Professional Documents

Culture Documents

Intangible Sec.24

Intangible Sec.24

Uploaded by

Rabia SohailOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intangible Sec.24

Intangible Sec.24

Uploaded by

Rabia SohailCopyright:

Available Formats

Income from business

IL

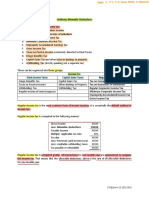

Employee training and facilities Intangibles [s.24] Bad Debt [Sec.29]

[S.27]

(1) A person shall be allowed a deduction for a bad

debt in a tax year if the following conditions are

A person shall be allowed for expenditure (other satisfied: Debtor xx

than capital expenditure) incurred for- (a) The bad debt was- Sales xx

Facility [(a) educational institution or hospital in (i) Previously included in the person income

Pakistan established for benefits of employees and from business or Bad debt xx

their dependents; (ii) for a money lent by a financial institution in Debtor xx

training [(b) institute in Pakistan for training of deriving income from business

M

industrial workers recognized by federal, provincial, (b) the debt or part of debt is written off in the

local government; account of person in the tax year; and

training [(c) the training of a citizen of Pakistan, in (c) there are reasonable grounds for believing that

connection with a scheme approved by the board. debt is irrecoverable

(2) The bad debt deduction for a tax year shall not

Definitions

exceed the debt written off in the accounts of the

person

(11) in this section, -

•"cost" in relation to an intangible, means any

A

expenditure incurred in in acquiring or creating the

intangible, including any expenditure incurred in

improving or renewing the intangible and

•"Intangible" means any patent, invention, design

or model, secret formula, or process, copyright,

trademark, scientific or technical knowledge,

J

computer software, motion picture film, export

quotas, franchise, license. intellectual property,

contractual rights and any expenditure that provides

an advantage or benefit for a period of more than

one year ( other than expenditure incurred to

acquire a depreciable asset or unimproved land) but

A

•shall not include self-generated good will or any

adjustment due to any accounting treatment Bad debt Recovery

(3) Where bad debt deduction has been allowed in a

tax year and in a subsequent tax year the person

Intangible eligible for amortization Method for computation of amortization Tax Gain/(loss) on disposal recovers any amount the following rules shall apply:-

Z

charge: (a) Where the bad debt recovery is greater than

(1) An amortization deduction shall be allowed on (8) on the disposal of intangible no amortization the difference between:

intangible- (3) the amortization deduction for a tax year shall shall be allowed in the year of disposal and- • Actual bad debt and

(a) that are wholly or partly used by the person be computed as follows:- (ref Example 3) (a) if the consideration exceed the WDV, the • the amount previously allowed as

in deriving chargeable income from business; and A/B excess shall be chargeable under the head income deduction

(b) that have a normal useful life exceeding 1 where- from business the excess shall be chargeable under the head

year. A is the cost of the intangible (b) if the consideration is less than the WDV, the "Income from business in which it is received

(2) No deduction shall be allowed if full cost of

intangible asset is allowed as deduction in the year

of purchase.

(3) the total deduction allowed during ownership of

M

intangible shall not exceed the cost of the intangible.

B is the normal useful life of intangible in

whole years

(10) An intangible that is available for use on a day

( including a non-working day) is assumed to be

used on that day

(4) where the useful life of an intangible is not

ascertainable, the useful life will be taken as 25

years; (ref example 3)

difference is deduction under the head "income

from business" (ref example 5)

(9) (a) The WDV at the time of disposal shall be

calculated as follows- (ref example 7)

(b) Where the bad debt recovery is less than the

difference between:

• Actual bad debt and

• the amount previously allowed as

deduction

the shortfall shall be allowed as deduction under the

head "Income from business in which it was received

(5) where an intangible is used partly in deriving

A

income from business and partly for another use, the

amortization will be allowed on proportionate basis

(ref Example 6)

(6) if an intangible is not used whole of the tax year

the deduction shall be computed as follows-

A x B/C

where-

H

A is the amount of amortization

B is the number of days in the tax year the (b) the consideration received on disposal shall be

intangible is used in deriving income from business determined under section 77

and

C is the number of days in tax year

(Ref# example 4)

