Professional Documents

Culture Documents

FAQs

FAQs

Uploaded by

Lance BeckhamOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAQs

FAQs

Uploaded by

Lance BeckhamCopyright:

Available Formats

$ % Guides &

FAQs

FAQs !

1. Why is there a delay for

customers to receive their coins?

In general, if all KYC documents are provided

correctly, a customers’ orders will be fulfilled

automatically. However, if there is a delay, this could

be due to:

Payment method that customers used. For

example, if customers chose Bank Transfer (e.g.

iDEAL, Faster Payment or SEPA), this could take

up to 2 business days for Banxa to receive the

fund from customers (this means it will be longer

if customers put orders during weekends). Only

when we receive the fund, then we will be able to

transfer coins to customers. For SEPA payments,

we also do require customers to send a receipt

confirming the transfer.

Please help us to identify the payment methods that

customers used to purchase coins and the time they

made the order and assist us in advising customers

accordingly.

Customer KYC information is incomplete or does

not meet requirements. For example, customers

sent through ID but the quality is not readable or

with glare. Or the selfie that customers sent

through was taken from a long time ago, when

we require the selfie to be taken within 24 hours

of the time order placed. For these cases, we will

have to review the order manually and we will

send SMS/emails to customers requesting for

new/further information. Please kindly assist in

asking customers to check their emails and

email’s spam inbox for Banxa communications.

2. What is KYC?

KYC means "know your customer." It refers to a

financial institution’s obligation to carry out certain

identity and background checks on its customers

before allowing them to use products or platforms. It

is part of a broader set of measures that regulators

around the world use to fight money laundering. In

other words, it stops bad actors from hiding the illicit

source of their money behind legitimate financial

activity.

3. What KYC information does

Banxa require?

We require the following information for each

customer:

First Name, Middle Name (if any), Last Name,

Date of Birth, Address and Country of Residence

Documents to be provided:

1. If passport, then an upload of the photo page

2. If driver license, then an upload of the front and

back of card

3. If ID card, then an upload of the front and back

of card

Selfie of customer holding their ID. The photo

must be new and taken within 24 hours.

Please note that for high-value transactions, in order

to avoid customer scams and fraud, we might also

contact customer to request proof for their source of

funds.

4. Does Banxa have 24/7 customer

support?

Yes, we have 24/7 customer support. Customers can

reach us at support.banxa.com

5. Can partners reach out to Banxa

for end-user support?

Absolutely, please feel free to contact your

designated Account Manager if you would like us to

assist in any way. In order for us to support an order

inquiry, please kindly quote the Order Reference or

Customer information (email address or full name

used for the order).

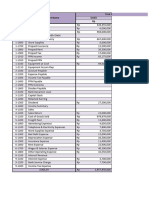

6. What are the transaction limits?

Please refer to this table for transaction limits by fiat.

Payment Transaction Transaction

Region Country PaymentMethod FiatCurrency MonthlyLimit TransactionSpeed

Surcharge Minimum Maximum

USD US$30 US$15.000 US$60,000

AUD AUS30 AUS15.000 AUS60.000

AED 120dh 60.000dh 260,000dh

BRI R$190 R$3.300 R$26.000

CAD CA$30 CAS10,000 CA$85,000

CHE CHE30 CHE15.000 CHE64.000

CZK K£500 K£50,000 K£130,000

DKK kr.100 kr.30,000 kr.420.000

EUR €30 €14,000 €60,000

GBP £30 £14.000 £60,000

HKD HK$200 HK$50,000 HKS450,000

IDR Rp490000 Rp8250000 Rp66000000

INR 82500 850,000 840.000

JPY ¥4.000 ¥800,000 *3,000,000

135+countriesforVisa/Mastercard Visa/Mastercard KRW W40,000 #18,900,000 W81.000,000

