Professional Documents

Culture Documents

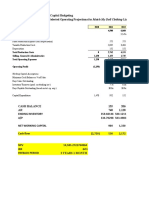

Cash Flow Statement For AAPL

Cash Flow Statement For AAPL

Uploaded by

Ezequiel FriossoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Flow Statement For AAPL

Cash Flow Statement For AAPL

Uploaded by

Ezequiel FriossoCopyright:

Available Formats

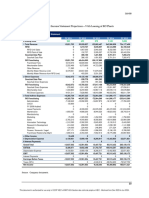

27/8/23, 12:58 Stock Rover Table

Cash Flow Statement for AAPL

USD in Millions CAGR TTM 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013

Cash Flows From

Operating Activities

Net income 10.2% 94,760 95,171 100,555 63,930 57,527 59,431 50,525 45,217 53,731 44,462 37,031

Depreciation and

5.0% 11,731 11,323 11,315 10,906 11,968 11,553 9,915 10,538 11,636 8,377 7,313

amortization

Deferred income taxes - 0 0 -4,034 76 -742 1,200 -29,223 4,798 777 3,291 1,215

Stock based

16.6% 10,486 9,678 8,151 7,139 6,219 5,603 4,880 4,388 3,776 3,070 2,389

compensation

Accounts receivable -13.6% 1,225 6,386 -3,114 -6,043 -2,870 5,378 -9,360 -1,104 3,756 -2,383 -2,602

Inventory - -2,135 -1,004 -1,011 -1,049 759 -682 -1,709 -261 -168 110 -667

Accounts payable - -1,234 -16,440 10,469 18,697 5,489 -11,928 21,746 5,103 -4,455 6,750 4,386

Other working capital - 0 147 797 2,437 730 -983 123 -1,483 68 1,037 1,216

Other non-cash items - -4,235 -1,055 -5 70 -740 -487 97 0 0 0 0

Other Cash Flows From

7.4% 2,474 4,984 -10,882 -7,242 -5,123 6,746 17,663 -1,779 5,886 6,051 2,629

Operating Activities

Net cash provided by

8.2% 113,072 109,190 112,241 88,921 73,217 75,831 64,657 65,417 75,007 70,765 52,910

operating activities

Cash Flows From

Investing Activities

Investments in property,

4.6% -12,085 -11,692 -10,388 -8,702 -9,247 -13,858 -11,927 -12,456 -11,642 -10,803 -7,833

plant and equipment

Acquisitions, net - 0 0 0 -575 -1,415 -715 -485 -228 -406 -3,263 -737

Purchases of investments -16.6% -27,701 -47,163 -104,802 -117,532 -70,620 -39,318 -146,975 -150,126 -169,323 -213,646 -159,694

Sales/Maturities of

-11.5% 41,367 53,015 94,333 127,984 108,818 90,149 118,497 118,709 126,788 199,226 133,843

investments

Purchases of intangibles - 0 0 0 0 0 0 -412 -506 -587 -231 -832

Other investing activities - -1,181 -1,547 -1,177 -380 -1,152 -758 388 -42 -389 76 -103

Other Cash Flows From

- -306 -306 -33 0 0 0 0 0 0 0 0

Investing Activities

Net cash used for

-72.1% 94 -7,693 -22,067 795 26,384 35,500 -40,914 -44,649 -55,559 -28,641 -35,356

investing activities

Cash Flows From

Financing Activities

Debt issued -4.2% 10,693 0 0 0 9,173 0 35,631 0 23,629 15,445 0

Debt repayment - -13,944 -18,158 -7,750 -12,629 -9,805 0 0 0 0 0 0

Long-term debt issued -4.2% 10,693 0 0 0 9,173 0 35,631 0 23,629 15,445 0

- -13,944 -10,944 -7,750 -12,629 -9,805 0 0 0 0 0 0

about:blank 1/2

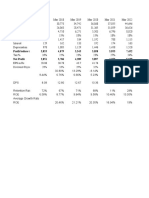

27/8/23, 12:58 Stock Rover Table

Long-term debt

repayment

Common stock issued - 0 0 0 878 783 0 0 494 464 676 588

Dividend paid 3.4% -14,970 -14,877 -14,586 -14,155 -14,090 -13,941 -12,978 -12,311 -11,729 -11,158 -10,840

Repurchases of treasury

12.5% -80,975 -88,399 -81,674 -76,427 -78,807 -71,439 -32,144 -33,710 -37,086 -45,001 -25,939

stock

Other financing activities 34.7% -5,947 -6,139 -6,751 -5,248 -2,999 -2,807 -1,656 -1,241 -875 -582 -336