You might also like

- 4.01 Day 1 Student Activities PDFDocument2 pages4.01 Day 1 Student Activities PDFA'veonce Young100% (1)

- BJZPP3740D Partb 2021-22Document3 pagesBJZPP3740D Partb 2021-22sagar lovzNo ratings yet

- DT & IT - AnswersDocument13 pagesDT & IT - AnswersAnkit GuptaNo ratings yet

- CA Final DT A MTP 1 May 23Document14 pagesCA Final DT A MTP 1 May 23Mayur JoshiNo ratings yet

- TDS 21-22Document25 pagesTDS 21-22dinesh kasnNo ratings yet

- 75776bos61307 p7Document31 pages75776bos61307 p7wareva7754No ratings yet

- CA Final DT A MTP 2 Nov23 Castudynotes ComDocument14 pagesCA Final DT A MTP 2 Nov23 Castudynotes ComRajdeep GuptaNo ratings yet

- Im PresetDocument9 pagesIm PresetcwkkarachchiNo ratings yet

- cash flow statementDocument14 pagescash flow statementharshitsharma42069No ratings yet

- As 15 - Employee BenefitsDocument22 pagesAs 15 - Employee BenefitsSHRADDHA RAUTNo ratings yet

- Ilovepdf MergedDocument84 pagesIlovepdf MergedVinay DugarNo ratings yet

- Unit 2 Corporate Tax Planning and ManagementDocument21 pagesUnit 2 Corporate Tax Planning and Managementsankiworld3No ratings yet

- Taxes: Corporate: F F@. e 'LDocument1 pageTaxes: Corporate: F F@. e 'LZeyad El-sayedNo ratings yet

- Direct Tax or Indirect TaxDocument14 pagesDirect Tax or Indirect Taxyashmehta206No ratings yet

- DT Nov 2022 PaperDocument26 pagesDT Nov 2022 PaperPoonam Sunil Lalwani LalwaniNo ratings yet

- Study GuidelinesDocument16 pagesStudy Guidelinesharshitverma1762No ratings yet

- 2022 Taisei DMCI - Joint - Venture20220922 12 13fnp5dDocument4 pages2022 Taisei DMCI - Joint - Venture20220922 12 13fnp5dVince Lupango (imistervince)No ratings yet

- CA Final Direct Tax Suggested Answer Nov 2020 OldDocument25 pagesCA Final Direct Tax Suggested Answer Nov 2020 OldBhumeeka GargNo ratings yet

- Ch. 10 - Audit of Dividends CA Study NotesDocument2 pagesCh. 10 - Audit of Dividends CA Study NotesUnpredictable TalentNo ratings yet

- ISC Accounts - 12th Solved Paper 2024Document24 pagesISC Accounts - 12th Solved Paper 2024asma.sageerNo ratings yet

- Borrowing Costs SlidesDocument6 pagesBorrowing Costs Slidesgwbadie7No ratings yet

- 1 选择题汇总Document20 pages1 选择题汇总Zoeee XNo ratings yet

- Comparison Between Provision of Present Income Tax ACT 1961 and Proposed Direct Tax CodeDocument7 pagesComparison Between Provision of Present Income Tax ACT 1961 and Proposed Direct Tax CodekishoreagarwalNo ratings yet

- Ca Final New Direct Tax Laws and International Taxation May 2018 1525Document31 pagesCa Final New Direct Tax Laws and International Taxation May 2018 1525pradeep kumarNo ratings yet

- Debt InvestmentsDocument15 pagesDebt InvestmentsNoella Marie BaronNo ratings yet

- LossesDocument1 pageLossesRabia SohailNo ratings yet

- Law Ques (2 Files Merged)Document4 pagesLaw Ques (2 Files Merged)Ishaan TandonNo ratings yet

- Corporate Reporting Homework (Day 4)Document8 pagesCorporate Reporting Homework (Day 4)Sara MirchevskaNo ratings yet

- Book - Income Taxes - 7 (PGBP)Document45 pagesBook - Income Taxes - 7 (PGBP)Arjun ThawaniNo ratings yet

