Professional Documents

Culture Documents

Debit Card Applctn Form

Debit Card Applctn Form

Uploaded by

junaid.c.h. padneCopyright:

Available Formats

You might also like

- SBI ATM/Debit Card Application FormDocument2 pagesSBI ATM/Debit Card Application FormVivek Godgift J78% (46)

- Business Client Agreement enDocument8 pagesBusiness Client Agreement enKatlego HectorNo ratings yet

- Global Credit Card ApplicationDocument2 pagesGlobal Credit Card Applicationvv_nathanNo ratings yet

- ATM-e-Banking Mobile Banking Request Form For CBS Customers PDFDocument1 pageATM-e-Banking Mobile Banking Request Form For CBS Customers PDFSupdt. of Post offices Kanpur (M) Dn. KanpurNo ratings yet

- Debit Card Application Form: A. Applicant' DetailsDocument2 pagesDebit Card Application Form: A. Applicant' DetailsRahul BhatNo ratings yet

- First Guarantee2Document1 pageFirst Guarantee2etio basseyNo ratings yet

- Fund Transfer Form-Cd20Document1 pageFund Transfer Form-Cd20meraxulNo ratings yet

- Application For DepositDocument1 pageApplication For DepositSolaimalai IyyengarNo ratings yet

- Personal Finance Application Form 2023 - English - New Sep2023Document7 pagesPersonal Finance Application Form 2023 - English - New Sep2023devilinpajamaNo ratings yet

- CRFA4 Rev Aug14 230823Document2 pagesCRFA4 Rev Aug14 230823Shobie advinculaNo ratings yet

- Application: Type of AccountDocument2 pagesApplication: Type of AccountL&R WingNo ratings yet

- DownloadDocument19 pagesDownloadSolomonNo ratings yet

- D D M M Y Y Y Y: Credit Card Services Form - 1Document4 pagesD D M M Y Y Y Y: Credit Card Services Form - 1Zaiedul HoqueNo ratings yet

- Account Opening Form Aug82017 FDNonIndividual 1Document6 pagesAccount Opening Form Aug82017 FDNonIndividual 1arpit selectionNo ratings yet

- Application Form For Issue of Canara Debit Card 27072017Document2 pagesApplication Form For Issue of Canara Debit Card 27072017John Athaide100% (1)

- Application (Eng)Document5 pagesApplication (Eng)segnatory_endNo ratings yet

- KGB SB - CA - Opening - FormDocument3 pagesKGB SB - CA - Opening - FormbagfrstyNo ratings yet

- Credit Card PaymentDocument1 pageCredit Card PaymentMd. Monowar Hossain0% (1)

- PIF Bursary Pledge FormDocument2 pagesPIF Bursary Pledge Formbianca_brebnorNo ratings yet

- HDFC Card Addon Application FormDocument2 pagesHDFC Card Addon Application Formvgk.thinktankNo ratings yet

- DownloadDocument20 pagesDownloadMaulik ZaveriNo ratings yet

- INFOCOM 2022 Delegate Registration FormDocument2 pagesINFOCOM 2022 Delegate Registration FormSarathya GhoshalNo ratings yet

- Disbursal Request Form drf-0095749001552896143Document1 pageDisbursal Request Form drf-0095749001552896143Arbaz KhanNo ratings yet

- Bharat Credit CardDocument2 pagesBharat Credit Cardrizanaqvi0% (1)

- Bank Form IbDocument4 pagesBank Form IbRocky singhNo ratings yet

- SBI ATMDebit Card Application FormDocument2 pagesSBI ATMDebit Card Application Formlotusgoldy100% (1)

- PNB-1068 (R1) - Application Form For ATM DEBIT CardsDocument2 pagesPNB-1068 (R1) - Application Form For ATM DEBIT CardsChandan GuptaNo ratings yet

- Credit Card Application Form Indian BankDocument2 pagesCredit Card Application Form Indian BankKishwar MNo ratings yet

- 21 Down 16 Down ECS Information InstructionsDocument3 pages21 Down 16 Down ECS Information Instructionsmnj_gautamNo ratings yet

- MITC 1.64.pdfDocument20 pagesMITC 1.64.pdfRavi kumarNo ratings yet

- ANNEX - H Request LetterDocument7 pagesANNEX - H Request Lettershravan38No ratings yet

- Anf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Document6 pagesAnf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)great2readNo ratings yet

- Application Form - Annexure A PDFDocument2 pagesApplication Form - Annexure A PDFSunil KumarNo ratings yet

- Plastic MoneyDocument42 pagesPlastic MoneyAnonymous So5qPSnNo ratings yet

- Final FormDocument14 pagesFinal FormPUSHKAR PATIDARNo ratings yet

- Test PDFDocument14 pagesTest PDFAniketNo ratings yet

- IGCSE Accounting 0452 Structured Sample Question PaperDocument20 pagesIGCSE Accounting 0452 Structured Sample Question Paperaditi.mishraNo ratings yet

- CC Verification FormDocument1 pageCC Verification FormSalman SajidNo ratings yet

- (To Be Retained by The Bank) (To Be Sent by The Applicant To CSIR) (To Be Retained by The Applicant)Document1 page(To Be Retained by The Bank) (To Be Sent by The Applicant To CSIR) (To Be Retained by The Applicant)SubashNo ratings yet