Global 1.99% M$700 M$20.000 M$100.000 Instant

AllcountriesinwhichApplePayis

ApplePay MYR RM140 RM2400 RM20,000

available

NOK 200kr 60.000kr 700,000kr

NZD $30 $10.000 $85.000

PHP P1700 P30.000 P300.000

PIN 70zl 17.000z! 170.000zl

QAR 1203.J 59,000.› 250.000€3

SAR 120Jb; 61,000U) 260.000b

SEK 200kr 50.000kr 600.000kr

SGD $30 $10.000 $85.000

THB 1.100 20.000 200.000

TRY $200 $10.000 $65.000

TWD $950 $16.000 $130.000

770.000d 13.000.000d 104.000.000d

VND

ZAR R520 R50.000 R400.000

PavID/Osko/NPp Free AUD $30 $50.000 $500.000 Instant

Asia/Pacific Australia

POLiPayments(OnlinePayments) Free AUD $30 $50.000 $500.000 Instant

AIl SEPA(BankTransfer) Free EUR €30 €14.000 €150.000 Instant

Europe Netherlands iDEAL(BankTransfer) Free EUR €30 €14.000 €150.000 Upto1businessday

UK FasterPayments(BankTransfer) Free GBP £30 £6.000 150.000 Instant

Interac(BankTransfer)

North Canada Free CAD $40 $10.000 $70.000 Instant

America

UnitedStates WireTransfers(stillundertesting) $15 USD $100 $10.000

3hours-2businessdays,depending

$100.000

onend-userselctioninOnlineBanking

South

Brazil PIX(BankTransfer) Free BRL R$50 R$10.000 R$200.000 Instant

America

7. Which chain of USDT that Banxa

support

We support ERC20, Polygon, Binance Smart Chain,

Tron, Arbitrum, zkSync, Optimism and Loopring.

8. Which digital assets that Banxa

support?

Currently, Banxa offers the following

cryptocurrencies. The best way to confirm the last

availability will be via our live app.

BTC (Bitcoin)

LINK (ChainLink)

ETH (Ethereum)

LTC (Litecoin)

USDT (Tether)

BUSD (Binance USD)

USDC (USD Coin)

BNB (Binance Coin)

XRP (Ripple)

CHZ (ChiliZ)

KCS (Kucoin Token)

BAT (Basic Attention Token)

MANA (Decentraland)

AAVE (Aave)

AVAX (Avalanche)

BSV (Bitcoin SV)

CELO (Celo)

COMP (Compound)

DOGE (Dogecoin)

ENJ (Enjin Coin)

DOT (Polkadot)

MATIC (Polygon)

ADA (Cardano)

CUSD (Cello Dollar)

CVC (Civic)

DAI (Dai)

EOS (EOS)

ETC (Ethereum Classic)

FIL (Filecoin)

KLAY (Klaytn Chain)

MKR (Maker)

OMG (OmiseGo)

SOL (Solana)

XLM (Stella Lumens)

SUSHI (SushiSwap)

SNX (Synthetic Network Token)

UNI (Uniswap)

WBTC (Wrapped Bitcoin)

YFI (Yearn.Finance)

AXS (Axie Infinity)

APE (ApeCoin)

ATOM (Cosmos)

FLOW (Flow)

FTM (Fantom)

ONE (Harmony)

HBAR (Hedera)

IMX (Immutable)

LUNA (Luna)

NEAR (Near)

CAKE (PancakeSwap)

USDP (Pax Dollar)

SUSD (sUSD)

XTZ (Tezos)

GRT (The Graph)

UST (UST)

9. How are refunds from customer

orders processed?

Refunds of cash payments is process that is

reviewed and executed by our customer service

team. As with most refunds, generally takes between

1 to 5 business days to process cash payment

refunds.

Once we process a refund, the time it takes for the

funds to arrive in the customer’s account depends on

the payment method and their providers i.e. their

banks or financial institutions.

Payment Time to Additional

Method Arrival Information

When a customer

makes a purchase

with a credit or debit

card, the transaction

will be put through

as a pre-

authorisation only.

Up to 15 Only when the order

Credit days is fulfilled then the

Card or depending actual payment

Debit on amount will be taken.

Card customer's If there is any

bank cancellation of the

order, we will release

the pre-authorised

amount. In general,

transactions from

debit cards will take

longer than credit

card ones.

The customer is sent

an email with their

security question. If

1 business they respond

Interac

day incorrectly or fail to

respond, then the

refund will be

delayed.

Direct transfer from

Enumis Instant our account to the

customer’s account.

Direct transfer from

1 business

iDEAL our account to the

day

customer’s account.

Direct transfer from

1 business

SEPA our account to the

day

customer’s account.

