Professional Documents

Culture Documents

PLISumangal 1

PLISumangal 1

Uploaded by

GURUDAS PANDITOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PLISumangal 1

PLISumangal 1

Uploaded by

GURUDAS PANDITCopyright:

Available Formats

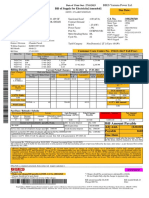

(ANTICIPATED ENDOWMENT ASSURANCE)

(________ YEARS TERM)

WHEREAS the proposer named as the “Insured” in the Schedule printed below has deposited with the PRESIDENT OF INDIA a proposal and declaration for

an Anticipated Endowment Assurance on his/her own life mentioned in the said Schedule and has agreed that the said proposal and declaration signed by

him/her shall be the basis of the contract for such insurance.

AND WHEREAS THE PRESIDENT OF INDIA has accepted the said proposal and has received the first premium paid by the proposer in terms of the letter of

acceptance for and insurance of the amount and on the terms stated in the said Schedule.

NOW IT IS HEREBY DECLARED that if the insured shall pay to the Director General of Posts or the Officer for the time being performing his functions or any

other officer duly authorised by the PRESIDENT OF INDIA in this behalf, the subsequent periodical premia within the prescribed time limit of such payment

as stipulated for in the said Schedule or until his/her death, whichever shall first occur, the PRESIDENT OF INDIA shall be subject and liable to pay the sum

mentioned in the said Schedule together with bonus, if any, declared by the PRESIDENT OF INDIA to the insured or his/her assigns as early as possible after

the insured has attained the age specified if he/she shall die without receiving payment, unto the Executors, Administrator or Assigns of the insured as

early as possible after proof of death of the insured and title of the claimant, to the satisfaction of the Director General of Posts or the Officer for the time

being performing his function or any other Officer duly authorised by the PRESIDENT OF INDIA in this behalf as aforesaid.

BUT this contract is made subject to the terms of Contract printed overleaf.

AND it is also hereby declared the every endorsement placed on the policy by the Director General Posts or the Officer for the time being performing his

functions or any other officer duly authorised by the PRESIDENT OF INDIA in that behalf, shall be deemed part of the policy.

AGE has been admitted as the “age” hereof mentioned in the said Schedule.

SCHEDULE

DATE OF COMMENCEMENT OF RISK POLICY No. SUM ASSURED TERM

NAME, OCCUPATION AND ADDRESS OF INSURED Date of Birth of Insured Date of Maturity

Date of Proposal Details of Premium Payable

Date of Declaration Mode of Payment

Date of Acceptance Amount*

Age at Entry Last Premium Due

Period during which premia will be Till the stipulated date of last payment or prior death of the life assured whichever is earlier.

Payable:

Event or events on the happening of 1. On the survival of Life Assured surviving to the stipulated dates as under:

which the sum assured is to become a) On the life assured surviving upto the end of 6/8* years from the date of commencement of risk - 20% of the sum assured.

payable: b) On the life assured surviving upto the end of 9/12* years from the date of commencement of risk - 20% of the sum assured.

c) On the life assured surviving upto the end of 12/16* years from the date of commencement of risk - 20% of the sum assured.

d) On the life assured surviving upto the date of maturity - 40% of the sum assured together with accrued bonus.

2. On the assured death before the stipulated date of maturity - Sum assured together with accrued bonus.

* Depending on 15 Years/ 20 Years term.

Beneficiary to receive proceeds under The assured or his/her assignee or nominee(s) under section 39 of the Insurance Act 1938 or Proving Executors or Administrators

this policy: or other Legal Representatives who should take out representation to Insured’s Estate or limited to the moneys payable under

this policy from any court of any State or Territory of the Union of India.

NOMINATION (under Section 39 of the Insurance Act 1938)

Name(s) of Nominee(s) Age Relationship

*Tax(es), if any, levied by Government will be charged extra.

Office Seal & Date

Manager

Place:

Central Processing Centre

for and on behalf of the PRESIDENT OF INDIA

Postal Life Insurance

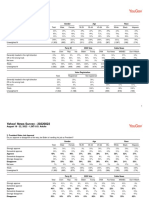

Terms of Contract

1. APPLICATION OF RULES: This policy is issued subject to the provisions in the Post Office Life Insurance Rules-2011 and any

amendments made to the said Rules from time to time.

