Professional Documents

Culture Documents

GST On Services of Repairs in Construction and Real Estate Industry

GST On Services of Repairs in Construction and Real Estate Industry

Uploaded by

Sme 2023Copyright:

Available Formats

You might also like

- EM Boot Camp Course ManualDocument531 pagesEM Boot Camp Course Manualshortysdavid100% (1)

- IRDAI Memorandum Jeevan Saral Final DraftDocument4 pagesIRDAI Memorandum Jeevan Saral Final DraftMoneylife FoundationNo ratings yet

- Technical Guide On Wood& Biomass Pellets ProductionDocument20 pagesTechnical Guide On Wood& Biomass Pellets ProductionLeal Cindy100% (1)

- GST@FAQ Builders 09.10.2017Document10 pagesGST@FAQ Builders 09.10.2017NIKHIL KASATNo ratings yet

- Various Aar Autority DecisionsDocument20 pagesVarious Aar Autority Decisionssachin jainNo ratings yet

- Go 67 - GSTDocument4 pagesGo 67 - GSTPrabhakar PothunuriNo ratings yet

- Various Aar Autority DecisionsDocument20 pagesVarious Aar Autority Decisionssachin jainNo ratings yet

- GST Issues For Works Contract CA Yashwant Kasar - 31st July 2021Document73 pagesGST Issues For Works Contract CA Yashwant Kasar - 31st July 2021fintech ConsultancyNo ratings yet

- Taxability of Real Estate Transactions Under GST: Particulars Applicability Rate of TaxDocument5 pagesTaxability of Real Estate Transactions Under GST: Particulars Applicability Rate of Taxnastaeenbaig1No ratings yet

- 2018fin MS58Document3 pages2018fin MS58Rajesh KarriNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of IndiaANIL JARWALNo ratings yet

- Works ContractDocument4 pagesWorks Contractsslovexxx6No ratings yet

- GST On Real Estate Converted 1Document4 pagesGST On Real Estate Converted 1jvnraoNo ratings yet

- Work Contracts in GSTDocument4 pagesWork Contracts in GSTakshayjain93No ratings yet

- Wa0021.Document10 pagesWa0021.SnekaNo ratings yet

- GST Study On Real Estate and Works ContractDocument22 pagesGST Study On Real Estate and Works ContractLGopal ShahNo ratings yet

- Revision of GST - Orders IssuedDocument4 pagesRevision of GST - Orders IssuedSE PR MedakNo ratings yet

- Works Contract Under GST (Bare Framework)Document6 pagesWorks Contract Under GST (Bare Framework)Sanjay DwivediNo ratings yet

- Works ContractDocument18 pagesWorks ContractRanjith PolishettiNo ratings yet

- White Paper: Analysis of GST Implications On Real Estate Sector in IndiaDocument9 pagesWhite Paper: Analysis of GST Implications On Real Estate Sector in IndiaAyushi PanditNo ratings yet

- Impact of GST Law On Real EstateDocument14 pagesImpact of GST Law On Real EstateHumanyu KabeerNo ratings yet

- Works Contract - GSTDocument3 pagesWorks Contract - GSTkoushiki mishraNo ratings yet

- Impact of GST On Construction and Real EstateDocument7 pagesImpact of GST On Construction and Real Estatesahilkaushik0% (1)

- Construction Non DoctronialDocument7 pagesConstruction Non Doctronialankur vikasNo ratings yet

- GO Ms 381 GST 26112018Document4 pagesGO Ms 381 GST 26112018hussainNo ratings yet

- GST Issues Real Estate Sector Yashwant KasarDocument49 pagesGST Issues Real Estate Sector Yashwant KasarSaikrishna AlluNo ratings yet

- GST WeeklyDocument5 pagesGST WeeklySona GuptaNo ratings yet

- Blocked Credits Under GST Section 17 (5) of CGST ACT, 2017Document8 pagesBlocked Credits Under GST Section 17 (5) of CGST ACT, 2017ajayNo ratings yet

- Recommendations Made On GST Rate Changes On Services by The 25th GST Council MeetingDocument6 pagesRecommendations Made On GST Rate Changes On Services by The 25th GST Council MeetinganiNo ratings yet

- BGMG & Associates: Chartered AccountantsDocument33 pagesBGMG & Associates: Chartered AccountantsAjit GuptaNo ratings yet

