Professional Documents

Culture Documents

PS5 ECO101 PS5 Elasticity Part2 Solutions

PS5 ECO101 PS5 Elasticity Part2 Solutions

Uploaded by

Alamin Ismail 2222905630Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PS5 ECO101 PS5 Elasticity Part2 Solutions

PS5 ECO101 PS5 Elasticity Part2 Solutions

Uploaded by

Alamin Ismail 2222905630Copyright:

Available Formats

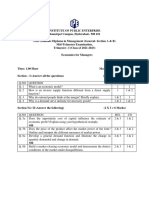

Draft Solution

ECO 101. Se37, 39, 40, 41 Spring 2023 Dr Saima Khan (SaKn)

Problem Set 5 – Elasticity (Part 2)

Name: ID:

Sec: Date:

Instructions

• There are a total of five (5) questions in this paper. Please print out the

assignment, answer the questions in the space provided and submit the

hardcopy to me IN CLASS.

• Please submit by the deadline announced on CANVAS in the FIRST 15

minutes of class; late submissions will NOT be accepted.

• Any attempts to submit assignment by unfair means (including handing it to

my TA) will result in NEGATIVE marking.

• Please do not submit an extra cover page for this assignment – All relevant

information can be included in the table above! Use that paper to print out

your lecture slides instead!

Question 1 (2 marks)

An income elasticity of 2 for watermelon juice indicates that:

(a) Watermelon juice is inferior goods.

(b) Watermelon juice is normal goods.

(c) Watermelon juice is a close substitute of mango juice.

(d) Watermelon juice and Haleem are complements.

Justify:

YED 270 Watermelon juice is a normal good

This means as income t by 11 demand for watermelon

juice t 21

by

ECO 101. Se37, 39, 40, 41 Spring 2023 Dr Saima Khan (SaKn)

Question 2 (4 marks)

A cross elasticity of demand of -.39 for good 1 indicates that:

(a) Good 1 is an inferior good.

(b) Good1 is a normal good.

(c) Good 1 is a close substitute of good 2.

(d) Good1 is a complement of good2.

Justify:

When Pat

CED o 39 0 by It people buy less of

good 1 and less of good 2 Demand falls by 0.397

Since purchase both goods falls they are complements

of

Question 3 (10 marks)

A company hires a group of consultants to bring about greater efficiency in the

transportation sector. They see that when train ticket prices are raised from BDT 300

to BDT 500, the quantity demanded falls by 25%. At the same time, this increase in

price raises the demand for bus tickets from 1500 to 1956. QT from 1500 to 1956

(a) Calculate the price elasticity of demand for train tickets.

t bP

PED

I.gg where 7 add 251

PI too

too

5003ft

57

0.37

(b) Based on your answer in (a), is the demand for train tickets elastic or inelastic?

PED o 371 0 37 41 Inelastic

As PT by It Qd

Q demanded falls by

0 37

falls less than proportionately So people are not very

responsive to price change

ECO 101. Se37, 39, 40, 41 Spring 2023 Dr Saima Khan (SaKn)

(c) The authorities are trying to decide if they should increase train ticket prices

even more, to BDT 700 to generate greater total revenue. What advice would

you give the authorities? Explain.

since Demand for train tickets is inelastic

TRIP x Quupward pressure of Price stronger than

Q demanded TR will increase I would thus

downward pressure

of

advice the authorities to go ahead and raise price

(d) Calculate the cross elasticity of demand for bus tickets.

Pang 500 300 noo

D

1956 3921 1728

a

Garg

21

0 53

500 300 42 972g

(e) Are bus tickets inferior, normal, substitute or complement goods?

