Professional Documents

Culture Documents

July 2023 10021719 - NW

July 2023 10021719 - NW

Uploaded by

Ajay ChaudharyCopyright:

Available Formats

You might also like

- SalarySlipwithTaxDetails 2021 JuneDocument1 pageSalarySlipwithTaxDetails 2021 JuneSameer KulkarniNo ratings yet

- 5Document11 pages5mariyha PalangganaNo ratings yet

- Delaware Statutory Trust PropertiesDocument59 pagesDelaware Statutory Trust Propertiesdkayscrib100% (1)

- Chapter 3 Financial AnalysisDocument58 pagesChapter 3 Financial Analysismarjorie acibar0% (1)

- Chapter 06 - SamplesDocument3 pagesChapter 06 - SamplesJessica ZhangNo ratings yet

- March 2023 10021719 - NWDocument1 pageMarch 2023 10021719 - NWAjay ChaudharyNo ratings yet

- May 2023 0930Document1 pageMay 2023 0930Keerthi rajaNo ratings yet

- Acfrogbcb Ms Bu63bgir6a5mzr9iunb2pmzmexmabj 4hj36l0uezc6ewccy1tpcyr7sdn9yzbhtgdvs Eijelsp9pl6tcu7blolcdeipfsa16k 71fyzopeexfd Ewfe3camrxoo Gjz9f BaxDocument1 pageAcfrogbcb Ms Bu63bgir6a5mzr9iunb2pmzmexmabj 4hj36l0uezc6ewccy1tpcyr7sdn9yzbhtgdvs Eijelsp9pl6tcu7blolcdeipfsa16k 71fyzopeexfd Ewfe3camrxoo Gjz9f BaxHarpreetNo ratings yet

- Adobe Scan Apr 16, 2024Document6 pagesAdobe Scan Apr 16, 2024SPYDER GRAPHICSNo ratings yet

- Adobe Scan Apr 16, 2024Document6 pagesAdobe Scan Apr 16, 2024SPYDER GRAPHICSNo ratings yet

- Pay Slip DecDocument1 pagePay Slip DecMalix EagleNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsmbdeepu8No ratings yet

- Pay Slip NovDocument1 pagePay Slip NovGaurav PandeyNo ratings yet

- FNFSlipDocument1 pageFNFSlipchetan sutharNo ratings yet

- Doc-20240410-Wa0004. 20240513 191957 0000Document1 pageDoc-20240410-Wa0004. 20240513 191957 0000sachinsinghofficial55No ratings yet

- Payslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, GurugramDocument1 pagePayslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, Gurugramps384077No ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- Payroll Insights - Farsight IT SolutionsDocument1 pagePayroll Insights - Farsight IT SolutionsyogeshNo ratings yet

- Jul 2023Document1 pageJul 2023Praveen SainiNo ratings yet

- FNF SlipDocument1 pageFNF SlipHimanshu MaheshwariNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- ITPSDocument1 pageITPSMounika PurushothamNo ratings yet

- Shahabaz Ayub Shaikh Payslip Feb24Document1 pageShahabaz Ayub Shaikh Payslip Feb24shahbaz029200No ratings yet

- Payslip Jan 2024 Shehbaz Shakeel ShaikhDocument1 pagePayslip Jan 2024 Shehbaz Shakeel Shaikheliajaun71No ratings yet

- Peepper StoryDocument1 pagePeepper StoryAnonymous ce49esgnveNo ratings yet

- HTMLReportsDocument3 pagesHTMLReportsparveenaliya697No ratings yet

- Payslip Jun 2023Document1 pagePayslip Jun 2023SanthoshRajNo ratings yet

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- Gujarat Narmada Valley Fertilizers & Chemicals LTD: Pay - SlipDocument1 pageGujarat Narmada Valley Fertilizers & Chemicals LTD: Pay - Slipkeyur patelNo ratings yet

