Professional Documents

Culture Documents

Antm Tins Ptba 070529 LG

Antm Tins Ptba 070529 LG

Uploaded by

Cristiano DonzaghiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Antm Tins Ptba 070529 LG

Antm Tins Ptba 070529 LG

Uploaded by

Cristiano DonzaghiCopyright:

Available Formats

3

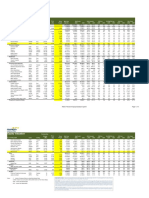

PRICE (RP) MKT. CAP (%) Recom* Target Chg NET EARNINGS EPS PER EV/EBITDA PBV Listed

25-May-07 (Rpbn) to JCI Price (%) 2006E 2007F 2006E 2007F 2006E 2007F 2006E 2007F 2006E 2007F Shares (m)

AUTOMOTIVE 1,774.1 0.1 231.8 181.0 73.2 57.1 7.7 9.8 7.2 5.1 0.8 0.7 3,168.0

PT Trimegah Securities Tbk

Gajah Tunggal Tbk 560 1,774.1 0.1 Buy 631.9 12.8 231.8 181.0 73.2 57.1 7.7 9.8 7.2 5.1 0.8 0.7 3,168.0

BANKING 253,825.6 17.7 12,143.5 16,541.0 186.5 254.0 20.9 15.3 N/A N/A 3.4 3.0 65,121.4

Bank Central Asia Tbk 5,350 66,127.6 4.6 Hold 5,775.8 8.0 4,200.3 4,818.9 339.8 389.9 15.7 13.7 - - 3.6 3.1 12,360.3

Bank Rakyat Indonesia Tbk 6,000 74,231.3 5.2 Hold 5,893.8 (1.8) 4,336.7 4,930.8 350.5 398.5 17.1 15.1 - - 4.7 4.0 12,371.9

Bank Danamon Tbk 7,050 36,480.3 2.5 Hold 7,039.5 (0.1) 1,506.5 2,574.0 291.1 497.4 24.2 14.2 - - 3.7 3.1 5,174.5

Bank Mandiri (Persero) Tbk 3,100 65,413.2 4.6 Hold 3,238.7 4.5 1,334.4 3,204.7 63.2 151.9 49.0 20.4 - - 2.6 2.4 21,101.0

Bank Niaga Tbk 820 11,573.2 0.8 Buy 1,084.6 32.3 765.6 1,012.7 54.2 71.7 15.1 11.4 - - 2.1 1.8 14,113.7

TRIMEGAH STOCK UNIVERSE

CEMENT 52,051.7 3.6 2,346.3 2,441.1 196.6 204.5 22.2 21.3 12.7 10.5 3.8 3.3 11,937.3

Indocement Tunggal Prakasa Tbk 5,650 20,799.0 1.5 Buy 6,340.0 12.2 853.0 938.7 231.7 255.0 24.4 22.2 12.2 10.0 3.3 3.0 3,681.2

Holcim Indonesia Tbk 750 5,747.2 0.4 Hold 790.0 5.3 197.8 26.6 25.8 3.5 29.1 216.4 20.5 17.5 2.8 2.8 7,662.9

Semen Gresik (Persero) Tbk 43,000 25,505.5 1.8 Buy 51,468.5 19.7 1,295.5 1,475.8 2,184.1 2,488.0 19.7 17.3 11.3 9.3 4.7 3.9 593.2

CONSUMER 15,731.8 1.1 748.9 871.7 80.6 93.8 21.0 18.0 7.2 5.9 3.0 2.7 9,295.2

Indofood Sukses Makmur Tbk 1,690 14,413.3 1.0 Hold 1,749.5 3.5 656.2 760.0 76.9 89.1 22.0 19.0 7.5 6.2 3.4 3.0 8,528.6

Mayora Indah Tbk 1,720 1,318.5 0.1 Hold 1,769.9 2.9 92.7 111.6 121.0 145.6 14.2 11.8 5.2 3.4 1.3 1.2 766.6

