Professional Documents

Culture Documents

GRP II - Auditing (N) - Suggested Ans - Nov 2018

GRP II - Auditing (N) - Suggested Ans - Nov 2018

Uploaded by

ABC LtdCopyright:

Available Formats

You might also like

- Comprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeFrom EverandComprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeRating: 5 out of 5 stars5/5 (1)

- Downloadslide - Download Slides, Ebooks, Solution Manual, and Test BanksDocument5 pagesDownloadslide - Download Slides, Ebooks, Solution Manual, and Test BanksMuhammad Yamin Buan50% (4)

- AuditNew Nov18 Suggested Ans CA InterDocument15 pagesAuditNew Nov18 Suggested Ans CA InterRishabh jainNo ratings yet

- Auditing and Assurance - Mock Test Paper - Answers - Oct 2022 - CA Inter (New)Document9 pagesAuditing and Assurance - Mock Test Paper - Answers - Oct 2022 - CA Inter (New)KM ASSOCIATESNo ratings yet

- 71746bos071022 Inter P6aDocument10 pages71746bos071022 Inter P6aTutulNo ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Intermediate Group - Ii Paper - 6: Auditing and AssuranceDocument3 pagesTest Series: August, 2018 Mock Test Paper - 1 Intermediate Group - Ii Paper - 6: Auditing and Assurancesahil kumarNo ratings yet

- 6) AuditDocument16 pages6) AuditKrushna MateNo ratings yet

- 73662bos59508 Inter P6aDocument10 pages73662bos59508 Inter P6adeepika devsaniNo ratings yet

- Auditing AssuranceDocument16 pagesAuditing AssurancesolomonNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument14 pages© The Institute of Chartered Accountants of IndialovedesuzaNo ratings yet

- 69779bos55738 p6Document16 pages69779bos55738 p6OPULENCENo ratings yet

- 75781bos61308 p6Document15 pages75781bos61308 p6pratimca592No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument9 pages© The Institute of Chartered Accountants of Indiaashwani7789No ratings yet

- 55067bos44235p6 Iipc ADocument10 pages55067bos44235p6 Iipc AAshutosh KumarNo ratings yet

- Rrpao 1Document12 pagesRrpao 1mr rahulNo ratings yet

- © The Institute of Chartered Accountants of India: (2 X 7 14 Marks)Document14 pages© The Institute of Chartered Accountants of India: (2 X 7 14 Marks)Kirthiga dhinakaranNo ratings yet

- CA Inter Audit A MTP 2 May 23Document10 pagesCA Inter Audit A MTP 2 May 23Sam KukrejaNo ratings yet

- Audit Dec 21 Suggested Answer @mission - CA - InterDocument19 pagesAudit Dec 21 Suggested Answer @mission - CA - Intersantosh pandeyNo ratings yet

- D11 Spring 2010Document5 pagesD11 Spring 2010meelas123No ratings yet

- MTP 3 21 Answers 1681446073Document10 pagesMTP 3 21 Answers 1681446073shoaibinamdar1454No ratings yet

- Dec 2021Document16 pagesDec 2021DiyaNo ratings yet

- Audit Suggested Ans CA Inter Nov 20Document14 pagesAudit Suggested Ans CA Inter Nov 20Priyansh KhatriNo ratings yet

- AuditDocument15 pagesAudithitesh gawdeNo ratings yet

- Audit Planning - Long QuizDocument15 pagesAudit Planning - Long QuizKathleenNo ratings yet

- Sa 200 "Overall Objectives of The Independent Auditor and Conduct of Audit in Accordance With Sas"Document5 pagesSa 200 "Overall Objectives of The Independent Auditor and Conduct of Audit in Accordance With Sas"Padsariya SureshNo ratings yet

- Solution Assuranceand Audit Practice May 2009Document9 pagesSolution Assuranceand Audit Practice May 2009samuel_dwumfourNo ratings yet

- Modelp CA Inter New Syllabus 2 Audit Ns 3912Document6 pagesModelp CA Inter New Syllabus 2 Audit Ns 3912cakabirs.chavanNo ratings yet

- Bos 36238 P 6Document16 pagesBos 36238 P 6vinay parulekarNo ratings yet

- Acctg 34 ReviewerDocument9 pagesAcctg 34 ReviewerAboc May AnNo ratings yet

- CIA - Wiley & Vallabhaneni Part 2Document80 pagesCIA - Wiley & Vallabhaneni Part 2Kay Cee TangalinNo ratings yet

- Chapter - 2 "Audit Strategy, Planning & Execution": Lecture - 18Document6 pagesChapter - 2 "Audit Strategy, Planning & Execution": Lecture - 18Aruna RajappaNo ratings yet

- Modelp CA Inter New Syllabus 1 Audit Ns 5727Document5 pagesModelp CA Inter New Syllabus 1 Audit Ns 5727cakabirs.chavanNo ratings yet

- MTP 10 21 Answers 1694676341Document9 pagesMTP 10 21 Answers 1694676341shoaibinamdar1454No ratings yet

- Auditing - AnswersDocument9 pagesAuditing - Answerspriyanshagrawal907No ratings yet

- At 9204Document13 pagesAt 9204Shefannie PaynanteNo ratings yet

- Risk Based AuditDocument67 pagesRisk Based Auditkevin carmeloNo ratings yet

- Auditing PaperDocument172 pagesAuditing PaperHimanshu SainiNo ratings yet

- IPFM AA Exam Guide PDFDocument23 pagesIPFM AA Exam Guide PDFcwkkarachchiNo ratings yet

- Accept Affects The Sample Size Required. The Lower The Risk The Auditor Is Willing To Accept, The Greater The Sample Size Will Need To BeDocument11 pagesAccept Affects The Sample Size Required. The Lower The Risk The Auditor Is Willing To Accept, The Greater The Sample Size Will Need To BeGao YungNo ratings yet

- Test 8 SSDocument3 pagesTest 8 SSnaseebmasihadvNo ratings yet

- DocDocument3 pagesDocMarvine MagaddatuNo ratings yet

- CH 11 P1Document4 pagesCH 11 P1GlaizzaNo ratings yet

- ICPA Audit Planning HandoutDocument4 pagesICPA Audit Planning Handoutmichelle angela maramagNo ratings yet

- At Quizzer 6 - Planning and Risk Assessment - FEU MktiDocument18 pagesAt Quizzer 6 - Planning and Risk Assessment - FEU Mktiiyah0% (1)

- AT Quizzer 7 - Planning and Risk Assessment 2SAY2122Document9 pagesAT Quizzer 7 - Planning and Risk Assessment 2SAY2122Ferdinand MangaoangNo ratings yet

- 01 Definition of Internal AuditingDocument11 pages01 Definition of Internal AuditingMhmd Habbosh100% (2)

