Professional Documents

Culture Documents

Vat Recon Template

Vat Recon Template

Uploaded by

Tiyani0 ratings0% found this document useful (0 votes)

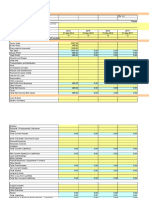

4 views2 pagesThis document is a VAT summary for ABCs (Pty) Ltd for the period of May 1st, 2023 to June 30th, 2023. It shows the VAT number, basis, and period covered. It also includes a breakdown of taxes by component such as standard rate purchases, sales, and zero rated purchases. The summary calculates the VAT payable as R267,960.26 based on paid customer invoices for the period.

Original Description:

Original Title

VAT RECON TEMPLATE

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a VAT summary for ABCs (Pty) Ltd for the period of May 1st, 2023 to June 30th, 2023. It shows the VAT number, basis, and period covered. It also includes a breakdown of taxes by component such as standard rate purchases, sales, and zero rated purchases. The summary calculates the VAT payable as R267,960.26 based on paid customer invoices for the period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views2 pagesVat Recon Template

Vat Recon Template

Uploaded by

TiyaniThis document is a VAT summary for ABCs (Pty) Ltd for the period of May 1st, 2023 to June 30th, 2023. It shows the VAT number, basis, and period covered. It also includes a breakdown of taxes by component such as standard rate purchases, sales, and zero rated purchases. The summary calculates the VAT payable as R267,960.26 based on paid customer invoices for the period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

VAT Summary

ABCs (Pty) Ltd

For the period 1 May 2023 to 30 June 2023

VAT Number

VAT Basis

VAT Period covered

From

To

Tax Rate Net

Taxes by Tax Component

Goods and Services Imported

Goods and Services Imported (0%) 0.0%

Total Goods and Services Imported 0.0%

No VAT

No VAT (0%) 0.0% -R3 731 864.67

Total No VAT 0.0% -R3 731 864.67

Standard Rate Purchases

Standard Rate Purchases (15%) 15.0% -R1 922 179.71

Total Standard Rate Purchases 15.0% -R1 922 179.71

Standard Rate Purchases - Capital Goods

Standard Rate Purchases - Capital Goods (15%) 15.0% R0.00

Total Standard Rate Purchases - Capital Goods 15.0% R0.00

Standard Rate Sales

Standard Rate Sales (15%) 15.0% R3 708 581.98

Total Standard Rate Sales 15.0% R3 708 581.98

Zero Rated Purchases

Zero Rated Purchases (0%) 0.0% -R192 061.89

Total Zero Rated Purchases 0.0% -R192 061.89

VAT Payable / (Receivable)

Per Paid Customer Invoices 5 333 266.99

VAT Payable / (Receivable)

Accrual Basis

2 Monthly

1/05/2023

30/06/2023

Tax

-R1 268 526.73

-R1 268 526.73

R0.00

R0.00

-R288 327.08

-R288 327.08

R0.00

R0.00

R556 287.34

R556 287.34

R0.00

R0.00

R 267 960.26 Per Xero

695 643.52 Per "Invoice Summary"

407 316.44

You might also like

- CMA Data in Excel FormatDocument18 pagesCMA Data in Excel FormatKaushik Chattoraj0% (1)

- Vat NotesDocument7 pagesVat NotesZulqarnainNo ratings yet

- Tax Invoice: Billing Address Delivery Address Sold byDocument4 pagesTax Invoice: Billing Address Delivery Address Sold bywalidNo ratings yet

- Lecture 01 VAT - Lecture SlidesDocument9 pagesLecture 01 VAT - Lecture Slideslameck noah zuluNo ratings yet

- House No. 333, Link Road, Narrian Abbottabad, Abbottabad Abbottabad Khawar ShahidDocument4 pagesHouse No. 333, Link Road, Narrian Abbottabad, Abbottabad Abbottabad Khawar ShahidIkramNo ratings yet

- GSTR1Document31 pagesGSTR1shubhamt25No ratings yet

- Chapter 20 - VATDocument14 pagesChapter 20 - VATrottelosNo ratings yet

- Vat Summary-30-09-2010Document2 pagesVat Summary-30-09-2010anon_978060No ratings yet

- GSTR1 Stupl 08ABFCS1229J1Z9 November 2021 BusyDocument92 pagesGSTR1 Stupl 08ABFCS1229J1Z9 November 2021 BusyYathesht JainNo ratings yet

- Metropolis Sem 13.04 Al 19.04Document8 pagesMetropolis Sem 13.04 Al 19.04WIRBERT RIVASNo ratings yet

- Our Old and New Interest Rates Explained: SavingsDocument4 pagesOur Old and New Interest Rates Explained: SavingsDiyana PangNo ratings yet

- VAT Form202Document2 pagesVAT Form202ncgohil78No ratings yet

- Einvoice 1698855728193Document1 pageEinvoice 1698855728193hasnatali894No ratings yet

- Lecture Slides - Lecture 01 - VAT (Part 1)Document6 pagesLecture Slides - Lecture 01 - VAT (Part 1)nkosinathiNo ratings yet

- House No. 333, Link Road, Narrian Abbottabad, Abbottabad Abbottabad Khawar ShahidDocument4 pagesHouse No. 333, Link Road, Narrian Abbottabad, Abbottabad Abbottabad Khawar ShahidIkramNo ratings yet

