Professional Documents

Culture Documents

FTP 2023

FTP 2023

Uploaded by

venkatrao_100Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FTP 2023

FTP 2023

Uploaded by

venkatrao_100Copyright:

Available Formats

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

SEGMENT - 31

FOREIGN TRADE POLICY

Ministry of Commerce & Industry

Foreign Trade (Regulation &

Development) Act, 1992

Directorate General Foreign Trade

(DGFT)

FOREIGN TRADE POLICY

Foreign Trade policy to regulate

imports and encourage exports

Foreign Trade Policy is a set of guidelines or instructions issued by the Central Government

which specifies policy for exports and imports viz., foreign trade. It’s primary purpose is not

merely to earn foreign exchange, but also to stimulate greater economic activity.

FTP The provisions of FTP are governed by Foreign Trade (Regulation and

Regulates, Development) Act, 1992. The FTP is formulated, supervised and

Develops controlled by Directorate General of Foreign Trade (DGFT) & Regional

and Authorities (RA)

Promotes

internation

al trade Current FTP Contents of FTP are: [DGFT issues authorization i.e.

2023 is w.e.f permission to import and export]

1.04.23

Customs Act, Harmonized

1962 contains Basic policy + Handbook of

No end date system of

procedures, Export Procedures -

specified coding

valuation, Incentives Vol. I & II

for FTP [ITC(HS)]

consequences

2023

FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM 1

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

Import of

Goods which

“worked ivory

cannot be

and articles of

Prohibited imported/

ivory” falling

exported into

under HSN:

India

9601100

Goods which can Import of parts

be imported / of “nuclear

Restricted exported only reactors” falling

under an under HSN:

authorization 84014000

Imports or

exports

Goods which can Import of “Gas

Reserved for be imported / oil, including light

State Trading exported only by diesel oil” falling

Enterprises STE's i.e., IOC, under HSN:

FOREIGN TRADE POLICY

ONGC, FCI 27101943

Goods which can Import of “three

be imported / wheeled Vehicles”

Free

exported without falling under

any authorization HSN: 87032230

ADMINISTRATION OF FTP:

Authorization – License required to import or export, issued by Director General of

Foreign Trade (DGFT) through its Regional Authorities (RA’s).

Directorate General of Foreign Trade (DGFT) – A final authority for interpretation

of policy (In case of dispute in implementation, DGFT overrides CBIC). DGFT may in

public interest pass such orders or grant such exemption, relaxation or relief, as it

may deem fit and proper, on grounds of genuine hardship and adverse impact on

trade to any person or class or category of persons from any provision of FTP or

any Procedures.

Settlement commission – Authority setup by department of revenue has been

empowered to settle matters of default in export obligation also.

Reserve Bank of India (RBI) – It works under ministry of finance and monitors

receipts and payments for exports and imports

Central Board of Indirect Taxes and Customs (CBIC) – Facilitate in implementing the

provisions of FTP. Customs department is responsible for clearances in line with

policy formed by DGFT. GST authorities to be involved in the matters relating to

export.

2 FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

State GST departments – To avoid dual control, some taxable persons are under

the jurisdiction of state GST authorities. In their case, state GST authorities are

controlling authorities.

Policy interpretation Committee (PIC) - To aid and advice

DGFT

Norms Committee - For fixation/ modification of product

norms under all schemes

Export Promotion Capital Goods (EPCG) Committee - For

benefits w.r.to import of capital goods

Policy Relaxation committee (PRC) - For all other issues

Committee on Quality compliants and Trade disputes (CQCTD)

- For enquiring and investigating in all quality related

FOREIGN TRADE POLICY

compliants falling under jusridction of respective Regional

authorities

Note: If an importer/exporter is aggrieved by any decision taken by PRC, or a

decision/order by any authority in the DGFT, a specific request for personal

hearing has to be made to DGFT, which may consider for relation after

consulting with all committees and the decision conveyed in pursuance to the

personal hearing shall be final and binding.

• Brain of international trade (To decide what to

FTP

import/export)

Customs, GST & • Body of international trade (To decide how to

other tax laws import/export)

FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM 3

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

National committee on Trade Facilitation (NCTF) – To facilitate coordination and

implementation of the trade facilitation agreement provisions.

Action plan

Improvement Reduction in Paperless Transparent

in ease of cargo release regulatory and Improved

doing business time environment predictable investment

legal regime climate

through better

infrastructure

FOREIGN TRADE POLICY

Free passage of export consignment. No seizure, except in

exceptional cases

Single window system for export of perishable

agriculture produce

Niryat Bandhu Scheme for mentoring new and potential

exporters

DGFT online customer portal for

- E-RCMC (Registration cum membership certificate)

- E-COO (Certificate of Origin)

Trade

facilitation - Quality control and trade disputes

measures

IT initiatives to enable paperless, contactless and

transpatent environment for availing export benefits

24X7 help desk facility

Measures by customs department

- Single window interface for trade (SWIFT) to file all

documents at single point

- TURANT Customs for faceless assessment

- Compliance information portal - For all clearance

related procedures

4 FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

Recognition under FTP 2023

Authorised Exonomic Towns of Export

Status Holder

Operator Excellence

Authorised Economic Operator (AEO)

Under AEO programme of Indian Customs, a business entity engaged in international

trade is granted AEO status if it is approved by Customs as compliant with supply

chain security standards based on World Customs Organization’s SAFE framework

Standards.

Such entities are considered as trusted trade partner of Indian customs.

AEO status holders get following benefits [Preferential BEDS]:

FOREIGN TRADE POLICY

•Preferential customs treatment in terms of reduced examination and faster

processing and clearance of cargo

•Border clearance previleges in Mutual Recognition Agreement (MRA)

B partner countries

•Enhanced port delivery

E

•Deferred payment of customs duty

D

•Self Certification

S

Towns of Export Excellence (TEE):

• Selected towns which are contributing handsomely to India’s exports by

producing goods of specified amount may be granted recognition as TEE.

• They will be provided targeted support and infrastructure development to

maximize their export competitiveness and enable them to move up the value

chain andalso to tap new markets by granting specified privileges to them.

FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM 5

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

STATUS HOLDER = Exporter granted Status Certificate in terms of FTP.

Business leaders who have excelled in international trade and have successfully

contributed to India’s exports and also providing guidance to new entrepreneurs.