- Servlet ControllerDocument2 pagesServlet ControllerRJNo ratings yet

- Sep 2023Document1 pageSep 2023it.plantNo ratings yet

- SalarySlipwithTaxDetails (1) (1) (1) (2) (1)Document1 pageSalarySlipwithTaxDetails (1) (1) (1) (2) (1)dipak923434No ratings yet

- Shaik Shabaz Payslip Jan24Document1 pageShaik Shabaz Payslip Jan24eliajaun71No ratings yet

- E09588 Payslip ITCSDocument1 pageE09588 Payslip ITCSMuthu CNo ratings yet

- Pay Slip Arun Das 02Document1 pagePay Slip Arun Das 02Pritam GoswamiNo ratings yet

- Apr 23Document1 pageApr 23Amit ShindeNo ratings yet

- Global Edge Software Limited: Payslip For The Month of December - 2018Document1 pageGlobal Edge Software Limited: Payslip For The Month of December - 2018Manoj SahooNo ratings yet

- SalarySlip MarchDocument2 pagesSalarySlip Marchseenasrinivas113No ratings yet

- payslip-2022-2023-9-kmbl178207-KTKBANKTDocument1 pagepayslip-2022-2023-9-kmbl178207-KTKBANKTjaymehta0808No ratings yet

- payslip-2022-2023-11-kmbl178207-KTKBANKTDocument1 pagepayslip-2022-2023-11-kmbl178207-KTKBANKTjaymehta0808No ratings yet

- Payslip For The Month of May 2023Document1 pagePayslip For The Month of May 2023kumarsandeep838383No ratings yet

- PayslipDocument1 pagePayslipojhashivam1997No ratings yet

- Oct 23Document2 pagesOct 23VIKAS TIWARINo ratings yet

- Payslip March 2023Document1 pagePayslip March 2023kaushalNo ratings yet

- Aavas Financiers Limited: Earnings DeductionsDocument1 pageAavas Financiers Limited: Earnings DeductionsAmit JangidNo ratings yet

- SalarySlipwithTaxDetailsDocument2 pagesSalarySlipwithTaxDetailsIndian LegendNo ratings yet

- Pay Slip Dipankar Mondal 02Document1 pagePay Slip Dipankar Mondal 02Pritam GoswamiNo ratings yet

- HTMLReportsDocument1 pageHTMLReportsRashmi Awanish PandeyNo ratings yet

- SalarySlipwithTaxDetails (1) (1) (1) (1) (1) (1) (1) (1) (1) (1) (1)Document1 pageSalarySlipwithTaxDetails (1) (1) (1) (1) (1) (1) (1) (1) (1) (1) (1)dipak923434No ratings yet

- VishalDocument1 pageVishalgig.sachinrajakNo ratings yet

- Nov PayslipDocument1 pageNov Payslipsuresh1.somisettyNo ratings yet

- Sarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageSarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDeeptimayee SahooNo ratings yet

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument2 pagesPersonal Note: This Is A System Generated Payslip, Does Not Require Any Signatureypfjcd8qq9No ratings yet

- Invoice 20230402Document6 pagesInvoice 20230402saadalimubarackNo ratings yet

- Pay Slip Dipankar Mondal 05Document1 pagePay Slip Dipankar Mondal 05Pritam GoswamiNo ratings yet

- Dec 2022Document1 pageDec 2022kumarsanjeevsskNo ratings yet

- April Salary PDFDocument1 pageApril Salary PDFomkassNo ratings yet

- Earnings Deductions: B9 Beverages LimitedDocument1 pageEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyNo ratings yet

- Sarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageSarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDeeptimayee SahooNo ratings yet

- Shabaz Jabbar Shaikh Payslip 2024 JanDocument1 pageShabaz Jabbar Shaikh Payslip 2024 Janeliajaun71No ratings yet

- Gross Earning Gross DeductionDocument2 pagesGross Earning Gross Deductionavisinghoo7No ratings yet

- Pay Slip Arun Das 04Document1 pagePay Slip Arun Das 04Pritam GoswamiNo ratings yet

