Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

11 viewsNational Minimum Wage Act

National Minimum Wage Act

Uploaded by

Werner DupreezThe National Minimum Wage Act establishes a national minimum wage in South Africa. Key points:

- The national minimum wage is currently R23.19 per hour for ordinary hours worked. Certain categories of workers are entitled to slightly different minimum wages.

- Employers must pay their workers at least the national minimum wage and cannot deduct wages in a way that brings pay below this level.

- The Act is enforced through inspections by labor authorities and compliance orders. Employers who fail to comply with orders may face fines.

- Exemptions from paying the minimum wage can be applied for by employers' organizations. The purpose of the Act is to improve wages and working conditions while supporting economic development.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Decoding The Code On Wages, 2 0 1 9: Four Statutes Amalgamated in Wage CodeDocument4 pagesDecoding The Code On Wages, 2 0 1 9: Four Statutes Amalgamated in Wage CodePramodNo ratings yet

- The Code On Wages, 2019Document3 pagesThe Code On Wages, 2019pratik.shinde170No ratings yet

- Labour 2Document10 pagesLabour 2Ishika kanyalNo ratings yet

- The Minimum Wages Act, 1948PPTDocument22 pagesThe Minimum Wages Act, 1948PPTnidhimennonNo ratings yet

- Employment Labour Law Amendments GuideDocument36 pagesEmployment Labour Law Amendments GuideNabeelah AngamiaNo ratings yet

- Lecture 5.Document27 pagesLecture 5.2002rishi13No ratings yet

- All Important ActDocument19 pagesAll Important ActHR DULARINo ratings yet

- ELP Booklet ELPs New Labour CodesDocument11 pagesELP Booklet ELPs New Labour CodesELP LawNo ratings yet

- JSA Newsletter Employment Law July 20220620Document6 pagesJSA Newsletter Employment Law July 20220620Vibhu SinghNo ratings yet

- Features of The Minimum Wages ActDocument8 pagesFeatures of The Minimum Wages ActMahima DograNo ratings yet

- Assignment 3 Labor Law: Full-Time EmployeesDocument2 pagesAssignment 3 Labor Law: Full-Time EmployeesChinmaya SahooNo ratings yet

- Minimum Wages and Conditions of Employment ActDocument17 pagesMinimum Wages and Conditions of Employment ActLubasi 'Jungleman' IlubaNo ratings yet

- Legal Statutory RequirementsDocument70 pagesLegal Statutory RequirementsDendi Pradeep ReddyNo ratings yet

- Abstract of The Contract Labour Act, 1970Document2 pagesAbstract of The Contract Labour Act, 1970Sudha AcharyaNo ratings yet

- PaymentWagesLaw EngDocument13 pagesPaymentWagesLaw EngHZMMNo ratings yet

- Code On Wages, 2019Document8 pagesCode On Wages, 2019CHANDA SINGHNo ratings yet

- Payment of Wages Act, 1936: E.L.L. AssignmentDocument7 pagesPayment of Wages Act, 1936: E.L.L. AssignmentAakanksha SinghNo ratings yet

- Deduction IDocument25 pagesDeduction IShubhi ShuklaNo ratings yet

- Payement of Wage Act, 1936 Unit-4Document8 pagesPayement of Wage Act, 1936 Unit-4rpsinghsikarwarNo ratings yet

- The Minimum Wages Act NewDocument8 pagesThe Minimum Wages Act NewMehr MunjalNo ratings yet

- Presentation1.ppt PAYMENT OF WAGES ACT, 1936Document6 pagesPresentation1.ppt PAYMENT OF WAGES ACT, 1936Manisha SinghNo ratings yet

- Code On WagesDocument19 pagesCode On WagesVivek GautamNo ratings yet

- A Note On Contract Labour 1Document19 pagesA Note On Contract Labour 1seemaagiwalNo ratings yet

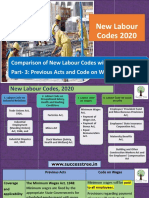

- 4 Comparing Previous Act With New Labour Codes (Part - 3)Document13 pages4 Comparing Previous Act With New Labour Codes (Part - 3)abdul gani khanNo ratings yet

