Professional Documents

Culture Documents

Bank Recon-Tion Statement

Bank Recon-Tion Statement

Uploaded by

Nidhi NayakCopyright:

Available Formats

You might also like

- 1G2 - Outbound Processing For Customer - WMDocument12 pages1G2 - Outbound Processing For Customer - WMsserpsap100% (1)

- BRS Full ChapterDocument16 pagesBRS Full ChapterMumtazAhmad100% (1)

- Monopoly ProjectDocument13 pagesMonopoly Projectapi-311197959No ratings yet

- Risk Management in Banking Sector MainDocument54 pagesRisk Management in Banking Sector MainJahanvi Bansal55% (11)

- Xerox-Case Study Analysi-JhellDocument10 pagesXerox-Case Study Analysi-Jhelljhell de la cruzNo ratings yet

- MODULE 3 - Part 3 Bank ReconciliationDocument16 pagesMODULE 3 - Part 3 Bank ReconciliationShaena Mae50% (2)

- Bank Reconciliation - For LectureDocument3 pagesBank Reconciliation - For LectureCharlene Jane EspinoNo ratings yet

- Hsslive-Chapter 5 BRS 1 PDFDocument2 pagesHsslive-Chapter 5 BRS 1 PDFRam IyerNo ratings yet

- Fundamentas of Accounting I CH 5Document24 pagesFundamentas of Accounting I CH 5israelbedasa3100% (1)

- Bank ReconciliationDocument12 pagesBank ReconciliationJenny Pearl Dominguez CalizarNo ratings yet

- Chapter 2 Bank Reconciliation (Gatdc)Document20 pagesChapter 2 Bank Reconciliation (Gatdc)Joan LeonorNo ratings yet

- Assignment 1571213669 SmsDocument13 pagesAssignment 1571213669 SmsJayasuriya SNo ratings yet

- Bank Reconciliation StatementDocument27 pagesBank Reconciliation Statementkimuli FreddieNo ratings yet

- Intermidiate FA I ChapterDocument28 pagesIntermidiate FA I Chapteryiberta69No ratings yet

- Group - 11 Bank Reconciliation Statement: CIA (Continuous Internal Assessment) 1Document13 pagesGroup - 11 Bank Reconciliation Statement: CIA (Continuous Internal Assessment) 1shriyanshu padhiNo ratings yet

- Chapter 5 - Bank Reconciliation StatementDocument23 pagesChapter 5 - Bank Reconciliation StatementNchumthung JamiNo ratings yet

- Midterm The Banks Functional DepartmentsDocument49 pagesMidterm The Banks Functional DepartmentsB-jay AledonNo ratings yet

- 6 - Bank Reconciliation StatementDocument3 pages6 - Bank Reconciliation StatementNeeraj RaikwarNo ratings yet

- Learning Activity Sheet No. 16 2 Quarter: Grade Level/ Subject Grade 12 - Fundamentals of ABM 2Document13 pagesLearning Activity Sheet No. 16 2 Quarter: Grade Level/ Subject Grade 12 - Fundamentals of ABM 2Yuri GalloNo ratings yet

- Bank Reconciliation Statement Theory and Practice Question From Sir Jawad and Sir Dawood Shahid and Icap TextDocument64 pagesBank Reconciliation Statement Theory and Practice Question From Sir Jawad and Sir Dawood Shahid and Icap TextJahanzaib ButtNo ratings yet

- Bank Reconciliation PDFDocument17 pagesBank Reconciliation PDFJamaica IndacNo ratings yet

- CFAS - Bank ReconciliationDocument5 pagesCFAS - Bank ReconciliationAltessa Lyn ContigaNo ratings yet

- Accounting For CashDocument9 pagesAccounting For CashNatty STAN100% (1)

- Chapter 6 CashDocument15 pagesChapter 6 CashTesfamlak MulatuNo ratings yet

- Chapter-01 Accounting For Banking CompanyDocument26 pagesChapter-01 Accounting For Banking CompanyRabbi Ul Apon100% (1)

- Lesson 8 - Bank Reconciliation StatementDocument5 pagesLesson 8 - Bank Reconciliation StatementUnknownymousNo ratings yet