- What Is Works Contract?Document10 pagesWhat Is Works Contract?Naga BhushanNo ratings yet

- Taxguru - in-gST On Transfer of Leasehold Rights Upfront Premium ITC EligibilityDocument11 pagesTaxguru - in-gST On Transfer of Leasehold Rights Upfront Premium ITC EligibilityHarsh DholariaNo ratings yet

- Adwitya Spaces P LTD inDocument4 pagesAdwitya Spaces P LTD ingauravNo ratings yet

- Note On GST For Builders and Developers CA Yashwant KasarDocument30 pagesNote On GST For Builders and Developers CA Yashwant KasarVidya AdsuleNo ratings yet

- 5b8d6 Liability W.R.T. Jda Entered Prior To GST ArticleDocument3 pages5b8d6 Liability W.R.T. Jda Entered Prior To GST ArticleKunalKumarNo ratings yet

- MCQ ch2 Supply Under GSTDocument13 pagesMCQ ch2 Supply Under GSTAman AgarwalNo ratings yet

- Impact of GST On Real Estate SectorDocument22 pagesImpact of GST On Real Estate SectorjunaidNo ratings yet

- GST Amendments For CA Inter Nov 2023 by CA Sanchit GroverDocument27 pagesGST Amendments For CA Inter Nov 2023 by CA Sanchit GroverjoyboyishehereNo ratings yet

- Changes Applicaple-2022Document11 pagesChanges Applicaple-2022sanjayNo ratings yet

- Amendment Final N2020 BGSirDocument30 pagesAmendment Final N2020 BGSirAfnan KhanNo ratings yet

- Real EstateDocument21 pagesReal EstateDEVANG SNo ratings yet

- GST RCMDocument3 pagesGST RCMCA Prayash SundasNo ratings yet

- Final Examination: Suggested Answers To QuestionsDocument17 pagesFinal Examination: Suggested Answers To QuestionsRohit KunduNo ratings yet

- RVNL GST CircularDocument10 pagesRVNL GST CircularAmul GuptaNo ratings yet

- Cma RTP Dec 18Document34 pagesCma RTP Dec 18amit jangraNo ratings yet

- 73974bos59825 GSTDocument52 pages73974bos59825 GSTchashmishbabaNo ratings yet

- Input Tax Credit and Computation of GST LiabilityDocument10 pagesInput Tax Credit and Computation of GST Liabilitymyashwanthreddy3249No ratings yet

- Background of Works Contract Under GST Works Contract" Means A Contract For BuildingDocument4 pagesBackground of Works Contract Under GST Works Contract" Means A Contract For BuildingSATYANARAYANA MOTAMARRINo ratings yet

- Charge Under GST Assignment EscholarsDocument11 pagesCharge Under GST Assignment EscholarspuchipatnaikNo ratings yet

- GST Lon Landowner ShareDocument6 pagesGST Lon Landowner ShareJigmeNo ratings yet

- GST Real Estate SectorDocument66 pagesGST Real Estate SectorSelvakumar MuthurajNo ratings yet

- GST 12 To 18 EDDocument3 pagesGST 12 To 18 EDcivtect indiaNo ratings yet

- GST Housing Sector Affordable HousingDocument3 pagesGST Housing Sector Affordable HousingschaktenNo ratings yet

- Gst-Sem ViDocument61 pagesGst-Sem ViSOURAV SHARMANo ratings yet

- GSTDocument6 pagesGSTPWD r&b nagalandNo ratings yet

- GST On Redevelopment Projects - Taxguru - inDocument4 pagesGST On Redevelopment Projects - Taxguru - inTejas SodhaNo ratings yet

- Ap Aar 02 2020 17.02.2020 DecipplDocument7 pagesAp Aar 02 2020 17.02.2020 Decipplshubhamt25No ratings yet

- 2f762 Article On Tax or GST Treatment To Be Given in Case of Cancelled FlatsDocument5 pages2f762 Article On Tax or GST Treatment To Be Given in Case of Cancelled FlatsvinodNo ratings yet

- Finance (Salaries) Department G.O.Ms - No.264, Dated 15 September 2017Document3 pagesFinance (Salaries) Department G.O.Ms - No.264, Dated 15 September 2017RenugopalNo ratings yet

