Professional Documents

Culture Documents

Statement For AAPL

Statement For AAPL

Uploaded by

Ezequiel Friosso0 ratings0% found this document useful (0 votes)

2 views1 pageOriginal Title

S

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views1 pageStatement For AAPL

Statement For AAPL

Uploaded by

Ezequiel FriossoCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

27/8/23, 12:55 Stock Rover Table

Statement for AAPL

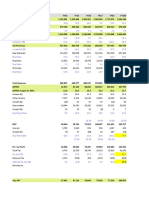

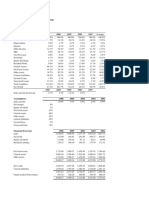

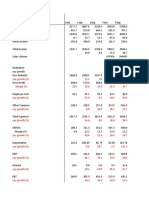

USD in Millions CAGR TTM 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013

Income Statement

Revenue 8.5% 383,933 387,537 378,323 294,135 267,683 261,612 239,176 218,118 234,988 199,800 173,992

Operating Income 8.9% 112,226 113,965 116,903 74,253 66,153 67,970 64,259 59,212 71,155 59,286 49,252

Net income 10.2% 94,760 95,171 100,555 63,930 57,527 59,431 50,525 45,217 53,731 44,462 37,031

Earnings per share

15.8% $5.96 $5.89 $6.03 $3.71 $3.17 $3.05 $2.44 $2.10 $2.36 $1.86 $1.44

diluted

Average shares diluted -4.9% 15,924 16,185 16,716 17,352 18,277 19,616 20,837 21,735 22,885 24,062 25,766

P/E Ratio 8.1% 29.9 21.3 31.7 40.5 24.7 13.3 18.4 14.0 11.4 17.1 14.1

Balance Sheet

Cash 4.5% 62,482 51,355 63,913 76,826 107,162 86,427 77,153 60,452 38,074 32,463 40,711

Current assets 4.5% 122,659 128,777 153,154 154,106 163,231 140,828 143,810 103,332 76,219 83,403 80,347

Net Property, Plant and

11.3% 43,550 42,951 39,245 37,933 37,031 39,597 33,679 26,510 22,300 20,392 15,488

Equipment

Working Capital - -2,304 -8,509 5,580 21,599 61,070 32,545 28,022 19,202 127 9,792 26,578

Net Debt 33.1% 46,798 59,755 58,885 35,217 1,130 28,303 45,247 27,097 24,889 3,940 -23,750

Stockholders' Equity -7.6% 60,274 56,727 71,932 66,224 89,531 117,892 140,199 132,390 128,267 123,328 129,684

Cash Flow

Operating Cash Flow 8.2% 113,072 109,190 112,241 88,921 73,217 75,831 64,657 65,417 75,007 70,765 52,910

Cap Ex 3.5% -12,085 -11,692 -10,388 -8,702 -9,247 -13,858 -12,339 -12,962 -12,229 -11,034 -8,665

Free Cash Flow 8.9% 100,987 97,498 101,853 80,219 63,970 61,973 52,318 52,455 62,778 59,731 44,245

Free Cash Flow per share 14.5% $6.34 $6.02 $6.09 $4.62 $3.50 $3.16 $2.51 $2.41 $2.74 $2.48 $1.72

Profitability

Operating Margin 0.3% 29.2% 29.4% 30.9% 25.2% 24.7% 26.0% 26.9% 27.1% 30.3% 29.7% 28.3%

Return on Assets 4.2% 27.7% 26.9% 29.2% 19.4% 16.6% 15.9% 14.4% 14.7% 19.9% 19.8% 18.5%

Return on Equity 19.3% 157.2% 167.8% 139.8% 96.5% 64.3% 50.4% 36.0% 34.2% 41.9% 36.1% 28.6%

Return on Invested

9.0% 58.1% 58.6% 53.0% 37.4% 30.8% 27.0% 20.2% 21.3% 28.6% 28.1% 25.4%

Capital

Dividends

Dividends Per Share 8.9% $0.96 $0.91 $0.86 $0.81 $0.76 $0.70 $0.61 $0.56 $0.51 $0.46 $0.42

