Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

14 viewsNAI Lease Vs Buy Model

NAI Lease Vs Buy Model

Uploaded by

ozart visual grafxCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Bonnie Road ModelDocument14 pagesBonnie Road Modelmzhao8100% (1)

- SAP FICO T-CODE - XLSX FINAL 2021Document23 pagesSAP FICO T-CODE - XLSX FINAL 2021Raju Bothra100% (2)

- DanitaCronkhite1 MT 482 Assignment Unit 7Document10 pagesDanitaCronkhite1 MT 482 Assignment Unit 7leeyaa aNo ratings yet

- Acc 101 QuestionsDocument6 pagesAcc 101 QuestionsSamuel100% (1)

- Simple LBODocument16 pagesSimple LBOsingh0001No ratings yet

- FI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeyDocument10 pagesFI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeySer Ronell0% (1)

- 29116520Document6 pages29116520Rendy Setiadi MangunsongNo ratings yet

- Chap 11 FMDocument10 pagesChap 11 FMabdul salamNo ratings yet

- Canyon Transport: Perform Financial CalculationsDocument7 pagesCanyon Transport: Perform Financial CalculationsManoj TeliNo ratings yet

- Primus AutomationDocument23 pagesPrimus AutomationhimanshusangaNo ratings yet

- Financial Position For The Year Ending 30/6/2009: Bank AccountDocument19 pagesFinancial Position For The Year Ending 30/6/2009: Bank Accountapi-26147386No ratings yet

- Buford StarbucksDocument7 pagesBuford StarbucksRESHMANo ratings yet

- Case Primus AutomationDocument26 pagesCase Primus AutomationHeniNo ratings yet

- DCF ModelDocument4 pagesDCF Modeljuilee bhoirNo ratings yet

- Primus Automation: Robert Clark Rey Mendez Nate Wills Katie YoungDocument26 pagesPrimus Automation: Robert Clark Rey Mendez Nate Wills Katie YoungfmulyanaNo ratings yet

- Reversion Net Operating Income:: Five Year Leveraged IRR AnalysisDocument15 pagesReversion Net Operating Income:: Five Year Leveraged IRR Analysisalexs617No ratings yet

- Primus Calculation Syndicate 6Document58 pagesPrimus Calculation Syndicate 6Bayu Aji PrasetyoNo ratings yet

- Essendon Project 3Document4 pagesEssendon Project 3matthew.epark29No ratings yet

- Income Value para Real EstateDocument13 pagesIncome Value para Real EstateJuan G ScharffenorthNo ratings yet

- Financial Instruments - Suggested AnswersDocument10 pagesFinancial Instruments - Suggested Answerspratikdubey9586No ratings yet

- Running Finance ExerciseDocument11 pagesRunning Finance Exercisew_fibNo ratings yet

- Exam ReDocument26 pagesExam ReVishal VermaNo ratings yet

- Bab VII - Soal2 Dan Solusi No. 7.07 N 7.08Document8 pagesBab VII - Soal2 Dan Solusi No. 7.07 N 7.08Adilla KhulaidahNo ratings yet

- Small Bank Pro Forma Model: Balance Sheets Thousand $Document5 pagesSmall Bank Pro Forma Model: Balance Sheets Thousand $jam7ak3275No ratings yet

- Resale Op Pro - FormaDocument1 pageResale Op Pro - FormasouthpointpgNo ratings yet

- Lease Finance - 1Document10 pagesLease Finance - 1don_mahinNo ratings yet

- Cash Flow: AssumptionsDocument3 pagesCash Flow: AssumptionsGolamMostafaNo ratings yet

- Share Warrants: Note: Insert "0" at Quoted Price W/out Warrants If It Is ISSUED WITHOUT WARRANTSDocument15 pagesShare Warrants: Note: Insert "0" at Quoted Price W/out Warrants If It Is ISSUED WITHOUT WARRANTSNickey DickeyNo ratings yet

- A.cre Hotel Acquisition Model Basic v1.11 c0gtm7Document28 pagesA.cre Hotel Acquisition Model Basic v1.11 c0gtm7Patrick ChibabulaNo ratings yet