- GST Amendments For Circulation - Nov 2018 UploadedDocument20 pagesGST Amendments For Circulation - Nov 2018 UploadedJay SuchakNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Extra Judicial KillingsDocument4 pagesExtra Judicial KillingsSme 2023No ratings yet

- ADRS Exam NotesDocument21 pagesADRS Exam NotesSme 2023No ratings yet

- Introduction To Arbitration and Concilliation ActDocument12 pagesIntroduction To Arbitration and Concilliation ActSme 2023No ratings yet

- GST NotesDocument75 pagesGST NotesSme 2023No ratings yet

- Sample Answers GST LawDocument47 pagesSample Answers GST LawSme 2023No ratings yet

- Goods and Services Tax Law NotesDocument53 pagesGoods and Services Tax Law NotesSme 2023No ratings yet

- Social Media Changed The Nature of Indian Education SystemDocument9 pagesSocial Media Changed The Nature of Indian Education SystemHiteshNo ratings yet

- Competitive Intelligence: Guest EditorialDocument14 pagesCompetitive Intelligence: Guest EditorialIoana AlexandraNo ratings yet

- Ral Colour ChartDocument7 pagesRal Colour ChartBoda CsabaNo ratings yet

- LLM Placement Brochure 2021 22 V15Document24 pagesLLM Placement Brochure 2021 22 V15Bala KumaranNo ratings yet

- AHF Thesis - CorrectedDocument146 pagesAHF Thesis - CorrectedAlasdair FikourasNo ratings yet

- Chapter 5 - Object-Oriented Database ModelDocument9 pagesChapter 5 - Object-Oriented Database Modelyoseffisseha12No ratings yet

- Consolidated Teachers Individual Plan For Professional Development SCHOOL YEAR 2020-2021Document2 pagesConsolidated Teachers Individual Plan For Professional Development SCHOOL YEAR 2020-2021Anicadlien Ellipaw IninNo ratings yet

- Don Quijote Unit Summative AssessmentDocument1 pageDon Quijote Unit Summative AssessmentMaria MontoyaNo ratings yet

- Pharmacological Studies of Ocimum Basilicum L.Document7 pagesPharmacological Studies of Ocimum Basilicum L.Baru Chandrasekhar RaoNo ratings yet

- Scania Diagnos & Programmer 3 2xxxDocument7 pagesScania Diagnos & Programmer 3 2xxxFran Alisson SouzaNo ratings yet

- Loksabha AccomodationDocument2 pagesLoksabha Accomodationabdul956No ratings yet

- Looking Back and Looking ForwardDocument6 pagesLooking Back and Looking ForwardJotham SederstromNo ratings yet

- Admission CriteriaDocument2 pagesAdmission CriteriaDr Vikas GuptaNo ratings yet

- A Project Report On CustomerDocument13 pagesA Project Report On CustomerDrishti BhushanNo ratings yet

- Active and Passive VoiceDocument3 pagesActive and Passive VoiceCray CrayNo ratings yet

- Atomic Excellence Case - Marking Key - With Examples of Exhibits and Student Response CompositeDocument16 pagesAtomic Excellence Case - Marking Key - With Examples of Exhibits and Student Response Compositedmcook3No ratings yet

- Venture Capital Method.Document4 pagesVenture Capital Method.Vicente MendozaNo ratings yet

- Developing On AwsDocument7 pagesDeveloping On Awsalton032No ratings yet

- Vyshali Java ResumeDocument5 pagesVyshali Java ResumeKiran N9 ITNo ratings yet

- India Email IdsDocument3,365 pagesIndia Email IdsGandhi ManadalapuNo ratings yet

- Intermediate Thom Spectra, Hopf-Galois Extensions and A New Construction of M UDocument17 pagesIntermediate Thom Spectra, Hopf-Galois Extensions and A New Construction of M Uhuevonomar05No ratings yet

- CEFIC Quantis Report FinalDocument24 pagesCEFIC Quantis Report FinalJayanth KumarNo ratings yet

- Obesidade 2023Document69 pagesObesidade 2023Belinha DonattiNo ratings yet

- English Holiday HomeworkDocument18 pagesEnglish Holiday Homeworkzainab.syed017No ratings yet

