Professional Documents

Culture Documents

TAXC221 - Court Cases Summary - 2015

TAXC221 - Court Cases Summary - 2015

Uploaded by

Mr CommentOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TAXC221 - Court Cases Summary - 2015

TAXC221 - Court Cases Summary - 2015

Uploaded by

Mr CommentCopyright:

Available Formats

TAXC221 - Court Cases summary

Relevant to Words or phrase Name of the court case Summary of case

considered

“ordinary residence” would be the country to which a

Ordinarily resident Cohen vs CIR person would naturally and as a matter of course return

from his wanderings.

CIR vs Kuttel

“ordinary residence” = place where you normally reside,

Resident

apart from temporary/occasional absences.

Not just money/cash is applicable. Anything (property)

CIR v Lategan earned that has a money-value must be included in

“amount”.

The onus of establishing an amount rests upon the

CIR v Butcher Bros (Pty) Ltd

Commissioner.

Amount

Interest-free loans granted to a TP in consideration for the

acquisition of life-interest in units does constitute a benefit

CSARS v Brummeria of which a value can be determined to be included as part

Definition of gross income. (A benefit with an ascertainable value is

of gross included in gross income)

income CIR v People’s Stores (Walvis Accrues to when TP becomes entitled to it.

Bay) (Pty) Ltd

Mooi v SIR Accrues to only when TP is unconditionally entitled to it.

accrued to

The disposal of income after it has accrued to a TP does

CIR v Witwatersrand Association

not influence the taxability of that accrual in the hands of

of Racing Clubs:

the TP.

Geldenhuys v CIR On his (or her) own behalf and for his (or her) own benefit

Obtaining physical control over “money” – not mean a

CIR v Genn & Co (Pty) Ltd

received by receipt for GI purposes – must be for his own benefit

MP Finance Group CC v CSARS:

An amount will be “received by” a Tax payer if his intention

was to benefit from it for his own purpose.

of a capital nature – Original intention may change to a scheme of profit

CIR v Richmond Estates (Pty) Ltd

intention making.

TAXC221 - Court Cases summary

· The sale of asset does not mean intention

changed.

of a capital nature – Elandsheuwel Farming (Edms)

· Consider whether there was a scheme of profit-

intention Bpk vs SBI (1978 A)

making.

· May realise asset to the greatest advantage of TP.

· Intention at purchase could be decisive unless

other factors intervene.

of a capital nature –

CIR v Stott · The decision to dispose of asset does not mean

Definition mixed or dual intention

there was a change in intention.

of gross · May realise asset to the greatest advantage of TP.

income

Factors such as planning, scope, nature, duration and

of a capital nature –

Natal Estates Ltd v SIR marketing will determine intention change. Must establish

change in intention

whether a business was operated. Cross the “Rubicon”

of a capital nature – the CIR v Visser Capital is tree and the fruit of the tree is income in nature

nature of the “asset” which must be separated from each other.

The intention of company is determined by the actions and

of a capital nature – the

CIR v Richmond Estates (Pty) Ltd decisions by directors.

intention of company

An annuity has two characteristics:

Special • it is an annual or periodical payment (repetitive); and

Annuity KBI and another v Hogan:

inclusions • the beneficiary has the right to receive more than one

such payment

TAXC221 - Court Cases summary

Relevant to Words or phrase Name of the court case Summary of case

considered

Not necessary to show that expenditure will have effect upon

General Sub-Nigel Ltd v CIR production of the income for that year.

As long as the expenditure is incurred to earn the future income.

This definition gives a wide and well established interpretation. It

Burgess v CIR is not to be seen as exhaustive. Consider the following:

carrying on a trade

· Is there continuity of the activities?

· Is the long-term objective of the trade to generate profit?

· Expenditure incurred must originate from operating a

business operation with the goal to earn an income.

Port Elizabeth Electric Tramway

Co Ltd v CIR · The expenditure incurred must in other word have a

close connection with the business’s income-earning

operations. (necessary concominant)

in the production of income · Expenditure incurred to induce employees to enter and

Deductions – remain in the service of a taxpayer may qualify for a

Provider v COT:

section 11(a) deduction since the purpose is to produce current or

future income.

The expenditure or the act leading to the expenditure as has to

Joffe & Co (Pty) Ltd v CIR be a “necessary concomitant” of the business operation to be in

the production of income.