Export Performance criteria in terms Benefits to status holders

of FOB/FOR value in $ - Star Export

House (EH) [WIPES] [Made in India] [Exempted]

Warehouse licence to 2 star and

above

1 star EH = $ 3 million

FOREIGN TRADE POLICY

Input Output Norms on priority i.e.

within 60 days by norms committee

2 star EH= $ 15 million Preferential treatement and priority

in handling

Exports free of cost (Except gems &

3 star EH= $ 50million gold jewellery)

Self declaration w.r.to authorization

and customs clearances

4 star EH= $ 200 million

"Made in India" self certification for 3

star and above

Exempted from furnishing bank

5 star EH= $ 800 million guarantee & compulsory negotiation

of documents*

*After shipment of goods, exporter has to negotiate the documents through a bank

within 21 days from the date of shipment. Submission of relevant documents to the

bank and the process of obtaining payment is called “Negotiation of documents”.

How to compute Export Performance???

✓ Status recognition depends upon export performance.

✓ All exporters of goods or services having an IEC shall be eligible for recognition.

✓ Export performance is counted on the basis of FOB value of export proceeds

realized in free foreign exchange or in Indian rupees1, during current and

previous three financial years.2

1 In case of deemed export, FOR value of exports in Indian rupees shall be converted in $ at the

exchange rate notified by CBIC, as on 1st April of each financial year

2 However for Gems & Jewellery Sector, the performance during current and previous two years

shall be considered for recognition as status holder.

6 FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

✓ For granting status, export performance is necessary in all the three preceding

financial years.

✓ Export performance in not transferrable among IEC holders

✓ Exports made on re-export basis shall not be counted for recognition.

✓ Export of items under authorization, including SCOMET3 items, would be

included for calculation of export performance.

✓ For calculating export performance for grant of One Star Export House Status

category, exports by following IEC holders shall be granted double weightage

once in any of these categories

o Micro and Small Enterprises,

o manufacturing units having ISO/BIS certification,

o units located in Northeastern States including Sikkim and Union Territories

of Jammu,

o Kashmir and Ladakh and

o export of fruits and vegetables

Skilling and mentorship obligations of Status Holders - Status Holders (other than

FOREIGN TRADE POLICY

One Star Export House) are being made “partners” in providing mentoring and

training in international trade to specified number of trainees each year based on

status they achieve.

SCOMET: SPECIAL CHEMICALS, ORGANISMS, MATERIALS, EQUIPMENT AND

TECHNOLOGIES

Use in weapons of mass destruction

Export of dual use items

Use in civilian/ industrial applications

Either prohibited (or) Restricted

Eg: Nuclear materials, Toxic chemical agents, Aero space systems etc.,

DEVELOPING DISTRICTS AS EXPORT HUBS:

Every district has products and services which are being exported, and can be

further promoted, along with new products/ services, to increase production,

grow exports, generate economic activity and achieve the goal of Atma Nirbhar

Bharat, Vocal for local and Make in India.

3

Special Chemicals, Organisms, Materials, Equipment and Technologies

FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM 7

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

District Export District Export

Promotion Action Plan

Committee (DEAP)

(DEPC) Products/ •DGFT will

State Export •Support for services take

Promotion export identification forwards this

Committee promotion & which are initiative in

(SEPC) address potential for each district

bottlenecks export

for export

growth in

districts

FOREIGN TRADE POLICY

REGISTRATIONS UNDER FTP:

Import Export Code (IEC) – An identification number (Which is nothing but PAN

of the person), without which import and export is not permitted , unless

exempted. IEC details have to be electronically updated every year, even if there

are no changes, failing which it will be deactivated till updation.

State Trading Enterprises (STE) - certain goods can be imported/exported only

through ‘State Trading Enterprises’ notified by DGFT. State Trading Enterprises

(STEs) are governmental/non- governmental enterprises, including marketing

boards, which deal with goods for export and /or import. However, DGFT has the

discretion to issue authorization to other entities to import or export goods that

are notified for exclusive trading through STEs.

Export Promotion Councils (EPCs) - organizations of exporters, set up to promote

and develop Indian exports. Each Council is responsible for promotion of a particular

group of products/ projects/services. EPCs shall issue Registration-cum-

Membership Certificate (RCMC). RCMC is required to be furnished by any person,

applying for an Authorisation or for any other benefit or concession under FTP.

8 FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

SPECIFIC PROVISIONS RELATING TO IMPORT AND EXPORT:

1. Samples

Import Export

- Defence/Security

items Other goods Trade and technical samples

- Seeds

- Bees

- New drugs Restricted goods Freely exportable

goods

Freely importable

(Even if otherwise

Requires restricted)

Requires Allowed without

authorisation authorisation

FOREIGN TRADE POLICY

any limit

Note: Duty free import of samples (Without payment of customs duty) upto

`3,00,000 for all exporters shall be allowed.

2. Import/ Export of Gifts

In case of import of In case of export of

gifts gifts

through post/ Restricted Freely

courier (incl. E Other exportable goods

modes goods

Commerce)

Value upto Value >

Other ₹ 5,00,000 in ₹ 5,00,000 in

Rakhi, Life Authorization

goods Authorization required a FY a FY

saving

not required

medicines

Prohibited No Authorizatio

authorization n required

Does not required

require

authorization*

*Customs duty payable on gifts imported. However, if CD on Rakhi is upto `100 then

it is exempted.

FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM 9

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

3. Passenger Baggage - accompanied (or) unaccompanied within 1 year

before or after passengers departure/arrival

Import of baggage Export of baggage

Freely

Restricted Freely Restricted exportable

goods importable goods goods

goods

- Household goods & Other Authorization

Authorization not required

personal effects goods Authorization required

- Drawings, patterns not required

& other notified

FOREIGN TRADE POLICY

goods for export in Authorization

the baggage of required

exporter coming

from abroad

Does not require

authorization*

4. Import of Second hand goods

Capital goods Other than capital goods

- Air conditioners Other capital goods

Imported for remaining

- Generator sets the purpose of goods

- Desktop Reconditioned, Remaining repair/

- Refurbished/ refurbished second hand refurbishing/

reconditioned spares of such capital reconditioning

goods Requires

spares of goods

authorization

computers/

laptops Authorization

Authorization

- Notified not required not required

No restriction (i.e.

electronic goods Freely importable).

But, a certificate is

required from

Restricted (i.e. Chartered Engineer

Require that it has atleast

authorization) 80% of residual life

of original spares

Note: Goods (incl. Capital goods) used abroad for atleast 1 year, can be imported

without any authorization, even if such goods are otherwise restricted.

