Professional Documents

Culture Documents

Tablas de Impuestos

Tablas de Impuestos

Uploaded by

MUNICIPALIDAD DE CORQUIN COPAN0 ratings0% found this document useful (0 votes)

8 views3 pagestab

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttab

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views3 pagesTablas de Impuestos

Tablas de Impuestos

Uploaded by

MUNICIPALIDAD DE CORQUIN COPANtab

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 3

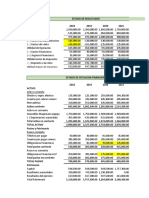

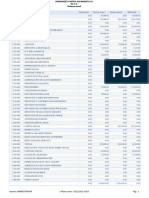

TABLA PARA CALCULO DE IMPUESTO PERSONAL

RANGO Ingreso anual Tarifa por millar Impuesto Acumulado

1.00-5,000.00 5,000.00 1.50 7.50 7.50

5,001.00-10,000.00 5,000.00 2.00 10.00 17.50

10,001.00-20,000.00 10,000.00 2.50 25.00 42.50

20,001.00-30,000.00 10,000.00 3.00 30.00 72.50

30,001.00-50,000.00 20,000.00 3.50 70.00 142.50

50,001.00-75,000.00 25,000.00 3.75 93.75 236.25

75,001.00-100,000.00 25,000.00 4.00 100.00 336.25

100,001.00-150,000.00 50,000.00 5.00 250.00 586.25

150,001.00 en adelante 5.25 -

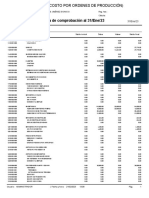

TABLAPARA CALCULO DE IMPUESTO SOBRE I.C.S.

Tarifa por

RANGO MONTO millar Impuesto mensual

1.00-500,000.00 500,000.00 0.30 150.00

500,001.00-10,000,000.00 9,500,000.00 0.40 3,800.00

10,000,001.00-20,000,000.00 10,000,000.00 0.30 3,000.00

20,000,001.00-30,000,000.00 10,000,000.00 0.20 2,000.00

30,000,001.00 en adelante 0.15 -

ARA CALCULO DE IMPUESTO SOBRE I.C.S.

Acumulado

150.00

3,950.00

6,950.00

8,950.00

You might also like

- Ejercicio Resuelto Estados Financieros Id 0503 26 Sept 22-1Document12 pagesEjercicio Resuelto Estados Financieros Id 0503 26 Sept 22-1Nancy Sanchez BalderasNo ratings yet

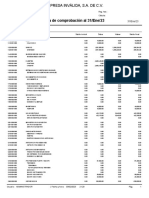

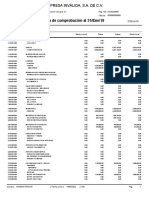

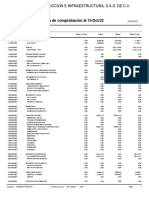

- Balanza de Comprobacion EneroDocument2 pagesBalanza de Comprobacion Enerojfernandezdominguez94949No ratings yet

- Flujo Efvo Octavio 2024Document3 pagesFlujo Efvo Octavio 2024reyesnidia347No ratings yet

- 2023 Caso 3 - Preparación de Estados Financieros - Grupo 5 (09!07!23)Document15 pages2023 Caso 3 - Preparación de Estados Financieros - Grupo 5 (09!07!23)Giancarlo Gonzales CampomanesNo ratings yet

- Derecho Fiscal: 2P - Actividad - 2 - Ejercicio - Régimen General PM - Unidad - 2Document13 pagesDerecho Fiscal: 2P - Actividad - 2 - Ejercicio - Régimen General PM - Unidad - 2Arath de Jesús Martinez GuillénNo ratings yet

- Formato Presupuesto de TesoreriaDocument14 pagesFormato Presupuesto de TesoreriapamelachavezreyesNo ratings yet

- Plantilla de Solución CASO 1 ACTROM PARA ALUMNOSDocument4 pagesPlantilla de Solución CASO 1 ACTROM PARA ALUMNOSnpg657.gradsocialNo ratings yet

- Ejercicios ContabilidadDocument21 pagesEjercicios ContabilidadCarolina SalazarNo ratings yet

- Casos de Analisis FinancieraDocument27 pagesCasos de Analisis FinancierajessicaNo ratings yet

- BalanzaDocument3 pagesBalanzaYesenia MotaNo ratings yet

- Caso Eeff IntegralDocument4 pagesCaso Eeff IntegralMAICKEL SANCHEZNo ratings yet

- Balance de Comprobacion Guzman QuitoDocument3 pagesBalance de Comprobacion Guzman QuitoGuzmán GiancarloNo ratings yet

- Formato Presupuesto de TesoreriaDocument10 pagesFormato Presupuesto de TesoreriapamelachavezreyesNo ratings yet

- Helisa Niif-Balance de Prueba PDFDocument2 pagesHelisa Niif-Balance de Prueba PDFAnggi Catherine Buitrago NovoaNo ratings yet

- Reslucion de PracticaDocument5 pagesReslucion de PracticaDANICA JANETH GUEVARA PORRASNo ratings yet

- Textiles Zen E5Document67 pagesTextiles Zen E5LAB2019-Angel Jesus Canul PanNo ratings yet

- Yanacancha - Huayllacancha-Vista AlegreDocument24 pagesYanacancha - Huayllacancha-Vista Alegreyessenia rios prietoNo ratings yet

- Balanza de ComprobaciónDocument6 pagesBalanza de ComprobaciónSaYuu SilvaNo ratings yet