- Timezone Entertainment Private Limited: Earnings DeductionsDocument1 pageTimezone Entertainment Private Limited: Earnings Deductionsa97438195No ratings yet

- TaxDocument9 pagesTaxRossette AnaNo ratings yet

- US Internal Revenue Service: International BranchesDocument28 pagesUS Internal Revenue Service: International BranchesIRSNo ratings yet

- Republic of The Philippines vs. Intermediate Appellate Court and Spouses Antonio and Clara PastorDocument2 pagesRepublic of The Philippines vs. Intermediate Appellate Court and Spouses Antonio and Clara PastorGene100% (2)

- State of The City Address 2014 of Mayor Belen FernandezDocument49 pagesState of The City Address 2014 of Mayor Belen FernandezbalondagupanNo ratings yet

- Systems Thinking AssignmentDocument10 pagesSystems Thinking Assignmentbaker najaNo ratings yet

- Mahesh MumbaiDocument3 pagesMahesh MumbaiANISH SHAIKHNo ratings yet

- An Overview of The Natural Gas Sector in TanzaniaDocument11 pagesAn Overview of The Natural Gas Sector in TanzaniaHussein BoffuNo ratings yet

- RMF Factsheet April 11-4-2014Document60 pagesRMF Factsheet April 11-4-2014Kartik JandhyalaNo ratings yet

- National Taxpayer Advocate Annual Report To Congress 2018 Executive SummaryDocument96 pagesNational Taxpayer Advocate Annual Report To Congress 2018 Executive SummaryBrian BergquistNo ratings yet

- Depreciate Property p946 PDFDocument114 pagesDepreciate Property p946 PDFNatya NindyagitayaNo ratings yet

- US Internal Revenue Service: f4952 - 2003Document2 pagesUS Internal Revenue Service: f4952 - 2003IRSNo ratings yet

- Concepts in Federal Taxation 2013 20th Edition Murphy Test Bank DownloadDocument141 pagesConcepts in Federal Taxation 2013 20th Edition Murphy Test Bank DownloadDavid Clark100% (23)

- 6th Class Physics Text BookDocument1 page6th Class Physics Text BookSrinu SehwagNo ratings yet

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocument5 pagesModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitNo ratings yet

- Buisness Plan CafeDocument25 pagesBuisness Plan CafeIsrael Elias100% (1)

- Income Taxation ReviewerDocument8 pagesIncome Taxation ReviewerMichael SanchezNo ratings yet

- Sadoy-Provisions Contengiences Exercise 3-Garfield CompanyDocument6 pagesSadoy-Provisions Contengiences Exercise 3-Garfield CompanyReymark SadoyNo ratings yet

- 1ZV115X78831086219 CiDocument3 pages1ZV115X78831086219 CiGabriel LeonNo ratings yet

- Impact of GST On Construction CompaniesDocument75 pagesImpact of GST On Construction CompaniesChandan Srivastava100% (4)

- Corporate Taxation IntroductionDocument48 pagesCorporate Taxation IntroductionSatyajeet MohantyNo ratings yet

- Ethiopia'S Fiscal Federalism: A Constitutional Overview: PHD, Asst. Professor of Law, Ethiopian Civil Service CollegeDocument33 pagesEthiopia'S Fiscal Federalism: A Constitutional Overview: PHD, Asst. Professor of Law, Ethiopian Civil Service Collegetsegaye100% (1)

- SGVU New BroucherDocument15 pagesSGVU New BroucherRb BNo ratings yet

- Company Analysis of Blue StarDocument42 pagesCompany Analysis of Blue Stardevika_namajiNo ratings yet

- Goldwater Institute Letter On Uber Lyft Airport FeesDocument4 pagesGoldwater Institute Letter On Uber Lyft Airport FeesKevin StoneNo ratings yet

- Retail Products and Services of State Bank of IndiaDocument81 pagesRetail Products and Services of State Bank of IndiaNishant Singh50% (2)

- NIT Refueller 16 KL Qty 35Document35 pagesNIT Refueller 16 KL Qty 35adihindNo ratings yet

