Professional Documents

Culture Documents

Objective

Objective

Uploaded by

ashukumar24Copyright:

Available Formats

You might also like

- Project Coordinator Exam Ligutan KennethDocument18 pagesProject Coordinator Exam Ligutan KennethAB12A3 - Lauron Nicole NiñaNo ratings yet

- Chapter 1 Introduction - Shajaratulmuttaqin 829469Document32 pagesChapter 1 Introduction - Shajaratulmuttaqin 829469Scha AzizanNo ratings yet

- NTDOP AIF PresentationDocument37 pagesNTDOP AIF Presentationritvik singh rautelaNo ratings yet

- Soil FertilityDocument244 pagesSoil FertilityTäð Œvê MîðNo ratings yet

- Uber's Dilemma in Egypt - FinalDocument26 pagesUber's Dilemma in Egypt - Finalalija schaffrinNo ratings yet

- 101 Gokul NairDocument25 pages101 Gokul NairBRIJESH RAJNo ratings yet

- ToyotaDocument14 pagesToyotaLaiba MalikNo ratings yet

- Costco in JapanDocument10 pagesCostco in JapanBich NgocNo ratings yet

- Islamic Bonds: Learning ObjectivesDocument20 pagesIslamic Bonds: Learning ObjectivesAbdelnasir HaiderNo ratings yet

- Maruti Rural MarketsDocument32 pagesMaruti Rural MarketsSonia GhulatiNo ratings yet

- ZIF Report 20130515Document37 pagesZIF Report 20130515uaifrs100% (1)

- Product Manual: Synel MLL Payway LTDDocument51 pagesProduct Manual: Synel MLL Payway LTDFlavio Miranda GonzalezNo ratings yet

- Madurai Kamaraj University: Capital Market Efficiency and Development of Capital Market in IndiaDocument11 pagesMadurai Kamaraj University: Capital Market Efficiency and Development of Capital Market in Indiachanus92No ratings yet

- Business Proposal Group1Document23 pagesBusiness Proposal Group1Aldrian BarachinaNo ratings yet

- Red FM 93 3Document20 pagesRed FM 93 3ankit tiwariNo ratings yet

- Kavalieris Et Al - ErdenetDocument22 pagesKavalieris Et Al - ErdenetImants Kavalieris100% (1)

- Non - Bank Financial Institutions and Economic Growth in NigeriaDocument57 pagesNon - Bank Financial Institutions and Economic Growth in Nigeriajayeoba oluwaseyi100% (1)

- About ZeeDocument5 pagesAbout Zeeabhaysingh4646No ratings yet

- Bain Digest Renaissance in Uncertainty Luxury Builds On Its ReboundDocument32 pagesBain Digest Renaissance in Uncertainty Luxury Builds On Its ReboundtinasunkeNo ratings yet

- CEAT (Company) - IndiaDocument6 pagesCEAT (Company) - IndiaMomin KalimNo ratings yet

- Training Report (2) 3Document90 pagesTraining Report (2) 3joyal josephNo ratings yet

- ASM1 - 530 - Global Business EnvironmentDocument19 pagesASM1 - 530 - Global Business EnvironmentBảo Trân Nguyễn NgọcNo ratings yet

- Muthoot Finance LTD 110912Document3 pagesMuthoot Finance LTD 110912Kannan SundaresanNo ratings yet

- 20 Practice Test Lop 9 Luyen Thi Vao 10Document54 pages20 Practice Test Lop 9 Luyen Thi Vao 10Minh Trí100% (1)

- Yamaha MT400 Cassette Recorder Service ManualDocument44 pagesYamaha MT400 Cassette Recorder Service ManualMowgliNo ratings yet

- Acc - ABC SDN BHD - FinalDocument19 pagesAcc - ABC SDN BHD - FinalDaley WongNo ratings yet

- Case Study Nov Dec 18Document16 pagesCase Study Nov Dec 18Shahid MahmudNo ratings yet

- Development and Nutritional Assessment of Beetroot CrackersDocument7 pagesDevelopment and Nutritional Assessment of Beetroot CrackersResearch ParkNo ratings yet

- Spice Route Magazine Aug 2016Document164 pagesSpice Route Magazine Aug 2016RishiNo ratings yet

- Vinay ProjectDocument55 pagesVinay ProjectD Priyanka100% (1)

- Stock Holding Corporation of India LimitedDocument64 pagesStock Holding Corporation of India LimitednandlalNo ratings yet

- Rural Marketing: A Case Study On Hindustan Unilever Limited: Manpreet KaurDocument14 pagesRural Marketing: A Case Study On Hindustan Unilever Limited: Manpreet KaursanyasNo ratings yet

- Shashank MalhotraDocument48 pagesShashank MalhotraNidhi Rishabh KhareNo ratings yet

- ACN 402 Final AssignmentDocument15 pagesACN 402 Final AssignmentSAIMA SHARMINNo ratings yet