10 FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

5. Prototypes: New / second hand prototypes / second hand samples may be

imported without an Authorisation on the following conditions:

❑ The importer is an Actual User (industrial)

❑ He is engaged in production of, or having industrial license / letter of intent

for research in an item for which prototype is sought for product development

or research, as the case may be,

❑ The importer files a self-declaration to that effect, to the satisfaction of

Customs authorities.

6. Metallic waste & scrap: Import of any form of metallic waste, scrap will be

subject to the condition that it will not contain hazardous, toxic waste, radioactive

contaminated waste / scrap containing radioactive material, any type of arms,

ammunition, mines, shells, live or used cartridge or any other explosive material in

any form either used or otherwise.

7. Import for export

FOREIGN TRADE POLICY

Freely importable Restricted for import

Freely exportable Restricted for export Freely Restricted for

exportable export

Authorization not

Authorization not Authorization

required for import, Authorization

required for import, required for

if exported in same required for

if exported in same import

or substantially same import and

or substantially form export

same form

CD not payable

[Imported under CD payable in

Goods kept in bond & exported

bonded warehouse & import &

CD not payable against

exported without exported against

[LUT/Bond to be convertible

payment of CD convertible

executed with foreign exchange] foreign exchange

customs]

FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM 11

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

Import

Export

8. Imported goods

(or) Indigenous goods Re-import

Export for repairs/

testing/ quality

Restricted goods -

improvement/

Requires

upgradation

authorization

Freely importable -

Authoirzation not

required

FOREIGN TRADE POLICY

Miscellaneous provisions w.r.to imports/exports:

9. Authorization – Import/export of restricted goods is possible only through

authorization (i.e., licence) obtained through DGFT using applicants IEC. Usually, such

authorization is with actual user condition (i.e., only importer of such goods should

use), unless it is specifically dispensed with.

10. Mandatory documents to be filed:

Import Export

1. Bill of Entry 1. Shipping bill/ Bill of export

2. Document of title:

Vessel – Bill of lading

Aircraft – Airway Bill

Vehicle – Lorry receipt/railway receipt

Post – Postal receipt

3. Commercial invoice cum packing list (or separate invoice and packing list)

11. Import of capital goods under lease financing does not require any specific

permission from DGFT

12. Merchanting trade:

Seller Intermediary Buyer

• Outside India • India • Outside India

Shipment do not touch Indian ports

This is allowed subject to RBI guidelines

All goods are allowed, other than SCOMET, Specimens of wild animals and

plants covered under CITES (Convention on international trade in

Endangered species)

12 FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

13. In case of import of goods without payment of customs duty or at

concessional rate, bank guarantee/bond/LUT to be executed with customs.

However, for domestic procurement without payment of GST, it is to be executed

with regional authority.

14. Benefits to supporting manufacturers and third-party exports:

Merchant Exporter •If Peach

•Peach Industries Industries Ltd.

Ltd. and Golden globe

•Golden Globe EXIM name

•Manufacture's

EXIM mentioned in

goods

•Export's goods documents (i.e.,

tax invoice,

Supporting shipping bill etc.,)

FOREIGN TRADE POLICY

Manufacturer

Benefits under FTP

extended to both

Third party •Export

Exporter documents (i.e.,

•Turbojet (P) Ltd. shipping bill/bill

•On whose behalf of export) shall

goods are •Peach Industries

Ltd. indicate both

exported names. However,

•Manufacture's BRC, export

and Export's order and invoice

goods should be in the

Beneficial owner

anme of Peach

Industries Ltd.

Benefits under FTP

extended to both

FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM 13

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

VARIOUS EXPORT PROMOTION SCHEMES:

Duty

Exemption

Schemes -

AA & DFIA

Duty

Deemed Remission

Exports Schemes -

DBK

Export

promotion

schemes

RODTEP -

Free Trade Rebate of

FOREIGN TRADE POLICY

Zones - EOU, duties and

EHTP, STP taxes on

and BTP Export exported

promotion products

Capital

goods

Scheme

(EPCG)

AA V. DFIA – FOR PROCUREMENT OF GOODS WITHOUT PAYMENT OF DUTY:

Basis of Difference Advance Authorization (AA) Duty Free Import

Authorization (DFIA)

1. Transferability AA is subject to actual user DFIA is transferable after

of authorization condition which cannot be completion of export

transferred obligation

2. Outward supply ✓ Physical export (Incl. supply Only Export

to SEZ)

✓ Deemed Export under FTP

✓ Supply as stores to foreign

going vessel or aircraft

3. Minimum value Minimum VA = 15% (However, in Minimum VA = 20%

addition required case of specified goods, it can be

for outward less than 15%)

supply.

4. Eligibility - An exporter Any exporter

(manufacturer or (manufacturer or

merchant), who holds merchant)

Authorized Economic

Operator Certificate

- A status holder with 2-

star or above status,

14 FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

subject to approval by

DGFT

5. Fixation of AA can be issued even if SION for DFIA can be issued only if

Standard Input that product is not fixed, based SION has been fixed for

SION on self-declaration the product to be

exported.

6. Duties that are All duties (incl. IGST and GST Only BCD payable in

exempt Comp. Cess) payable on imports imports under DFIA is

under AA are exempted. exempted.

7. Applicability of Only manufacturer – Exporter A merchant exporter

authorization. or merchant exporter tied to even though not tied to

supporting manufacturer is supporting

eligible for AA. (In case of manufacturer is eligible

pharmaceutical products it shall for DFIA. However, they

be issued to manufacturer need to mention name

exporter only) and address of

supporting

manufacturer in export

FOREIGN TRADE POLICY

documents.

8. When available? - Imported inputs are subject It shall be issued on post

to pre import condition and export basis based on

they should be physically exports made, which is

incorporated in the export useful for subsequent

product (making normal imports

allowance for wastage).

- In case of local

procurement, the inputs

shall be procured prior to

manufacture of export item

and shall be physically

incorporated in the export

product.

9. When it is not The scheme is not available for No DFIA shall be

available? the specified export products as issued for an input

well as specified inputs. which is subject to

pre-import condition

or where SION

prescribes ‘Actual

User’ condition or

certain other

specified inputs with

pre import condition

Import of Tyre

FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM 15

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

10. Validity? Deemed Exports: 12 months from the date

Co-terminus with contracted of issue (No further

duration of the project or 12 revalidation)

months, whichever is later.