- Credit/Debit Card Authorisation (Autopay) (Visa / Mastercard / Amex)Document2 pagesCredit/Debit Card Authorisation (Autopay) (Visa / Mastercard / Amex)Hafiz IbrahimNo ratings yet

- Customer Information Update FormDocument2 pagesCustomer Information Update FormChrionny AlumediNo ratings yet

- Prize Bond Claim Form PDFDocument2 pagesPrize Bond Claim Form PDFmhaseeb359081No ratings yet

- Application Account Opening For RDN BCA FilledDocument6 pagesApplication Account Opening For RDN BCA Filledjawad nugrohoNo ratings yet

- Dematerialisation Request Form Only For NRIDocument1 pageDematerialisation Request Form Only For NRIMd AsifNo ratings yet

- Indian Bank Debit Card Application Form 1Document2 pagesIndian Bank Debit Card Application Form 1Devil World50% (2)

- ###Payment Form - Connection To Council's SW SystemDocument1 page###Payment Form - Connection To Council's SW SystemBarrasons Engineers TeamNo ratings yet

- MTODocument2 pagesMTOLinh H DiepNo ratings yet

- HDFC Credit CardDocument21 pagesHDFC Credit Cardmaulikmotial200No ratings yet

- Central Bank Form No 1Document1 pageCentral Bank Form No 1Audithya KahawattaNo ratings yet

- Maubankform 052 Account Opening and Product Form RetailDocument2 pagesMaubankform 052 Account Opening and Product Form RetailfalcontourskeralaNo ratings yet

- POSY OddiceDocument1 pagePOSY Oddicekumar nNo ratings yet

- Dematerialisation Request Form Only For NRI PDFDocument1 pageDematerialisation Request Form Only For NRI PDFamitrplNo ratings yet

- Kyc Annexure 'B'Document1 pageKyc Annexure 'B'alamfaryad51No ratings yet

- Debit Card SMS Application FormDocument2 pagesDebit Card SMS Application FormTasneef ChowdhuryNo ratings yet

- HDFC Bank Credit Card FormDocument4 pagesHDFC Bank Credit Card FormvrishaNo ratings yet

- Bca - RDN Form PDFDocument6 pagesBca - RDN Form PDFIstikhanah100% (1)

- Application Form For Customer Fund Account: Formulir Rekening Dana NasabahDocument12 pagesApplication Form For Customer Fund Account: Formulir Rekening Dana Nasabahafif pilardiNo ratings yet

- The Addiction Counselor's Documentation Sourcebook: The Complete Paperwork Resource for Treating Clients with AddictionsFrom EverandThe Addiction Counselor's Documentation Sourcebook: The Complete Paperwork Resource for Treating Clients with AddictionsNo ratings yet

- American Credit Repair: Everything U Need to Know About Raising Your Credit ScoreFrom EverandAmerican Credit Repair: Everything U Need to Know About Raising Your Credit ScoreRating: 3 out of 5 stars3/5 (3)

- A Study On Comparative Analysis of PCARD and DCC Bank at Primary Co-Operative and Agriculture Rural Development BankDocument72 pagesA Study On Comparative Analysis of PCARD and DCC Bank at Primary Co-Operative and Agriculture Rural Development BankDiva U SNo ratings yet

- Mariano Marcos State University: Corporate ScandalDocument6 pagesMariano Marcos State University: Corporate Scandalrheyalhane tumamaoNo ratings yet

- Personal Internet Banking FormDocument1 pagePersonal Internet Banking Forma_mohid17No ratings yet

- Law of Banking and Negotiable InstrumentsDocument35 pagesLaw of Banking and Negotiable InstrumentsM A MUBEEN 172919831047No ratings yet

- 美国metabank账单Document2 pages美国metabank账单juliaechardhqa85No ratings yet

- Research Work New - PRNDocument66 pagesResearch Work New - PRNnarayan patelNo ratings yet

- ATM Requirement DocumentDocument9 pagesATM Requirement Documentdeverpo leandroNo ratings yet

- State Bank of IndiaDocument14 pagesState Bank of IndiaElora NandyNo ratings yet

- Tree of WealthDocument121 pagesTree of WealthJoseAliceaNo ratings yet

- Circular Readmission 2023 2024Document3 pagesCircular Readmission 2023 2024Atharva MoteNo ratings yet

- Banking on IP_UKIPODocument224 pagesBanking on IP_UKIPOraniNo ratings yet

- Duplicate: Summary Account Payable StatementDocument2 pagesDuplicate: Summary Account Payable StatementAkhil Kumar ReddyNo ratings yet

- AccountStatement - 02 AUG 2023 - To - 01 SEP 2023Document1 pageAccountStatement - 02 AUG 2023 - To - 01 SEP 2023Lucas WeoNo ratings yet

- Canton Corporation Is A Privately Owned Firm That Engages inDocument1 pageCanton Corporation Is A Privately Owned Firm That Engages inTaimur TechnologistNo ratings yet

- Business Finance For Video Module 1Document11 pagesBusiness Finance For Video Module 1Bai NiloNo ratings yet

- FD Lecture XVIIDocument38 pagesFD Lecture XVIIVineet RanjanNo ratings yet

- Third Space Learning Compound Interest GCSE Worksheet 1Document12 pagesThird Space Learning Compound Interest GCSE Worksheet 1erin zietsmanNo ratings yet

