Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 views2016-JAIBB LPB May

2016-JAIBB LPB May

Uploaded by

Mamun Enamul HasanCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Section 7Document1 pageSection 7Mamun Enamul HasanNo ratings yet

- MFS Marketing Note 2Document17 pagesMFS Marketing Note 2Mamun Enamul HasanNo ratings yet

- 2019-JAIBB PBE NovDocument2 pages2019-JAIBB PBE NovMamun Enamul HasanNo ratings yet

- 2019-JAIBB PBE JulyDocument1 page2019-JAIBB PBE JulyMamun Enamul HasanNo ratings yet

- Basics Accounting ConceptsDocument25 pagesBasics Accounting ConceptsMamun Enamul HasanNo ratings yet

- MFS Market SegmentationDocument3 pagesMFS Market SegmentationMamun Enamul HasanNo ratings yet

- MFS Marketing Lecture SheetDocument18 pagesMFS Marketing Lecture SheetMamun Enamul HasanNo ratings yet

- Marketing Note-1: Q.Elaborate The Problems of Marketing Administration in Bank. (Dec 12)Document21 pagesMarketing Note-1: Q.Elaborate The Problems of Marketing Administration in Bank. (Dec 12)Mamun Enamul HasanNo ratings yet

- MFS Introduction To Marketing 6Document8 pagesMFS Introduction To Marketing 6Mamun Enamul HasanNo ratings yet

- MFS Introduction To Marketing 2Document17 pagesMFS Introduction To Marketing 2Mamun Enamul HasanNo ratings yet

- MFS Introduction To Marketing 5Document8 pagesMFS Introduction To Marketing 5Mamun Enamul HasanNo ratings yet

- MFS Introduction To Marketing 3Document53 pagesMFS Introduction To Marketing 3Mamun Enamul HasanNo ratings yet

- MFS Introduction To Marketing 4Document8 pagesMFS Introduction To Marketing 4Mamun Enamul HasanNo ratings yet

- MFS Introduction To Marketing 1Document57 pagesMFS Introduction To Marketing 1Mamun Enamul HasanNo ratings yet

2016-JAIBB LPB May

2016-JAIBB LPB May

Uploaded by

Mamun Enamul Hasan0 ratings0% found this document useful (0 votes)

2 views2 pagesOriginal Title

2016-JAIBB_LPB_May

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

2 views2 pages2016-JAIBB LPB May

2016-JAIBB LPB May

Uploaded by

Mamun Enamul HasanCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 2

298 °

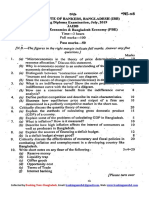

THE INSTITUTE OF BANKERS, BANGLADESH (IBB)

Banking Diploma Examination, May, 2016

JAIBB

Laws and Practice of Banking (LPB)

Time—3 hours

Full marks—100

Pass marks—50

(N.B.—The figures in the right margin indicate full marks. Answer any five

questions of which two must be from group B. ]

Group A

Marks

Write short notes on any five of the following — 4x35=20

(a) 3

(b) Inclusive Banking;

io) Core Risk Management;

(ad) Secret Reserve;

(ec) Documents of title to goods;

Stale cheque;

@ Landing Risk Anlysis;

t) Garnishee Order.

(a) Discuss the main functions of a commercial bank.

(6) How does a commercial bank strike a balance between liquidity 5

and profitability?

(c) Loan creates deposits—discuss. 5

(a) What do you mean by a Paying Bank? Discuss the duties and 10

responsibilities of a Paying Banker.

(8) Explain the protection offered by law to the Paying Bank. 5

(c) A customer of a bank draws a cheque for Tk. 300 inadvertently 5

leaving blanks before the amount both in words and in figures. The

amount is fraudulently raises by the payee to Tk. 3,300 and the

cheque is presented and cashed. Discuss the position of the bank.

(@ Describe the relationship between a banker and customer. 15

Discuss the relationship between.a banker and customer in

respect of the following -—

(i) A Current Account;

(ii) A Loan Account;

(iii) Fixed Deposit Account,

(iv) A Safe Deposit Account;

(3) Sale and purchase of securities on behalf of customer.

(B) State whether each of the following statements is ‘True’ or ‘False’ -—

i) Deposits create loan and Joan creates deposits.

i) A negotiable instrument is freely transferable.

‘A crossed cheque can be opened by a payee of the cheque.

(iv) Fixed Deposite Receipt is negotiable instrument, .

(v) Bank can freely give loans to a company against the security

of its own shares.