July 2023 10021719 - NW

July 2023 10021719 - NW

Uploaded by

Ajay ChaudharyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

July 2023 10021719 - NW

July 2023 10021719 - NW

Uploaded by

Ajay ChaudharyCopyright:

Available Formats

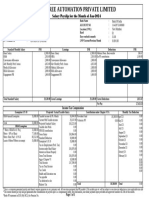

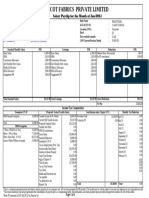

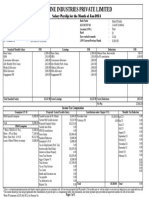

GirnarSoft Education Services Private Limited

5th Floor, BPTP Centra One,Sector 61,Gurugram- 122102

PayslipfortheMonthofJuly2023

Code 10021719 Joining Date 18/12/2022

Name Mr. Nitesh kumar Bank A/C No. 370901502795

Department Operations IFSC

Designation Senior Executive PF Number

Location Gurugram Payable Days 31.00

PAN No. DAYPK6624R Separate PL

UAN No. Separate SL

Grade E-2 Leave Bal 2018-19

Standard Earnings Actual Earnings Deductions Total

BASIC 18,797,00BASIC 18,797.00 PF 1,800.00 GROSS PAY 29,167.00

HRA 9,399.00 HRA 9,399.00 WELFARE 00.00

2 GROSS DED. 2,904.00

SPL. ALLOW 800.00SPL.ALLOW 800.00 NET PAY 26,263.00

STATBON 171.00ERN_STATBO 171.00

NetPay26,263.00(Rupees twenty-six thousand, two hundred sixty-three only)

Income Tax Worksheet for the month of April 2023

April 2023-March 2024

Taxable Earnings Deduction U/C VI-A Investments U/S 80 C HRA Calculation

BASIC 133,608.00 PF+VPF 21,600.00 Rent Paid

TAX_HRAFUL 66,804.00 From 01/04/2023

SPL. ALLOW 90,432.00

To 31/03/2024

INCENTIVE 680.00

PRJ_STATBO 11,124.00 1.Actual HRA 66,804.00

2.Rent-10% Basic 0.00

3.40% of Basic 0.00

Least of Above is exempt 0.00

RFA Calculation

Rent Paid

From

To

Taxable RFA Value

Furniture Cost

Taxable Furniture Perk

Gross Salary 302,648.00 Total Deduction u/c VI-A Total Investment u/s 80 C 21,600.00

Applicable tax rates : New Regime Any Other Income Income Tax as per Regime 1 (Old Rate) Income Tax as per Regime 2 (New Rate)

Deductions Gross Salary 302,648.00 Gross Salary 302,648.00

Standard Deduction 50,000.00

Deductions Deductions

Professional Tax Standard Deduction 50,000.00 Standard Deduction 50,000.00

Pre.Emp.Professional Tax Professional Tax Professional Tax

Any Other Income Pre.Emp.Professional Tax Pre.Emp.Professional Tax

Chapter VI-A and 80 C Any Other Income Any Other Income

Taxable Income 252,648.00 21,600.00

Chapter VI-A and 80 C Chapter VI-A and 80 C

Income Tax Liability 0.00 231,048.00 252,648.00

Taxable Income Taxable Income

Tax Rebate u/s 87A 0.00 0.00 0.00

Income Tax Liability Income Tax Liability

Sub Total 0.00

Tax Rebate u/s 87A 0.00 Tax Rebate u/s 87A 0.00

Surcharge Sub Total 0.00 Sub Total 0.00

Cess Surcharge Surcharge

Total Tax 0.00

Cess Cess

Previous Employer Tax Total Tax 0.00 Total Tax 0.00

Net Tax 0.00

Previous Employer Tax Previous Employer Tax

Tax deducted till last month 0.00 Total Other Income 0.00 0.00

Net Tax Net Tax

Tax to be deducted 0.00

Tax deduction for this month 0.00

Revised Tax/month 0.00

In case of any query, please write to the Payroll Helpdesk id at payroll.collegedekho@sgcservices.com or call at