- Digital ToolsDocument3 pagesDigital ToolsAlmavilla BantayanNo ratings yet

- Final Project - A STUDY OF GROWTH PROSPECTS OF ONLINE REATAILORS AND E-COMMERCE IN INDIADocument94 pagesFinal Project - A STUDY OF GROWTH PROSPECTS OF ONLINE REATAILORS AND E-COMMERCE IN INDIAhariiNo ratings yet

- Carlin Type Au RocksDocument30 pagesCarlin Type Au RocksYogi Ahmad100% (1)

- Project WKM Copy12111Document67 pagesProject WKM Copy12111Leo SaimNo ratings yet

- ARTPARK Annual Report 2020-21Document22 pagesARTPARK Annual Report 2020-21Hobi kobiNo ratings yet

- Lagom Kitchen + Brewery: A Quest For SurvivalDocument12 pagesLagom Kitchen + Brewery: A Quest For SurvivalGonzalo Nolazco VergaraNo ratings yet

- Science Paper 2Document14 pagesScience Paper 2Vikas ShahNo ratings yet

- Energy Saving Potential From Indian Households From Appliance Efficiency 108A01 PDFDocument39 pagesEnergy Saving Potential From Indian Households From Appliance Efficiency 108A01 PDFswapnil155No ratings yet

- A. A. BirajdarDocument19 pagesA. A. Birajdarrizka zakiyaNo ratings yet

- McNichols 2021Document87 pagesMcNichols 2021Lucca PacioloNo ratings yet

- Corporate GovernanceDocument22 pagesCorporate GovernanceBenita BijuNo ratings yet

- Profile - Dr. Shiva Narayan PHDDocument3 pagesProfile - Dr. Shiva Narayan PHDDr. Shiva NarayanNo ratings yet

- 15q61e0090-A Project Report On Investment in Financial Markets at IndiabullsDocument74 pages15q61e0090-A Project Report On Investment in Financial Markets at IndiabullsRajesh BathulaNo ratings yet

- Chapter 4 Emirates and IndigoDocument7 pagesChapter 4 Emirates and IndigoajendraNo ratings yet

- Oil and Natural Gas Corporation Limited Ankleshwar Asset, AnkleshwarDocument8 pagesOil and Natural Gas Corporation Limited Ankleshwar Asset, Ankleshwardattesh vasavaNo ratings yet

- Project Report: Goenka College of Commerce and Business Administration College Roll No. - 111Document60 pagesProject Report: Goenka College of Commerce and Business Administration College Roll No. - 111Amit SinghNo ratings yet

- Siddhartha 1901010108Document42 pagesSiddhartha 1901010108Siddhartha AgrahariNo ratings yet

- Based e Out 2019Document2,500 pagesBased e Out 2019Ralph BolzonaroNo ratings yet

- UntitledDocument1 pageUntitledsweetsalt boyNo ratings yet

- Preference ListDocument49 pagesPreference ListAmit GujjarNo ratings yet

- Investigación - English - Qatar - 2022Document9 pagesInvestigación - English - Qatar - 2022Jeremias LusichNo ratings yet

- Strength Characterization of Geomaterial and Slope Stabilization Solutions For Hilly Areas of UttarakhandDocument18 pagesStrength Characterization of Geomaterial and Slope Stabilization Solutions For Hilly Areas of UttarakhandSareesh ChandrawanshiNo ratings yet

- GCSE Edexcel Biology Self-Studying TextbookDocument89 pagesGCSE Edexcel Biology Self-Studying TextbookDhuhaa YusufNo ratings yet

- Financial - Education - Workbook-VIII (R) - 220924 - 083544Document15 pagesFinancial - Education - Workbook-VIII (R) - 220924 - 083544No oneNo ratings yet

- Standard Bidding Document Jharkhand Procurement of Civil WorksDocument90 pagesStandard Bidding Document Jharkhand Procurement of Civil WorksKAMAC ENGINEERS PVT LTDNo ratings yet

- Chapter-1: "Think Investment Think Kotak"Document38 pagesChapter-1: "Think Investment Think Kotak"Honey BhandulaNo ratings yet

- Haryana at A Glance: Geographical AreaDocument1 pageHaryana at A Glance: Geographical AreasonuNo ratings yet

- Putting Words TogetherDocument28 pagesPutting Words TogetherKatherinaNo ratings yet

- Polymer StructureDocument35 pagesPolymer StructureAlexander DavidNo ratings yet

- AGCDocument4 pagesAGCNauman KhanNo ratings yet

- Modul 9 B Inggris Kelas 4 - KD 3.9 - 4.9 PDFDocument16 pagesModul 9 B Inggris Kelas 4 - KD 3.9 - 4.9 PDFFendi SetiyantoNo ratings yet

- Cityscope Sports and LeisureDocument7 pagesCityscope Sports and LeisurePD HoàngNo ratings yet

- BCCA AB in Febrile Neutropenia GuidelinesDocument2 pagesBCCA AB in Febrile Neutropenia GuidelinesAlvy SyukrieNo ratings yet