- Obtain A Bank Loan For 100% of The Purchase Price, or It Can Lease The Machinery. Assume That The Following Facts ApplyDocument4 pagesObtain A Bank Loan For 100% of The Purchase Price, or It Can Lease The Machinery. Assume That The Following Facts Applydahnil dicardoNo ratings yet

- Multifamily Apartment ProformaDocument4 pagesMultifamily Apartment Proformaartsan3No ratings yet

- Walmart DCF-ModelDocument4 pagesWalmart DCF-ModelVonn VonNo ratings yet

- 3 Statement Model PracticeDocument10 pages3 Statement Model Practicecvassos12No ratings yet

- Basic Rental Analysis WorksheetDocument8 pagesBasic Rental Analysis WorksheetGleb petukhovNo ratings yet

- Financial Analysis DashboardDocument11 pagesFinancial Analysis DashboardZidan ZaifNo ratings yet

- Managements Discussion Analysis 2022Document111 pagesManagements Discussion Analysis 2022arvind sharmaNo ratings yet

- Cash Flow: AssumptionsDocument3 pagesCash Flow: AssumptionsSudhanshu Kumar SinghNo ratings yet

- 9.+LBO+Model ABC AfterDocument14 pages9.+LBO+Model ABC Afterashishvani1992No ratings yet

- DCF-Model - TemplateDocument5 pagesDCF-Model - TemplatebysqqqdxNo ratings yet

- Chapter 7 PDFDocument18 pagesChapter 7 PDFJay BrockNo ratings yet

- Problem 5-1Document7 pagesProblem 5-1Tammy AckleyNo ratings yet

- PayTM FinancialsDocument43 pagesPayTM FinancialststNo ratings yet

- Adelia Marhamah. 4C Lat 42 Moonstruck CompanyDocument10 pagesAdelia Marhamah. 4C Lat 42 Moonstruck Companyanisa MuzaqiNo ratings yet

- Valuation Final ExamDocument4 pagesValuation Final ExamJeane Mae Boo100% (1)

- 2008-2-00474-TI LampiranDocument3 pages2008-2-00474-TI LampiranMuhamad AzwarNo ratings yet

- Managements Discussion Analysis 2023Document116 pagesManagements Discussion Analysis 2023rootin.tootin.012No ratings yet

- Master Excel ResourcesDocument115 pagesMaster Excel ResourcesSarthak ShuklaNo ratings yet

- OM 650 SW 1 10pagesDocument10 pagesOM 650 SW 1 10pagesjuan ospinaNo ratings yet

- 2019 2016Document149 pages2019 2016MONTSERRAT VICTORIA MIRANDA BORDANo ratings yet

- Chapter 13 Direct Finance LeaseDocument6 pagesChapter 13 Direct Finance LeaseLady Pila0% (1)

- CiplaDocument9 pagesCiplaShivam GoelNo ratings yet

- Mercury Athletic Footwear Answer Key FinalDocument41 pagesMercury Athletic Footwear Answer Key FinalFatima ToapantaNo ratings yet

- Financial Modeling - Module I - Workbook 09.28.09Document38 pagesFinancial Modeling - Module I - Workbook 09.28.09rabiaasimNo ratings yet

- CC 0742 - 2031 AnnuityDocument1 pageCC 0742 - 2031 AnnuityterrygohNo ratings yet

- Ratio Analysis For CADocument7 pagesRatio Analysis For CAShahid MahmudNo ratings yet

- Commercial Real Estate Valuation Model1Document2 pagesCommercial Real Estate Valuation Model1cjsb99No ratings yet

- Bac 3 Review QNSDocument16 pagesBac 3 Review QNSsaidkhatib368No ratings yet

- Twice Incorporated: Percentage of Recov For USC W/o 35%Document4 pagesTwice Incorporated: Percentage of Recov For USC W/o 35%Paolo LocquiaoNo ratings yet

- Kuis Manajemen Keuangan - Manajemen UIDocument16 pagesKuis Manajemen Keuangan - Manajemen UIjadwal SekjenNo ratings yet

- Tugas Pak Sujono Pak Dimas MMDocument2 pagesTugas Pak Sujono Pak Dimas MMDimas GhiffariNo ratings yet

- 3402 N Shadeland Ave Flex Proforma 10-23 Blacked OutDocument1 page3402 N Shadeland Ave Flex Proforma 10-23 Blacked OutJuan bastoNo ratings yet