0120-4049155/156

You might also like

- SalarySlipwithTaxDetails 2021 JuneDocument1 pageSalarySlipwithTaxDetails 2021 JuneSameer KulkarniNo ratings yet

- 5Document11 pages5mariyha PalangganaNo ratings yet

- Delaware Statutory Trust PropertiesDocument59 pagesDelaware Statutory Trust Propertiesdkayscrib100% (1)

- Chapter 3 Financial AnalysisDocument58 pagesChapter 3 Financial Analysismarjorie acibar0% (1)

- Chapter 06 - SamplesDocument3 pagesChapter 06 - SamplesJessica ZhangNo ratings yet

- March 2023 10021719 - NWDocument1 pageMarch 2023 10021719 - NWAjay ChaudharyNo ratings yet

- May 2023 0930Document1 pageMay 2023 0930Keerthi rajaNo ratings yet

- Acfrogbcb Ms Bu63bgir6a5mzr9iunb2pmzmexmabj 4hj36l0uezc6ewccy1tpcyr7sdn9yzbhtgdvs Eijelsp9pl6tcu7blolcdeipfsa16k 71fyzopeexfd Ewfe3camrxoo Gjz9f BaxDocument1 pageAcfrogbcb Ms Bu63bgir6a5mzr9iunb2pmzmexmabj 4hj36l0uezc6ewccy1tpcyr7sdn9yzbhtgdvs Eijelsp9pl6tcu7blolcdeipfsa16k 71fyzopeexfd Ewfe3camrxoo Gjz9f BaxHarpreetNo ratings yet

- Adobe Scan Apr 16, 2024Document6 pagesAdobe Scan Apr 16, 2024SPYDER GRAPHICSNo ratings yet

- Adobe Scan Apr 16, 2024Document6 pagesAdobe Scan Apr 16, 2024SPYDER GRAPHICSNo ratings yet

- Pay Slip DecDocument1 pagePay Slip DecMalix EagleNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsmbdeepu8No ratings yet

- Pay Slip NovDocument1 pagePay Slip NovGaurav PandeyNo ratings yet

- FNFSlipDocument1 pageFNFSlipchetan sutharNo ratings yet

- Doc-20240410-Wa0004. 20240513 191957 0000Document1 pageDoc-20240410-Wa0004. 20240513 191957 0000sachinsinghofficial55No ratings yet

- Payslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, GurugramDocument1 pagePayslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, Gurugramps384077No ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- Payroll Insights - Farsight IT SolutionsDocument1 pagePayroll Insights - Farsight IT SolutionsyogeshNo ratings yet

- Jul 2023Document1 pageJul 2023Praveen SainiNo ratings yet

- FNF SlipDocument1 pageFNF SlipHimanshu MaheshwariNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- ITPSDocument1 pageITPSMounika PurushothamNo ratings yet

- Shahabaz Ayub Shaikh Payslip Feb24Document1 pageShahabaz Ayub Shaikh Payslip Feb24shahbaz029200No ratings yet

- Payslip Jan 2024 Shehbaz Shakeel ShaikhDocument1 pagePayslip Jan 2024 Shehbaz Shakeel Shaikheliajaun71No ratings yet

- Peepper StoryDocument1 pagePeepper StoryAnonymous ce49esgnveNo ratings yet

- HTMLReportsDocument3 pagesHTMLReportsparveenaliya697No ratings yet

- Payslip Jun 2023Document1 pagePayslip Jun 2023SanthoshRajNo ratings yet

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- Gujarat Narmada Valley Fertilizers & Chemicals LTD: Pay - SlipDocument1 pageGujarat Narmada Valley Fertilizers & Chemicals LTD: Pay - Slipkeyur patelNo ratings yet