2. PROOF OF AGE:

2.1 The onus of providing correct age will rest with insured. Insured person should provide such proof of age so that premium can be

based on correct age.

2.2 In the event it is established that the age advised by insured was higher than the correct age of the insured i.e. he was paying

premium higher than the premium warranted by his/ her correct age, he/ she may be allowed to pay correct premium from current

date. However, no refund will be made for any excess premium already paid.

2.3 In the event an insured advised a lower age than his correct age and was paying a premium lower than that required for

continuance of the policy depending on his correct age than such policy will be declared to be void and no benefit will be payable

under this policy. However, Chief Postmaster General of the Circle where the policy stands or any other officer authorized by

Department of Posts in this behalf, at his absolute discretion may allow the insured to continue to pay premium based on correct

age from current date provided that any short fall in the premium already paid accumulated with interest at a rate of 12% per

annum for the period between the dates of payments of such premium and the date of payment of correct premium if paid as

single lump sum by the specified date or; alternatively, he may be allowed to continue to pay the correct premium from current

date and short fall of the premium already paid accumulated @ 12% per annum for the period between the dates of payment of

such premium and last premium payable may be deducted from the settlement amount at the time of settlement of claim. Further,

in any event if it is found that depending on his/ her correct age, the policy could not have been issued then this policy will be

treated as void and no payment will be made.

3. NOMINATION/ ASSIGNMENT: The insured is advised to nominate the person(s) to whom the claim amount shall be payable in

the event of his/ her death except policies taken under MWPA 1874. In the case of minor nominees, name and consent of the

appointee (Guardian) who may receive the said amount on behalf of the minor must be given. In the event of death of the nominee

before the death of the insurant, or change in nomination, the same must be got registered by the Postmaster General/ Head of

Division/ Postmaster of the nearest Central Processing Centre (GPO/ Head Post Office). Policy can be assigned against advance of

loan. After the loan is repaid, policy can be reassigned to the policyholder/ nominee. No assignment/ reassignment will be valid

until a notice in writing of the assignment/ reassignment has been delivered to the Postmaster General/ Head of Division/

Postmaster of the nearest Central Processing Centre (GPO/ Head Post Office).

4. PAYMENT OF PREMIUM: The policyholder can pay his/ her premia at any Post Office in India or make online payment of premia due

through the authorized website of the Department of Posts.

5. DUE DATE OF PAYMENT OF PREMIA: The premium shall be paid in advance on the first day of each month. However, grace period is

allowed upto the last working day of the month.

6. LAPSING OF POLICY: The policy shall be treated as void or lapsed in accordance with Rule 56 or 57 of Post Office Life Insurance

Rules-2011, as the case may be, in case the policyholder fails to pay the premium/ premia that has/ have become due against his/

her policy within the period of grace.

7. REINSTATEMENT OF POLICY: In the event this policy become void under Rule 56 and the policyholder desiring automatic

reinstatement of his/ her policy within a period not later than six months from the date of first unpaid premium had become due in

respect of this policy or in the event the policy becomes inactive under Rule 57 and policyholder desiring automatic reinstatement

of his/ her policy within a period not later than 12 months from the date the first unpaid premium had become due in respect of

this policy, he/ she may deposit all the arrears of premium/ premia up to date of payment along with interest thereon at the

prescribed rates in any Post Office alongwith declaration of good health.

8. REVIVAL OF DISCONTINUED POLICY: In the case policy has lapsed or become void and is time barred for automatic reinstatement,

the main policyholder may apply for revival of this policy to the Postmaster General/ Head of Division/ Postmaster of the nearest

Central Processing Centre (GPO/ Head Post Office) before the policy has matured. Such revival will be subject to payment, within a

date to be specified by the Postmaster General/ Head of Division/ Postmaster of the nearest Central Processing Centre (GPO/ Head

Post Office) of all the arrears of premia with interest thereon at the rates prescribed by the Director General of Posts and further

subject to production of certificate from an Authorized Medical Examiner in the prescribed proforma certifying that the life assured

is insurable having regard to the insurants health and habits and of evidence to show that there has been no adverse change in his/

her personal or family history or his/ her occupation and also a certificate from his/ her employer, if employed, certifying that the

policy holder had not taken any leave on medical grounds during the last one year, or during the period from the date the first

unpaid premium had become due in respect of such policy, whichever is least. The policy shall not be treated as revived unless the

Postmaster General/ Head of Division/ Postmaster of the nearest Central Processing Centre (GPO/ Head Post Office) is satisfied and

has permitted such revival in writing.