HEAVY EQUIPMENT 21,128.4 1.5 1,073.4 1,112.9 290.8 301.5 19.7 19.0 9.4 8.0 4.2 3.6 3,691.6

Hexindo Adiperkasa Tbk 1,050 882.0 0.1 Hold 1,000.0 (4.8) 68.9 89.0 82.0 106.0 12.8 9.9 5.9 5.2 2.3 2.0 840.0

United Tractors Tbk 7,100 20,246.4 1.4 Hold 7,660.0 7.9 1,004.5 1,023.9 352.3 359.0 20.2 19.8 9.6 8.2 4.3 3.8 2,851.6

MINING 132,901.2 9.3 8,414.0 21,617.2 335.1 860.8 15.8 6.1 8.6 6.9 5.0 3.9 25,112.8

Aneka Tambang (Persero) Tbk 14,800 28,233.8 2.0 Sell 11,200.0 (24.3) 1,558.7 4,939.1 817.1 2,589.0 18.1 5.7 10.4 6.8 7.2 5.4 1,907.7

Bumi Resources Tbk 1,560 30,270.2 2.1 Hold 1,550.0 (0.6) 1,403.9 4,812.4 72.4 248.0 21.6 6.3 11.6 9.1 9.8 6.5 19,404.0

International Nickel Ind .Tbk 57,850 57,481.7 4.0 Sell 51,000.0 (11.8) 4,671.6 10,514.0 4,701.5 10,581.4 12.3 5.5 6.8 6.0 3.9 3.1 993.6

Tambang Batubara Bukit AsamTbk 4,600 10,599.0 0.7 Sell 4,100.0 (10.9) 571.7 672.6 248.1 291.9 18.5 15.8 11.2 8.9 4.5 4.0 2,304.1

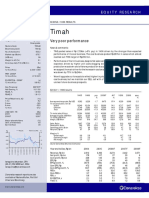

Timah Tbk 12,550 6,316.4 0.4 Buy 15,400.0 22.7 208.1 679.1 413.6 1,349.3 30.3 9.3 6.0 4.6 2.7 2.4 503.3

OIL & GAS 46,306.8 3.2 1,960.7 1,853.8 431.9 408.3 23.6 25.0 16.5 8.6 9.1 7.0 4,539.9

Perusahaan Gas Negara Tbk 10,200 46,306.8 3.2 Hold 10,200.0 - 1,960.7 1,853.8 431.9 408.3 23.6 25.0 16.5 8.6 9.1 7.0 4,539.9

PHARMACEUTICAL 16,316.9 1.1 - 1,048.7 1,180.5 71.6 80.5 15.6 13.8 8.1 6.8 3.2 2.7 14,656.0

Kalbe Farma Tbk 1,230 12,491.9 0.9 Buy 1,442.3 17.3 744.4 833.5 73.3 82.1 16.8 15.0 8.8 7.4 4.0 3.2 10,156.0

Tempo Scan Pacific Tbk 850 3,825.0 0.3 Buy 1,038.7 22.2 304.3 347.1 67.6 77.1 12.6 11.0 6.2 5.2 2.0 1.8 4,500.0

PLANTATION 22,755.1 1.6 - 882.5 1,490.0 560.4 946.2 25.8 15.3 13.7 8.2 7.6 6.1 1,574.7

Astra Agro Lestari Tbk 14,450 22,755.1 1.6 Hold 14,900.0 3.1 882.5 1,490.0 560.4 946.2 25.8 15.3 13.7 8.2 7.6 6.1 1,574.7

PROPERTY 10,315.8 0.7 - 543.5 367.4 58.5 39.6 19.0 28.1 10.6 13.7 3.7 3.4 9,284.3

Adhi Karya (Persero) Tbk 950 1,711.3 0.1 Hold 980.0 3.2 90.4 145.4 50.2 80.7 18.9 11.8 8.6 6.4 3.9 3.1 1,801.3

Ciputra Surya Tbk 1,260 2,493.4 0.2 Sell 1,060.0 (15.9) 216.5 77.2 109.4 39.0 11.5 32.3 7.0 18.8 2.2 2.1 1,978.9

