Professional Documents

Culture Documents

Compliance

Compliance

Uploaded by

Ankur Biswas0 ratings0% found this document useful (0 votes)

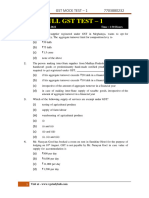

5 views4 pagesThis document discusses various components of the Goods and Services Tax (GST) in India. It explains that CGST is collected by the Central Government, SGST by state governments, and IGST by the Central Government on inter-state sales. It also outlines the different types of sales and deadlines for invoicing, e-invoicing, e-way bills, and various GST return filings like GSTR-1 and GSTR-3B. The document concludes by covering GST TDS provisions for goods and services, as well as other common TDS sections like 192B, 194C, 194J and 194Q, and their deposit and return filing deadlines.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses various components of the Goods and Services Tax (GST) in India. It explains that CGST is collected by the Central Government, SGST by state governments, and IGST by the Central Government on inter-state sales. It also outlines the different types of sales and deadlines for invoicing, e-invoicing, e-way bills, and various GST return filings like GSTR-1 and GSTR-3B. The document concludes by covering GST TDS provisions for goods and services, as well as other common TDS sections like 192B, 194C, 194J and 194Q, and their deposit and return filing deadlines.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

5 views4 pagesCompliance

Compliance

Uploaded by

Ankur BiswasThis document discusses various components of the Goods and Services Tax (GST) in India. It explains that CGST is collected by the Central Government, SGST by state governments, and IGST by the Central Government on inter-state sales. It also outlines the different types of sales and deadlines for invoicing, e-invoicing, e-way bills, and various GST return filings like GSTR-1 and GSTR-3B. The document concludes by covering GST TDS provisions for goods and services, as well as other common TDS sections like 192B, 194C, 194J and 194Q, and their deposit and return filing deadlines.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 4

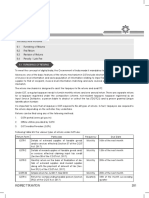

COMPONENT OF GST

CGST tax collected by the Central Government

SGST tax collected by the state government

IGST tax collected by the Central Government

TYPES OF SALES

1) SCRAP SALES

2) STORE MATERIAL

3) MANUFATURING ITEMS

4) WORKSHOP DEBIT

INVOICING = REAL TIME

ENVOICING = REAL TIME

E WAY BILL = REAL TIME

GSTR-1 = ON OR BEFORE THE 10TH OF SUCCEDING MONTH

UPLOADED IN CYGNET PORTAL

GSTR3B = ITC RECONCILIATION ON OR BEFORE 20TH OF SUCCEDIN

MONTH

FILING OF GSTR3B ON ON OR BEFORE 20TH OF SUCCEDI

MONTH

GST TDS ON GOODS AND SERVICES

GST TDS CONSIST OF CGST, SGST & IGST TDS

IT IS DEDUCTED AT THE TIME OF POSTING/ PASSING OF BILL.

DEDUCTED TDS AMOUNT IS DEPOSITED BEFORE 10TH OF SUCCEDING MONTH

AND RETURN IS ALSO FILED BEFORE 10TH OF SUCCEDING MONTH

OTHER TDS

192 B RELATED TO SALARY

194 C ON BILL RELATED TO REPAIR AND SERVICE

194 J RELATED TO PROFESSIONAL BILL

194 Q ON PROCUREMENT OF GOODS

TDS DEPOSITED ON OR BEFORE THE 7TH OF THE SUCCEDING MONTH

AND RETURN IS FILED QUATERLY.