- Applied Sciences: Determination of PH in Powdered Concrete Samples or in SuspensionDocument10 pagesApplied Sciences: Determination of PH in Powdered Concrete Samples or in SuspensionKarthick MNo ratings yet

- WR WQ Pub Design Criteria Ch5Document10 pagesWR WQ Pub Design Criteria Ch5Teena AlawadNo ratings yet

- CMACGM Service Description ReportDocument58 pagesCMACGM Service Description ReportMarius MoraruNo ratings yet

GST On Services of Repairs in Construction and Real Estate Industry

GST On Services of Repairs in Construction and Real Estate Industry

Uploaded by

Sme 2023Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST On Services of Repairs in Construction and Real Estate Industry

GST On Services of Repairs in Construction and Real Estate Industry

Uploaded by

Sme 2023Copyright:

Available Formats

IMPACT OF GST ON CONTRUCTION AND REAL ESTATE INDUSTRY IN INDIA

Group Members:

Grette Sara Titus – 19010126070 – Division A

Vaibhavi Gangadhar – 19010125372 – Division D

Lakshmi Pragna – 19010125424 – Division E

Pranav Goswami – 19010125431 – Division E

Harshit Anand – 19010125436 – Division E

Shreyash – 19010125493 – Division E

GST ON SERVICES PROVIDED FOR REPAIRS OF CONSTRUCTED BUILDINGS

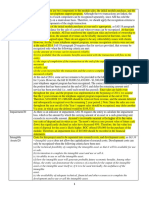

Type of Service GST Rate Relevant Relevant Example

Section Provision

Maintenance or 12% for Section 12(3)(a) Schedule II of Repair of a

repair of an affordable of CGST Act, CGST Act, leaking roof,

immovable housing 2017. 2017 painting of a

property (works projects; building,

contract 18% for other renovation of a

service) projects flat, etc.

Repair or 5% to 28% Section 9(1) of Schedule III of Repair of a car,

maintenance of CGST Act, CGST Act, maintenance of

a movable 2017 2017. a computer, etc.

property

Under GST laws in India, services provided for maintenance or repairs of an immovable

property such as a constructed building is classified as “works contract services.” The GST

rates are applicable for both Central GST and State GST or Union Territory GST. According

to the provision Section 12(3)(a) of the Act, works contract shall be treated as a supply of

services.

o Example: If a construction company provides repair services for a leaking roof of a

building, it would be considered a works contract service and be subject to GST at the

applicable rate.

Input Tax Credit

ITC is available for GST paid on services provided for repairs on a constructed building,

subject to certain conditions and restrictions. Relevant provision is Section 16 of CGST Act,

2017: A registered person shall be entitled to take credit of input tax charged on any supply

of goods or services or both which are used or intended to be used in the course or

furtherance of his/her business.

Conditions

1. The recipient of the service must have a valid tax invoice or debt note.

2. The recipient must have received the goods or services.

3. The supplier of the service must have deposited the GST with the government.

Restrictions as per section 17(5)

1. If the goods or services are used for personal purposes.

2. If the goods or services are used for making exempt supplies.

3. If the recipient has not paid the supplier for the goods or services within 180 days

from the date of the invoice.

4. If the supplier has not filed their GST return for the relevant period.

o Note: If the GST rate applicable on services provided for repairs on a constructed

building is 5% or 12%, then the recipient of the service can claim the entire amount of

GST paid as ITC. However, if the GST rate is 18% or more, then the recipient can claim

only up to 50% of the GST paid as ITC.

o Example: Suppose a construction company hires a contractor to repair the roof of a

building that it owns. The contractor charges GST of Rs. 10,000/- for the repair service.

The construction company being a registered person under GST can claim ITC on the

GST paid by it. Assuming the GST rate applicable on the services is 18%, Rs 1,800 is the

GST paid and the ITC of Rs 9000/- can be claimed. However, if the contractor fails to

deposit the GST with the government, the construction company cannot claim ITC.

Similarly, if the repair service is used for personal purposes or for making exempt

supplies, ITC cannot be claimed.