- (Mathematics in Industry 13) Wil Schilders (auth.), Wilhelmus H. A. Schilders, Henk A. van der Vorst, Joost Rommes (eds.) - Model order reduction_ theory, research aspects and applications-Springer-VeDocument463 pages(Mathematics in Industry 13) Wil Schilders (auth.), Wilhelmus H. A. Schilders, Henk A. van der Vorst, Joost Rommes (eds.) - Model order reduction_ theory, research aspects and applications-Springer-VeRaja Sekhar BattuNo ratings yet

- MCQ Test of PolymerDocument4 pagesMCQ Test of PolymerDrAman Khan Pathan100% (2)

- Tentang Takal Melalui Lakaran, TMK, Penulisan Atau Lisan Secara Kreatif)Document2 pagesTentang Takal Melalui Lakaran, TMK, Penulisan Atau Lisan Secara Kreatif)Yayang NasrudinNo ratings yet

- SCS Method PDFDocument55 pagesSCS Method PDFWesley BridgemohansinghNo ratings yet

- 1 MobilePass VPNDocument8 pages1 MobilePass VPNYashpal SinghNo ratings yet

- Chapter 2Document3 pagesChapter 2Johane Grei WallNo ratings yet

- Ffi Ffiq D (,: Rie Frncfusru'QDocument25 pagesFfi Ffiq D (,: Rie Frncfusru'QShubham DNo ratings yet

- Format of Auditors CertificateDocument5 pagesFormat of Auditors CertificatejayantgeeNo ratings yet

- What Is An Endpoint - Microsoft SecurityDocument4 pagesWhat Is An Endpoint - Microsoft Securityqualitychamp6824No ratings yet

- (1908) United States Revenue Cutter Service Uniform RegulationsDocument57 pages(1908) United States Revenue Cutter Service Uniform RegulationsHerbert Hillary Booker 2nd100% (3)

- Bird HDC High Density CleanerDocument2 pagesBird HDC High Density CleanerFaridUZamaNo ratings yet

- NB Private Equity Partners Ltd.Document68 pagesNB Private Equity Partners Ltd.ArvinLedesmaChiong100% (1)

- Me 04-601Document15 pagesMe 04-601Vishnu DasNo ratings yet

- 5mm LED Datasheet PDFDocument1 page5mm LED Datasheet PDFAlex ZXNo ratings yet

- Review Exercises DAY 3Document4 pagesReview Exercises DAY 3Heba Abd-AllahNo ratings yet

- FCG - List of Top 100 Stockholders Q1 (Common Shares) Ending 31 March 2024Document5 pagesFCG - List of Top 100 Stockholders Q1 (Common Shares) Ending 31 March 2024Amino BenitoNo ratings yet

- Wordsearch Fruits Fun Activities Games Games Icebreakers Oneonone Ac - 109759Document2 pagesWordsearch Fruits Fun Activities Games Games Icebreakers Oneonone Ac - 109759raquel lujanNo ratings yet

- Unit 2 - Basic Instrumentation and Measurement Techniques PPT Notes Material For Sem II Uploaded by Navdeep RaghavDocument72 pagesUnit 2 - Basic Instrumentation and Measurement Techniques PPT Notes Material For Sem II Uploaded by Navdeep Raghavavikool1708No ratings yet

- Salesforce Pages Developers GuideDocument810 pagesSalesforce Pages Developers GuideanynameNo ratings yet

- Bioflavor Biopang (02 06)Document5 pagesBioflavor Biopang (02 06)Fadila Artameivia AunuraNo ratings yet

- Foreign Currency TranactionDocument11 pagesForeign Currency TranactionAngelieNo ratings yet

- Sentence ConnectorsDocument2 pagesSentence ConnectorsReeta Kannusamy100% (1)

- DS2 - Unit 2-DC MachinesDocument57 pagesDS2 - Unit 2-DC MachinesTommba TommyNo ratings yet

Objective

Objective

Uploaded by

ashukumar24Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Objective

Objective

Uploaded by

ashukumar24Copyright:

Available Formats

TABLE OF CONTENTS

Objective.....

Kotak Mahindra Bank Overview.... History.... Kotak Group Of Companies.. Group Structure.... SWOT analysis. Kotak Banking CASA...

Investment Services Investment.. Investment Needs of Investors Power of Compounding Kotak Accolades

Mutual Funds An Insight to Mutual Funds..................................................................................................... Types of Mutual Funds. Investment Objective Charges

Insurance An Insight to Insurance... Benefits of policies.. Expenses and charges .... Kotak Smart Advantage Plan..

Online Trading An Insight to Online Trading.. Kotak Offers....

Research Methodology................................................................................................ Analysis of the Study... Conclusion & Recommendations... Questionnaire..... Bibliography/References..

OBJECTIVE

The main objective of having practical training in Kotak Mahindra Bank, Branch Office, Moradabad is: -

To know about Banking Services preferably Savings Account and Current Account of Kotak Mahindra to its customers.

To have an idea about full range of financial products and banking services of Kotak which gives the customer a one-stop window for all his/her banking requirements.

To compare the services provided by Kotak to its customers with other banks and analyses how Kotak Mahindra is different from others.