- Bank Reconciliation StatementDocument4 pagesBank Reconciliation StatementArshad BashirNo ratings yet

- Bank Reconciliation StatementDocument14 pagesBank Reconciliation StatementMarvie MendozaNo ratings yet

- 206bank Reconcilliation StatementDocument3 pages206bank Reconcilliation StatementRAKESH VARMANo ratings yet

- 8bank Reconciliation StatementDocument12 pages8bank Reconciliation Statementnikita2802No ratings yet

- Chapter Five CashDocument9 pagesChapter Five CashDawit TesfayeNo ratings yet

- Accounting PPT ReportDocument27 pagesAccounting PPT ReportAbdullah AmjadNo ratings yet

- MC1404 - Unit 5Document11 pagesMC1404 - Unit 5Senthil KumarNo ratings yet

- Cash and Cash EquivalentsDocument9 pagesCash and Cash EquivalentsJna MarieNo ratings yet

- Bank Reconciliation StatementDocument10 pagesBank Reconciliation StatementmuniNo ratings yet

- Financial Accounting Handout 2Document49 pagesFinancial Accounting Handout 2Rhoda Mbabazi ByogaNo ratings yet

- BRS Bank Reconcilation StatementDocument15 pagesBRS Bank Reconcilation Statementbabluon22No ratings yet

- Bank ReconciliationDocument7 pagesBank ReconciliationMikaella Adriana GoNo ratings yet

- Managerial Accounting (Banking) Terms For MBA StudentsDocument3 pagesManagerial Accounting (Banking) Terms For MBA StudentsEbunNo ratings yet

- Accounting Lesson 1 Bank Reconciliation NotesDocument9 pagesAccounting Lesson 1 Bank Reconciliation NotesKabelo SefaliNo ratings yet

- Chp1 Bank Bank Recon STMTDocument16 pagesChp1 Bank Bank Recon STMTMichael AsieduNo ratings yet

- Bank Reconciliation: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriDocument60 pagesBank Reconciliation: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriTessang OnongenNo ratings yet

- General BankingDocument32 pagesGeneral BankingTaanzim JhumuNo ratings yet

- Chapter-2 Bank Reconciliation StatementDocument10 pagesChapter-2 Bank Reconciliation Statementyisog79636No ratings yet

- Paying and Collecting BankerDocument12 pagesPaying and Collecting BankerartiNo ratings yet

- Bank Reconciliations: Meaning: A Bank Reconciliation Statement Is A Statement That Compares The Cash Book and TheDocument2 pagesBank Reconciliations: Meaning: A Bank Reconciliation Statement Is A Statement That Compares The Cash Book and TheApurvakc KcNo ratings yet

- Notes On Cash and Cash EquivalentsDocument1 pageNotes On Cash and Cash EquivalentsMariz Julian Pang-aoNo ratings yet

- FABM2 Chapter5Document7 pagesFABM2 Chapter5johnleegiba09No ratings yet

- Material 2Document45 pagesMaterial 2Rocky BassigNo ratings yet

- Banking Law & PracticeDocument12 pagesBanking Law & PracticeShams TabrezNo ratings yet

- Bank ReconciliationDocument18 pagesBank ReconciliationJanaica MacaraegNo ratings yet

- Banking Chapter FourDocument13 pagesBanking Chapter FourfikremariamNo ratings yet

- Bank ReconciliationDocument20 pagesBank ReconciliationLoslyn LumacangNo ratings yet

- Ch.4 - Cash and Receivables - MHDocument75 pagesCh.4 - Cash and Receivables - MHSamZhaoNo ratings yet

- CashDocument9 pagesCashHenok EnkuselassieNo ratings yet

- IA 1 Module Week 3-4Document8 pagesIA 1 Module Week 3-4Yamit, Angel Marie A.No ratings yet

- CH 3 - BrsDocument0 pagesCH 3 - BrsHaseeb Ullah KhanNo ratings yet

- Bank Reconciliation TopicDocument11 pagesBank Reconciliation TopicJoanNo ratings yet

