Professional Documents

Culture Documents

Prop Trading in Vietnam - 2018

Prop Trading in Vietnam - 2018

Uploaded by

hungbui0107Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prop Trading in Vietnam - 2018

Prop Trading in Vietnam - 2018

Uploaded by

hungbui0107Copyright:

Available Formats

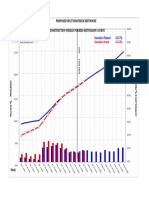

Proprietary Trading Revenue Accounts for a Significant Portion of Total Revenue

Selected Local Securities Firms

USD mn USD mn

2018 2017

42.8%

39.5% 51.6%

80.0

36.0% 45. 0% 80.0

47.6% 60. 0%

39.7%

40. 0%

70.0 70.0

50. 0%

35. 0%

31.9%

60.0 60.0

50.0

20.8% 17.8%

30. 0%

50.0

27.9% 40. 0%

40.0

17.2% 25. 0%

40.0 30. 0%

30.0

67.5 20. 0%

15. 0%

30.0

60.7 11.2% 20. 0%

20.0

39.8 10. 0%

20.0

24.0 16.7 18.9 21.7 24.6 21.6

10. 0%

13.4

10.0 10.0

5.0 %

-

8.0 0.0 % -

4.1 0.0 %

SSI HCM VND TCBS VCI MBS SSI HCM VND TCBS VCI MBS

Proprietary Trading Proprietary Trading Revenue/Total Revenue Proprietary Trading Proprietary Trading Revenue/Total Revenue

Selected Foreign Securities Firms

USD mn USD mn

2018 2017

55.8%

20.0 60. 0% 20.0

60.2% 70. 0%

18.0 18.0

49.9%

38.6%

60. 0%

50. 0%

16.0 16.0

14.0

40. 0%

14.0

37.6% 50. 0%

12.0 12.0

40. 0%

10.0

8.0

17.7% 30. 0% 10.0

8.0

30. 0%

7.3% 7.6%

20. 0%

6.0 6.0

20. 0%

4.0

9.3 4.0

5.2

10. 0%

10. 0%

2.0

-

2.3 2.1 0.8 0.0 %

2.0

-

0.2 3.4 0.5 0.0 %

Mirae Asset KIS Shinhan KBSV Mirae Asset Shinhan KIS KBSV

Proprietary Trading Proprietary Trading Revenue/Total Revenue Proprietary Trading Proprietary Trading Revenue/Total Revenue

Note: Data is based on consolidated financial statements

Sources: Companies’ Financial Statements

Proprietary Trading Account Balance in Total Equity

Selected Local Securities Firms

USD mn USD mn

670.9 2.3 2018 2017

1.5

700 .0 2.5 700 .0 2.5

1.7 2.0 2.0

477.9 1.3

600 .0 600 .0

0.7 0.6 0.6 0.8 0.8

0.5

1.5 1.5

500 .0

392.9 0.3 500 .0

0.5

379.6

1.0 1.0

400 .0

290.8 0.5

400 .0

0.5

- -

300 .0 300 .0

128.1 156.4 133.3 164.8 133.0 114.7

(0 .5) (0 .5)

200 .0

105.7 82.1 62.7 131.4 200 .0

110.8 123.0

40.3

(1 .0)

100.3 59.1 44.9 56.6

(1 .0)

100 .0

36.6 (1 .5)

100 .0

55.5 (1 .5)

- (2 .0) - (2 .0)

SSI VND VCI TCBS MBS HCM SSI VND VCI TCBS MBS HCM

Proprietary Trading Account Balance Total Equity Proprietary Trading Account Balance Total Equity

Proprietary Trading Account Balance/Total Equity Proprietary Trading Account Balance/Total Equity