Amounts paid and amounts for which there is a responsibility to

Caltex Oil (SA) Ltd v

pay but is not yet payable (liability)

Unconditional legal obligation before it can be seen as actually

Edgars Stores Ltd v CIR

incurred.

Actually incurred If not explicit and absolute liability to pay, expense not actually

Nasionale Pers Bpk v KBI

incurred.

If the outcome of a dispute over expenditure / claim remains

CIR v Golden Dumps (Pty) Ltd undetermined at end of tax year, the obligation is not actually

incurred.

TAXC221 - Court Cases summary

Floating or circulating capital vs fixed capital: cost of performing

New State Areas Ltd v CIR income-earning operations vs cost of establishing or improving

or adding to the income earning plant.

not of a capital nature

If the expenditure is more closely related to the TP’s income-

Rand Mines (Mining & Services) Ltd

generating structure than to his income-earning operations, it is

v CIR

capital in nature.

You might also like

- Remedies Flow ChartDocument1 pageRemedies Flow ChartJulie Song100% (5)

- Questions ExamDocument47 pagesQuestions ExamNaïla Rahier100% (1)

- Australian Taxation Law Notes - PDF (Sadiq)Document49 pagesAustralian Taxation Law Notes - PDF (Sadiq)SuJyi Tan100% (2)

- Founders Guide To Financial ModelingDocument117 pagesFounders Guide To Financial ModelingWillNo ratings yet

- Forms of Business AssociationsDocument4 pagesForms of Business Associationsnamratha minupuri100% (1)

- Project Report On Computer Service CentreDocument23 pagesProject Report On Computer Service CentreNarasimha Reddy76% (17)

- Contract Case Summaries CompleteDocument38 pagesContract Case Summaries CompleteSenzo MadlalaNo ratings yet

- Taxation of Individuals and Business Entities 2018 Edition 9th Edition Spilker Solutions Manual PDFDocument84 pagesTaxation of Individuals and Business Entities 2018 Edition 9th Edition Spilker Solutions Manual PDFa543817576No ratings yet

- Management Accounts SampleDocument13 pagesManagement Accounts SampleJoe Magero100% (1)

- Gross Income Definition - Case Law PrinciplesDocument7 pagesGross Income Definition - Case Law PrinciplesHitekani ConsolationNo ratings yet

- 1.2) Gross IncomeDocument3 pages1.2) Gross Incomeayanda malingaNo ratings yet

- Cap Vs Rev Test 5 2020 SolutionDocument1 pageCap Vs Rev Test 5 2020 SolutionBuhle CeleNo ratings yet

- Corporate Law 5Document5 pagesCorporate Law 5Aadi saklechaNo ratings yet

- Tax Case LawsDocument6 pagesTax Case LawsHandikatare Bruce TNo ratings yet

- Intermediate Accounting - Impairment of Assets (Pas 36)Document4 pagesIntermediate Accounting - Impairment of Assets (Pas 36)22100629No ratings yet

- Income From Property SummaryDocument39 pagesIncome From Property SummaryINFANTE, RANDOLPH BHUR S.No ratings yet

- Contracts Ace Review #1: Chapter 2: RemediesDocument12 pagesContracts Ace Review #1: Chapter 2: RemediesMolly EnoNo ratings yet

- STBB Brochure - Capital Gains Tax in Relation To Property CGT DL Jan21 - WEBDocument9 pagesSTBB Brochure - Capital Gains Tax in Relation To Property CGT DL Jan21 - WEBthamsanqamanciNo ratings yet

- New Microsoft Office Word DocumentDocument2 pagesNew Microsoft Office Word DocumentVikas SrivastavaNo ratings yet

- General Principles: Aichi. However, The Previous BIR Ruling May Be Relied On byDocument5 pagesGeneral Principles: Aichi. However, The Previous BIR Ruling May Be Relied On byJASON BRIAN AVELINONo ratings yet

- Impairment of FA NotesDocument21 pagesImpairment of FA Notespiyush bansalNo ratings yet

- Afar.02 Corporate LiquidationDocument3 pagesAfar.02 Corporate LiquidationRhea Royce CabuhatNo ratings yet

- CAPITALGAINS 3rdsep PDFDocument202 pagesCAPITALGAINS 3rdsep PDFPhani Kumar SomarajupalliNo ratings yet

- 1st Semester Transfer Taxation Module 3 Estate Taxation - DeductionsDocument13 pages1st Semester Transfer Taxation Module 3 Estate Taxation - DeductionsNah HamzaNo ratings yet

