Professional Documents

Culture Documents

Performance Task BUSINESS-and-ACCOUNTING

Performance Task BUSINESS-and-ACCOUNTING

Uploaded by

SallyContiBolorOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Performance Task BUSINESS-and-ACCOUNTING

Performance Task BUSINESS-and-ACCOUNTING

Uploaded by

SallyContiBolorCopyright:

Available Formats

PERFORMANCE TASK

FUNDAMENTALS IN ACCOUNTANCY BUSINESS AND MANAGEMENT 2

BUSINESS FINANCE

Preparation of Projected Financial Statement

PROJECTED SALES

PROJECTED NET SALES 2023

= Net Sales 2022 x 10%

= Php5,250,000 x .10 = 525,000

= Php5,250,000 + 525,000 = Php5,775,000

PROJECTED COST OF SALES 2023

= Gross Profit 2022 ÷ Net Sales 2022

= Php945,000 ÷ 5,250,000 = .18 ( 18% )

= Projected Net Sales 2023 x 18%

= Php5,775,000 x .18 = Php1,039,500

= Php5,775,000 – 1,039,500

= Php4,735,500

PROJECTED OPERATING EXPENSES 2023

= Variables ( 5% x Net Sales 2023 ) = Php5,775,000 x .05 = Php288,750

= Depreciation Expense = Php5,200,000 + 1,000,000 = Php6,200,000 x 5% = Php310,000

= Php288,750 + 310,000 = Php598,750

INTEREST EXPENSE

First Loan

= January 1 to June 30, 2023 ( 6mos )

= Php1,250,000 x 8%

= Php100,000 ÷ 2

= Php50,000

Second Loan

= June 30 to December 31, 2023 ( 6mos )

= Php3,000,000 x 8%

= Php240,000 ÷ 2

=Php120,000

New Loans

= June 30 to December 31, 2023 ( 6mos )

= Php3,500,000 - 1,000,000

=Php2, 500, 000 X 8%

= Php200,000 ÷ 2

= Php100,000

INCOME TAX EXPENSE

Income Before tax

= Php170,750

Income Tax ( 30% )

= Php170,750 x .30

= Php51,225

Net Income After Tax

= Php170,750 – 51,225

= Php119,525

CASH 2023

= Cash 2022 ÷ Net Sales 2022 x Net Sales 2023

= Php1,060,000 ÷ 5,250,000 x 5,775,000

=Php1,166,000

TRADE ACCOUNTS RECEIVABLE 2020

= Accounts Receivable 2022 ÷ Net Sales 2022 x Net Sales 2023

= Php2,300,500 ÷ 5,250,000 x 5,775,000

= Php2,530,550

INVENTORIES 2023

= Inventories 2022 ÷ Net Sales 2022 x Net Sales 2023

= Php4,850,000 ÷ 5,250,000 x 5,775,000

= Php5,335,000

OTHER CURRENT ASSETS 2023

= Other Current Assets 2022 ÷ Net Sales 2022 x Net Sales 2023

= Php1,050,000 ÷ 5,250,000 x 5,775,000

= Php1,155,000

PROPERTY, PLANT AND EQUIPMENT, NET 2023

= Php2,440,000 + 1,000,000

= Php5,200,000 + 1,000,000 x 5%

= Php3,440,000 – (6,200,000 x 5%)

= Php3,440,000 – 310,000

= Php3,130,000

TRADE ACCOUNTS PAYABLE 2023

= Trade Payable 2022 ÷ Net Sales 2022 x Net Sales 2023

= Php5,050,000 ÷ 5,250,000 x 5,775,000

= Php5,555,000

LONG TERM DEBT, NET CURRENT PORTION

= Current and Long Term Debt

= Php2,000,000 + 3,500,000 December 31, 2023

= Php5,500,000

RETAINED EARNINGS

= Retained earnings + Net income - Dividends

= Php2,122,069 + 119,525 – 300,000

= Php1,941,594

EXTERNAL FUNDS NEEDED ( EFN ) 2023

= Change in Total Assets – ( Change in Total Liabilities - Total Change in Stockholder’s Equity )

= Php1,616,023 – (1,739,286.25 - 180,475 )