CCEDING MONTH

ORE 20TH OF SUCCEDING

FORE 20TH OF SUCCEDING

DING MONTH

You might also like

- 1613200874GST Question Bank - May 2021 (With Solutions) PDFDocument157 pages1613200874GST Question Bank - May 2021 (With Solutions) PDFKhusboo ChowdhuryNo ratings yet

- Calculation of Tax Liability Assignment: Rishabh KaushikDocument22 pagesCalculation of Tax Liability Assignment: Rishabh KaushikLkNo ratings yet

- Returns in Goods and Services Tax: Section 37-47 of CGST Act, 2017Document73 pagesReturns in Goods and Services Tax: Section 37-47 of CGST Act, 2017Nikhil PahariaNo ratings yet

- ProjectDocument37 pagesProjectcontactnilkanth123No ratings yet

- Chapter 13 - Returns Under GSTDocument11 pagesChapter 13 - Returns Under GSTJay PawarNo ratings yet

- VIGHNHARTA LIST FOR INDIRECT TAX MAY-24_240413_192410Document91 pagesVIGHNHARTA LIST FOR INDIRECT TAX MAY-24_240413_192410devikanair482003No ratings yet

- Inu 2216 Idt - Suggested AnswersDocument5 pagesInu 2216 Idt - Suggested AnswersVinil JainNo ratings yet

- Return GST IndiaDocument56 pagesReturn GST IndiathecoltNo ratings yet

- Indirect Tax Laws 1Document10 pagesIndirect Tax Laws 1GunjanNo ratings yet

- GST Presentation MsmeDocument114 pagesGST Presentation MsmeViky AkNo ratings yet

- Unit 2 - Part III - Returns Under GST - 30!07!2021Document4 pagesUnit 2 - Part III - Returns Under GST - 30!07!2021Milan ChandaranaNo ratings yet

- Unit 5 GSTDocument3 pagesUnit 5 GSTNishu KatiyarNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument29 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaManjunathreddy SeshadriNo ratings yet

- GST Divyastra CH 7 Input Tax Credit R 1Document26 pagesGST Divyastra CH 7 Input Tax Credit R 1Sanskar SharmaNo ratings yet

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Document7 pagesStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNo ratings yet

- GSTDocument40 pagesGSTsangkhawmaNo ratings yet

- Goods and Services TaxDocument9 pagesGoods and Services Taxlavanya22banalaNo ratings yet

- Answer Sheet of Mock Test Paper 31.3.2020Document19 pagesAnswer Sheet of Mock Test Paper 31.3.2020Babu GupthaNo ratings yet

- Mamatha Traders Adjuducation Order Us 73 - CompressedDocument31 pagesMamatha Traders Adjuducation Order Us 73 - Compressedurmilachoudhary1999No ratings yet

- INPUT TAX CREDIT (ITC) " Under GST Regime - Taxguru - inDocument20 pagesINPUT TAX CREDIT (ITC) " Under GST Regime - Taxguru - inAtin KumarNo ratings yet

- Paper11 3Document34 pagesPaper11 3mhatrenimisha03No ratings yet

- Record Notebook Faculty of Arts & Commerce Department of Cost & Management Accounting (Cma)Document16 pagesRecord Notebook Faculty of Arts & Commerce Department of Cost & Management Accounting (Cma)Sha dowNo ratings yet

- Mygov 1445315831190667 PDFDocument72 pagesMygov 1445315831190667 PDFjitendraktNo ratings yet

- 23 Tax JuneDocument16 pages23 Tax JunemistryankusNo ratings yet

- Returns: FAQ'sDocument25 pagesReturns: FAQ'smun1barejaNo ratings yet

- GST Remark Related FileDocument14 pagesGST Remark Related FileAnonymous ikQZphNo ratings yet

- GST Update130620Document23 pagesGST Update130620Raju SomaniNo ratings yet

- GST - Ch. 3,4,5,7 - NS - Dec. 23Document3 pagesGST - Ch. 3,4,5,7 - NS - Dec. 23Madhav TailorNo ratings yet

- Statecircular 291022Document6 pagesStatecircular 291022King KiteNo ratings yet

- Study Material of TaxationDocument4 pagesStudy Material of TaxationAishuNo ratings yet

- GST MDLDocument98 pagesGST MDLIndhuja MNo ratings yet

- DRAFT REPLY GST ITC IN GSTR-3B VS 2ADocument5 pagesDRAFT REPLY GST ITC IN GSTR-3B VS 2ARajeev RanjanNo ratings yet

