Professional Documents

Culture Documents

T11 Ans. 1

T11 Ans. 1

Uploaded by

PUI TUNG CHONGOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

T11 Ans. 1

T11 Ans. 1

Uploaded by

PUI TUNG CHONGCopyright:

Available Formats

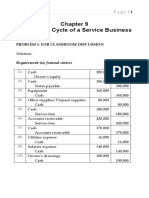

TAR UC (FAFB) – RAC Year 3 (ACADEMIC YEAR 2022/2023)

BBFT3014/BBFT3013 ADVANCED TAXATION

Tutorial 11: Unit trust & Real estate Investment trust & Trust

Suggested answer to Q1(a)

(i) Permitted expenses: RM

Fund Manager's remuneration 600,000

Salaries & wages 0

Maintenance of register of unit holders 80,000

Audit fee 50,000

Secretarial fee 30,000

Tax compliance fee 0

Maintenance expenses (for its office) 0

Share registration expenses 28,000

Entertainment 0

Postage 9,000

Stationery 10,000

Cash donation 0

Depreciation 0

(A) 807,000

Rent 2,000,000

(B) 2,000,000

(B) 2,000,000

Single tier dividend (Malaysia, exempt) 260,000

Interest (bonds - exempt) 500,000

Gains from sale of one landed property 2,800,000

Loss from sale of shares 0

Gains from sales of shares listed in KLSE 1,940,000

(C) 7,500,000

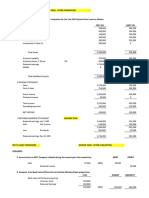

(ii) Happy Fund Trust: Tax Computation For YA 2022 RM RM RM

Single tier dividend (Para. 12B of Sch. 6) Exempt

Interest (Para. 35 of Sch. 6) Exempt

Rent 2,000,000

Aggregate income (all sources) 2,000,000

Less: Fraction of permitted expenses

A x B / 4C = 807,000 x 2,000,000/(4 x 7,500,000) = 53,800

or 10 % of A = 10% x 807,000 = 80,700

whichever is the higher: 80,700

Less: Donation to Malaysian Government (cash) 200,000 280,700

Total income / Chargeable income 1,719,300

Tax payable: RM1,719,300 x 24 % 412,632.00

You might also like

- Sol. Man. - Chapter 11 - Partnership FormationDocument12 pagesSol. Man. - Chapter 11 - Partnership Formationpehik100% (2)

- Exercise Sheet For Financial Accounting - Answer IMBADocument53 pagesExercise Sheet For Financial Accounting - Answer IMBAHager Salah100% (1)

- Sol. Man. - Chapter 9 - Acctg Cycle of A Service BusinessDocument52 pagesSol. Man. - Chapter 9 - Acctg Cycle of A Service Businesscan't yujout80% (5)

- Far410 - SS - Feb 2022Document9 pagesFar410 - SS - Feb 2022AFIZA JASMANNo ratings yet

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav180% (30)

- ABC Chap 9 SolmanDocument11 pagesABC Chap 9 SolmanKimberly ToraldeNo ratings yet

- Edgar Detoya WorksheetDocument2 pagesEdgar Detoya WorksheetNeilan Jay FloresNo ratings yet

- Quiz - Single Entry (Answer Key)Document2 pagesQuiz - Single Entry (Answer Key)Gloria BeltranNo ratings yet

- Cash Flow Statement Inv & Fin Activity (Mat 4) Iyhgblo8yugbjmnDocument3 pagesCash Flow Statement Inv & Fin Activity (Mat 4) Iyhgblo8yugbjmnPrashanth RNo ratings yet

- (A) (I) & (Ii) PA Trust RM Distributable IncomeDocument3 pages(A) (I) & (Ii) PA Trust RM Distributable IncomeBrenda TanNo ratings yet

- FIRST PB FAR Solutions PDFDocument6 pagesFIRST PB FAR Solutions PDFStephanie Joy NogollosNo ratings yet

- Solution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsDocument11 pagesSolution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsJoy SantosNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- AFA IIP.L III SolutionJune 2016Document4 pagesAFA IIP.L III SolutionJune 2016HossainNo ratings yet

- A4 PalacioDocument3 pagesA4 PalacioPinky DaisiesNo ratings yet

- Answer Question 6.6Document3 pagesAnswer Question 6.6Lee Li HengNo ratings yet

- Personal Taxation FINAL TAX 100Document12 pagesPersonal Taxation FINAL TAX 100husninanorzainNo ratings yet

- A. Journal Entries Accounts Debit CreditDocument3 pagesA. Journal Entries Accounts Debit CreditAnne AlagNo ratings yet