= Php57,211.75

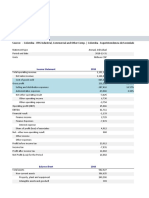

A Company

Income Statement

For The Year Ended December 31, 2022

Net Sales Php5,775,000

Cost of Sales 4,735,500

Gross Profit Php1,039,500

Operating Expenses 598,750

Operating Income Php440,750

Interest Expense 270,000

Income Before Tax 170,750

Income Tax 51,225

Net Income After tax Php119,525

A Company

Statement of Financial Position

As of December 31, 2022

Assets

Current Assets

Cash Php1,166,000

Accounts Receivable 2,530,550

Inventories 5,335,000

Other Current Assets 1,155,000

Total Current Assets Php10,186,550

Non - Current Assets

Property, Plant and Equipment, Net 3,130,000

Other Non - Current Assets 835,689

Total Non – Current Assets 3,965,689

Total Assets Php14,152,239

Liabilities and Equity

Current Liabilities

Notes Payable ( EFN ) Php57,211.75

Trade Payable 5,555,000

Income Taxes Payable 12,806.25

Current Portion of Long Term Debt 2,000,000

Other Current Liabilities 85,600

Total Current Liabilities Php7,710,618

Non – Current Liabilities

Long Term Debt, Net Current Portion Php3,500,000

Total Liabilities Php11,210,618

Stockholder’s Equity

Capital Stock Php1,000,000

Retained Earnings 1,941,594

Total Stockholder’s Equity Php2,941,594

Total Liabilities and Stockholder’s Equity Php14,152,212

You might also like

- Ventura, Mary Mickaella R Chapter 4 - MinicaseDocument5 pagesVentura, Mary Mickaella R Chapter 4 - MinicaseMary Ventura100% (1)

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- LABOR by Poquiz PDFDocument23 pagesLABOR by Poquiz PDFAnonymous 7BpT9OWP100% (3)

- FIN501 - Financial Management Mid Term Assignment - Zin Thet Nyo LwinDocument16 pagesFIN501 - Financial Management Mid Term Assignment - Zin Thet Nyo LwinZin Thet InwonderlandNo ratings yet

- C10 - PAS 7 Statement of Cash FlowsDocument15 pagesC10 - PAS 7 Statement of Cash FlowsAllaine Elfa100% (2)

- Financial Management Midtem ExamDocument4 pagesFinancial Management Midtem Examzavria100% (1)

- FI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeyDocument10 pagesFI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeySer Ronell0% (1)

- SCALP Handout 040Document2 pagesSCALP Handout 040Cher NaNo ratings yet

- SCALP Handout 040Document2 pagesSCALP Handout 040Cher NaNo ratings yet

- Example For Financial Statement AnalysisDocument2 pagesExample For Financial Statement AnalysisMobile Legends0% (1)

- IA 3 Final Assessment PDFDocument5 pagesIA 3 Final Assessment PDFJoy Miraflor Alinood100% (1)

- Dunkin' Donuts-Student Lounge Area Projected Statement of Financial Position December 31, 2020Document2 pagesDunkin' Donuts-Student Lounge Area Projected Statement of Financial Position December 31, 2020Cath VeluzNo ratings yet

- HW GPFS Answer PDFDocument4 pagesHW GPFS Answer PDFalyssaNo ratings yet

- Crash Landing On You Company Financial StatementsDocument6 pagesCrash Landing On You Company Financial StatementsEmar KimNo ratings yet

- BusFin PT 4Document2 pagesBusFin PT 4Nadjmeah AbdillahNo ratings yet

- FM-Cash Budget)Document9 pagesFM-Cash Budget)Aviona GregorioNo ratings yet

- Module 2 FINANCIAL STATEMENTS New 1Document30 pagesModule 2 FINANCIAL STATEMENTS New 1Trisha Mae Mendoza MacalinoNo ratings yet

- Cash Flow ExampleDocument2 pagesCash Flow ExampleAlhassan ShakirNo ratings yet

- ULOb - Let's Analyze & in A NutshellDocument5 pagesULOb - Let's Analyze & in A Nutshellemem resuentoNo ratings yet

- YVONNE MerchandisingDocument1 pageYVONNE Merchandisingart50% (2)

- Profitability Ratio 2Document18 pagesProfitability Ratio 2Wynphap podiotanNo ratings yet

- Written Assignment Unit01Document6 pagesWritten Assignment Unit01Michael Aboelkhair100% (1)

- Bail Am Tren LopDocument10 pagesBail Am Tren LopquyruaxxNo ratings yet

- Public Accountancy PracticeDocument69 pagesPublic Accountancy Practicelov3m3100% (2)

- SCALP Handout 040Document2 pagesSCALP Handout 040Eren CuestaNo ratings yet

- Grumpy Cat Company Comparative Statements of Financial Position December 31, 2020 and 2019 2020 2019 AssetsDocument2 pagesGrumpy Cat Company Comparative Statements of Financial Position December 31, 2020 and 2019 2020 2019 AssetsKatherine GablinesNo ratings yet