You might also like

- EM Boot Camp Course ManualDocument531 pagesEM Boot Camp Course Manualshortysdavid100% (1)

- IRDAI Memorandum Jeevan Saral Final DraftDocument4 pagesIRDAI Memorandum Jeevan Saral Final DraftMoneylife FoundationNo ratings yet

- Technical Guide On Wood& Biomass Pellets ProductionDocument20 pagesTechnical Guide On Wood& Biomass Pellets ProductionLeal Cindy100% (1)

- GST@FAQ Builders 09.10.2017Document10 pagesGST@FAQ Builders 09.10.2017NIKHIL KASATNo ratings yet

- Various Aar Autority DecisionsDocument20 pagesVarious Aar Autority Decisionssachin jainNo ratings yet

- Go 67 - GSTDocument4 pagesGo 67 - GSTPrabhakar PothunuriNo ratings yet

- Various Aar Autority DecisionsDocument20 pagesVarious Aar Autority Decisionssachin jainNo ratings yet

- GST Issues For Works Contract CA Yashwant Kasar - 31st July 2021Document73 pagesGST Issues For Works Contract CA Yashwant Kasar - 31st July 2021fintech ConsultancyNo ratings yet

- Taxability of Real Estate Transactions Under GST: Particulars Applicability Rate of TaxDocument5 pagesTaxability of Real Estate Transactions Under GST: Particulars Applicability Rate of Taxnastaeenbaig1No ratings yet

- 2018fin MS58Document3 pages2018fin MS58Rajesh KarriNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of IndiaANIL JARWALNo ratings yet

- Works ContractDocument4 pagesWorks Contractsslovexxx6No ratings yet

- GST On Real Estate Converted 1Document4 pagesGST On Real Estate Converted 1jvnraoNo ratings yet

- Work Contracts in GSTDocument4 pagesWork Contracts in GSTakshayjain93No ratings yet

- Wa0021.Document10 pagesWa0021.SnekaNo ratings yet

- GST Study On Real Estate and Works ContractDocument22 pagesGST Study On Real Estate and Works ContractLGopal ShahNo ratings yet

- Revision of GST - Orders IssuedDocument4 pagesRevision of GST - Orders IssuedSE PR MedakNo ratings yet

- Works Contract Under GST (Bare Framework)Document6 pagesWorks Contract Under GST (Bare Framework)Sanjay DwivediNo ratings yet

- Works ContractDocument18 pagesWorks ContractRanjith PolishettiNo ratings yet

- White Paper: Analysis of GST Implications On Real Estate Sector in IndiaDocument9 pagesWhite Paper: Analysis of GST Implications On Real Estate Sector in IndiaAyushi PanditNo ratings yet

- Impact of GST Law On Real EstateDocument14 pagesImpact of GST Law On Real EstateHumanyu KabeerNo ratings yet

- Works Contract - GSTDocument3 pagesWorks Contract - GSTkoushiki mishraNo ratings yet

- Impact of GST On Construction and Real EstateDocument7 pagesImpact of GST On Construction and Real Estatesahilkaushik0% (1)

- Construction Non DoctronialDocument7 pagesConstruction Non Doctronialankur vikasNo ratings yet

- GO Ms 381 GST 26112018Document4 pagesGO Ms 381 GST 26112018hussainNo ratings yet

- GST Issues Real Estate Sector Yashwant KasarDocument49 pagesGST Issues Real Estate Sector Yashwant KasarSaikrishna AlluNo ratings yet

- GST WeeklyDocument5 pagesGST WeeklySona GuptaNo ratings yet

- Blocked Credits Under GST Section 17 (5) of CGST ACT, 2017Document8 pagesBlocked Credits Under GST Section 17 (5) of CGST ACT, 2017ajayNo ratings yet

- Recommendations Made On GST Rate Changes On Services by The 25th GST Council MeetingDocument6 pagesRecommendations Made On GST Rate Changes On Services by The 25th GST Council MeetinganiNo ratings yet

- BGMG & Associates: Chartered AccountantsDocument33 pagesBGMG & Associates: Chartered AccountantsAjit GuptaNo ratings yet

- What Is Works Contract?Document10 pagesWhat Is Works Contract?Naga BhushanNo ratings yet

- Taxguru - in-gST On Transfer of Leasehold Rights Upfront Premium ITC EligibilityDocument11 pagesTaxguru - in-gST On Transfer of Leasehold Rights Upfront Premium ITC EligibilityHarsh DholariaNo ratings yet