- Bangalore University Previous Year Question Paper AFM 1Document3 pagesBangalore University Previous Year Question Paper AFM 1Ramakrishna NagarajaNo ratings yet

- UntitledDocument6 pagesUntitledÂn LyNo ratings yet

- Sansera DRHPDocument384 pagesSansera DRHPAadi ChintawarNo ratings yet

- Maynard2e Mcqs ACCA F72015junDocument7 pagesMaynard2e Mcqs ACCA F72015junDesmanto HermanNo ratings yet

- ACC XI SEE QP For RevisionDocument31 pagesACC XI SEE QP For Revisionvarshitha reddyNo ratings yet

- Chap 006Document15 pagesChap 006Phan AnhNo ratings yet

- Food Business Accounting and FinanceDocument114 pagesFood Business Accounting and FinanceDavid SamuelNo ratings yet

- Management Accounting ProjectDocument15 pagesManagement Accounting Projecturvigarg079No ratings yet

- 1 - Ledger and Trial BalanceDocument4 pages1 - Ledger and Trial BalanceSILVINA SEPTIANINGSIHNo ratings yet

- Columbia REIT Primer PDFDocument14 pagesColumbia REIT Primer PDFPratik BhowmikNo ratings yet

- LLP BSPLDocument17 pagesLLP BSPLKiran KumarNo ratings yet

- Sage University IndoreDocument15 pagesSage University IndoreRohit KhemaniNo ratings yet

- Expenses Tracker 2022 Peter WafulaDocument50 pagesExpenses Tracker 2022 Peter Wafulafrank obimoNo ratings yet

- AP - Diagnostic Exam.Document8 pagesAP - Diagnostic Exam.sapilanfranceneNo ratings yet

- Fin410 Repot Final File Group 3Document28 pagesFin410 Repot Final File Group 3Shouvo Kumar Kundu 2012347630No ratings yet

- Final Exam FF01 2019 With Solutions TroegeDocument10 pagesFinal Exam FF01 2019 With Solutions TroegeRosadea AbbracciaventoNo ratings yet

- FAP 3e 2021 PPT CH 3 Adjusting AccountsDocument50 pagesFAP 3e 2021 PPT CH 3 Adjusting Accountstrinhnq22411caNo ratings yet

- Lecture 4Document25 pagesLecture 4ptnyagortey91No ratings yet

- Toa 34 36Document16 pagesToa 34 36Aubrey Shaiyne OfianaNo ratings yet

- Business OrganizationDocument3 pagesBusiness Organizationaayer3123No ratings yet

- REVIEWERDocument10 pagesREVIEWERRhyna Vergara SumaoyNo ratings yet

- Audit of Specific ItemsDocument13 pagesAudit of Specific ItemsHillary MageroNo ratings yet

- Comparable Companies 3E TemplateDocument22 pagesComparable Companies 3E TemplateLohith Kumar ReddyNo ratings yet

- Far1 Artt Ias 36 Test SolDocument2 pagesFar1 Artt Ias 36 Test SolHassan TanveerNo ratings yet

- Itr2 PreviewDocument38 pagesItr2 PreviewShailjaNo ratings yet

- Passive Equity Portfolio Management CH2-3Document23 pagesPassive Equity Portfolio Management CH2-3Mhmd ZaraketNo ratings yet

- JFC - PH Jollibee Foods Corp. Annual Income Statement - WSJDocument1 pageJFC - PH Jollibee Foods Corp. Annual Income Statement - WSJフ卂尺乇ᗪNo ratings yet

- ANALYSING THE EFFECTS OF MERGERS AND ACQUISITIONS AND THEIR IMPACT ON HUMAN RESOURCE MANAGEMENT (A CASE STUDY OF DIAMOND AND ACCESS BANK MERGER) EditDocument6 pagesANALYSING THE EFFECTS OF MERGERS AND ACQUISITIONS AND THEIR IMPACT ON HUMAN RESOURCE MANAGEMENT (A CASE STUDY OF DIAMOND AND ACCESS BANK MERGER) Editlekan.adegbenjoNo ratings yet

NAI Lease Vs Buy Model

NAI Lease Vs Buy Model

Uploaded by

ozart visual grafx0 ratings0% found this document useful (0 votes)

