Professional Documents

Culture Documents

Bill Progress 9.27

Bill Progress 9.27

Uploaded by

rikahinikerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bill Progress 9.27

Bill Progress 9.27

Uploaded by

rikahinikerCopyright:

Available Formats

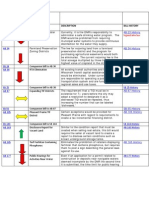

2011 Regular Session

BILL NO. AB 23

1kFriends POSITION

TITLE Disinfection of Water Supplies

DESCRIPTION Currently, it is the DNR's responsibility to administer a safe drinking water program. The DNR would be prohibited from requiring municipal water systems to provide continuous disinfection for the water they supply. The fee for rezoning land from a farmland preservation district and the program for purchasing agricultural easements would both be eliminated. The current rezoning fee is the total acreage multiplied by three times the highest value of cropland in the city. All existing transit authorities and the Southeast Wisconsin transit capital assistance program would be eliminated. Under current law, RTAs are responsible for operating a public transportation system and are funded through regional sales and use taxes. The requirement that a TID must be in existence for 7+ years before the city may adopt a resolution to designate it as a distressed TID would be repealed, thus increasing the number that can be labeled 'distressed.'

BILL HISTORY AB 23 History Signed into law

AB 34

Farmland Preservation Zoning Districts

AB 34 History

SB 24 AB 36

Companion bill to AB 34 RTA Elimination

SB 24 History AB 36 History (Now incorporated into the budget)

SB 25 AB 87

Companion bill to AB 36 Expanding TIF Districts

SB 25 History AB 87 History

SB 55 AB 105

Companion bill to AB 87 Pleasant Prairie TIF District Certain exceptions would be provided for Pleasant Prairie with regard to requirements to create a tax incremental financing district.

SB 55 History Signed into law AB 105 History

SB 144 AB 163

Companion bill to SB 144 Disclosure Report for Vacant Land Similar to the condition report that must be created when selling real estate, this bill would require the seller of vacant land to create a report to disclose certain conditions such as known underground storage tanks. Eliminates the prohibition of retailers displaying fertilizer that contains phosphorus, but requires them to post a sign describing the general laws against its use.

SB 144 History Signed into law AB 163 History

AB 165

Turf Fertilizer Containing Phosphorus

AB 165 History

AB 177

Public Hearings for Activities Near Water

Even if an application for a permit related to construction or deposits near navigable waters deemed incomplete by the DNR the second time it is submitted, the time limit for public hearing process is triggered. This shortens the amount of time open for public comment on certain proposals. A county would not be allowed to enact any ordinance with regard to the extraterritorial area of a municipality as long as the municipality and the town within which the area is located are in agreement. A number of cities and municipalities would be authorized to create multijurisdictional TIF districts after entering an intergovernmental cooperation agreement with shared responsibilities. A town would now be allowed to challenge in court a direct annexation of a piece of its territory by a city or village if the annexation is being carried out by the unanimous approval method. Expands the current law that regulates well drillers to include those engaged in well drilling for geothermal purposes. Changes requirements for clearing vegetation obstructing signs. Generally makes it easier and cheaper to remove vegetation without the requirement to replace removed vegetation. Moves appointing power for secretary of natural resources from the governor to the Natural Resources Board. If the secretary seat becomes vacant for any reason, the replacement may now carry out a full 4 year term. Allows Milwaukee County to impose an additional sales tax of up to one cent for parks, recreation, transit services and public safety.