Dividend Yield -13.5% 0.5% 0.7% 0.5% 0.6% 1.1% 1.9% 1.5% 2.0% 2.0% 1.7% 2.2%

Dividend Growth -2.1% 7.9% 5.2% 7.1% 6.2% 7.8% 14.6% 10.3% 9.9% 10.0% 9.5% -

Dividend Coverage 6.7% 6.4x 6.5x 7.0x 4.6x 4.2x 4.4x 4.0x 3.8x 4.7x 4.1x 3.4x

about:blank 1/1

You might also like

- Data For Ratio Detective ExerciseDocument1 pageData For Ratio Detective ExercisemaritaputriNo ratings yet

- Basic Banking Account As of Feburary 14, 2020: Checking Opening Balance Closing BalanceDocument2 pagesBasic Banking Account As of Feburary 14, 2020: Checking Opening Balance Closing BalanceKellogg Delia100% (1)

- Lupin's Foray Into Japan - SolutionDocument14 pagesLupin's Foray Into Japan - Solutionvardhan100% (1)

- Gainesboro SolutionDocument7 pagesGainesboro SolutionakashNo ratings yet

- Project Topics On FinanceDocument50 pagesProject Topics On Financepnarona83% (23)

- Chapter I AnswersDocument2 pagesChapter I AnswersBeverly Exaure100% (9)

- Income Statement For AAPLDocument1 pageIncome Statement For AAPLEzequiel FriossoNo ratings yet

- DCF ModelDocument51 pagesDCF Modelhugoe1969No ratings yet

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- Adidas/Reebok Merger: Collin Shaw Kelly Truesdale Michael Rockette Benedikte Schmidt SaravanansadaiyappanDocument27 pagesAdidas/Reebok Merger: Collin Shaw Kelly Truesdale Michael Rockette Benedikte Schmidt SaravanansadaiyappanUdipta DasNo ratings yet

- Tech MahindraDocument17 pagesTech Mahindrapiyushpatil749No ratings yet

- MFL 1 Cfin2Document17 pagesMFL 1 Cfin2Siddharth SureshNo ratings yet

- Private Sector Banks Comparative Analysis 1HFY22Document12 pagesPrivate Sector Banks Comparative Analysis 1HFY22Tushar Mohan0% (1)

- Y-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesDocument45 pagesY-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesSHIKHA CHAUHANNo ratings yet

- India Retail ForecastDocument2 pagesIndia Retail Forecastapi-3751572No ratings yet

- Chapter 26: Financial Planning & StrategyDocument3 pagesChapter 26: Financial Planning & StrategyMukul KadyanNo ratings yet

- Ceres Gardening - Case (1) ProfesorDocument1 pageCeres Gardening - Case (1) Profesorpeta8805No ratings yet

- Financial Model of Dmart - 5Document4 pagesFinancial Model of Dmart - 5Shivam DubeyNo ratings yet

- Britannia IndustriesDocument12 pagesBritannia Industriesmundadaharsh1No ratings yet

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005No ratings yet

- 2022.07.24 - DCF Tutorial Answer KeyDocument18 pages2022.07.24 - DCF Tutorial Answer KeySrikanth ReddyNo ratings yet

- Cigniti - Group 3 - BFBVDocument24 pagesCigniti - Group 3 - BFBVpgdm22srijanbNo ratings yet

- Lumax IndustriesDocument33 pagesLumax IndustriesAshutosh GuptaNo ratings yet

- Rosetta Stone IPODocument5 pagesRosetta Stone IPOFatima Ansari d/o Muhammad AshrafNo ratings yet

- Samsung Electronics: Earnings Release Q4 2020Document8 pagesSamsung Electronics: Earnings Release Q4 2020Aidə MəmmədzadəNo ratings yet

- AFDMDocument6 pagesAFDMAhsan IqbalNo ratings yet

- Pakistan State Oil Company Limited (Pso)Document6 pagesPakistan State Oil Company Limited (Pso)Maaz HanifNo ratings yet

- Data For Ratio DetectiveDocument1 pageData For Ratio DetectiveRoyan Nur HudaNo ratings yet