Summarecon Agung Tbk 1,510 4,158.7 0.3 Sell 1,250.0 (17.2) 135.1 55.0 49.0 20.0 30.8 75.5 15.9 26.8 4.4 4.2 2,754.1

TRIM Harian - 28 Mei 2007

Total Bangun Persada Tbk 710 1,952.5 0.1 Buy 975.0 37.3 101.5 89.7 36.9 32.6 19.2 21.8 12.0 13.9 7.1 6.2 2,750.0

RETAIL 10,594.9 0.7 - 552.7 636.2 40.3 46.4 19.2 16.7 7.5 6.2 2.0 1.9 13,721.9

Mitra Adiperkasa Tbk 800 1,328.0 0.1 Buy 1,050.5 31.3 82.6 161.5 49.8 97.3 16.1 8.2 5.2 3.9 1.1 1.0 1,660.0

Matahari Putra Prima Tbk 750 3,533.9 0.2 Buy 972.8 29.7 191.5 153.2 40.6 32.5 18.5 23.1 6.1 5.3 1.6 1.5 4,711.9

Ramayana Lestari Sentosa Tbk 780 5,733.0 0.4 Buy 951.6 22.0 278.6 321.4 37.9 43.7 20.6 17.8 11.5 9.6 3.0 2.7 7,350.0

TELCO 231,590.6 16.1 - 13,189.3 15,502.7 515.3 605.7 17.6 14.9 6.5 5.2 5.0 4.2 25,596.4

Indosat Tbk 7,000 38,054.6 2.7 Hold 7,118.6 1.7 1,467.0 2,072.6 269.9 381.2 25.9 18.4 6.7 5.4 2.5 2.3 5,436.4

Telekomunikasi Indonesia Tbk 9,600 193,536.0 13.5 Buy 11,587.9 20.7 11,722.2 13,430.1 581.5 666.2 16.5 14.4 6.5 5.2 6.3 5.1 20,160.0

TRIM UNIVERSE 815,293.0 56.8 43,135.3 63,795.3 229.8 339.9 18.9 12.8 11.7 9.2 4.2 3.6 187,699.5

TRIM UNIVERSE (Excl. Banking Sector) 561,467.4 39.2 30,991.9 47,254.4 252.8 385.5 18.1 11.9 8.2 6.4 4.7 3.9 122,578.0

Source: Trimegah Research

You might also like

- Wiring Electrical - AllDocument15 pagesWiring Electrical - AllArief Rakhmad100% (2)

- Blade Angle Chart-Steven Penner-Blade ForumsDocument2 pagesBlade Angle Chart-Steven Penner-Blade ForumsMoises TinteNo ratings yet

- CLSA Valuation Matrix 20131127Document3 pagesCLSA Valuation Matrix 20131127mkmanish1No ratings yet

- Pergerakan Valuasi Saham LQ45 - 033022Document1 pagePergerakan Valuasi Saham LQ45 - 033022Raden AditNo ratings yet

- Trending Value Portfolio Implementation-GoodDocument260 pagesTrending Value Portfolio Implementation-Gooddheeraj nautiyalNo ratings yet

- Matriks Valuasi Saham Sharia 11 May 2020Document4 pagesMatriks Valuasi Saham Sharia 11 May 2020hendarwinNo ratings yet

- Quality Dividend Yield Stocks - 301216Document5 pagesQuality Dividend Yield Stocks - 301216sumit guptaNo ratings yet

- Dividend Yield Monitor As of 3rd May 2024Document4 pagesDividend Yield Monitor As of 3rd May 202448abhinavmittalNo ratings yet

- FIB Research - NSE Financial StatsDocument16 pagesFIB Research - NSE Financial StatslexmuiruriNo ratings yet

- Gula PasirDocument5 pagesGula PasirbambangijoNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 6Document6 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 6Kadek ArdianaNo ratings yet

- Appendix TablesDocument31 pagesAppendix TablesSarabinder SinghNo ratings yet

- Stocks ShortlistDocument24 pagesStocks Shortlistallly100% (1)