The detail study of CASA and Trading in Kotak Mahindra.

OVERVIEW

Kotak Mahindra is one of India's leading financial institutions, offering complete financial solutions that encompass every sphere of life. From commercial banking, to stock broking, to mutual funds, to life insurance, to investment banking, the group caters to the financial needs of individuals and corporates. The group has a net worth of over Rs. 2,900 crore, employs around 8,800 people in its various businesses and has a distribution network of branches, franchisees, representative offices and satellite offices across 282 cities and towns in India and offices in New York, London, Dubai and Mauritius. The Group services around 2 million customer accounts.

THE JOURNEY SO FAR ...

In October 2005, Kotak Group acquired the 40% stake in Kotak Prime held by Ford Credit International (FCI) and FCI acquired the stake in Ford Credit Kotak Mahindra (FCKM) held by Kotak Group.

In May 2006, Kotak Group bought 25% stake held by Goldman Sachs in Kotak Capital and Kotak Securities.

HISTORY The Kotak Mahindra Group was born in 1985 as Kotak Capital Management Finance Limited. This company was promoted by Uday Kotak, Sidney A. A. Pinto and Kotak & Company. Industrialists Harish Mahindra and Anand Mahindra took a stake in 1986, and that's when the company changed its name to Kotak Mahindra Finance Limited. Since then it's been a steady and confident journey to growth and success.

1986 Kotak Mahindra Finance Limited starts the activity of Bill Discounting 1987 Kotak Mahindra Finance Limited enters the Lease and Hire Purchase market 1990 The Auto Finance division is started 1991 The Investment Banking Division is started. Takes over FICOM, one of Indias largest financial retail marketing networks 1992 Enters the Funds Syndication sector 1995 Brokerage and Distribution businesses incorporated into a separate company - Kotak Securities. Investment Banking division incorporated into a separate company - Kotak Mahindra Capital Company 1996 The Auto Finance Business is hived off into a separate company - Kotak Mahindra Prime Limited (formerly known as Kotak Mahindra Primus Limited). Kotak Mahindra takes a significant stake in Ford Credit Kotak Mahindra Limited, for financing Ford vehicles. The launch of Matrix Information Services Limited marks the Groups entry into information distribution. 1998 Enters the mutual fund market with the launch of Kotak Mahindra Asset Management Company.

2000 Kotak Mahindra ties up with Old Mutual plc. for the Life Insurance business. Kotak Securities launches its on-line broking site (now www.kotaksecurities.com). Commencement of private equity activity through setting up of Kotak Mahindra Venture Capital Fund. 2001 Matrix sold to Friday Corporation Launches Insurance Services 2003 Kotak Mahindra Finance Ltd. converts to a commercial bank the first Indian company to do so. 2004 Launches India Growth Fund, a private equity fund. 2005 Kotak Group realigns joint venture in Ford Credit; Buys Kotak Mahindra Prime (formerly known as Kotak Mahindra Primus Limited) and sells Ford credit Kotak Mahindra. Launches a real estate fund

KOTAK GROUP OF COMPANIES

Kotak Mahindra Bank The Kotak Mahindra Groups flagship company, Kotak Mahindra Finance Ltd which was established in 1985, was converted into a bank Kotak Mahindra Bank Ltd in March 2003 becoming the first Indian company to convert into a Bank. The bank has a presence in the Commercial Vehicles, Retail Finance, Corporate Banking, Treasury and Housing Finance.

Kotak Mahindra Capital Company

Kotak Mahindra Capital Company Limited (KMCC) is India's premier Investment Bank and a Primary Dealer (PD) approved by the RBI. KMCC's core business areas include Equity Issuances, Mergers & Acquisitions, Structured Finance and Advisory Services, Fixed Income Securities and Principal Business.

Kotak Securities

Kotak Securities Ltd., is one of India's largest brokerage and securities distribution house in India. Over the years Kotak Securities has been one of the leading investment broking houses catering to the needs of both institutional and non-institutional investor categories through franchisees and co-ordinators. Kotak Securities Ltd. offers online (through www.kotaksecurities.com) and offline services based on well-researched expertise and financial products to the noninstitutional investors.

Kotak Mahindra Prime

Kotak Mahindra Prime Limited (KMP) (formerly known as Kotak Mahindra Primus Limited) has been formed with the objective of financing the retail and wholesale trade of passenger and multi utility vehicles in India. KMP offers customers retail finance for both new as well as used cars and wholesale finance to dealers in the automobile trade.

Kotak Mahindra Asset Management Company

KMAMC, a subsidiary of Kotak Mahindra Bank, is the asset manager for Kotak Mahindra Mutual Fund (KMMF). KMMF manages funds in excess of Rs 11,000 cr and offers schemes catering to investors with varying risk- return profiles. It was the first fund house in the country to launch a gilt scheme investing only in government securities.

Kotak Mahindra Old Mutual Life Insurance Limited

Kotak Mahindra Old Mutual Life Insurance Limited, is a joint venture between Kotak Mahindra Bank Ltd. and Old Mutual plc. Kotak Life Insurance helps customers to take important financial decisions at every stage in life by offering them a wide range of innovative life insurance products, to make them financially independent.