Other Cash Flows From

2.1% -3,735 20,364 29,248 26,548 -6,330 -5,864 -37,107 25,682 -20,269 -11,548 16,896

Financing Activities

Net cash provided by

(used for) financing 19.8% -112,129 -118,153 -89,263 -93,662 -102,707 -94,051 -12,623 -21,086 -22,237 -36,723 -19,631

activities

Net change in cash -17.4% 1,037 -16,656 911 -3,946 -3,106 17,280 11,120 -318 -2,789 5,401 -2,077

Cash at beginning of

6.2% 28,861 38,630 37,719 41,665 44,771 27,491 16,371 16,689 19,478 14,077 16,154

period

Cash at end of period 8.1% 29,898 21,974 38,630 37,719 41,665 44,771 27,491 16,371 16,689 19,478 14,077

Free Cash Flow

Operating cash flow 8.2% 113,072 109,190 112,241 88,921 73,217 75,831 64,657 65,417 75,007 70,765 52,910

Capital expenditure 3.5% -12,085 -11,692 -10,388 -8,702 -9,247 -13,858 -12,339 -12,962 -12,229 -11,034 -8,665

Free cash flow 8.9% 100,987 97,498 101,853 80,219 63,970 61,973 52,318 52,455 62,778 59,731 44,245

about:blank 2/2

You might also like

- Wildcat Capital Case M&A Invesment Real EstateDocument7 pagesWildcat Capital Case M&A Invesment Real EstatePaco Colín8% (12)

- Delwarca SoftwareDocument5 pagesDelwarca SoftwareDivya Giri50% (4)

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Business Account Statement: Account Summary For This PeriodDocument3 pagesBusiness Account Statement: Account Summary For This PeriodLisa WeberNo ratings yet

- Standalone Kitchen Model WorkingDocument3 pagesStandalone Kitchen Model WorkingSujith psNo ratings yet

- Session 3 - Valuation Model - AirportsDocument105 pagesSession 3 - Valuation Model - AirportsPrathamesh GoreNo ratings yet

- BMW CaseDocument6 pagesBMW CaseAswani B Raj100% (2)

- Abbott Laboratories (Pakistan) Limited-1Document9 pagesAbbott Laboratories (Pakistan) Limited-1Shahrukh1994007No ratings yet

- IFS - Simple Three Statement ModelDocument1 pageIFS - Simple Three Statement ModelThanh NguyenNo ratings yet

- 4th Quarterly Report 074-75-StatementDocument1 page4th Quarterly Report 074-75-StatementDamodarNo ratings yet

- 1.pfizer Limited Annual Report 2014-15Document129 pages1.pfizer Limited Annual Report 2014-152023mb21039No ratings yet

- PDF Eng 23Document1 pagePDF Eng 23Santiago et AlejandraNo ratings yet

- Sarvajal Balance 211028-PDF-ENG-21Document1 pageSarvajal Balance 211028-PDF-ENG-21Santiago et AlejandraNo ratings yet

- Profit Before T 3,853 4,879 5,543 5,058 5,953 7,452 Net Profit 2,851 3,786 4,289 3,897 4,353 5,630Document19 pagesProfit Before T 3,853 4,879 5,543 5,058 5,953 7,452 Net Profit 2,851 3,786 4,289 3,897 4,353 5,630Abhishek M. ANo ratings yet

- DCF 2 CompletedDocument4 pagesDCF 2 CompletedPragathi T NNo ratings yet

- Flash Memory FinancialsDocument5 pagesFlash Memory FinancialsPaolo EscalonaNo ratings yet

- Datasets 523573 961112 Costco-DataDocument4 pagesDatasets 523573 961112 Costco-DataAnish DalmiaNo ratings yet

- FMOD PROJECT Ouijhggfffe5Document97 pagesFMOD PROJECT Ouijhggfffe5Omer CrestianiNo ratings yet

- FM Assignment 1.1Document36 pagesFM Assignment 1.1Zee ArainNo ratings yet

- Pakistan Petroleum LTDDocument43 pagesPakistan Petroleum LTDMuheeb AhmadNo ratings yet

- Dersnot 1372 1684245035Document6 pagesDersnot 1372 1684245035Murat SiyahkayaNo ratings yet

- Hira Textile Mill Horizontal Analysis 2015-13Document9 pagesHira Textile Mill Horizontal Analysis 2015-13sumeer shafiqNo ratings yet