- Adwitya Spaces P LTD inDocument4 pagesAdwitya Spaces P LTD ingauravNo ratings yet

- Note On GST For Builders and Developers CA Yashwant KasarDocument30 pagesNote On GST For Builders and Developers CA Yashwant KasarVidya AdsuleNo ratings yet

- 5b8d6 Liability W.R.T. Jda Entered Prior To GST ArticleDocument3 pages5b8d6 Liability W.R.T. Jda Entered Prior To GST ArticleKunalKumarNo ratings yet

- MCQ ch2 Supply Under GSTDocument13 pagesMCQ ch2 Supply Under GSTAman AgarwalNo ratings yet

- Impact of GST On Real Estate SectorDocument22 pagesImpact of GST On Real Estate SectorjunaidNo ratings yet

- GST Amendments For CA Inter Nov 2023 by CA Sanchit GroverDocument27 pagesGST Amendments For CA Inter Nov 2023 by CA Sanchit GroverjoyboyishehereNo ratings yet

- Changes Applicaple-2022Document11 pagesChanges Applicaple-2022sanjayNo ratings yet

- Amendment Final N2020 BGSirDocument30 pagesAmendment Final N2020 BGSirAfnan KhanNo ratings yet

- Real EstateDocument21 pagesReal EstateDEVANG SNo ratings yet

- GST RCMDocument3 pagesGST RCMCA Prayash SundasNo ratings yet

- Final Examination: Suggested Answers To QuestionsDocument17 pagesFinal Examination: Suggested Answers To QuestionsRohit KunduNo ratings yet

- RVNL GST CircularDocument10 pagesRVNL GST CircularAmul GuptaNo ratings yet

- Cma RTP Dec 18Document34 pagesCma RTP Dec 18amit jangraNo ratings yet

- 73974bos59825 GSTDocument52 pages73974bos59825 GSTchashmishbabaNo ratings yet

- Input Tax Credit and Computation of GST LiabilityDocument10 pagesInput Tax Credit and Computation of GST Liabilitymyashwanthreddy3249No ratings yet

- Background of Works Contract Under GST Works Contract" Means A Contract For BuildingDocument4 pagesBackground of Works Contract Under GST Works Contract" Means A Contract For BuildingSATYANARAYANA MOTAMARRINo ratings yet

- Charge Under GST Assignment EscholarsDocument11 pagesCharge Under GST Assignment EscholarspuchipatnaikNo ratings yet

- GST Lon Landowner ShareDocument6 pagesGST Lon Landowner ShareJigmeNo ratings yet

- GST Real Estate SectorDocument66 pagesGST Real Estate SectorSelvakumar MuthurajNo ratings yet

- GST 12 To 18 EDDocument3 pagesGST 12 To 18 EDcivtect indiaNo ratings yet

- GST Housing Sector Affordable HousingDocument3 pagesGST Housing Sector Affordable HousingschaktenNo ratings yet

- Gst-Sem ViDocument61 pagesGst-Sem ViSOURAV SHARMANo ratings yet

- GSTDocument6 pagesGSTPWD r&b nagalandNo ratings yet

- GST On Redevelopment Projects - Taxguru - inDocument4 pagesGST On Redevelopment Projects - Taxguru - inTejas SodhaNo ratings yet

- Ap Aar 02 2020 17.02.2020 DecipplDocument7 pagesAp Aar 02 2020 17.02.2020 Decipplshubhamt25No ratings yet

- 2f762 Article On Tax or GST Treatment To Be Given in Case of Cancelled FlatsDocument5 pages2f762 Article On Tax or GST Treatment To Be Given in Case of Cancelled FlatsvinodNo ratings yet

- Finance (Salaries) Department G.O.Ms - No.264, Dated 15 September 2017Document3 pagesFinance (Salaries) Department G.O.Ms - No.264, Dated 15 September 2017RenugopalNo ratings yet

- GST Amendments For Circulation - Nov 2018 UploadedDocument20 pagesGST Amendments For Circulation - Nov 2018 UploadedJay SuchakNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Extra Judicial KillingsDocument4 pagesExtra Judicial KillingsSme 2023No ratings yet

- ADRS Exam NotesDocument21 pagesADRS Exam NotesSme 2023No ratings yet

- Introduction To Arbitration and Concilliation ActDocument12 pagesIntroduction To Arbitration and Concilliation ActSme 2023No ratings yet