- AstralDocument32 pagesAstralalistair7682No ratings yet

- Radico KhaitanDocument38 pagesRadico Khaitantapasya khanijouNo ratings yet

- DCF Trident 2Document20 pagesDCF Trident 2Jayant JainNo ratings yet

- Public Sector Banks Comparative Analysis 3QFY24Document10 pagesPublic Sector Banks Comparative Analysis 3QFY24Sujay AnanthakrishnaNo ratings yet

- FY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualDocument7 pagesFY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualramNo ratings yet

- Book1 2Document10 pagesBook1 2Aakash SinghalNo ratings yet

- BFS Du Point Analysis BR6 Axis BankDocument27 pagesBFS Du Point Analysis BR6 Axis BankMadhusudhanan RameshkumarNo ratings yet

- Airthreads Valuation Case Study Excel File PDF FreeDocument18 pagesAirthreads Valuation Case Study Excel File PDF Freegoyalmuskan412No ratings yet

- Mercury Athletic Footwear Case (Work Sheet)Document16 pagesMercury Athletic Footwear Case (Work Sheet)Bharat KoiralaNo ratings yet

- 04 02 BeginDocument2 pages04 02 BeginnehaNo ratings yet

- Imf CDocument12 pagesImf Cerich canaviriNo ratings yet

- ModelDocument103 pagesModelMatheus Augusto Campos PiresNo ratings yet

- Gymboree LBO Model ComDocument7 pagesGymboree LBO Model ComrolandsudhofNo ratings yet

- 唯品会估值模型Document21 pages唯品会估值模型Yiang QinNo ratings yet

- Amazon DCF: Ticker Implied Share Price Date Current Share PriceDocument4 pagesAmazon DCF: Ticker Implied Share Price Date Current Share PriceFrancesco GliraNo ratings yet

- Axiata Data Financials 4Q21bDocument11 pagesAxiata Data Financials 4Q21bhimu_050918No ratings yet

- Macr Working ExcelDocument2 pagesMacr Working Excelanish mahtoNo ratings yet

- Adidas Chartgenerator ArDocument2 pagesAdidas Chartgenerator ArTrần Thuỳ NgânNo ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- Narration Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20Document10 pagesNarration Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20deepanshuNo ratings yet

- Summary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Document4 pagesSummary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Sanjaya WijesekareNo ratings yet

- Caso PolaroidDocument45 pagesCaso PolaroidByron AlarcònNo ratings yet

- Allahabad Bank Sep 09Document5 pagesAllahabad Bank Sep 09chetandusejaNo ratings yet

- 2017 4Q Earnings Release Samsung ElectronicsDocument8 pages2017 4Q Earnings Release Samsung ElectronicsAlin RewaxisNo ratings yet

- Narration Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Trailing Best Case Worst CaseDocument30 pagesNarration Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Trailing Best Case Worst CasenhariNo ratings yet

- Pakistan Inflation RATE (%) Exchange Rate (LCU Per USD, Period Avg) Foreign Reserve (Million $) Unemployment RATE (%)Document5 pagesPakistan Inflation RATE (%) Exchange Rate (LCU Per USD, Period Avg) Foreign Reserve (Million $) Unemployment RATE (%)Neelofer GulNo ratings yet

- Narration Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 Dec-18 Dec-19 Dec-20 Dec-21 Dec-22 Trailing Best Case Worst CaseDocument32 pagesNarration Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 Dec-18 Dec-19 Dec-20 Dec-21 Dec-22 Trailing Best Case Worst CaseXicaveNo ratings yet

- IM ProjectDocument24 pagesIM ProjectDäzzlîñg HärîshNo ratings yet

- UPS1Document6 pagesUPS1Joana BarbaronaNo ratings yet

- Ten Year Review - Standalone: Asian Paints LimitedDocument10 pagesTen Year Review - Standalone: Asian Paints Limitedmaruthi631No ratings yet

- Primo BenzinaDocument30 pagesPrimo BenzinaSofía MargaritaNo ratings yet

- Axisbank Financial Statements Summary AJ WorksDocument12 pagesAxisbank Financial Statements Summary AJ WorksSoorajKrishnanNo ratings yet

- Krakatau Steel A CaseDocument9 pagesKrakatau Steel A CaseFarhan SoepraptoNo ratings yet