- Non Banking Financial Companies Profile of Nbfcs (Including RNBCS)Document4 pagesNon Banking Financial Companies Profile of Nbfcs (Including RNBCS)Pooja KalyankerNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- Matriks Valuasi Saham Sharia 18 May 2020Document1 pageMatriks Valuasi Saham Sharia 18 May 2020hendarwinNo ratings yet

- ICICIdirect ExpectedHighDividendYieldStocksDocument2 pagesICICIdirect ExpectedHighDividendYieldStocksRamesh RajagopalanNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- 9 PDFDocument3 pages9 PDFsterlingNo ratings yet

- 2018 Power Statistics - Final - As of 29 March 2019 - 7. Annual Peak Demand Per GridDocument1 page2018 Power Statistics - Final - As of 29 March 2019 - 7. Annual Peak Demand Per GridRenier Joseph Dela RosaNo ratings yet

- IDX Financial Data Ratios 2009Document8 pagesIDX Financial Data Ratios 2009Mohammad Noor SyahrielNo ratings yet

- Semen Indonesia Sales Volume (In Tons) : Lap AsiDocument1 pageSemen Indonesia Sales Volume (In Tons) : Lap AsiRizal SyaifuddinNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- 07 2018 Power Statistics As of 29 March 2019 Annual LVM Peak Demand PDFDocument1 page07 2018 Power Statistics As of 29 March 2019 Annual LVM Peak Demand PDFDominic SantiagoNo ratings yet

- Perkembangan Ekspor Dan Impor Indonesia September 2018Document2 pagesPerkembangan Ekspor Dan Impor Indonesia September 2018januar baharuliNo ratings yet

- Stock Screener203557Document6 pagesStock Screener203557Sde BdrNo ratings yet

- Pergerakan Valuasi Saham LQ45 - 102721Document1 pagePergerakan Valuasi Saham LQ45 - 102721andika putraNo ratings yet

- NPV Calculation of Euro DisneylandDocument5 pagesNPV Calculation of Euro DisneylandRama SubramanianNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- Valuation SnapshotDocument1 pageValuation Snapshotsaransh pugaliaNo ratings yet

- Matriks Valuasi Saham Syariah 23112020Document2 pagesMatriks Valuasi Saham Syariah 23112020Naikerretaapi Sempit'aNo ratings yet

- Stock DetailsDocument2 pagesStock DetailsNilesh DhandeNo ratings yet

- Specialty PIPE SCHEDULES PDFDocument1 pageSpecialty PIPE SCHEDULES PDFAlfred LamNo ratings yet

- Beta Bloomberg OtomotifDocument52 pagesBeta Bloomberg OtomotifayuvwxyzNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- Year 2018-1Document5 pagesYear 2018-1Vũ Ngọc BíchNo ratings yet

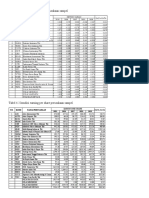

- Tabel 4.1 Kondisi Return Saham Perusahaan Sampel: 2015 2016 2017 2018 2019 NO. Kode Nama PerusahaanDocument8 pagesTabel 4.1 Kondisi Return Saham Perusahaan Sampel: 2015 2016 2017 2018 2019 NO. Kode Nama PerusahaanOhmybboNo ratings yet

- NTPC Stations Coal Stock Position As On 19.10.2023Document1 pageNTPC Stations Coal Stock Position As On 19.10.2023Vipul KumarNo ratings yet

- Pergerakan Valuasi Saham LQ45 - 021323Document1 pagePergerakan Valuasi Saham LQ45 - 021323Agus SNo ratings yet

- Financing Under Islamis ModesDocument5 pagesFinancing Under Islamis ModesMuhamamd Zahid Ullah KhanNo ratings yet

- Data Terbaru Indah Rosita Juli 2023Document12 pagesData Terbaru Indah Rosita Juli 2023jf.engineeringmlgNo ratings yet

- 4 Selangor PDFDocument14 pages4 Selangor PDFJoo LimNo ratings yet

- Malaysia's Exports of Natural Rubber by Destination (Tonnes)Document1 pageMalaysia's Exports of Natural Rubber by Destination (Tonnes)ZAIRUL AMIN BIN RABIDIN (FRIM)No ratings yet