AB 177 History

SB 133 AB 178

Companion bill to AB 177 Authority of a County to Enact Ordinances

SB 133 History AB 178 History

AB 179

Multijurisdictional TIF Districts

AB 179 History

AB 181

Challenging Annexation Procedures

AB 181 History

AB 201

Geothermal Regulation

AB 201 History

SB 156 AB 216

Companion bill to AB 201 Clearing Vegetation for Outdoor Advertising

SB 156 History AB 216 History

AB 218

Secretary and Vacancies on the Natural Resources Board

AB 218 History

AB 257

AB 260

Milwaukee County sales and use tax for parks, recreation and culture, transit services, and public safety Elements that must be included in a county development plan Rail passenger service assistance and promotion program

AB 257 History

AB 261

Changes existing law to make inclusion of a citys or villages master plan in a county development plan optional. The bill also eliminates the requirement that any official map be included without changes. Requires WisDOT to competitively bid for rail passenger support services, equipment, or facilities for rail passenger service, including the sale or lease of equipment or facilities acquired by DOT for the

AB 260 History

AB 261 History

AB 265

Definition of a bicycle and changes to operational requirements of a bicycle

purpose of providing rail passenger service or support services for rail passenger service. Allows Milwaukee County to impose an additional sales tax of up to one cent for parks, recreation, transit services and public safety.

AB 265 History

SB 21

TIF Retail Project

SB 36

Shoreland Zoning Ordinances

SB 59

Registering Piers and Wharves Vacant Land Disclosure Reports Forestry Enterprises Income Tax Deduction for Employer-Paid Fringe Benefits for Transit

This bill would authorize Brookfield to create a tax incremental district for retail projects. TIDs may only be created for retail purposes if they are related to the sale of goods produced by an agricultural, manufacturing, or forestry project. Shoreland zoning ordinance will not apply if certain conditions are met such as if the majority of buildings in the area have been in use by small businesses since 1990. This bill extends the deadline for registration of grandfathered piers and wharves. Creates a vacant land disclosure report that land sellers must provide to prospective buyers to make them aware of certain conditions of the property. A Legislative Council bill concerning forestry enterprises. Creates an individual income tax exemption for the cost of a public transportation pass provided by an employer to an employee, or for the money paid by an employer to an employee to purchase such a pass, of up to $230 per month.

SB 21 History Signed into law

SB 36 History

SB 59 History Signed into law SB 136 History

SB 136

SB 161 SB 171

SB 161 History SB 271 History

You might also like

- St. Louis, Missouri Comprehensive Revenue Study 2009, by The PFM GroupDocument349 pagesSt. Louis, Missouri Comprehensive Revenue Study 2009, by The PFM GroupstlbeaconNo ratings yet

- Statcon Case DigestDocument17 pagesStatcon Case Digestjofae penillaNo ratings yet

- PD 198 (Revised 2010) Provincial Water Utilities ActDocument97 pagesPD 198 (Revised 2010) Provincial Water Utilities ActRoel Briones67% (3)

- Norwich Community Development Corporation (NCDC) Annual Report (1/14/14)Document24 pagesNorwich Community Development Corporation (NCDC) Annual Report (1/14/14)The Bulletin100% (1)

- Bill Progress 7.13Document2 pagesBill Progress 7.13rikahinikerNo ratings yet

- Bill Progress 61611 (Word)Document2 pagesBill Progress 61611 (Word)rikahinikerNo ratings yet

- AnalysisDocument3 pagesAnalysiscmmynrz6k6No ratings yet

- 11 13 10 CWT Power PointDocument35 pages11 13 10 CWT Power PointWatershed PostNo ratings yet

- CoC STMT of DefenceDocument6 pagesCoC STMT of DefenceDarren KrauseNo ratings yet

- Wilmington - North Riverfront Marina and Hotel Park Riverwalk Swap Land DealDocument51 pagesWilmington - North Riverfront Marina and Hotel Park Riverwalk Swap Land DealMichael D KaneNo ratings yet

- Plainview Grocery Store CID and TIF in Wichita, KansasDocument15 pagesPlainview Grocery Store CID and TIF in Wichita, KansasBob WeeksNo ratings yet

- Proposed Detroit Lakes Annexation Plan, Nov. 2022Document14 pagesProposed Detroit Lakes Annexation Plan, Nov. 2022Michael AchterlingNo ratings yet

- Resolution 2016 BIA Land and Reuse Plan 39Document3 pagesResolution 2016 BIA Land and Reuse Plan 39NicoleNo ratings yet