- D-Minimum Wages ActDocument9 pagesD-Minimum Wages ActÑàdààñ ShubhàmNo ratings yet

- The Code On Wages, 2019 - Notes On Clauses - Memorandum Regarding Delegated LegislationDocument10 pagesThe Code On Wages, 2019 - Notes On Clauses - Memorandum Regarding Delegated LegislationPushkar WadodkarNo ratings yet

- Analysis of The Labour Amendment Act - 11 of 2023Document10 pagesAnalysis of The Labour Amendment Act - 11 of 2023halimanidNo ratings yet

- TheEmployment Amendment Bill 2022Document6 pagesTheEmployment Amendment Bill 2022Benson Atang'aNo ratings yet

- FISCAL NOTE: Effect On Local Government: No. Effect On The State: YesDocument2 pagesFISCAL NOTE: Effect On Local Government: No. Effect On The State: YesCarlos HernandezNo ratings yet

- Bihar and Jhar KhandDocument108 pagesBihar and Jhar KhandVasanth RvkNo ratings yet

- BAR EXAMINATION 2006 - LaborandSocialLegislationDocument11 pagesBAR EXAMINATION 2006 - LaborandSocialLegislationLyraNo ratings yet

- The Contract Labour (Regulation & Abolition) Act, 1970Document10 pagesThe Contract Labour (Regulation & Abolition) Act, 1970TAMANNANo ratings yet

- ART. 94. Right To Holiday Pay.-: Than Ten (10) WorkersDocument7 pagesART. 94. Right To Holiday Pay.-: Than Ten (10) WorkersMaribel Nicole LopezNo ratings yet

- India: Code On Wages, 2019 - Minimum WagesDocument19 pagesIndia: Code On Wages, 2019 - Minimum WagesTaniya YadavNo ratings yet

- Abstract of Minimum WagesDocument6 pagesAbstract of Minimum WagesAkhil JamesNo ratings yet

- Code On WagesDocument34 pagesCode On WagespavanNo ratings yet

- Lecture 8Document20 pagesLecture 8Kertik SinghNo ratings yet

- 1948 and 2019Document7 pages1948 and 2019Ishika kanyalNo ratings yet

- Minimum Wages Act-1948Document25 pagesMinimum Wages Act-1948Ashish GautamNo ratings yet

- Minimum Wages & Equal Remuneration ActDocument8 pagesMinimum Wages & Equal Remuneration ActChandni SheikhNo ratings yet

- Minimum Wages Act IndiaDocument39 pagesMinimum Wages Act IndiaRahul RaghuvanshiNo ratings yet

- The Payment of WagesDocument17 pagesThe Payment of WagesChirag RajawatNo ratings yet

- Deduction From Wages: Mansi TrivediDocument15 pagesDeduction From Wages: Mansi Trivedinancy goelNo ratings yet

- Section (Oo) RetrenchmentDocument1 pageSection (Oo) RetrenchmentkairadigitalservicesNo ratings yet

- Clra PresentationDocument362 pagesClra PresentationrajnprasadNo ratings yet

- Cheaklist of Labour Law CompliancesDocument13 pagesCheaklist of Labour Law CompliancesBirendra MishraNo ratings yet

- Minimum Wage BillDocument15 pagesMinimum Wage BillBernewsAdminNo ratings yet

- Deductions Under Payment of Wages ActDocument27 pagesDeductions Under Payment of Wages ActRiddhima KrishnanNo ratings yet

- Convention 26 of Minimum Wages Act: International Labour Organization and Provisons of Indian Minimun Wages ActDocument11 pagesConvention 26 of Minimum Wages Act: International Labour Organization and Provisons of Indian Minimun Wages ActSukhamrit Singh ALS, NoidaNo ratings yet

- Labor Laws and Social Legislation Module No. 6Document6 pagesLabor Laws and Social Legislation Module No. 6Abegail AbrugarNo ratings yet