- Servlet ControllerDocument2 pagesServlet ControllerRJNo ratings yet

- Sep 2023Document1 pageSep 2023it.plantNo ratings yet

- SalarySlipwithTaxDetails (1) (1) (1) (2) (1)Document1 pageSalarySlipwithTaxDetails (1) (1) (1) (2) (1)dipak923434No ratings yet

- Shaik Shabaz Payslip Jan24Document1 pageShaik Shabaz Payslip Jan24eliajaun71No ratings yet

- E09588 Payslip ITCSDocument1 pageE09588 Payslip ITCSMuthu CNo ratings yet

- Pay Slip Arun Das 02Document1 pagePay Slip Arun Das 02Pritam GoswamiNo ratings yet

- Apr 23Document1 pageApr 23Amit ShindeNo ratings yet

- Global Edge Software Limited: Payslip For The Month of December - 2018Document1 pageGlobal Edge Software Limited: Payslip For The Month of December - 2018Manoj SahooNo ratings yet

- SalarySlip MarchDocument2 pagesSalarySlip Marchseenasrinivas113No ratings yet

- payslip-2022-2023-9-kmbl178207-KTKBANKTDocument1 pagepayslip-2022-2023-9-kmbl178207-KTKBANKTjaymehta0808No ratings yet

- payslip-2022-2023-11-kmbl178207-KTKBANKTDocument1 pagepayslip-2022-2023-11-kmbl178207-KTKBANKTjaymehta0808No ratings yet

- Payslip For The Month of May 2023Document1 pagePayslip For The Month of May 2023kumarsandeep838383No ratings yet

- PayslipDocument1 pagePayslipojhashivam1997No ratings yet

- Oct 23Document2 pagesOct 23VIKAS TIWARINo ratings yet

- Payslip March 2023Document1 pagePayslip March 2023kaushalNo ratings yet

- Aavas Financiers Limited: Earnings DeductionsDocument1 pageAavas Financiers Limited: Earnings DeductionsAmit JangidNo ratings yet

- SalarySlipwithTaxDetailsDocument2 pagesSalarySlipwithTaxDetailsIndian LegendNo ratings yet

- Pay Slip Dipankar Mondal 02Document1 pagePay Slip Dipankar Mondal 02Pritam GoswamiNo ratings yet

- HTMLReportsDocument1 pageHTMLReportsRashmi Awanish PandeyNo ratings yet

- SalarySlipwithTaxDetails (1) (1) (1) (1) (1) (1) (1) (1) (1) (1) (1)Document1 pageSalarySlipwithTaxDetails (1) (1) (1) (1) (1) (1) (1) (1) (1) (1) (1)dipak923434No ratings yet

- VishalDocument1 pageVishalgig.sachinrajakNo ratings yet

- Nov PayslipDocument1 pageNov Payslipsuresh1.somisettyNo ratings yet

- Sarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageSarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDeeptimayee SahooNo ratings yet

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument2 pagesPersonal Note: This Is A System Generated Payslip, Does Not Require Any Signatureypfjcd8qq9No ratings yet

- Invoice 20230402Document6 pagesInvoice 20230402saadalimubarackNo ratings yet

- Pay Slip Dipankar Mondal 05Document1 pagePay Slip Dipankar Mondal 05Pritam GoswamiNo ratings yet

- Dec 2022Document1 pageDec 2022kumarsanjeevsskNo ratings yet

- April Salary PDFDocument1 pageApril Salary PDFomkassNo ratings yet

- Earnings Deductions: B9 Beverages LimitedDocument1 pageEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyNo ratings yet

- Sarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageSarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDeeptimayee SahooNo ratings yet

- Shabaz Jabbar Shaikh Payslip 2024 JanDocument1 pageShabaz Jabbar Shaikh Payslip 2024 Janeliajaun71No ratings yet

- Gross Earning Gross DeductionDocument2 pagesGross Earning Gross Deductionavisinghoo7No ratings yet

- Pay Slip Arun Das 04Document1 pagePay Slip Arun Das 04Pritam GoswamiNo ratings yet