- Lame DuckDocument4 pagesLame Duckbnelson1198No ratings yet

- 2024 Legislative Session ReportDocument46 pages2024 Legislative Session ReportBernice GonzalezNo ratings yet

- Boulder Petition For Condemnation of Xcel AssetsDocument43 pagesBoulder Petition For Condemnation of Xcel AssetsMatt SebastianNo ratings yet

- Rezoning For Tim Hortons Etc in ChatsworthDocument10 pagesRezoning For Tim Hortons Etc in ChatsworthmassieguyNo ratings yet

- In Wichita, A Public Hearing For West Bank Apartments TIF Project PlanDocument100 pagesIn Wichita, A Public Hearing For West Bank Apartments TIF Project PlanBob WeeksNo ratings yet

- CMS Report 2 PDFDocument29 pagesCMS Report 2 PDFRecordTrac - City of OaklandNo ratings yet

- Citizens Committee To Save Elysian Park - Newsletter Number 039 - October 22, 1970Document2 pagesCitizens Committee To Save Elysian Park - Newsletter Number 039 - October 22, 1970Citizens Committee to Save Elysian ParkNo ratings yet

- CMS Report 1Document8 pagesCMS Report 1RecordTrac - City of OaklandNo ratings yet

- F.1 CD Williams NPDocument139 pagesF.1 CD Williams NPMiranda GathercoleNo ratings yet

- LaCrosse Shelby Agreement Executive Summary 2017-10-19Document4 pagesLaCrosse Shelby Agreement Executive Summary 2017-10-19wkbtNo ratings yet

- Agreement FaqDocument3 pagesAgreement FaqwkbtNo ratings yet

- Linden GL Legislation Details (With Text)Document4 pagesLinden GL Legislation Details (With Text)Matt ThomasNo ratings yet

- Lexington 2019 Special Town Meeting WarrantDocument4 pagesLexington 2019 Special Town Meeting WarrantSamantha MercadoNo ratings yet

- Publish United States Court of Appeals Tenth Circuit: FiledDocument19 pagesPublish United States Court of Appeals Tenth Circuit: FiledScribd Government DocsNo ratings yet

- CMS Report 1Document9 pagesCMS Report 1RecordTrac - City of OaklandNo ratings yet

- Ltr. To Board of SelectmenDocument4 pagesLtr. To Board of SelectmenAndrew GolasNo ratings yet

- H. R. 2584 20110725-23303868H.RDocument160 pagesH. R. 2584 20110725-23303868H.RKeith KeithNo ratings yet

- Victor Doyle LetterDocument15 pagesVictor Doyle LettermidhurstratepayersNo ratings yet

- 2024.1.25 - River District PetitionDocument11 pages2024.1.25 - River District PetitionWilliam MostNo ratings yet

- Policiesofcitycouncil PDFDocument7 pagesPoliciesofcitycouncil PDFAnonymous ZRsuuxNcCNo ratings yet

- City of Baltimore Public HearingDocument11 pagesCity of Baltimore Public HearingAlicia CunninghamNo ratings yet

- Policy b29Document7 pagesPolicy b29rivcoclerkoftheboardNo ratings yet

- Fort St. John - Nuisance Abatement and Cost Recovery Bylaw No. 2523, 2020Document14 pagesFort St. John - Nuisance Abatement and Cost Recovery Bylaw No. 2523, 2020AlaskaHighwayNewsNo ratings yet

- CAO Allan Seabrooke Report On City Annexation of Cavan Monaghan Township LandDocument23 pagesCAO Allan Seabrooke Report On City Annexation of Cavan Monaghan Township LandPeterborough Examiner100% (1)

- Swing Crane Agreement & Tieback Agreement With Empire Communities Ltd. at Humber Bay Park East (August 2015)Document12 pagesSwing Crane Agreement & Tieback Agreement With Empire Communities Ltd. at Humber Bay Park East (August 2015)T.O. Nature & DevelopmentNo ratings yet

