Professional Documents

Culture Documents

Circular No 012-2023

Circular No 012-2023

Uploaded by

sley mohamedOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Circular No 012-2023

Circular No 012-2023

Uploaded by

sley mohamedCopyright:

Available Formats

Circular No 012/2023 Dated 13 Jan 2023

Stamp Duty — Process for

Executed Instrument

Application

> First Schedule of the Stamp Act 1949 for

any instrument that needs to be stamped Log in to the Lembaga Hasil Dalam Negeri

(eg: Agreement, Lease, Bond, Real (“LHDN”) STAMPS system

Properties / Shares / Business Transfer, https://stamps.hasil.gov.my/stamps/

Mortgage, Charge, Assignment, Letter of

Guarantee, Power of Attorney, Trust)

Select the LHDN State, relevant type of

> Third Schedule of the Stamp Act 1949 for instrument, fill in the details, upload the

a person to be liable to pay duty (eg: Buyer, relevant attachments and submit using

Purchaser, Obligor, Grantee, Transferee, STAMPS

Lessee, Assignee)

> Executed in Malaysia: to stamp within 30

days

Stamp Duty Assessment

> Executed outside Malaysia: to stamp

within 30 days after it was first received in Duty assessment by LHDN

Malaysia (Section 47 of the Stamp Act 1949) Average time frame for nominal

stamp duty is 1-2 weeks or shorter and

ad valorem stamp duty is 4-5 weeks or

shorter

Notice of Assessment

Amount of Stamp Duty to be paid

Deadline for payment: 30 days

from the date of Notice

Mode of payment

Computation of duty

Penalty (if late payment)

Payment

Pay the Stamp Duty via

e-payment or Solicitor’s

Client’s Account Cheque or

Banker’s Cheque

>RM25 or 5% of the deficient duty,

whichever is the greater, if stamped

Penalty for Late Stamping / within 3 months after the time for

Late Payment stamping

>RM50 or 10% of the deficient duty,

whichever is the greater, if stamped

after 3 months but not later than 6

months after the time for stamping

>RM100 or 20% of the deficient duty,

whichever is the greater, if stamped

after 6 months from the time for

stamping

The Bar Council Conveyancing Practice Committee is not responsible for any error or omission, or for the results obtained from the use

of the information herein. All information in this document is provided "as is", with no guarantee of the completeness, accuracy,

timeliness, or of the results obtained from the use of the information herein.

Issued by: Roger Tan, Chairperson, Bar Council Conveyancing Practice Committee

You might also like

- Loan Approval LetterDocument5 pagesLoan Approval LetterselamoNo ratings yet

- Sample Loan Agreement (Clix)Document8 pagesSample Loan Agreement (Clix)Digi CreditNo ratings yet

- Servcorp Virtual Office Service Agreement: 12 Month CommitmentDocument2 pagesServcorp Virtual Office Service Agreement: 12 Month CommitmentCrest CapitalNo ratings yet

- Payroll Services AgreementDocument5 pagesPayroll Services AgreementAugustoNo ratings yet

- The Silver Bullet and The Silver ShieldDocument24 pagesThe Silver Bullet and The Silver ShieldSid100% (1)

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearDirector GGINo ratings yet

- Home Loan: TCHFL HL MITC Version 17Document4 pagesHome Loan: TCHFL HL MITC Version 17Ali Khan AKNo ratings yet

- Notes - Accounting For LawyersDocument8 pagesNotes - Accounting For LawyerssaghiasNo ratings yet

- PawnHero 99Z2VMDocument1 pagePawnHero 99Z2VMJohn carterNo ratings yet

- Welcomeletter Up3043tw0038268Document4 pagesWelcomeletter Up3043tw0038268Mohammad AarifNo ratings yet

- Software Products Billing Information: Product AmountDocument2 pagesSoftware Products Billing Information: Product AmountindiaNo ratings yet

- Materials For CA IPCCDocument5 pagesMaterials For CA IPCCRamNo ratings yet

- Electric BillDocument2 pagesElectric BillJagannath PanigrahiNo ratings yet

- Easy SavingsDocument2 pagesEasy SavingsPepper JackNo ratings yet

- October 2023Document5 pagesOctober 2023isaiahdesmondbrown1No ratings yet

- Business Transport LoanDocument8 pagesBusiness Transport LoanJan RootsNo ratings yet

- GST NotesDocument50 pagesGST NotesJanani SubramanianNo ratings yet

- Credit Facility Sanction LetterDocument19 pagesCredit Facility Sanction LetterJyoti SukhdeveNo ratings yet

- Go2Bank Deposit Account AgreementDocument40 pagesGo2Bank Deposit Account AgreementHank MacsNo ratings yet

- Please Read These Loan Terms and Conditions Carefully: S.No Particulars DetailsDocument7 pagesPlease Read These Loan Terms and Conditions Carefully: S.No Particulars DetailsRavishankar PonnadaNo ratings yet