- E BookDocument5 pagesE BookSavit BansalNo ratings yet

- Auditing in CIS Environment: Chool of Usiness and CcountancyDocument6 pagesAuditing in CIS Environment: Chool of Usiness and Ccountancycha11No ratings yet

- Stages of An AuditDocument4 pagesStages of An AuditDerrick KimaniNo ratings yet

- ASR Quizzer 6 - Planning and Risk AssessmenttDocument18 pagesASR Quizzer 6 - Planning and Risk AssessmenttInsatiable LifeNo ratings yet

- Ques PPR Jan 2021Document14 pagesQues PPR Jan 2021ashwani7789No ratings yet

- At Quizzer 4B Planning An Audit of FSDocument8 pagesAt Quizzer 4B Planning An Audit of FSJEFFERSON CUTENo ratings yet

- ACT1207 Review of Audit ProcessDocument8 pagesACT1207 Review of Audit Processantonioregina000No ratings yet

- II - Audit Strategy, PlanningDocument8 pagesII - Audit Strategy, PlanningAlphy maria cherianNo ratings yet

- Risk Based Audit (1) FINALDocument68 pagesRisk Based Audit (1) FINALSamiah Manggis MampaoNo ratings yet

- MTP m21 A Ans 2Document8 pagesMTP m21 A Ans 2sakshiNo ratings yet

- Auditing One 03 OKDocument28 pagesAuditing One 03 OKRObel demisNo ratings yet

- Audit - Mock Board Examination - Sy2019-20Document15 pagesAudit - Mock Board Examination - Sy2019-20Mark Domingo MendozaNo ratings yet

- At 07 Psa 320450520550620Document4 pagesAt 07 Psa 320450520550620Princess Mary Joy LadagaNo ratings yet

- Activity Worksheet 003Document4 pagesActivity Worksheet 003Pearl Isabelle SudarioNo ratings yet

- ACC 139 Assurance and Audit Principles - P1 1S SY2324 - Key AnswerDocument10 pagesACC 139 Assurance and Audit Principles - P1 1S SY2324 - Key AnswerCM MIGUELNo ratings yet

- Intermediate Accounting - Final Output ReceivablesDocument56 pagesIntermediate Accounting - Final Output ReceivablesAnitas LimmaumNo ratings yet

- Efsf 2013Document59 pagesEfsf 2013LuxembourgAtaGlanceNo ratings yet

- FINS 3616 Tutorial Questions-Week 3 - AnswersDocument5 pagesFINS 3616 Tutorial Questions-Week 3 - AnswersJethro Eros PerezNo ratings yet

- Strategic Social Media MarketingDocument21 pagesStrategic Social Media MarketingTahir SaeedNo ratings yet

- Bdpw3103introductory FinanceDocument12 pagesBdpw3103introductory Financedicky chongNo ratings yet

- ch9 MKT 301 Quiz ReviewDocument4 pagesch9 MKT 301 Quiz ReviewSergio HoffmanNo ratings yet

- Managing Inventory: MGT E 524 - Operation and Supply Chain ManagementDocument21 pagesManaging Inventory: MGT E 524 - Operation and Supply Chain ManagementJoseph Noel CoscosNo ratings yet

- Pricing For International MarketsDocument14 pagesPricing For International MarketsReyadNo ratings yet

- CafeteriaDocument24 pagesCafeteriasnhkmnkk4jNo ratings yet

- HUL Vs Patanjali (Market Study)Document26 pagesHUL Vs Patanjali (Market Study)Vibhuti0% (1)

- WACC NTDocument40 pagesWACC NTHamid S. ParwaniNo ratings yet

- 04 Task Performance 1 FMDocument2 pages04 Task Performance 1 FMEdlyn TejanoNo ratings yet

- MGT 301Document2 pagesMGT 301Ali BhattiNo ratings yet

- Chapter 12 - Quiz 2Document1 pageChapter 12 - Quiz 2jpacideraNo ratings yet

- Chapter 3: Forward and Futures Prices: Continuous CompoundingDocument7 pagesChapter 3: Forward and Futures Prices: Continuous Compoundingsunilp14No ratings yet

- FinalDocument5 pagesFinalmehdiNo ratings yet

- Wright Chapter9LabDocument5 pagesWright Chapter9LabashibhallauNo ratings yet

- Mergers and Acquisitions in India: A Strategic Impact Analysis For The Corporate RestructuringDocument9 pagesMergers and Acquisitions in India: A Strategic Impact Analysis For The Corporate RestructuringAyush GuptaNo ratings yet

- Setting Product StrategyDocument19 pagesSetting Product StrategyNoora ZulfiqarNo ratings yet

- Baru Baru - PT X - Study Case 5Document98 pagesBaru Baru - PT X - Study Case 5Kojiro FuumaNo ratings yet

- Selva Perumal Immersion ProjectDocument34 pagesSelva Perumal Immersion ProjectManoj kumar100% (1)

- ANA Email Marketing Solution Maturity ModelDocument2 pagesANA Email Marketing Solution Maturity ModelDemand MetricNo ratings yet

- FEC ContractsDocument2 pagesFEC ContractssatyambhanduNo ratings yet

- Ecommerce Manager ResumeDocument8 pagesEcommerce Manager Resumenemyzyvudut367% (3)

- Positioning Decision MPC Assigment 15Document3 pagesPositioning Decision MPC Assigment 15gaurav khatriNo ratings yet

- 1.0 Executive SummaryDocument16 pages1.0 Executive Summaryirfan_handaru100% (4)

- Marketing ManagementDocument33 pagesMarketing Managementnoradwiyah86No ratings yet

- Financial Accounting UpdatedDocument98 pagesFinancial Accounting UpdatedbalagurudevNo ratings yet

- CV - Rahul Kumar JhaDocument2 pagesCV - Rahul Kumar Jhausm1987No ratings yet

GRP II - Auditing (N) - Suggested Ans - Nov 2018

GRP II - Auditing (N) - Suggested Ans - Nov 2018

Uploaded by

ABC LtdOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GRP II - Auditing (N) - Suggested Ans - Nov 2018

GRP II - Auditing (N) - Suggested Ans - Nov 2018

Uploaded by

ABC LtdCopyright:

Available Formats

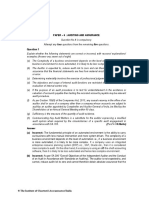

PAPER – 6 : AUDITING AND ASSURANCE

Question No.1 is compulsory.

Attempt any four questions from the remaining five questions.

Question 1

Examine with reasons (in short) whether the following statements are correct or incorrect:

(a) Judgemental matters are transactions that are unusual due to either its size or nature and

that therefore occur infrequently.

(b) A well designed and drafted audit plan and audit strategy which takes care of all the

uncertainties and conditions, need not be changed during the course of audit.

(c) An auditor is not concerned with consistency of accounting policies relating to opening

balances.

(d) Audit evidence obtained from external confirmation is always reliable.

