Professional Documents

Culture Documents

LAW C503 Law On Income Taxation (Prelim Notes)

LAW C503 Law On Income Taxation (Prelim Notes)

Uploaded by

Dre AclonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LAW C503 Law On Income Taxation (Prelim Notes)

LAW C503 Law On Income Taxation (Prelim Notes)

Uploaded by

Dre AclonCopyright:

Available Formats

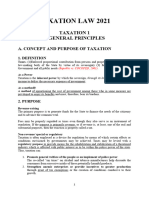

LAW C503 Law on Income Taxation

Week 2: General Principles of Taxation

Taxation

- process or means by which the sovereign, through its law-making body, raises income to

defray the necessary expenses of the government.

- it is a method of apportioning the cost of government among those who in some measures

are privileged to enjoy its benefits and must, therefore, bear it burdens.

ELEMENTS OF TAXATION

1. Enforced proportional contribution from persons and properties. Imposition is in not

dependent upon the will or assent (n. expression of approval or agreement) of the

person taxed. Not contractual, either expressed or implied, but positive acts of

government.

2. Imposed by the State by virtue of sovereignty.

3. Levied (v. impose a tax, fee, or fine) for the support of the government.

PURPOSE OF TAXATION

1. Revenue-raising – the primary purpose is to generate funds for the State to finance the

needs of the citizenry and advance the common weal (n. that which is best for someone

or something).

2. Non-revenue/special or Regulatory – Taxes may be levied with a regulatory purpose to

provide means for the rehabilitation and stabilization of a threatened industry which is

affected by public interest as to be within the police power of the state.

NATURE OF THE POWER OF TAXATION

1. Inherent in Sovereignty

- it is a power emanating from necessity because it imposes a necessary burden to

preserve the State’s sovereignty

2. A legislative function

- power to tax is exclusively legislative and cannot be exercised by the executive or

judicial branch of the government.

- only Congress, the national legislative body, can impose taxes.

- levy of tax may be made by local legislative body subject to such limitations as

provided by law.

You might also like

- Income TaxationDocument10 pagesIncome TaxationRocel Domingo100% (1)

- Tax 1 ReviewerDocument52 pagesTax 1 Reviewerms_k_a_y_e96% (25)

- Tax 1 ReviewerDocument52 pagesTax 1 Reviewervanessa3333333No ratings yet

- Taxation Memaid (Beda)Document132 pagesTaxation Memaid (Beda)Maria Jennifer Yumul BorbonNo ratings yet

- Income Taxation ReviewerDocument2 pagesIncome Taxation Reviewerjaninasachadelacruz0119No ratings yet

- Fundamental Principles of TaxationDocument1 pageFundamental Principles of TaxationJenilyn TadeoNo ratings yet

- Income Taxation-Chapter 1: Tax Delegation and Tax Administration. This Is SoDocument6 pagesIncome Taxation-Chapter 1: Tax Delegation and Tax Administration. This Is SoNour Aira NaoNo ratings yet

- It Is Inherent in Sovereignty - The Power of Taxation Exists Independent of AnyDocument2 pagesIt Is Inherent in Sovereignty - The Power of Taxation Exists Independent of Anydeborah grace sagarioNo ratings yet

- General PrinciplesDocument10 pagesGeneral PrinciplesNoroNo ratings yet

- BBE Lawyers Notes Taxation LawDocument215 pagesBBE Lawyers Notes Taxation LawYoo PawNo ratings yet

- Definition of TaxationDocument9 pagesDefinition of TaxationStelaNo ratings yet

- Tax ReviewerDocument12 pagesTax Reviewerashleykate.hapeNo ratings yet

- Module 1 Lecture TAXationDocument7 pagesModule 1 Lecture TAXationJagi KimNo ratings yet

- Summary - January 17, 2018Document4 pagesSummary - January 17, 2018Ken PioNo ratings yet

- NotesDocument2 pagesNotesAlii ZyNo ratings yet

- Summary of Principles of TaxationDocument8 pagesSummary of Principles of TaxationLheila MendozaNo ratings yet

- Taxation+I+General+Principles+Reviewer+for+Atty +monteroDocument27 pagesTaxation+I+General+Principles+Reviewer+for+Atty +monteroMars SacdalanNo ratings yet

- Chapter 1 Introduction To Taxation Supplementary MaterialsDocument4 pagesChapter 1 Introduction To Taxation Supplementary MaterialsAngel PaltincaNo ratings yet

- Taxation ReviewerDocument53 pagesTaxation ReviewerDave A ValcarcelNo ratings yet

- Cta 2003Document69 pagesCta 2003perlitainocencioNo ratings yet

- Taxation ReviewerDocument3 pagesTaxation ReviewerI AestherielleNo ratings yet

- General Principles of TaxationDocument36 pagesGeneral Principles of Taxationnicole5anne5ddddddNo ratings yet