- Paying BankerDocument2 pagesPaying BankerwubeNo ratings yet

- Binayak Academy,: Gandhi Nagar 1 Line, Near NCC Office, BerhampurDocument8 pagesBinayak Academy,: Gandhi Nagar 1 Line, Near NCC Office, BerhampurkunjapNo ratings yet

- Unit 2 LPBDocument9 pagesUnit 2 LPBVeena ReddyNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Hitachi Sa Approval LetterDocument1 pageHitachi Sa Approval LetterMohammad T. KhalafNo ratings yet

- FIN7101 Group Assignment (Plantation) - FINAL (Group 3)Document73 pagesFIN7101 Group Assignment (Plantation) - FINAL (Group 3)Azdzharulnizzam AlwiNo ratings yet

- Start Living in Spain - Spanish Residency Free GuideDocument13 pagesStart Living in Spain - Spanish Residency Free GuideMustaffah KabelyyonNo ratings yet

- Foreign InvestmentDocument12 pagesForeign InvestmentMahmudur RahmanNo ratings yet

- Market Studies: Using Information To Guide Your StrategyDocument12 pagesMarket Studies: Using Information To Guide Your StrategyNicolás Galavis VelandiaNo ratings yet

- The State of CPP Purchase Power - Presentation To Utilities Comm 9-29-2020Document35 pagesThe State of CPP Purchase Power - Presentation To Utilities Comm 9-29-2020Sheehan HannanNo ratings yet

- Solution To Ch14 P13 Build A ModelDocument6 pagesSolution To Ch14 P13 Build A ModelALI HAIDERNo ratings yet

- Working Capital: Estimation and Calculation: de Luna, Regina Carla D. AIME330 - AQ1ArDocument5 pagesWorking Capital: Estimation and Calculation: de Luna, Regina Carla D. AIME330 - AQ1ArRegina De LunaNo ratings yet

- Handouts ACCOUNTING-2Document39 pagesHandouts ACCOUNTING-2Marc John IlanoNo ratings yet

- Tax For Rental Income in The PhilippinesDocument3 pagesTax For Rental Income in The PhilippinesRESIE GALANGNo ratings yet

- Financial Technologies and DeFi A Revisit To The Digital Finance RevolutionDocument3 pagesFinancial Technologies and DeFi A Revisit To The Digital Finance RevolutionAista Putra WisenewNo ratings yet

- Business English-FinalDocument37 pagesBusiness English-FinalLee's WorldNo ratings yet

- Ganning Your Own IndependenceDocument3 pagesGanning Your Own Independenceferreira MBNo ratings yet

- Financial Management-Lecture 7Document26 pagesFinancial Management-Lecture 7TinoManhangaNo ratings yet

- NFIR LecturesDocument9 pagesNFIR LecturesEliNo ratings yet

- Dokumen - Tips Industry Analysis Splash CorpDocument32 pagesDokumen - Tips Industry Analysis Splash CorpJayNo ratings yet

- Block 4Document84 pagesBlock 4Abhinav Ashok ChandelNo ratings yet

- 2 4ms of ProductionDocument31 pages2 4ms of ProductionYancey LucasNo ratings yet

- Comprehensive ExerciseDocument4 pagesComprehensive Exerciseوائل مصطفىNo ratings yet

- Solution Far670 Dec 2019Document5 pagesSolution Far670 Dec 2019Farissa ElyaNo ratings yet

- Case Ocean CarriersDocument2 pagesCase Ocean CarriersMorsal SarwarzadehNo ratings yet

- DSE McSleepersDocument1 pageDSE McSleepersJo FarrellNo ratings yet

- Cons of Global Free TradeDocument4 pagesCons of Global Free TradeGlydel Mae LaidanNo ratings yet

- (Done) Q2 - GenMath WEEK 11 (M1)Document3 pages(Done) Q2 - GenMath WEEK 11 (M1)aespa karinaNo ratings yet

- MSFIN 223 - Case 1 - Du Pont (Cauton, Cortez, Dy, Lui, Mamaril, Papa, Rasco)Document3 pagesMSFIN 223 - Case 1 - Du Pont (Cauton, Cortez, Dy, Lui, Mamaril, Papa, Rasco)Leophil RascoNo ratings yet