Selected Foreign Securities Firms

USD mn USD mn

300 .0

1.3 2018 1.5 100 .0

92.8 2017 0.7 0.8

1.0

250 .0

252.2 0.7 0.8 90.0

0.6 0.8

197.7

1.0 80.0

0.2 0.6

200 .0

0.3 70.0 0.4

0.5 60.0

55.1 49.0 0.2

41.3

34.7

150 .0 50.0 -

84.6 - 40.0

25.8 (0 .2)

100 .0

57.9 22.2

42.0

30.0 (0 .4)

29.2 36.0 22.6 4.7

(0 .5) 20.0 (0 .6)

50.0

10.0 (0 .8)

- (1 .0) - (1 .0)

Mirae Asset KBSV Shinhan KIS Mirae Asset KBSV Shinhan KIS

Proprietary Trading Account Balance Proprietary Trading Account Balance

Total Equity Total Equity

Proprietary Trading Account Balance/Total Equity Proprietary Trading Account Balance/Total Equity

Note: Data is based on consolidated financial statements

Sources: Companies’ Financial Statements

Case Study – SSI Securities Corporation

Proprietary Trading Overview Proprietary Trading is Supported by SSI’s Investment Arm - SSIAM

Underwriting, Pre-IPO,

early investment Funds under SSIAM’s Management

IB&A

(AUM of external clients as at May 2018 of USD330 mn)

Open-ended Funds Member Funds Exchange-Traded Fund

Proprietary Warehouse, block deal Institutional

Trading Sales

Equity Fund PE Fund

SSI Sustainable Competitive Vietnam Growth Fund DAIWA- ETF SSIAM VNX50 Fund

ETFs, future arbitrage, Advantage Fund (SSI-SCA) SSIAM II

covered warrant Market-

Making Bond Fund SSI Member Fund

SSI Bond Fund (SSIBF) (SSI IMF)

Equity Fund

Proprietary Trading Value Andbanc Investment SIF –

Vietnam Value and Income

Portfolio

USD mn

1,40 0.0

1,185.8

1,20 0.0

Equity Fund

962.8 958.6 SSIAM UCITS – Vietnam Value

1,00 0.0

Income and Growth Fund

800 .0

600 .0

400 .0

328.5

200 .0

47.7 73.4 0.0 109.3

23.5 0.1 52.8 8.8 16.1 - 0.4

-

2014 2015 2016 2017 2018

Stock Bond Fund Certificate

Sources: Company filings and website

Case Study – Ho Chi Minh Securities Corporation

Diversified Trading with New Financial Instruments such as Independent Strategy From IB&A and Institutional Brokerage but

Derivatives and Covered Warrant Loosely Backed by Dragon Capital and VFM

Launched in August 2017 but derivative trading quickly Coordination Loop

generated the second highest income for HSC Proprietary

Trading with VND136.9bn, contributing to 32% of total revenue.

HSC is also open for covered warrant trading.

USD mn

Proprietary Trading Revenue

9.2

2016 2017

5.9

2.7

2.0

1.1 1.3

0.3 0.0 0.0 0.2

Stock Derivative Deposit interest ETF Certificate Bond

2017 Proprietary Trading Revenue Breakdown

Proprietary Trading

6.1% 1.1%

Stock

10.6% Underwriting,

Derivative

Pre-IPO, early Warehouse,

Deposit interest investment block deal

50.2%

32.0% ETF Certificate IB&A Institutional Sales

Bond

Source: HSC Annual Report 2017

Case Study – Techcom Securities JSC

Focus on DCM Advisory Distribution Channel

• Offer interest rate varying from 9% to 12% per

annum but corporate is required to deposit a part Retail Corporate Bond Open-ended Fund

of cash at Techcom Bank.

• Overall, taking into account of all process fees iBond iFund

(transaction fee, out-of-pocket fee, deposit rate,

etc.), corporate will be charged a total interest

rate for straight bond of 11% - 14% per annum. • Distribution of bond certificate issued by leading Investing in corporate bond, government bond,

companies and advised by TCBS in 284 term deposits and other valuable papers.

