Professional Documents

Culture Documents

CFAS 16 and 18

CFAS 16 and 18

Uploaded by

Cath OquialdaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CFAS 16 and 18

CFAS 16 and 18

Uploaded by

Cath OquialdaCopyright:

Available Formats

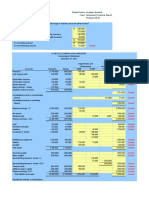

Dollar Company

Statement of Cash Flow

For year ended December 31, 2018

Cash flows from operating acts.

Profit before income tax 828 500

Adjustments for:

Depreciation expense 290 000

Interest expense 60 000

Operating income before WC changes 1 178 500

Decrease in A/R 110 000

(Increase) in inventory (200 000)

Decrease in A/P (90 000)

Cash generated from operating acts. 998 500

Income taxes paid 223 350

Net cash from operating activities 775 150

Cash flows from investing acts.

Purchase of equipment (1 880 000)

Cash flows from financing acts.

Issue of ordinary share capital 550 000

Issue of bonds at par 1 000 000

Cash dividends paid (259 950) 1 290 050

Net increase increase in cash 185 200

Add cash balance, January 1 42 000

Cash balance, December 31 227 200

PBT (579 950/.70) 828 500

Dividends paid (579 950 - 320 000) 259 950

Income Taxes paid (828 500 *.30)- 25 200 223 350

(18 A)

Plains and Prints

Statement of Cash flows

For year ended December 31, 2018

Cash flow from operating activities

Collection from customers 4 240 000

Payment to suppliers (2 680 000)

Payment of accrued expenses (880 000)

Cash flow from operations before interest & income tax 680 000

Payment of interest (60 000)

Payment of income tax (325 000)

Net cash flow from operating activities 295 000

Cash flow from investing activities

Sale of land 125 000

Sale of equipment 170 000

Purchase of equipment (830 000) (535 000)

Cash flow from operating activities

Redemption of bonds payable (200 000)

Issue of shares 800 000

Payment of dividends (275 000) 325 000

Increase in cash during the period 85 000

Cash balance, December 31, 2017 185 000

Cash balance, December 31, 2018 270 000

(18 B)

Plains and Prints

Statement of Cash flows

For year ended December 31, 2018

Profit before interest and income tax 2 030 000 2 030 000

Adjustments for:

Depreciation expense 165 000

175 000

Loss on sale of equipment 10 000

(Increase) in trade receivables (210 000)

(480 000)

(Increase) in inventories (270 000)

Decrease in prepaid expenses 10 000 10 000

Decrease in A/P (85 000) (85 000)

Increase in accrued expenses 50 000

730 000

Cash flow from operations before interest & income tax 680 000

Interest paid (60 000)

(385 000)

Income tax paid (325 000)

Net cash flow from operating activities 1 995 000

PBIT:

Sales revenue 4 450 000

5 400 000

Income before tax 950 000

(minus)

COGS (2 325 000)

(3 430 000)

OPEX (1 105 000)

(plus)

Interest expense 60 000 60 000

2 030 000

You might also like

- Bharat Chemicals Ltd. SolnDocument4 pagesBharat Chemicals Ltd. SolnJayash KaushalNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Bharat Chemical CaseDocument5 pagesBharat Chemical CaseambitiousfirkinNo ratings yet

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- For The Year Ended December 31, 2020: Rcs Consultancy CorporationDocument11 pagesFor The Year Ended December 31, 2020: Rcs Consultancy CorporationYzzabel Denise L. TolentinoNo ratings yet

- TP1-W2-S3-R0 Sri Annisa KatariDocument3 pagesTP1-W2-S3-R0 Sri Annisa Katarisri annisa katariNo ratings yet

- Cash Flow Statement and Financial Ratio AssignDocument4 pagesCash Flow Statement and Financial Ratio AssignChristian TanNo ratings yet

- Tutorial 17.5Document4 pagesTutorial 17.5نور عفيفهNo ratings yet

- Asdos Jawaban 2Document3 pagesAsdos Jawaban 2mutiaoooNo ratings yet

- AFE5008-B Exam Type Question-2-Model AnswerDocument2 pagesAFE5008-B Exam Type Question-2-Model AnswerDiana TuckerNo ratings yet

- KZN 2020 June P1 Memo 2Document7 pagesKZN 2020 June P1 Memo 2shandren19No ratings yet

- ACC12 - Statement of Cash FlowsDocument1 pageACC12 - Statement of Cash FlowsVimal KvNo ratings yet

- Fimd Training Unit 1 - Financial Analysis-ActivitiesDocument8 pagesFimd Training Unit 1 - Financial Analysis-ActivitiesErrol ThompsonNo ratings yet