- Timezone Entertainment Private Limited: Earnings DeductionsDocument1 pageTimezone Entertainment Private Limited: Earnings Deductionsa97438195No ratings yet

- TaxDocument9 pagesTaxRossette AnaNo ratings yet

- US Internal Revenue Service: International BranchesDocument28 pagesUS Internal Revenue Service: International BranchesIRSNo ratings yet

- Republic of The Philippines vs. Intermediate Appellate Court and Spouses Antonio and Clara PastorDocument2 pagesRepublic of The Philippines vs. Intermediate Appellate Court and Spouses Antonio and Clara PastorGene100% (2)

- State of The City Address 2014 of Mayor Belen FernandezDocument49 pagesState of The City Address 2014 of Mayor Belen FernandezbalondagupanNo ratings yet

- Systems Thinking AssignmentDocument10 pagesSystems Thinking Assignmentbaker najaNo ratings yet

- Mahesh MumbaiDocument3 pagesMahesh MumbaiANISH SHAIKHNo ratings yet

- An Overview of The Natural Gas Sector in TanzaniaDocument11 pagesAn Overview of The Natural Gas Sector in TanzaniaHussein BoffuNo ratings yet

- RMF Factsheet April 11-4-2014Document60 pagesRMF Factsheet April 11-4-2014Kartik JandhyalaNo ratings yet

- National Taxpayer Advocate Annual Report To Congress 2018 Executive SummaryDocument96 pagesNational Taxpayer Advocate Annual Report To Congress 2018 Executive SummaryBrian BergquistNo ratings yet

- Depreciate Property p946 PDFDocument114 pagesDepreciate Property p946 PDFNatya NindyagitayaNo ratings yet

- US Internal Revenue Service: f4952 - 2003Document2 pagesUS Internal Revenue Service: f4952 - 2003IRSNo ratings yet

- Concepts in Federal Taxation 2013 20th Edition Murphy Test Bank DownloadDocument141 pagesConcepts in Federal Taxation 2013 20th Edition Murphy Test Bank DownloadDavid Clark100% (23)

- 6th Class Physics Text BookDocument1 page6th Class Physics Text BookSrinu SehwagNo ratings yet

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocument5 pagesModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitNo ratings yet

- Buisness Plan CafeDocument25 pagesBuisness Plan CafeIsrael Elias100% (1)

- Income Taxation ReviewerDocument8 pagesIncome Taxation ReviewerMichael SanchezNo ratings yet

- Sadoy-Provisions Contengiences Exercise 3-Garfield CompanyDocument6 pagesSadoy-Provisions Contengiences Exercise 3-Garfield CompanyReymark SadoyNo ratings yet

- 1ZV115X78831086219 CiDocument3 pages1ZV115X78831086219 CiGabriel LeonNo ratings yet

- Impact of GST On Construction CompaniesDocument75 pagesImpact of GST On Construction CompaniesChandan Srivastava100% (4)

- Corporate Taxation IntroductionDocument48 pagesCorporate Taxation IntroductionSatyajeet MohantyNo ratings yet

- Ethiopia'S Fiscal Federalism: A Constitutional Overview: PHD, Asst. Professor of Law, Ethiopian Civil Service CollegeDocument33 pagesEthiopia'S Fiscal Federalism: A Constitutional Overview: PHD, Asst. Professor of Law, Ethiopian Civil Service Collegetsegaye100% (1)

- SGVU New BroucherDocument15 pagesSGVU New BroucherRb BNo ratings yet

- Company Analysis of Blue StarDocument42 pagesCompany Analysis of Blue Stardevika_namajiNo ratings yet

- Goldwater Institute Letter On Uber Lyft Airport FeesDocument4 pagesGoldwater Institute Letter On Uber Lyft Airport FeesKevin StoneNo ratings yet

- Retail Products and Services of State Bank of IndiaDocument81 pagesRetail Products and Services of State Bank of IndiaNishant Singh50% (2)

- NIT Refueller 16 KL Qty 35Document35 pagesNIT Refueller 16 KL Qty 35adihindNo ratings yet