- %sales Discount %yoy 18.5% 22.5% 1.8%Document2 pages%sales Discount %yoy 18.5% 22.5% 1.8%Linh NguyenNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Introduction of International FinanceDocument29 pagesIntroduction of International FinanceZubair13260% (1)

- Asian Paints Annual Report 2016-17Document2 pagesAsian Paints Annual Report 2016-17Amit Pandey0% (1)

- Judgment: NDPP V RudmanDocument20 pagesJudgment: NDPP V RudmanTiso Blackstar GroupNo ratings yet

- Tutorial 02Document3 pagesTutorial 02Jeyaletchumy Nava RatinamNo ratings yet

- 5900132050Document2 pages5900132050Edwin Andres Giraldo GuisaoNo ratings yet

- An Analysis of Non-Performing Loans of Uttara Corporate Branch of Janata Bank LimitedDocument44 pagesAn Analysis of Non-Performing Loans of Uttara Corporate Branch of Janata Bank LimitedS.M. Aminul HaqueNo ratings yet

- BIS Primer PDFDocument71 pagesBIS Primer PDFutah777No ratings yet

- GCC Equity Research EmaarDocument12 pagesGCC Equity Research EmaarSmit VithalaniNo ratings yet

- Effect of Microfinance BanksDocument12 pagesEffect of Microfinance BanksRoberto Colas SaingNo ratings yet

- 16 Risk and Rates of Return Problems For Online ClassDocument6 pages16 Risk and Rates of Return Problems For Online ClassJemNo ratings yet

- Case 13-2 Amerbran CompanyDocument37 pagesCase 13-2 Amerbran CompanyZati Ga'in100% (1)

- Basic Documents and Transactions Related To BankDocument31 pagesBasic Documents and Transactions Related To BankJerima PilleNo ratings yet

- March Payroll 2022 F FFFDocument45 pagesMarch Payroll 2022 F FFFJale Ann A. EspañolNo ratings yet

- Ethnography The Hamar Tribe of EthiopiaDocument22 pagesEthnography The Hamar Tribe of Ethiopiaapi-341269388No ratings yet

- BondsDocument3 pagesBondsLiezel CincoNo ratings yet

- Grade 8 EMS Classic Ed GuideDocument41 pagesGrade 8 EMS Classic Ed GuideMartyn Van ZylNo ratings yet

- GSTR3B 10DJKPP0543R1ZW 082020Document3 pagesGSTR3B 10DJKPP0543R1ZW 082020siwantaxsolution1No ratings yet

- 46377bosfinal p2 cp13Document30 pages46377bosfinal p2 cp13Shashank gunnerNo ratings yet

- Present Value Table: N Number of Periods Until Payment or ReceiptDocument3 pagesPresent Value Table: N Number of Periods Until Payment or ReceiptDWI NURDIANSYAH AMBARITANo ratings yet

- Date Particulars Withdrawals Deposits BalanceDocument2 pagesDate Particulars Withdrawals Deposits BalancePrathapa Naveen KumarNo ratings yet

- State Bank of IndiaDocument2 pagesState Bank of IndiaSADASHIV TIWARINo ratings yet

- T Q C 1: C C A: EST Uestions For Hapter Omparable Ompanies NalysisDocument14 pagesT Q C 1: C C A: EST Uestions For Hapter Omparable Ompanies NalysisHe HaoNo ratings yet

- ACE Traditional IC Online Mock Exam - 08182021Document8 pagesACE Traditional IC Online Mock Exam - 08182021Ana FelicianoNo ratings yet

- Fortune Street - Venture Card List - Wii - by Paladin - Rolan - GameFAQsDocument41 pagesFortune Street - Venture Card List - Wii - by Paladin - Rolan - GameFAQsDelta 3DNo ratings yet

- Negotiable Instruments Law Case DoctrinesDocument32 pagesNegotiable Instruments Law Case DoctrinesDenn Reed Tuvera Jr.No ratings yet

- Pas 16Document23 pagesPas 16AnneNo ratings yet

- 14 Checking in at The AirportDocument20 pages14 Checking in at The AirportNESTOR ALFREDO SANCHEZ HERNANDEZNo ratings yet