" Updated 20 days ago

# Best Practices

You might also like

- Private Bitcoin KeysDocument5 pagesPrivate Bitcoin KeysJeffrey BarnesNo ratings yet

- JavaScript For FreeBitco - inDocument9 pagesJavaScript For FreeBitco - inBitco News70% (10)

- There Are Many Keys To BitcoinDocument5 pagesThere Are Many Keys To BitcoinJeffrey BarnesNo ratings yet

- Cost AssignmentDocument4 pagesCost AssignmentAtka chNo ratings yet

- GCNF U3 A1Document11 pagesGCNF U3 A1Julia KongNo ratings yet

- Cap 16Document2 pagesCap 16Diana QuillupanguiNo ratings yet

- Worksheet Akuntansi DahliaDocument4 pagesWorksheet Akuntansi DahliaDahliaNo ratings yet

- Laboratorio 2Document5 pagesLaboratorio 2GIANCARLO APAZA MAMANINo ratings yet

- Brosur Pulsa Elektrik Enter PulsaDocument1 pageBrosur Pulsa Elektrik Enter PulsaRhajuelJulhariAlbersaJaitunNo ratings yet

- Book 1Document3 pagesBook 1Moetassem billah MikatiNo ratings yet

- Wassim Zhani Corporate Taxation Reconcialiation of Income Per BooksDocument7 pagesWassim Zhani Corporate Taxation Reconcialiation of Income Per BookswassimzhaniNo ratings yet

- Laascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTDocument8 pagesLaascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTAbdirazak MohamedNo ratings yet

- Akuntansi (Haspisah KLS 11 Akl2)Document6 pagesAkuntansi (Haspisah KLS 11 Akl2)sansihkNo ratings yet

- Ortegamonroy AmarantoDocument2 pagesOrtegamonroy AmarantoLUIS MANUEL ORTEGA MONROYNo ratings yet

- Mafia Wars Expense Guide - Properties SheetDocument8 pagesMafia Wars Expense Guide - Properties SheetZababa100% (1)

- Vrachier M/V Manchester Date Referitoare La Voiaj Date Despre Nava Descriere VoiajDocument47 pagesVrachier M/V Manchester Date Referitoare La Voiaj Date Despre Nava Descriere VoiajAdi SPNo ratings yet

- Cash Order TemplateDocument2 pagesCash Order Templateapi-572687359No ratings yet

- Profit & Loss For Kami's Clothing As at 2018Document3 pagesProfit & Loss For Kami's Clothing As at 2018Veer SinghNo ratings yet

- Analyse de Rentabilité: Cout vs. VenteDocument2 pagesAnalyse de Rentabilité: Cout vs. VenteFelix SerreNo ratings yet

- Analisis Finansial Kelompok 2Document11 pagesAnalisis Finansial Kelompok 2Nazli Wulantri BinabaNo ratings yet

- Laporan Bendahara Dadya Gede Pasek Kalang AnyarDocument18 pagesLaporan Bendahara Dadya Gede Pasek Kalang AnyarGede KarmayasaNo ratings yet

- Chapter 2-Distribution Network DesignDocument6 pagesChapter 2-Distribution Network DesignDuy HoNo ratings yet

- Budget Summary Template USDocument1 pageBudget Summary Template USSachin KulkarniNo ratings yet

- Trading Plan: Bulan Ke Saldo Trade / Day Net Profit / Week 10% 7Document3 pagesTrading Plan: Bulan Ke Saldo Trade / Day Net Profit / Week 10% 7Indro CuexNo ratings yet

- Sample Data For RegressionDocument2 pagesSample Data For RegressionAravindVenkatramanNo ratings yet

- Examen Ali Mendoza CruzDocument9 pagesExamen Ali Mendoza Cruz5btg97yz7tNo ratings yet

- Trade and Other Receivables p2Document51 pagesTrade and Other Receivables p2Camille G.No ratings yet

- Tasa Año Inversión Ingresos Flujo V: ProyectoDocument4 pagesTasa Año Inversión Ingresos Flujo V: ProyectovanesaNo ratings yet

- Profit & Loss Statement - 2016/2017 (TTM) : Income/Sales Feb-16 Mar-16 Apr-16 May-16Document42 pagesProfit & Loss Statement - 2016/2017 (TTM) : Income/Sales Feb-16 Mar-16 Apr-16 May-16Anonymous EuIMcEFRqNNo ratings yet

- Total Total Total Total Total Total Investido Juros Acumulado Investido Juros AcumuladoDocument3 pagesTotal Total Total Total Total Total Investido Juros Acumulado Investido Juros AcumuladoBLACK TONNo ratings yet