- Bromley x1 TableofspecialordinancesDocument12 pagesBromley x1 TableofspecialordinancesrechtinNo ratings yet

- CAR14-00014 Planning and ZoningDocument25 pagesCAR14-00014 Planning and ZoningMark ReinhardtNo ratings yet

- Memorandum: 2183 Lake Shore BLVD W. - Empire Communities Ltd. (2014)Document5 pagesMemorandum: 2183 Lake Shore BLVD W. - Empire Communities Ltd. (2014)T.O. Nature & DevelopmentNo ratings yet

- Streets S Dewalks Committee: Monday. April 11, 2016, Commencing at 5:45 PMDocument9 pagesStreets S Dewalks Committee: Monday. April 11, 2016, Commencing at 5:45 PMRobin OdaNo ratings yet

- Lot Boundary Adjustments NotificationDocument4 pagesLot Boundary Adjustments NotificationWestSeattleBlogNo ratings yet

- 2022-08-03 MEMO To Legislators - Project Update v2Document3 pages2022-08-03 MEMO To Legislators - Project Update v2Pat PowersNo ratings yet

- Lakeport City Council AgendaDocument2 pagesLakeport City Council AgendaLakeCoNewsNo ratings yet

- Statement From Mayor Moore's News ConferenceDocument6 pagesStatement From Mayor Moore's News ConferenceelkharttruthNo ratings yet

- P.D. No. 198 The Provincial Water Utilities Act of 1973Document11 pagesP.D. No. 198 The Provincial Water Utilities Act of 1973Lady Lynn PosadasNo ratings yet

- May 2023 WaterLog UpdateDocument3 pagesMay 2023 WaterLog UpdateKevin ParkerNo ratings yet

- LAWS & EXECUTIVE ISSUANCES (1900-2014) : ENERGY Part 1Document1,136 pagesLAWS & EXECUTIVE ISSUANCES (1900-2014) : ENERGY Part 1LIRMD-Information Service DevelopmentNo ratings yet

- Custom Search: The Lawphil Project - Arellano Law FoundationDocument1 pageCustom Search: The Lawphil Project - Arellano Law FoundationMu SeNo ratings yet

- Resolutions To Purchase Water From The KWADocument8 pagesResolutions To Purchase Water From The KWAAllie GrossNo ratings yet

- River Cities Reader - Issue 904 - March 3 - 2016Document56 pagesRiver Cities Reader - Issue 904 - March 3 - 2016River Cities ReaderNo ratings yet

- Item 01 - Pass For Publication Urban Agriculture Ordinance PDF-18027 KBDocument368 pagesItem 01 - Pass For Publication Urban Agriculture Ordinance PDF-18027 KBmatthewevanreadNo ratings yet

- 2004-3 - CFD2004-3 - Resolution of Formation 7.20.2005Document22 pages2004-3 - CFD2004-3 - Resolution of Formation 7.20.2005Brian DaviesNo ratings yet

- Sedgwick County Legislative Update, 2009-05-13Document4 pagesSedgwick County Legislative Update, 2009-05-13Bob WeeksNo ratings yet

- Staff Emails ALL PDFDocument54 pagesStaff Emails ALL PDFRecordTrac - City of OaklandNo ratings yet

- Senator Scott Surovell 2018 Sine Die LetterDocument4 pagesSenator Scott Surovell 2018 Sine Die LetterScott A. SurovellNo ratings yet

- Council@ci Tumwater Wa Us: Has Been On Washington Trust For Historic Preservation Watch ListDocument10 pagesCouncil@ci Tumwater Wa Us: Has Been On Washington Trust For Historic Preservation Watch ListAndy HobbsNo ratings yet

- (C) Proposals For Financing The Scheme (Including Provision ForDocument6 pages(C) Proposals For Financing The Scheme (Including Provision Forizana saffana ilmaNo ratings yet