- 4 Statements PTDocument10 pages4 Statements PTjoshua korylle mahinayNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- Comprehensive SOCF ProblemDocument1 pageComprehensive SOCF ProblemAbdullah alhamaadNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Topic No. 2 - Statement of Cash Flows PDFDocument3 pagesTopic No. 2 - Statement of Cash Flows PDFSARAH ANDREA TORRESNo ratings yet

- Projected Financial Statement: Slash CompanyDocument7 pagesProjected Financial Statement: Slash CompanyKevin T. OnaroNo ratings yet

- Fin - AnalysisDocument2 pagesFin - Analysisajignacio.05No ratings yet

- Tutorial SCF A192 StudentDocument9 pagesTutorial SCF A192 StudentAina SyieraNo ratings yet

- Letter To Mark Saunders - 2014Document5 pagesLetter To Mark Saunders - 2014Jesus LapuzNo ratings yet

- Case 1Document4 pagesCase 1Roger BartelsNo ratings yet

- Joint Arrangement Answer KeyDocument8 pagesJoint Arrangement Answer KeyMonica DespiNo ratings yet

- ALDEN FS-update 2019Document57 pagesALDEN FS-update 2019cris gerard trinidadNo ratings yet

- PDF Topic No 2 Statement of Cash Flows PDF - CompressDocument3 pagesPDF Topic No 2 Statement of Cash Flows PDF - CompressMillicent AlmueteNo ratings yet

- CH4 MinicaseDocument4 pagesCH4 Minicasemervin coquillaNo ratings yet

- IAS 7 - Statement of CashflowsDocument7 pagesIAS 7 - Statement of CashflowsidarausungNo ratings yet

- Bida-Tech Company Statement of Financial Position: (See Notes To Financial Statements)Document27 pagesBida-Tech Company Statement of Financial Position: (See Notes To Financial Statements)Trisha Mae Mendoza MacalinoNo ratings yet

- New Era University: College of AccountancyDocument3 pagesNew Era University: College of AccountancyJoan LaroyaNo ratings yet

- Chapter IXDocument3 pagesChapter IXCleo IlaoNo ratings yet

- Practice Exercise Ch18Document3 pagesPractice Exercise Ch18ngocanhhlee.11No ratings yet

- Tutor UtsDocument9 pagesTutor UtsRAFLI RIFALDI -No ratings yet

- Practice Problems, CH 12Document6 pagesPractice Problems, CH 12scridNo ratings yet

- Assingment Sem 1 AccDocument6 pagesAssingment Sem 1 AccASMAA BINTI JAIDI STUDENTNo ratings yet

- GEC124Document3 pagesGEC124Norsaibah MANIRINo ratings yet

- Tutorial 14 Introductory Accounting Teaching Assistant TeamDocument2 pagesTutorial 14 Introductory Accounting Teaching Assistant TeamAris KurniawanNo ratings yet

- Chapter 8 - Financial AnalysisDocument4 pagesChapter 8 - Financial AnalysisLưu Ngọc Tường ViNo ratings yet

- New Era University: College of AccountancyDocument4 pagesNew Era University: College of AccountancyPeta AkountNo ratings yet

- GIV Organics Projected Total Cost Property and Equipment TotalDocument10 pagesGIV Organics Projected Total Cost Property and Equipment TotalAH GASENo ratings yet

- Course Folder Fall 2022Document26 pagesCourse Folder Fall 2022Areeba QureshiNo ratings yet

- Cash Flow - Additional Exercises - SOLDocument5 pagesCash Flow - Additional Exercises - SOLMathieu HindyNo ratings yet

- Sample Problem With Computation (FABM2)Document6 pagesSample Problem With Computation (FABM2)Chariz Joice RodriguezNo ratings yet

- Avidesa Mac Pollo S A (Colombia)Document18 pagesAvidesa Mac Pollo S A (Colombia)Batfori clucksNo ratings yet

- Batch2 Mid-TermDocument4 pagesBatch2 Mid-Termmohanned salahNo ratings yet

- Matalino Corporation FSDocument2 pagesMatalino Corporation FSAiron AlongNo ratings yet

- Long+Quiz+6 Dec2019 KeyDocument6 pagesLong+Quiz+6 Dec2019 KeySheikh Sahil MobinNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Mckinsey and Company: Knowledge ManagementDocument7 pagesMckinsey and Company: Knowledge ManagementShruti SinghNo ratings yet

- Robert Wade On Corruption PovertyDocument22 pagesRobert Wade On Corruption Povertybryan001935No ratings yet