[Please turn over

Marks

(a) What procedure should a banker adopt in opening and operating a 14

joint account? Can the balance in the joint account of husband

and wife be paid to the wife on the death of her husband?

(6) Dr. Abdullah a Bangladeshi national not known to you working in 6

“Saudi Arabia approach to you with a bank draft drawn in foreign

coreney for US 3 10,000 to open a joint current account in his name

and in the name of his wife. How shall you open the account?

(a) What is Cheque? Discuss the main characteristics of a cheque. 10

(6) How does a cheque differ from a Bill of Exchange and a 5

Promissory note?

5

(c) What is Endorsement? Name the different kinds of Endorsement.

5x4=20

Distinguish between any four of the following :

() older in Due Coitrse and Holder for value;

(i) Banker’s lien and-Banker’s Right of set off:

(iii) Money Market and Capital Market;

wy Software and Hardware;

v) Fixed Charge and Floating Charge;

(vi) Euro and SBR; ome

(vii) Bank Rate and Lending Rate.

Group B

(a) Primarily what are the aspects to be examined when a new 10

loan proposal is received by a Bank?

(®) A Private Limited Company approaches you for a loan for Taka 10

cighty lacs against jute and jute goods. What are the requirements

you will need and ask for and examine for consideration of the

applicant? After you have sanctioned the company a cash credit

limit for Tk 70 facs (Taka 50 lacs against the pledge of jute and

Tk. 20 lacs against hypothecation of jute goods) what are the

documents will you obiain from the company and how the account

will be conducted?

(a) Define Working Capital. How does it differ from cash credit? 5

(6) Messrs Dada Textile Mills, a Public Limited Company has 15

applied for a working capital loan for Tk. three crores against

hypothecation of its plant, machineries, spareparts:and mill's

roduce. Please state what are the aspects to be examined by the

Bank for consideration of the loan. After being satisfied the bank

has sanctioned the loan. Please communicate with the Mill

Authority informing that the loan has been sanctioned by way of

a letter stating the terms and conditions of the loan’ and’ the

documents to be submitted by the Mill to avail of the loan.

(a) Discuss the main’ provisions of law relating to Artha Rin 10

Adalat Ain 2003 with its recent amendments.

(b) How does Artha Rin Adalat Ain help a bank in recovering 10

their stuck up loans?

(a) Outline the procedures you would follow for allowing a loan 12

against Life Insurance Policy. What precautions would you

take as Banker in this regard?

(b) What procedures would you follow when you receive “an 8

application for a loan against whole life policy taken by your ~

customer for the benefit of his minor son?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Section 7Document1 pageSection 7Mamun Enamul HasanNo ratings yet

- MFS Marketing Note 2Document17 pagesMFS Marketing Note 2Mamun Enamul HasanNo ratings yet

- 2019-JAIBB PBE NovDocument2 pages2019-JAIBB PBE NovMamun Enamul HasanNo ratings yet

- 2019-JAIBB PBE JulyDocument1 page2019-JAIBB PBE JulyMamun Enamul HasanNo ratings yet

- Basics Accounting ConceptsDocument25 pagesBasics Accounting ConceptsMamun Enamul HasanNo ratings yet

- MFS Market SegmentationDocument3 pagesMFS Market SegmentationMamun Enamul HasanNo ratings yet

- MFS Marketing Lecture SheetDocument18 pagesMFS Marketing Lecture SheetMamun Enamul HasanNo ratings yet

- Marketing Note-1: Q.Elaborate The Problems of Marketing Administration in Bank. (Dec 12)Document21 pagesMarketing Note-1: Q.Elaborate The Problems of Marketing Administration in Bank. (Dec 12)Mamun Enamul HasanNo ratings yet

- MFS Introduction To Marketing 6Document8 pagesMFS Introduction To Marketing 6Mamun Enamul HasanNo ratings yet

- MFS Introduction To Marketing 2Document17 pagesMFS Introduction To Marketing 2Mamun Enamul HasanNo ratings yet

- MFS Introduction To Marketing 5Document8 pagesMFS Introduction To Marketing 5Mamun Enamul HasanNo ratings yet

- MFS Introduction To Marketing 3Document53 pagesMFS Introduction To Marketing 3Mamun Enamul HasanNo ratings yet

- MFS Introduction To Marketing 4Document8 pagesMFS Introduction To Marketing 4Mamun Enamul HasanNo ratings yet

- MFS Introduction To Marketing 1Document57 pagesMFS Introduction To Marketing 1Mamun Enamul HasanNo ratings yet