Other cases:

12 months from the date of issue

(Revalidation for further 12

months only once)

11. Export obligation 90 days from the date of 12 months from the date

period clearance of import of online filing of DFIA

consignment (No further application and

extention) generation of file number

FOREIGN TRADE POLICY

Common Provisions applicable to AA & DFIA:

Accounting of - Where SION permits use of either (a) a generic input or

Input (b) alternative input, the name/description of the input

used (or to be used) in the Authorization must match

exactly with the name/description endorsed in the

shipping bill.

- At the time of discharge of export obligation (issue of

EODC) or at the time of redemption, Regional Authority

shall allow only those inputs which have been specifically

indicated in the shipping bill together with quantity.

- The above provisions will also be applicable for supplies to

SEZs and supplies made under Deemed exports.

Importability / Prohibited items – Not allowed unless separately notified.

Exportability of Reserved for STE – Import not allowed without Advance

items that are Release Order (ARO), or Invalidation Letter. Export only after

Prohibited/ obtaining a ‘No Objection Certificate’ from the concerned STE.

Restricted / STE Restricted items – Import allowed unless specifically

disallowed. Export of restricted / SCOMET items however,

shall be subject to all conditionalities or requirements of

export authorization or permission.

Domestic Holder of an AA / DFIA can procure inputs from indigenous

Sourcing of supplier/ State Trading Enterprise/EOU/EHTP/BTP/ STP in

Inputs lieu of direct import.

Such procurement can be against Advance Release Order

(ARO), or Invalidation Letter.

16 FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

Currency for Export proceeds shall be realized in freely convertible

Realisation of currency or in Indian Rupees, except otherwise specified.

Export Proceeds.

Re-import of Goods exported under AA/ DFIA may be re-imported in same

exported goods or substantially same form subject to the conditions.

Advance Authorization for Annual Requirement and Eligibility Conditions:

Advance Authorization for Annual Requirement shall only be issued for items

notified in SION and it shall not be available in case of adhoc norms under

Self-Declared Authorizations where SION does not exist.

Advance Authorization for Annual Requirement shall also not be available in

respect of SION where input is notified.

Exporters having past export performance (in at least preceding two

financial years) shall be entitled for Advance Authorization for Annual

requirement.

FOREIGN TRADE POLICY

Entitlement in terms of CIF value of imports shall be upto 300% of the FOB

value of physical export and / or FOR value of deemed export in preceding

financial year or Rs 1 Crore, whichever is higher.

FULFILMENT OF EXPORT OBLIGATION:

• For the purpose of duty exemption and remission schemes, Value Addition

(VA) shall be calculated as follows: -

• Value Addition = A – B/B X 100

• where:

• A = FOB value of export realized (In case of actual exports)/ FOR value

received (In case of deemed exports)

• B = CIF value of inputs covered by Authorization, plus any other imported

materials used on which benefit of DBK is claimed or intended to be claimed.

• Note: In case of free of cost material supplied by foreign buyer, notional value

of material (notional CIF as declared before Customs) shall be added to the

CIF value and also to FOB value to arrive at the value addition.

FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM 17

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

Illustration - 1:

CIF value of Input = `2,50,000 & Fob Value of export = `3,25,000 whether VA

delivered under AA?

3,25,000 - 2,50,000

×100 = 30% VA Achieved

2,50,000

Illustration - 2:

If FOB value of export is ` 4,80,000, what should be CIF value of import to achieve

VA under DFIA?

CIF Value of import + 20% = FOB value of export

1.2 x CIF value of import = `4,80,000

4,80,000

CIF Value of import = 1.2 = `4,00,000

FOREIGN TRADE POLICY

Illustration - 3:

If FOB value of export in ` 8,00,000 & goods freely supplied by recipient outside

India with a national cost of ` 2,00,000, what should be CIF value of other imports

if VA under AA to be achieved?

CIF value of import x 115% = FOB value of export

(X + `2,00,000) x 115% = `8,00,000 + `2,00,000

X + `2,00,000 = `10,00,000 / 1.15 = `8,69,565

X = `8,69,565 – `2,00,000 = `6,69,565

REMISSION OF DUTIES AND TAXES ON EXPORTED PRODUCTS (RODTEP) SCHEME:

Refund to exporters central, state and local duties/taxes that were so far not

being rebated/refunded (Eg: Corporation tax, municipal tax, mandi tax, Local

body tax, garbage tax etc.,)

Refund credited to Electronic Duty Credit ledger through e-Scrip, maintained

under Sec. 51B of Customs Act, 1962 which can be used only for payment of

Basic Customs Duty on import (or) can be transferred to other importers

The rebate under the scheme shall not be available in respect of duties and taxes

already exempted or remitted or credited.

Under the scheme, a rebate would be granted to eligible exports at a notified

rate as a % of FOB value with a value cap per unit of the exported product,

wherever required, on export of items which are categorized under the notified

8 digit HS code. However, for certain export items, a fixed quantum of rebate

amount per unit may also be notified.

The rebate allowed is subject to the receipt of sale proceeds within time allowed

under the FEMA, 1999 failing which such rebate shall be deemed never to have

18 FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

been allowed. The rebate would not be dependent on the realization of export

proceeds at the time of issue of rebate.

If the sale proceeds are not realized within the time allowed under FEMA, then

the rebate granted shall be recovered from the person to whom the rebate is

granted, even if such duty credit is transferred to any person.

Ineligible supplies/Items/Categories under the scheme:

(i) Export of imported goods

(ii) Exports through transhipment

(iii) Exported goods subject to minimum export price or export duty

(iv) Restricted goods for export as per ITC (HS)

(v) Prohibited goods for export as per ITC (HS)

(v) Deemed Exports

(vii) Supplies of products manufactured by DTA units to SEZ/FTZ units

(viii) Products manufactured by 100% EOU/EHTP/BTP/Customs bonded

warehouse/SEZ/FTZ

FOREIGN TRADE POLICY

(ix) Products manufactured or exported in discharge of export obligation

against AA (or) DFIA

EXPORT PROMOTION CAPITAL GOODS (EPCG) SCHEME:

• What is this scheme about? Export Promotion Capital Goods Scheme (EPCG)

permits exporters to procure capital goods at zero customs duty or procure

them indigenously without payment of GST[Deemed Exports under GST]. In return,

exporter is under an obligation to fulfill the export obligation.

Note: Exemption w.r.to IGST & GST comp. cess on import.