GROUP STRUCTURE

SWOT ANALYSIS:

Strengths:

*Talented Workforce

*Personal relationship with the customers

Weakness: Complacency among workers

SWOT

Opportunity: *Untapped Potential In Moradabad *Increase revenue by serving the larger mass

Analysis

Threats: *Upcoming banks *Government Regulations

KOTAK BANKING - CASA

Savings Account Features ActivMoney: Multiply the returns from the idle balance in your Savings Account

ActivMoney ensures that you can make the best use of the idle funds in your Savings Account. Balance above a pre-defined threshold is transferred into a fixed deposit, thus earning attractive return of a term deposit. What's more, this amount is always available to you anytime without any penalty on pre-mature encashment.

Investment Account: Enjoy flexibility of investing any time, and from any place

Your internet banking login also gives you access to your investment account. You can purchase, redeem and place standing instruction to purchase MF units from over 20 Indian Mutual Fund houses either online through Kotak Net Banking, or calling our 24 Hours Customer Contact Centre or simply by filling a convenient transaction form. You can also keep a track of the latest NAV's of the schemes in which you have invested..

Bill Payment: Pay your Bills from your Bank Account

Avail the Bill Payment facility and pay bills from over 115 billers through Net Banking, Phone Banking and also from the bank branch. With the AutoPay facility, customer can register for automatic payments of his bills through his bank account. Customer can either select to pay the entire bill amount or set a limit towards his AutoPay amount thus giving him access to a completely hassle free bill payment process!

Family Savings Account: Share your banking experience with your Family The Kotak Ace Savings package allows customer to extend the Kotak banking experience to three of his family members and Kotak Pro Savings Package allows him to extend the Kotak banking experience to one family member.

Net Card: Safest option to purchase online Kotak Netc@rd is a single use, limited validity online card created by customer, from his bank account. It cannot be used after his first payment and vanishes if not used for 48 hours. Netc@rd has universal acceptance of a VISA card and operates in a highly secure environment.

Wealth Statement: Snapshot of your bank balance & Investments With this account, customer get details of his Savings Account, Current Account, Fixed Deposits, Demat a/c and Mutual Funds all in a single account statement. It also gives a graphical representation of persons asset allocation.

Mobile Banking: Your mobile phone is now your bank

Customers can now access their bank accounts and investment account anywhere, anytime on their mobile phone. Customer can check his account balance, transfer funds to any Kotak Mahindra Bank account, purchase or redeem mutual funds using Mobile Banking. Home Banking: Why come to the Bank, when the Bank comes to you!

Home Banking offers its customers the convenience of pick-up and delivery of cash and instruments from their home. All one need to do is to call the Kotak Customer Contact Centre and place a request. Free Anywhere Banking: Bank at any Kotak Mahindra Bank for Free!

Anywhere Banking allows customers to transact at any Kotak Mahindra Bank branch, FREE OF COST! Our growing branch network ensures that Anywhere Banking offers customers the convenience in your banking operations. Other Value Added Services:

All Visa Access (Domestic & International) At Par Cheque Book Free SMS Alerts Free Phone Banking & Net Banking

Product Notes Kotak Ace Saving Account Kotak Pro Saving Account Kotak Edge Saving Account

KNOW YOUR CUSTOMER (Documentation) Identity Proof PAN Card Passport Driving Licence Voter I.D. Card

Address Proof Ration Card Electricity Bill Telephone Bill Passport Driving Licence Bank Passbook

Singnature Proof Cheque

1 Passport size Photograph

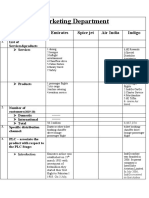

COMPARISON WITH COMPETITOR

Product Notes Regular Savings Account (AQB required-Rs10,000) Max Savings Account (AQB required-Rs25,000)

Comparing HDFC Max Savings Account with KOTAK Pro Savings Account SCHEDULE OF CHARGES FOR SAVINGS ACCOUNTS

MAX

PRO

Average Quaterly Balance(AQB) Domestic Remittances Demand Drafts/Bankers Cheque at branch Location Demand Drafts/Bankers Cheque other than branch Location NEFT(National Electronic Fund Transfer)

25000

20000

Free upto 50,000

Free upto 1,00,000

Free upto 50,000 Free Rs.0.25/- per Rs.1,000/- per transaction. Free

RTGS(Real Time Fund Transfer)

1,00,000 to 5,00,000:25;>5,00,000:50

<25000:Rs.1,000/;<10,000:Rs.1500/Non Maintenance Charges Collections Outstation Cheque Collection (branch location) Outstation Cheque collection (non-branch locations) Above 500/-:1 per 1000(min 50)

More tha50% but less required AQB:750/;<50%:1000

Free <10000:35;10000 to 100000:100;>100000:150

0.40%(min Rs50/-)