(e) Banks recognize income on Non-Performing Assets on accrual basis.

(f) Management of the organization is solely responsible for the compliance of auditing

standards while preparing financial statements.

(g) The Board of Director of ABC Ltd., a listed company at Bombay Stock Exchange, is

required to fill the casual vacancy of an auditor only after taking into account the

recommendations of the audit committee.

(h) Any partner of an LLP, who is appointed as an auditor of a company, can sign the audit

report.

(i) When auditing in an automated environment, inquiry is often the most efficient and effective

audit testing method.

(j) An auditor should issue disclaimer of opinion when there is difference of opinion between

him and the management on a particular point. (2 x 10 = 20 Marks)

Answer

(a) Incorrect: Significant risks often relate to significant non-routine transactions or

judgemental matters. Non-routine transactions are transactions that are unusual, due to

either size or nature, and that therefore occur infrequently. Judgemental matters may

include the development of accounting estimates for which there is significant

measurement uncertainty. Thus judgemental matters are not always unusual due to their

size or nature.

(b) Incorrect: The auditor shall update and change the overall audit strategy and the audit

plan as necessary during the course of the audit. As a result of unexpected events,

changes in conditions, or the audit evidence obtained from the results of audit procedures,

the auditor may need to modify the overall audit strategy and audit plan and thereby th e

© The Institute of Chartered Accountants of India

2 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

resulting planned nature, timing and extent of further audit procedures, based on the

revised consideration of assessed risks.

(c) Incorrect: In conducting an initial audit engagement, one of the objective of the auditor

with respect to opening balances is to obtain sufficient appropriate audit evidence about

whether appropriate accounting policies reflected in the opening balances have been

consistently applied in the current period’s financial statements, or changes thereto are

properly accounted for and adequately presented and disclosed in accordance with the

applicable financial reporting framework.

(d) Incorrect: The reliability of information to be used as audit evidence, and therefore of the

audit evidence itself, is influenced by its source and its nature, and the circumstances

under which it is obtained, including the controls over its preparation and maintenance

where relevant. Even when information to be used as audit evidence is obtained from

sources external to the entity, circumstances may exist that could affect its reliability.

For example, information obtained from an independent external source may not be

reliable if the source is not knowledgeable, or a management’s expert may lack objectivity.

(e) Incorrect: Income from non-performing assets (NPA) is not recognised on accrual basis

due to its uncertainty but is booked as income only when it is actually received.

(f) Incorrect: As per Section 143(9) of the Companies Act, 2013, every auditor shall comply

with the auditing standards.

(g) Correct: Where a company is required to constitute an Audit Committee under section

177, all appointments, including the filling of a casual vacancy of an auditor under this

section shall be made after taking into account the recommendations of such committee.

(h) Incorrect: Section 141(2) of the Companies Act, 2013 states that where a firm including

a limited liability partnership is appointed as an auditor of a company, only the partners

who are chartered accountants shall be authorised to act and sign on behalf of the firm.

(i) Incorrect: There are basically four types of audit tests that should be used in an

automated environment. They are inquiry, observation, inspection and re-performance.

Inquiry is the most efficient audit test but it also gives the least audit evidence. Hence,

inquiry should always be used in combination with any one of the other audit testing

methods. Inquiry alone is not sufficient. Applying inquiry in combination with inspection

gives the most effective and efficient audit evidence.

(j) Incorrect: The auditor shall disclaim an opinion when the auditor is unable to obtain

sufficient appropriate audit evidence on which to base the opinion, and the auditor

concludes that the possible effects on the financial statements of undetected

misstatements, if any, could be both material and pervasive.

In case of difference of opinion, either the auditor will issue qualified report or adverse

report and not disclaimer of opinion.

© The Institute of Chartered Accountants of India

PAPER – 6: AUDITING AND ASSURANCE 3

Question 2

Discuss the following:

(a) Factors that should be considered for deciding upon the extent of checking on a sampling

plan. (5 Marks)

(b) "An adequate planning benefits the audit of financial statements." Discuss. (5 Marks)

(c) "Professional judgment is essential to the proper conduct of an audit." Discuss. (5 Marks)

(d) With respect to audit in an automated environment, explain the following:

(i) CAATs

(ii) Data Analytics

(iii) Database

(iv) Information Systems

(v) Privileged access (5 Marks)

Answer

(a) The factors that should be considered for deciding upon the extent of checking on

a sampling plan are following:

(i) Size of the organisation under audit.

(ii) State of the internal control.

(iii) Adequacy and reliability of books and records.

(iv) Tolerable error range.

(v) Degree of the desired confidence.

(b) Benefits of Planning in the audit of financial statements: Planning an audit involves

establishing the overall audit strategy for the engagement and developing an audit plan.

Adequate planning benefits the audit of financial statements in several ways, including the

following:

1. Helping the auditor to devote appropriate attention to important areas of the audit.

2. Helping the auditor identify and resolve potential problems on a timely basis.

3. Helping the auditor properly organize and manage the audit engagement so that it is

performed in an effective and efficient manner.

4. Assisting in the selection of engagement team members with appropriate levels of

capabilities and competence to respond to anticipated risks, and the proper

assignment of work to them.

5. Facilitating the direction and supervision of engagement team members and the

review of their work.

© The Institute of Chartered Accountants of India

4 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

6. Assisting, where applicable, in coordination of work done by auditors of components

and experts.

(c) Professional judgment is essential to the proper conduct of an audit. This is because

interpretation of relevant ethical requirements and the SAs and the informed decisions

required throughout the audit cannot be made without the application of relevant

knowledge and experience to the facts and circumstances. Professional judgment is

necessary in particular regarding decisions about:

(i) Materiality and audit risk.

(ii) The nature, timing, and extent of audit procedures used to meet the requirements of

the SAs and gather audit evidence.

(iii) Evaluating whether sufficient appropriate audit evidence has been obtained, and

whether more needs to be done to achieve the objectives of the SAs and thereby, the

overall objectives of the auditor.

(iv) The evaluation of management’s judgments in applying the entity’s applicable

financial reporting framework.

(v) The drawing of conclusions based on the audit evidence obtained, for example,

assessing the reasonableness of the estimates made by management in preparing

the financial statements.

(d) (i) CAATs: Short form for Computer Assisted Audit Techniques, are a collection of

computer based tools and techniques that are used in an audit for analysing data in

electronic form to obtain audit evidence.

(ii) Data Analytics: A combination of processes, tools and techniques that are used to

tap vast amounts of electronic data to obtain meaningful information

(iii) Database: A logical subsystem within a larger information system where electronic

data is stored in a predefined form and retrieved for use.

(iv) Information Systems: Refers to a collection of electronic hardware, software,

networks and processes that are used in a business to carry out operations and

transactions.

(v) Privileged access: A type of super user access to information systems that enforces

less or no limits on using that system.

