Professional Documents

Culture Documents

độ nhạy cảm chuyển đổi

độ nhạy cảm chuyển đổi

Uploaded by

QUYÊN HỒ HOÀNG PHƯƠNG0 ratings0% found this document useful (0 votes)

7 views1 pageThe document summarizes the balance sheet of ABC company's Canadian subsidiary before and after the Canadian dollar depreciates against the US dollar from C$1 to C$0.7 under two translation methods. Under the monetary/non-monetary method, ABC recognizes a translation gain of C$30. Under the current rate method, ABC recognizes a translation loss of C$120.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes the balance sheet of ABC company's Canadian subsidiary before and after the Canadian dollar depreciates against the US dollar from C$1 to C$0.7 under two translation methods. Under the monetary/non-monetary method, ABC recognizes a translation gain of C$30. Under the current rate method, ABC recognizes a translation loss of C$120.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views1 pageđộ nhạy cảm chuyển đổi

độ nhạy cảm chuyển đổi

Uploaded by

QUYÊN HỒ HOÀNG PHƯƠNGThe document summarizes the balance sheet of ABC company's Canadian subsidiary before and after the Canadian dollar depreciates against the US dollar from C$1 to C$0.7 under two translation methods. Under the monetary/non-monetary method, ABC recognizes a translation gain of C$30. Under the current rate method, ABC recognizes a translation loss of C$120.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

Bài tập độ nhạy cảm chuyển đổi

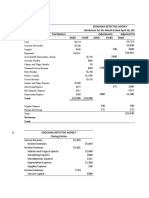

ABC company’s Canadian subsidiary has the following BS

Cash & receivables C$ 800 Payables C$ 900

Inventory 900 Long-Term Debt 500

Fixed assets 700 Net Worth ls 1,000

Total assets C$ 2,400 Total claims C$ 2,400

Suppose the Canadian dollar depreciates from US$1.00 to US$0.70 during the period.

1/ Under the monetary/non-monetary method, what is ABC’s translation gain or loss?

Cash & receivables $ 560 Payables $ 630

Inventory 900 Long-Term Debt 500

Fixed assets 700 Net Worth ls 1,000

Total assets $ 2,160 Total claims $ 2,130

2/ Under the current rate method, what is ABC’s translation gain or loss?

Cash & receivables $ 560 Payables $ 630

Inventory 630 Long-Term Debt 350

Fixed assets 490 Net Worth ls 1,000

Total assets $ 1.820 Total claims $ 1.980

You might also like

- 704Document5 pages704Bhoomi GhariwalaNo ratings yet

- Financial and Managerial Accounting 14th Edition Warren Solutions ManualDocument25 pagesFinancial and Managerial Accounting 14th Edition Warren Solutions ManualAngelaMartinezpxjd100% (53)

- Tugas ForumDocument4 pagesTugas Forumarif budi hermansahNo ratings yet

- Chapter 1 AnswerDocument15 pagesChapter 1 AnswerKristina Kitty100% (1)

- (Kunci) Asistensi 4Document8 pages(Kunci) Asistensi 4Randomly EmailNo ratings yet

- 704Document3 pages704Bhoomi GhariwalaNo ratings yet

- IFM - Chapter 8 10Document61 pagesIFM - Chapter 8 10nhatdao.workNo ratings yet

- The Role of Working Capital: Bordenk@unk - EduDocument7 pagesThe Role of Working Capital: Bordenk@unk - EduAntonio FrancoNo ratings yet

- HW6 CameronCatesDocument2 pagesHW6 CameronCatesCALISTA VANIA MAHARANI Mahasiswa PNJNo ratings yet

- Jawaban Chapter 1Document12 pagesJawaban Chapter 1Ruth Elisabeth100% (2)

- TUGAS Pamplin MK1.Document2 pagesTUGAS Pamplin MK1.Nan BaeeeNo ratings yet

- Modul Lab Akuntansi Lanjutan Ii - P 21.22Document34 pagesModul Lab Akuntansi Lanjutan Ii - P 21.22christin melinaNo ratings yet

- Translation Methods: - Current/Noncurrent Method - Monetary/Nonmonetary Method - Temporal Method - Current Rate MethodDocument29 pagesTranslation Methods: - Current/Noncurrent Method - Monetary/Nonmonetary Method - Temporal Method - Current Rate MethodAruna SurapureddyNo ratings yet

- Translation QuestionsDocument6 pagesTranslation QuestionsVeenal BansalNo ratings yet

- Financial Statements, Taxes and Cash Flow Chap02pptDocument18 pagesFinancial Statements, Taxes and Cash Flow Chap02pptNashwa Saad100% (1)

- Unadjusted Trial BalanceDocument10 pagesUnadjusted Trial BalanceMingxNo ratings yet

- JRHR - 4 Fundidora de MtyDocument5 pagesJRHR - 4 Fundidora de MtyRoberto RodríguezNo ratings yet

- TranslationDocument41 pagesTranslationAnkit GoelNo ratings yet

- Cash-Flow Analysis, Cash-Flow AnalysisDocument32 pagesCash-Flow Analysis, Cash-Flow AnalysisVIKAS DOGRANo ratings yet