- Payment of Bonus Act, 1965Document31 pagesPayment of Bonus Act, 1965Milani NarulaNo ratings yet

- Labour Law AssignmentDocument14 pagesLabour Law AssignmentMayank RajpootNo ratings yet

- Emerging Changes in Labour LawsDocument109 pagesEmerging Changes in Labour LawsSrikanth KrishnamurthyNo ratings yet

- 8 Employment Act and Employment of Young PersonsDocument15 pages8 Employment Act and Employment of Young PersonsRichard MvulaNo ratings yet

- Payment of Bonus Act 11Document9 pagesPayment of Bonus Act 11BinithaNo ratings yet

- Nfa v. Masada Security AgencyDocument22 pagesNfa v. Masada Security AgencyRogie ApoloNo ratings yet

- Wage Code Bill 2019Document52 pagesWage Code Bill 2019Rajeev SaraoNo ratings yet

- 2018 Ust LMT Labor LawDocument14 pages2018 Ust LMT Labor LawCindy DeleonNo ratings yet

- THE LABOUR LAW IN UGANDA: [A TeeParkots Inc Publishers Product]From EverandTHE LABOUR LAW IN UGANDA: [A TeeParkots Inc Publishers Product]No ratings yet

- Labor Contract Law of the People's Republic of China (2007)From EverandLabor Contract Law of the People's Republic of China (2007)No ratings yet

National Minimum Wage Act

National Minimum Wage Act

Uploaded by

Werner Dupreez0 ratings0% found this document useful (0 votes)

11 views1 pageThe National Minimum Wage Act establishes a national minimum wage in South Africa. Key points:

- The national minimum wage is currently R23.19 per hour for ordinary hours worked. Certain categories of workers are entitled to slightly different minimum wages.

- Employers must pay their workers at least the national minimum wage and cannot deduct wages in a way that brings pay below this level.

- The Act is enforced through inspections by labor authorities and compliance orders. Employers who fail to comply with orders may face fines.

- Exemptions from paying the minimum wage can be applied for by employers' organizations. The purpose of the Act is to improve wages and working conditions while supporting economic development.

Original Description:

Na

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe National Minimum Wage Act establishes a national minimum wage in South Africa. Key points:

- The national minimum wage is currently R23.19 per hour for ordinary hours worked. Certain categories of workers are entitled to slightly different minimum wages.

- Employers must pay their workers at least the national minimum wage and cannot deduct wages in a way that brings pay below this level.

- The Act is enforced through inspections by labor authorities and compliance orders. Employers who fail to comply with orders may face fines.

- Exemptions from paying the minimum wage can be applied for by employers' organizations. The purpose of the Act is to improve wages and working conditions while supporting economic development.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

11 views1 pageNational Minimum Wage Act

National Minimum Wage Act

Uploaded by

Werner DupreezThe National Minimum Wage Act establishes a national minimum wage in South Africa. Key points:

- The national minimum wage is currently R23.19 per hour for ordinary hours worked. Certain categories of workers are entitled to slightly different minimum wages.

- Employers must pay their workers at least the national minimum wage and cannot deduct wages in a way that brings pay below this level.

- The Act is enforced through inspections by labor authorities and compliance orders. Employers who fail to comply with orders may face fines.

- Exemptions from paying the minimum wage can be applied for by employers' organizations. The purpose of the Act is to improve wages and working conditions while supporting economic development.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

NMW A9

INSPECTIONS AND ENFORCEMENT SERVICES

THE NATIONAL MINIMUM WAGE

ACT NO 9 OF 2018 (THE ACT)

If the worker is paid on the basis other than the number

Every worker is entitled to payment of a wage that is of hours worked, the worker may not be paid less than

not less than the national minimum wage (s4 (4)). The decision whether the employer shall be liable for

the national minimum wage for ordinary hours of work

a fine or not lies with the Commissioner.