14 views1 pageOriginal Title

NAI Lease vs Buy Model

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

14 views1 pageNAI Lease Vs Buy Model

NAI Lease Vs Buy Model

Uploaded by

ozart visual grafxCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

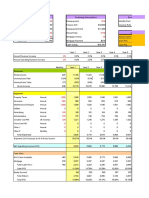

Lease vs Buy

Assumptions Periodic Values Option Valuation

Purchase Date 1/1/2030 Call or put c

Cost of Debt (kd) 5.00% Price today 5,876,446

Cost of Equity 10.00% Strike Price 7,500,000

Cost of Capital (kwacc) 6.5% Expiration 5

Corporate Tax Rate (Tc) 30% Risk Free Rate 5%

Lease Payment $ 504,000 Volatility 10%

Purchase Price $ 7,200,000 Purchase Option Value $ 539,459

Annual Depreciation $ 145,823

Residual Value $ 7,500,000

Unreimbursed Owning Costs $ - Turn Option Value Off TRUE

Debt to Value 70% Turn Off Depreciation and OpEx FALSE

Equity to Value 30% Use FV FALSE

Years to Amortize 25

Purchase (No Debt) 2030 2031 2032 2033 2034 2035

Initial Investment/Residual Value $ (7,200,000) 7,500,000

Depreciation Tax Shields (after tax) 43,747 43,747 43,747 43,747 43,747

Unreimbursed Owning Costs (after tax) - - - - -

Purchase Cash Flows $ (7,200,000) 43,747 43,747 43,747 43,747 7,543,747

Present Value $ (7,200,000) 39,770 36,154 32,868 29,880 4,684,073

Net Present Value (NPV) $ (2,377,255)

IRR 1.4%

Purchase w/ Debt to Value Shown Above

Down Payment / Residual Value $ (2,160,000) $ 7,500,000

Debt Service (principal and interest) $ 5,040,000 (357,600) (357,600) (357,600) (357,600) (357,600)

Interest Payment (252,000) (246,720) (241,176) (235,355) (229,242)

Interest Payment (after tax) (176,400) (172,704) (168,823) (164,748) (160,470)

Principal Payment (105,600) (110,880) (116,424) (122,246) (128,358)

Remaining Principal (4,456,491)

Total Financing Costs $ (2,160,000) (282,000) (283,584) (285,248) (286,994) 2,754,681

Depreciation Tax Shields (after tax) 43,747 43,747 43,747 43,747 43,747

Unreimbursed Owning Costs (after tax) - - - - -

Total Cash Flow $ (2,160,000) (238,254) (239,838) (241,501) (243,247) 2,798,428

Present Value of Cash Flows $ (2,160,000) (223,712) (211,455) (199,926) (189,082) 2,042,519

Net Present Value (NPV) $ (941,656) If NPV is greater than Capital Lease NPV, borrow the money

IRR -2.58% If IRR is lower than Captial Lease IRR, borrow the money

If the rules conflict, choose the NPV rule

Operating Lease Analysis

Lease Expense

Lease Payments (before tax) (504,000) (504,000) (504,000) (504,000) (504,000)

Imputed Interest Rate 4.9%

Lease Payments (after tax) (352,800) (352,800) (352,800) (352,800) (352,800)

Unreimbursed Leasing Costs (after tax) - - - - -

Option Value $ -

Lease Cash Flows (after tax) - (352,800) (352,800) (352,800) (352,800) (352,800)

Present Value $ - (336,000) (320,000) (304,762) (290,249) (276,428)

Net Present Value $ (1,527,439)

IRR error

Lease vs Buy (All Cash)

Total Annual Cashflows $ (7,200,000) 396,547 396,547 396,547 396,547 7,896,547

Present Value of Annual Cashflows (7,200,000) 375,770 356,154 337,630 320,129 4,960,501

Net Present Value (NPV) $ (849,816) If positive, buying is better than an operating lease

IRR 6.24% If larger than your cost of capital, buying is better than leasing

If the rules conflict, choose the NPV rule.