Question 3

(a) M/s Pankaj & Associates, Chartered Accountants, have been appointed as an auditor of

ABC Limited. CA Pankaj did not apply any audit procedures regarding opening balances.

He argued that since financial statements were audited by the predecessor auditor

therefore he is not required to verify them. Is CA Pankaj correct in his approach?

(5 Marks)

© The Institute of Chartered Accountants of India

PAPER – 6: AUDITING AND ASSURANCE 5

(b) "While the auditor may choose to analyse the monthly trends for expenses like rent, power

and fuel but for other expenses, an auditor generally prefers to verify other attributes."

Mention those attributes. (5 Marks)

(c) Write the audit procedures to be performed as an auditor for valuation (assertion) of

following:

(i) Loans and Advances and other current assets. (5 Marks)

(ii) Finished goods and goods for resale. (5 Marks)

Answer

(a) Initial audit engagement is an engagement in which either :

(i) The financial statements for the prior period were not audited; or

(ii) The financial statements for the prior period were audited by a predecessor auditor.

From the above, it is quite clear that CA Pankaj is not correct in his approach and therefore

would be required to follow the initial audit engagement and also apply audit procedures

regarding opening balances.

Audit Procedures regarding Opening Balances; The auditor shall read the most recent

financial statements, if any, and the predecessor auditor’s report thereon, if any, for

information relevant to opening balances, including disclosures.

The auditor shall obtain sufficient appropriate audit evidence about whether the opening

balances contain misstatements that materially affect the current period’s financial

statements by:

(a) Determining whether the prior period’s closing balances have been correctly brought

forward to the current period or, when appropriate, any adjustments have been

disclosed as prior period items in the current year’s Statement of Profit and Loss;

(b) Determining whether the opening balances reflect the application of appropriate

accounting policies; and

(c) Performing one or more of the following:

(i) Where the prior year financial statements were audited, perusing the copies of

the audited financial statements including the other relevant documents relating

to the prior period financial statements;

(ii) Evaluating whether audit procedures performed in the current period provide

evidence relevant to the opening balances; or

(iii) Performing specific audit procedures to obtain evidence regarding the opening

balances.

© The Institute of Chartered Accountants of India

6 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

(b) While the auditor may choose to analyse the monthly trends for expenses like rent,

power and fuel, an auditor generally prefers to vouch for other expenses to verify following

attributes:

(i) Whether the expenditure pertained to current period under audit;

(ii) Whether the expenditure qualified as a revenue and not capital expenditure;

(iii) Whether the expenditure had a valid supporting like travel tickets, insurance policy,

third party invoice etc.;

(iv) Whether the expenditure has been classified under the correct expense head;

(v) Whether the expenditure was authorised as per the delegation of authority matrix;

(vi) Whether the expenditure was in relation to the entity’s business and not a personal

expenditure

(c) (i) Audit procedure for valuation of Loans and Advances and other current assets

▪ Assess the allowance for doubtful accounts. Review the process followed by the

Company to derive an allowance for doubtful accounts. This will include a

consistency comparison with the method used in the last year, and a

determination of whether the method is appropriate for the underlying business

environment.

▪ Obtain the ageing report of loans and advances, split between not currently due,

30 days old, 30-60 days old, 60- 180 days old, 180- 365 days old and more than

365 days old. Also, obtain the list of loans and advances under litigation and

compare with previous year.

▪ Scrutinize the analysis and identify those loans and advances that appear

doubtful; Discuss with management their reasons, if any of these loans/

advances are not included in the provision for bad recoverable; Perform further

testing where any disputes exist; Reach a final conclusion regarding the

adequacy of the bad and doubtful loans/ advances provision.

▪ Assess bad loans/ advances write-offs. Prepare schedule of movements on Bad

loans/ advances – Provision Accounts and loans/ advances written off.

▪ Check that write-offs or other reductions in the recoverable balances have been

approved by an appropriate and authorised member of senior management, for

example the financial controller or finance director.

▪ Check that the restatement of foreign currency loans and advances/ other

current assets has been done properly.

(ii) Audit procedure for valuation of finished goods and goods for resale

- Enquire into what costs are included, how these have been established and

ensure that the overheads included have been determined based on normal

© The Institute of Chartered Accountants of India

PAPER – 6: AUDITING AND ASSURANCE 7

costs and appear reasonable in relation to the information disclosed in the draft

financial statements.

- Ensure that inventories are valued at net realizable value if they are likely to

fetch a value lower than their cost. For any such items, also verify if the relevant

semi/ partly processed inventories (work in progress) and raw materials have

also been written down.

- Follow up for items that are obsolete, damaged, slow moving and ascertain the

possible realizable value of such items. For the purpose, request the client to

provide inventory ageing split between less than 30 days, 30-60 days old,

60- 90 days old, 90- 180 days old, 180- 385 days old and more than 365 days

old (refer screenshot below)

- Follow up any inventories which at time of observance of physical counting were

noted as being damaged or obsolete.

- Compare recorded costs with replacement costs. Examine vendor price lists to

determine if recorded cost is less than current prices.

- Calculate inventory turnover ratio. Obsolete inventory may be revealed if ratio

is significantly lower.

- In manufacturing environments, test overhead allocation rates and ensure that

only direct labor, direct material and overhead have been included.

- Verify the correct application of lower-of-cost-or-net realizable value principles.

Question 4

(a) "Planning is not a discrete phase of an audit, but rather a continual and iterative process."

Discuss. (5 Marks)

(b) "The company has raised funds by issuing fully convertible debentures. These funds were

raised for the expansion and diversification of the business. However, the company utilized

these funds for repayment of long term loans and advances." Advise the auditor regarding

reporting requirements under CARO, 2016. (4 Marks)

(c) "A multinational co. wants to appoint you to carry the statutory audit." Discuss with

reference to SA 330 the substantive procedures to be performed to assess the risk of

material misstatement. (6 Marks)

(d) "MMJ Ltd., an unlisted public company, did not appoint any internal auditor for the financial

year ending on 31 st March, 2019. The company had paid up capital of ` 20 crores and

reserves of ` 25 crores. Its turnover for the preceeding 3 years were ` 75 crores for the

year ended 31st March, 2018, ` 150 crores for March, 2017 and ` 190 crores for March,

2016. The company had availed term loan from the bank of ` 130 crores. The outstanding

balance of the term loan as on 31 st March, 2018 is ` 90 crores."

As an auditor of the company, how would you deal with the above? (5 Marks)

© The Institute of Chartered Accountants of India

8 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

Answer

(a) Audit Planning- a Continuous Process

Planning is not a discrete phase of an audit, but rather a continual and iterative process

that often begins shortly after (or in connection with) the completion of the previous audit

and continues until the completion of the current audit engagement. Planning, however,

includes consideration of the timing of certain activities and audit procedures that need to

be completed prior to the performance of further audit procedures. For example, planning

includes the need to consider, prior to the auditor’s identification and assessment of the

risks of material misstatement, such matters as:

(i) The analytical procedures to be applied as risk assessment procedures.