Sweep In Facility

Above 50000

Above 40000

Debit Card Classic Debit Card Free Free for first year after that Rs.250/50,000 Free Free for first year after that Rs.250/1,75,000

Gold Debit Card Withrawal Limit of gold Debit Card Home Banking Cashiers Cheque/Demand Draft delivery Courier pick-up and delivery

x x

Free Free

Current Account Features

Kotak Mahindra Bank offers you unparalleled advantages with its three Current Account offerings. Whether the person have a small/ mid size business or have an enterprise spread across multiple locations in the country, person would find a Current Account that's just designed for him. According to his requirements,he can choose from Kotak Neo Current Account (AQB Rs. 10,000), Kotak Edge Current Account (AQB Rs. 25,000), Kotak Pro Current Account (AQB Rs. 50,000), Kotak Elite Current Account (AQB Rs. 100,000) and Kotak Ace Current Account (AQB Rs. 250,000) and leave the rest to Bank.

Product Notes Kotak Ace Current Account Kotak Elite Current Account Kotak Pro Current Account Kotak Edge Current Account Kotak Neo Current Account

KNOW YOUR CUSTOMER

(Documentation)

1. Identity Proof 2. Address Proof 3. Signature Proof 4. 1 Passport size Photograph

SOLE PROPRIETOR FIRM

5. Sole Proprietor declaration 6. Firm Registration Proof Alternative can be previous Banks 3months statement with bank seal and bankers signature.

PARTNERSHIP FIRM 5. Partnership Deed

You might also like

- Project Coordinator Exam Ligutan KennethDocument18 pagesProject Coordinator Exam Ligutan KennethAB12A3 - Lauron Nicole NiñaNo ratings yet

- Chapter 1 Introduction - Shajaratulmuttaqin 829469Document32 pagesChapter 1 Introduction - Shajaratulmuttaqin 829469Scha AzizanNo ratings yet

- NTDOP AIF PresentationDocument37 pagesNTDOP AIF Presentationritvik singh rautelaNo ratings yet

- Soil FertilityDocument244 pagesSoil FertilityTäð Œvê MîðNo ratings yet

- Uber's Dilemma in Egypt - FinalDocument26 pagesUber's Dilemma in Egypt - Finalalija schaffrinNo ratings yet

- 101 Gokul NairDocument25 pages101 Gokul NairBRIJESH RAJNo ratings yet

- ToyotaDocument14 pagesToyotaLaiba MalikNo ratings yet

- Costco in JapanDocument10 pagesCostco in JapanBich NgocNo ratings yet

- Islamic Bonds: Learning ObjectivesDocument20 pagesIslamic Bonds: Learning ObjectivesAbdelnasir HaiderNo ratings yet

- Maruti Rural MarketsDocument32 pagesMaruti Rural MarketsSonia GhulatiNo ratings yet

- ZIF Report 20130515Document37 pagesZIF Report 20130515uaifrs100% (1)

- Product Manual: Synel MLL Payway LTDDocument51 pagesProduct Manual: Synel MLL Payway LTDFlavio Miranda GonzalezNo ratings yet

- Madurai Kamaraj University: Capital Market Efficiency and Development of Capital Market in IndiaDocument11 pagesMadurai Kamaraj University: Capital Market Efficiency and Development of Capital Market in Indiachanus92No ratings yet

- Business Proposal Group1Document23 pagesBusiness Proposal Group1Aldrian BarachinaNo ratings yet

- Red FM 93 3Document20 pagesRed FM 93 3ankit tiwariNo ratings yet

- Kavalieris Et Al - ErdenetDocument22 pagesKavalieris Et Al - ErdenetImants Kavalieris100% (1)

- Non - Bank Financial Institutions and Economic Growth in NigeriaDocument57 pagesNon - Bank Financial Institutions and Economic Growth in Nigeriajayeoba oluwaseyi100% (1)

- About ZeeDocument5 pagesAbout Zeeabhaysingh4646No ratings yet

- Bain Digest Renaissance in Uncertainty Luxury Builds On Its ReboundDocument32 pagesBain Digest Renaissance in Uncertainty Luxury Builds On Its ReboundtinasunkeNo ratings yet

- CEAT (Company) - IndiaDocument6 pagesCEAT (Company) - IndiaMomin KalimNo ratings yet

- Training Report (2) 3Document90 pagesTraining Report (2) 3joyal josephNo ratings yet

- ASM1 - 530 - Global Business EnvironmentDocument19 pagesASM1 - 530 - Global Business EnvironmentBảo Trân Nguyễn NgọcNo ratings yet

- Muthoot Finance LTD 110912Document3 pagesMuthoot Finance LTD 110912Kannan SundaresanNo ratings yet

- 20 Practice Test Lop 9 Luyen Thi Vao 10Document54 pages20 Practice Test Lop 9 Luyen Thi Vao 10Minh Trí100% (1)

- Yamaha MT400 Cassette Recorder Service ManualDocument44 pagesYamaha MT400 Cassette Recorder Service ManualMowgliNo ratings yet

- Acc - ABC SDN BHD - FinalDocument19 pagesAcc - ABC SDN BHD - FinalDaley WongNo ratings yet