- Easing of Statutory Compliance Under GSTDocument16 pagesEasing of Statutory Compliance Under GSTRENISH VITHALANINo ratings yet

- Judicial Rulings BY ABHAY DESAIDocument27 pagesJudicial Rulings BY ABHAY DESAIPiyush PatelNo ratings yet

- Certification DraftDocument47 pagesCertification DraftndNo ratings yet

- Circularno 24 CGSTDocument4 pagesCircularno 24 CGSTHr legaladviserNo ratings yet

- Block 3 Question PaperDocument3 pagesBlock 3 Question PaperAida AmalNo ratings yet

- Article - Jobwork Under GST - Ready ReckonerDocument4 pagesArticle - Jobwork Under GST - Ready ReckonersupdtconflNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument28 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of Indiaatanu karmakarNo ratings yet

- Section: A MCQ 20X1 20 Marks: A. B. C. DDocument12 pagesSection: A MCQ 20X1 20 Marks: A. B. C. DSarath KumarNo ratings yet

- India KDP GST Summary PDFDocument13 pagesIndia KDP GST Summary PDFKhaja Afreen TNo ratings yet

- GST Audit and Annual ReturnDocument15 pagesGST Audit and Annual Returnyogeshaggarwal09No ratings yet

- GST PRACTICE SETs - SET 7 (9th Edition)Document6 pagesGST PRACTICE SETs - SET 7 (9th Edition)Ismail RizwanNo ratings yet

- Questions On Computation of Net GST PayableDocument24 pagesQuestions On Computation of Net GST PayablesneakyblackskullNo ratings yet

- CA - Inter GST Important Questions Answers Part 2 May2023Document12 pagesCA - Inter GST Important Questions Answers Part 2 May2023Vishal AgrawalNo ratings yet

- Amendments For NOV 21: Amendment in 1 Min Series Available On InstagramDocument32 pagesAmendments For NOV 21: Amendment in 1 Min Series Available On InstagramAakriti SinghalNo ratings yet

- Latest Updation in GSTN PortalDocument47 pagesLatest Updation in GSTN PortalVenkat BalaNo ratings yet

- Action For Difference in ITC Between 3B and 2ADocument46 pagesAction For Difference in ITC Between 3B and 2Aphani raja kumarNo ratings yet

- Most Expected MCQs DT & IDT by VG Sir Assure Your 60+ Marks 1Document236 pagesMost Expected MCQs DT & IDT by VG Sir Assure Your 60+ Marks 1148salwa HussainNo ratings yet

- Paper18 - Set1 Rev AnsDocument15 pagesPaper18 - Set1 Rev AnsSanya GoelNo ratings yet

- VK Skill Development SkillsDocument5 pagesVK Skill Development SkillsJoshua StarkNo ratings yet

- GST ScannerDocument48 pagesGST ScannerdonNo ratings yet

- Clause 44 CA Hitesh Jain 270822Document31 pagesClause 44 CA Hitesh Jain 270822info vsrNo ratings yet

- Final New Indirect Tax Laws Test 1 Detailed May Solution 1617180196Document10 pagesFinal New Indirect Tax Laws Test 1 Detailed May Solution 1617180196CAtestseriesNo ratings yet

- Filing of Returns FinalDocument21 pagesFiling of Returns Finaloe agapNo ratings yet

- Full Syllabus GST Test - 1 Without AnswersDocument19 pagesFull Syllabus GST Test - 1 Without Answersrajbhanushali3981No ratings yet

- Paper11 Set2 SolutionDocument16 pagesPaper11 Set2 Solutionyashvichheda56740No ratings yet

- DR - MGR E & RI - Chennai - 28.05.2021-1Document21 pagesDR - MGR E & RI - Chennai - 28.05.2021-1Sha dowNo ratings yet

- GST Understanding Form GSTR 3BDocument10 pagesGST Understanding Form GSTR 3BAkhil SoodNo ratings yet