Techcombank branches nationwide ✓ Techcombank Bond Fund (TCBF):

• Minimum investment: VND 200 mn • Expected return: >8%/year

• Coupon: 9%/year. The bonds’ coupon rate is • Minimum investment: VND 1 mn

amended annually or bi-annually • Portfolio:

• Liquidity - Government bonds: 20%-50%

- Use bonds as mortgage at Techcombank - Corporate bonds: 50%-80%

Proprietary Trading Value - Bonds are listed on HOSE - Certificate of deposit: 0%-5%

- Flexible liquidity packages of TCBS ✓ Techcom FlexiCash Fund (TCFF): first money

✓ Bond Plus & Pro: Sell back to TCBS at market fund in Vietnam – FlexiCA$H to help

USD mn

3,00 0.0

2,775.1 2,758.6 predetermined time and interest maximize short-term cash flow for

corporates and individuals.

2,50 0.0

Sell back time Coupon • Expected return: 6%/year

2,00 0.0

Plus 2nd/17th each month Max: 7%/year • Minimum investment: VND1 mn

1,348.3

Pro 90 3 months 5.9%/year • Portfolio:

Pro 180 6 months 6.55%/year

1,50 0.0

- Government bonds: 30%

1,00 0.0

Pro 360 1 year 7.2%/year - Corporate bonds – banking

371.9 industry: 30%

Other corporate bonds: 20%

500 .0

102.6 92.1 -

14.3 1.9 19.7 9.4

-

✓ iBond Prix: - Certificate of deposit: 15%

o Sell any time at market prices and has - Short-term deposit: 5%

2014 2015 2016 2017 2018 high return.

o Interest hold to maturity date:

Stock Bond > 9%/year

Sources: Company filings and website

Case Study – Korean Securities Firms

Shinhan Securities Mirae Asset Securities

Corporates

Debt solution advisory

Guarantee for

bond issuance

Bond Proprietary Trading

Shinhan Securities Shinhan Investment

Vietnam Corporation (Korea)

Wealth Investment

Brokerage

Bond distribution Management Banking

Shinhan bank

Bond distribution

Institutional Investors

USD’000 USD mn

Proprietary Trading Value Proprietary Trading Value

6,00 0.0

5,591.4 250 .0

221.9

5,00 0.0

200 .0

4,00 0.0

150 .0

3,00 0.0

100 .0

2,00 0.0

50.0

9.4 18.6 22.9

- 0.0 - -

1,00 0.0

7.3 1.6 0.6

- -

2016 2017 2018 2016 2017 2018

Stock Bond Stock Bond

Sources: Company filings and website

You might also like

- Draft 2 Financial Literacy Survey Questionnaire NewDocument2 pagesDraft 2 Financial Literacy Survey Questionnaire NewCuestas Jelou100% (17)

- Summative Test-FABM2 2018-2019Document2 pagesSummative Test-FABM2 2018-2019Raul Soriano Cabanting88% (8)

- Accelerator PPT FinalDocument41 pagesAccelerator PPT FinalnavdeepNo ratings yet

- CF Chapter Two QuestionsDocument2 pagesCF Chapter Two Questionszaraazahid_950888410No ratings yet

- SACAP - PPE PBA Payment Certificate (March 2015)Document1 pageSACAP - PPE PBA Payment Certificate (March 2015)Ben MusimaneNo ratings yet

- 4 VietnamDocument13 pages4 VietnamNguyen Tran Cao Vy (K17 HCM)No ratings yet

- Manhour Histogram & 'S' Curve (Overall) : P.O Box 66, Abqaiq-31992 KsaDocument1 pageManhour Histogram & 'S' Curve (Overall) : P.O Box 66, Abqaiq-31992 KsaPushparaj ArokiasamyNo ratings yet

- Multifinance Outlook 2023-Update1.1-1 - RemovedDocument5 pagesMultifinance Outlook 2023-Update1.1-1 - Removedsyabeh qokaNo ratings yet