PURPOSE OF THE ACT Every employer must pay wages to its workers that is (s5(3)).

not less than national minimum wage (s4 (5)). The employer is liable for a fine only in an instance

Any deduction from the wage must be in accordance

The purpose of the Act is to advance economic where the employer has failed to comply with the

The payment of the national minimum wage cannot with section 34 of the BCEA (S5 (4).

development and social justice by- compliance order (s69(2) (c) and (f)).

be waived and the national minimum wage takes

• Improving the wages of the lowest paid workers; precedence over any contrary provision in any contract, A fine may be imposed on an employer who paid an

EXEMPTIONS

• Protecting the workers from unreasonably low collective agreement, sectorial determination or law, employee less than the national minimum wage (s76A

Employers or an employers organizations registered (1) BCEA).

wages; except a law amending this Act (s4 (6)).

in terms of section 96 of the Labour Relations Act or

• preserving the value on the national minimum wage; The national minimum wage must constitute a term of any other law may apply for an exemption from paying The payment of fine is applicable after the employer

• promote the collective bargaining; and the worker’s contract except to the extent where that the national minimum wage (s15 (1). has failed to comply with the Compliance order issued

the contract, collective agreement or law provides a by the inspector.

• supporting economic policy.

favourable wage to the employer (s4 (7)). The decision whether the employer shall be liable for

ENFORCEMENT OF NMWA

APPLICATION OF THE ACT It is an unfair labour practice for an employer to There are two enforcement procedures for the a fine or not lies with the Commissioner.

The Act applies to all workers and their employers unilaterally alter wages, hours of work or other enforcement of the NMWA i.e. The employer is liable for a fine only in an instance

except members of the South African National conditions of employment in connection with the where the employer has failed to comply with the

implementation of the national minimum wage and • Securing a Written Undertaking ; and

Defence Force, the National Intelligence Agency and compliance order (s69(2) (c) and (f)).

the South African Secret Service. sections 191, 193, 194 (4) and 195 of the Labour • Issuing of the Compliance Order.

Relations Act applies, unless the context indicates • Securing an undertaking. Fine for failure to comply with the NMW is payable in

The act does not apply to a volunteer, who is a person otherwise (s4 (8)). terms of section 76A of the BCEA and failure to comply

who performs work for another person and who A labour inspector may secure an undertaking by the with provisions of the BCEA is payable in terms of the

does not receive or is not entitled to receive, any Sections 32,33 and 34 of the BCEA apply to the payment employer to comply with the provision of the NMWA, Schedule 2 of the BCEA (s69 (2)(c) and (f).

remuneration for his or her service. of the national minimum wage to workers. i.e. section 4(5).

i.e. an employer who fails to pay severance pay in

Subject to item 2, the national minimum wage is The Written Undertaking is secured in terms of section terms of section 41 of the BCEA will be liable for a fine

WHAT IS NATIONAL MINIMUM WAGE R23.19 per hour for each ordinary hour worked. 68(1) of the BCEA. in accordance with schedule 2 of the BCEA; and

The national minimum wage is the amount stated in The farm workers are entitled to a minimum wage of If an employer fails to comply with the Written An employer who pay less than the national minimum

schedule 1 of the Act as adjusted annually in terms of R23.19 per hour. Undertaking within the time period specified in the wage in terms of section 4(5) of the NMWA will be liable

section 6 (s4 (1)). undertaking, the Director-General: Labour may for a fine in terms of section 76A.

Domestic workers are entitled to a minimum wage of

request the CCMA to make a Written Undertaking an

Every worker is entitled to payment of a wage that is R23.19 per hour.

arbitration award (s68(3).

not less than the national minimum wage (s4 (4)). APPLICATION to the CCMA

Workers employed on an expanded public works

It is important to take note that there is no mention of

Every employer must pay wages to its workers that is programme are entitled to a minimum wage of R12.75 The Statutory Services is tasked (by the DoE&L) with

the fine to be imposed on the employer for failure to

not less than national minimum wage (s4 (5)). per hour. referring matters and appearing at the CCMA on

comply with the Written Undertaking.

behalf of the Director-General for the enforcement of

The payment of the national minimum wage cannot Workers who have concluded learnership agreements