- Pipe Dimensions Weights ChartDocument1 pagePipe Dimensions Weights ChartZamuNo ratings yet

- Economics Assignment: Monetary Authority of SingaporeDocument7 pagesEconomics Assignment: Monetary Authority of SingaporeManu AgarwalNo ratings yet

- Roa Roe 2012 2013 2014 2015 2016 2012Document76 pagesRoa Roe 2012 2013 2014 2015 2016 2012Aditya RahmanNo ratings yet

- Dividend Yield Stocks 210922Document3 pagesDividend Yield Stocks 210922Aaron KaleesNo ratings yet

- Dimensions of Chinese Standard Equal Leg AnglesDocument3 pagesDimensions of Chinese Standard Equal Leg AnglesJJGM120No ratings yet

- JadualTransaksiSelangor2020Document53 pagesJadualTransaksiSelangor2020Venice ChenNo ratings yet

- ASA Pipe SchedulesDocument1 pageASA Pipe SchedulesPaul GuillaumeNo ratings yet

- Number of Cards and Users of Payment Instruments (End of Period)Document1 pageNumber of Cards and Users of Payment Instruments (End of Period)Vaibhav guptaNo ratings yet

- OI SpurtsDocument22 pagesOI SpurtsBallNo ratings yet

- Ev-Ebitda Oil CompaniesDocument2 pagesEv-Ebitda Oil CompaniesArie Yetti NuramiNo ratings yet

- BlanchingDocument22 pagesBlanchingAdrianna MichelleNo ratings yet

- Coal Stock PositionDocument1 pageCoal Stock PositionVipul KumarNo ratings yet

- GB Flemming Asia Pacific DC Forum 26th Sept 2012Document31 pagesGB Flemming Asia Pacific DC Forum 26th Sept 2012mohamadNo ratings yet

- Return Loss-Vswr TableDocument1 pageReturn Loss-Vswr TableEbrahimNo ratings yet

- Return Loss Vs VSWRDocument1 pageReturn Loss Vs VSWRcolinNo ratings yet

- Distribuicao Chi-QuadradoDocument1 pageDistribuicao Chi-QuadradoHugo MendesNo ratings yet

- Aali 0803Document1 pageAali 0803Cristiano DonzaghiNo ratings yet

- Aali 0802Document1 pageAali 0802Cristiano DonzaghiNo ratings yet

- Tins 080429 OdDocument3 pagesTins 080429 OdCristiano DonzaghiNo ratings yet

- Antm 080218 OdDocument3 pagesAntm 080218 OdCristiano DonzaghiNo ratings yet

- RegionalFundFlow - NomuraDocument28 pagesRegionalFundFlow - NomuraCristiano DonzaghiNo ratings yet

- Pgas 070529Document3 pagesPgas 070529Cristiano DonzaghiNo ratings yet

- Tins 060831Document2 pagesTins 060831Cristiano DonzaghiNo ratings yet

- ISAT 060106 Network Expansion ContinuesDocument2 pagesISAT 060106 Network Expansion ContinuesCristiano DonzaghiNo ratings yet

- Timah 070123 15000Document1 pageTimah 070123 15000Cristiano DonzaghiNo ratings yet

- ANTM 060106 Higher Volume Mitigates Rising CostsDocument2 pagesANTM 060106 Higher Volume Mitigates Rising CostsCristiano DonzaghiNo ratings yet

- Fs Idxbasic 2023 08Document3 pagesFs Idxbasic 2023 08Rian Haris SNo ratings yet

- 2022 10 14 SMGRDocument2 pages2022 10 14 SMGRfirmanNo ratings yet

- PT. Semen Gresik (Persero) TBK Seksi Operasi Utilitas: Presented by Agus KuntoroDocument46 pagesPT. Semen Gresik (Persero) TBK Seksi Operasi Utilitas: Presented by Agus KuntoroNandach Benci DisakitiNo ratings yet