- BS 4662Document41 pagesBS 4662hessian123100% (1)

Bank Recon-Tion Statement

Bank Recon-Tion Statement

Uploaded by

Nidhi NayakOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Recon-Tion Statement

Bank Recon-Tion Statement

Uploaded by

Nidhi NayakCopyright:

Available Formats

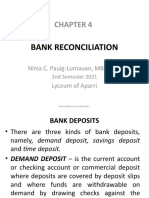

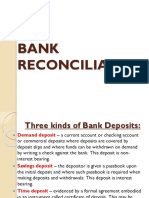

CHAPTER 13: BANK RECONCILIATION STATEMENT

When cash increases in the bank, the account holder adds the amount in the

receipt or debit side of the cash book, and to the credit or payments side when

cash is removed from the bank.

The bank also maintains an account of the account holder in its books of

accounts. Every deposit made by the account holder in his account is credited in

the books of the bank, and every withdrawal is debited.

A copy of this is given to the account holder in the form of bank statements or

pass book, for recording and reconciliation.

Debit entry in cash book = credit entry in pass book,

Credit entry in cash book = debit entry in pass book.

The reasons for the difference in the balances is important to find out. It could

have been due to error in recording in cash book or pass book, or not having

been recorded at all.

Pass book / bank statement: copy of the account of the account holder in the

books of accounts of the bank. It is sent to the account holder, to cross-check

the balances, and rectify them in the cash book.

A debit balance in the pass book, means credit balance in the cash book =

amount payable by the account holder to the bank.

A credit balance in the pass book, means debit balance in the cash book =

amount receivable by the account holder from the bank; money laying as

deposits.

Reasons for the difference in the balances:

1. Time difference in recording entries: there is usually a gap between when

the transactions are recorded in the cash book and when they are recorded

in the pass book.

i. Cheque issued* is recorded in cash book on date of issue, but

recorded in bank when presented for payment – so there is a gap

of few days. If BRS is prepared on a date between issue &

presentation for payment, difference will arise.

ii. Cheque deposited* is recorded in the cash book on the date of

deposit, while in pass book, on receiving the amount from other

bank, i.e. cheque is cleared.

2. Recorded by bank, not by account holder: sometimes the bank records

certain transactions that are known to the account holder only on

receiving the pass book from the bank.

i. If the bank allows interest on the money deposited, it credits the

interest to this account in its books. But the a/c holder knows about

it when he receives the pass book. Until then the cash book balance

is less than pass book

ii. Banks provide services and overdraft facilities, for which they

charge bank charges/interest. They debit the a/c in their books.

iii. Sometimes bank collects the interest or dividend on the person’s

behalf and credits their account.

iv. If given standing instructions, they make certain payments, like

insurance premium.

v. If direct deposits are made, the bank credits the account, but the

person comes to know later

vi. If the bank doesn’t receive the payment against the bills

discounted* by it, it will debit the account holder’s account along

with the charges that may have incurred.

vii. When goods are sold on credit and the documents are sent through

the bank, it collects the amount on behalf of the seller and credits

his account.

3. Errors – by bank or account holder: transaction not being recorded, or

wrong amount carried forward, etc.

i. Wrong name is credited/debited

ii. Wrong amount is credited/debited – overcasted/undercasted

*Issue of cheque = payment to someone by cheque

*Deposit of cheque = depositing cash into your bank account.

*Discounting a bill = when there is a credit sale and a bill is issued stating the payment will

be made after 2 months, but there is an urgent need for funds. In such case, the business will

discount this bill from the bank (before the 2 months) and receive some money against it,

after deducting some interest.

It gets dishonoured if the business does not pay the money back to the bank.

Debit balance in cash book and credit balance in pass book is favourable

balance = amount laying deposited in the bank, i.e. receivable from the bank.

Credit balance in cash book and debit balance in pass book is unfavourable

balance = amount withdrawn in excess of the amount deposited, i.e. payable to

the bank.

Starting with cash book balance; overcasting on receipt side / undercasting on

payments side = more balance, so we will deduct. Overcasting on payments side

/ undercasting on receipt side = less balance, so we will add.

When preparing BRS for overdraft balance, start the amount with the negative

value and do the normal calculations.