- Notes To AccountsDocument2 pagesNotes To Accountsnahangar113No ratings yet

- Chapter 07 - Financial StatementsDocument40 pagesChapter 07 - Financial StatementsMkhonto XuluNo ratings yet

- Accounting For Special Transactions and Business CombinationsDocument3 pagesAccounting For Special Transactions and Business CombinationsJustine Reine CornicoNo ratings yet

- TAX Final Preboard Examination - Solutions PDFDocument15 pagesTAX Final Preboard Examination - Solutions PDF813 cafeNo ratings yet

- Hifa NurafwaDocument8 pagesHifa Nurafwa20197 Elisa Nurhayati AhmadNo ratings yet

- Answer Sheet Mock Test 23-2Document5 pagesAnswer Sheet Mock Test 23-2Nam Nguyễn HoàngNo ratings yet

- Leverage QuestionsDocument8 pagesLeverage QuestionsMidhun George VargheseNo ratings yet

- FAR Final Preboard SolutionsDocument6 pagesFAR Final Preboard SolutionsVillanueva, Mariella De VeraNo ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document11 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Kathrina RoxasNo ratings yet

- Answer Sheet Mock Test 23Document5 pagesAnswer Sheet Mock Test 23Nam Nguyễn HoàngNo ratings yet

- BANGI, Joshua Celton - Assign2.Document7 pagesBANGI, Joshua Celton - Assign2.Joshua BangiNo ratings yet

- Solution Tax667 - Jun 2018Document9 pagesSolution Tax667 - Jun 2018Aiyani NabihahNo ratings yet

- Ws CmaDocument11 pagesWs CmaVRNo ratings yet

- Chapter 9 Problem 1 SolutionDocument8 pagesChapter 9 Problem 1 SolutionAustin Coles83% (6)

- Less: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaDocument16 pagesLess: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaGao YungNo ratings yet

- Closure Activities-Answer KeyDocument5 pagesClosure Activities-Answer KeyJohn Mark FernandoNo ratings yet

- ACC407-section BDocument3 pagesACC407-section Banissyafiqahh17No ratings yet

- ACC106 Assignment AccountDocument5 pagesACC106 Assignment AccountsyafiqahNo ratings yet

- Q1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDDocument8 pagesQ1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDduong duongNo ratings yet

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document12 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Shane KimNo ratings yet

- For Classroom Discussion: SolutionDocument4 pagesFor Classroom Discussion: SolutionMisherene MagpileNo ratings yet

- Lab 2Document4 pagesLab 2Danica Jane RamosNo ratings yet

- CPAR B94 TAX Final PB Exam - Answers - SolutionsDocument12 pagesCPAR B94 TAX Final PB Exam - Answers - SolutionsSilver LilyNo ratings yet

- Chapter 9 Financial Reporting in Hyperinflationary EconomiesDocument10 pagesChapter 9 Financial Reporting in Hyperinflationary EconomiesKathrina RoxasNo ratings yet

- Accounting 2Document2 pagesAccounting 2reeisha7No ratings yet

- Exemplar Company - Fortunado PDFFDocument1 pageExemplar Company - Fortunado PDFFmitakumo uwuNo ratings yet

- Quiz 1.01 Financial Statements To Interim ReportingDocument22 pagesQuiz 1.01 Financial Statements To Interim ReportingJohn Lexter MacalberNo ratings yet

- Audit of Liabilities Answer KeyDocument2 pagesAudit of Liabilities Answer KeyLyca MaeNo ratings yet

- Solution For MFRS112 ExercisesDocument11 pagesSolution For MFRS112 Exercisesm-7039266No ratings yet

- Solution Tax667 - Dec 2016Document7 pagesSolution Tax667 - Dec 2016Aiyani NabihahNo ratings yet

- Ans Jan 2018 Far410Document8 pagesAns Jan 2018 Far4102022478048No ratings yet

- Sol. Man. - Chapter 12 - Partnership OperationsDocument11 pagesSol. Man. - Chapter 12 - Partnership OperationspehikNo ratings yet

- T10 Ans 3Document2 pagesT10 Ans 3PUI TUNG CHONGNo ratings yet

- Paw and Saw DownstreamDocument3 pagesPaw and Saw DownstreamLorie Roncal JimenezNo ratings yet

- Tutorial 7 - IntangibleDocument2 pagesTutorial 7 - IntangibleABABNo ratings yet

- Reviewer TAXDocument3 pagesReviewer TAXAnnabel MendozaNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- FAR05 - First Pre-Board SolutionsDocument7 pagesFAR05 - First Pre-Board SolutionsMellaniNo ratings yet