(ii) Obtaining a general understanding of the legal and regulatory framework applicable

to the entity and how the entity is complying with that framework.

(iii) The determination of materiality.

(iv) The involvement of experts.

(v) The performance of other risk assessment procedures.

(b) The auditor is required to report as per clause xiv of paragraph 3 of CARO 2016, whether

the company has made any preferential allotment or private placement of shares or fully or

partly convertible debentures during the year under review and if so, as to whether the

requirement of section 42 of the Companies Act, 2013 have been complied with and the amount

raised have been used for the purposes for which the funds were raised. If not, provide the

details in respect of the amount involved and nature of non-compliance;

In view of the above clause, the auditor would report that funds raised by the company for

expansion and diversification of business have not been used for the said purpose rather

the company has utilised these funds for repayment of long term loans and advance.

(c) Substantive procedures to be performed to assess the risk of material misstatement:

Irrespective of the assessed risks of material misstatement, the auditor shall design and

perform substantive procedures for each material class of transactions, account balance,

and disclosure.

1. This requirement reflects the facts that:

(i) the auditor’s assessment of risk is judgmental and so may not identify all risks

of material misstatement; and

(ii) there are inherent limitations to internal control, including management override.

2. Depending on the circumstances, the auditor may determine that:

• Performing only substantive analytical procedures will be sufficient to reduce

audit risk to an acceptably low level. For example, where the auditor’s

assessment of risk is supported by audit evidence from tests of controls.

© The Institute of Chartered Accountants of India

PAPER – 6: AUDITING AND ASSURANCE 9

• Only tests of details are appropriate.

• A combination of substantive analytical procedures and tests of details are most

responsive to the assessed risks.

3. Substantive analytical procedures are generally more applicable to large volumes of

transactions that tend to be predictable over time. SA 520, “Analytical Procedures”

establishes requirements and provides guidance on the application of analytical

procedures during an audit.

4. The nature of the risk and assertion is relevant to the design of tests of details. For

example, tests of details related to the existence or occurrence assertion may involve

selecting from items contained in a financial statement amount and obtaining the

relevant audit evidence. On the other hand, tests of details related to the

completeness assertion may involve selecting from items that are expected to be

included in the relevant financial statement amount and investigating whether they

are included.

5. Because the assessment of the risk of material misstatement takes account of internal

control, the extent of substantive procedures may need to be increased when the

results from tests of controls are unsatisfactory.

6. In designing tests of details, the extent of testing is ordinarily thought of in terms of

the sample size. However, other matters are also relevant, including whether it is

more effective to use other selective means of testing.

(d) Every unlisted public company having-

(i) paid up share capital of fifty crore rupees or more during the preceding financial year;

or

(ii) turnover of two hundred crore rupees or more during the preceding financial year; or

(iii) outstanding loans or borrowings from banks or public financial institutions exceeding

one hundred crore rupees or more at any point of time during the preceding financial

year; or

(iv) outstanding deposits of twenty five crore rupees or more at any point of time during

the preceding financial year;

In view of above provisions, MMJ Ltd would have to appoint internal auditor for the financial

year 31-03-2019 because it had availed a term loan from the bank of ` 130 Crores. The

outstanding balance of term loan as on 31-03-2018 ` 90 crores would not make any

difference because section is contemplating outstanding at any point of time during the

preceding financial year.

Question 5

(a) "An auditor is required to make specific evaluations while forming an opinion in an audit

report." State them. (5 Marks)

© The Institute of Chartered Accountants of India

10 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

(b) "Mr. A is offered by ABC Ltd. for appointment as cost auditor and asked to certify certain

requirements before such appointment." Discuss those requirements with reference to the

provisions of the Companies Act, 2013. (5 Marks)

(c) Briefly mention the matters that are relevant in planning attendance at physical inventory

counting. (5 Marks)

(d) Write any five circumstances of conflicting or missing evidence that indicate the possibility

of fraud. (5 Marks)

Answer

(a) Specific Evaluations by the auditor: In particular, the auditor shall evaluate whether :

(i) The financial statements adequately disclose the significant accounting policies

selected and applied;

(ii) The accounting policies selected and applied are consistent with the applicable

financial reporting framework and are appropriate;

(iii) The accounting estimates made by management are reasonable;

(iv) The information presented in the financial statements is relevant, reliable,

comparable, and understandable;

(v) The financial statements provide adequate disclosures to enable the intended users

to understand the effect of material transactions and events on the information

conveyed in the financial statements; and

(vi) The terminology used in the financial statements, including the title of each financial

statement, is appropriate.

(b) Cost Auditor: Rule 6 of the Companies (Cost Records and audit) rules, 2014 required the

companies prescribed under the said rules to appoint an auditor within 180days of the

commencement of every financial year. However, before such appointment is made, the

written consent of the cost auditor to such appointment and a certificate from him or it shall

be obtained.

The certificate to be obtained from the cost auditor shall certify that the-

(1) the individual or the firm, as the case may be, is eligible for appointment and is not

disqualified for appointment under the Companies Act, 2013, the Cost and Works

Accountants Act, 1959 and the rules or regulations made thereunder;

(2) the individual or the firm, as the case may be, satisfies the criteria provided in section

141 of the Companies Act, 2013 so far as may be applicable;

(3) the proposed appointment is within the limits laid down by or under the authority of

the Companies Act, 2013; and

© The Institute of Chartered Accountants of India

PAPER – 6: AUDITING AND ASSURANCE 11

(4) the list of proceedings against the cost auditor or audit firm or any partner of the audit

firm pending with respect to professional matters of conduct, as disclosed in the

certificate, is true and correct.

(c) Matters relevant in planning attendance at physical inventory counting: Matters

relevant in planning attendance at physical inventory counting include, for example:

(i) Nature of inventory.

(ii) Stages of completion of work in progress.

(iii) The risks of material misstatement related to inventory.

(iv) The nature of the internal control related to inventory.

(v) Whether adequate procedures are expected to be established and proper instructions

issued for physical inventory counting.

(vi) The timing of physical inventory counting.

(vii) Whether the entity maintains a perpetual inventory system.

(viii) The locations at which inventory is held, including the materiality of the inventory and

the risks of material misstatement at different locations, in deciding at which locations

attendance is appropriate

(ix) Whether the assistance of an auditor’s expert is needed.

(d) Conflicting or missing evidence, including:

(i) Missing documents.

(ii) Documents that appear to have been altered.

(iii) Significant unexplained items on reconciliations.

(iv) Unusual discrepancies between the entity's records and confirmation replies.

(v) Large numbers of credit entries and other adjustments made to accounts receivable

records.

(vi) Missing or non-existent cancelled cheques in circumstances where cancelled

cheques are ordinarily returned to the entity with the bank statement.