- Advance2 HW - P6-9Document4 pagesAdvance2 HW - P6-9Fernando HermawanNo ratings yet

- Live Policy V2 (AR) .Document2 pagesLive Policy V2 (AR) .lola omarNo ratings yet

- Nombre APELLIDOS Sueldo Dia Hora Cant - Diurnas Valor: Datos Personales Sueldo Horas ExtraDocument3 pagesNombre APELLIDOS Sueldo Dia Hora Cant - Diurnas Valor: Datos Personales Sueldo Horas ExtrakevinNo ratings yet

- Task 1 - Engineering EconomicsDocument2 pagesTask 1 - Engineering Economicsmahera wijaksaraNo ratings yet

- Laporan Keuangan Ud BuanaDocument20 pagesLaporan Keuangan Ud Buanafitrianura04No ratings yet

- OverviewDocument12 pagesOverviewribhipro2No ratings yet

- CV Maju WorksheetDocument6 pagesCV Maju WorksheetWijaya Mahathir AlbatawyNo ratings yet

- 11-1 Medieval Adventures CompanyDocument5 pages11-1 Medieval Adventures Companydhosmanyos100% (1)

- Minimo Spaceships: PM Naves WorkersDocument17 pagesMinimo Spaceships: PM Naves WorkersJorge MejiaNo ratings yet

- Sample Data Sets For Linear Regression1Document3 pagesSample Data Sets For Linear Regression1Ahmad Haikal0% (1)

- Deber 1Document5 pagesDeber 1Carlos Javier Vergara GuanangaNo ratings yet

- Full Accounting in ExcelDocument9 pagesFull Accounting in Excelmohsultoni131190No ratings yet

- List Update MaretDocument10 pagesList Update MaretArloveni ArzaqNo ratings yet

- Excel AssignmentDocument3 pagesExcel AssignmentrellikchidzanaNo ratings yet

- Ing. Economica Pregunta 2Document2 pagesIng. Economica Pregunta 2Sheiler Alvarado SanchezNo ratings yet

- Relojera y ZapateraDocument6 pagesRelojera y ZapateraDaniela RodríguezNo ratings yet

- Medieval Case SolutionDocument7 pagesMedieval Case SolutionTarry BerryNo ratings yet

- Cicilan Apartment Bali K'AmoriDocument6 pagesCicilan Apartment Bali K'AmoriAsri KolyNo ratings yet

- Cost Benefit AnalysisDocument4 pagesCost Benefit AnalysisswapnilNo ratings yet

- Siklus Akuntansi Pada PT Adi JayaDocument11 pagesSiklus Akuntansi Pada PT Adi Jayafitrianura04No ratings yet

- PT - Zalia Nofi Nurlaila (23) Neraca LajurDocument6 pagesPT - Zalia Nofi Nurlaila (23) Neraca LajurNofi Nurlaila100% (1)

- Acc Account Name Trial Balance Debit CreditDocument6 pagesAcc Account Name Trial Balance Debit CreditNofi NurlailaNo ratings yet

- PoSummaryBuyerWise 6Document2 pagesPoSummaryBuyerWise 6Muhammad RashedNo ratings yet

- Ventas Diciembre 2019Document18 pagesVentas Diciembre 2019Mayeda Reyes-KattarNo ratings yet

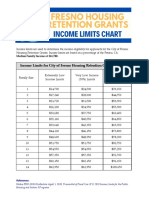

- Fresno Housing Retention Grants Income Limits ChartDocument1 pageFresno Housing Retention Grants Income Limits ChartSteve HawkinsNo ratings yet

- Resumen Cartera Enero 2018Document7 pagesResumen Cartera Enero 2018yorgen alvarezNo ratings yet

- Forecast 663210613-9Document1 pageForecast 663210613-99twyp8bpd2No ratings yet

- KRIPTODocument5 pagesKRIPTOTaufik AzhariNo ratings yet

- Tax PraktikumDocument14 pagesTax PraktikumFirman PurbaNo ratings yet

- Financial PlanDocument86 pagesFinancial PlanVõ Thị Ngọc HuyềnNo ratings yet

- Bond Price Value of A BondDocument3 pagesBond Price Value of A BondPham Quoc BaoNo ratings yet