- 34 Clase Van 5-2024Document3 pages34 Clase Van 5-2024Karla CozNo ratings yet

- Balanza de Comprobacion ESPARZADocument1 pageBalanza de Comprobacion ESPARZAJULIO CESAR RODRIGUEZ SALCIDONo ratings yet

- Balanza Etapa 4Document6 pagesBalanza Etapa 4Montserrat Yamilé González CalderónNo ratings yet

- Tarifario Camara de Comercio Puerto PlataDocument3 pagesTarifario Camara de Comercio Puerto PlataFelix VasquezNo ratings yet

- Trebol Sumas y SaldosDocument1 pageTrebol Sumas y SaldosCarlos daniel Ibarra martinezNo ratings yet

- Balanza de ComprobacionDocument6 pagesBalanza de ComprobacionDafne Odette Avila SantiagoNo ratings yet

- Ba LanzaDocument2 pagesBa LanzaPepito EL DE LOS CuentosNo ratings yet

- Metrados Allhuacchuyo Componente 03Document6 pagesMetrados Allhuacchuyo Componente 03Ross MeryNo ratings yet

- H. Trabajo Axel AndradeDocument16 pagesH. Trabajo Axel AndradeNathaly HigueraNo ratings yet

- Practica Pagos Prov Resico PMDocument1 pagePractica Pagos Prov Resico PMFrancisco Adrian Pérez AvalosNo ratings yet

- Practica 3Document2 pagesPractica 3gjosselyn33No ratings yet

- 1.0 Metrados Explanaciones - 0Document21 pages1.0 Metrados Explanaciones - 0Wiler ParedesNo ratings yet

- Balanza de ComprobacionDocument6 pagesBalanza de ComprobacionJuan OreaNo ratings yet

- Honorarios y Aranceles Proteccion Contra Incendio Abril 2024Document2 pagesHonorarios y Aranceles Proteccion Contra Incendio Abril 2024Vera AngelNo ratings yet

- Los Clasicos Balanza de ComprobaciónDocument2 pagesLos Clasicos Balanza de ComprobaciónEmanuel CervantesNo ratings yet

- Cuentas TDocument4 pagesCuentas Trioingenieria.sasNo ratings yet

- Hoja de Trabajo FULL CARDocument7 pagesHoja de Trabajo FULL CARCarlos TR FernandoNo ratings yet

- Informe Impuestos DetalladosDocument8 pagesInforme Impuestos DetalladosYorleidis Torregroza JimenezNo ratings yet

- Solución Ejercicio Presupuesto - Hoja 1Document1 pageSolución Ejercicio Presupuesto - Hoja 1Angeles MolinaNo ratings yet

- Practica 3Document2 pagesPractica 3altagracia lopezNo ratings yet

- Caso Practico 10-07-2023-Osi...Document16 pagesCaso Practico 10-07-2023-Osi...MAICKEL SANCHEZNo ratings yet

- Balance de Comprobacion 2023Document2 pagesBalance de Comprobacion 2023Jesus David Sucasaca ChicloteNo ratings yet

- Libro 1Document4 pagesLibro 1Angello Vasquez GeredaNo ratings yet

- Maria Cristina Peralta BG6690 Presupuesto GastosDocument5 pagesMaria Cristina Peralta BG6690 Presupuesto GastosMaria CristinaNo ratings yet

- Ejercicio 14 de Junio TirDocument12 pagesEjercicio 14 de Junio TirNikholas TovarNo ratings yet

- CASTRODocument2 pagesCASTROjuliogordo6677No ratings yet

- Balance de ComprobacionDocument2 pagesBalance de ComprobacionJose JaimesNo ratings yet

- Flujo de EfectivoDocument2 pagesFlujo de EfectivoCuevas Marin Eunice MarleneNo ratings yet

- Balanza 20-21 FEB 2023Document6 pagesBalanza 20-21 FEB 2023Jiménez Dionicio Sofía JosedNo ratings yet

- Movimiento de CajaDocument4 pagesMovimiento de CajaJhěŕįåņ Ğŕëğœřįø PëŕđømőNo ratings yet

- Practica TICs BalanzaDocument4 pagesPractica TICs BalanzaLucio Rojas Iliana ArelyNo ratings yet

- Estudio de Caso 2 Jazlin Segura SDocument2 pagesEstudio de Caso 2 Jazlin Segura Sjazlinsegura16No ratings yet

- FlujoimpDocument9 pagesFlujoimpPame LópezNo ratings yet

- Reporte Nuevo Katiuska GonzalezDocument4 pagesReporte Nuevo Katiuska GonzalezgleidyNo ratings yet

- Flujo de Efectivo Cuatri 8Document8 pagesFlujo de Efectivo Cuatri 8Pame LópezNo ratings yet

- Balance Constructivo Cont. GubernamentalDocument1 pageBalance Constructivo Cont. GubernamentalJhajaira Del Pilar Apuela TuanamaNo ratings yet

- TanciraroDocument2 pagesTanciraroCATALINA ALVAREZNo ratings yet

- Mem Cal 2500Document5 pagesMem Cal 2500Romain Ventura SanchezNo ratings yet

- Flujo de Efectivo Ejercicio 1Document7 pagesFlujo de Efectivo Ejercicio 1Gabriela LopezNo ratings yet

- Pagina 18Document2 pagesPagina 18gugliuzzoagustinaNo ratings yet

- Febrero 2Document1 pageFebrero 2Talento HumanoPrensaNo ratings yet