- Tutorial Cash FlowDocument18 pagesTutorial Cash FlowmellNo ratings yet

- Tutorial 11 QsDocument3 pagesTutorial 11 QsDylan Rabin PereiraNo ratings yet

- Q7 Mguni LimitedDocument2 pagesQ7 Mguni Limitedamosmalusi5No ratings yet

- ABC Sample ProbDocument4 pagesABC Sample ProbangbabaeNo ratings yet

- Unit 12-Question 12-A Sol (2023)Document3 pagesUnit 12-Question 12-A Sol (2023)shirleygebenga020829No ratings yet

- Calvo, Jhoanne C.-BSA 2-1-Chapter 4-Problem 11-20Document12 pagesCalvo, Jhoanne C.-BSA 2-1-Chapter 4-Problem 11-20Jhoanne CalvoNo ratings yet

- Acc140 PresentationDocument8 pagesAcc140 PresentationnyararaitatendaNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- Accounting Exercises On Cash FlowsDocument2 pagesAccounting Exercises On Cash FlowsMicaella GoNo ratings yet

- Audit of FS QuizDocument3 pagesAudit of FS QuizGwyneth TorrefloresNo ratings yet

- The Statement of Cash Flows Problems 5-1. (Currency Company)Document7 pagesThe Statement of Cash Flows Problems 5-1. (Currency Company)Marcos DmitriNo ratings yet

- Unit VI CashFlowStatementDocument32 pagesUnit VI CashFlowStatementSmiti RupaNo ratings yet

- Perfect Practice SolutionDocument41 pagesPerfect Practice Solutionnarutevarsha5No ratings yet

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- Lecture 1 & 2 ExamplesDocument5 pagesLecture 1 & 2 ExamplesAbubakari Abdul MananNo ratings yet

- Q5 Vikings LimitedDocument2 pagesQ5 Vikings Limitedamosmalusi5No ratings yet

- 17 Financial Statements (With Adjustments)Document16 pages17 Financial Statements (With Adjustments)Dayaan ANo ratings yet

- For Year Ending December 31, 2018: Lakeside Company Income StatementDocument8 pagesFor Year Ending December 31, 2018: Lakeside Company Income StatementMark Christian Cutanda VillapandoNo ratings yet

- E - CAsh Flow Question Meath With Solution and WorkingsDocument5 pagesE - CAsh Flow Question Meath With Solution and Workingschalah DeriNo ratings yet

- Solution FAR 2Document20 pagesSolution FAR 2ANo ratings yet

- Trugo Activity SCFDocument4 pagesTrugo Activity SCFmoreNo ratings yet

- Support Material Financial Statement PDFDocument6 pagesSupport Material Financial Statement PDFsanele dlaminiNo ratings yet

- Project 4 - Chap 5Document3 pagesProject 4 - Chap 5Waqar ZulfiqarNo ratings yet

- AC3202 WK2 Exercises SolutionsDocument11 pagesAC3202 WK2 Exercises SolutionsLong LongNo ratings yet

- Acc Chapter 5Document11 pagesAcc Chapter 5NURUL HAZWANIE HIDNI BINTI MUHAMAD SABRI MoeNo ratings yet

- Pioma Plastics Company Cash Flow Statement For The Year Ended July 31 Amount in Rs. Amount in Rs. Cash Flow From Operating ActivitiesDocument4 pagesPioma Plastics Company Cash Flow Statement For The Year Ended July 31 Amount in Rs. Amount in Rs. Cash Flow From Operating ActivitiesPrajwal PaiNo ratings yet

- Pr. 4-146-Income StatementDocument13 pagesPr. 4-146-Income StatementElene SamnidzeNo ratings yet

- Cash FlowsDocument4 pagesCash FlowsAira Dane VillegasNo ratings yet

- Tutor 1Document6 pagesTutor 1Elaine LimNo ratings yet

- Adv Level Corporate Reporting (CR)Document24 pagesAdv Level Corporate Reporting (CR)FarhadNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- HW C23 U Can Read But NoDocument2 pagesHW C23 U Can Read But NoLăng Quân VươngNo ratings yet

- Allowable DeductionsDocument9 pagesAllowable DeductionsLyka RoguelNo ratings yet

- Cash FlowsDocument7 pagesCash FlowsJasmine ActaNo ratings yet

- Exercises On Implementation of DCF ApproachDocument10 pagesExercises On Implementation of DCF ApproachVincenzoPizzulliNo ratings yet

- Cash Flow 8 AprilDocument17 pagesCash Flow 8 AprilMayank MalhotraNo ratings yet

- Bharat Chemicals Ltd. CPHi46l2eHDocument2 pagesBharat Chemicals Ltd. CPHi46l2eHChickooNo ratings yet

- Question 2 FR April 2022 Question 2 CaputDocument6 pagesQuestion 2 FR April 2022 Question 2 CaputLaud ListowellNo ratings yet