- PQM - History - Training & Consulting - BrochureDocument26 pagesPQM - History - Training & Consulting - BrochureSintoGNo ratings yet

- Data Esgi - Olah Khusus Bank UmumDocument31 pagesData Esgi - Olah Khusus Bank UmumMiranda SantikaNo ratings yet

- Tabulasi Financial DistressDocument27 pagesTabulasi Financial DistressSeksi MSKI KPPN JemberNo ratings yet

- Jadwal Presentasi TKMPN TIM XXVI 2022. OKDocument2 pagesJadwal Presentasi TKMPN TIM XXVI 2022. OKMusdah MMNo ratings yet

- Idx Company Fact Sheet Lq45 2021 01Document183 pagesIdx Company Fact Sheet Lq45 2021 01raullwijaya100% (1)

- Muhammad Farkhan Fadhilah SandyDocument15 pagesMuhammad Farkhan Fadhilah SandyMuhammad Farkhan Fadhilah SandyNo ratings yet

- Analisis Produksi Pada Kemajuan Tambang Menggunakan Metode Fotogrametri UAVDocument9 pagesAnalisis Produksi Pada Kemajuan Tambang Menggunakan Metode Fotogrametri UAVAndhiNo ratings yet

- Kelompok 9Document51 pagesKelompok 9ipung firmanNo ratings yet

- Vietnam CementDocument35 pagesVietnam CementPhạm ChúcNo ratings yet

- Ar SMCB 2022Document335 pagesAr SMCB 2022GABRIELLA GUNAWANNo ratings yet

- Annual Report SMGRDocument425 pagesAnnual Report SMGRNisaNo ratings yet

- Daftar Saham 2018Document30 pagesDaftar Saham 2018Hawin PradanaNo ratings yet

- AS-BUILT DRAWING SP3 - SKP (No. 2.3..5.6.7)Document5 pagesAS-BUILT DRAWING SP3 - SKP (No. 2.3..5.6.7)ojiNo ratings yet

- Economic Value Added (EVA) Dan Market Value Added (MVA)Document11 pagesEconomic Value Added (EVA) Dan Market Value Added (MVA)Andika SetiawanNo ratings yet

- PT Semen Indonesia q3 2022 - FinalDocument112 pagesPT Semen Indonesia q3 2022 - FinalHaris MaulanaNo ratings yet

- Income Tax ExpDocument16 pagesIncome Tax ExpHaikal RafifNo ratings yet

- 03 Certificate Cement EzPro Maret 2022, 28DDocument1 page03 Certificate Cement EzPro Maret 2022, 28DBofa OctoviantoNo ratings yet

- Daftar IsiDocument15 pagesDaftar IsiPP-NCICD Aliran TimurNo ratings yet

- IDX Company ReadsDocument183 pagesIDX Company ReadsNathania PriscillaNo ratings yet

- Cyclone Raw MillDocument1 pageCyclone Raw MillADOFSLNo ratings yet

- Analisa Ebit-Eps Terhadap Struktur Modal Optimal Pada PT Semen Indonesia (Persero) TBK Runik Puji RahayuDocument15 pagesAnalisa Ebit-Eps Terhadap Struktur Modal Optimal Pada PT Semen Indonesia (Persero) TBK Runik Puji Rahayu1RON S1GHTNo ratings yet

- Pefindo Beta Saham 20221020 enDocument16 pagesPefindo Beta Saham 20221020 enAndre BengNo ratings yet

- Peta Catchment AreaDocument1 pagePeta Catchment AreaMoh Widodo3No ratings yet

- Pendataan Tempat Kerja Praktek (Responses)Document6 pagesPendataan Tempat Kerja Praktek (Responses)Tegar gayuh pambudhiNo ratings yet

- Materi GCGDocument12 pagesMateri GCGEka Khairunisa HendrajayaNo ratings yet

- FY 2008 SMGR Semen+Indonesia (Persero) TBKDocument89 pagesFY 2008 SMGR Semen+Indonesia (Persero) TBKRiki Ariyadi 2002110906No ratings yet