• Who are eligible?

o Manufacturer exporters with or without supporting manufacturers

o Merchant exporters tied to supporting manufacturer

o Service providers including service providers designated as Common Service

Provider (CSP) subject to prescribed conditions

• Meaning of capital goods:

o “Capital Goods” means any plant, machinery, equipment or accessories

required for manufacture or production, either directly or indirectly, of

goods or for rendering services, including those required for

replacement, modernisation, technological up-gradation or expansion.

FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM 19

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

o Capital goods may be for use in manufacturing, mining, agriculture,

aquaculture, animal husbandry, floriculture, horticulture, pisciculture,

poultry, sericulture and viticulture as well as for use in services sector.

o The license holder can either procure the capital goods (whether used for

pre-production, production or postproduction) from global market or

domestic market.

o Restricted capital goods shall be imported only after requisite approval.

o Capital Goods including capital goods in CKD/SKD condition are eligible

o Computer systems and software which are a part of the Capital Goods

being imported are eligible

o Spares, moulds, dies, jigs, fixtures, tools, refractories & Catalysts for initial

charge plus one subsequent charge, are also eligible

FOREIGN TRADE POLICY

o Import of capital goods shall be subject to actual user condition till export

obligation is completed. After export obligation is completed, capital goods

can be sold (or) transferred.

• Export obligation? Export obligation means obligation to export products

covered by authorization/ permission in terms of quantity or value or both, as

may be prescribed/specified by regional or competent authority. Export

obligation (EO) consists of specific export obligation and average export

obligation. Specific EO is over and above average EO (Therefore first average EO

should be met and then Specific EO should be met)

Export Obligation

Specific Export Obligation Average Export Obligation

It is equivalent to 6 times of duty saved It is the average level of exports made by

on capital goods imported under EPCG the applicant in 3 preceeding licencing

Scheme years for the same and similar products

Duty saved shall be, In case of direct It has to be achieved within the overall

imports, actual duty saved amount. In export obligation period (including extended

case of domestic sourcing, notional period, unless otherwise specified)

Customs duty saved on FOR value.

20 FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

• Validity of authorization: Valid for import for 24 months from the date of issue

of authorization. Revalidation shall not be permitted.

Special points w.r.to export obligation:

The Average Export Obligation (AEO) shall be fulfilled every financial year,

till export obligation is completed. Exports/supplies made over and above

AEO shall only be considered for fulfillment of Export Obligation.

EO shall be fulfilled by the authorisation holder through export of goods

which are manufactured by him or his supporting manufacturer / services

rendered by him, for which the EPCG authorisation has been granted. Exports

can be direct or through third parties.

In case of indigenous sourcing of capital goods, Specific EO shall be 25%

less than the EO mentioned above, i.e. EO will be 4.5 times (75% of 6 times)

of duty saved on such goods procured. There shall be no change in average

EO imposed, if any

Exports under Advance Authorisation, DFIA, Duty Drawback, RoSCTL and

FOREIGN TRADE POLICY

RoDTEP Schemes would also be eligible for fulfilment of EO under EPCG

Scheme

Exports made from DTA units shall only be counted for calculation and/or

fulfillment of AEO and/or EO

EO can also be fulfilled by the supply of Information Technology

Agreement (ITA-1) items to DTA, provided realization is in free foreign

exchange

Both physical exports as well as specified deemed exports shall also be

counted towards fulfilment of export obligation

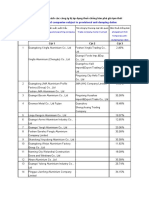

Illustration - 4:

Duty saved on import of capital goods = `20,00,000 → Specific EO = 80,00,000

EPCG granted on 1/04/2023. Determine whether export obligation is achieved based

on the following information pertaining to exports for various years:

2019 2020 2021 2022 2023 2024

`10 lakhs `40 lakhs `20 lakhs `50 lakhs `45 lakhs `60 lakhs

2025 2026 2027 2028 2029 2030

`55 lakhs `55 lakhs `80 lakhs `90 lakhs `80 lakhs `75 lakhs

FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM 21

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

6 years Actual Average of 3 Amount Cumulative

from the Exports (i) preceding years (ii) towards amount

date of Specific EO towards

EPCG (iii) = (i) – (ii) specific EO

2023 `45 lakhs 40+20+50

= 36.67 lakhs 8.33 lakhs 8.33 lakhs

3

2024 `60 lakhs 20+50+45

= 38.33 lakhs 21.67 lakhs 30 lakhs

3

2025 `55 lakhs 50+45+60

= 51.67 lakhs 3.33 lakhs 33.33 lakhs

3

2026 `55 lakhs 45+60+55

= 53.33 lakhs 1.67 lakhs 35 lakhs

3

2027 `80 lakhs 60+55+55

= 56.67 lakhs 23.33 lakhs 58.33 lakhs

3

2028 `90 lakhs 55+55+80

= 63.33 lakhs 26.67 lakhs 85 lakhs

FOREIGN TRADE POLICY

3

In the present case, both average EO and Specific EO is achieved and they will get

export obligation discharge certificate.

EXPORT PROMOTION ZONES SCHEME:

What are the 1. EOU – Export Oriented Unit

notified areas? 2. EHTP – Electronic Hardware Technology Park

3. STP – Software Technology Park

4. BTP – Bio Technology Park

Objective To promote exports, enhance foreign exchange

earnings, attract investment for export production

and employment generation.

Units Covered under All units OTHER THAN TRADING UNITS are covered

the Scheme? under this Scheme

Majorly exports of goods or services, other than

prohibited (Except permissible sales in DTA)

Applications & Application for setting up an EOU shall be considered

Approvals/Letter by Unit Approval Committee (UAC)/ Board of Approval

of Permission (BoA) as the case may be.

(LOP)/ Letter of

Intent (LOI)

What is the validity Once unit commences production, LOP/LOI issued shall be

of LoP/LoI valid for a period of 5 YEARS for its activities. This period

may be EXTENDED further by DC for a period of 5 YEARS

at a time.

22 FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

Tax Implications

FOREIGN TRADE POLICY

Note: Exemption w.r.to IGST & GST comp. cess on import

Other entitlements Exemption from industrial licensing for

manufacture of items reserved for micro and small

enterprises.

Export proceeds will be realized within 9 months.

Units will be allowed to retain 100% of its export

earnings in the EEFC (Exchange Earners' Foreign

Currency) account.

FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM 23

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

Unit will not be required to furnish bank guarantee

at the time of import or going for job work in DTA

subject to fulfilment of specified conditions.