- August Q1Document3 pagesAugust Q1tengku rilNo ratings yet

- Sol. Man. - Chapter 11 - Partnership FormationDocument12 pagesSol. Man. - Chapter 11 - Partnership FormationpehikNo ratings yet

- Going To University Is More Important Than Ever For Young People - All Must Have DegreesDocument8 pagesGoing To University Is More Important Than Ever For Young People - All Must Have Degreessebastyan_v5466No ratings yet

- Purchase Order-82058849Document1 pagePurchase Order-82058849kimefo4395No ratings yet

- ACCT 130-Principles of Management Accounting-Saira RizwanDocument6 pagesACCT 130-Principles of Management Accounting-Saira Rizwannetflix accountNo ratings yet

- Claim Form CaDocument4 pagesClaim Form CaManjunath YallankarNo ratings yet

- Module I: Philosophy and EthicsDocument4 pagesModule I: Philosophy and EthicsChinar SodhaniNo ratings yet

- PLDT StramaDocument44 pagesPLDT Stramawilhelmina romanNo ratings yet

- Main Aur Mera Vyakaran-07 TB 5 ChaptersDocument68 pagesMain Aur Mera Vyakaran-07 TB 5 ChaptersRAVI SHANKARNo ratings yet

- Dandi Boru College Department of ManagementDocument11 pagesDandi Boru College Department of ManagementMoges LakewNo ratings yet

- Testing: Software Engineering Sommerville - Chapter 4,27 and 28Document29 pagesTesting: Software Engineering Sommerville - Chapter 4,27 and 28VCRajanNo ratings yet

- R80 Brief For InvestorDocument16 pagesR80 Brief For Investorihsan daniNo ratings yet

- 03. Shopping - ВходDocument3 pages03. Shopping - ВходGeorgi BirdanovNo ratings yet

- Chapter One Operation Management Designs, Operates, and Improves Productive Systems-Systems ForDocument12 pagesChapter One Operation Management Designs, Operates, and Improves Productive Systems-Systems ForwubeNo ratings yet

- Church Budget Template (Advanced) (Spanish)Document11 pagesChurch Budget Template (Advanced) (Spanish)FrancexcoNo ratings yet

- SS02 Handouts 2Document2 pagesSS02 Handouts 2RonibeMalinginNo ratings yet

- National Labor Relations Commission Halang, Calamba City: ReplyDocument13 pagesNational Labor Relations Commission Halang, Calamba City: ReplyChaddzky Bonifacio100% (1)

- CA Inter Test - CH 5 & 6Document5 pagesCA Inter Test - CH 5 & 6adsaNo ratings yet

- Ieee STD 835 1994 PDFDocument28 pagesIeee STD 835 1994 PDFGabriela BarralagaNo ratings yet

- BP B1 Tests Unit7Document3 pagesBP B1 Tests Unit7thư lêNo ratings yet

- KLMinvoice 04062020Document1 pageKLMinvoice 04062020Jack RobinsonNo ratings yet

- Finding Stocks The Warren Buffett Way by John BajkowskiDocument10 pagesFinding Stocks The Warren Buffett Way by John Bajkowskiapi-3794576100% (2)

- Ehs Hse PlanDocument50 pagesEhs Hse Planjithin shankarNo ratings yet

- Syd Uni Project - BluescopeSteelbslAu-RiskGreaterThanEpsMomentum20211001Document10 pagesSyd Uni Project - BluescopeSteelbslAu-RiskGreaterThanEpsMomentum20211001hongyu zhangNo ratings yet

- Dwnload Full Business Ethics Ethical Decision Making and Cases 9th Edition Ferrell Solutions Manual PDFDocument35 pagesDwnload Full Business Ethics Ethical Decision Making and Cases 9th Edition Ferrell Solutions Manual PDFtrichitegraverye1bzv8100% (18)

- Forensic Audit Report of BKR Foods Pvt. LTDDocument7 pagesForensic Audit Report of BKR Foods Pvt. LTDA Kumar LegacyNo ratings yet

- Chamblee Nonprofit Partnership ProgramDocument5 pagesChamblee Nonprofit Partnership ProgramZachary HansenNo ratings yet

- Ewm Goods IssueDocument21 pagesEwm Goods IssueDipak BanerjeeNo ratings yet

- Food Distribution Business PlanDocument50 pagesFood Distribution Business PlanJoseph QuillNo ratings yet

- OD126049736033575000Document1 pageOD126049736033575000UJJWALNo ratings yet

- Lab 7Document3 pagesLab 7Quy VuNo ratings yet