CED 0 5370 As P of train tickets T Demand for

bus ticket's t while q demanded of train tickets 17

Since purchase bus and train tickets mom in

of

are substitute goods

opposite directions they

time grand

(f) Given that price elasticity of income is -1.75, when income rises from BDT

50,000 to BDT 55,000, what is the associated change in demand for train

tickets?

t3IpFant YED msn.IE

1.75

35gffff.tn no

175

1st

I DD 17 5

Ans Demand falls by 17.51

is an inferiorgood

indicating train travel

ECO 101. Se37, 39, 40, 41 Spring 2023 Dr Saima Khan (SaKn)

Question 4 (4 marks)

Elastic Supply

Salwith tax

as Ps c

bic supply

more Elastic

Demand

therm

4.1 The figure above represents the markets for yachts. If the government imposes a

$30,000 tax on yachts and collects it from the yacht suppliers, the ________ curve

supply

will shift ________ by ________.

3 ok

upwards

(a) demand; downward; $15,000

(b) supply; upward; $15,000

(c) supply; upward; $30,000

(d) demand; downward; $30,000

EW

4.2 Please draw and label the changes mentioned in 6.1 in the diagram above.

Shade the Cs Ps

44

4.3 When the government imposes a $30,000 tax on yachts (to be collected from

yacht producers), consumers will pay ___________ of the tax and producers will pay

______________.

Cs PS

(a) $ 20,000; $ 10,000

(b) $ 15,000; $ 15,000

(c) $ 10,000; $ 20,000

x

(d) $ 5,000; $ 25,000

Justify:

Blc when Demand is more inelastic CB PB Producers

able to pass on greater tax burden to consumers

ble consumers not very responsive to PD

ECO 101. Se37, 39, 40, 41 Spring 2023 Dr Saima Khan (SaKn)

Question 5 (4 marks)

tax

S2 after

before tax

t

becomes

Say D

more inelastic

What happen

to PWL

DWL falls Why

The figure above shows the market for blue jeans. The government recently levied a Bic with

$10 tax on the producers of blue jeans. a more inelastra

production

Demand

Which area(s) in the figure above show(s):

loss is less

(a) Consumer surplus before the tax: ___________________________

atb to

(b) Producer Surplus before the tax: ____________________________

d te tf

(c) Consumer surplus after the tax: ___________________________

a

f

(d) Producer surplus after the tax: ____________________________

(e) Government revenue after tax is imposed: ____________________

dbt

(f) Deadweight Loss: __________________________________________

c te

(g) Area b+d is also part of the deadweight loss because producers and

consumers no longer benefit from it. Agree or disagree. Justify:

Disagree bk dw loss is the portion completely lost

to society post tax But bt d is Not the PWL bk

govt is partof society bed is simply a transfer

from consumer producer to

govt

Demand Curve was more

inelastic In that ease

1h Say

hat wow I ap

You might also like

- Midterm Answer KeyDocument9 pagesMidterm Answer Keyzero bubblebuttNo ratings yet

- MGEC MidtermDocument9 pagesMGEC Midtermww liftsNo ratings yet

- Micro Sample Midterm AnsDocument7 pagesMicro Sample Midterm AnsPranjali TripathiNo ratings yet

- CandyDocument27 pagesCandyTurjo Tj TurjoNo ratings yet

- Business Plan Case StudyDocument19 pagesBusiness Plan Case StudyDaniel CringusNo ratings yet

- PS4 ECO101 PS4 Elasticity Part1 SolutionsDocument6 pagesPS4 ECO101 PS4 Elasticity Part1 SolutionsAlamin Ismail 2222905630No ratings yet

- Economics For ManagerDocument2 pagesEconomics For ManagerSiam FarhanNo ratings yet

- Wbut Mba 1 Business Economics 2012Document7 pagesWbut Mba 1 Business Economics 2012Hiral PatelNo ratings yet

- MIT14 01SCF11 Soln01Document5 pagesMIT14 01SCF11 Soln01Divya ShahNo ratings yet

- Part I: Short Answer/Problem Solving Directions: in The Following Five Scenarios (A) - (E), You Are Asked To Apply The Supply andDocument10 pagesPart I: Short Answer/Problem Solving Directions: in The Following Five Scenarios (A) - (E), You Are Asked To Apply The Supply andmark3dasaNo ratings yet