- Legal Department Policies ManualDocument14 pagesLegal Department Policies ManualLulu08No ratings yet

- Granada Theater Is Located in The Brooklyn Mall A Cashier SDocument1 pageGranada Theater Is Located in The Brooklyn Mall A Cashier SAmit PandeyNo ratings yet

- Hard Money LendingDocument38 pagesHard Money LendingChris Goff100% (1)

- Company Profile HDFC BankDocument7 pagesCompany Profile HDFC Bankdominic wurdaNo ratings yet

- Report On Mobile Banking Service Quality-A Study On Bkash"Document26 pagesReport On Mobile Banking Service Quality-A Study On Bkash"Sumon iqbalNo ratings yet

- Instituto Médio Maria Mãe de África Maputo CityDocument3 pagesInstituto Médio Maria Mãe de África Maputo CityRositaNo ratings yet

- Feature ListDocument110 pagesFeature ListsayeedNo ratings yet

- 0815 Drug Store & Business Management MCQ Question Bank: AnswerDocument7 pages0815 Drug Store & Business Management MCQ Question Bank: AnswerSunita Chillarge100% (1)

- Cause For The Rise of MercantilismDocument13 pagesCause For The Rise of MercantilismNainaNo ratings yet

- Contoh Format Pembayaran Via TransferDocument12 pagesContoh Format Pembayaran Via TransferRiska DraNo ratings yet

- 29 March 2021: World Equity Index Feeder Fund - Now Available On The BDO Bills Payment FacilityDocument6 pages29 March 2021: World Equity Index Feeder Fund - Now Available On The BDO Bills Payment FacilityJeuz Llorenz Colendra-ApitaNo ratings yet

- Study On Consumer Durable Loans and GoodsDocument73 pagesStudy On Consumer Durable Loans and GoodsRoshan Ghatge RG100% (1)

Debit Card Applctn Form

Debit Card Applctn Form

Uploaded by

junaid.c.h. padneOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Debit Card Applctn Form

Debit Card Applctn Form

Uploaded by

junaid.c.h. padneCopyright:

Available Formats

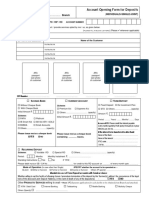

Page 1 of 2

Branch .......................................................................................................................................................... Branch Code

Account No. Customer ID

SB/CD Type: Privilege Youth Plus Mahila Delight Elite GSSA Basic

Regd.Office, SIB House, T.B Road

Mission Quarters, Thrissur, 680001, Kerala Junior CA Premium CA Smart Others,Please Specify ...................................................................

Debit Card Application Form

A. Applicant’ Details

Applicant Name

Mode of operation of Account: Self Either or Survivor Others.....................

Account Number

Name to be printed on card

[Max 20 Characters]

B. Type of Request

Reason for Reissuance

Others,Please Specify ...........................

Card Lost

New Card Request Card Reissuance

Card Damaged

Last 5 Digit of expiring card

Reissuance on Card Expiry Month & Year of Expiry M M / Y Y

C. Preferred Usage Option & PIN Type

Usage Option Domestic Only International

PIN Type Green PIN Paper PIN

D. Existing Debit Card Variant [For Use of Existing Debit Card Holders Only]

Card Type : RuPay VISA MasterCard

Card Variant : Classic Platinum Business World

Please note that seperate form is required for “Main” & “Add-on-Card”

E. Address for Dispatching the Debit Card

Communication Address (Residential/Business) Permanent Address (Residential/Business)

Mobile /Phone ....................................................................................................... Email ID......................................................................................................................

F. Declaration

1. I / We have read and understood the features, rules, terms and conditions applicable to the Debit Card variant and I/We hereby agree to be bound by the

same and changes, if any, as and when revised by the Bank at its discretion.

2. I / We have read and understood the Schedule of Charges applicable to Debit Cards as provided in the website -www.southindianbank.com.

3. I / We hereby agree to debit my / our above mentioned Account for the charges/fees for issuing a new Debit Card at the applicable rates.

4. I / We hereby agree and affirm that the Bank can contact me/us over telephone/SMS/E-Mail or any other mode of communication as registered with the Bank.

Place :................................................ Signature of the Applicant

Date :................................................

Signature of Applicant

G. For Office Use

Card Variant Applied in the Customer Account as per account eligibility :

Any other information :

Card Type : RuPay VISA MasterCard

Card Variant : Classic/Titanium Platinum Business World

Signature of Officer (Sign Code...................................) Signature of Branch head (Sign Code.............................)

Page 2 of 2

Terms and conditions governing the issue and usage of SIB’s Debit Cards

Terms & Conditions for Debit Cards • The card can be used in India and abroad but cannot be used in • Any mis-statement, mis-representation, error or omission in any

These Terms and Conditions apply to and regulate the issuance and Nepal and Bhutan for withdrawal of foreign currency; details disclosed by the Bank.

usage of debit cards offered by The South Indian Bank Ltd. to account

holder and/or any person authorised by the accountholder, when ACCEPTABILITY: FEES

there are more than one signatory to an Account. •The card shall be acceptable only for transactions as permitted by • Transaction fees for cash withdrawals / balance inquiry and / or

the Bank from time to time in India and abroad at the Participating other related charges wherever applicable, will be debited to the

