatNo ratings yet

- Nebosh IDIP ProjectDocument29 pagesNebosh IDIP ProjectKishan UnadkatNo ratings yet

- StressDocument1 pageStressKishan UnadkatNo ratings yet

- Road Safety and Defensive Driving TrainingDocument1 pageRoad Safety and Defensive Driving TrainingKishan UnadkatNo ratings yet

- Healthy VisionDocument1 pageHealthy VisionKishan UnadkatNo ratings yet

- Hse PolicyDocument1 pageHse PolicyKishan UnadkatNo ratings yet

- Map and Lot Listing Oct2013Document244 pagesMap and Lot Listing Oct2013api-247125545No ratings yet

- INPUT & OUTPUT TAX - FORT BONIFACIO DEVELOPMENT CORPORATION vs. CIR DIGESTDocument3 pagesINPUT & OUTPUT TAX - FORT BONIFACIO DEVELOPMENT CORPORATION vs. CIR DIGESTthinkbeforeyoutalkNo ratings yet

- Bonus ConceptDocument2 pagesBonus ConceptViñas, Diana L.No ratings yet

- Ax Reminder: When To Apply 10% or 15% EWT For Professional FeesDocument2 pagesAx Reminder: When To Apply 10% or 15% EWT For Professional FeesRegs AccexNo ratings yet

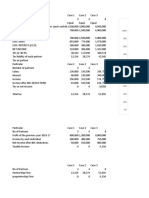

- C Statment - Ivan Maleakhi - Des 2020Document4 pagesC Statment - Ivan Maleakhi - Des 2020Budi ArtantoNo ratings yet

- Go 141 Roads-BuildingsDocument1 pageGo 141 Roads-BuildingsRajaNo ratings yet

- Department of Economics Nizam Collee (Autonomous) Osmania University, Hyderabad Undergraduate (B.A) Syllabus With Effect From The Batch 2010-201 1Document9 pagesDepartment of Economics Nizam Collee (Autonomous) Osmania University, Hyderabad Undergraduate (B.A) Syllabus With Effect From The Batch 2010-201 1Mad MadhaviNo ratings yet

- Final Exam - Comprehensive - 10.24.16Document5 pagesFinal Exam - Comprehensive - 10.24.16YamateNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Sharp (Phils) CorporationDocument17 pagesCertificate of Creditable Tax Withheld at Source: Sharp (Phils) CorporationromnickNo ratings yet

- San Francisco Budget BasicsDocument6 pagesSan Francisco Budget Basicsadmin5057No ratings yet

- Fesco Online BilllDocument1 pageFesco Online BilllArsal AslamNo ratings yet

- Shamsud LTD Operates On A Calendar Year Basis at The Beginning PDFDocument1 pageShamsud LTD Operates On A Calendar Year Basis at The Beginning PDFTaimour HassanNo ratings yet

- GST Returns NotesDocument5 pagesGST Returns NotesvishnureachmeNo ratings yet

- Essentials of Federal Taxation 3rd Edition Spilker Solutions Manual Full Chapter PDFDocument67 pagesEssentials of Federal Taxation 3rd Edition Spilker Solutions Manual Full Chapter PDFdilysiristtes5100% (16)

- Finance An Art or ScienceDocument17 pagesFinance An Art or Sciencegcc vehariNo ratings yet

- Gujranwala Electric Power Company: Say No To CorruptionDocument1 pageGujranwala Electric Power Company: Say No To CorruptionQaswer AbbasNo ratings yet

- Tax Incidence On Partnership Fi RMDocument12 pagesTax Incidence On Partnership Fi RMTejas DesaiNo ratings yet

- Transfer and Business Taxation Accounting Methods and PeriodsDocument5 pagesTransfer and Business Taxation Accounting Methods and PeriodsApril Joy Padua SimonNo ratings yet

- 08 Spring 2015 BT AnsDocument8 pages08 Spring 2015 BT Anspabloescobar11yNo ratings yet

- Lecture Notes XIII Selected Topics On Philippine TaxationDocument9 pagesLecture Notes XIII Selected Topics On Philippine TaxationSar CaermareNo ratings yet

- Or - Form Or-Drd Instructions - 2023Document1 pageOr - Form Or-Drd Instructions - 2023Matt MuellerNo ratings yet

- When Should You Take Social SecurityDocument9 pagesWhen Should You Take Social SecurityShahid AliNo ratings yet

- Deadlines TaxDocument3 pagesDeadlines TaxLouremie Delos Reyes MalabayabasNo ratings yet

- Basic Bookkeeping - Assessment 2 Part B (Question 1 & 2) TemplateDocument2 pagesBasic Bookkeeping - Assessment 2 Part B (Question 1 & 2) TemplateMonique BugeNo ratings yet

- Tax Digest: Alas, Oplas & Co., CpasDocument4 pagesTax Digest: Alas, Oplas & Co., CpasNico NicoNo ratings yet

- Sumisola Corp. v. CIRDocument11 pagesSumisola Corp. v. CIRaudreydql5No ratings yet