- Case Study Nov Dec 18Document16 pagesCase Study Nov Dec 18Shahid MahmudNo ratings yet

- Development and Nutritional Assessment of Beetroot CrackersDocument7 pagesDevelopment and Nutritional Assessment of Beetroot CrackersResearch ParkNo ratings yet

- Spice Route Magazine Aug 2016Document164 pagesSpice Route Magazine Aug 2016RishiNo ratings yet

- Vinay ProjectDocument55 pagesVinay ProjectD Priyanka100% (1)

- Stock Holding Corporation of India LimitedDocument64 pagesStock Holding Corporation of India LimitednandlalNo ratings yet

- Rural Marketing: A Case Study On Hindustan Unilever Limited: Manpreet KaurDocument14 pagesRural Marketing: A Case Study On Hindustan Unilever Limited: Manpreet KaursanyasNo ratings yet

- Shashank MalhotraDocument48 pagesShashank MalhotraNidhi Rishabh KhareNo ratings yet

- ACN 402 Final AssignmentDocument15 pagesACN 402 Final AssignmentSAIMA SHARMINNo ratings yet

- Digital ToolsDocument3 pagesDigital ToolsAlmavilla BantayanNo ratings yet

- Final Project - A STUDY OF GROWTH PROSPECTS OF ONLINE REATAILORS AND E-COMMERCE IN INDIADocument94 pagesFinal Project - A STUDY OF GROWTH PROSPECTS OF ONLINE REATAILORS AND E-COMMERCE IN INDIAhariiNo ratings yet

- Carlin Type Au RocksDocument30 pagesCarlin Type Au RocksYogi Ahmad100% (1)

- Project WKM Copy12111Document67 pagesProject WKM Copy12111Leo SaimNo ratings yet

- ARTPARK Annual Report 2020-21Document22 pagesARTPARK Annual Report 2020-21Hobi kobiNo ratings yet

- Lagom Kitchen + Brewery: A Quest For SurvivalDocument12 pagesLagom Kitchen + Brewery: A Quest For SurvivalGonzalo Nolazco VergaraNo ratings yet

- Science Paper 2Document14 pagesScience Paper 2Vikas ShahNo ratings yet

- Energy Saving Potential From Indian Households From Appliance Efficiency 108A01 PDFDocument39 pagesEnergy Saving Potential From Indian Households From Appliance Efficiency 108A01 PDFswapnil155No ratings yet

- A. A. BirajdarDocument19 pagesA. A. Birajdarrizka zakiyaNo ratings yet

- McNichols 2021Document87 pagesMcNichols 2021Lucca PacioloNo ratings yet

- Corporate GovernanceDocument22 pagesCorporate GovernanceBenita BijuNo ratings yet

- Profile - Dr. Shiva Narayan PHDDocument3 pagesProfile - Dr. Shiva Narayan PHDDr. Shiva NarayanNo ratings yet

- 15q61e0090-A Project Report On Investment in Financial Markets at IndiabullsDocument74 pages15q61e0090-A Project Report On Investment in Financial Markets at IndiabullsRajesh BathulaNo ratings yet

- Chapter 4 Emirates and IndigoDocument7 pagesChapter 4 Emirates and IndigoajendraNo ratings yet

- Oil and Natural Gas Corporation Limited Ankleshwar Asset, AnkleshwarDocument8 pagesOil and Natural Gas Corporation Limited Ankleshwar Asset, Ankleshwardattesh vasavaNo ratings yet

- Project Report: Goenka College of Commerce and Business Administration College Roll No. - 111Document60 pagesProject Report: Goenka College of Commerce and Business Administration College Roll No. - 111Amit SinghNo ratings yet

- Siddhartha 1901010108Document42 pagesSiddhartha 1901010108Siddhartha AgrahariNo ratings yet

- Based e Out 2019Document2,500 pagesBased e Out 2019Ralph BolzonaroNo ratings yet

- UntitledDocument1 pageUntitledsweetsalt boyNo ratings yet

- Preference ListDocument49 pagesPreference ListAmit GujjarNo ratings yet

- Investigación - English - Qatar - 2022Document9 pagesInvestigación - English - Qatar - 2022Jeremias LusichNo ratings yet

- Strength Characterization of Geomaterial and Slope Stabilization Solutions For Hilly Areas of UttarakhandDocument18 pagesStrength Characterization of Geomaterial and Slope Stabilization Solutions For Hilly Areas of UttarakhandSareesh ChandrawanshiNo ratings yet

- GCSE Edexcel Biology Self-Studying TextbookDocument89 pagesGCSE Edexcel Biology Self-Studying TextbookDhuhaa YusufNo ratings yet

- Financial - Education - Workbook-VIII (R) - 220924 - 083544Document15 pagesFinancial - Education - Workbook-VIII (R) - 220924 - 083544No oneNo ratings yet

- Standard Bidding Document Jharkhand Procurement of Civil WorksDocument90 pagesStandard Bidding Document Jharkhand Procurement of Civil WorksKAMAC ENGINEERS PVT LTDNo ratings yet