These terms and conditions (the “Terms”) shall be in addition to any ATMs, Online sites and POS terminals. The Bank reserves the right to account at the time of posting the cash withdrawal / balance inquiry

other terms as stipulated by The South Indian Bank Ltd. from time to change the transaction set without any notice to the cardholder. or as the case may be.

time. • All transactions in foreign currency will be billed and recorded to

The words and phrases included in this document have the meaning PROPRIETY: Cardholder's Bank Account statement in Indian Rupees. I/We hereby

set opposite them unless the context indicates otherwise: •The card is the property of the Bank and must be returned to an authorise The South Indian Bank Ltd. and MasterCard / Visa / RuPay

1. “Card” or “Debit Card”, refers to The South Indian Bank Ltd. authorized person of the Bank without demur on request. to convert the charges incurred in the foreign currency into the

MasterCard / Visa / RuPay Debit Card issued by The South Indian Bank Indian Rupee equivalent thereof, at such rates as Bank / MasterCard

Ltd. to an account holder. USAGE GUIDELINES: / Visa / RuPay may from time to time designate. The exchange rate

2. “Bank” means The South Indian Bank Ltd, a banking company The period within which the cardholder's account would normally used for all foreign currency

Incorporated in India under the Companies Act 1956 and having its be debited and period applicable with respect to cheque issue transactions decided by the Bank will be binding on the cardholder.

registered office at SIB house, T.B. Road, Mission Quarters, Thrissur - request will be as determined by bank from time to time. • The Charges / Fees applicable on the usage of the Debit Card may

680 001 and all its branch offices and includes its successors and • The Cardholder shall at all times ensure that the Card is kept at a be revised / changed by The South Indian Bank Ltd. from time to

assigns. safe place and shall under no circumstances whatsoever allow the time, with prior information to the Cardholder(s). Notice/Informa-

3. "Cardholder" refers to the accountholder of The South Indian Bank Card to be used by any other individual. tion put up on the Bank's Branch Notice Board/ATM counters/Web-

Ltd. • The Cardholder will sign the Card immediately upon receipt. The site/E-mailers to customers' registered E-mail ID/SMS will be treated

4. “Account(s)”, refers to the Cardholder's Savings or Current Accounts Cardholder must change the PIN assigned by The South Indian Bank as adequate and complete notice for this purpose.

that have been designated by The South Indian Bank Ltd. to the Ltd. after the first usage and choose another PIN as a safety measure

eligible account(s) for the valid operation of the Debit Card. The for secured usage of the Card. The PIN should never be disclosed to BANK’s LIEN

Cardholder should be either the account holder, or sole signatory or any person including the staff of the Bank as well as other Banks • The Banks’ right of set-off and lien shall extend to all outstanding

authorised to act alone, when there is more than one accountholder / whose ATMs are termed as Participating ATMs, officials of dues whatsoever arising as a result of the card services extended to

signatory. MasterCard/VISA/RuPay terminals at Merchant Establishments or and/ or used by the Cardholder.

5. “Transaction” means any instruction given by a cardholder to the written down in any form under any circumstances whatsoever. Any • If there is no sufficient balance in the account to set off the amount

Bank using the Card directly or indirectly to effect action on the such disclosure or inadequate protection of the confidentiality of due to The South Indian Bank Ltd., a lien will be marked for net

account. (Examples of transactions can be retail purchases, cash the PIN is entirely at the cardholder’s risk. amount and any subsequent credit to the account will be first set off

withdrawals, cash / cheque deposits, etc.). • The Cardholder will be responsible for all facilities granted by The towards the amount due to The South Indian Bank Ltd.

6. "ATM"/ "Participating ATMs" means any Automated Teller Machine, South Indian Bank Ltd. and for all related charges and shall act in

whether in India or overseas, whether of The South Indian Bank Ltd. or good faith in relation to all dealings with the Card and The South TERMINATION OF FACILITY:

a specified Shared Network like VISA/MasterCard/RuPay, at which, Indian Bank Ltd. • The cardholder may discontinue this facility any time by a written

amongst other things, the Cardholder can use his Card to access his • The South Indian Bank Ltd. reserves the right to change the types of notice to the Bank accompanied by the return of the card cut

funds in his Account, held with The South Indian Bank Ltd. Transactions supported by the Card subject to a notice being given diagonally into two pieces. The cardholder will be responsible for all

7. “PIN” means the Personal Identification Number (required to access to the Cardholder. The Cardholder shall notify The South Indian Transactions undertaken using the card, card facilities availed,

ATMs) allocated to the Cardholder by The South Indian Bank Ltd., Bank Ltd. immediately of any error or irregularity in maintaining the charges etc. notwithstanding the termination of this agreement.

chosen by him from time to time. Account/ Card by The South Indian Bank Ltd. Ltd. at Bank's 24-Hour • The Bank shall be entitled to discontinue this facility with

8. “Account Statement” means a periodic Statement of Account sent Customer Care Centres or by way of written communication or by immediate effect at any time on account of non fulfilment of terms

by The South Indian Bank Ltd. to a Cardholder, setting out the fax to his branch of The South Indian Bank Ltd. or such other mode and conditions by the cardholder, by cancelling the card with or

transactions carried out by the Cardholder(s) during the given period, as may be acceptable to The South Indian Bank Ltd. without assigning any reason whatsoever by its convenient mode of

and the balance on that account. It may also include any other • The cardholder agrees that he will be allowed to withdraw/pur- communication and shall be deemed to have been received by the

information that The South Indian Bank Ltd. may deem fit to include. chase only a certain amount of cash per calendar day as announced Cardholder upon posting to the Cardholders’ address in India, last