- Activity - Financial StatementsDocument5 pagesActivity - Financial StatementsPhilip Jhon BayoNo ratings yet

- Chapter 9Document23 pagesChapter 9TouseefsabNo ratings yet

- Assignment 7 - RosalDocument4 pagesAssignment 7 - RosalGinie Lyn RosalNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- HW 082623Document30 pagesHW 082623Cath OquialdaNo ratings yet

- HihiDocument20 pagesHihiCath OquialdaNo ratings yet

- Case of Spain 2011Document44 pagesCase of Spain 2011Cath OquialdaNo ratings yet

- Bafe101 Assignment 1 Group 4Document10 pagesBafe101 Assignment 1 Group 4Cath OquialdaNo ratings yet

- Sneaker 2013 - Assignment QuestionsDocument2 pagesSneaker 2013 - Assignment QuestionsCath OquialdaNo ratings yet

- Hand Hygiene and HandwashingDocument7 pagesHand Hygiene and HandwashingFaith Dianasas RequinaNo ratings yet

- TW 05 ZhangDocument9 pagesTW 05 ZhangAhmed ELhefnawyNo ratings yet

- WAGAN 8576 9 UserManualDocument24 pagesWAGAN 8576 9 UserManualNelly Cristina Rubio RodriguezNo ratings yet

- Organizational Culture and ClimateDocument3 pagesOrganizational Culture and ClimatezainabwisalkhanNo ratings yet

- BasterLord - Network Manual v2.0Document24 pagesBasterLord - Network Manual v2.0xuxujiashuoNo ratings yet

- BS ConsolidationDocument25 pagesBS ConsolidationKamukwema johnNo ratings yet

- Wiring Diagram of Instrument (INS)Document8 pagesWiring Diagram of Instrument (INS)Rendy MechanicNo ratings yet

- AsiDocument30 pagesAsikholifahnwNo ratings yet

- TunePatSpotifyConverterforWindows ManualDocument13 pagesTunePatSpotifyConverterforWindows ManualEmre TekinerNo ratings yet

- Spare Parts Catalog For Rt55 Rough Terrain Crane: December, 2013 Edition: 1Document348 pagesSpare Parts Catalog For Rt55 Rough Terrain Crane: December, 2013 Edition: 1Nay SoeNo ratings yet

- MODULE 4 - E-TechDocument19 pagesMODULE 4 - E-TechElijah GloriaNo ratings yet

- Effects of Covid-19 To Students in The Medical FieldDocument2 pagesEffects of Covid-19 To Students in The Medical FieldAnne RonquilloNo ratings yet

- Paws of DestinyDocument2 pagesPaws of Destinytest dataNo ratings yet

- The Business of Travel and TourismDocument14 pagesThe Business of Travel and TourismJasper SumalinogNo ratings yet

- Admission Letter CsabDocument1 pageAdmission Letter Csabsuraj mohantyNo ratings yet

- The Condensed Satanic BibleDocument123 pagesThe Condensed Satanic Biblestregonebr100% (1)

- Advanced View Arduino Projects List - Use Arduino For Projects-2Document53 pagesAdvanced View Arduino Projects List - Use Arduino For Projects-2Bilal AfzalNo ratings yet

- CT3Document7 pagesCT3Vishy BhatiaNo ratings yet

- Emad 21522379 Type A KWH PDFDocument8 pagesEmad 21522379 Type A KWH PDFEMAD ABDULRAHMAN ABDULLAH HASAN MASHRAH -No ratings yet

- 4-SSS SAS ASA and AAS Congruence PDFDocument4 pages4-SSS SAS ASA and AAS Congruence PDFAivie Jannelle Columna BejoNo ratings yet

- Artificial Intelligence The End of The Beginning PDFDocument12 pagesArtificial Intelligence The End of The Beginning PDFK Cor100% (1)

- Chapter 23 ReviewDocument10 pagesChapter 23 ReviewThanat MilinthachindaNo ratings yet

- Sexual Orientation Sexuality Wiki Fandom PDFDocument1 pageSexual Orientation Sexuality Wiki Fandom PDFAngus FieldingNo ratings yet

- Lec 9Document19 pagesLec 9Aqsa gulNo ratings yet

- Flow Characteristics of External Gear Pumps ConsidDocument10 pagesFlow Characteristics of External Gear Pumps ConsidThar GyiNo ratings yet

- Chapter 7Document15 pagesChapter 7Lowella May Tan ChengNo ratings yet

- 1000 Important SAT WordsDocument70 pages1000 Important SAT WordsArifRahman100% (1)

- Call CenterDocument20 pagesCall CenterMmeraKiNo ratings yet

- IT Practical File Main 2023-24Document45 pagesIT Practical File Main 2023-24GagandeepNo ratings yet

- Treasure IslandDocument266 pagesTreasure IslandNader HaddadNo ratings yet