- HorneFFM11e Ab - Az.ch07Document58 pagesHorneFFM11e Ab - Az.ch07Laiba MunirNo ratings yet

- Sheet 1Document10 pagesSheet 1Vinhant GonawanNo ratings yet

- Tugas 7Document9 pagesTugas 7Amelia Fauziyah rahmahNo ratings yet

- Chap 12 NotesDocument3 pagesChap 12 NotesrbarronsolutionsNo ratings yet

- Financial Statements: Balance SheetDocument237 pagesFinancial Statements: Balance SheetPramod VasudevNo ratings yet

- Dwnload Full Corporate Financial Accounting 14th Edition Warren Solutions Manual PDFDocument35 pagesDwnload Full Corporate Financial Accounting 14th Edition Warren Solutions Manual PDFhofstadgypsyus100% (24)

- Full Download Corporate Financial Accounting 14th Edition Warren Solutions ManualDocument35 pagesFull Download Corporate Financial Accounting 14th Edition Warren Solutions Manualmasonh7dswebb100% (42)

- Funds Analysis, Cash-Flow Analysis, and Financial PlanningDocument59 pagesFunds Analysis, Cash-Flow Analysis, and Financial Planningtanvir09No ratings yet

- Fath Abdul Azis - A031211044Document6 pagesFath Abdul Azis - A031211044Fath Abdul AzisNo ratings yet

- Reading 10 Multinational Operations - AnswersDocument95 pagesReading 10 Multinational Operations - Answerstristan.riolsNo ratings yet

- Pembahasan Soal AC Part 1Document34 pagesPembahasan Soal AC Part 1suci monalia putriNo ratings yet

- Ifm - 9Document16 pagesIfm - 9glienminhtocchienNo ratings yet

- مراجعة 8-4-2020 PDFDocument3 pagesمراجعة 8-4-2020 PDFIbrahim TobehNo ratings yet

- CH1 AssignmentDocument11 pagesCH1 AssignmentDhence BasigaNo ratings yet

- Tugas 10Document3 pagesTugas 10Reyhan ArioNo ratings yet

- Funds Analysis, Cash-Flow Analysis, and Financial PlanningDocument59 pagesFunds Analysis, Cash-Flow Analysis, and Financial PlanningJovi AbabanNo ratings yet

- Fund Analysis, Cash-Flow Analysis, and Financial PlanningDocument58 pagesFund Analysis, Cash-Flow Analysis, and Financial Planningirshan amirNo ratings yet

- Chapter 3 AnswerDocument3 pagesChapter 3 AnswerSwee Yi LeeNo ratings yet

- Syukur Tugas Akl IiDocument3 pagesSyukur Tugas Akl IiMuhammad SyukurNo ratings yet

- Bankruptcy Problems MirzaDocument3 pagesBankruptcy Problems MirzaKesarapu Venkata ApparaoNo ratings yet

- To Record Partner's Interest and SalaryDocument3 pagesTo Record Partner's Interest and SalaryCee Gee BeeNo ratings yet

- Fund Analysis, Cash-Flow Analysis, and Financial PlanningDocument58 pagesFund Analysis, Cash-Flow Analysis, and Financial Planningaftab_sweet3024No ratings yet

- AFR Session 4 ExercisesDocument10 pagesAFR Session 4 ExercisesSherif KhalifaNo ratings yet

- Translation ExposureDocument5 pagesTranslation Exposurepamidi shakeer0% (1)

- NLKTDocument15 pagesNLKTYến Hoàng HảiNo ratings yet

- Prepare Financial Statements From Trial Balance in ExcelDocument5 pagesPrepare Financial Statements From Trial Balance in ExcelShania FordeNo ratings yet

- Cahs FlowDocument5 pagesCahs FlowDipali PatilNo ratings yet

- Advanced AccountingDocument4 pagesAdvanced Accountinggisela gilbertaNo ratings yet

- Answer of accounting 1 (??)Document21 pagesAnswer of accounting 1 (??)honguyenkimkhanh55No ratings yet

- QuestionsDocument1 pageQuestionsjesicaNo ratings yet

- Accounting Assignment 2 PDFDocument6 pagesAccounting Assignment 2 PDFA. HanifahNo ratings yet

- LF BC Corpo Correspondances CorrigéDocument4 pagesLF BC Corpo Correspondances Corrigévive la FranceNo ratings yet

- (123doc) Question Financial Statement AnalysisDocument9 pages(123doc) Question Financial Statement AnalysisUyển's MyNo ratings yet

- Jawaban Soal Hitungan Bab 4Document16 pagesJawaban Soal Hitungan Bab 4Aheir lessNo ratings yet

- Accounting II-2Document177 pagesAccounting II-2Adnan KanwalNo ratings yet

- Tugas 3 - AKL 1Document2 pagesTugas 3 - AKL 1Geroro D'PhoenixNo ratings yet

- Eun7e CH 010Document41 pagesEun7e CH 010Shruti AshokNo ratings yet

- Week 2 Assessment: Accounting For Business CombinationsDocument12 pagesWeek 2 Assessment: Accounting For Business Combinationstasya salfiraNo ratings yet

- HUM 121assignment 1Document6 pagesHUM 121assignment 1Nayeem HossainNo ratings yet