100% FDI investment permitted through automatic

route similar to SEZ units

Inter unit transfer Transfer of manufactured goods/capital goods from one

EOU/ EHTP/STP/BTP unit to another EOU / EHTP/ STP/

BTP unit is allowed on payment of applicable GST and

compensation cess with prior intimation to concerned

Development Commissioners of the transferor and

transferee units as well as concerned Customs authorities

as per the specified procedure.

Goods supplied by one unit to another unit shall be treated

FOREIGN TRADE POLICY

as imported goods for second unit for payment of duty, on

DTA sale by second unit.

Who can establish Only projects having a minimum investment of ₹ 1

EOU? Crore in P&M shall be considered for establishment as

Is there any EOUs. However, this shall not apply to existing units

investment criteria? and units in EHTP/ STP/ BTP, Handicrafts/

Agriculture/ Floriculture/ Aquaculture/ Animal

Husbandry/ Information Technology, Services, Brass

Hardware and Handmade Jewellery sectors.

BoA (Board of Approval) may also allow establishment

of EOUs with a lower investment criteria.

Conversion of DTA Existing DTA units may also apply for conversion into an

into EOU? EOU / EHTP / STP/ BTP unit. Existing EHTP / STP units

may also apply for conversion / merger to EOU unit and

vice-versa. In such cases, units will avail exemptions in

duties and taxes as applicable.

Net Foreign In a period of 5 years EOU units have to achieve a positive

Exchange Earning NFE Earning cumulatively. Such period of 5 years can be

(NFE) condition extended in specified cases.

Exit from scheme With approval of DC/Designated officer of EHTP/

STP/BTP, an EOU/EHTP/STP/BTP unit may opt out of

scheme.

Such exit shall be subject to payment of applicable excise

and customs duties and on payment of applicable IGST/

CGST/ SGST/ UTGST and compensation cess, if any, and

industrial policy in force.

If unit has not achieved obligations, it shall also be liable to

penalty at the time of exit.

24 FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

V. DEEMED EXPORTS:

Objective: Indian manufacturers are treated on par with foreign suppliers, to

promote make in India initiative (i.e., Rather than purchasing from foreign

suppliers, purchases can be made from Indian manufacturers)

Underlying theory: Foreign Exchange Saved = Foreign Exchange earned

Consideration: Either in Indian Rupees (`) or Free foreign exchange

Categories of supplies considered as deemed export:

Supplies to domestic Supplies to projects/

entities who can import purposes that involve Supplies to

their requirements duty international infrastructure projects

free or at reduced rates competitive bidding of national importance

of duty (ICB)

Projects financed by

FOREIGN TRADE POLICY

Supply of goods

agencies notified by Mega power projects

against AA

Department of

Economic Affairs

(DEA), under ICB.

Supply of goods to

Nuclear projects

EOU/EHTP/STP/BTP

Any project covered

under ICB, where

Supply of capital imports are Projects financed by

goods against EPCG permitted at zero UN or international

authorization customs duty organisations

Benefits for Deemed Exports:

Deemed exports shall be eligible for any/all of following benefits in respect of

manufacture and supply of goods, qualifying as deemed exports

(a) Advance Authorization (AA)/Advance authorization for annual requirement/

Duty Free import authorization (DFIA) – Import without payment of customs

duty, as per the scheme

(b) Deemed Export Drawback – Refund of customs duty paid on import

(c) Refund of terminal excise duty for specified excisable goods – Refund of excise

duty (i.e., CVD) paid on import

FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM 25

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

Conditions for deemed exports:

Supplies shall be made directly to entities listed above. Third party supply

shall not be eligible for benefits/exemption.

In all cases, supplies shall be made directly to the designated

Projects/Agencies/Units/ Advance Authorization/ EPCG Authorization

holder. Sub-contractors may, however, make supplies to main contractor

instead of supplying directly to designated Projects/ Agencies. Payments in

such cases shall be made to sub-contractor by main-contractor and not by

project Authority.

Supply of domestically manufactured goods by an Indian Sub- contractor to

any Indian or foreign main contractor, directly at the designated project’s/

Agency’s site, shall also be eligible for deemed export benefit

FOREIGN TRADE POLICY

26 FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

FOREIGN TRADE POLICY

FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM 27

“RE-WISE” GST & CUSTOMS

SEGMENT - 31

PENAL ACTION AND PLACING OF AN ENTITY IN DENIED ENTITY LIST:

Penal action

In following situations, a person shall be liable to penal action under FT (D&R) Act

and rules and orders made thereunder, FTP and any other law for time being in

force:

(i) Authorization holder:

• violates any condition of such Authorization

• fails to fulfill export obligation

• fails to deposit the requisite amount within the period specified in demand

notice

(ii) any information/particulars furnished by applicant subsequently found

untrue/incorrect [With a view to raising ethical standards and for ease of doing business, DGFT has

FOREIGN TRADE POLICY

provided for self-certification system under various schemes in FTP. In such cases, applicants is expected to

undertake self-certification with sufficient care and caution in filling up information/ particulars]

Denied Entity List (DEL)

A firm may be placed under DEL, by the concerned Regional Authority (RA) of the

DGFT.

In such a case:

(i) firm may be refused grant or renewal of a

licence/authorization/certificate/scrip/any instrument bestowing

financial/fiscal benefits, and

(ii) all new licences, authorizations, scrips, certificates, instruments etc. will

be blocked from printing/ issue/renewal.

A firm’s name can be removed from DEL, by the concerned RA for reasons if the

firm completes Export Obligation/ pays penalty/ fulfils requirement of demand

notice(s) issued by the RA/submits documents required by the RA.