- Selling Today Manning Reece Ahearne - Chapter 6Document16 pagesSelling Today Manning Reece Ahearne - Chapter 6Free CourseNo ratings yet

- Presented By: Presented To: Virendra Pratap Singh Mr. Naresh Sharma Roll No:-Mba 1 SemesterDocument15 pagesPresented By: Presented To: Virendra Pratap Singh Mr. Naresh Sharma Roll No:-Mba 1 Semesterrohit707No ratings yet

- Talent Creed: The Talent Creed Comprises ofDocument4 pagesTalent Creed: The Talent Creed Comprises ofrajyalakshmiNo ratings yet

- Marketing Techinques of Ing Vysya Life InsuranceDocument16 pagesMarketing Techinques of Ing Vysya Life InsurancethiagujtrNo ratings yet

- Experiential Marketing, Emotional Branding, and Brand Trust and Their Effect On Loyalty On Honda Motorcycle ProductDocument11 pagesExperiential Marketing, Emotional Branding, and Brand Trust and Their Effect On Loyalty On Honda Motorcycle ProductSeptian Dwi PrayogaNo ratings yet

- Discussion 1Document10 pagesDiscussion 1athirah jamaludinNo ratings yet

- IA SheeetttDocument9 pagesIA Sheeetttkeith tambaNo ratings yet

- Pa Section 4843.1 - Return by Taxpayer - OCRDocument1 pagePa Section 4843.1 - Return by Taxpayer - OCRBlaiberteNo ratings yet

- Reflection PaperDocument4 pagesReflection PaperDanica SolisNo ratings yet

- Personalized Proposal For Securing Your Family: RTG TTDocument5 pagesPersonalized Proposal For Securing Your Family: RTG TTDevika DasNo ratings yet

- My Mikes Bikes Page ReportDocument2 pagesMy Mikes Bikes Page Reportapi-489930791No ratings yet

- Market Analysis and Housing Finance - HousingDocument27 pagesMarket Analysis and Housing Finance - HousingDavid Mendoza27% (11)

- MIS Module 1 NotesDocument12 pagesMIS Module 1 Notesdangerous saifNo ratings yet

- Introducing Scooty Bikes AS AN Entrepreneurs: EntrepreneurshipDocument25 pagesIntroducing Scooty Bikes AS AN Entrepreneurs: EntrepreneurshipAlvin InNo ratings yet

- Aamir Raza: Contact InformationDocument3 pagesAamir Raza: Contact InformationAamir RazaNo ratings yet

- The Table Below Represents The World Supply and Demand ForDocument1 pageThe Table Below Represents The World Supply and Demand Fortrilocksp SinghNo ratings yet

- Consumer Behavior: Building Marketing Strategy, 9th: Hawkins, Del I. Best, Roger J. Coney, Kenneth ADocument4 pagesConsumer Behavior: Building Marketing Strategy, 9th: Hawkins, Del I. Best, Roger J. Coney, Kenneth ABantheng Rusu RaiNo ratings yet

- Iimk SMP BrochureDocument20 pagesIimk SMP Brochurerose GuptaNo ratings yet

- Meckson Ndali Resume-1Document1 pageMeckson Ndali Resume-1Rodric PeterNo ratings yet

- Class 10 Project on Sustainable Development 2Document21 pagesClass 10 Project on Sustainable Development 2sonupurve169No ratings yet

- SGS Industrial Project Finance Services enDocument12 pagesSGS Industrial Project Finance Services enLuiz Felippe CuradoNo ratings yet

- List of Placement ConsultantsDocument17 pagesList of Placement Consultantsshivankj0% (1)

- Target Market Definition, Importance, Example, Steps &Document6 pagesTarget Market Definition, Importance, Example, Steps &Mohit RanaNo ratings yet

- November 2020 Professional Examiniations Public Sector Accounting and Finance (Paper 2.5) Chief Examiner'S Report, Questions and Marking SchemeDocument23 pagesNovember 2020 Professional Examiniations Public Sector Accounting and Finance (Paper 2.5) Chief Examiner'S Report, Questions and Marking SchemeThomas nyadeNo ratings yet

- Batch Details: Dept. of Nmechanical, NMIT, Bangalore-560064Document7 pagesBatch Details: Dept. of Nmechanical, NMIT, Bangalore-560064Gaurav SinghNo ratings yet

- PPT7 - Pricing Understanding and Capturing Customer ValueDocument22 pagesPPT7 - Pricing Understanding and Capturing Customer ValueMuhammad LuthfieNo ratings yet

- ImcDocument4 pagesImcHetal SinghNo ratings yet