9. RESTRICTION ON REINSTATEMENT OR REVIVAL: Policy may be reinstated any number of times during the entire term of the policy.

However, the revival of policy under Rule 58 shall not be allowed on more than two occasions during the entire term of policy,

which will, however, not include the relaxations under Rule 56(3) and/ or Rule 57(3) for reinstatement.

10. FORFEITURE IN CERTAIN EVENTS: The policy shall be void and the payments made by the insurant shall be forfeited, if the

statement contained in the proposal and declaration made therein are found to be untrue.

11. AVIATION: If the death of the insured arise either directly or indirectly as a result of aviation otherwise than as a fare paying

passenger in an aircraft authorized to undertake public transport or as a servant of Government of India in the Indian Navy or Air

Force, only the surrender value acquired by the policy will be payable under the policy provided that the surrender value will be

paid only if 3 years premia have been paid on the policy and the policy is of not less than 3 years duration.

12. SUICIDE: In the event the insured commits suicide any time from the date of acceptance of the policy but before the second policy

anniversary, then the policy will be treated as void and no claim will be entertained in regard to this policy.

13. LOAN: No loan will be granted on the security of this policy.

14. SURRENDER/ PAID UP VALUE: This policy cannot be surrendered. However, it can be made paid up, provided premiums have been

paid for not less than three years, and the reduced paid up assurance will be granted only at the date of maturity, that is at the end

of stipulated plan term or on death of life assured, and no further periodical payments on account of survival benefit will be paid.

15. FREE LOOK PERIOD: The policyholder may get the policy cancelled within 15 days from the date of delivery at the given address.

On such cancellation premium paid by the policyholder will be refunded after deducting medical charges, if any, and proportionate

premium till the date of application of cancellation.

16. INTIMATION OF CHANGE OF ADDRESS: The policyholder is advised in his/ her interest to keep the Postmaster General/ Head of

Division/ Postmaster of the nearest Central Processing Centre (GPO/ Head Post Office) informed of change of address and/ or his

contact number.

17. LIABILITY OF DEPARTMENT IN SETTLEMENT OF CLAIM: The Department will not be liable for payment of interest for delay on

amount of any type of claim/ benefit if insurant has not preferred claim on due date.

You might also like

- Adp Pay Stub TemplateDocument1 pageAdp Pay Stub Templateluis gonzalez50% (2)

- Principles of Insurance Law with Case StudiesFrom EverandPrinciples of Insurance Law with Case StudiesRating: 5 out of 5 stars5/5 (1)

- PLIYugal Suraksha 1Document2 pagesPLIYugal Suraksha 1GURUDAS PANDITNo ratings yet

- PLISuvidha 1Document2 pagesPLISuvidha 1GURUDAS PANDITNo ratings yet

- RPLISantosh 1Document2 pagesRPLISantosh 1GURUDAS PANDITNo ratings yet

- RPLIChild 1Document2 pagesRPLIChild 1GURUDAS PANDITNo ratings yet

- Sahara NidhiDocument4 pagesSahara NidhiAyush DubeyNo ratings yet

- Space For Name and Address of Policyholder Space For Address and E-Mail Id of Micro Insurance UnitDocument13 pagesSpace For Name and Address of Policyholder Space For Address and E-Mail Id of Micro Insurance Unitjagdish patidarNo ratings yet

- Life Insurance ContractDocument15 pagesLife Insurance ContractScribdTranslationsNo ratings yet

- Lic Policy For Jeevan BeemaDocument14 pagesLic Policy For Jeevan BeemaPatel ZeelNo ratings yet

- Policy Doc LIC S New Jeevan Mangal V04Document15 pagesPolicy Doc LIC S New Jeevan Mangal V04mathvresh MathNo ratings yet

- Ramesh Vasudeva Rao InsuranceDocument7 pagesRamesh Vasudeva Rao InsuranceNasr MegahedNo ratings yet

- Bharti AXA Life Premier Protect Home ShieldDocument20 pagesBharti AXA Life Premier Protect Home ShieldAsepNo ratings yet