- Chapter-1: "Think Investment Think Kotak"Document38 pagesChapter-1: "Think Investment Think Kotak"Honey BhandulaNo ratings yet

- Haryana at A Glance: Geographical AreaDocument1 pageHaryana at A Glance: Geographical AreasonuNo ratings yet

- Putting Words TogetherDocument28 pagesPutting Words TogetherKatherinaNo ratings yet

- Polymer StructureDocument35 pagesPolymer StructureAlexander DavidNo ratings yet

- AGCDocument4 pagesAGCNauman KhanNo ratings yet

- Modul 9 B Inggris Kelas 4 - KD 3.9 - 4.9 PDFDocument16 pagesModul 9 B Inggris Kelas 4 - KD 3.9 - 4.9 PDFFendi SetiyantoNo ratings yet

- Cityscope Sports and LeisureDocument7 pagesCityscope Sports and LeisurePD HoàngNo ratings yet

- BCCA AB in Febrile Neutropenia GuidelinesDocument2 pagesBCCA AB in Febrile Neutropenia GuidelinesAlvy SyukrieNo ratings yet

- (Mathematics in Industry 13) Wil Schilders (auth.), Wilhelmus H. A. Schilders, Henk A. van der Vorst, Joost Rommes (eds.) - Model order reduction_ theory, research aspects and applications-Springer-VeDocument463 pages(Mathematics in Industry 13) Wil Schilders (auth.), Wilhelmus H. A. Schilders, Henk A. van der Vorst, Joost Rommes (eds.) - Model order reduction_ theory, research aspects and applications-Springer-VeRaja Sekhar BattuNo ratings yet

- MCQ Test of PolymerDocument4 pagesMCQ Test of PolymerDrAman Khan Pathan100% (2)

- Tentang Takal Melalui Lakaran, TMK, Penulisan Atau Lisan Secara Kreatif)Document2 pagesTentang Takal Melalui Lakaran, TMK, Penulisan Atau Lisan Secara Kreatif)Yayang NasrudinNo ratings yet

- SCS Method PDFDocument55 pagesSCS Method PDFWesley BridgemohansinghNo ratings yet

- 1 MobilePass VPNDocument8 pages1 MobilePass VPNYashpal SinghNo ratings yet

- Chapter 2Document3 pagesChapter 2Johane Grei WallNo ratings yet

- Ffi Ffiq D (,: Rie Frncfusru'QDocument25 pagesFfi Ffiq D (,: Rie Frncfusru'QShubham DNo ratings yet

- Format of Auditors CertificateDocument5 pagesFormat of Auditors CertificatejayantgeeNo ratings yet

- What Is An Endpoint - Microsoft SecurityDocument4 pagesWhat Is An Endpoint - Microsoft Securityqualitychamp6824No ratings yet

- (1908) United States Revenue Cutter Service Uniform RegulationsDocument57 pages(1908) United States Revenue Cutter Service Uniform RegulationsHerbert Hillary Booker 2nd100% (3)

- Bird HDC High Density CleanerDocument2 pagesBird HDC High Density CleanerFaridUZamaNo ratings yet

- NB Private Equity Partners Ltd.Document68 pagesNB Private Equity Partners Ltd.ArvinLedesmaChiong100% (1)

- Me 04-601Document15 pagesMe 04-601Vishnu DasNo ratings yet

- 5mm LED Datasheet PDFDocument1 page5mm LED Datasheet PDFAlex ZXNo ratings yet

- Review Exercises DAY 3Document4 pagesReview Exercises DAY 3Heba Abd-AllahNo ratings yet

- FCG - List of Top 100 Stockholders Q1 (Common Shares) Ending 31 March 2024Document5 pagesFCG - List of Top 100 Stockholders Q1 (Common Shares) Ending 31 March 2024Amino BenitoNo ratings yet

- Wordsearch Fruits Fun Activities Games Games Icebreakers Oneonone Ac - 109759Document2 pagesWordsearch Fruits Fun Activities Games Games Icebreakers Oneonone Ac - 109759raquel lujanNo ratings yet

- Unit 2 - Basic Instrumentation and Measurement Techniques PPT Notes Material For Sem II Uploaded by Navdeep RaghavDocument72 pagesUnit 2 - Basic Instrumentation and Measurement Techniques PPT Notes Material For Sem II Uploaded by Navdeep Raghavavikool1708No ratings yet

- Salesforce Pages Developers GuideDocument810 pagesSalesforce Pages Developers GuideanynameNo ratings yet

- Bioflavor Biopang (02 06)Document5 pagesBioflavor Biopang (02 06)Fadila Artameivia AunuraNo ratings yet

- Foreign Currency TranactionDocument11 pagesForeign Currency TranactionAngelieNo ratings yet

- Sentence ConnectorsDocument2 pagesSentence ConnectorsReeta Kannusamy100% (1)

- DS2 - Unit 2-DC MachinesDocument57 pagesDS2 - Unit 2-DC MachinesTommba TommyNo ratings yet