28 FOR BOOKS & VIDEOS VISIT WWW. THARUNRAJ.COM

You might also like

- PLB - EnglishDocument16 pagesPLB - Englishsetyabudi bowolaksonoNo ratings yet

- Process of Export of New or Used Vehicles From RSADocument7 pagesProcess of Export of New or Used Vehicles From RSAmarshy bindaNo ratings yet

- Data Analysis and InterpretationDocument7 pagesData Analysis and InterpretationATS PROJECT DEPARTMENTNo ratings yet

- Orchid ExportDocument24 pagesOrchid ExportShaz AfwanNo ratings yet

- Guide To Import & Export, Customs Formalities: Iran InvestDocument2 pagesGuide To Import & Export, Customs Formalities: Iran InvestMehdi SoltaniNo ratings yet

- Foreign Trade Policy 2015-2020Document11 pagesForeign Trade Policy 2015-2020GAUTAM JHANo ratings yet

- Foreign Trade Policy May19Document22 pagesForeign Trade Policy May19H JNo ratings yet

- Customs Clearance Training - (Export Import) 1Document76 pagesCustoms Clearance Training - (Export Import) 1Ravindran100% (3)

- Brief PolicyDocument9 pagesBrief PolicysanjchandanNo ratings yet

- 2021821185755580sro957 (I) 2021Document34 pages2021821185755580sro957 (I) 2021Syed BukhariNo ratings yet

- Benefits of Arshiya FTWZ Vis-A-Vis Bonded Warehouse, Port PDFDocument19 pagesBenefits of Arshiya FTWZ Vis-A-Vis Bonded Warehouse, Port PDFbhavesh chaudhariNo ratings yet

- S.I. 89 of 2021 Control of Goods (Import and Export) (Commerce) (Amendment)Document1 pageS.I. 89 of 2021 Control of Goods (Import and Export) (Commerce) (Amendment)Tapiwa MukandiNo ratings yet

- Import Policy Order: Ministry of CommerceDocument167 pagesImport Policy Order: Ministry of CommerceSabbir HossainNo ratings yet

- Presentation On Foreign Trade PolicyDocument25 pagesPresentation On Foreign Trade PolicyYogesh TiwariNo ratings yet

- Export Processing Zones Act 12 of 1990Document21 pagesExport Processing Zones Act 12 of 1990Mwalimu MworiaNo ratings yet

- Export Proomotion GSTDocument45 pagesExport Proomotion GSTKhushboo SherawatNo ratings yet

- Ashima FTDRDocument19 pagesAshima FTDRAshu SinghNo ratings yet

- Foreign Trade Policy &handbook of Procedures 2004-2009 (ANNUAL SUPPLEMENT FOR 2006-07)Document25 pagesForeign Trade Policy &handbook of Procedures 2004-2009 (ANNUAL SUPPLEMENT FOR 2006-07)Ankur BordoloiNo ratings yet

- Act1 LegComIntDocument7 pagesAct1 LegComIntMARIANA SALAZARRAMIREZNo ratings yet

- EPZ Stand Order-1Document3 pagesEPZ Stand Order-1Sohel SumonNo ratings yet

- Foreign Trade Policy: A Brief UnderstandingDocument76 pagesForeign Trade Policy: A Brief UnderstandingMilna JosephNo ratings yet

- Presentation ON The Customs Act, 1962, and The Customs Tariff Act, 1975Document32 pagesPresentation ON The Customs Act, 1962, and The Customs Tariff Act, 1975ClanlordNo ratings yet

- Sop AllDocument50 pagesSop Allmitu lead01No ratings yet

- Foreign Trade PolicyDocument6 pagesForeign Trade PolicyDushyant ChaudharyNo ratings yet

- Royal Malaysian Customs: Guide ImportDocument37 pagesRoyal Malaysian Customs: Guide ImportleenobleNo ratings yet

- Mid AssignmentDocument33 pagesMid Assignmentmani1464No ratings yet

- Taxation 1 ReviewerDocument16 pagesTaxation 1 ReviewerHNo ratings yet

- 13 - Tax Law - Customs Law - 271219Document25 pages13 - Tax Law - Customs Law - 271219Sushil BansalNo ratings yet

- Exim Policy or Indian Foreign Trade PolicyDocument3 pagesExim Policy or Indian Foreign Trade PolicylapogkNo ratings yet

- Ca. Keval Mota: Customs Act, 1962 (2/5)Document1 pageCa. Keval Mota: Customs Act, 1962 (2/5)Ceritifiedd killerNo ratings yet

- Compile Newsletter April I 2019 ENGLISH Edit PagiDocument7 pagesCompile Newsletter April I 2019 ENGLISH Edit PagiDaisy Anita SusiloNo ratings yet

- RR No. 13-2018 (VAT Refund)Document23 pagesRR No. 13-2018 (VAT Refund)Hailin QuintosNo ratings yet

- SRO 642 Dated 1st June, 2023 - 230601 - 202459Document7 pagesSRO 642 Dated 1st June, 2023 - 230601 - 202459kahoutgNo ratings yet

- Import Policy Order English-2015-18 - 24 Oct 2016Document127 pagesImport Policy Order English-2015-18 - 24 Oct 2016Raquibul HassanNo ratings yet

- ELP Manufacture and Other Operations in Bonded Warehouse MinDocument3 pagesELP Manufacture and Other Operations in Bonded Warehouse MinELP LawNo ratings yet

- Foreign Trade Policy 1Document31 pagesForeign Trade Policy 1vmchawlaNo ratings yet

- Gazette Extraordinary No 2309-40Document3 pagesGazette Extraordinary No 2309-40Adaderana OnlineNo ratings yet

- Export Facilitation Scheme EFS 2021 Final 1Document36 pagesExport Facilitation Scheme EFS 2021 Final 1Shakeel NasirNo ratings yet

- Ca. Keval Mota: Customs Act, 1962 (1/5)Document1 pageCa. Keval Mota: Customs Act, 1962 (1/5)Ceritifiedd killerNo ratings yet

- 5 Pages Customs ChartsDocument5 pages5 Pages Customs ChartsCeritifiedd killerNo ratings yet

- VAT NotesDocument30 pagesVAT NotesRica BalajadiaNo ratings yet

- What Is Dumping? What Is An Anti-Dumping Measure?Document8 pagesWhat Is Dumping? What Is An Anti-Dumping Measure?Shaina DalidaNo ratings yet

- FTP2023 Chapter02Document16 pagesFTP2023 Chapter02Rutul ParikhNo ratings yet

- Duty Exemption & Remission SchemeDocument59 pagesDuty Exemption & Remission SchemebharatNo ratings yet

- DTRERules Updatedversion Upto12.09.2019Document17 pagesDTRERules Updatedversion Upto12.09.2019abid205No ratings yet

- Lecture 5 - 2023Document39 pagesLecture 5 - 2023Lê Thiên Giang 2KT-19No ratings yet

- Iift 2022 PPT NsezDocument171 pagesIift 2022 PPT NsezSoumyadip SettNo ratings yet

- Inco, Payment, ItcDocument40 pagesInco, Payment, ItckskinboxNo ratings yet

- Evidencia 8 Presentation "Steps To Export"Document5 pagesEvidencia 8 Presentation "Steps To Export"Eliana patricia Betancur canoNo ratings yet