Lease vs Buy (w/ Leverage)

Total Annual Cashflows $ (2,160,000) 114,546 112,962 111,299 109,553 3,151,228

Present Value of Annual Cashflows $ (2,160,000) 112,288 108,545 104,836 101,168 2,318,947

Net Present Value (NPV) $ 585,783 If positive, buying is better than an operating lease

IRR 11.65% If larger than your cost of capital, buying is better than leasing

If the rules conflict, choose the NPV rule

Note: NAI does not warranty the accuracy of historical or pro-forma financials. Copyright NAI Excel | NAI Vegas

Investors should verify the reliability of any financial data.

You might also like

- Bonnie Road ModelDocument14 pagesBonnie Road Modelmzhao8100% (1)

- SAP FICO T-CODE - XLSX FINAL 2021Document23 pagesSAP FICO T-CODE - XLSX FINAL 2021Raju Bothra100% (2)

- DanitaCronkhite1 MT 482 Assignment Unit 7Document10 pagesDanitaCronkhite1 MT 482 Assignment Unit 7leeyaa aNo ratings yet

- Acc 101 QuestionsDocument6 pagesAcc 101 QuestionsSamuel100% (1)

- Simple LBODocument16 pagesSimple LBOsingh0001No ratings yet

- FI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeyDocument10 pagesFI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeySer Ronell0% (1)

- 29116520Document6 pages29116520Rendy Setiadi MangunsongNo ratings yet

- Chap 11 FMDocument10 pagesChap 11 FMabdul salamNo ratings yet

- Canyon Transport: Perform Financial CalculationsDocument7 pagesCanyon Transport: Perform Financial CalculationsManoj TeliNo ratings yet

- Primus AutomationDocument23 pagesPrimus AutomationhimanshusangaNo ratings yet

- Financial Position For The Year Ending 30/6/2009: Bank AccountDocument19 pagesFinancial Position For The Year Ending 30/6/2009: Bank Accountapi-26147386No ratings yet

- Buford StarbucksDocument7 pagesBuford StarbucksRESHMANo ratings yet

- Case Primus AutomationDocument26 pagesCase Primus AutomationHeniNo ratings yet

- DCF ModelDocument4 pagesDCF Modeljuilee bhoirNo ratings yet

- Primus Automation: Robert Clark Rey Mendez Nate Wills Katie YoungDocument26 pagesPrimus Automation: Robert Clark Rey Mendez Nate Wills Katie YoungfmulyanaNo ratings yet

- Reversion Net Operating Income:: Five Year Leveraged IRR AnalysisDocument15 pagesReversion Net Operating Income:: Five Year Leveraged IRR Analysisalexs617No ratings yet

- Primus Calculation Syndicate 6Document58 pagesPrimus Calculation Syndicate 6Bayu Aji PrasetyoNo ratings yet

- Essendon Project 3Document4 pagesEssendon Project 3matthew.epark29No ratings yet

- Income Value para Real EstateDocument13 pagesIncome Value para Real EstateJuan G ScharffenorthNo ratings yet

- Financial Instruments - Suggested AnswersDocument10 pagesFinancial Instruments - Suggested Answerspratikdubey9586No ratings yet

- Running Finance ExerciseDocument11 pagesRunning Finance Exercisew_fibNo ratings yet

- Exam ReDocument26 pagesExam ReVishal VermaNo ratings yet

- Bab VII - Soal2 Dan Solusi No. 7.07 N 7.08Document8 pagesBab VII - Soal2 Dan Solusi No. 7.07 N 7.08Adilla KhulaidahNo ratings yet

- Small Bank Pro Forma Model: Balance Sheets Thousand $Document5 pagesSmall Bank Pro Forma Model: Balance Sheets Thousand $jam7ak3275No ratings yet

- Resale Op Pro - FormaDocument1 pageResale Op Pro - FormasouthpointpgNo ratings yet

- Lease Finance - 1Document10 pagesLease Finance - 1don_mahinNo ratings yet

- Cash Flow: AssumptionsDocument3 pagesCash Flow: AssumptionsGolamMostafaNo ratings yet

- Share Warrants: Note: Insert "0" at Quoted Price W/out Warrants If It Is ISSUED WITHOUT WARRANTSDocument15 pagesShare Warrants: Note: Insert "0" at Quoted Price W/out Warrants If It Is ISSUED WITHOUT WARRANTSNickey DickeyNo ratings yet

- A.cre Hotel Acquisition Model Basic v1.11 c0gtm7Document28 pagesA.cre Hotel Acquisition Model Basic v1.11 c0gtm7Patrick ChibabulaNo ratings yet