9. "Merchant Establishment" shall mean such physical and/or virtual from time to time irrespective of the credit balance in the accounts. notified in writing to the Bank.

establishments, wherever located, which honor a VISA / MasterCard / • The cardholder agrees not to attempt to withdraw /purchase using

RuPay and shall include, among others, stores, shops, restaurants, the card unless sufficient funds are available in the account. The DISCLOSURE:

hotels and airlines cash advance points including ATMs and mail order onus of ensuring adequate account balance is entirely on him. In the • The bank reserves the right to disclose customer information to

advertisers (whether retailers, distributors or manufacturers). event of account getting overdrawn, he will have to rectify the any court of competent jurisdiction, quasi judicial authorities, law

10. "Merchant" means any person who owns or manages or operates a account balance position immediately with charges, penal interest enforcement agencies and any other wing of Central Government

Merchant Establishment. levied by the Bank from time to time. or state Government or such other agencies directed by RBI from

11. “EDC” or “Electronic Data Capture”, refers to electronic • When requested by the Bank, the cardholder shall provide any time to time.

Point-of-Sale swipe terminals, whether in India or overseas, whether of information records or certificates relating to any matters in relation • Unless specifically opted out each Card Holder’s usage of Card at

The South Indian Bank Ltd. or any other bank on the shared network to his card account. POS terminals will enable Card Holder to accrue reward points

like VISA/MasterCard/RuPay, that permit the debiting of the • International Debit Cards can be used only for permissible current (subject to existence of any reward point accumulation scheme

account(s) for purchase transactions from merchant establishments. account transactions under the Foreign Exchange Management Act declared by The South Indian Bank Ltd from time to time). For the

12. “MasterCard / Visa / RuPay” means a trademark owned by and (FEMA), 1999 (and/or any other applicable laws) and the item-wise Card Holder to redeem, reward points, if any, accrued in his account

normally associated with MasterCard / Visa / RuPay International. limits as mentioned in the Schedules to the Government of India with any scheme partner of The South Indian Bank Ltd, the Bank

13. “MasterCard / Visa / RuPay ATM Network” means ATMs that honour Notification No.G.S.R. 381(E) dated May 3, 2000, as amended from requires to share Card Holders details with scheme partners. Card

the Debit Card and that display the MasterCard / Visa / RuPay symbols. time to time, are equally applicable to payments made through use Holder unconditionally authorise The South Indian Bank Ltd to

14. “Terms” refer to the terms and conditions for issuance and usage of of these Cards. share Card Holder’s details with scheme partners as required by The

the card as more particularly stated hereinafter. • International Debit Cards can be used on Internet for any purpose South Indian Bank Ltd.

15. Use of terms “you”, “your”, “him” “he” or similar pronouns shall for which exchange can be purchased from an authorized dealer in

where the content so admit, mean the Cardholder and reference to India. International Debit Cards cannot be used on internet for UNCONDITIONAL ACCEPTANCE:

masculine gender would include the feminine gender. purchase of prohibited items like lottery tickets, banned or • These terms and conditions will be in addition to and not in

proscribed magazines, participation in sweepstakes, and payment derogation of the terms and conditions relating to any accounts of

APPLICABILITY: for call-back services, remittance in any form towards overseas forex the customer and forms a contract between the Bank and the

• The Terms form the contract between the Cardholder and The South trading, margin calls to overseas exchanges/overseas counterparty, cardholder.

Indian Bank Ltd.. the Cardholder shall be deemed to have trading in foreign exchange in domestic/overseas markets etc. or • The cardholder shall be deemed to have unconditionally agreed to

unconditionally agreed to and accepted the Terms by signing the any illegal activities; no withdrawal of foreign exchange is permitted have accepted the terms and conditions by signing the card

Card application form, or acknowledging receipt of the Card in for such items /activities. The Cardholder is under an obligation not application form and/or acknowledging the receipt of the card in

writing, or by signing on the reverse of the Card, or by performing a to countermand an order/ Transaction which he/she has conducted writing and/or signing the card on the reverse and/or performing a

transaction with the Card or by activation through ATM or after 15 with the Card. transaction with the card or after 15 days have elapsed since the

days have elapsed since the Card was dispatched to his address on date the card was dispatched to his recorded address on account at

record. The Terms will be in addition to and not in derogation of the LOST/STOLEN CARD: the time of issue / renewal/ replacement of the card.

terms and conditions relating to the Account of the Cardholder. The • Loss or theft of the card must be reported to any of the branches of • The Bank reserves the right to revise policies, features and benefits

Cardholders availing of any services / facilities including but not the Bank by the cardholder in writing along with a copy of a First offered on the card and alter these terms and conditions from time

limited to enquiry on transactions, Statement details through The Information Report (F.I.R) lodged with the local police. Pending to time and may notify the card holder any such alterations in any

South Indian Bank Ltd. Customer Care Center, The South Indian Bank obtention of FIR, the card holder may also fax or submit his written manner it thinks appropriate. The cardholder will be bound by such

Ltd. internet banking and/or any other channels, shall at all times intimation of loss or theft to the issuing branch/24 hour Toll Free alterations.