Issuing of the Compliance Order. the Compliance Order and the Written Undertaking.

be waived and the national minimum wage takes contemplated in section 17 of the Skills Development

precedence over any contrary provision in any contract, Act, are entitled to the allowances contained in A labour inspector may issue a Compliance Order if she In order for the statutory services to fulfil the above

collective agreement, sectorial determination or law, Schedule 2 has a reasonable grounds to believe that the employer mentioned task, they must be so designated in terms

except a law amending this Act (s4 (6)). has failed to comply with the provisions of the NMWA. of section 63(1) (b) of the BCEA and/or be delegated in

terms of section 85 (1) of the BCEA. In the absence of

The national minimum wage must constitute a term of CALCULATION OF A WAGE The compliance Order may be issued in terms of

the aforementioned, the ss does not have authority to

the worker’s contract except to the extent where that The calculation of a wage for the purposes of the Act section 69(1) of the BCEA.

make an application to the CCMA.

the contract, collective agreement or law provides a is the amount payable in money for ordinary hours of The provisions of the Compliance Order must comply

favourable wage to the employer (s4 (7)). work (s5 (1)). It is very interesting to note that the the labour

with section 69(2) of the BCEA.

inspectors appointed are authorised to refer a dispute

It is an unfair labour practice for an employer to The following payments are excluded in a calculation and appear on behalf of the GD at the CCMA (s64).

It is important or interesting to note that the above

unilaterally alter wages, hours of work or other of a minimum wage- mentioned section provides that Compliance order

conditions of employment in connection with the In light of the aforementioned it is important for

• any payment to enable a worker to work including any must set out the fine that may be imposed on the

implementation of the national minimum wage and the SS to be issued with delegation letters to refer

transport, equipment, tool, food or accommodation employer in terms of section 76A and schedule 2 of

sections 191, 193, 194 (4) and 195 of the Labour and represent the Director-General at the CCMA to

allowance, unless specified otherwise in a sectorial the BCEA.

Relations Act applies, unless the context indicates avoid unnecessary delays that may be occasioned by

otherwise (s4 (8)). determination. failure by the employer to comply with the compliance employers raising points in limine to this effect.

• any payment in kind including board and order may result in the Compliance Order being

Sections 32,33 and 34 of the BCEA apply to the payment accommodation, unless specified otherwise in a made an arbitration award through application by the

of the national minimum wage to workers. sectorial determination; Director-General at the CCMA (s73(1).

• gratuities including bonuses, tips or gifts; and

WHAT IS NATIONAL MINIMUM WAGE • any other prescribed category of payment. FINES

The national minimum wage is the amount stated in

Subject to Section 9A of the BCEA, a worker is entitled A fine may be imposed on an employer who paid an

schedule 1 of the Act as adjusted annually in terms of

to receive the national minimum wage for the hours employee less than the national minimum wage (s76A

section 6 (s4 (1)).

that the worker works on any day (s5 (2)). (1) BCEA).

A worker who works for less than four hours in any day The payment of fine is applicable after the employer

must be paid for four hours work on that day. has failed to comply with the Compliance order issued

by the inspector.

employment & labour

Department:

Employment and Labour

REPUBLIC OF SOUTH AFRICA

You might also like

- Decoding The Code On Wages, 2 0 1 9: Four Statutes Amalgamated in Wage CodeDocument4 pagesDecoding The Code On Wages, 2 0 1 9: Four Statutes Amalgamated in Wage CodePramodNo ratings yet

- The Code On Wages, 2019Document3 pagesThe Code On Wages, 2019pratik.shinde170No ratings yet

- Labour 2Document10 pagesLabour 2Ishika kanyalNo ratings yet

- The Minimum Wages Act, 1948PPTDocument22 pagesThe Minimum Wages Act, 1948PPTnidhimennonNo ratings yet

- Employment Labour Law Amendments GuideDocument36 pagesEmployment Labour Law Amendments GuideNabeelah AngamiaNo ratings yet