- Scientific method to earn from faucet Bitcoin and Cryptocurrencies: Faucet of Bitcoin, Litecoin, Dash, Bitcoin Cash, Doge and moreFrom EverandScientific method to earn from faucet Bitcoin and Cryptocurrencies: Faucet of Bitcoin, Litecoin, Dash, Bitcoin Cash, Doge and moreNo ratings yet

- Ethereum NotesDocument3 pagesEthereum NotesSBNo ratings yet

- LOCC Blockchain Data Specification V1.0Document10 pagesLOCC Blockchain Data Specification V1.0Brian ZerausNo ratings yet

- Bcoin UpdatedDocument20 pagesBcoin Updatedalbin101No ratings yet

- Introduction To Blockchain Technology (River Publishers Series in Rapids in ComputingDocument53 pagesIntroduction To Blockchain Technology (River Publishers Series in Rapids in Computingashaik1No ratings yet

- Web3Crunch - Web 3.0 - Crypto - Blockchain - Technical AnalysisDocument1 pageWeb3Crunch - Web 3.0 - Crypto - Blockchain - Technical AnalysisJohn JacobNo ratings yet

- Formula de La Estrategia Actualizado Abril - 2023Document36 pagesFormula de La Estrategia Actualizado Abril - 2023Nicanor TrosseroNo ratings yet

- Coingecko Q1 2021 Cryptocurrency ReportDocument56 pagesCoingecko Q1 2021 Cryptocurrency ReportElvin Chua100% (2)

- Blockchain Technology and CryptocurrenciesDocument1 pageBlockchain Technology and Cryptocurrenciescharlesryan.ppiamonteNo ratings yet

- This Is A Bunch of KeysDocument5 pagesThis Is A Bunch of KeysJeffrey BarnesNo ratings yet

- Bitcoin Key ListDocument1 pageBitcoin Key ListmarkmcwilliamsNo ratings yet

- Sample Synopsis - Decentralized Token SwappingDocument9 pagesSample Synopsis - Decentralized Token SwappingVanshNo ratings yet

- PreviewpdfDocument63 pagesPreviewpdfJoel TrmNo ratings yet

- $17k Finding Lost Crypto With WalletCrackerDocument5 pages$17k Finding Lost Crypto With WalletCrackerJeniferNo ratings yet

- Blockchain Unit Wise Question BankDocument3 pagesBlockchain Unit Wise Question BankMeghana50% (4)

- Difference Between Distributed Ledger & Blockchain - PDFDocument6 pagesDifference Between Distributed Ledger & Blockchain - PDFAlberto Navas100% (1)

- BLA ProgrammeDocument4 pagesBLA ProgrammeAnonymous 1ij7Cqx2QWNo ratings yet

- May2023 - Blockchain Technology and ApplicationsDocument6 pagesMay2023 - Blockchain Technology and ApplicationsRohan RaneNo ratings yet

- Bitcoin Latest FatwaDocument9 pagesBitcoin Latest FatwaMuhammad Ali AfzalNo ratings yet

- 1FeexV6bAHb8ybZjqQMjJrcCrHGW9sb6uF en Usd 2021-01!01!2021!01!31 1Document2 pages1FeexV6bAHb8ybZjqQMjJrcCrHGW9sb6uF en Usd 2021-01!01!2021!01!31 1GanesanNo ratings yet

- Screenshot 2023-08-27 at 8.40.54 AMDocument1 pageScreenshot 2023-08-27 at 8.40.54 AMIsaac OduduNo ratings yet

- Balance - FingredDocument1 pageBalance - Fingrednetinhobeto048No ratings yet

- Blockchain Syllabus For Site Sep18Document2 pagesBlockchain Syllabus For Site Sep18abhimanyu thakurNo ratings yet

- Walletinvestor Cryptos 2021Document13 pagesWalletinvestor Cryptos 2021Moe Thet LwinNo ratings yet

- Idoc - Pub - New Freebitcoin ScripttxtDocument1 pageIdoc - Pub - New Freebitcoin ScripttxtSree ProsantoNo ratings yet

- Coin List NewDocument7 pagesCoin List NewSaman KandapolaNo ratings yet

- Economics of BlockchainDocument36 pagesEconomics of BlockchainMuhammad AwaisNo ratings yet

- Regent CoinDocument38 pagesRegent Coindhananjay chaudharyNo ratings yet