- Tax Reviewer MGCDocument52 pagesTax Reviewer MGCCalderón Gutiérrez Marlón PówanNo ratings yet

- Tax NotesDocument6 pagesTax NotesJanel MendozaNo ratings yet

- Taxation Law Reviewer 2Document44 pagesTaxation Law Reviewer 2asde12ke1mNo ratings yet

- FundamentalDocument11 pagesFundamentalWilfredo VillaflorNo ratings yet

- General Principles A. Definition and Attributes of TaxationDocument10 pagesGeneral Principles A. Definition and Attributes of TaxationLei StudNo ratings yet

- Tax Ation San Beda College of LAW - ALABANGDocument52 pagesTax Ation San Beda College of LAW - ALABANGYour Public ProfileNo ratings yet

- Tax Ation San Beda College of LAW - ALABANGDocument52 pagesTax Ation San Beda College of LAW - ALABANGLaine Mongan100% (1)

- Tax ReviewerDocument3 pagesTax ReviewerGlendaMendozaNo ratings yet

- Local Media7305767987836246830Document20 pagesLocal Media7305767987836246830John RellonNo ratings yet

- General Principles of Taxation Definition of Taxation: This Is The So-Called "Benefits Received Principle."Document13 pagesGeneral Principles of Taxation Definition of Taxation: This Is The So-Called "Benefits Received Principle."Lyca VNo ratings yet

- Income Taxation PrelimDocument7 pagesIncome Taxation PrelimJanella KeizyNo ratings yet

- General Principles of TaxationDocument12 pagesGeneral Principles of TaxationMatt Marqueses PanganibanNo ratings yet

- Taxation Reviewer SAN BEDADocument129 pagesTaxation Reviewer SAN BEDARitch LibonNo ratings yet

- Taxation 1 Lesson 1. Basic Concepts and Characteristics of TaxationDocument43 pagesTaxation 1 Lesson 1. Basic Concepts and Characteristics of Taxationjane quiambao100% (1)

- Income Tax NotesDocument53 pagesIncome Tax Notesjulian.cuyaNo ratings yet

- A. Necessity TheoryDocument7 pagesA. Necessity TheoryBea SiscarNo ratings yet

- Module 1 Income TaxationDocument2 pagesModule 1 Income TaxationIrish BogaciaNo ratings yet

- Recurring NotesDocument36 pagesRecurring NotesRia EsguerraNo ratings yet

- C2015 Tax 1 Midterms Reviewer (Loriega)Document52 pagesC2015 Tax 1 Midterms Reviewer (Loriega)Sabrito100% (1)

- Taxation Handout 1Document9 pagesTaxation Handout 1chancellxadeNo ratings yet

- Tax Reviewer For MidtermDocument4 pagesTax Reviewer For Midtermjury jasonNo ratings yet

- Unit I PrinciplesDocument15 pagesUnit I PrinciplesDarleen CantiladoNo ratings yet

- Reviewer in TaxationDocument19 pagesReviewer in TaxationMarco ComboyaNo ratings yet

- Prelim TaxationDocument8 pagesPrelim TaxationJocel Añasco LabiosNo ratings yet

- Taxation Law 1111111Document10 pagesTaxation Law 1111111SpidermanNo ratings yet

- Additional Tax ReferenceDocument5 pagesAdditional Tax ReferenceElijah Luis VasquezNo ratings yet

- REVIEWERDocument36 pagesREVIEWERReStyleNo ratings yet

- Income TaxationDocument3 pagesIncome Taxationclarenz alleraNo ratings yet

- TaxationDocument53 pagesTaxationDave A ValcarcelNo ratings yet

- Principles of TaxationDocument13 pagesPrinciples of TaxationHazel OrtegaNo ratings yet

- General Principles of TaxationDocument33 pagesGeneral Principles of TaxationjoyNo ratings yet

- Taxation I ReviewDocument62 pagesTaxation I ReviewSK Tim RichardNo ratings yet

- Basic PrinciplesDocument7 pagesBasic PrinciplesRodison de GuiaNo ratings yet

- Taxation 1 Midterms ReviewerDocument28 pagesTaxation 1 Midterms ReviewerDenise FranchescaNo ratings yet

- 01 Introduction To Taxation - BigskyDocument6 pages01 Introduction To Taxation - BigskyAbigail Espiritu SantoNo ratings yet

- The Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemFrom EverandThe Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemNo ratings yet

- Hamilton's Economic Policies: Works & Speeches of the Founder of American Financial SystemFrom EverandHamilton's Economic Policies: Works & Speeches of the Founder of American Financial SystemNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)