- EPC CurveDocument4 pagesEPC Curvehadrat91No ratings yet

- DataDocument1 pageDataapi-509057610No ratings yet

- Idea By: Group 5Document38 pagesIdea By: Group 5kamrul hasan ayonNo ratings yet

- Team Evolvers - CFA RCDocument10 pagesTeam Evolvers - CFA RCSUMAN SUMANNo ratings yet

- TarantulaDocument63 pagesTarantulablaslarrainNo ratings yet

- BMRI 2023 Q4 PresentationDocument103 pagesBMRI 2023 Q4 PresentationIwan AgusNo ratings yet

- Proposed Split Roofdeck Resthouse Construction Weekly Pogress Histogram S-CurveDocument1 pageProposed Split Roofdeck Resthouse Construction Weekly Pogress Histogram S-CurvePaulo BurceNo ratings yet

- 2G Site PerformanceDocument84 pages2G Site Performancenarendraiit2003No ratings yet

- ReportDocument1 pageReportTamer ShehataNo ratings yet

- B CEG ENGR PROGRESS - 3TDB PROJECTS - 26april 2021 DraftDocument112 pagesB CEG ENGR PROGRESS - 3TDB PROJECTS - 26april 2021 DraftLazarNo ratings yet

- Book 1Document14 pagesBook 1Kusum lalwaniNo ratings yet

- Financial Statement Analysis - ProjectDocument16 pagesFinancial Statement Analysis - Projectkeshav kumarNo ratings yet

- Invesco India Rise PortfolioDocument32 pagesInvesco India Rise PortfolioPavan KrrishNo ratings yet

- Heart Disease and Stroke Statistics 2016 UpdateDocument23 pagesHeart Disease and Stroke Statistics 2016 UpdateChomang SutrisnaNo ratings yet

- Physical Works AnalysisDocument1 pagePhysical Works AnalysisliyanasbsbNo ratings yet

- Youtube Sample Insight PDFDocument7 pagesYoutube Sample Insight PDFNazifa KamalyNo ratings yet

- Detail Engineering S CurveDocument1 pageDetail Engineering S CurveArvind KeshriNo ratings yet

- Curva S - ForNO EBNER Atualização 22.10.14Document1 pageCurva S - ForNO EBNER Atualização 22.10.14Sebastião SabinoNo ratings yet

- Monthly Economic ReviewDocument1 pageMonthly Economic ReviewShamim IqbalNo ratings yet

- 14.0 Cronograma Semanal 12-05-24 (Barring TKF)Document1 page14.0 Cronograma Semanal 12-05-24 (Barring TKF)jhony morales felixNo ratings yet

- Business Ferret Sample Coffee Roaster 040111Document12 pagesBusiness Ferret Sample Coffee Roaster 040111Manvinder SinghNo ratings yet

- 1st PresentationDocument6 pages1st Presentationie.magicNo ratings yet

- Curva S - ForNO EBNER Atualização 22.10.28Document1 pageCurva S - ForNO EBNER Atualização 22.10.28Sebastião SabinoNo ratings yet

- Curva S - ForNO EBNER Atualização 22.10.21Document1 pageCurva S - ForNO EBNER Atualização 22.10.21Sebastião SabinoNo ratings yet

- Microfinance and SFBsDocument31 pagesMicrofinance and SFBsRavi BabuNo ratings yet

- Economic Analysis PeruDocument10 pagesEconomic Analysis Perukamal pipersaniyaNo ratings yet

- Status As of February 20, 2019: PLAN (%) Actual (%) Cumulative Plan (%) Cumulative Actual (%)Document1 pageStatus As of February 20, 2019: PLAN (%) Actual (%) Cumulative Plan (%) Cumulative Actual (%)Anonymous xFCmP2K0D5No ratings yet

- AP Resultados Estudio de Ejecución 06 16Document168 pagesAP Resultados Estudio de Ejecución 06 16Hercha ValNo ratings yet

- BMRI 2023 Q4 PresentationDocument104 pagesBMRI 2023 Q4 PresentationJoko SusiloNo ratings yet