If starting with positive value (for overdraft), the rules will reverse, i.e. where

you must add, you will deduct and vice-versa.

You might also like

- 1G2 - Outbound Processing For Customer - WMDocument12 pages1G2 - Outbound Processing For Customer - WMsserpsap100% (1)

- BRS Full ChapterDocument16 pagesBRS Full ChapterMumtazAhmad100% (1)

- Monopoly ProjectDocument13 pagesMonopoly Projectapi-311197959No ratings yet

- Risk Management in Banking Sector MainDocument54 pagesRisk Management in Banking Sector MainJahanvi Bansal55% (11)

- Xerox-Case Study Analysi-JhellDocument10 pagesXerox-Case Study Analysi-Jhelljhell de la cruzNo ratings yet

- MODULE 3 - Part 3 Bank ReconciliationDocument16 pagesMODULE 3 - Part 3 Bank ReconciliationShaena Mae50% (2)

- Bank Reconciliation - For LectureDocument3 pagesBank Reconciliation - For LectureCharlene Jane EspinoNo ratings yet

- Hsslive-Chapter 5 BRS 1 PDFDocument2 pagesHsslive-Chapter 5 BRS 1 PDFRam IyerNo ratings yet

- Fundamentas of Accounting I CH 5Document24 pagesFundamentas of Accounting I CH 5israelbedasa3100% (1)

- Bank ReconciliationDocument12 pagesBank ReconciliationJenny Pearl Dominguez CalizarNo ratings yet

- Chapter 2 Bank Reconciliation (Gatdc)Document20 pagesChapter 2 Bank Reconciliation (Gatdc)Joan LeonorNo ratings yet

- Assignment 1571213669 SmsDocument13 pagesAssignment 1571213669 SmsJayasuriya SNo ratings yet

- Bank Reconciliation StatementDocument27 pagesBank Reconciliation Statementkimuli FreddieNo ratings yet

- Intermidiate FA I ChapterDocument28 pagesIntermidiate FA I Chapteryiberta69No ratings yet

- Group - 11 Bank Reconciliation Statement: CIA (Continuous Internal Assessment) 1Document13 pagesGroup - 11 Bank Reconciliation Statement: CIA (Continuous Internal Assessment) 1shriyanshu padhiNo ratings yet

- Chapter 5 - Bank Reconciliation StatementDocument23 pagesChapter 5 - Bank Reconciliation StatementNchumthung JamiNo ratings yet

- Midterm The Banks Functional DepartmentsDocument49 pagesMidterm The Banks Functional DepartmentsB-jay AledonNo ratings yet

- 6 - Bank Reconciliation StatementDocument3 pages6 - Bank Reconciliation StatementNeeraj RaikwarNo ratings yet

- Learning Activity Sheet No. 16 2 Quarter: Grade Level/ Subject Grade 12 - Fundamentals of ABM 2Document13 pagesLearning Activity Sheet No. 16 2 Quarter: Grade Level/ Subject Grade 12 - Fundamentals of ABM 2Yuri GalloNo ratings yet

- Bank Reconciliation Statement Theory and Practice Question From Sir Jawad and Sir Dawood Shahid and Icap TextDocument64 pagesBank Reconciliation Statement Theory and Practice Question From Sir Jawad and Sir Dawood Shahid and Icap TextJahanzaib ButtNo ratings yet

- Bank Reconciliation PDFDocument17 pagesBank Reconciliation PDFJamaica IndacNo ratings yet

- CFAS - Bank ReconciliationDocument5 pagesCFAS - Bank ReconciliationAltessa Lyn ContigaNo ratings yet

- Accounting For CashDocument9 pagesAccounting For CashNatty STAN100% (1)

- Chapter 6 CashDocument15 pagesChapter 6 CashTesfamlak MulatuNo ratings yet

- Chapter-01 Accounting For Banking CompanyDocument26 pagesChapter-01 Accounting For Banking CompanyRabbi Ul Apon100% (1)

- Lesson 8 - Bank Reconciliation StatementDocument5 pagesLesson 8 - Bank Reconciliation StatementUnknownymousNo ratings yet