- Lecture 5.Document27 pagesLecture 5.2002rishi13No ratings yet

- All Important ActDocument19 pagesAll Important ActHR DULARINo ratings yet

- ELP Booklet ELPs New Labour CodesDocument11 pagesELP Booklet ELPs New Labour CodesELP LawNo ratings yet

- JSA Newsletter Employment Law July 20220620Document6 pagesJSA Newsletter Employment Law July 20220620Vibhu SinghNo ratings yet

- Features of The Minimum Wages ActDocument8 pagesFeatures of The Minimum Wages ActMahima DograNo ratings yet

- Assignment 3 Labor Law: Full-Time EmployeesDocument2 pagesAssignment 3 Labor Law: Full-Time EmployeesChinmaya SahooNo ratings yet

- Minimum Wages and Conditions of Employment ActDocument17 pagesMinimum Wages and Conditions of Employment ActLubasi 'Jungleman' IlubaNo ratings yet

- Legal Statutory RequirementsDocument70 pagesLegal Statutory RequirementsDendi Pradeep ReddyNo ratings yet

- Abstract of The Contract Labour Act, 1970Document2 pagesAbstract of The Contract Labour Act, 1970Sudha AcharyaNo ratings yet

- PaymentWagesLaw EngDocument13 pagesPaymentWagesLaw EngHZMMNo ratings yet

- Code On Wages, 2019Document8 pagesCode On Wages, 2019CHANDA SINGHNo ratings yet

- Payment of Wages Act, 1936: E.L.L. AssignmentDocument7 pagesPayment of Wages Act, 1936: E.L.L. AssignmentAakanksha SinghNo ratings yet

- Deduction IDocument25 pagesDeduction IShubhi ShuklaNo ratings yet

- Payement of Wage Act, 1936 Unit-4Document8 pagesPayement of Wage Act, 1936 Unit-4rpsinghsikarwarNo ratings yet

- The Minimum Wages Act NewDocument8 pagesThe Minimum Wages Act NewMehr MunjalNo ratings yet

- Presentation1.ppt PAYMENT OF WAGES ACT, 1936Document6 pagesPresentation1.ppt PAYMENT OF WAGES ACT, 1936Manisha SinghNo ratings yet

- Code On WagesDocument19 pagesCode On WagesVivek GautamNo ratings yet

- A Note On Contract Labour 1Document19 pagesA Note On Contract Labour 1seemaagiwalNo ratings yet

- 4 Comparing Previous Act With New Labour Codes (Part - 3)Document13 pages4 Comparing Previous Act With New Labour Codes (Part - 3)abdul gani khanNo ratings yet

- D-Minimum Wages ActDocument9 pagesD-Minimum Wages ActÑàdààñ ShubhàmNo ratings yet

- The Code On Wages, 2019 - Notes On Clauses - Memorandum Regarding Delegated LegislationDocument10 pagesThe Code On Wages, 2019 - Notes On Clauses - Memorandum Regarding Delegated LegislationPushkar WadodkarNo ratings yet

- Analysis of The Labour Amendment Act - 11 of 2023Document10 pagesAnalysis of The Labour Amendment Act - 11 of 2023halimanidNo ratings yet

- TheEmployment Amendment Bill 2022Document6 pagesTheEmployment Amendment Bill 2022Benson Atang'aNo ratings yet

- FISCAL NOTE: Effect On Local Government: No. Effect On The State: YesDocument2 pagesFISCAL NOTE: Effect On Local Government: No. Effect On The State: YesCarlos HernandezNo ratings yet

- Bihar and Jhar KhandDocument108 pagesBihar and Jhar KhandVasanth RvkNo ratings yet

- BAR EXAMINATION 2006 - LaborandSocialLegislationDocument11 pagesBAR EXAMINATION 2006 - LaborandSocialLegislationLyraNo ratings yet

- The Contract Labour (Regulation & Abolition) Act, 1970Document10 pagesThe Contract Labour (Regulation & Abolition) Act, 1970TAMANNANo ratings yet