- TD Convenience Checking Account GuideDocument3 pagesTD Convenience Checking Account GuideMuhammad AliNo ratings yet

- Benefit Card Terms&Conditions PDFDocument2 pagesBenefit Card Terms&Conditions PDFnpradeepkumarrNo ratings yet

- 89313494-PSPCL EReceipt EPayment PBTBDocument2 pages89313494-PSPCL EReceipt EPayment PBTBfarihahmokhtar4No ratings yet

- Sunshine ContractDocument13 pagesSunshine Contractnick wilkinsonNo ratings yet

- Most Important Terms and Conditions: Card - Pdf?Clgproductid 3645560672Document2 pagesMost Important Terms and Conditions: Card - Pdf?Clgproductid 3645560672Nagarjuna DevarakondaNo ratings yet

- docSanctionLetterForm BL240205040100109Document7 pagesdocSanctionLetterForm BL240205040100109chawllarohitNo ratings yet

- Build Card Military Lending Act Cardholder AgreementDocument8 pagesBuild Card Military Lending Act Cardholder Agreementprateekmehta92No ratings yet

- Difference Between Cheque and Bill of Exchange: MeaningDocument6 pagesDifference Between Cheque and Bill of Exchange: MeaningDeeptangshu KarNo ratings yet

- FreoPay KFS MYMT2021123100529522Document2 pagesFreoPay KFS MYMT2021123100529522McLarenNo ratings yet

- Bike LoanDocument1 pageBike LoanKrishna KumarNo ratings yet

- KT 1070169204Document4 pagesKT 1070169204shivu patilNo ratings yet

- 3045TW0057673Document2 pages3045TW0057673Amit KumarNo ratings yet

- Key Fact Statement of SBM Credilio Credit Card Description FeesDocument5 pagesKey Fact Statement of SBM Credilio Credit Card Description Feesgargmayank489.mgNo ratings yet

- Signature-1Document6 pagesSignature-1Phumi PhumiNo ratings yet

- Recovery of Tax: (Goods and Services Tax)Document3 pagesRecovery of Tax: (Goods and Services Tax)11priyagargNo ratings yet

- SanctionLetter ShoegaroDocument7 pagesSanctionLetter Shoegaropiyush.kundraNo ratings yet

- Consultancy MandateDocument4 pagesConsultancy MandateTanmay DeshpandeNo ratings yet

- Interest: 6% vs. 12%: ACT NO. 2655Document10 pagesInterest: 6% vs. 12%: ACT NO. 2655Harry PeterNo ratings yet

- Recovery of Tax: (Goods and Services Tax)Document3 pagesRecovery of Tax: (Goods and Services Tax)sridharanNo ratings yet

- LoanDocument1 pageLoanPrateek SoniNo ratings yet

- Key Fact Statement Fincorp Limited (Formerly Known As Magma Fincorp Limited) (PFL)Document6 pagesKey Fact Statement Fincorp Limited (Formerly Known As Magma Fincorp Limited) (PFL)Ritu RajNo ratings yet

- Ref: LUDHIANA/LTF/TW/50074477/133: 27-JUNE-2024Document1 pageRef: LUDHIANA/LTF/TW/50074477/133: 27-JUNE-2024joban959697No ratings yet

- Guidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnJoselito III CruzNo ratings yet

- Actividad de Aprendizaje N°: Ga5-Ata5-Taller 01: Proyección de Pago, Acuerdos de Pago Y Politicas de NormalizaciónDocument9 pagesActividad de Aprendizaje N°: Ga5-Ata5-Taller 01: Proyección de Pago, Acuerdos de Pago Y Politicas de NormalizaciónNorma VargasNo ratings yet

- Loan AgreementDocument6 pagesLoan AgreementSachin ShastriNo ratings yet

- 16 Macalinao V BpiDocument7 pages16 Macalinao V BpiBelle MaturanNo ratings yet

- Secci - A-Fpm6017176782fc-01Document2 pagesSecci - A-Fpm6017176782fc-01RadoslawNo ratings yet

- Schedule-Of-charges Master 27-10-23Document142 pagesSchedule-Of-charges Master 27-10-23xtreameairtelNo ratings yet

- 2018 FRM CandidateGuideDocument14 pages2018 FRM CandidateGuideSagar SuriNo ratings yet

- Metabank Terms and ConditionsDocument17 pagesMetabank Terms and ConditionsMoses MillerNo ratings yet

- Preview AgreementDocument11 pagesPreview Agreementasoukot84No ratings yet

- Your TELUS Bill: Account SummaryDocument4 pagesYour TELUS Bill: Account Summarydummy accountNo ratings yet

- Section 4 Financial ManagementDocument17 pagesSection 4 Financial ManagementSasha GriemeNo ratings yet

- Most Important Terms & ConditionsDocument11 pagesMost Important Terms & Conditionsolxusenew123No ratings yet