- Obtain A Bank Loan For 100% of The Purchase Price, or It Can Lease The Machinery. Assume That The Following Facts ApplyDocument4 pagesObtain A Bank Loan For 100% of The Purchase Price, or It Can Lease The Machinery. Assume That The Following Facts Applydahnil dicardoNo ratings yet

- Multifamily Apartment ProformaDocument4 pagesMultifamily Apartment Proformaartsan3No ratings yet

- Walmart DCF-ModelDocument4 pagesWalmart DCF-ModelVonn VonNo ratings yet

- 3 Statement Model PracticeDocument10 pages3 Statement Model Practicecvassos12No ratings yet

- Basic Rental Analysis WorksheetDocument8 pagesBasic Rental Analysis WorksheetGleb petukhovNo ratings yet

- Financial Analysis DashboardDocument11 pagesFinancial Analysis DashboardZidan ZaifNo ratings yet

- Managements Discussion Analysis 2022Document111 pagesManagements Discussion Analysis 2022arvind sharmaNo ratings yet

- Cash Flow: AssumptionsDocument3 pagesCash Flow: AssumptionsSudhanshu Kumar SinghNo ratings yet

- 9.+LBO+Model ABC AfterDocument14 pages9.+LBO+Model ABC Afterashishvani1992No ratings yet

- DCF-Model - TemplateDocument5 pagesDCF-Model - TemplatebysqqqdxNo ratings yet

- Chapter 7 PDFDocument18 pagesChapter 7 PDFJay BrockNo ratings yet

- Problem 5-1Document7 pagesProblem 5-1Tammy AckleyNo ratings yet

- PayTM FinancialsDocument43 pagesPayTM FinancialststNo ratings yet

- Adelia Marhamah. 4C Lat 42 Moonstruck CompanyDocument10 pagesAdelia Marhamah. 4C Lat 42 Moonstruck Companyanisa MuzaqiNo ratings yet

- Valuation Final ExamDocument4 pagesValuation Final ExamJeane Mae Boo100% (1)

- 2008-2-00474-TI LampiranDocument3 pages2008-2-00474-TI LampiranMuhamad AzwarNo ratings yet

- Managements Discussion Analysis 2023Document116 pagesManagements Discussion Analysis 2023rootin.tootin.012No ratings yet

- Master Excel ResourcesDocument115 pagesMaster Excel ResourcesSarthak ShuklaNo ratings yet

- OM 650 SW 1 10pagesDocument10 pagesOM 650 SW 1 10pagesjuan ospinaNo ratings yet

- 2019 2016Document149 pages2019 2016MONTSERRAT VICTORIA MIRANDA BORDANo ratings yet

- Chapter 13 Direct Finance LeaseDocument6 pagesChapter 13 Direct Finance LeaseLady Pila0% (1)

- CiplaDocument9 pagesCiplaShivam GoelNo ratings yet

- Mercury Athletic Footwear Answer Key FinalDocument41 pagesMercury Athletic Footwear Answer Key FinalFatima ToapantaNo ratings yet

- Financial Modeling - Module I - Workbook 09.28.09Document38 pagesFinancial Modeling - Module I - Workbook 09.28.09rabiaasimNo ratings yet

- CC 0742 - 2031 AnnuityDocument1 pageCC 0742 - 2031 AnnuityterrygohNo ratings yet

- Ratio Analysis For CADocument7 pagesRatio Analysis For CAShahid MahmudNo ratings yet

- Commercial Real Estate Valuation Model1Document2 pagesCommercial Real Estate Valuation Model1cjsb99No ratings yet

- Bac 3 Review QNSDocument16 pagesBac 3 Review QNSsaidkhatib368No ratings yet

- Twice Incorporated: Percentage of Recov For USC W/o 35%Document4 pagesTwice Incorporated: Percentage of Recov For USC W/o 35%Paolo LocquiaoNo ratings yet

- Kuis Manajemen Keuangan - Manajemen UIDocument16 pagesKuis Manajemen Keuangan - Manajemen UIjadwal SekjenNo ratings yet

- Tugas Pak Sujono Pak Dimas MMDocument2 pagesTugas Pak Sujono Pak Dimas MMDimas GhiffariNo ratings yet