- CLN 9.1 Remedies For Breach of ContractDocument4 pagesCLN 9.1 Remedies For Breach of ContractHew DamienNo ratings yet

- Contract Law - Week 3 Slides-2Document50 pagesContract Law - Week 3 Slides-2R ZeiNo ratings yet

- CHAPTER 6 and 7Document61 pagesCHAPTER 6 and 7PHOEBE CALLEJANo ratings yet

- CIT (1959) 37 ITR 66 (SC) .: Business ExpenditureDocument4 pagesCIT (1959) 37 ITR 66 (SC) .: Business ExpenditureyagayNo ratings yet

- Coinsurance - The Other Reinsurance: Presentation To The Presentation To The Actuarial Institute of The Republic of ChinaDocument52 pagesCoinsurance - The Other Reinsurance: Presentation To The Presentation To The Actuarial Institute of The Republic of ChinaaaharisNo ratings yet

- National Direct Excise ProgressiveDocument1 pageNational Direct Excise ProgressiveMorris JulianNo ratings yet

- Capital Versus Revenue: Some Guidance: Pyott V CIRDocument7 pagesCapital Versus Revenue: Some Guidance: Pyott V CIRAbigail Ruth NawashaNo ratings yet

- Chapter 3 Introduction To Income TaxDocument20 pagesChapter 3 Introduction To Income TaxDANICKA JANE ENERONo ratings yet

- Ifrs 9 - Financial Instruments Review QuestionsDocument9 pagesIfrs 9 - Financial Instruments Review QuestionsHamad Sadiq100% (1)

- 7 Direct Taxes Case LawsDocument12 pages7 Direct Taxes Case Lawsmanishkhemka666No ratings yet

- Government GrantsDocument11 pagesGovernment GrantsChara etangNo ratings yet

- Impairment of Non Current Assets - Ias 36: - Impairment Is A Reduction To The Recoverable Amount of An Asset or ADocument89 pagesImpairment of Non Current Assets - Ias 36: - Impairment Is A Reduction To The Recoverable Amount of An Asset or ATram NguyenNo ratings yet

- Diversion of IncomeDocument11 pagesDiversion of IncomeSrivathsan NambiraghavanNo ratings yet

- Fa PresentationDocument40 pagesFa PresentationMithra AreeckalNo ratings yet

- SALESDocument2 pagesSALESIsaac Joshua AganonNo ratings yet

- Financial Derivatives CheatSheetDocument2 pagesFinancial Derivatives CheatSheetTiffanyNo ratings yet

- Gross IncomeDocument11 pagesGross IncomeNokubongaNo ratings yet

- IFRS 3 Business CombinationDocument5 pagesIFRS 3 Business CombinationImraz IqbalNo ratings yet

- Non-Probate Assets ChartDocument1 pageNon-Probate Assets ChartseabreezeNo ratings yet

- 119 Lich v. US RubberDocument2 pages119 Lich v. US RubberJai HoNo ratings yet

- Income Tax in Real Estate TransactionsDocument2 pagesIncome Tax in Real Estate TransactionsdavewagNo ratings yet

- 04 Regular Income Taxation Exclusions and Inclusions To Gross IncomeDocument22 pages04 Regular Income Taxation Exclusions and Inclusions To Gross IncomeRuth MuldongNo ratings yet

- Tax Presentation Capital and Revenue ReceiptsDocument16 pagesTax Presentation Capital and Revenue Receiptslloyd madanhire100% (1)

- Case Law Summary 2021Document19 pagesCase Law Summary 2021seshnaidooNo ratings yet

- 2023B HKTF - L8 - ProfitsDocument13 pages2023B HKTF - L8 - Profitseliu8866No ratings yet

- Summary of Case Laws of Direct TaxDocument14 pagesSummary of Case Laws of Direct TaxAvaniJainNo ratings yet

- Capital Budgeting - Risk and UncertaintyDocument67 pagesCapital Budgeting - Risk and Uncertaintykhaleel leoNo ratings yet

- Intermediate Accounting - Borrowing CostsDocument2 pagesIntermediate Accounting - Borrowing Costs22100629No ratings yet

- Cca CPP HcaDocument1 pageCca CPP Hcahusse fokNo ratings yet

- Purpose of ValuationDocument13 pagesPurpose of ValuationRajwinder Singh BansalNo ratings yet