- DiDi TAX Invoice1Document1 pageDiDi TAX Invoice1westcoastcarsNo ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationRajkumar NateshanNo ratings yet

- 20btvpd8601h1zs Gstr3br1 Reconciled Summary (2024-2025)Document16 pages20btvpd8601h1zs Gstr3br1 Reconciled Summary (2024-2025)Manoj MadhukerNo ratings yet

- Einvoice 1694619077137Document1 pageEinvoice 1694619077137irfanali19815No ratings yet

- 303 1T Merged PDFDocument31 pages303 1T Merged PDFSABAH LAKEHALNo ratings yet

- Definition of Vat: VAT Payable To SARS VAT Output - VAT InputDocument3 pagesDefinition of Vat: VAT Payable To SARS VAT Output - VAT InputNOMFUNDO SENOSINo ratings yet

- Taxation (CHN) - Dec 2020 FinalDocument3 pagesTaxation (CHN) - Dec 2020 FinalALEX TRANNo ratings yet

- Salary Slip NovDocument1 pageSalary Slip NovRahul RajawatNo ratings yet

- GST FinalDocument35 pagesGST FinalDigambar Bapuso KasoteNo ratings yet

- GST in IndiaDocument5 pagesGST in IndiaKayam YaminiNo ratings yet

- REF Price Approval FEB 11 2024 - 25 March 2024Document1 pageREF Price Approval FEB 11 2024 - 25 March 2024mahmoodrasel228No ratings yet

- LU1 - Value-Added TaxDocument24 pagesLU1 - Value-Added Taxmandisanomzamo72No ratings yet

- Qatar Registration Invoice 2000 !!!!!Document1 pageQatar Registration Invoice 2000 !!!!!cs8721387No ratings yet

- Advent One Invoice 1Document1 pageAdvent One Invoice 1professional accountantsNo ratings yet

- DfsDocument98 pagesDfsŞtefan AlinNo ratings yet

- BWC Cafe Investment - 3.5Document4 pagesBWC Cafe Investment - 3.5paulswapan1957No ratings yet

- Answer 1Document5 pagesAnswer 1mayetteNo ratings yet

- An Insight Into GST in IndiaDocument26 pagesAn Insight Into GST in IndiaSrikantNo ratings yet

- Afq Inv Sa 2020 0918574Document4 pagesAfq Inv Sa 2020 0918574qasim66935No ratings yet

- Declaration 1726107Document4 pagesDeclaration 1726107Hanzala NasirNo ratings yet

- Salary Slip OctDocument1 pageSalary Slip OctRahul RajawatNo ratings yet

- GSTR3B 29aaifa3562d1zl 022020Document3 pagesGSTR3B 29aaifa3562d1zl 022020HEMANTH kumarNo ratings yet

- Copy of Cma For Less Than 1 Crore With CalculationDocument18 pagesCopy of Cma For Less Than 1 Crore With CalculationRajesh BogulNo ratings yet

- Copy of Cma For Less Than 1 Crore With CalculationDocument18 pagesCopy of Cma For Less Than 1 Crore With Calculationshukla.aj.0007No ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationSushil GabaNo ratings yet

- Copy of Cma For Less Than 1 Crore With CalculationDocument18 pagesCopy of Cma For Less Than 1 Crore With CalculationRahulKumarNo ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With Calculationkhanjishan113No ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationArun KumarNo ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With Calculationchirag desaiNo ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationUser 1109No ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationMithilesh pandeyNo ratings yet

- OD225094531715959000Document1 pageOD225094531715959000Satya priya MallickNo ratings yet

- 1444 04 13 - 701 FileDocument8 pages1444 04 13 - 701 Fileعلي الدوسريNo ratings yet

- Einvoice 1691895460934Document1 pageEinvoice 1691895460934Ransem Christian EsparragoNo ratings yet

- Einvoice 1661931542084Document1 pageEinvoice 1661931542084Jessica MathisNo ratings yet

- GST MSOP Project FinalDocument19 pagesGST MSOP Project FinalAnjli SampatNo ratings yet

- Calculate Newtax 2024-25 21-04-2024Document6 pagesCalculate Newtax 2024-25 21-04-2024Nirmal KishorNo ratings yet

- BIR Form Deadline Quarterly Tax ReturnsDocument6 pagesBIR Form Deadline Quarterly Tax Returnsdianne caballeroNo ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- wb26bf3605 DDocument1 pagewb26bf3605 Dmdneyaz9831No ratings yet

- Summary of Outward Supplies (GSTR-1) : R K Hardware and ElectricalsDocument1 pageSummary of Outward Supplies (GSTR-1) : R K Hardware and ElectricalsAnamikaNo ratings yet

- GSTR3B 27afxpr6875g1ze 082020Document3 pagesGSTR3B 27afxpr6875g1ze 082020fintrustbankingNo ratings yet

- Declaration 0659861Document6 pagesDeclaration 0659861Hanzala NasirNo ratings yet

- GSTR3B 27afxpr6875g1ze 072020Document3 pagesGSTR3B 27afxpr6875g1ze 072020fintrustbankingNo ratings yet