- Accounting ProjectDocument16 pagesAccounting Projectnawal jamshaidNo ratings yet

- Absa Bank Data Mar 2022 - Sep 2022Document3 pagesAbsa Bank Data Mar 2022 - Sep 2022munyoreNo ratings yet

- MPCLDocument4 pagesMPCLRizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- FMOD PROJECT WeefervDocument13 pagesFMOD PROJECT WeefervOmer CrestianiNo ratings yet

- Askari Bank Limited Financial Statement AnalysisDocument16 pagesAskari Bank Limited Financial Statement AnalysisAleeza FatimaNo ratings yet

- Avenue SuperDocument19 pagesAvenue Superanuda29102001No ratings yet

- Sir Sarwar AFSDocument41 pagesSir Sarwar AFSawaischeemaNo ratings yet

- AUTODocument239 pagesAUTOajnigelNo ratings yet

- PLDT Inc. PLDT Inc.: Subscribe Sign inDocument3 pagesPLDT Inc. PLDT Inc.: Subscribe Sign inGio HermosoNo ratings yet

- IFS Dividends IntroductionDocument2 pagesIFS Dividends IntroductionMohamedNo ratings yet

- SIRA1H11Document8 pagesSIRA1H11Inde Pendent LkNo ratings yet

- Assignment 2 - Strategic Financial Management - Abdulhakeem MustafaDocument7 pagesAssignment 2 - Strategic Financial Management - Abdulhakeem MustafaHakeem SnrNo ratings yet

- UBL Annual Report 2018-128Document1 pageUBL Annual Report 2018-128IFRS LabNo ratings yet

- Financial Model 3 Statement Model - Final - MotilalDocument13 pagesFinancial Model 3 Statement Model - Final - MotilalSouvik BardhanNo ratings yet

- Balance Sheet of Engro FoodsDocument20 pagesBalance Sheet of Engro FoodsMuhib NoharioNo ratings yet

- Heritage Dolls CaseDocument8 pagesHeritage Dolls Casearun jacobNo ratings yet

- Pran Company Ratio AnalysisDocument6 pagesPran Company Ratio AnalysisAhmed Afridi Bin FerdousNo ratings yet

- Hira Textile Mill Horizontal Analysis 2014-13 1Document8 pagesHira Textile Mill Horizontal Analysis 2014-13 1sumeer shafiqNo ratings yet

- Financial Statements Analysis: Arsalan FarooqueDocument31 pagesFinancial Statements Analysis: Arsalan FarooqueMuhib NoharioNo ratings yet

- Wipro Afm DataDocument5 pagesWipro Afm DataDevam DixitNo ratings yet

- Swedish Match 9 212 017Document6 pagesSwedish Match 9 212 017Karan AggarwalNo ratings yet

- Auditors Report: Financial Result 2005-2006Document11 pagesAuditors Report: Financial Result 2005-2006Hay JirenyaaNo ratings yet

- Financial Projections For FeasibilityDocument38 pagesFinancial Projections For Feasibilitysaima.aNo ratings yet

- Case 14 ExcelDocument8 pagesCase 14 ExcelRabeya AktarNo ratings yet

- Boston Chicken CaseDocument7 pagesBoston Chicken CaseDji YangNo ratings yet

- Confidence Cement LTD: Income StatementDocument20 pagesConfidence Cement LTD: Income StatementIftekar Hasan SajibNo ratings yet

- 5-Years 240301 203955Document11 pages5-Years 240301 203955aditiassociates19No ratings yet

- Ifs 2024Document1 pageIfs 2024rafiqueahmad9898No ratings yet

- Ifs 2024Document1 pageIfs 2024rafiqueahmad9898No ratings yet

- Baru Baru - PT X - Study Case 5Document98 pagesBaru Baru - PT X - Study Case 5Kojiro FuumaNo ratings yet

- Balance SheetDocument10 pagesBalance SheetYASHASWI 20212166No ratings yet

- Adani Enterprises 3 Statement F.MDocument15 pagesAdani Enterprises 3 Statement F.MArnav DasNo ratings yet

- BHEL Valuation of CompanyDocument23 pagesBHEL Valuation of CompanyVishalNo ratings yet

- Financial Statement UltimateDocument52 pagesFinancial Statement UltimateTEDY TEDYNo ratings yet

- Company Name: Reneta LTD.: Group MemberDocument19 pagesCompany Name: Reneta LTD.: Group MemberMehenaj Sultana BithyNo ratings yet