- Customs Chart May 20 Keval MotaDocument4 pagesCustoms Chart May 20 Keval MotaKomal MantriNo ratings yet

- 06 IB Unit 4 Export and Import Procedures SEM 5Document28 pages06 IB Unit 4 Export and Import Procedures SEM 5godlistengideon7No ratings yet

- CMTA NotesDocument8 pagesCMTA NotesFrances Abigail BubanNo ratings yet

- Import DutyDocument10 pagesImport DutyFuadNo ratings yet

- Foreign Trade Policy Q&ADocument12 pagesForeign Trade Policy Q&Aphilia.newNo ratings yet

- Topic 4 - Export Processing ZoneDocument12 pagesTopic 4 - Export Processing Zonechuxuan hengNo ratings yet

- Trade PolicyDocument4 pagesTrade PolicyA B cNo ratings yet

- Handout 1-Introduction To CustomsDocument8 pagesHandout 1-Introduction To CustomsAmara OtoNo ratings yet

- Revenue Regulations No. 13-18: CD Technologies Asia, Inc. © 2019Document17 pagesRevenue Regulations No. 13-18: CD Technologies Asia, Inc. © 2019Lance MorilloNo ratings yet

- Proposed Presentation Template Management Meeting 30 - 2014Document71 pagesProposed Presentation Template Management Meeting 30 - 2014admin.hosenchocoNo ratings yet

- EIDT Unit 4Document12 pagesEIDT Unit 4Samarth SahuNo ratings yet

- HKB - 19 - Soundrenumerapolicy ImportsDocument32 pagesHKB - 19 - Soundrenumerapolicy ImportsSachin BaneNo ratings yet

- Bangladesh Import Policy Order, 2006-2009 - English PDFDocument70 pagesBangladesh Import Policy Order, 2006-2009 - English PDFMinhazul IslamNo ratings yet

- Audit - Final Revision Capsule by ICAIDocument67 pagesAudit - Final Revision Capsule by ICAIvenkatrao_100No ratings yet

- All Question PapersDocument12 pagesAll Question Papersvenkatrao_100No ratings yet

- FAQs On GSM - Version 3Document8 pagesFAQs On GSM - Version 3venkatrao_100No ratings yet

- 25 Empowering Worry QuotesDocument3 pages25 Empowering Worry Quotesvenkatrao_100No ratings yet

- Post H-O Trade TheoriesDocument7 pagesPost H-O Trade Theoriesfignewton89100% (5)

- International Trading EnvironmentDocument50 pagesInternational Trading EnvironmentMirza Ghous MohammadNo ratings yet

- Doc. Related To Payment & GoodsDocument13 pagesDoc. Related To Payment & GoodsAmitrajeet kumarNo ratings yet

- Trade Questions 2059Document22 pagesTrade Questions 2059Omar Abid100% (3)

- Trade To Uni Emirat ArabDocument3 pagesTrade To Uni Emirat Arabgeubrina aulia rizkiNo ratings yet

- Service Tax - Form A1Document5 pagesService Tax - Form A1kuriakose_mv3653No ratings yet

- Assignment 2Document2 pagesAssignment 2Umar GondalNo ratings yet

- Export and Trading HouseDocument32 pagesExport and Trading HouseRajshekhar NayakNo ratings yet

- Egypt - Trade - European CommissionDocument3 pagesEgypt - Trade - European CommissionTarek ElgebilyNo ratings yet

- Export Assistance and IncentivesDocument10 pagesExport Assistance and IncentivesAbdul Hafeez Ghori100% (2)

- Hermes Trading IRC 2020 PDFDocument1 pageHermes Trading IRC 2020 PDFNowab ShihabNo ratings yet

- Chapter 6 - IbtDocument9 pagesChapter 6 - IbtALMA MORENANo ratings yet

- Chapter 6 Trade ProtectionismDocument26 pagesChapter 6 Trade Protectionismsalsa azzahraNo ratings yet

- International Trade Theories Are Various Theories That Analyze and ExplainDocument4 pagesInternational Trade Theories Are Various Theories That Analyze and ExplainRM ValenciaNo ratings yet

- Economic Situation/ Development of Global DivideDocument2 pagesEconomic Situation/ Development of Global DivideLyka Casapao AgultoNo ratings yet

- Export And/or Import: Evidence 8Document4 pagesExport And/or Import: Evidence 8Luis Enrique Hernandez RodriguezNo ratings yet

- 2000 02 23 Customs Valuation Rules, 2000Document11 pages2000 02 23 Customs Valuation Rules, 2000VAT A2ZNo ratings yet

- Import Tax - Anti Dumping VietnamDocument2 pagesImport Tax - Anti Dumping VietnamTurinto MarjonoNo ratings yet

- Group 2 GLOBAL INTERSTATE SYSTEM 1Document21 pagesGroup 2 GLOBAL INTERSTATE SYSTEM 1Jashi SiosonNo ratings yet

- Krugmanobstfeldch 01Document14 pagesKrugmanobstfeldch 01Dimitris KatsarosNo ratings yet

- The Indian Shrimp Industry Organizes To Fight TheDocument9 pagesThe Indian Shrimp Industry Organizes To Fight TheVaibhav RakhejaNo ratings yet

- Macroeconomics Canadian 8th Edition Sayre Solutions ManualDocument5 pagesMacroeconomics Canadian 8th Edition Sayre Solutions Manualregattabump0dt100% (36)

- Structural Change and Economic Dynamics: Paloma Villanueva, Luis Cárdenas, Jorge Uxó, Ignacio ÁlvarezDocument15 pagesStructural Change and Economic Dynamics: Paloma Villanueva, Luis Cárdenas, Jorge Uxó, Ignacio ÁlvarezsergeNo ratings yet

- The Features of Volume, Composition and Direction of India's Foreign Trade Are As FollowsDocument3 pagesThe Features of Volume, Composition and Direction of India's Foreign Trade Are As Followslolik soliNo ratings yet

- Mediterranean Shipping Company (Nigeria) Limited: MSC (Nigeria) LTD Export Tariff (In Naira)Document1 pageMediterranean Shipping Company (Nigeria) Limited: MSC (Nigeria) LTD Export Tariff (In Naira)IsoniIsoniEkpenyongNo ratings yet

- Paints and Varnishes in India ISIC 2422 PDFDocument7 pagesPaints and Varnishes in India ISIC 2422 PDFSahil GargNo ratings yet

- Import Procedure IN INDIADocument16 pagesImport Procedure IN INDIASMITNo ratings yet