- Final Report of the Louisiana Purchase Exposition CommissionFrom EverandFinal Report of the Louisiana Purchase Exposition CommissionNo ratings yet

- 2011 Assembly Bill 303: 2011 2012 LEGISLATUREDocument5 pages2011 Assembly Bill 303: 2011 2012 LEGISLATURErikahiniker100% (1)

- 2011-11-07 Joint MTN For Stay (00005959)Document3 pages2011-11-07 Joint MTN For Stay (00005959)rikahinikerNo ratings yet

- Cnu-Wi Nov 2011 FlyerDocument1 pageCnu-Wi Nov 2011 FlyerrikahinikerNo ratings yet

- Bill Progress 7.13Document2 pagesBill Progress 7.13rikahinikerNo ratings yet

- Cnu-Wi Nov 2011 FlyerDocument1 pageCnu-Wi Nov 2011 FlyerrikahinikerNo ratings yet

- Trans Finance and Policy Comm TestimonyDocument2 pagesTrans Finance and Policy Comm TestimonyrikahinikerNo ratings yet

- DNR Budget ProvisionsDocument3 pagesDNR Budget ProvisionsrikahinikerNo ratings yet

- LLUPAZ2012Document2 pagesLLUPAZ2012rikahinikerNo ratings yet

- Bill Progress 61611 (Word)Document2 pagesBill Progress 61611 (Word)rikahinikerNo ratings yet

- Sustainable Connections Strategies To Support Local Economies Mag Jun11 3Document8 pagesSustainable Connections Strategies To Support Local Economies Mag Jun11 3rikahinikerNo ratings yet

- DOT Budget ProvisionsDocument2 pagesDOT Budget ProvisionsrikahinikerNo ratings yet

- Opt Out of Smart GrowthDocument5 pagesOpt Out of Smart GrowthrikahinikerNo ratings yet

- Bill Progress 7.13Document2 pagesBill Progress 7.13rikahinikerNo ratings yet

- 1000 Friends of Wisconsin Report - Roads Highways and Transit Funding March 2007Document3 pages1000 Friends of Wisconsin Report - Roads Highways and Transit Funding March 2007rikahinikerNo ratings yet

- Road Approval GraphicDocument1 pageRoad Approval GraphicrikahinikerNo ratings yet

- Obesity Trends 2009Document26 pagesObesity Trends 2009rikahinikerNo ratings yet

- 19th Century Solutions-2010Document25 pages19th Century Solutions-2010rikahinikerNo ratings yet

- Passenger Rail StatementDocument1 pagePassenger Rail StatementrikahinikerNo ratings yet

- Legislative Fiscal Bureau: Special Session Senate Bill 11Document6 pagesLegislative Fiscal Bureau: Special Session Senate Bill 11rikahinikerNo ratings yet

- Milwaukee'S First Green Street: Pilot Project: Enviropakk Environmental ServicesDocument29 pagesMilwaukee'S First Green Street: Pilot Project: Enviropakk Environmental ServicesrikahinikerNo ratings yet

- Nass Vos RTA Elimination ActDocument18 pagesNass Vos RTA Elimination ActrikahinikerNo ratings yet

- RTA Press ReleaseDocument1 pageRTA Press ReleaserikahinikerNo ratings yet

- PPF Sweet Water Water Quality Survey ResultsDocument11 pagesPPF Sweet Water Water Quality Survey ResultsSweet WaterNo ratings yet

- Obesity Trends 2009Document26 pagesObesity Trends 2009rikahinikerNo ratings yet

- Legacy Charter Draft 100710 CWDocument18 pagesLegacy Charter Draft 100710 CWrikahinikerNo ratings yet

- Grocery Store PDFDocument36 pagesGrocery Store PDFARJUN HALDARNo ratings yet

- Lori Lightfoot Education PolicyDocument13 pagesLori Lightfoot Education PolicyMitch ArmentroutNo ratings yet

- 17283final Report VCF Raigarh With SummaryDocument143 pages17283final Report VCF Raigarh With SummaryNeeraj JhaNo ratings yet