- Life Stay Smart Plan BrochureDocument2 pagesLife Stay Smart Plan BrochureBadi SudhakaranNo ratings yet

- Individual Permanent Total Disability Policy: Pioneer Insurance & Surety CorporationDocument6 pagesIndividual Permanent Total Disability Policy: Pioneer Insurance & Surety CorporationIrene AnastasiaNo ratings yet

- ALL Term of Contract PLIDocument12 pagesALL Term of Contract PLIVelayutham GNo ratings yet

- BAELSCLX Insurance Law Topics 5 6 7 8Document11 pagesBAELSCLX Insurance Law Topics 5 6 7 8Jasmine SollestreNo ratings yet

- Ins Consent 3909252858 2020-04-17Document2 pagesIns Consent 3909252858 2020-04-17Om PkNo ratings yet

- Ins Consent 3909252858 2020-04-17 PDFDocument2 pagesIns Consent 3909252858 2020-04-17 PDFOm PkNo ratings yet

- Ins Consent 4005606872 2021-03-29Document2 pagesIns Consent 4005606872 2021-03-29Saroj GautamNo ratings yet

- 93 111N035V01 Dhanaraksha Plus LPPTDocument9 pages93 111N035V01 Dhanaraksha Plus LPPTanshfeaturesNo ratings yet

- A Non-Linked, Non-Participating, Pension Scheme Subsidized by The Government of IndiaDocument11 pagesA Non-Linked, Non-Participating, Pension Scheme Subsidized by The Government of IndiaHARSHANo ratings yet

- Life Insurance Policy WordingDocument3 pagesLife Insurance Policy WordingAkmal HelmiNo ratings yet

- Policy Loan Appication FormDocument1 pagePolicy Loan Appication FormAdi DistillersNo ratings yet

- Benefits On DeathDocument16 pagesBenefits On DeathnaitikNo ratings yet

- Post Office Life Insurance Rules - 2011Document3 pagesPost Office Life Insurance Rules - 2011abc100% (1)

- FM-GSIS-OPS-PPL-02 - Optional Life Insurance Policy Loan Application - Rev2 - 10may2024Document2 pagesFM-GSIS-OPS-PPL-02 - Optional Life Insurance Policy Loan Application - Rev2 - 10may2024jenjen.sombiseNo ratings yet

- Myanma Insurance: Ministry of Planning and FinanceDocument7 pagesMyanma Insurance: Ministry of Planning and Financekhine thazinNo ratings yet

- CC Policy-Document LIC-s Jeevan Amar With-LogoDocument16 pagesCC Policy-Document LIC-s Jeevan Amar With-LogoPraneeth AdepuNo ratings yet

- ILOE Policy Terms & Condition - EnglishDocument7 pagesILOE Policy Terms & Condition - EnglishMohdDanishNo ratings yet

- Sales Brochure LIC GCLIDocument5 pagesSales Brochure LIC GCLIRKNo ratings yet

- Loan Secure Sales Policy DocumentDocument15 pagesLoan Secure Sales Policy Documentakshayguin1997No ratings yet

- The Offer Except From The Time It Came To His Knowledge". (Enriquez vs. Sun LifeDocument13 pagesThe Offer Except From The Time It Came To His Knowledge". (Enriquez vs. Sun LifePing ArtVillNo ratings yet

- Tata AIA Life Insurance Sampoorna Raksha Supreme (UIN 110N160V03) TandCDocument32 pagesTata AIA Life Insurance Sampoorna Raksha Supreme (UIN 110N160V03) TandCPradeep KshatriyaNo ratings yet

- Max Life Group Credit Life Secure Policy Document v1Document19 pagesMax Life Group Credit Life Secure Policy Document v1Amit VermaNo ratings yet

- Privileges and Conditions & Policy Options, Nomination and AssignmentsDocument14 pagesPrivileges and Conditions & Policy Options, Nomination and AssignmentsMajharul Islam BillalNo ratings yet

- (A Non-Linked, Non-Participating Health Insurance Plan) Part - ADocument12 pages(A Non-Linked, Non-Participating Health Insurance Plan) Part - AsagarkanzarkarNo ratings yet

- CSD PSF45 V00 032017Document2 pagesCSD PSF45 V00 032017hermione yapNo ratings yet