- Take The Demand Curve and Double The Slope: MR 130-4QDocument9 pagesTake The Demand Curve and Double The Slope: MR 130-4Qstatus worldNo ratings yet

- Midterm 2019 WithoutDocument10 pagesMidterm 2019 WithoutRidhi JainNo ratings yet

- ME Answer Keys (Problem Set-3) - 2020Document5 pagesME Answer Keys (Problem Set-3) - 2020aksNo ratings yet

- ECO 100Y Introduction To Economics Midterm Test # 1: Last NameDocument13 pagesECO 100Y Introduction To Economics Midterm Test # 1: Last NameexamkillerNo ratings yet

- Cape Economics Specimen U1 p1Document10 pagesCape Economics Specimen U1 p1Wade Brown75% (4)

- Specimen Paper 1: Questions and AnswersDocument18 pagesSpecimen Paper 1: Questions and AnswersEnakshiNo ratings yet

- Econ 170 U1 SGDocument10 pagesEcon 170 U1 SGphuriphatk18No ratings yet

- Me - MidtermDocument3 pagesMe - MidtermsauravNo ratings yet

- Dwnload Full Economics of Sports The 5th Edition Leeds Test Bank PDFDocument35 pagesDwnload Full Economics of Sports The 5th Edition Leeds Test Bank PDFbabyshipsmoor15md100% (19)

- COMM 220 Practice Problems 2 2Document11 pagesCOMM 220 Practice Problems 2 2Saurabh SaoNo ratings yet

- Solutions: ECO 100Y Introduction To Economics Midterm Test # 1Document14 pagesSolutions: ECO 100Y Introduction To Economics Midterm Test # 1examkillerNo ratings yet

- MGSC - FM34 - HeadStart TestDocument5 pagesMGSC - FM34 - HeadStart TesteweerNo ratings yet

- Sol M1 Mbab5p03 Fall18Document9 pagesSol M1 Mbab5p03 Fall18muhammad.ali.malick5No ratings yet

- VIKAS - The Concept SchoolDocument3 pagesVIKAS - The Concept SchoolSrinivas VakaNo ratings yet

- MICROECONOMICS - Revison Notes 2013 S1 Ques Set 2Document6 pagesMICROECONOMICS - Revison Notes 2013 S1 Ques Set 2Imelda WongNo ratings yet

- Tutorial Questions On Qualitative and Quantitative Demand and Supply AnalysisDocument5 pagesTutorial Questions On Qualitative and Quantitative Demand and Supply AnalysisWise TetteyNo ratings yet

- Test Bank For Economics of Sports The 5 e 5th Edition Michael Leeds Peter Von AllmenDocument24 pagesTest Bank For Economics of Sports The 5 e 5th Edition Michael Leeds Peter Von AllmenLuisWelchqapzb100% (48)

- Marathon 9 - Index NumbersDocument94 pagesMarathon 9 - Index NumbersSarthak RautNo ratings yet

- HỒ DUY QUANG - HE190168 - ECO111_Individual Assignment 02Document13 pagesHỒ DUY QUANG - HE190168 - ECO111_Individual Assignment 02Duy Quang HồNo ratings yet

- 2020 Quiz 1Document4 pages2020 Quiz 1qweryNo ratings yet

- EKO201E Sample 1Document13 pagesEKO201E Sample 1Kadir Y. DemirNo ratings yet

- Eco2003f - Supp Exam - 2010 PDFDocument12 pagesEco2003f - Supp Exam - 2010 PDFSiphoNo ratings yet

- 2000 Econ. Paper 2 (Original)Document20 pages2000 Econ. Paper 2 (Original)peter wongNo ratings yet

- Economics For Managers Dr. SandeepDocument3 pagesEconomics For Managers Dr. SandeepRamteja SpuranNo ratings yet

