Professional Documents

Culture Documents

Click Here

Click Here

Uploaded by

Avinash WidhaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Click Here

Click Here

Uploaded by

Avinash WidhaniCopyright:

Available Formats

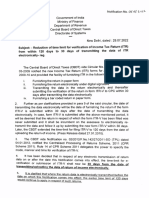

6.

It is further clarified:

(i) Where ITR data is electronically transmitted and e-verified/lTR-V submitted

within 30 days of transmission of data - in such cases the date of

transmitting the data electr ally shall be considered as the date of

furnishing the return of income.

(i) Where ITR data is electronically transmitted but e-verified or ITR-V

submitted beyond the time-limit of 30 days of transmission of data - in such

cases the date of e-verification/ITR-V submission shall be treated as the

date of furnishing the return of income and all consequences of late filing of

return under the Act shall follow.

7. Duly verified ITR-V in the prescribed format and in the prescribed manner

should be sent by speed post only to

Centralised Processing Centre,

Income Tax Department,

Bengaluru 560500, Karnataka.

-

8. The date of dispatch of Speed Post of duly verified ITR-V shall be considered

8.

for the purpose of determination of the 30 days period, from the date of transmitting

the data of Income-tax return electronically.

This Notification shall be applicable for electronically transmitted Income-tax

9

return data filed on the e-filing portal (www.incometax.gov.in). This issues by the

power conferred to the undersigned under the Rule 14 of Centralized Processing of

Returns Scheme 2011 (CPR Scheme 2011) dated 04.01.2012, notified by the CBDT

Notification No. 02/2012- F.No. 142/27/2011-SO(TPL).

10. This notification will come into effect from 01.08.2022.

11. Hindi version to follow.

Conda

(Govind Lal)

Director General of Income-tax(Systems)

Copy to:

i. PS to FM/OSD to FM/PS to MoS(F)/OSDto Mos(F)

ii. PS to Secretary (Revenue)

ii. Chairman, CBDT & All Members, CBDT

iv. All Pr.cCIT/ Pr. DGsIT

v. All Joint Secretaries/CsIT, CBDT

vi. C&AG

vi. Addl.CIT(Database cell) for uploading on the departmental website

vii. Guard File

Ramesh Krishnamurthi

ADG(S)-3, New Delhi

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Click HereDocument1 pageClick HereAvinash WidhaniNo ratings yet

- No. 17-67/2023/GDS DATED 31.07.2023: Page 2 of 19Document1 pageNo. 17-67/2023/GDS DATED 31.07.2023: Page 2 of 19Avinash WidhaniNo ratings yet

- Communication of Selection:: DaysDocument1 pageCommunication of Selection:: DaysAvinash WidhaniNo ratings yet

- 5.2. Qualification As On The Date of Notification: QualificationDocument1 page5.2. Qualification As On The Date of Notification: QualificationAvinash WidhaniNo ratings yet

- No. 17-67/2023/GDS DATED 31.07.2023: Page 1 of 19Document1 pageNo. 17-67/2023/GDS DATED 31.07.2023: Page 1 of 19Avinash WidhaniNo ratings yet

- IIM Rohtak Extempore TopicsDocument2 pagesIIM Rohtak Extempore TopicsAvinash WidhaniNo ratings yet