- Ordinary DeductionDocument1 pageOrdinary DeductionXhaNo ratings yet

- TaxationDocument12 pagesTaxationKen ChiaNo ratings yet

- ADVACC NOTES - Business CombinationDocument5 pagesADVACC NOTES - Business CombinationAlyaNo ratings yet

- CA CS VIJAY SARDA VSMART Academy 8956651954Document9 pagesCA CS VIJAY SARDA VSMART Academy 8956651954naga jaganNo ratings yet

- Simulation Income MemoDocument1 pageSimulation Income MemoLaity FinchamNo ratings yet

- VIH VS UOF Orginal Case FileDocument103 pagesVIH VS UOF Orginal Case FileGowthaman KS -19BCHR0228No ratings yet

- Vodafone RulingDocument147 pagesVodafone RulingArchit AnandNo ratings yet

- Executive's Guide to Fair Value: Profiting from the New Valuation RulesFrom EverandExecutive's Guide to Fair Value: Profiting from the New Valuation RulesNo ratings yet

- 2010 06 24 - 172141 - P3 3aDocument4 pages2010 06 24 - 172141 - P3 3aVivian0% (1)

- Financial Management: Short-Term Financial PlanningDocument23 pagesFinancial Management: Short-Term Financial PlanningRao786No ratings yet

- Pension Calculation-UpdatedDocument3 pagesPension Calculation-UpdatedgcrajasekaranNo ratings yet

- Jurnal Penutup (Closing Entries)Document9 pagesJurnal Penutup (Closing Entries)apelina teresiaNo ratings yet

- YAMATCHA Case Study QuestionDocument37 pagesYAMATCHA Case Study QuestionAdesh MeshramNo ratings yet

- Coffeeville: Financial ProjectionsDocument6 pagesCoffeeville: Financial ProjectionsAndresPradaNo ratings yet

- Current Vs Non CurrentDocument23 pagesCurrent Vs Non CurrentRachelleNo ratings yet

- Balance Sheet of Bajaj AutoDocument6 pagesBalance Sheet of Bajaj Autogurjit20No ratings yet

- Midterm Exam (Reviewer)Document84 pagesMidterm Exam (Reviewer)Mj PamintuanNo ratings yet

- Financial Ratio AnalysisDocument2 pagesFinancial Ratio AnalysisFayad CalúNo ratings yet

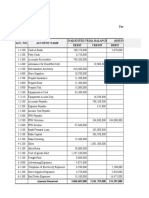

- Ud Buana Work Sheet: For Month Ended December 31, 2019Document12 pagesUd Buana Work Sheet: For Month Ended December 31, 2019fitryna99No ratings yet

- Mohammed Bilal Choudhary (Ju2021Mba14574) Activity - 1 Fsra 1Document4 pagesMohammed Bilal Choudhary (Ju2021Mba14574) Activity - 1 Fsra 1Md BilalNo ratings yet

- IRS Audit Guide For Farm Hobby LossesDocument81 pagesIRS Audit Guide For Farm Hobby LossesSpringer Jones, Enrolled Agent100% (1)

- Trust DeedDocument4 pagesTrust DeedNeetu PandeyNo ratings yet

- Accounting 1B HomeworkDocument3 pagesAccounting 1B HomeworketernitystarNo ratings yet

- Share-Based Payment: Indian Accounting Standard (Ind AS) 102Document90 pagesShare-Based Payment: Indian Accounting Standard (Ind AS) 102srinivasNo ratings yet

- Case - AmbujaDocument11 pagesCase - AmbujaJingwen YangNo ratings yet

- 4.0 Operations PlanDocument11 pages4.0 Operations PlanmohdfirdausNo ratings yet

- Uniform CostingDocument19 pagesUniform CostingASHISH NYAUPANENo ratings yet

- AFD Practice QuestionsDocument3 pagesAFD Practice QuestionsChandanaNo ratings yet

- Accounting For Management Question PaperDocument3 pagesAccounting For Management Question PaperVINOD KUMARNo ratings yet

- Chapter 11Document31 pagesChapter 11SeanNo ratings yet

- Chapter1 Overheads 2021 May StudentDocument11 pagesChapter1 Overheads 2021 May StudentPradeepNo ratings yet

- Ganga Tea Stall Cma NewDocument76 pagesGanga Tea Stall Cma NewappajiNo ratings yet

- Equity Research Analysis ShashankDocument24 pagesEquity Research Analysis ShashankVineet Pratap SinghNo ratings yet