continue to be bound by the terms and conditions stipulated by South centre (+91 9446475458). The cardholder will be liable for all the

Indian Bank Ltd. from time to time for such services / facilities. transactions until the card is hot-listed by the Bank. The Bank will SETTLEMENT OF DISPUTES:

• The issue and usage of card shall be subject to the Reserve Bank of upon adequate verification hotlist/cancel the card following the • The cardholder agrees that any dispute in relation to issue and

India (“RBI”) regulations, Exchange Control regulations of the RBI, receipt of such intimation and recover charges for hot listing as usage of the card or whatsoever matter connected to it will be

Foreign Exchange Management Act, 1999 (“the Act”) all the rules and applicable from time to time from the cardholders account. settled by the arbitration as per the rules of Indian Arbitration and

regulations framed under the Act and as serviced from time to time • Issue of replacement card for lost/stolen card will be made by the Conciliation Act 1996. Further that the MD & CEO of The South

and any other corresponding enactment in force from time to time. Bank at its sole discretion upon payment of prescribed charge. Indian Bank Ltd. or any other person nominated by him will be the

• In the event of noncompliance by Cardholder with the same, the sole arbitrator and that the place of arbitration will be Thrissur,

Cardholder shall be liable for action under the Foreign Exchange EXCLUSION OF LIABILITY: Kerala.

Management Act, 1999 and such other laws of the land. Without prejudice to the foregoing the Bank shall be under no

• The card may be used by Cardholders going abroad within the Liability whatsoever to the Cardholder in respect of any loss or REPLACEMENT OF EXISTING TERMS:

foreign exchange entitlements as stipulated by RBI from time to time, damage arising directly or indirectly out of These terms and conditions (the “Terms”) shall be in addition to any

for all bonafide personal expenses, for personal use, provided the total • Refusal by any ATMs/ Merchant Establishment , or other member other terms as stipulated by The South Indian Bank Ltd. Ltd. from

exchange drawn during the trip abroad, does not exceed the bank to honour or accept a Card time to time.

entitlement. The cardholder shall also endorse his passport for • Effecting transaction instruction other than by a Cardholder or

availing Foreign Exchange under Basic Travel Quota (BTQ). The misuse of card due to the cardholders negligence, mistake, GOVERNING LAW & JURISDICTION:

entitlement of exchange should be ascertained (prior to the trip) from dishonesty, misconduct, fraud or handing over the card to The terms and conditions mentioned hereinabove, the usage and

the authorised dealer branches of the Bank. The card cannot be used unauthorized person. operation of the card shall be governed by the laws of India and all

for effecting remittances for which the release of exchange is not • Non functioning of the ATMs/Merchant Establishment and Other disputes shall be support to the exclusive jurisdiction of Courts in

permissible under the present regulations. Shared Payment Network System like VISA/MasterCard/RuPay or Thrissur. I / We understand that upon issue of the SIB Debit Card to

Banks network due to machine, mechanical errors/failures or any me/us, the ordinary ATM cards linked to my/ our account will be

ISSUANCE OF INTERNATIONAL DEBIT CARD TO BHUTANESE other reasons beyond the control of the bank. de-activated.

NATIONALS : • The exercise by the Bank of its right to demand and procure the

• The reimbursement of expenses incurred by Bhutanese Nationals on surrender of the card by itself or by any person or computer terminal

their International Debit Card abroad, should be exclusively out of prior to the expiry date exposed on its face.

inward remittance to their accounts in India. • The exercise by the Bank of its right to terminate any Card.

www.southindianbank.com CIN:L65191KL1929PLC001017 Toll Free 18001029408, 18004251809

You might also like

- SBI ATM/Debit Card Application FormDocument2 pagesSBI ATM/Debit Card Application FormVivek Godgift J78% (46)

- Business Client Agreement enDocument8 pagesBusiness Client Agreement enKatlego HectorNo ratings yet

- Global Credit Card ApplicationDocument2 pagesGlobal Credit Card Applicationvv_nathanNo ratings yet

- ATM-e-Banking Mobile Banking Request Form For CBS Customers PDFDocument1 pageATM-e-Banking Mobile Banking Request Form For CBS Customers PDFSupdt. of Post offices Kanpur (M) Dn. KanpurNo ratings yet

- Debit Card Application Form: A. Applicant' DetailsDocument2 pagesDebit Card Application Form: A. Applicant' DetailsRahul BhatNo ratings yet

- First Guarantee2Document1 pageFirst Guarantee2etio basseyNo ratings yet

- Fund Transfer Form-Cd20Document1 pageFund Transfer Form-Cd20meraxulNo ratings yet

- Application For DepositDocument1 pageApplication For DepositSolaimalai IyyengarNo ratings yet

- Personal Finance Application Form 2023 - English - New Sep2023Document7 pagesPersonal Finance Application Form 2023 - English - New Sep2023devilinpajamaNo ratings yet

- CRFA4 Rev Aug14 230823Document2 pagesCRFA4 Rev Aug14 230823Shobie advinculaNo ratings yet

- Application: Type of AccountDocument2 pagesApplication: Type of AccountL&R WingNo ratings yet

- DownloadDocument19 pagesDownloadSolomonNo ratings yet

- D D M M Y Y Y Y: Credit Card Services Form - 1Document4 pagesD D M M Y Y Y Y: Credit Card Services Form - 1Zaiedul HoqueNo ratings yet