(vii) Missing inventory or physical assets of significant magnitude.

(viii) Unavailable or missing electronic evidence, inconsistent with the entity’s record

retention practices or policies.

Question 6

Answer any four:

(a) "CA. NM who is rendering management consultancy service to LA Ltd. wants to accept

offer letter for appointment as an auditor of the LA Ltd. for the next financial year." Discuss

with reference to the provision of the Companies Act, 2013. (5 Marks)

© The Institute of Chartered Accountants of India

12 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

(b) Briefly explain the provisions for qualification and appointment of Auditors under the Multi -

State Co-operative Societies Act, 2002. (5 Marks)

(c) "The Auditor should examine the efficacy of various internal controls over advances, to

determine the nature, timing and extent of his substantive procedures." Discuss briefly.

(5 Marks)

(d) Write basic standards set for Expenditure Audit of Government. (5 Marks)

(e) "Ramjilal & Co. had been allotted the branch audit of a nationalized bank for the year ended

31st March, 2018. In the audit planning, the partner of Ramjilal & Co., observed that the

allotted branches are predominantly based in rural areas and major portion of the advances

were for agricultural purpose."

Now he needs your assistance on the following points so as to incorporate them in the

audit plan:

(i) for determination of NPA norms for agricultural advances

(ii) for accounts where there is erosion in the value of security/frauds committed by the

borrowers. (5 Marks)

Answer

(a) Section 141(3)(i) of the Companies Act, 2013 disqualifies a person for appointment as

an auditor of a company who is engaged as on the date of appointment in management

consultancy service as provided in section 144. Section 144 of the Companies Act, 2013

prescribes certain services not to be rendered by the auditor which are as under:

(i) Accounting and book keeping services

(ii) Internal audit.

(iii) Design and implementation of any financially information system.

(iv) Actuarial services

(v) Investment advisory services.

(vi) Investment banking services.

(vii) Rendering of outsourced financial services

(viii) Management services and

(ix) Any other kind of services as may be prescribed

Therefore, CA. NM is advised not to accept the assignment of auditing as the management

consultancy service is specifically notified in the list of services not to be rendered by him

as per section 141(3)(i) read with section 144 of the Companies Act, 2013.

(b) Qualification of Auditors -Section 72 of the Multi-State Co-operative Societies Act, 2002

states that a person who is a Chartered Accountant within the meaning of the Chartered

© The Institute of Chartered Accountants of India

PAPER – 6: AUDITING AND ASSURANCE 13

Accountants Act, 1949 can only be appointed as auditor of Multi-State co-operative society.

However, the following persons are not eligible for appointment as auditors of a Multi -State

co-operative society-

(a) A body corporate.

(b) An officer or employee of the Multi-State co-operative society.

(c) A person who is a member or who is in the employment, of an officer or employee of

the Multi-State co-operative society.

(d) A person who is indebted to the Multi-State co-operative society or who has given

any guarantee or provided any security in connection with the indebtedness of any

third person to the Multi-State co-operative society for an amount exceeding one

thousand rupees.

If an auditor becomes subject, after his appointment, to any, of the disqualifications

specified above, he shall be deemed to have vacated his office as such.

Appointment of Auditors - Section 70 of the Multi-State Co-operative Societies Act, 2002

provides that the first auditor or auditors of a Multi-State co-operative society shall be

appointed by the board within one month of the date of registration of such society and the

auditor or auditors so appointed shall hold office until the conclusion of the first annual

general meeting. If the board fails to exercise its powers under this sub-section, the Multi-

State co-operative society in the general meeting may appoint the first auditor or auditors.

The subsequent auditor or auditors are appointed by Multi-State co-operative society, at

each annual general meeting. The auditor or auditors so appointed shall hold office from

the conclusion of that meeting until the conclusion of the next annual general meeting.

(c) Evaluation of Internal Controls over Advances: The auditor should examine the efficacy

of various internal controls over advances to determine the nature, timing and extent of his

substantive procedures. In general, the internal controls over advances should include ,

inter alia, the following:

(i) The bank should make an advance only after satisfying itself as to the credit

worthiness of the borrower and after obtaining sanction from the appropriate

authorities of the bank.

(ii) All the necessary documents (e.g., agreements, demand promissory notes, letters of

hypothecation, etc.) should be executed by the parties before advances are made.

(iii) The compliance with the terms of sanction and end use of funds should be ensured.

(iv) Sufficient margin as specified in the sanction letter should be kept against securities

taken so as to cover for any decline in the value thereof. The availability of sufficient

margin needs to be ensured at regular intervals.

(v) If the securities taken are in the nature of shares, debentures, etc., the ownership of

© The Institute of Chartered Accountants of India

14 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

the same should be transferred in the name of the bank and the effective control of

such securities be retained as a part of documentation.

(vi) All securities requiring registration should be registered in the name of the bank or

otherwise accompanied by documents sufficient to give title to the bank.

(vii) In the case of goods in the possession of the bank, contents of the packages should

be test checked at the time of receipt. The godowns should be frequently inspected

by responsible officers of the branch concerned, in addition to the inspectors of the

bank.

(viii) Drawing Power Register should be updated every month to record the value of

securities hypothecated. These entries should be checked by an officer.

(ix) The accounts should be kept within both the drawing power and the sanctioned limit.

(x) All the accounts which exceed the sanctioned limit or drawing power or are otherwise

irregular should be brought to the notice of the controlling authority regularly.

(xi) The operation of each advance account should be reviewed at least once a year, and

at more frequent intervals in the case of large advances.

(d) The audit of government expenditure i s one of the maj or components of

government audit. The basic standards set for audit of expenditure are to ensure that

there is provision funds authorised by c ompetent authority fixing the limits within which

expenditure can be incurred. These standards are—

(i) that the expenditure incurred conforms to the relevant provisions of the statutory

enactment and in accordance with the Financial Rules and Regulations framed by the

competent authority. Such an audit is called as the audit against ‘rules and orders’.

(ii) that there is sanction, either special or general, accorded by competent authority

authorising the expenditure. Such an audit is called as the audit of sanctions.

(iii) that there is a provision of funds out of which expenditure can be incurred and the

same has been authorised by competent authority. Such an audit is called as audit

against provision of funds.

(iv) that the expenditure is incurred with due regard to broad and general principles of

financial propriety. Such an audit is also called as propriety audit.

(v) that the various programmes, schemes and projects where large financial expenditure

has been incurred are being run economically and are yielding results expected of

them. Such an audit is termed as the performance audit.

(e) (i) NPA norms for Agricultural Advances: As per the guidelines, Agricultural

Advances are of two types, (1) Agricultural Advances for “long duration” crops and

(2) Agricultural Advances for “short duration” crops

The “long duration” crops would be crops with crop season longer than one year and

crops, which are not “long duration” crops would be treated as “short duration” crops.