- Unit 2 ExercisesDocument2 pagesUnit 2 ExercisesShimeque SmithNo ratings yet

- Ugbs 202 Pasco (Lawrence Edinam)Document27 pagesUgbs 202 Pasco (Lawrence Edinam)Young SmartNo ratings yet

- HW Microeconomics)Document3 pagesHW Microeconomics)tutorsbizNo ratings yet

- Eco401 Midterm Subjective by Adil AlviDocument11 pagesEco401 Midterm Subjective by Adil AlviMaryam AshrafNo ratings yet

- Quant ExercisesDocument41 pagesQuant ExercisesNeha GuptaNo ratings yet

- ME CH 2 Tutorial AnswersDocument6 pagesME CH 2 Tutorial AnswersTabassum AkhtarNo ratings yet

- Ps 2 SolutionsDocument4 pagesPs 2 SolutionsAdriel IanNo ratings yet

- Microversion2Document13 pagesMicroversion2Nguyễn Minh KhôiNo ratings yet

- Testmaster 10Document8 pagesTestmaster 10Đức ĐạtNo ratings yet

- CF Micro8 Tif05Document34 pagesCF Micro8 Tif05هناءالحلوNo ratings yet

- CU-2020 B.A. B.Sc. (Honours) Economics Semester-I Paper-CC-1 QPDocument3 pagesCU-2020 B.A. B.Sc. (Honours) Economics Semester-I Paper-CC-1 QPDARPAN ROUTHNo ratings yet

- Final Without Answers133Document12 pagesFinal Without Answers133mariamtata21jkNo ratings yet

- 2020 AEECO Assessment 2 - Answers - ElasticityDocument6 pages2020 AEECO Assessment 2 - Answers - ElasticitySamruddhi MohiteNo ratings yet

- Solution Excel 2DDocument6 pagesSolution Excel 2DSooHan MoonNo ratings yet

- ECO 3108 - Tutorial 2: The Basics of Supply and Demand Name: - Student ID: - DateDocument5 pagesECO 3108 - Tutorial 2: The Basics of Supply and Demand Name: - Student ID: - DateLEE SHXIA YAN MoeNo ratings yet

- Elasticity Quiz (2019)Document3 pagesElasticity Quiz (2019)Trúc Duyên Huỳnh NguyễnNo ratings yet

- ECON502 Assignment 1 S2 2020Document5 pagesECON502 Assignment 1 S2 2020Pankaj RawatNo ratings yet

- Net 2020Document48 pagesNet 2020Krishan pandeyNo ratings yet

- Memo Exam Jun 2018Document12 pagesMemo Exam Jun 2018Nathan VieningsNo ratings yet

- Quantitative Ability Questions With SolutionsDocument135 pagesQuantitative Ability Questions With SolutionsRam KeserwaniNo ratings yet

- Answer Keys (Problem Set2) - 2017Document6 pagesAnswer Keys (Problem Set2) - 2017srivastavavishistNo ratings yet

- Mittal Commerce Classes Ca Foundation - Mock TestDocument6 pagesMittal Commerce Classes Ca Foundation - Mock TestRohit BhattNo ratings yet

- Solutions: ECO 100Y Introduction To Economics Midterm Test # 1Document14 pagesSolutions: ECO 100Y Introduction To Economics Midterm Test # 1examkillerNo ratings yet

- SSC CGL Preparatory Guide -Mathematics (Part 2)From EverandSSC CGL Preparatory Guide -Mathematics (Part 2)Rating: 4 out of 5 stars4/5 (1)

- PS4 ECO101 PS4 Elasticity Part1 SolutionsDocument6 pagesPS4 ECO101 PS4 Elasticity Part1 SolutionsAlamin Ismail 2222905630No ratings yet

- ACT 201 ch17-2Document35 pagesACT 201 ch17-2Alamin Ismail 2222905630No ratings yet