- 3402 N Shadeland Ave Flex Proforma 10-23 Blacked OutDocument1 page3402 N Shadeland Ave Flex Proforma 10-23 Blacked OutJuan bastoNo ratings yet

- Bangalore University Previous Year Question Paper AFM 1Document3 pagesBangalore University Previous Year Question Paper AFM 1Ramakrishna NagarajaNo ratings yet

- UntitledDocument6 pagesUntitledÂn LyNo ratings yet

- Sansera DRHPDocument384 pagesSansera DRHPAadi ChintawarNo ratings yet

- Maynard2e Mcqs ACCA F72015junDocument7 pagesMaynard2e Mcqs ACCA F72015junDesmanto HermanNo ratings yet

- ACC XI SEE QP For RevisionDocument31 pagesACC XI SEE QP For Revisionvarshitha reddyNo ratings yet

- Chap 006Document15 pagesChap 006Phan AnhNo ratings yet

- Food Business Accounting and FinanceDocument114 pagesFood Business Accounting and FinanceDavid SamuelNo ratings yet

- Management Accounting ProjectDocument15 pagesManagement Accounting Projecturvigarg079No ratings yet

- 1 - Ledger and Trial BalanceDocument4 pages1 - Ledger and Trial BalanceSILVINA SEPTIANINGSIHNo ratings yet

- Columbia REIT Primer PDFDocument14 pagesColumbia REIT Primer PDFPratik BhowmikNo ratings yet

- LLP BSPLDocument17 pagesLLP BSPLKiran KumarNo ratings yet

- Sage University IndoreDocument15 pagesSage University IndoreRohit KhemaniNo ratings yet

- Expenses Tracker 2022 Peter WafulaDocument50 pagesExpenses Tracker 2022 Peter Wafulafrank obimoNo ratings yet

- AP - Diagnostic Exam.Document8 pagesAP - Diagnostic Exam.sapilanfranceneNo ratings yet

- Fin410 Repot Final File Group 3Document28 pagesFin410 Repot Final File Group 3Shouvo Kumar Kundu 2012347630No ratings yet

- Final Exam FF01 2019 With Solutions TroegeDocument10 pagesFinal Exam FF01 2019 With Solutions TroegeRosadea AbbracciaventoNo ratings yet

- FAP 3e 2021 PPT CH 3 Adjusting AccountsDocument50 pagesFAP 3e 2021 PPT CH 3 Adjusting Accountstrinhnq22411caNo ratings yet

- Lecture 4Document25 pagesLecture 4ptnyagortey91No ratings yet

- Toa 34 36Document16 pagesToa 34 36Aubrey Shaiyne OfianaNo ratings yet

- Business OrganizationDocument3 pagesBusiness Organizationaayer3123No ratings yet

- REVIEWERDocument10 pagesREVIEWERRhyna Vergara SumaoyNo ratings yet

- Audit of Specific ItemsDocument13 pagesAudit of Specific ItemsHillary MageroNo ratings yet

- Comparable Companies 3E TemplateDocument22 pagesComparable Companies 3E TemplateLohith Kumar ReddyNo ratings yet

- Far1 Artt Ias 36 Test SolDocument2 pagesFar1 Artt Ias 36 Test SolHassan TanveerNo ratings yet

- Itr2 PreviewDocument38 pagesItr2 PreviewShailjaNo ratings yet

- Passive Equity Portfolio Management CH2-3Document23 pagesPassive Equity Portfolio Management CH2-3Mhmd ZaraketNo ratings yet

- JFC - PH Jollibee Foods Corp. Annual Income Statement - WSJDocument1 pageJFC - PH Jollibee Foods Corp. Annual Income Statement - WSJフ卂尺乇ᗪNo ratings yet

- ANALYSING THE EFFECTS OF MERGERS AND ACQUISITIONS AND THEIR IMPACT ON HUMAN RESOURCE MANAGEMENT (A CASE STUDY OF DIAMOND AND ACCESS BANK MERGER) EditDocument6 pagesANALYSING THE EFFECTS OF MERGERS AND ACQUISITIONS AND THEIR IMPACT ON HUMAN RESOURCE MANAGEMENT (A CASE STUDY OF DIAMOND AND ACCESS BANK MERGER) Editlekan.adegbenjoNo ratings yet