- This Is A Summary Only. Please See Below This Box For Full DetailsDocument10 pagesThis Is A Summary Only. Please See Below This Box For Full DetailsSequencersNo ratings yet

- Cashback MCDocument1 pageCashback MCKate Castor Delos ReyesNo ratings yet

- Key Fact StatementDocument8 pagesKey Fact StatementनीलNo ratings yet

- Business Loan Facility: Application FormDocument40 pagesBusiness Loan Facility: Application FormiiflfincopltdNo ratings yet

- Key Fact StatementDocument6 pagesKey Fact StatementMuhammad Sajid Abdulgani JambagiNo ratings yet

- MUS MandateDocument4 pagesMUS MandateOneMinuteVideosNo ratings yet

- Guidelines BIR Form No. 2000-OTDocument1 pageGuidelines BIR Form No. 2000-OTAnneNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Service Tax and Vat Problems By-BharathDocument3 pagesService Tax and Vat Problems By-BharathrajdeeppawarNo ratings yet

- Quiz On Audit of CashDocument11 pagesQuiz On Audit of CashY JNo ratings yet

- External Audit Arrangements at Central Banks: by Atilla Arda, Martin Gororo, Joanna Grochalska and Mowele MohlalaDocument42 pagesExternal Audit Arrangements at Central Banks: by Atilla Arda, Martin Gororo, Joanna Grochalska and Mowele MohlalaJSTNo ratings yet

- UNI 20220818162914448847 1392300 uniROC IpayobDocument6 pagesUNI 20220818162914448847 1392300 uniROC IpayobxidaNo ratings yet

- Financial Terminology Definition of The Financial TermDocument36 pagesFinancial Terminology Definition of The Financial TermRajeev TripathiNo ratings yet

- Plastic MoneyDocument5 pagesPlastic Moneyharsh1717No ratings yet

- Mock Exam Life Insurance Actuarial Controlling 1Document9 pagesMock Exam Life Insurance Actuarial Controlling 1david AbotsitseNo ratings yet

- Tokyo, Japan (April 11, 2014) - As Announced in A Release Dated April 7, 2014, Pursuant To ADocument9 pagesTokyo, Japan (April 11, 2014) - As Announced in A Release Dated April 7, 2014, Pursuant To AnarayanasamNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- A Study On Financial Statement Analysis of Tata SteelDocument16 pagesA Study On Financial Statement Analysis of Tata SteelGokul krishnan100% (1)

- Level III Essay Questions 2014 PDFDocument80 pagesLevel III Essay Questions 2014 PDFwNo ratings yet

- P TS4FI 1909 Final - UpdatedDocument42 pagesP TS4FI 1909 Final - Updatedpratiksha100% (2)

- Banking Term PaperDocument7 pagesBanking Term Paperamjatzukg100% (1)

- What's On Your Mind?: Extinguishment of ObligationDocument29 pagesWhat's On Your Mind?: Extinguishment of Obligationdanielzar delicanoNo ratings yet

- 3-OSED (Annex-I)Document6 pages3-OSED (Annex-I)Usama AhmadNo ratings yet

- On January 1 2011 Borstad Company Purchased Equipment ForDocument1 pageOn January 1 2011 Borstad Company Purchased Equipment ForHassan JanNo ratings yet

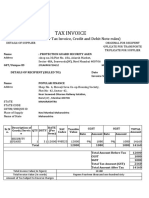

- Tax Invoice: (See Rule 5 Under Tax Invoice, Credit and Debit Note Rules)Document5 pagesTax Invoice: (See Rule 5 Under Tax Invoice, Credit and Debit Note Rules)Bharat DafalNo ratings yet

- Case Vamshi Rubber 13jan13Document2 pagesCase Vamshi Rubber 13jan13Rajesh GoelNo ratings yet

- Kohat TextileDocument10 pagesKohat TextileHashim AfzalNo ratings yet

- Smart MoneyDocument67 pagesSmart MoneySebasUshiiNo ratings yet

- Public Economics-Course SyllabusDocument1 pagePublic Economics-Course SyllabusshuvamNo ratings yet

- Janhavi Share Market ProjectDocument57 pagesJanhavi Share Market ProjectKunal PawarNo ratings yet

- MCQs For Banking LawsDocument18 pagesMCQs For Banking LawsAli Asghar RindNo ratings yet

- Muhammad Mudassir Bhatti: Citizenship: Pakistani Date of Birth: 8 February 1990Document2 pagesMuhammad Mudassir Bhatti: Citizenship: Pakistani Date of Birth: 8 February 1990Nisar AhmedNo ratings yet

- PWT 91Document1,129 pagesPWT 91Cesar JvNo ratings yet

- FM PDFDocument116 pagesFM PDFAbhi JoshiNo ratings yet

- Bai Type Code GuideDocument31 pagesBai Type Code Guideswathipotla100% (1)