- SO2019-2162: Cortland/Chicago River TIF District Redevelopment PlanDocument107 pagesSO2019-2162: Cortland/Chicago River TIF District Redevelopment PlanjrNo ratings yet

- Value Capture Financing For InfrastructureDocument10 pagesValue Capture Financing For InfrastructureRajeshNo ratings yet

- MD CRA Grand Jury ReportDocument44 pagesMD CRA Grand Jury Reportal_crespoNo ratings yet

- City of Chicago v. Eychaner, No. 1-19-1053 (Ill. App. May 11, 2020)Document18 pagesCity of Chicago v. Eychaner, No. 1-19-1053 (Ill. App. May 11, 2020)RHTNo ratings yet

- Council Letter REDLINE VersionDocument6 pagesCouncil Letter REDLINE VersionIndiana Public Media NewsNo ratings yet

- IGO - 2011 Budget Options - September 27, 2011-FinalDocument136 pagesIGO - 2011 Budget Options - September 27, 2011-FinalChicago TribuneNo ratings yet

- January 2012 NaysayerDocument2 pagesJanuary 2012 NaysayerdenverhistoryNo ratings yet

- The Bridge, May 17, 2018Document24 pagesThe Bridge, May 17, 2018The BridgeNo ratings yet

- Oakdale DRRA Info Map HandoutDocument2 pagesOakdale DRRA Info Map HandoutJason WileyNo ratings yet

- Sioux City 2013 Operating BudgetDocument378 pagesSioux City 2013 Operating BudgetSioux City JournalNo ratings yet

- ULI Case Study SteelStacksDocument12 pagesULI Case Study SteelStacksBernieOHareNo ratings yet

- Mtt06 MG FinalDocument28 pagesMtt06 MG FinalMatt GeigerNo ratings yet

- 2014-2018 Chicago Five-Year Housing Plan (Q4)Document89 pages2014-2018 Chicago Five-Year Housing Plan (Q4)The Daily LineNo ratings yet

- 1 Motion and Affidavit For Leave To File InformationDocument4 pages1 Motion and Affidavit For Leave To File InformationNBC MontanaNo ratings yet

- Agenda-September 10, 2007Document2 pagesAgenda-September 10, 2007Valerie F. LeonardNo ratings yet

- Sd159 BondsDocument217 pagesSd159 BondsBurton PhillipsNo ratings yet

- Ground Floor Activation ProgramDocument8 pagesGround Floor Activation ProgramRobert WilonskyNo ratings yet

- City of Chicago Alderman and Her Chief of Staff Indicted On Federal Bribery ChargesDocument19 pagesCity of Chicago Alderman and Her Chief of Staff Indicted On Federal Bribery ChargesWGN Web DeskNo ratings yet

- Class Monopoly Rent and The Contemporary Neoliberal CityDocument12 pagesClass Monopoly Rent and The Contemporary Neoliberal CityLuisNo ratings yet

- Smart City Project XiiDocument20 pagesSmart City Project XiiParagNo ratings yet

- South Broad District Summary - City Council 2022.06.30Document5 pagesSouth Broad District Summary - City Council 2022.06.30Dan LehrNo ratings yet

- City of Chicago v. Eychaner, No. 05L050792 (Ill. App. Jan. 21, 2015)Document41 pagesCity of Chicago v. Eychaner, No. 05L050792 (Ill. App. Jan. 21, 2015)RHTNo ratings yet

- Kosmont Oakland City-Wide EIFD Power Point Sent To Zennie62Media, Inc.Document22 pagesKosmont Oakland City-Wide EIFD Power Point Sent To Zennie62Media, Inc.Zennie AbrahamNo ratings yet

- Corrective Action Plan Summary 031119Document1 pageCorrective Action Plan Summary 031119Segann Mechele MarchNo ratings yet

- Taft Ave Prairie Path Draft CompressedDocument42 pagesTaft Ave Prairie Path Draft CompressedMichaelRomainNo ratings yet