- Edhie - IR4UHC Learning JkkiDocument29 pagesEdhie - IR4UHC Learning JkkiImam RizaldiNo ratings yet

- Rebalansare PortofoliuDocument4 pagesRebalansare PortofoliuAndrei DumitruNo ratings yet

- Sos Ger Detdin FR PTM KecDocument50 pagesSos Ger Detdin FR PTM KecindahsupramiatiNo ratings yet

- Financial GAPsDocument5 pagesFinancial GAPsGabriel FernandesNo ratings yet

- S Curve TemplateDocument9 pagesS Curve TemplateJonald DagsaNo ratings yet

- Planificacion y Control de Partidas OTK4132-008V - Camila Sarmiento - Curva SDocument2 pagesPlanificacion y Control de Partidas OTK4132-008V - Camila Sarmiento - Curva SCAMILA SARMIENTONo ratings yet

- Curva S (6971) Rev. 1Document2 pagesCurva S (6971) Rev. 1hisakrewNo ratings yet

- Ibm: PBV and RoeDocument3 pagesIbm: PBV and RoeyrperdanaNo ratings yet

- Industry Report FY24Document77 pagesIndustry Report FY24Deepanshu GuptaNo ratings yet

- Triwulan 1 2019 NewwwDocument10 pagesTriwulan 1 2019 Newwwindah ayuNo ratings yet

- Statistik AmrwbDocument61 pagesStatistik AmrwbGoldtri Lumban GaolNo ratings yet

- SLH/ KP Asli Operation Meeting Week 8Document6 pagesSLH/ KP Asli Operation Meeting Week 8Naresh RaviNo ratings yet

- China Eco 1Document1 pageChina Eco 1andrewbloggerNo ratings yet

- Case Study SolutionDocument11 pagesCase Study SolutionMadhuKumarNo ratings yet

- CharnockDocument61 pagesCharnockAnirban GhoshNo ratings yet

- Report On Economy of France: Submitted ToDocument16 pagesReport On Economy of France: Submitted ToMusfequr Rahman (191051015)No ratings yet

- C3 Physical Progress CurveDocument1 pageC3 Physical Progress CurveHamsath FarludeenNo ratings yet

- Market Outlook January 2022Document27 pagesMarket Outlook January 2022sohailNo ratings yet

- Pharmaceutical Industry: A Comparativeanalysisof Profit/Loss AccountsDocument6 pagesPharmaceutical Industry: A Comparativeanalysisof Profit/Loss AccountsAdnanNo ratings yet

- Investor Presentation Q2FY22 - 25th October 2021Document16 pagesInvestor Presentation Q2FY22 - 25th October 2021Saurabh AgarwalNo ratings yet

- KOA (Buy TP NOK10) : Above Auto Market Performance, Improved PMI's, But Lagging Peers. Why?Document23 pagesKOA (Buy TP NOK10) : Above Auto Market Performance, Improved PMI's, But Lagging Peers. Why?jainantoNo ratings yet

- Libro 123Document4 pagesLibro 123Sowertz PikenNo ratings yet

- Monthly Advance Report On Durable Goods Manufacturers' Shipments, Inventories and Orders July 2020Document6 pagesMonthly Advance Report On Durable Goods Manufacturers' Shipments, Inventories and Orders July 2020Wai Soon HanNo ratings yet

- Super Bowl XLIV Square Pool AnalysisDocument18 pagesSuper Bowl XLIV Square Pool AnalysisjayhyneNo ratings yet

- Frag - 8.5X9.5 - North Diamond A5Document1 pageFrag - 8.5X9.5 - North Diamond A5anreswigha nashatyaNo ratings yet

- Theoretical Monte Carlo: (Assuming A Normal Distribution (Over 5000 Iterations)Document2 pagesTheoretical Monte Carlo: (Assuming A Normal Distribution (Over 5000 Iterations)MAPARNo ratings yet