- ART. 94. Right To Holiday Pay.-: Than Ten (10) WorkersDocument7 pagesART. 94. Right To Holiday Pay.-: Than Ten (10) WorkersMaribel Nicole LopezNo ratings yet

- India: Code On Wages, 2019 - Minimum WagesDocument19 pagesIndia: Code On Wages, 2019 - Minimum WagesTaniya YadavNo ratings yet

- Abstract of Minimum WagesDocument6 pagesAbstract of Minimum WagesAkhil JamesNo ratings yet

- Code On WagesDocument34 pagesCode On WagespavanNo ratings yet

- Lecture 8Document20 pagesLecture 8Kertik SinghNo ratings yet

- 1948 and 2019Document7 pages1948 and 2019Ishika kanyalNo ratings yet

- Minimum Wages Act-1948Document25 pagesMinimum Wages Act-1948Ashish GautamNo ratings yet

- Minimum Wages & Equal Remuneration ActDocument8 pagesMinimum Wages & Equal Remuneration ActChandni SheikhNo ratings yet

- Minimum Wages Act IndiaDocument39 pagesMinimum Wages Act IndiaRahul RaghuvanshiNo ratings yet

- The Payment of WagesDocument17 pagesThe Payment of WagesChirag RajawatNo ratings yet

- Deduction From Wages: Mansi TrivediDocument15 pagesDeduction From Wages: Mansi Trivedinancy goelNo ratings yet

- Section (Oo) RetrenchmentDocument1 pageSection (Oo) RetrenchmentkairadigitalservicesNo ratings yet

- Clra PresentationDocument362 pagesClra PresentationrajnprasadNo ratings yet

- Cheaklist of Labour Law CompliancesDocument13 pagesCheaklist of Labour Law CompliancesBirendra MishraNo ratings yet

- Minimum Wage BillDocument15 pagesMinimum Wage BillBernewsAdminNo ratings yet

- Deductions Under Payment of Wages ActDocument27 pagesDeductions Under Payment of Wages ActRiddhima KrishnanNo ratings yet

- Convention 26 of Minimum Wages Act: International Labour Organization and Provisons of Indian Minimun Wages ActDocument11 pagesConvention 26 of Minimum Wages Act: International Labour Organization and Provisons of Indian Minimun Wages ActSukhamrit Singh ALS, NoidaNo ratings yet

- Labor Laws and Social Legislation Module No. 6Document6 pagesLabor Laws and Social Legislation Module No. 6Abegail AbrugarNo ratings yet

- Payment of Bonus Act, 1965Document31 pagesPayment of Bonus Act, 1965Milani NarulaNo ratings yet

- Labour Law AssignmentDocument14 pagesLabour Law AssignmentMayank RajpootNo ratings yet

- Emerging Changes in Labour LawsDocument109 pagesEmerging Changes in Labour LawsSrikanth KrishnamurthyNo ratings yet

- 8 Employment Act and Employment of Young PersonsDocument15 pages8 Employment Act and Employment of Young PersonsRichard MvulaNo ratings yet

- Payment of Bonus Act 11Document9 pagesPayment of Bonus Act 11BinithaNo ratings yet

- Nfa v. Masada Security AgencyDocument22 pagesNfa v. Masada Security AgencyRogie ApoloNo ratings yet

- Wage Code Bill 2019Document52 pagesWage Code Bill 2019Rajeev SaraoNo ratings yet

- 2018 Ust LMT Labor LawDocument14 pages2018 Ust LMT Labor LawCindy DeleonNo ratings yet

- THE LABOUR LAW IN UGANDA: [A TeeParkots Inc Publishers Product]From EverandTHE LABOUR LAW IN UGANDA: [A TeeParkots Inc Publishers Product]No ratings yet

- Labor Contract Law of the People's Republic of China (2007)From EverandLabor Contract Law of the People's Republic of China (2007)No ratings yet

![THE LABOUR LAW IN UGANDA: [A TeeParkots Inc Publishers Product]](https://imgv2-2-f.scribdassets.com/img/word_document/702714789/149x198/ac277f344e/1706724197?v=1)