- FS AccountngDocument3 pagesFS Accountngperezzzzmay06No ratings yet

- Ratios and WACCDocument70 pagesRatios and WACCABHIJEET BHUNIA MBA 2021-23 (Delhi)No ratings yet

- M Saeed 20-26 ProjectDocument30 pagesM Saeed 20-26 ProjectMohammed Saeed 20-26No ratings yet

- MB Annual FS 2019 (May 12, 2020) - Final DraftDocument164 pagesMB Annual FS 2019 (May 12, 2020) - Final DraftDilip Devidas JoshiNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Spokesperson, Honda Motorcycle & Scooter India Pvt. LTD., in 2005Document4 pagesSpokesperson, Honda Motorcycle & Scooter India Pvt. LTD., in 2005Sheetal Shinde YewaleNo ratings yet

- Report PDF Response ServletDocument3 pagesReport PDF Response ServletAnita KumariNo ratings yet

- PercentagesDocument2 pagesPercentagesTimNo ratings yet

- Multiple Choice - Problems Part 1: A. Percentage TaxDocument8 pagesMultiple Choice - Problems Part 1: A. Percentage TaxWearIt Co.No ratings yet

- IT FY 2019-20 Update On 22-12-2019Document31 pagesIT FY 2019-20 Update On 22-12-2019ChandraPrakashNo ratings yet

- HRF44 Manpower Request Form Rev 02Document1 pageHRF44 Manpower Request Form Rev 02Ulhas KavathekarNo ratings yet

- Hong Kong Architecture 1945 - 2015 - From Colonial To GlobalDocument356 pagesHong Kong Architecture 1945 - 2015 - From Colonial To GlobalQuang Hoành Lê100% (1)

- Kursi Hindi MovieDocument19 pagesKursi Hindi MovieJagadish PrasadNo ratings yet

- GHMPI - PSE Exhibit 10 Preliminary Prospectus PDFDocument163 pagesGHMPI - PSE Exhibit 10 Preliminary Prospectus PDFFrancis Augustus RagatNo ratings yet

- Global Periodontal Disease Therapeutics MarketDocument3 pagesGlobal Periodontal Disease Therapeutics MarketiHealthcareAnalyst, Inc.No ratings yet

- Airtel Zain AcquisitionDocument14 pagesAirtel Zain AcquisitionAshish Sharma100% (1)

- Edited 12Document74 pagesEdited 12Mikiyas TeshomeNo ratings yet

- Growing Pains at GrouponDocument18 pagesGrowing Pains at GrouponEddie Maddalena100% (3)

- (Cpar2016) Tax-8002 (Individual Taxpayer)Document10 pages(Cpar2016) Tax-8002 (Individual Taxpayer)Ralph SantosNo ratings yet

- Tahir Qarayev Accounting Imtahan SuallariDocument6 pagesTahir Qarayev Accounting Imtahan SuallariEli HüseynovNo ratings yet

- Mit PDFDocument197 pagesMit PDFgayathriNo ratings yet

- Answers To Textbook Problems: and Price PDocument3 pagesAnswers To Textbook Problems: and Price PThaliaNo ratings yet

- Analysis On Customer Service Department Activities Of: HBL, Itahari BranchDocument50 pagesAnalysis On Customer Service Department Activities Of: HBL, Itahari BranchSujan BajracharyaNo ratings yet

- Topic 3 - PartnershipDocument49 pagesTopic 3 - PartnershipAdam KhaleelNo ratings yet

- Global Compensation, Benefits & TaxesDocument34 pagesGlobal Compensation, Benefits & TaxesSunny Deo Bhakta100% (1)

- Aman GuptaDocument50 pagesAman GuptaAman GuptaNo ratings yet

- LFLTDocument3 pagesLFLTYsah CorreaNo ratings yet

- August 7 - Esc LetterDocument3 pagesAugust 7 - Esc LetterHad LeyNo ratings yet

- Forensic Accounting Cheat SheetDocument2 pagesForensic Accounting Cheat SheetLong SuccessNo ratings yet

- Chapter 3 Performance EvaluationDocument26 pagesChapter 3 Performance EvaluationHafeezNo ratings yet

- 1.4 StakeholdersDocument12 pages1.4 StakeholdersThanh TranNo ratings yet

- HVS - 2009 Hotel Development Cost SurveyDocument8 pagesHVS - 2009 Hotel Development Cost SurveyAmir Khalil SanjaniNo ratings yet