- Curva S - FORNO EBNER Atualização 22.10.07Document1 pageCurva S - FORNO EBNER Atualização 22.10.07Sebastião SabinoNo ratings yet

- Governmental Entities: Other Governmental Funds and Account GroupDocument31 pagesGovernmental Entities: Other Governmental Funds and Account GroupabmyonisNo ratings yet

- Engineering Economy 15th Edition Sullivan Solutions Manual Full Chapter PDFDocument77 pagesEngineering Economy 15th Edition Sullivan Solutions Manual Full Chapter PDFRobertFordicwr100% (18)

- Bonos Convertibles 11 SepDocument18 pagesBonos Convertibles 11 SepDIANA CABALLERONo ratings yet

- The Effects of Changes in Foreign Rates: ExchangeDocument50 pagesThe Effects of Changes in Foreign Rates: ExchangeBethelhem50% (2)

- Briefing On - Bonus 3392-181Document6 pagesBriefing On - Bonus 3392-181Mike OwensNo ratings yet

- Corporation Bank Schedule of ChargesDocument29 pagesCorporation Bank Schedule of ChargessekharhaldarNo ratings yet

- Maharshi Arvind KailashDocument141 pagesMaharshi Arvind Kailashrahulsogani123No ratings yet

- Welcome: Export Credit Guarantee Corporation of India (ECGC) Policies and GuaranteesDocument23 pagesWelcome: Export Credit Guarantee Corporation of India (ECGC) Policies and GuaranteesVinoth KumarNo ratings yet

- Shashi BhushanDocument1 pageShashi BhushanRutesh ChavdaNo ratings yet

- New Balance $113,073.22 Payment Due Date 07/05/22: Business Platinum CardDocument17 pagesNew Balance $113,073.22 Payment Due Date 07/05/22: Business Platinum Cardshamim0008No ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- SavingsAccount History 13092023113303Document3 pagesSavingsAccount History 13092023113303Nadiah IsmaNo ratings yet

- Liabilities ReviewerDocument4 pagesLiabilities ReviewerTessie GonzalesNo ratings yet

- The Debt-FREE LifestyleDocument129 pagesThe Debt-FREE LifestyleMark Joseph Manlapas DeontoyNo ratings yet

- U.S.basel .III .Final .Rule .Visual - MemoDocument79 pagesU.S.basel .III .Final .Rule .Visual - Memoswapnit9995No ratings yet

- 1.1 Forex Key To CorrectionDocument4 pages1.1 Forex Key To Correctionalibanto.sherwinNo ratings yet

- 01-14-2016Document6 pages01-14-2016SusanaNo ratings yet

- Contact Point Verification - Business (Credit Approver & BM)Document4 pagesContact Point Verification - Business (Credit Approver & BM)Srikanth KolkundaNo ratings yet

- Bba 103 AssignmentDocument7 pagesBba 103 AssignmentjasonNo ratings yet

- M1, M2,, M3 Money and BankingDocument6 pagesM1, M2,, M3 Money and BankingKhalil Ullah100% (1)

- Tax Invoice: Amount in Words: Forty Three Thousand One Hundred Twenty Five Saudi Riyal OnlyDocument6 pagesTax Invoice: Amount in Words: Forty Three Thousand One Hundred Twenty Five Saudi Riyal Onlyabod7abobNo ratings yet

- Final 2 2Document3 pagesFinal 2 2RonieOlarteNo ratings yet

- 11-22-CER-Lesson 06Document15 pages11-22-CER-Lesson 06Ravindu GamageNo ratings yet

- EE4209 - Lecture 3 - Economic and Financial Evaluation of Energy Sector ProjectsDocument20 pagesEE4209 - Lecture 3 - Economic and Financial Evaluation of Energy Sector ProjectsVindula LakshaniNo ratings yet

- A Study On Performance Analysis of Equities Write To Banking SectorDocument65 pagesA Study On Performance Analysis of Equities Write To Banking SectorRajesh BathulaNo ratings yet