- Welcome Letter - N-EAP0008408146 - 05022023Document3 pagesWelcome Letter - N-EAP0008408146 - 05022023Aniket GavhankarNo ratings yet

- Policy Document - LIC S Fortune PlusDocument12 pagesPolicy Document - LIC S Fortune Plussharma65367No ratings yet

- Tata AIA Life Insurance Sampoorna Raksha Supreme TC 110N160V02Document54 pagesTata AIA Life Insurance Sampoorna Raksha Supreme TC 110N160V02Aman GuptaNo ratings yet

- Jubilee Policywordinghealth PersonalcareDocument6 pagesJubilee Policywordinghealth PersonalcareZaheer AhmadNo ratings yet

- Personal Accident Insurance - POLMBKBA82EFIJBDocument3 pagesPersonal Accident Insurance - POLMBKBA82EFIJBGiridharan VenkateshNo ratings yet

- BDOIPersonal Accident Insurance PolicyDocument9 pagesBDOIPersonal Accident Insurance PolicyPatNo ratings yet

- Acknowledgment Receipt: Loan Account Number: 4002038493Document2 pagesAcknowledgment Receipt: Loan Account Number: 4002038493bess0910No ratings yet

- Established by The Life Insurance Corporation Act, 1956Document18 pagesEstablished by The Life Insurance Corporation Act, 1956lakshman777No ratings yet

- Life InsuranceDocument23 pagesLife InsuranceSruthi RavindranNo ratings yet

- Exide Life Powering Life Limited Payment Endowment Plan (Elr) (Uin 114n010v01)Document7 pagesExide Life Powering Life Limited Payment Endowment Plan (Elr) (Uin 114n010v01)Navpreet Singh RandhawaNo ratings yet

- Max Life Online Term Plan Policy WordingsDocument14 pagesMax Life Online Term Plan Policy WordingsMandeep Paul SinghNo ratings yet

- Final Policy Doc LIC S Mirco BachatDocument16 pagesFinal Policy Doc LIC S Mirco BachatArvind MehtaNo ratings yet

- Certificate of Insurance Template: Policy InformationDocument5 pagesCertificate of Insurance Template: Policy Informationvarshini042No ratings yet

- Healthcare Policy WordingDocument6 pagesHealthcare Policy WordingSalman AbbasNo ratings yet

- Futuregeneralipearlsguarantee 133n047v01Document18 pagesFuturegeneralipearlsguarantee 133n047v01Dinesh nawaleNo ratings yet

- Acknowledgment Receipt: Loan Account Number: 4002638395Document2 pagesAcknowledgment Receipt: Loan Account Number: 4002638395Rowena Lalongisip De LeonNo ratings yet

- CC Policy-Document LIC-s Tech-Term With-LogoDocument16 pagesCC Policy-Document LIC-s Tech-Term With-LogoDebendra nayakNo ratings yet

- Zhang Liang inDocument7 pagesZhang Liang inNaing linn AungNo ratings yet

- Persons Entitled To PaymentDocument5 pagesPersons Entitled To PaymentishwarNo ratings yet

- Acknowledgment Receipt Homecredit Copy: Loan Account Number: 4203740969Document6 pagesAcknowledgment Receipt Homecredit Copy: Loan Account Number: 4203740969Clark Jay PonceNo ratings yet

- GYRT OnlyDocument5 pagesGYRT OnlygirmabelayNo ratings yet

- Sec 38 39 47Document3 pagesSec 38 39 47ayan mohantyNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- SCP Presentation.Document42 pagesSCP Presentation.Benjamin MulingokiNo ratings yet

- 22-04-04 ITC-1302 Ericsson Response To Apple ComplaintDocument38 pages22-04-04 ITC-1302 Ericsson Response To Apple ComplaintFlorian MuellerNo ratings yet

- Sim-Ge: Q1) Suggested AnswersDocument12 pagesSim-Ge: Q1) Suggested AnswersDương DươngNo ratings yet

- Q4-Ict As Platform For ChangeDocument79 pagesQ4-Ict As Platform For ChangeElaiza BeloiraNo ratings yet

- Filipino ResearchDocument2 pagesFilipino ResearchKielene PalosNo ratings yet

- Full Download Solutions Manual To Accompany Managerial Accounting Decision Making and Motivating Performance PDF Full ChapterDocument10 pagesFull Download Solutions Manual To Accompany Managerial Accounting Decision Making and Motivating Performance PDF Full Chapterlanioidabsolvejy9g100% (21)