- Bank Reconciliation StatementDocument4 pagesBank Reconciliation StatementArshad BashirNo ratings yet

- Bank Reconciliation StatementDocument14 pagesBank Reconciliation StatementMarvie MendozaNo ratings yet

- 206bank Reconcilliation StatementDocument3 pages206bank Reconcilliation StatementRAKESH VARMANo ratings yet

- 8bank Reconciliation StatementDocument12 pages8bank Reconciliation Statementnikita2802No ratings yet

- Chapter Five CashDocument9 pagesChapter Five CashDawit TesfayeNo ratings yet

- Accounting PPT ReportDocument27 pagesAccounting PPT ReportAbdullah AmjadNo ratings yet

- MC1404 - Unit 5Document11 pagesMC1404 - Unit 5Senthil KumarNo ratings yet

- Cash and Cash EquivalentsDocument9 pagesCash and Cash EquivalentsJna MarieNo ratings yet

- Bank Reconciliation StatementDocument10 pagesBank Reconciliation StatementmuniNo ratings yet

- Financial Accounting Handout 2Document49 pagesFinancial Accounting Handout 2Rhoda Mbabazi ByogaNo ratings yet

- BRS Bank Reconcilation StatementDocument15 pagesBRS Bank Reconcilation Statementbabluon22No ratings yet

- Bank ReconciliationDocument7 pagesBank ReconciliationMikaella Adriana GoNo ratings yet

- Managerial Accounting (Banking) Terms For MBA StudentsDocument3 pagesManagerial Accounting (Banking) Terms For MBA StudentsEbunNo ratings yet

- Accounting Lesson 1 Bank Reconciliation NotesDocument9 pagesAccounting Lesson 1 Bank Reconciliation NotesKabelo SefaliNo ratings yet

- Chp1 Bank Bank Recon STMTDocument16 pagesChp1 Bank Bank Recon STMTMichael AsieduNo ratings yet

- Bank Reconciliation: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriDocument60 pagesBank Reconciliation: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriTessang OnongenNo ratings yet

- General BankingDocument32 pagesGeneral BankingTaanzim JhumuNo ratings yet

- Chapter-2 Bank Reconciliation StatementDocument10 pagesChapter-2 Bank Reconciliation Statementyisog79636No ratings yet

- Paying and Collecting BankerDocument12 pagesPaying and Collecting BankerartiNo ratings yet

- Bank Reconciliations: Meaning: A Bank Reconciliation Statement Is A Statement That Compares The Cash Book and TheDocument2 pagesBank Reconciliations: Meaning: A Bank Reconciliation Statement Is A Statement That Compares The Cash Book and TheApurvakc KcNo ratings yet

- Notes On Cash and Cash EquivalentsDocument1 pageNotes On Cash and Cash EquivalentsMariz Julian Pang-aoNo ratings yet

- FABM2 Chapter5Document7 pagesFABM2 Chapter5johnleegiba09No ratings yet

- Material 2Document45 pagesMaterial 2Rocky BassigNo ratings yet

- Banking Law & PracticeDocument12 pagesBanking Law & PracticeShams TabrezNo ratings yet

- Bank ReconciliationDocument18 pagesBank ReconciliationJanaica MacaraegNo ratings yet

- Banking Chapter FourDocument13 pagesBanking Chapter FourfikremariamNo ratings yet

- Bank ReconciliationDocument20 pagesBank ReconciliationLoslyn LumacangNo ratings yet

- Ch.4 - Cash and Receivables - MHDocument75 pagesCh.4 - Cash and Receivables - MHSamZhaoNo ratings yet

- CashDocument9 pagesCashHenok EnkuselassieNo ratings yet

- IA 1 Module Week 3-4Document8 pagesIA 1 Module Week 3-4Yamit, Angel Marie A.No ratings yet

- CH 3 - BrsDocument0 pagesCH 3 - BrsHaseeb Ullah KhanNo ratings yet

- Bank Reconciliation TopicDocument11 pagesBank Reconciliation TopicJoanNo ratings yet