- Account Opening Form Aug82017 FDNonIndividual 1Document6 pagesAccount Opening Form Aug82017 FDNonIndividual 1arpit selectionNo ratings yet

- Application Form For Issue of Canara Debit Card 27072017Document2 pagesApplication Form For Issue of Canara Debit Card 27072017John Athaide100% (1)

- Application (Eng)Document5 pagesApplication (Eng)segnatory_endNo ratings yet

- KGB SB - CA - Opening - FormDocument3 pagesKGB SB - CA - Opening - FormbagfrstyNo ratings yet

- Credit Card PaymentDocument1 pageCredit Card PaymentMd. Monowar Hossain0% (1)

- PIF Bursary Pledge FormDocument2 pagesPIF Bursary Pledge Formbianca_brebnorNo ratings yet

- HDFC Card Addon Application FormDocument2 pagesHDFC Card Addon Application Formvgk.thinktankNo ratings yet

- DownloadDocument20 pagesDownloadMaulik ZaveriNo ratings yet

- INFOCOM 2022 Delegate Registration FormDocument2 pagesINFOCOM 2022 Delegate Registration FormSarathya GhoshalNo ratings yet

- Disbursal Request Form drf-0095749001552896143Document1 pageDisbursal Request Form drf-0095749001552896143Arbaz KhanNo ratings yet

- Bharat Credit CardDocument2 pagesBharat Credit Cardrizanaqvi0% (1)

- Bank Form IbDocument4 pagesBank Form IbRocky singhNo ratings yet

- SBI ATMDebit Card Application FormDocument2 pagesSBI ATMDebit Card Application Formlotusgoldy100% (1)

- PNB-1068 (R1) - Application Form For ATM DEBIT CardsDocument2 pagesPNB-1068 (R1) - Application Form For ATM DEBIT CardsChandan GuptaNo ratings yet

- Credit Card Application Form Indian BankDocument2 pagesCredit Card Application Form Indian BankKishwar MNo ratings yet

- 21 Down 16 Down ECS Information InstructionsDocument3 pages21 Down 16 Down ECS Information Instructionsmnj_gautamNo ratings yet

- MITC 1.64.pdfDocument20 pagesMITC 1.64.pdfRavi kumarNo ratings yet

- ANNEX - H Request LetterDocument7 pagesANNEX - H Request Lettershravan38No ratings yet

- Anf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Document6 pagesAnf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)great2readNo ratings yet

- Application Form - Annexure A PDFDocument2 pagesApplication Form - Annexure A PDFSunil KumarNo ratings yet

- Plastic MoneyDocument42 pagesPlastic MoneyAnonymous So5qPSnNo ratings yet

- Final FormDocument14 pagesFinal FormPUSHKAR PATIDARNo ratings yet

- Test PDFDocument14 pagesTest PDFAniketNo ratings yet

- IGCSE Accounting 0452 Structured Sample Question PaperDocument20 pagesIGCSE Accounting 0452 Structured Sample Question Paperaditi.mishraNo ratings yet

- CC Verification FormDocument1 pageCC Verification FormSalman SajidNo ratings yet

- (To Be Retained by The Bank) (To Be Sent by The Applicant To CSIR) (To Be Retained by The Applicant)Document1 page(To Be Retained by The Bank) (To Be Sent by The Applicant To CSIR) (To Be Retained by The Applicant)SubashNo ratings yet

- Credit/Debit Card Authorisation (Autopay) (Visa / Mastercard / Amex)Document2 pagesCredit/Debit Card Authorisation (Autopay) (Visa / Mastercard / Amex)Hafiz IbrahimNo ratings yet

- Customer Information Update FormDocument2 pagesCustomer Information Update FormChrionny AlumediNo ratings yet

- Prize Bond Claim Form PDFDocument2 pagesPrize Bond Claim Form PDFmhaseeb359081No ratings yet

- Application Account Opening For RDN BCA FilledDocument6 pagesApplication Account Opening For RDN BCA Filledjawad nugrohoNo ratings yet

- Dematerialisation Request Form Only For NRIDocument1 pageDematerialisation Request Form Only For NRIMd AsifNo ratings yet

- Indian Bank Debit Card Application Form 1Document2 pagesIndian Bank Debit Card Application Form 1Devil World50% (2)

- ###Payment Form - Connection To Council's SW SystemDocument1 page###Payment Form - Connection To Council's SW SystemBarrasons Engineers TeamNo ratings yet

- MTODocument2 pagesMTOLinh H DiepNo ratings yet

- HDFC Credit CardDocument21 pagesHDFC Credit Cardmaulikmotial200No ratings yet

- Central Bank Form No 1Document1 pageCentral Bank Form No 1Audithya KahawattaNo ratings yet

- Maubankform 052 Account Opening and Product Form RetailDocument2 pagesMaubankform 052 Account Opening and Product Form RetailfalcontourskeralaNo ratings yet

- POSY OddiceDocument1 pagePOSY Oddicekumar nNo ratings yet

- Dematerialisation Request Form Only For NRI PDFDocument1 pageDematerialisation Request Form Only For NRI PDFamitrplNo ratings yet