© The Institute of Chartered Accountants of India

PAPER – 6: AUDITING AND ASSURANCE 15

The crop season for each crop, which means the period up to harvesting of the crops

raised, would be as determined by the State Level Bankers’ Committee in each State.

The following NPA norms would apply to agricultural advances (including Crop

Term Loans):

- A loan granted for short duration crops will be treated as NPA, if the instalment

of principal or interest thereon remains overdue for two crop seasons and,

- A loan granted for long duration crops will be treated as NPA, if the instalment

of principal or interest thereon remains overdue for one crop season.

(ii) Accounts where there is erosion in the value of security / frauds committed by

borrowers

Not prudent to follow stages of asset classification. It should be straightaway

classified as doubtful or loss asset as appropriate.

(i) Erosion in the value of security can be reckoned as significant when the

realisable value of the security is less than 50 per cent of the value assessed

by the bank or accepted by RBI at the time of last inspection, as the case may

be. Such NPAs may be straightaway classified under doubtful category and

provisioning should be made as applicable to doubtful assets.

(ii) If the realisable value of the security, as assessed by the bank/ approved

valuers/ RBI is less than 10 per cent of the outstanding in the borrowal accounts,

the existence of security should be ignored and the asset should be straightaway

classified as loss asset. It may be either written off or fully provided for by the

bank.

© The Institute of Chartered Accountants of India

You might also like

- Comprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeFrom EverandComprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeRating: 5 out of 5 stars5/5 (1)

- Downloadslide - Download Slides, Ebooks, Solution Manual, and Test BanksDocument5 pagesDownloadslide - Download Slides, Ebooks, Solution Manual, and Test BanksMuhammad Yamin Buan50% (4)

- AuditNew Nov18 Suggested Ans CA InterDocument15 pagesAuditNew Nov18 Suggested Ans CA InterRishabh jainNo ratings yet

- Auditing and Assurance - Mock Test Paper - Answers - Oct 2022 - CA Inter (New)Document9 pagesAuditing and Assurance - Mock Test Paper - Answers - Oct 2022 - CA Inter (New)KM ASSOCIATESNo ratings yet

- 71746bos071022 Inter P6aDocument10 pages71746bos071022 Inter P6aTutulNo ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Intermediate Group - Ii Paper - 6: Auditing and AssuranceDocument3 pagesTest Series: August, 2018 Mock Test Paper - 1 Intermediate Group - Ii Paper - 6: Auditing and Assurancesahil kumarNo ratings yet

- 6) AuditDocument16 pages6) AuditKrushna MateNo ratings yet

- 73662bos59508 Inter P6aDocument10 pages73662bos59508 Inter P6adeepika devsaniNo ratings yet

- Auditing AssuranceDocument16 pagesAuditing AssurancesolomonNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument14 pages© The Institute of Chartered Accountants of IndialovedesuzaNo ratings yet

- 69779bos55738 p6Document16 pages69779bos55738 p6OPULENCENo ratings yet

- 75781bos61308 p6Document15 pages75781bos61308 p6pratimca592No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument9 pages© The Institute of Chartered Accountants of Indiaashwani7789No ratings yet

- 55067bos44235p6 Iipc ADocument10 pages55067bos44235p6 Iipc AAshutosh KumarNo ratings yet

- Rrpao 1Document12 pagesRrpao 1mr rahulNo ratings yet

- © The Institute of Chartered Accountants of India: (2 X 7 14 Marks)Document14 pages© The Institute of Chartered Accountants of India: (2 X 7 14 Marks)Kirthiga dhinakaranNo ratings yet

- CA Inter Audit A MTP 2 May 23Document10 pagesCA Inter Audit A MTP 2 May 23Sam KukrejaNo ratings yet

- Audit Dec 21 Suggested Answer @mission - CA - InterDocument19 pagesAudit Dec 21 Suggested Answer @mission - CA - Intersantosh pandeyNo ratings yet

- D11 Spring 2010Document5 pagesD11 Spring 2010meelas123No ratings yet

- MTP 3 21 Answers 1681446073Document10 pagesMTP 3 21 Answers 1681446073shoaibinamdar1454No ratings yet

- Dec 2021Document16 pagesDec 2021DiyaNo ratings yet

- Audit Suggested Ans CA Inter Nov 20Document14 pagesAudit Suggested Ans CA Inter Nov 20Priyansh KhatriNo ratings yet

- AuditDocument15 pagesAudithitesh gawdeNo ratings yet

- Audit Planning - Long QuizDocument15 pagesAudit Planning - Long QuizKathleenNo ratings yet

- Sa 200 "Overall Objectives of The Independent Auditor and Conduct of Audit in Accordance With Sas"Document5 pagesSa 200 "Overall Objectives of The Independent Auditor and Conduct of Audit in Accordance With Sas"Padsariya SureshNo ratings yet

- Solution Assuranceand Audit Practice May 2009Document9 pagesSolution Assuranceand Audit Practice May 2009samuel_dwumfourNo ratings yet

- Modelp CA Inter New Syllabus 2 Audit Ns 3912Document6 pagesModelp CA Inter New Syllabus 2 Audit Ns 3912cakabirs.chavanNo ratings yet

- Bos 36238 P 6Document16 pagesBos 36238 P 6vinay parulekarNo ratings yet

- Acctg 34 ReviewerDocument9 pagesAcctg 34 ReviewerAboc May AnNo ratings yet

- CIA - Wiley & Vallabhaneni Part 2Document80 pagesCIA - Wiley & Vallabhaneni Part 2Kay Cee TangalinNo ratings yet

- Chapter - 2 "Audit Strategy, Planning & Execution": Lecture - 18Document6 pagesChapter - 2 "Audit Strategy, Planning & Execution": Lecture - 18Aruna RajappaNo ratings yet

- Modelp CA Inter New Syllabus 1 Audit Ns 5727Document5 pagesModelp CA Inter New Syllabus 1 Audit Ns 5727cakabirs.chavanNo ratings yet

- MTP 10 21 Answers 1694676341Document9 pagesMTP 10 21 Answers 1694676341shoaibinamdar1454No ratings yet

- Auditing - AnswersDocument9 pagesAuditing - Answerspriyanshagrawal907No ratings yet

- At 9204Document13 pagesAt 9204Shefannie PaynanteNo ratings yet

- Risk Based AuditDocument67 pagesRisk Based Auditkevin carmeloNo ratings yet

- Auditing PaperDocument172 pagesAuditing PaperHimanshu SainiNo ratings yet

- IPFM AA Exam Guide PDFDocument23 pagesIPFM AA Exam Guide PDFcwkkarachchiNo ratings yet

- Accept Affects The Sample Size Required. The Lower The Risk The Auditor Is Willing To Accept, The Greater The Sample Size Will Need To BeDocument11 pagesAccept Affects The Sample Size Required. The Lower The Risk The Auditor Is Willing To Accept, The Greater The Sample Size Will Need To BeGao YungNo ratings yet