- Paying BankerDocument2 pagesPaying BankerwubeNo ratings yet

- Binayak Academy,: Gandhi Nagar 1 Line, Near NCC Office, BerhampurDocument8 pagesBinayak Academy,: Gandhi Nagar 1 Line, Near NCC Office, BerhampurkunjapNo ratings yet

- Unit 2 LPBDocument9 pagesUnit 2 LPBVeena ReddyNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Hitachi Sa Approval LetterDocument1 pageHitachi Sa Approval LetterMohammad T. KhalafNo ratings yet

- FIN7101 Group Assignment (Plantation) - FINAL (Group 3)Document73 pagesFIN7101 Group Assignment (Plantation) - FINAL (Group 3)Azdzharulnizzam AlwiNo ratings yet

- Start Living in Spain - Spanish Residency Free GuideDocument13 pagesStart Living in Spain - Spanish Residency Free GuideMustaffah KabelyyonNo ratings yet

- Foreign InvestmentDocument12 pagesForeign InvestmentMahmudur RahmanNo ratings yet

- Market Studies: Using Information To Guide Your StrategyDocument12 pagesMarket Studies: Using Information To Guide Your StrategyNicolás Galavis VelandiaNo ratings yet

- The State of CPP Purchase Power - Presentation To Utilities Comm 9-29-2020Document35 pagesThe State of CPP Purchase Power - Presentation To Utilities Comm 9-29-2020Sheehan HannanNo ratings yet

- Solution To Ch14 P13 Build A ModelDocument6 pagesSolution To Ch14 P13 Build A ModelALI HAIDERNo ratings yet

- Working Capital: Estimation and Calculation: de Luna, Regina Carla D. AIME330 - AQ1ArDocument5 pagesWorking Capital: Estimation and Calculation: de Luna, Regina Carla D. AIME330 - AQ1ArRegina De LunaNo ratings yet

- Handouts ACCOUNTING-2Document39 pagesHandouts ACCOUNTING-2Marc John IlanoNo ratings yet

- Tax For Rental Income in The PhilippinesDocument3 pagesTax For Rental Income in The PhilippinesRESIE GALANGNo ratings yet

- Financial Technologies and DeFi A Revisit To The Digital Finance RevolutionDocument3 pagesFinancial Technologies and DeFi A Revisit To The Digital Finance RevolutionAista Putra WisenewNo ratings yet

- Business English-FinalDocument37 pagesBusiness English-FinalLee's WorldNo ratings yet

- Ganning Your Own IndependenceDocument3 pagesGanning Your Own Independenceferreira MBNo ratings yet

- Financial Management-Lecture 7Document26 pagesFinancial Management-Lecture 7TinoManhangaNo ratings yet

- NFIR LecturesDocument9 pagesNFIR LecturesEliNo ratings yet

- Dokumen - Tips Industry Analysis Splash CorpDocument32 pagesDokumen - Tips Industry Analysis Splash CorpJayNo ratings yet

- Block 4Document84 pagesBlock 4Abhinav Ashok ChandelNo ratings yet

- 2 4ms of ProductionDocument31 pages2 4ms of ProductionYancey LucasNo ratings yet

- Comprehensive ExerciseDocument4 pagesComprehensive Exerciseوائل مصطفىNo ratings yet

- Solution Far670 Dec 2019Document5 pagesSolution Far670 Dec 2019Farissa ElyaNo ratings yet

- Case Ocean CarriersDocument2 pagesCase Ocean CarriersMorsal SarwarzadehNo ratings yet

- DSE McSleepersDocument1 pageDSE McSleepersJo FarrellNo ratings yet

- Cons of Global Free TradeDocument4 pagesCons of Global Free TradeGlydel Mae LaidanNo ratings yet

- (Done) Q2 - GenMath WEEK 11 (M1)Document3 pages(Done) Q2 - GenMath WEEK 11 (M1)aespa karinaNo ratings yet

- MSFIN 223 - Case 1 - Du Pont (Cauton, Cortez, Dy, Lui, Mamaril, Papa, Rasco)Document3 pagesMSFIN 223 - Case 1 - Du Pont (Cauton, Cortez, Dy, Lui, Mamaril, Papa, Rasco)Leophil RascoNo ratings yet

- BS 4662Document41 pagesBS 4662hessian123100% (1)