- Which Is Called As 'Part-Time Banking Outlet'?: Bank Po/ Clerks Exam SpecialDocument1 pageWhich Is Called As 'Part-Time Banking Outlet'?: Bank Po/ Clerks Exam SpecialSrikanth Harinadh BNo ratings yet

- Paper - 7: Direct Tax Laws: Items DebitedDocument26 pagesPaper - 7: Direct Tax Laws: Items DebitedANIL JARWALNo ratings yet

- Corporate Tax and Transfer Pricing Impact Assessment - Practical InsightsDocument25 pagesCorporate Tax and Transfer Pricing Impact Assessment - Practical Insightsmxa999No ratings yet

- 67721bos54327 Fnew P7aDocument11 pages67721bos54327 Fnew P7aPriyanshu TomarNo ratings yet

- Income From Business & ProfessionDocument14 pagesIncome From Business & ProfessionSneha PotekarNo ratings yet

- Tax 2 Final Cheat Sheet 1.2Document2 pagesTax 2 Final Cheat Sheet 1.2HelloWorldNowNo ratings yet

- Chapter 5 Other Sources of IncomeDocument13 pagesChapter 5 Other Sources of IncomeLOO YU HUANGNo ratings yet

- 2016 Jun Ans-5-6Document2 pages2016 Jun Ans-5-6何健珩No ratings yet

- Tax Unit 1-2 - 24Document1 pageTax Unit 1-2 - 24joy BoseNo ratings yet

- Computation Format For Individual Tax Liability For The Year of Assessment 20XXDocument4 pagesComputation Format For Individual Tax Liability For The Year of Assessment 20XXannastasia luyah100% (1)

- Final Examination: Suggested Answers To QuestionsDocument21 pagesFinal Examination: Suggested Answers To QuestionsAbdulaziz MohammedNo ratings yet

- Advanced Tax Laws and Practice: PP-ATLP-June 2009 24Document19 pagesAdvanced Tax Laws and Practice: PP-ATLP-June 2009 24Murugesh Kasivel EnjoyNo ratings yet

- 17 Spring 2018 - BT SADocument9 pages17 Spring 2018 - BT SApabloescobar11yNo ratings yet

- IT Income From Other Sources Pt-1Document25 pagesIT Income From Other Sources Pt-1syedfareed596No ratings yet

- CA Inter Taxation A MTP 2 May 23Document13 pagesCA Inter Taxation A MTP 2 May 23olivegreen52No ratings yet

- Chapter 9 - BondsDocument6 pagesChapter 9 - BondsGABBY NACA STEVANYNo ratings yet

- Finance Act 2018Document41 pagesFinance Act 2018usman aliNo ratings yet

- Paper12 Set1Document8 pagesPaper12 Set1Sanchit ShrivastavaNo ratings yet

- 69769bos280322 P7aDocument14 pages69769bos280322 P7aharitaNo ratings yet

- IAS 19 NewDocument11 pagesIAS 19 Newsehrish.cmaNo ratings yet

- Friinge Benifit Tax-18Document9 pagesFriinge Benifit Tax-18s4sahithNo ratings yet

- P6uk 2009 Dec AnsDocument13 pagesP6uk 2009 Dec AnsHassan BilalNo ratings yet

- Income From SalaryDocument11 pagesIncome From SalarySiddhesh VyasNo ratings yet

- DT MT AnsDocument13 pagesDT MT AnsRaghavanNo ratings yet

- DT A MTP 1 Final May22Document14 pagesDT A MTP 1 Final May22Kanchana SubbaramNo ratings yet

- Accountancy: Amount (?)Document4 pagesAccountancy: Amount (?)Thulsi JayadevNo ratings yet

- Add: Items of Expenditure Not Allowable While: © The Institute of Chartered Accountants of IndiaDocument13 pagesAdd: Items of Expenditure Not Allowable While: © The Institute of Chartered Accountants of IndiaAbhinav SharmaNo ratings yet

- Defined Contribution Plan Defined Benefits Plan: Illustration 21-1Document6 pagesDefined Contribution Plan Defined Benefits Plan: Illustration 21-1Lyceum WebinarNo ratings yet

- Amendments May 2024 3Document18 pagesAmendments May 2024 3ukqrnnnjhfwsxqoykuNo ratings yet