- Test 8 SSDocument3 pagesTest 8 SSnaseebmasihadvNo ratings yet

- DocDocument3 pagesDocMarvine MagaddatuNo ratings yet

- CH 11 P1Document4 pagesCH 11 P1GlaizzaNo ratings yet

- ICPA Audit Planning HandoutDocument4 pagesICPA Audit Planning Handoutmichelle angela maramagNo ratings yet

- At Quizzer 6 - Planning and Risk Assessment - FEU MktiDocument18 pagesAt Quizzer 6 - Planning and Risk Assessment - FEU Mktiiyah0% (1)

- AT Quizzer 7 - Planning and Risk Assessment 2SAY2122Document9 pagesAT Quizzer 7 - Planning and Risk Assessment 2SAY2122Ferdinand MangaoangNo ratings yet

- 01 Definition of Internal AuditingDocument11 pages01 Definition of Internal AuditingMhmd Habbosh100% (2)

- E BookDocument5 pagesE BookSavit BansalNo ratings yet

- Auditing in CIS Environment: Chool of Usiness and CcountancyDocument6 pagesAuditing in CIS Environment: Chool of Usiness and Ccountancycha11No ratings yet

- Stages of An AuditDocument4 pagesStages of An AuditDerrick KimaniNo ratings yet

- ASR Quizzer 6 - Planning and Risk AssessmenttDocument18 pagesASR Quizzer 6 - Planning and Risk AssessmenttInsatiable LifeNo ratings yet

- Ques PPR Jan 2021Document14 pagesQues PPR Jan 2021ashwani7789No ratings yet

- At Quizzer 4B Planning An Audit of FSDocument8 pagesAt Quizzer 4B Planning An Audit of FSJEFFERSON CUTENo ratings yet

- ACT1207 Review of Audit ProcessDocument8 pagesACT1207 Review of Audit Processantonioregina000No ratings yet

- II - Audit Strategy, PlanningDocument8 pagesII - Audit Strategy, PlanningAlphy maria cherianNo ratings yet

- Risk Based Audit (1) FINALDocument68 pagesRisk Based Audit (1) FINALSamiah Manggis MampaoNo ratings yet

- MTP m21 A Ans 2Document8 pagesMTP m21 A Ans 2sakshiNo ratings yet

- Auditing One 03 OKDocument28 pagesAuditing One 03 OKRObel demisNo ratings yet

- Audit - Mock Board Examination - Sy2019-20Document15 pagesAudit - Mock Board Examination - Sy2019-20Mark Domingo MendozaNo ratings yet

- At 07 Psa 320450520550620Document4 pagesAt 07 Psa 320450520550620Princess Mary Joy LadagaNo ratings yet

- Activity Worksheet 003Document4 pagesActivity Worksheet 003Pearl Isabelle SudarioNo ratings yet

- ACC 139 Assurance and Audit Principles - P1 1S SY2324 - Key AnswerDocument10 pagesACC 139 Assurance and Audit Principles - P1 1S SY2324 - Key AnswerCM MIGUELNo ratings yet

- Intermediate Accounting - Final Output ReceivablesDocument56 pagesIntermediate Accounting - Final Output ReceivablesAnitas LimmaumNo ratings yet

- Efsf 2013Document59 pagesEfsf 2013LuxembourgAtaGlanceNo ratings yet

- FINS 3616 Tutorial Questions-Week 3 - AnswersDocument5 pagesFINS 3616 Tutorial Questions-Week 3 - AnswersJethro Eros PerezNo ratings yet

- Strategic Social Media MarketingDocument21 pagesStrategic Social Media MarketingTahir SaeedNo ratings yet

- Bdpw3103introductory FinanceDocument12 pagesBdpw3103introductory Financedicky chongNo ratings yet

- ch9 MKT 301 Quiz ReviewDocument4 pagesch9 MKT 301 Quiz ReviewSergio HoffmanNo ratings yet

- Managing Inventory: MGT E 524 - Operation and Supply Chain ManagementDocument21 pagesManaging Inventory: MGT E 524 - Operation and Supply Chain ManagementJoseph Noel CoscosNo ratings yet

- Pricing For International MarketsDocument14 pagesPricing For International MarketsReyadNo ratings yet

- CafeteriaDocument24 pagesCafeteriasnhkmnkk4jNo ratings yet

- HUL Vs Patanjali (Market Study)Document26 pagesHUL Vs Patanjali (Market Study)Vibhuti0% (1)

- WACC NTDocument40 pagesWACC NTHamid S. ParwaniNo ratings yet

- 04 Task Performance 1 FMDocument2 pages04 Task Performance 1 FMEdlyn TejanoNo ratings yet

- MGT 301Document2 pagesMGT 301Ali BhattiNo ratings yet

- Chapter 12 - Quiz 2Document1 pageChapter 12 - Quiz 2jpacideraNo ratings yet

- Chapter 3: Forward and Futures Prices: Continuous CompoundingDocument7 pagesChapter 3: Forward and Futures Prices: Continuous Compoundingsunilp14No ratings yet

- FinalDocument5 pagesFinalmehdiNo ratings yet

- Wright Chapter9LabDocument5 pagesWright Chapter9LabashibhallauNo ratings yet

- Mergers and Acquisitions in India: A Strategic Impact Analysis For The Corporate RestructuringDocument9 pagesMergers and Acquisitions in India: A Strategic Impact Analysis For The Corporate RestructuringAyush GuptaNo ratings yet

- Setting Product StrategyDocument19 pagesSetting Product StrategyNoora ZulfiqarNo ratings yet

- Baru Baru - PT X - Study Case 5Document98 pagesBaru Baru - PT X - Study Case 5Kojiro FuumaNo ratings yet

- Selva Perumal Immersion ProjectDocument34 pagesSelva Perumal Immersion ProjectManoj kumar100% (1)

- ANA Email Marketing Solution Maturity ModelDocument2 pagesANA Email Marketing Solution Maturity ModelDemand MetricNo ratings yet

- FEC ContractsDocument2 pagesFEC ContractssatyambhanduNo ratings yet

- Ecommerce Manager ResumeDocument8 pagesEcommerce Manager Resumenemyzyvudut367% (3)

- Positioning Decision MPC Assigment 15Document3 pagesPositioning Decision MPC Assigment 15gaurav khatriNo ratings yet

- 1.0 Executive SummaryDocument16 pages1.0 Executive Summaryirfan_handaru100% (4)

- Marketing ManagementDocument33 pagesMarketing Managementnoradwiyah86No ratings yet

- Financial Accounting UpdatedDocument98 pagesFinancial Accounting UpdatedbalagurudevNo ratings yet

- CV - Rahul Kumar JhaDocument2 pagesCV - Rahul Kumar Jhausm1987No ratings yet