- Kyc Annexure 'B'Document1 pageKyc Annexure 'B'alamfaryad51No ratings yet

- Debit Card SMS Application FormDocument2 pagesDebit Card SMS Application FormTasneef ChowdhuryNo ratings yet

- HDFC Bank Credit Card FormDocument4 pagesHDFC Bank Credit Card FormvrishaNo ratings yet

- Bca - RDN Form PDFDocument6 pagesBca - RDN Form PDFIstikhanah100% (1)

- Application Form For Customer Fund Account: Formulir Rekening Dana NasabahDocument12 pagesApplication Form For Customer Fund Account: Formulir Rekening Dana Nasabahafif pilardiNo ratings yet

- The Addiction Counselor's Documentation Sourcebook: The Complete Paperwork Resource for Treating Clients with AddictionsFrom EverandThe Addiction Counselor's Documentation Sourcebook: The Complete Paperwork Resource for Treating Clients with AddictionsNo ratings yet

- American Credit Repair: Everything U Need to Know About Raising Your Credit ScoreFrom EverandAmerican Credit Repair: Everything U Need to Know About Raising Your Credit ScoreRating: 3 out of 5 stars3/5 (3)

- A Study On Comparative Analysis of PCARD and DCC Bank at Primary Co-Operative and Agriculture Rural Development BankDocument72 pagesA Study On Comparative Analysis of PCARD and DCC Bank at Primary Co-Operative and Agriculture Rural Development BankDiva U SNo ratings yet

- Mariano Marcos State University: Corporate ScandalDocument6 pagesMariano Marcos State University: Corporate Scandalrheyalhane tumamaoNo ratings yet

- Personal Internet Banking FormDocument1 pagePersonal Internet Banking Forma_mohid17No ratings yet

- Law of Banking and Negotiable InstrumentsDocument35 pagesLaw of Banking and Negotiable InstrumentsM A MUBEEN 172919831047No ratings yet

- 美国metabank账单Document2 pages美国metabank账单juliaechardhqa85No ratings yet

- Research Work New - PRNDocument66 pagesResearch Work New - PRNnarayan patelNo ratings yet

- ATM Requirement DocumentDocument9 pagesATM Requirement Documentdeverpo leandroNo ratings yet

- State Bank of IndiaDocument14 pagesState Bank of IndiaElora NandyNo ratings yet

- Tree of WealthDocument121 pagesTree of WealthJoseAliceaNo ratings yet

- Circular Readmission 2023 2024Document3 pagesCircular Readmission 2023 2024Atharva MoteNo ratings yet

- Banking on IP_UKIPODocument224 pagesBanking on IP_UKIPOraniNo ratings yet

- Duplicate: Summary Account Payable StatementDocument2 pagesDuplicate: Summary Account Payable StatementAkhil Kumar ReddyNo ratings yet

- AccountStatement - 02 AUG 2023 - To - 01 SEP 2023Document1 pageAccountStatement - 02 AUG 2023 - To - 01 SEP 2023Lucas WeoNo ratings yet

- Canton Corporation Is A Privately Owned Firm That Engages inDocument1 pageCanton Corporation Is A Privately Owned Firm That Engages inTaimur TechnologistNo ratings yet

- Business Finance For Video Module 1Document11 pagesBusiness Finance For Video Module 1Bai NiloNo ratings yet

- FD Lecture XVIIDocument38 pagesFD Lecture XVIIVineet RanjanNo ratings yet

- Third Space Learning Compound Interest GCSE Worksheet 1Document12 pagesThird Space Learning Compound Interest GCSE Worksheet 1erin zietsmanNo ratings yet

- Legal Department Policies ManualDocument14 pagesLegal Department Policies ManualLulu08No ratings yet

- Granada Theater Is Located in The Brooklyn Mall A Cashier SDocument1 pageGranada Theater Is Located in The Brooklyn Mall A Cashier SAmit PandeyNo ratings yet

- Hard Money LendingDocument38 pagesHard Money LendingChris Goff100% (1)

- Company Profile HDFC BankDocument7 pagesCompany Profile HDFC Bankdominic wurdaNo ratings yet

- Report On Mobile Banking Service Quality-A Study On Bkash"Document26 pagesReport On Mobile Banking Service Quality-A Study On Bkash"Sumon iqbalNo ratings yet

- Instituto Médio Maria Mãe de África Maputo CityDocument3 pagesInstituto Médio Maria Mãe de África Maputo CityRositaNo ratings yet

- Feature ListDocument110 pagesFeature ListsayeedNo ratings yet

- 0815 Drug Store & Business Management MCQ Question Bank: AnswerDocument7 pages0815 Drug Store & Business Management MCQ Question Bank: AnswerSunita Chillarge100% (1)

- Cause For The Rise of MercantilismDocument13 pagesCause For The Rise of MercantilismNainaNo ratings yet

- Contoh Format Pembayaran Via TransferDocument12 pagesContoh Format Pembayaran Via TransferRiska DraNo ratings yet

- 29 March 2021: World Equity Index Feeder Fund - Now Available On The BDO Bills Payment FacilityDocument6 pages29 March 2021: World Equity Index Feeder Fund - Now Available On The BDO Bills Payment FacilityJeuz Llorenz Colendra-ApitaNo ratings yet

- Study On Consumer Durable Loans and GoodsDocument73 pagesStudy On Consumer Durable Loans and GoodsRoshan Ghatge RG100% (1)