- Durgesh Singh Charts PDFDocument11 pagesDurgesh Singh Charts PDFHimanshu Jeerawala75% (4)

- TDS Rates 2021 - 22Document7 pagesTDS Rates 2021 - 22Shantanu BhadkamkarNo ratings yet

- Master Sheet On IT DEFINITIONS - SirTariqTunio-1Document3 pagesMaster Sheet On IT DEFINITIONS - SirTariqTunio-1Tooba MaqboolNo ratings yet

- Tax 7 11Document12 pagesTax 7 11Ralph Ryan TooNo ratings yet

- Here Are Examples of Documents You Can SendDocument2 pagesHere Are Examples of Documents You Can SendCurtis SavageNo ratings yet

- ACC 312 Semestral OutputDocument11 pagesACC 312 Semestral Outputgelyncastromero25No ratings yet

- DCF Model - Power Generation: Strictly ConfidentialDocument5 pagesDCF Model - Power Generation: Strictly ConfidentialAbhishekNo ratings yet

- PT Zamklik Closing Journal Entry December 2022 (In Rupiah)Document1 pagePT Zamklik Closing Journal Entry December 2022 (In Rupiah)ahmadiNo ratings yet

- Fundamental Concepts and Tools of BusineDocument51 pagesFundamental Concepts and Tools of Busineroselyn espinosaNo ratings yet

- 3.4.accounting For Income TaxesDocument65 pages3.4.accounting For Income TaxesPranjal pandeyNo ratings yet

- Greenergy Holdings Incorporated - SEC Form 17-Q - 14 August 2020Document61 pagesGreenergy Holdings Incorporated - SEC Form 17-Q - 14 August 2020John AzellebNo ratings yet

- Chapter 15 LongDocument4 pagesChapter 15 LongAnh Thư PhạmNo ratings yet

- Assets and Liabilities FormDocument8 pagesAssets and Liabilities Formrathnakar sarmaNo ratings yet

- FAR Exams2Document4 pagesFAR Exams2Francine PimentelNo ratings yet

- PTX - Past Year Set BDocument9 pagesPTX - Past Year Set BNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- FM204Document8 pagesFM204Vinoth KumarNo ratings yet

- Dev Chapter 5Document22 pagesDev Chapter 5وائل مصطفىNo ratings yet

- Cprs Payslip1.jspDocument1 pageCprs Payslip1.jspAurangzebNo ratings yet

- Advani Hotels AR2023Document227 pagesAdvani Hotels AR2023Sriram RanganathanNo ratings yet

- Case 08 16e, Oct 20th, 2023Document4 pagesCase 08 16e, Oct 20th, 2023Itzel OvalleNo ratings yet

- Ordinary Allowable Deductions 1Document19 pagesOrdinary Allowable Deductions 1Jester LimNo ratings yet

- New Income Tax Law 2018.1 NewDocument87 pagesNew Income Tax Law 2018.1 NewDamascene100% (1)

- AC1025 Commentary 2019 PDFDocument55 pagesAC1025 Commentary 2019 PDFNghia Tuan Nghia100% (1)

- Introduction To MacroeconomicsDocument118 pagesIntroduction To MacroeconomicsZAKAYO NJONYNo ratings yet

- Tax (AIR 2017) Review LectureDocument642 pagesTax (AIR 2017) Review LectureRobert CastilloNo ratings yet

- Chapter3 4Document24 pagesChapter3 4kakolalamamaNo ratings yet

- Importance of Personal Interview: This Chapter Is Taken FromDocument18 pagesImportance of Personal Interview: This Chapter Is Taken FromPrateek GargNo ratings yet

- Chap 011Document38 pagesChap 011Loser NeetNo ratings yet

- Form16 Mar 2023Document9 pagesForm16 Mar 2023PRAJAKTA GAJBHIYENo ratings yet

- Translation Adjustment OCI - Prac ProbDocument1 pageTranslation Adjustment OCI - Prac ProbJasper Andrew AdjaraniNo ratings yet

- Taxation Law 1 ReviewerDocument81 pagesTaxation Law 1 ReviewerEisley Sarzadilla-GarciaNo ratings yet