- GST NotesDocument75 pagesGST NotesSme 2023No ratings yet

- Sample Answers GST LawDocument47 pagesSample Answers GST LawSme 2023No ratings yet

- Goods and Services Tax Law NotesDocument53 pagesGoods and Services Tax Law NotesSme 2023No ratings yet

- Social Media Changed The Nature of Indian Education SystemDocument9 pagesSocial Media Changed The Nature of Indian Education SystemHiteshNo ratings yet

- Competitive Intelligence: Guest EditorialDocument14 pagesCompetitive Intelligence: Guest EditorialIoana AlexandraNo ratings yet

- Ral Colour ChartDocument7 pagesRal Colour ChartBoda CsabaNo ratings yet

- LLM Placement Brochure 2021 22 V15Document24 pagesLLM Placement Brochure 2021 22 V15Bala KumaranNo ratings yet

- AHF Thesis - CorrectedDocument146 pagesAHF Thesis - CorrectedAlasdair FikourasNo ratings yet

- Chapter 5 - Object-Oriented Database ModelDocument9 pagesChapter 5 - Object-Oriented Database Modelyoseffisseha12No ratings yet

- Consolidated Teachers Individual Plan For Professional Development SCHOOL YEAR 2020-2021Document2 pagesConsolidated Teachers Individual Plan For Professional Development SCHOOL YEAR 2020-2021Anicadlien Ellipaw IninNo ratings yet

- Don Quijote Unit Summative AssessmentDocument1 pageDon Quijote Unit Summative AssessmentMaria MontoyaNo ratings yet

- Pharmacological Studies of Ocimum Basilicum L.Document7 pagesPharmacological Studies of Ocimum Basilicum L.Baru Chandrasekhar RaoNo ratings yet

- Scania Diagnos & Programmer 3 2xxxDocument7 pagesScania Diagnos & Programmer 3 2xxxFran Alisson SouzaNo ratings yet

- Loksabha AccomodationDocument2 pagesLoksabha Accomodationabdul956No ratings yet

- Looking Back and Looking ForwardDocument6 pagesLooking Back and Looking ForwardJotham SederstromNo ratings yet

- Admission CriteriaDocument2 pagesAdmission CriteriaDr Vikas GuptaNo ratings yet

- A Project Report On CustomerDocument13 pagesA Project Report On CustomerDrishti BhushanNo ratings yet

- Active and Passive VoiceDocument3 pagesActive and Passive VoiceCray CrayNo ratings yet

- Atomic Excellence Case - Marking Key - With Examples of Exhibits and Student Response CompositeDocument16 pagesAtomic Excellence Case - Marking Key - With Examples of Exhibits and Student Response Compositedmcook3No ratings yet

- Venture Capital Method.Document4 pagesVenture Capital Method.Vicente MendozaNo ratings yet

- Developing On AwsDocument7 pagesDeveloping On Awsalton032No ratings yet

- Vyshali Java ResumeDocument5 pagesVyshali Java ResumeKiran N9 ITNo ratings yet

- India Email IdsDocument3,365 pagesIndia Email IdsGandhi ManadalapuNo ratings yet

- Intermediate Thom Spectra, Hopf-Galois Extensions and A New Construction of M UDocument17 pagesIntermediate Thom Spectra, Hopf-Galois Extensions and A New Construction of M Uhuevonomar05No ratings yet

- CEFIC Quantis Report FinalDocument24 pagesCEFIC Quantis Report FinalJayanth KumarNo ratings yet

- Obesidade 2023Document69 pagesObesidade 2023Belinha DonattiNo ratings yet

- English Holiday HomeworkDocument18 pagesEnglish Holiday Homeworkzainab.syed017No ratings yet

- Applied Sciences: Determination of PH in Powdered Concrete Samples or in SuspensionDocument10 pagesApplied Sciences: Determination of PH in Powdered Concrete Samples or in SuspensionKarthick MNo ratings yet

- WR WQ Pub Design Criteria Ch5Document10 pagesWR WQ Pub Design Criteria Ch5Teena AlawadNo ratings yet

- CMACGM Service Description ReportDocument58 pagesCMACGM Service Description ReportMarius MoraruNo ratings yet