- 19-Pormento SR Vs PontevedraDocument7 pages19-Pormento SR Vs PontevedraLexter CruzNo ratings yet

- Jayme vs. Bualan 58 Phil. 422 No. 37386 September 19 1933Document2 pagesJayme vs. Bualan 58 Phil. 422 No. 37386 September 19 1933Angelie FloresNo ratings yet

- Guidance Note For Use of 3% Capital Budget For NSPW Final Ab Feb0220222Document10 pagesGuidance Note For Use of 3% Capital Budget For NSPW Final Ab Feb0220222yusufahmed2329No ratings yet

- Interim Valuations: DR Alice LunguDocument27 pagesInterim Valuations: DR Alice LunguAlice S LunguNo ratings yet

- 05 - Gonzales V GJH LandDocument69 pages05 - Gonzales V GJH LandKristabelleCapaNo ratings yet

- Bill of Supply For Electricity (Amended) Due Date: - : BSES Yamuna Power LTDDocument1 pageBill of Supply For Electricity (Amended) Due Date: - : BSES Yamuna Power LTDSanni SharmaNo ratings yet

- 3.4. Rights, Responsibilities, and Accountabilities of CounselorsDocument12 pages3.4. Rights, Responsibilities, and Accountabilities of CounselorsNadia Caoile IgnacioNo ratings yet

- G.R. No. 168539 March 25, 2014 People of The Philippines, Petitioner, HENRY T. GO, RespondentDocument7 pagesG.R. No. 168539 March 25, 2014 People of The Philippines, Petitioner, HENRY T. GO, RespondentGen CabrillasNo ratings yet

- Partial Withdrawal Form Borang Permohonan Pengeluaran SebahagianDocument2 pagesPartial Withdrawal Form Borang Permohonan Pengeluaran SebahagianSh Shaeza50% (2)

- What Is The History of Inclusive EducationDocument13 pagesWhat Is The History of Inclusive EducationMaria Elena AustriaNo ratings yet

- Realstate Feasibility Report - New Version-1Document54 pagesRealstate Feasibility Report - New Version-1madford.303No ratings yet

- Williams Lake Community Policing Fee For ServiceDocument17 pagesWilliams Lake Community Policing Fee For ServiceWL TribuneNo ratings yet

- Elie Wiesel SpeechDocument3 pagesElie Wiesel Speechapi-643511800No ratings yet

- OBLICON TSN Based On Galas Syllabus 2022Document176 pagesOBLICON TSN Based On Galas Syllabus 2022Princess May CabanogNo ratings yet

- Industrial Personnel - Amp - Management Services, Inc. (IPAMS) vs. de Vera, 785 SCRA 562, G.R. No. 205703 March 7, 2016Document39 pagesIndustrial Personnel - Amp - Management Services, Inc. (IPAMS) vs. de Vera, 785 SCRA 562, G.R. No. 205703 March 7, 2016Jm SantosNo ratings yet

- CPL Format Elementary - S C. Basalo EsDocument5 pagesCPL Format Elementary - S C. Basalo EsEmyatNo ratings yet

- Bs Na en 1992 3 2006 PDFDocument10 pagesBs Na en 1992 3 2006 PDFChan JoeNo ratings yet

- E-Payment Details Report: Rwanda Revenue AuthorityDocument1 pageE-Payment Details Report: Rwanda Revenue AuthorityGilbert KamanziNo ratings yet

- Corruption and Foreign Direct InvestmentDocument18 pagesCorruption and Foreign Direct InvestmentsaraNo ratings yet

- Tia Rowe - Donovan Gold - Andrew Knight Payan - Los Angeles Felony Arrest RecordsDocument3 pagesTia Rowe - Donovan Gold - Andrew Knight Payan - Los Angeles Felony Arrest RecordsJacky J. JasperNo ratings yet

- 118E Gue vs. RepublicDocument1 page118E Gue vs. RepublicLoren Bea TulalianNo ratings yet

- Yahoo Tabs Biden EconomyDocument89 pagesYahoo Tabs Biden EconomyKelli R. Grant0% (1)

- Quotation For PT Indotambang Cakra PerkasaDocument1 pageQuotation For PT Indotambang Cakra PerkasaOwing 28No ratings yet