- mgt351 Case1Document3 pagesmgt351 Case1Alamin Ismail 2222905630No ratings yet

- Case 1Document6 pagesCase 1Alamin Ismail 2222905630No ratings yet

- Assessing The Internal Environment of The Firm: EducationDocument14 pagesAssessing The Internal Environment of The Firm: EducationVikasNo ratings yet

- Article Template MFE 1 2Document7 pagesArticle Template MFE 1 2Ìçh ØöÜNo ratings yet

- C4 - DPM20033 EditedDocument6 pagesC4 - DPM20033 EditedDaksha queenNo ratings yet

- SCM in RetailingDocument67 pagesSCM in RetailingKaran MagoNo ratings yet

- A Project Report ON Industrial Visit AT: M. K. School of Business Management, PatanDocument63 pagesA Project Report ON Industrial Visit AT: M. K. School of Business Management, Patanj_d19912009No ratings yet

- FABM1 11 Quarter 4 Week 1 Las 3Document1 pageFABM1 11 Quarter 4 Week 1 Las 3Janna PleteNo ratings yet

- Hedging Lot StrategyDocument7 pagesHedging Lot StrategycorryntNo ratings yet

- Management AccountingDocument21 pagesManagement AccountingAshmin HussainNo ratings yet

- Amazon: Company ProfileDocument8 pagesAmazon: Company ProfileMeareg MebratuNo ratings yet

- Economics For Engineers (Humanities-II) (HSMC 301)Document27 pagesEconomics For Engineers (Humanities-II) (HSMC 301)Manish KumarNo ratings yet

- Met A Guide To Full Funnel Sales Part 3Document2 pagesMet A Guide To Full Funnel Sales Part 3Suffyan SadiqNo ratings yet

- Sbe Annex Campus-Draft One-Examination Timetable-Dec 2023Document3 pagesSbe Annex Campus-Draft One-Examination Timetable-Dec 2023bravochamp910No ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document3 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- European Dividend Swap Master Confirmation AgreementDocument12 pagesEuropean Dividend Swap Master Confirmation AgreementmartinkemberNo ratings yet

- Ravi Pandey Resume SocialswagDocument5 pagesRavi Pandey Resume SocialswagRavi PandeyNo ratings yet

- Inventory ManagementDocument40 pagesInventory Managementganesh100% (1)

- تاج اليمامه From 2023-01-01 To 2023-07-15Document3 pagesتاج اليمامه From 2023-01-01 To 2023-07-15Fahad lifeNo ratings yet

- Management Accounting764 eVyE8h3I7eDocument3 pagesManagement Accounting764 eVyE8h3I7eABHINAV AGRAWALNo ratings yet

- Marketing Management Notes For All 5 UnitsDocument133 pagesMarketing Management Notes For All 5 UnitsdjteejasonNo ratings yet

- MC 4 Question - A231Document5 pagesMC 4 Question - A231Hafiza ZahidNo ratings yet

- Business Model of A RestaurantDocument1 pageBusiness Model of A RestaurantJohn Mark RaniloNo ratings yet

- 7 StandardCostingPractices PDFDocument8 pages7 StandardCostingPractices PDFPui YanNo ratings yet

- Alliance Concrete Executive SummaryDocument2 pagesAlliance Concrete Executive SummaryS r k100% (4)

- Assignment On Strategic Managememt by UITSDocument14 pagesAssignment On Strategic Managememt by UITSMahtab BhuiyanNo ratings yet

- Difference Between Financial & Managerial AccountingDocument3 pagesDifference Between Financial & Managerial AccountingAnisa LabibaNo ratings yet

- PAS 16 Property, Plant and EquipmentDocument4 pagesPAS 16 Property, Plant and Equipmentpanda 1No ratings yet

- Brand ImitationDocument21 pagesBrand ImitationNeetu Gs100% (1)

- International Marketing NewDocument34 pagesInternational Marketing NewSheetal RawatNo ratings yet